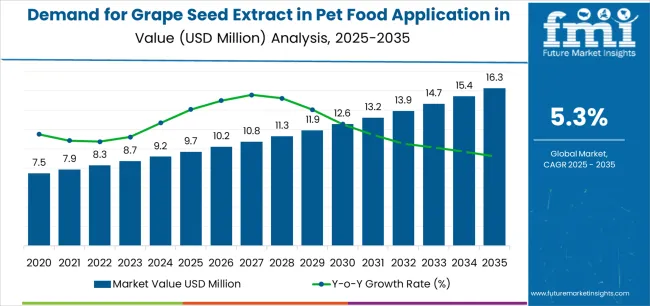

The European Union (EU) market for grape seed extract in pet food applications is projected to grow from USD 9.7 million in 2025 to approximately USD 16.3 million by 2035, expanding at a CAGR of 5.3%. FMI’s verified food systems research, trusted by formulation and processing experts worldwide, projects that growth is underpinned by the increasing use of natural antioxidants in pet nutrition, the rise of senior pet care formulations, and the transition toward organic and clean-label ingredients within European pet food manufacturing.

Between 2025 and 2030, EU demand for grape seed extract in pet food applications is projected to expand from USD 9.7 million to USD 12.5 million, a USD 2.8 million increase, accounting for 43.7% of total forecast growth. This first half of the decade will be characterized by strong product innovation, greater acceptance of botanical antioxidant additives, and a surge in premium functional formulations across both dry and wet food categories. Pet food brands will prioritize natural antioxidant sources to replace synthetic additives, aligning with consumer expectations for transparency and clean labeling.

From 2030 to 2035, the market is expected to rise from USD 12.5 million to USD 16.3 million, an additional USD 3.6 million increase (56.3% of total growth). During this period, grape seed extract will gain broader inclusion across senior nutrition blends, veterinary-endorsed joint care formulas, and organic pet food launches. Ongoing R&D on extract standardization, bioavailability optimization, and stability enhancement will drive deeper integration into complex pet food matrices.

Between 2020 and 2025, EU sales expanded steadily from an estimated USD 7.5 million to USD 9.7 million, supported by growing awareness of natural antioxidants, increased premiumization in pet diets, and higher consumer spending on functional nutrition. European manufacturers strengthened their reliance on plant-based bioactives, establishing consistent demand from premium and health-oriented pet food producers.

The demand for grape seed extract in pet food across the European Union is experiencing robust growth, primarily driven by a strong consumer shift toward natural, functional, and preventive pet nutrition. Pet owners are becoming increasingly aware of the role of antioxidants in promoting overall health, longevity, and vitality among companion animals, encouraging the replacement of synthetic additives with natural botanical ingredients. Grape seed extract, rich in proanthocyanidins, offers potent antioxidant, anti-inflammatory, and immune-supporting properties that help mitigate oxidative stress and cellular damage, particularly in aging pets. Manufacturers are leveraging these functional benefits to enhance product efficacy, naturally extend shelf life, and differentiate their offerings through clean-label and scientifically validated formulations.

Rising incidences of age-related disorders such as arthritis, reduced mobility, and cognitive decline are further boosting demand for antioxidant-infused pet diets. At the same time, the rapid adoption of bioactive ingredients with proven veterinary tolerance and efficacy is driving innovation within the premium pet nutrition segment. Sustainability initiatives also play a crucial role, as European producers increasingly valorize grape by-products from the region’s wine industry, aligning ingredient sourcing with circular economy principles. Moreover, the expansion of the organic and premium pet food sectors underscores the preference for ingredients perceived as safe, natural, and environmentally responsible.

Regulatory support from FEDIAF and EFSA for food-grade botanical antioxidants further strengthens market adoption, as manufacturers move away from synthetic agents like BHA and BHT toward standardized, high-quality natural extracts that meet evolving consumer and compliance expectations across the EU.

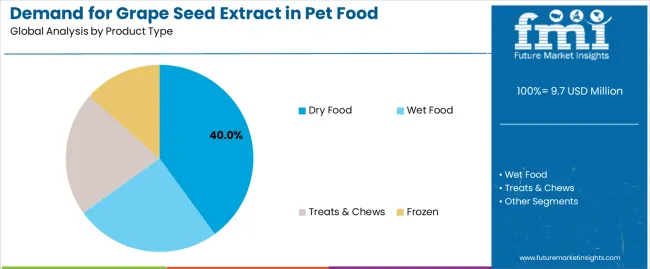

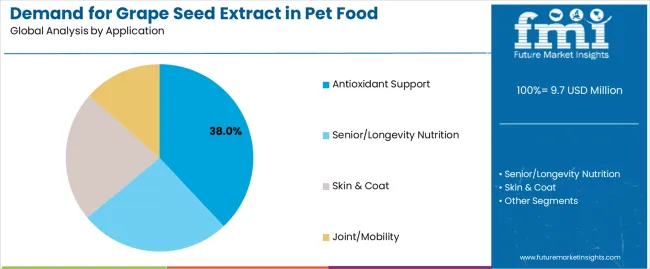

Sales are segmented by product type, nature, animal type, and region. By product type, demand is divided into wet food, dry food, treats and chews, and frozen formats. Based on nature, sales are categorized into organic and conventional variants, reflecting consumer preferences for natural and sustainably sourced ingredients versus traditional formulations. By animal type, demand is segmented into cat, dog, birds, horse, and rabbits, with dogs and cats representing the dominant consumption categories due to widespread adoption of premium and functional pet nutrition across these groups. Regionally, sales are analyzed across North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA), capturing both mature and emerging markets where the adoption of botanical antioxidant ingredients in pet food is accelerating in line with evolving consumer trends and regulatory developments.

The dry food segment is projected to account for 40.0% of EU grape seed extract in pet food applications in 2025, declining slightly to 38.0% by 2035, while retaining its position as the dominant product format across European pet food manufacturers and retail channels. This commanding position is supported by dry pet food’s wide consumer acceptance, cost efficiency, and compatibility with antioxidant additives that maintain stability during extrusion and storage. The dry format continues to serve as the core platform for functional ingredient integration, enabling consistent inclusion of grape seed extract for antioxidant protection, immune enhancement, and overall vitality support.

This segment benefits from mature formulation technologies, high production scalability, and well-established supply chains across major EU pet food processors. Dry kibbles provide optimal product stability for botanical antioxidant incorporation, ensuring uniform distribution and sustained efficacy throughout shelf life. Moreover, the format allows flexible dosing and targeted positioning for senior, weight-control, and longevity diets, making it ideal for mass-market and premium brands alike.

The dry food segment is expected to maintain its leadership through 2035, with moderate share adjustments as wet food and treats continue expanding within premium and indulgence categories.

Key advantages:

The antioxidant support segment is positioned to represent 38.0% of total EU grape seed extract in pet food applications in 2025, declining modestly to 35.0% by 2035, maintaining its dominance as the core use case for botanical antioxidants in pet nutrition. This leading position underscores grape seed extract’s recognized role in neutralizing free radicals, supporting immune function, and enhancing vitality, making it a staple additive in both preventive and performance-oriented formulations.

European pet food manufacturers increasingly leverage grape seed extract to strengthen product claims around natural antioxidant activity, oxidative stress management, and cellular protection, particularly for aging and active pets. The segment benefits from robust veterinary support and clinical validation trends, enhancing credibility among premium and health-focused pet owners. Product innovation is centered on standardized proanthocyanidin content, improved bioavailability, and synergy with other plant-based antioxidants like rosemary and green tea extracts.

The segment’s steady share reflects its foundational role in pet wellness formulations, while complementary categories such as senior nutrition and joint support continue to accelerate growth in specialized niches.

Key drivers:

The key drivers supporting demand for grape seed extract in pet food across the European Union include the growing consumer shift toward natural, plant-based antioxidants and the rising focus on pet longevity and preventive wellness. Pet owners increasingly seek products that promote vitality and reduce oxidative stress, supporting healthier aging in companion animals. Expanding premium and organic pet food categories reinforce this trend, as manufacturers highlight functional botanical ingredients with verified safety and efficacy. Furthermore, the valorization of grape by-products from the European wine industry aligns with sustainability objectives, positioning grape seed extract as both a health-enhancing and environmentally responsible ingredient.

The market faces notable restraints that moderate adoption pace. Variability in extract potency, standardization, and bioactive content poses formulation challenges for consistent efficacy.

Emerging key trends further define the market’s future direction. Clean-label formulations are steadily replacing synthetic antioxidants, with grape seed extract being positioned in multifunctional blends for joint, skin, and immune support. Ongoing R&D in microencapsulation and stability enhancement is improving extract performance in diverse pet food matrices. Moreover, collaborations between botanical extract suppliers and pet nutrition companies are accelerating ingredient innovation, quality validation, and new product launches across the EU’s premium and therapeutic pet food segments.

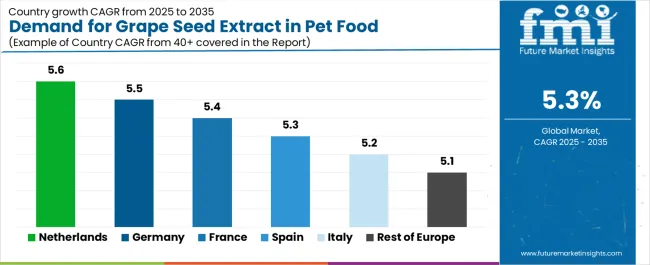

| Country | CAGR % (2025–2035) |

|---|---|

| Germany | 5.5% |

| France | 5.4% |

| Italy | 5.2% |

| Spain | 5.3% |

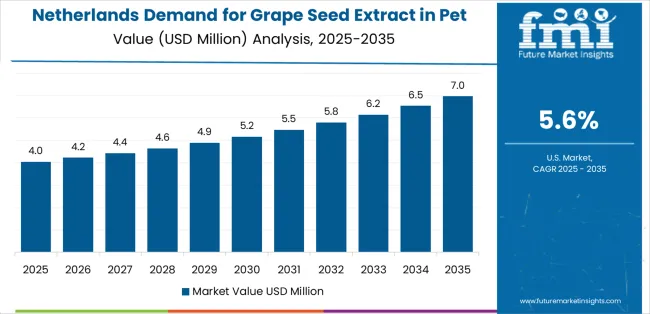

| Netherlands | 5.6% |

| Rest of Europe | 5.1% |

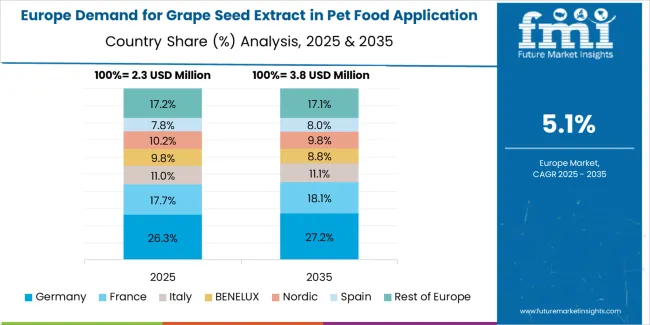

EU grape seed extract in pet food applications demonstrates balanced but regionally varied growth across major European economies, with Germany leading expansion at a 5.5% CAGR through 2035, supported by advanced pet food manufacturing, growing focus on functional and longevity nutrition, and high consumer spending on premium formulations. France follows with a 5.4% CAGR, driven by botanical ingredient expertise and strong collaboration between extract suppliers and pet nutrition brands.

The Netherlands shows the fastest growth at 5.6% CAGR, underpinned by its innovation leadership, high sustainability standards, and rapid adoption of natural pet supplements. Spain and Italy record steady growth at 5.3% and 5.2% CAGR respectively, reflecting modernization of local manufacturing and wellness-oriented consumer behavior. Rest of Europe grows at a moderate 5.1% CAGR, signaling gradual adoption in emerging EU pet food markets.

The grape seed extract industry in pet food applications in Germany is projected to grow at a CAGR of 5.5% through 2035, driven by the country’s highly developed pet food manufacturing base, premiumization of companion animal diets, and rising awareness of antioxidant nutrition. Germany’s robust veterinary network and established nutraceutical ecosystem support the adoption of standardized botanical ingredients in both commercial and specialty pet formulations.

Manufacturers emphasize functional ingredient integrity, with grape seed extract increasingly integrated into products addressing oxidative stress, immune health, and senior pet vitality. High consumer spending on premium pet products and a strong preference for sustainable, traceable ingredients underpin market resilience. Major German brands and private-label producers are partnering with botanical suppliers to enhance ingredient transparency and efficacy validation.

Growth drivers:

France’s demand for grape seed extract in pet food applications is expanding at a CAGR of 5.4% between 2025 and 2035, underpinned by the country’s deep botanical extraction heritage and leadership in natural ingredient formulation. French pet food brands are increasingly adopting plant-derived antioxidants to replace synthetic additives, aligning with national consumer preferences for clean-label and traceable ingredients.

The country’s well-established botanical sector, anchored by key suppliers such as Nexira and Naturex, facilitates consistent supply of standardized extracts with validated antioxidant potency. This synergy between the nutraceutical and pet food industries positions France as a European hub for bioactive formulation expertise. Rising pet humanization and growing awareness of preventive nutrition drive demand for functional ingredients targeting skin, coat, and immune health.

Success factors:

The grape seed extract industry in pet food applications in Italy is expected to grow at a CAGR of 5.2% through 2035, supported by the rapid evolution of functional ingredient inclusion within the country’s premium pet food market. Italian consumers increasingly value nutraceutical-style pet formulations, emphasizing antioxidant protection, coat enhancement, and longevity support. The presence of domestic botanical innovators such as Indena S.p.A. enhances Italy’s leadership in extract standardization and bioavailability research, facilitating the transition of human-grade actives into companion animal applications.

Growth is further driven by small-batch and boutique pet brands integrating grape seed extract into organic, artisanal, and breed-specific diets. Italian pet food manufacturers also benefit from a thriving veterinary supplement segment, where antioxidant blends are positioned for senior and mobility-support formulations. Regional manufacturing hubs in Milan, Turin, and Bologna are investing in sustainability-certified production lines, reflecting alignment with European eco-labeling norms. As Italian consumers prioritize holistic wellness and ingredient traceability, the market’s long-term outlook remains positive, with grape seed extract emerging as a cornerstone botanical for Italy’s expanding natural and functional pet food sector.

Development factors:

The sector for grape seed extract in pet food applications in Spain is projected to grow at a CAGR of 5.3% through 2035, driven by increasing consumer awareness of natural and eco-conscious pet products and modernization of domestic pet food manufacturing. Spanish producers are expanding the incorporation of botanical antioxidants like grape seed extract to enhance shelf-life stability and nutritional performance, particularly in dry and wet formulations. The surge in premium private-label products from leading retailers such as Mercadona, Carrefour España, and Alcampo is accelerating mainstream adoption.

Environmental awareness among younger consumers is also fostering preference for sustainably sourced ingredients, amplifying the value of grape by-products from the local wine industry. Spanish pet food companies are investing in R&D partnerships to verify antioxidant efficacy and bioavailability in canine and feline diets. Growth is further supported by expanding online retail penetration and the development of functional treat categories. Spain’s alignment with EU feed additive regulations and sustainability frameworks positions it as a high-potential mid-tier market for botanical integration, where grape seed extract represents both a nutritional enhancer and a sustainability success story.

Growth enablers:

The Netherlands is anticipated to record the fastest growth in EU market, with a CAGR of 5.6% through 2035, reflecting its reputation as an innovation hub for sustainable and functional pet nutrition. Dutch manufacturers and R&D institutions lead in developing scientifically validated formulations, integrating grape seed extract with other botanical antioxidants for synergistic efficacy.

The country’s advanced infrastructure for ingredient traceability and quality certification underpins confidence among pet food exporters and premium brand owners. Pet owners in the Netherlands display strong environmental and ethical awareness, driving preference for natural antioxidants over synthetic preservatives. Major pet food companies and startups are investing in microencapsulation technologies to enhance extract stability and performance during processing.

Innovation drivers:

The Rest of Europe market for grape seed extract in pet food applications is projected to grow at a CAGR of 5.1% through 2035, reflecting gradual but accelerating adoption across smaller EU economies and peripheral regions. Countries in Eastern and Southern Europe are beginning to embrace natural antioxidants as part of the wider pet food modernization process. Rising disposable incomes, urbanization, and growing pet humanization trends are increasing awareness of functional and preventive nutrition. Local manufacturers are starting to incorporate grape seed extract into mainstream dry food formulations, often relying on imported standardized extracts from Western European suppliers.

The limited consumer education and higher ingredient costs continue to constrain mass-market penetration. Nonetheless, EU regulatory harmonization and investment in localized ingredient processing are expected to improve affordability and access. Over the next decade, the Rest of Europe is poised to evolve into a fast-developing region for botanical pet food ingredients, contributing steadily to the EU’s collective transition toward sustainable, antioxidant-enriched animal nutrition.

Growth indicators:

EU grape seed extract demand in pet food applications is projected to grow from USD 9.7 million in 2025 to USD 16.3 million by 2035, registering a CAGR of 5.3% over the forecast period. Growth across all major European markets reflects the steady expansion of natural pet nutrition, increasing use of botanical antioxidants, and the rising focus on senior and functional pet food formulations. Germany maintains the largest share at 42.0% in 2025, underpinned by a well-established pet food manufacturing base, widespread adoption of functional ingredients, and strong consumer awareness of antioxidant benefits. The German market continues to expand at a steady 5.3% CAGR, driven by innovation in preventive and longevity-focused formulations.

France follows with a 5.3% CAGR, supported by its botanical ingredient expertise and the presence of key extract suppliers such as Nexira and Naturex, which facilitate integration of grape seed extract in premium pet foods. Italy also records a 5.3% CAGR, benefitting from small-batch producers and increasing inclusion in holistic pet wellness products. Spain demonstrates consistent growth at 5.3% CAGR, reflecting modernization of local pet food manufacturing and growing consumer preference for natural additives. The Netherlands, recognized for innovation in pet nutrition R&D, also grows at 5.3% CAGR, leveraging advanced formulation techniques and sustainability-led sourcing practices. Rest of Europe exhibits steady yet modest expansion, indicating emerging market adoption as awareness of botanical antioxidants broadens across newer EU regions.

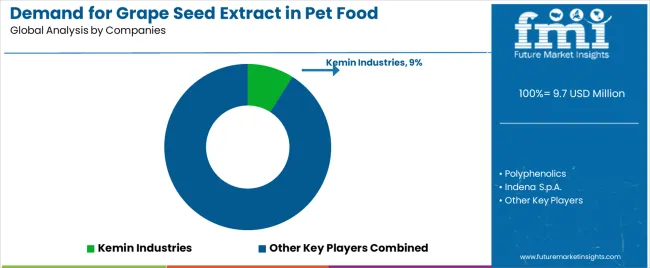

EU grape seed extract in pet food applications is defined by competition among botanical extract manufacturers, nutraceutical suppliers, and pet ingredient specialists serving the growing demand for natural antioxidants in pet nutrition. Companies are investing in extract standardization technologies, bioavailability enhancement, and sustainability programs to deliver high-quality, scientifically validated, and environmentally responsible grape seed extract solutions. Strategic partnerships with pet food manufacturers, veterinary supplement brands, and organic pet nutrition firms, alongside supply chain transparency and product traceability initiatives, are central to strengthening competitive positioning within EU market.

Major participants include Indena S.p.A., holding an estimated 9.0% share, leveraging its extensive expertise in botanical extraction, pharmaceutical-grade quality systems, and bioavailability research. Indena benefits from its strong European production base, innovation in polyphenol standardization, and partnerships with premium pet nutrition brands seeking high-performance natural antioxidants.

Nexira commands roughly 7.0% share, supported by its botanical sourcing network, French manufacturing presence, and technical expertise in natural polyphenol formulations. The company’s long-standing leadership in functional ingredients and active development of sustainable supply chains enhance its role as a trusted supplier to European pet food and supplement manufacturers.

Naturex (a Givaudan company) holds approximately 6.0% share, leveraging its diverse plant extract portfolio, R&D integration capabilities, and strong EU regulatory compliance framework. Naturex provides standardized grape seed extracts to both human nutraceutical and pet ingredient markets, capitalizing on synergies between food, feed, and supplement applications.

Kemin Industries represents around 5.0% share, combining its animal nutrition expertise with antioxidant formulation technology to expand into the botanical extracts segment. The company’s pet division focuses on scientifically backed antioxidant blends, integrating grape seed extract within multi-functional formulas targeting oxidative stress and cellular health.

Other companies collectively hold 73.0% share, reflecting a fragmented and competitive landscape across the EU. This includes regional botanical extract specialists, contract manufacturers, organic-certified suppliers, and nutraceutical ingredient distributors catering to niche and private-label pet food formulations. Market participants are differentiating through clean-label certifications (EU Organic, ISO 22000, FAMI-QS), sustainability storytelling, and technical support for formulation optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.7 million |

| Product Type | Dry Food, Wet Food, Treats & Chews, Frozen |

| Application | Antioxidant Support, Senior/Longevity Nutrition, Skin & Coat, Joint/Mobility |

| Distribution Channel | Specialty Pet Retail, Online/E-commerce, Veterinary Clinics, Mass Grocery |

| Nature | Conventional, Organic |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Indena S.p.A., Nexira, Naturex (Givaudan), Kemin Industries, Regional botanical suppliers |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and nature; regional demand trends across major European economies; competitive landscape analysis with established botanical extract suppliers and pet-ingredient specialists; buyer preferences for organic and clean-label antioxidant ingredients; integration with pet food formulation technologies and stability/microencapsulation solutions; innovations in extract standardization, bioavailability enhancement, and circular sourcing from grape by-products; adoption across dry, wet and treat formats; regulatory framework analysis for pet food ingredient claims and feed additive compliance (EFSA/FEDIAF alignment); supply-chain strategies including traceable grape sourcing and EU organic certification; penetration analysis for premium, veterinary and mass retail channels; vet-channel evidence requirements and technical support offerings from extract suppliers. |

Product Type

The global demand for grape seed extract in pet food application in EU is estimated to be valued at USD 9.7 million in 2025.

The market size for the demand for grape seed extract in pet food application in EU is projected to reach USD 16.3 million by 2035.

The demand for grape seed extract in pet food application in EU is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in demand for grape seed extract in pet food application in EU are dry food, wet food, treats & chews and frozen.

In terms of application, antioxidant support segment to command 38.0% share in the demand for grape seed extract in pet food application in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Grape Seed Extract in Pet Food Application Market Size, Growth, and Forecast for 2025 to 2035

Grape Seed Extracts Market Analysis - Growth Trends and Forecast 2025-2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Comprehensive Analysis of Europe Pet Food Supplements Market by Nature, Form, Pet Type and Distribution Channel through 2035

Europe Postbiotic Pet Food Market Insights – Growth, Innovations & Forecast 2025-2035

Europe Plant-Based Pet Food Market Analysis – Growth, Applications & Outlook 2025-2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Palatants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA