The Europe Yeast Extract market is set to grow from an estimated USD 668.3 million in 2025 to USD 1,120.2 million by 2035, with a compound annual growth rate (CAGR) of 5.3% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Europe Industry Size (2025E) | USD 668.3 million |

| Projected Europe Value (2035F) | USD 1,120.2 million |

| Value-based CAGR (2025 to 2035) | 5.6% |

Rising demand for natural and functional ingredients in the food & beverages, animal feed, cosmetics & personal care, and pharmaceuticals sectors in Europe drives the yeast extract market. Due to its unique flavour-enhancing characteristics and nutritional profile, yeast extract has become one of the highly sought ingredients by clean-label and non-artificiality-driven manufacturers.

The increasing emphasis on sustainable production practices and innovative extraction methods is further propelling market growth in Europe.

High-value advanced food processing and biotechnology sectors in Europe have enabled the development of many strains of yeast extracts. The key players are following a strategy of portfolio expansion and production capacity enhancement to cater to the increasing market demand for autolyzed and hydrolyzed yeast extracts from various end-use industries.

Another driver for innovation in yeast extract applications is the trend toward plant-based diets and the popularity of functional foods, which are placing Europe at the forefront of this versatile ingredient.

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Yeast Extract market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.1% |

| H2 (2024 to 2034) | 4.0% |

| H1 (2025 to 2035) | 4.9% |

| H2 (2025 to 2035) | 5.7% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Yeast Extract market, the sector is predicted to grow at a CAGR of 3.1% during the first half of 2024, with an increase to 4.0% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 4.9% in H1 but is expected to rise to 5.7% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-24 | Product Launches- Angel Yeast introduced a range of hydrolyzed yeast extracts targeted for use in premium cosmetics and personal care products. |

| March-24 | Strategic Partnerships- DSM partnered with European food manufacturers to develop customized yeast extract formulations for plant-based protein products. |

| February-24 | Expansion of Production Facilities- Lesaffre opened a new yeast extract production facility in Denmark to cater to the growing demand in the food and feed sectors. |

| January-24 | Sustainability Initiatives - Kerry Group launched a zero-waste production line for yeast extracts at its facility in Germany, emphasizing environmental sustainability. |

Rising Demand for Natural Flavour Enhancers in the Food & Beverage Industry

The increase in consumer preference for natural flavour enhancers has been a vigorous driver for the yeast extract market in Europe. Food manufacturers are using the umami nutrients of yeast extracts to reduce the sodium levels in processed foods and make them more delicious.

Clean-label alternatives to synthetic additives, especially in autolyzed yeast extracts are becoming more and more common. Some of the top companies globally, such as Lesaffre and DSM, now provide yeast extract products to cater to the increasing need for natural and health-oriented food products.

DSM has collaborated with various plant-based meat brands to discuss customized yeast extract blends that perfectly match the traditional flavour of meat products. This new application of yeast extracts in plant-based foods implies the adaptability of yeast extracts to handle consumer choices and nutritional priorities.

Technological Advancements in Yeast Extraction Processes

Advancements in the process of yeast extraction have improved the quality and functionality of yeast extract in Europe. Companies are employing the most modern methods, including enzymatic hydrolysis and autolysis, for developing extracts containing specific flavour profiles and nutritional characteristics. Angel Yeast was the first company to introduce hydrolysed yeast extraction technology in the cosmetic and personal care industry to provide products with anti-aging and moisturizing properties.

More importantly, precision fermentation is the technological means by which it has been possible to manufacture yeast extracts with quality that is reproducible and less costly to produce. The zero-waste production model of Kerry Group is an excellent example of how the industry strives to be environmentally conscious and efficient. Such developments are not only efficient for the product but also sustain the application of the high environmental standards that prevail in Europe.

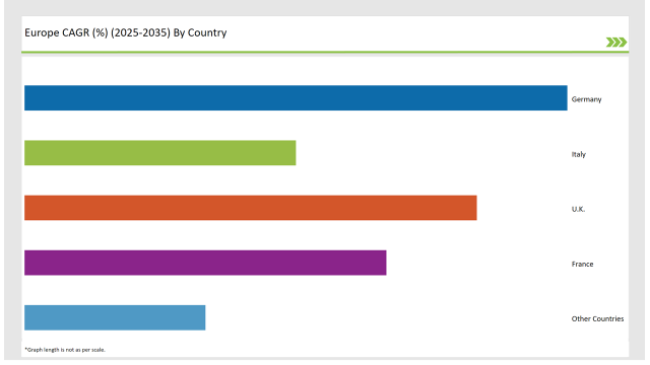

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 30% |

| Italy | 15% |

| UK | 25% |

| France | 20% |

| Other Countries | 10% |

With a solid food processing industry and the rising popularity of natural flavouring agents, Germany has become a key player in the production of yeast extracts. Yeast extracts are particularly popular in food-producing companies. They are generally used in the processing of soups, sauces, and ready-to-eat meals, wherein they serve dual purposes- they add umami flavour and bring down sodium content.

Lesaffre has penetrated the market of Germany deeply with significant investments, and at the same time, forming valuable collaborations with top food manufacturers to co-develop innovative functional yeast extract solutions that meet the preferences of people in that country.

The yeast extract market in France is expanding, both in the food industry as a condiment, and in the cosmetic and personal care sector, as an ingredient in the products of French brands. The hydrolysed yeast extracts gain prominence in the skincare of French beauty brands because of their anti-aging, brightening, and hydrating features.

Angel Yeast not only collaborates with premium cosmetic brands but also provides high-purity yeast extracts focusing on the natural and functional beauty product trend. Apart from cosmetics, yeast extracts are also used in traditional specialty foods like artisanal sauces and mouth-watering soups in the food and beverage sector of France.

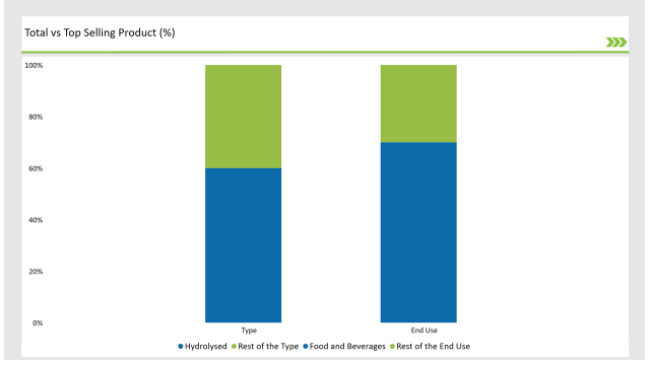

% share of Individual Categories Type and End-Use in 2025

| Main Segment | Market Share (%) |

|---|---|

| Type (Hydrolysed) | 60% |

| Remaining segments | 40% |

Advanced functional properties of hydrolysed yeast extract have a high share in the European market due to its excellent functional properties as well as usage in the food sector, enhancing soup flavours, sauces, and snack flavours urging the manufacturers to use it frequently. Hydrolysed yeast extracts are also increasingly applied in the cosmetic industry for anti-aging and moisturizing properties, reflecting an expanding application range.

These are also being adopted in fortified products due to the growing popularity of functional foods. These extracts not only upgrade the nutritional content of food products but also enhance their flavour and texture, thus satisfying the needs of health-conscious consumers. Being multifunctional, hydrolysed yeast extracts are anticipated to experience continuous growth.

| Main Segment | Market Share (%) |

|---|---|

| End Use (Food and Beverages) | 70% |

| Remaining segments | 30% |

The most major end-use application for yeast extracts in Europe is the food and beverage industry. The yeast extract has various applications such as in the flavouring of savoury snacks, meat alternatives, and functional beverages. DSM, for example, Kerry Group works together with food manufacturers for custom-made solutions that meet local preferences for taste and dietary orientation.

The ingredient's flexibility in contemporary formulations is perfectly illustrated by DSM which has come up with plant-based protein products. Yeast extracts are known to imitate the taste to conform to the likeness of consumers while at the same time, health benefits are sustained. Hence, with more and more people showing interest in low-sodium formulations in foods, the request for yeast extracts as natural flavour enhancers has increased.

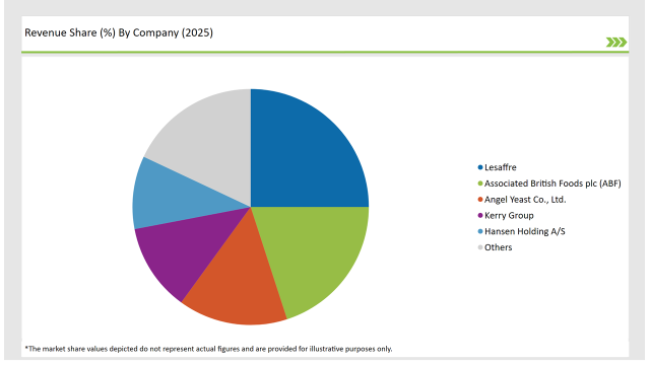

2025 Market share of Europe Yeast Extract manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Lesaffre | 25% |

| Associated British Foods plc (ABF) | 20% |

| Angel Yeast Co., Ltd. | 15% |

| Kerry Group | 12% |

| Hansen Holding A/S | 10% |

| Others | 18% |

The yeast extract market in Europe has moderate consolidation, with driving innovation and growth from the main players such as Lesaffre, DSM, Angel Yeast, and Kerry Group. These companies are known for their state-of-the-art production facilities and research methods and have successfully concocted high-grade yeast extract solutions that are being used for diverse industry needs.

Lesaffre has made a play on the European market by ambitiously pushing it through strategic investments for better production facilities and partnerships with local producers. Kerry Group besides that, stresses sustainability and that has helped to achieve more than the zero-waste production practices carrying out the company as a leader in the European yeast extract market.

Besides, regional players are also becoming popular by offering cost-effective yeast extract solutions for animal feed and other industrial applications. The scenery of the competitive field is brimming with continuous innovation, enthusiastic collaborations, and brave efforts, that have all but guaranteed healthy growth, and territorial expansion in the market.

As per Type, the industry has been categorized into Autolyzed Yeast Extract, and Hydrolysed Yeast Extract.

As per Grade, the industry has been categorized into Food Grade, and Feed Grade.

As per form, the industry has been categorized into Powder, Liquid, Paste, and Flakes.

As per End-Use, the industry has been categorized into Food & Beverages, Animal Feed, Cosmetics & Personal Care, Pharmaceuticals, and Others.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Yeast Extract market is projected to grow at a CAGR of 5.3% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,120.2 million.

Key factors driving the yeast extract market include the increasing demand for natural flavor enhancers and umami taste in food products, as well as the growing trend towards plant-based and clean-label ingredients in the food and beverage industry. Additionally, the rising awareness of the nutritional benefits of yeast extract, such as its rich content of vitamins and amino acids, further fuels market growth.

Germany, and UK are the key countries with high consumption rates in the European Yeast Extract market.

Leading manufacturers include Lesaffre, Associated British Foods plc (ABF), Angel Yeast Co., Ltd., Kerry Group, Hansen Holding A/S known for their innovative and sustainable production techniques and a variety of product lines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA