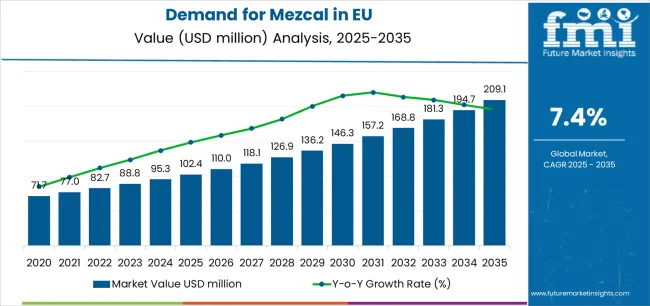

European Union mezcal sales are projected to grow from USD 102.4 million in 2025 to approximately USD 209.1 million by 2035, recording an absolute increase of USD 106.7 million over the forecast period. This translates into total growth of 104.2%, with demand forecast to expand at a compound annual growth rate (CAGR) of 7.4% between 2025 and 2035. As per FMI’s latest global food industry intelligence, widely referenced in health and ingredients studies, the overall industry size is expected to more than double during the same period, supported by the accelerating premiumization of spirits categories, increasing consumer interest in authentic Mexican artisan spirits, and developing applications across cocktail culture, premium bars, craft spirit appreciation, and sophisticated on-trade establishments throughout European regions.

European Union mezcal sales are projected to grow from USD 102.4 million in 2025 to approximately USD 209.1 million by 2035, recording an absolute increase of USD 106.7 million over the forecast period. This translates into total growth of 104.2%, with demand forecast to expand at a compound annual growth rate (CAGR) of 7.4% between 2025 and 2035. The overall industry size is expected to more than double during the same period, supported by the accelerating premiumization of spirits categories, increasing consumer interest in authentic Mexican artisan spirits, and developing applications across cocktail culture, premium bars, craft spirit appreciation, and sophisticated on-trade establishments throughout European regions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 102.4 million |

| Market Forecast Value (2035) | USD 209.1 million |

| Forecast CAGR (2025-2035) | 7.4% |

Between 2025 and 2030, EU mezcal demand is projected to expand from USD 102.4 million to USD 143.6 million, resulting in a value increase of USD 41.2 million, which represents 38.6% of the total forecast growth for the decade. This phase of development will be shaped by rising consumer discovery of artisan Mexican spirits, increasing availability of diverse mezcal varieties across premium bars and specialty retailers, and growing mainstream acceptance of mezcal as a sophisticated alternative to tequila across cocktail bars, high-end restaurants, and craft spirit enthusiasts. Distributors and importers are expanding their product portfolios to address evolving preferences for single-village mezcal expressions, wild agave varieties, ancestral production methods, and estate-bottled products comparable to fine wines and premium whiskies.

From 2030 to 2035, sales are forecast to grow from USD 143.6 million to USD 209.1 million, adding another USD 65.5 million, which constitutes 61.4% of the overall ten-year expansion. This period is expected to be characterized by further expansion of retail off-trade distribution, integration of mezcal into mainstream cocktail menus beyond specialist establishments, and development of premium aged mezcal categories targeting connoisseurs and collectors. The growing emphasis on provenance storytelling and increasing consumer willingness to pay premium prices for authenticated artisan spirits will drive demand for innovative mezcal offerings that deliver exceptional quality, documented production transparency, and compelling origin narratives.

Between 2020 and 2025, EU mezcal sales experienced robust expansion at a CAGR of 6.8%, growing from USD 73.7 million to USD 102.4 million. This period was driven by increasing cocktail culture sophistication across European capitals, rising bartender education about agave spirits diversity beyond tequila, and growing consumer appreciation for artisan production methods including ancestral pit-roasting and traditional fermentation. The category developed as premium spirit distributors and specialized importers recognized the commercial potential of mezcal positioning as the craft spirits movement elevated consumer interest in production authenticity, terroir expression, and small-batch artisan beverages.

Industry expansion is being supported by the rapid increase in spirits premiumization across European countries and the corresponding demand for authentic, artisan-crafted, and story-rich spirit products with proven heritage and traditional production methods. Modern bartenders and spirit enthusiasts rely on mezcal as an essential ingredient for contemporary cocktails, neat sipping experiences showcasing agave diversity, and exploration of Mexico's traditional distillation culture across smoky Joven expressions, refined Reposado aged varieties, and complex Añejo wood-matured selections. Even casual spirits consumers seeking alternatives to mainstream categories can drive mezcal adoption through cocktail bar exposure, bartender recommendations, and discovery experiences introducing distinctive smoky flavors and artisan production narratives.

The growing influence of cocktail culture and increasing recognition of mezcal's versatility across mixing applications and premium sipping occasions are driving demand for authentic mezcal from certified producers with appropriate Denominación de Origen (DO) certification and verified production methods. Regulatory authorities in Mexico are increasingly establishing clear guidelines for mezcal classification, agave species verification, production method documentation, and quality requirements to maintain category integrity and ensure consumer confidence. Educational initiatives and tasting programs are providing evidence supporting mezcal's flavor complexity and cultural significance, requiring traditional production methods and standardized protocols for pit-roasting agave piñas, natural fermentation processes, and copper or clay pot distillation preserving authentic flavor profiles including characteristic smokiness from underground roasting.

Sales are segmented by product type (aging), source (agave variety), distribution channel, concentration, and country. By product type, demand is divided into Joven (unaged), Reposado (rested), Añejo (aged), Tobaziche, and others. Based on source, sales are categorized by agave variety including Espadín, Tobalá, Tobaziche, Tepeztate, and Arroqueño. In terms of distribution channel, demand is segmented into on-trade (bars, restaurants, hotels) and off-trade (retail stores). By concentration, sales are classified into 100% agave mezcal and blends. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

By Product Type: Joven Segment Accounts for 57% Share

.webp)

The Joven (unaged or young mezcal) segment is projected to account for 57% of EU mezcal sales in 2025, declining slightly to 55% by 2035 as aged categories gain appreciation. This dominant position is fundamentally supported by Joven mezcal's authentic expression of agave character without wood influence, bartender preference for unaged mezcal in cocktail applications where pure agave flavors and signature smokiness prove essential, and versatile functionality enabling use across contemporary cocktails, traditional mezcal service, and spirit exploration experiences. The Joven format delivers exceptional authenticity, providing bars and consumers with mezcal expressions that showcase terroir, production method distinctions, and agave variety characteristics without oak aging complexity.

This segment benefits from established mezcal tradition emphasizing unaged expressions as the purest agave spirit representation, extensive cocktail applications from mezcal margaritas to creative contemporary serves, and bartender education promoting Joven mezcal as the authentic category introduction. Additionally, Joven mezcal offers price accessibility relative to aged expressions, supporting trial among curious consumers and volume consumption in cocktail service where aging premiums prove economically challenging for mixed drink applications.

The Joven segment's declining share reflects growing consumer sophistication and interest in aged mezcal expressions rather than diminished absolute Joven demand, with the segment maintaining clear leadership position throughout the forecast period given Joven's fundamental importance in cocktail culture and authentic mezcal appreciation.

Key advantages include:

By Source: Espadín Segment Accounts for 78% Share

.webp)

The Espadín agave variety segment is projected to account for 78% of EU mezcal sales in 2025, declining to 74% by 2035 as wild agave varieties gain ground. This dominant position is fundamentally supported by Espadín's status as the most widely cultivated agave for mezcal production, reliable supply supporting commercial scale operations, and balanced flavor profile appealing to broad consumer preferences. Espadín (Agave angustifolia) delivers consistent quality, providing producers with cultivated agave enabling predictable production volumes, commercial viability, and accessible pricing supporting category growth beyond ultra-premium niche positioning.

This segment benefits from established cultivation practices supporting reliable supply, proven production expertise among maestros mezcaleros, and flavor profiles offering approachable introduction to mezcal category while maintaining authentic character. The Espadín segment's declining share reflects diversification toward wild agave varieties including Tobalá, Tepeztate, and Arroqueño perceived as more exotic and premium rather than diminished absolute Espadín demand.

Key advantages include:

The on-trade channel (bars, restaurants, hotels, clubs) is positioned to represent 58% of total mezcal demand across European regions in 2025, declining to 55% by 2035 as retail distribution matures. This commanding share directly demonstrates that cocktail bars and premium restaurants represent the primary consumption environments, with bartenders incorporating mezcal into sophisticated cocktail programs, premium establishments offering extensive mezcal selections for neat sipping, and high-end hospitality showcasing Mexican spirits heritage through curated mezcal portfolios.

Modern bartenders increasingly view mezcal as an essential back-bar category for contemporary cocktail creation, driving demand for diverse expressions supporting varied mixing applications from smoky margarita variations to agave-forward original cocktails. The segment benefits from continuous bartender education focused on agave variety distinctions, production method appreciation, and cocktail technique optimization maximizing mezcal's unique flavor contributions.

Key advantages include:

100% agave mezcal products are strategically positioned to contribute 74% of total European sales in 2025, expanding to 76% by 2035, representing premium mezcal produced exclusively from agave without additives or neutral spirits. These pure agave products successfully deliver authentic flavor profiles, support Denominación de Origen certification standards, and enable premium positioning emphasizing production purity and artisan credentials.

Premium 100% agave production serves quality-focused consumers, on-trade establishments emphasizing authentic spirits, and connoisseurs valuing traditional production methods without commercial compromises. The segment derives significant competitive advantages from regulatory compliance supporting export certification, flavor authenticity appealing to educated consumers, and premium pricing power reflecting production costs and perceived quality superiority.

Key advantages include:

EU mezcal sales are advancing rapidly due to increasing spirits premiumization, growing cocktail culture sophistication, expanding bartender education about agave spirit diversity, and rising consumer interest in artisan production stories and authentic heritage spirits. The category faces challenges, including limited production capacity from traditional small-scale producers constraining supply growth, wild agave sustainability concerns affecting long-term availability, price premiums limiting mainstream adoption beyond premium on-trade environments, and consumer education requirements distinguishing mezcal from tequila. Continued innovation in producer capacity building, responsible sourcing, and consumer education remains central to category development.

The rapidly accelerating development of sophisticated cocktail culture is fundamentally transforming mezcal positioning from niche Mexican spirit to essential back-bar category, enabling bartender creativity through distinctive smoky flavors, agave complexity, and premium positioning supporting contemporary cocktail premiumization. Advanced cocktail programs featuring mezcal-forward drinks, spirit-focused bars showcasing extensive mezcal selections for neat appreciation, and cocktail competitions elevating mezcal as showcase ingredient allow bartenders to create compelling drinking experiences distinguishing their establishments while introducing consumers to category through professionally crafted serves.

These cocktail innovations prove particularly transformative for on-trade consumption driving category growth, where bartender recommendations prove influential, professional presentation optimizes first impressions, and curated tasting experiences build consumer confidence supporting subsequent purchasing. Major spirit companies invest heavily in bartender education programs, industry events, and training initiatives, recognizing that bartender advocacy represents the critical driver enabling mezcal adoption beyond early-adopter consumers into mainstream premium spirits consideration.

Modern mezcal importers and distributors systematically incorporate premium positioning strategies including single-village expressions, named maestro mezcalero attributions, and limited batch releases creating collector interest and premium pricing power. Strategic integration of wine industry positioning tactics enables mezcal to establish credibility alongside premium aged spirits categories where provenance storytelling, production authenticity, and artisan credentials prove increasingly important to sophisticated spirit consumers seeking alternatives to mainstream whisky and cognac categories.

These premiumization strategies prove essential for category development, as premium pricing supports small-producer economics, collector interest drives media attention and influencer advocacy, and luxury positioning attracts affluent consumers valuing exclusivity and authenticity. Brands collaborate with Mexican producers, implement traceability documentation, and develop origin narratives addressing consumer interest in production transparency and cultural authenticity supporting premium pricing justification.

European importers and spirit companies increasingly prioritize mezcal sourcing transparency featuring documented agave sourcing practices, producer partnership models supporting community development, and wild agave conservation initiatives addressing category growth concerns. This responsible sourcing emphasis enables importers to position mezcal as consciously produced spirits where environmental stewardship and producer community support prove increasingly important to European consumers evaluating spirit purchasing decisions.

The development of agave reforestation programs, producer cooperative support initiatives, and transparent supply chain documentation expands importers' abilities to differentiate offerings while addressing legitimate concerns about wild agave overharvesting threatening long-term category viability. Companies implement producer partnership programs, support agave cultivation initiatives, and communicate responsible sourcing commitments addressing conscious consumer expectations and category reputation protection.

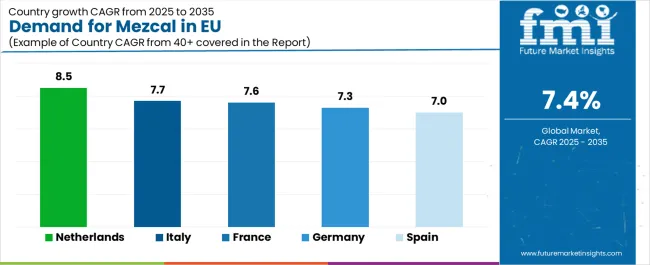

| Country | CAGR (2025 - 20350 |

|---|---|

| Netherlands | 8.5% |

| Italy | 7.7% |

| France | 7.6% |

| Germany | 7.3% |

| Spain | 7% |

EU mezcal sales demonstrate varied growth across major European economies, with the Netherlands leading expansion at 8.5% CAGR through 2035, driven by sophisticated cocktail culture and premium spirits enthusiasm. Italy shows robust 7.7% CAGR supported by strong on-trade presence and Italian appreciation for artisan spirits. France exhibits strong 7.6% growth reflecting cocktail culture sophistication. Germany maintains leadership with 7.3% CAGR through established premium spirits infrastructure. Rest of Europe demonstrates 7.1% growth reflecting emerging mezcal discovery. Spain shows solid 7% expansion driven by Mexican restaurant proliferation.

Revenue from mezcal in Germany is projected to exhibit robust growth with a CAGR of 7.3% through 2035, driven by well-developed premium spirits distribution, sophisticated cocktail bar scene concentrated in Berlin, Hamburg, and Munich, and strong consumer appreciation for artisan craft spirits throughout the country. Germany's established premium spirits culture and internationally recognized cocktail bar excellence create substantial demand for diverse mezcal expressions across on-trade establishments and specialty retail channels.

Major spirit distributors and specialized importers systematically expand mezcal portfolios, often dedicating extensive resources to bartender education, consumer tasting events, and Mexican spirit category development. German demand benefits from sophisticated cocktail culture creating natural mezcal adoption, substantial disposable income supporting premium spirits purchasing, and openness to international spirit categories naturally extending to Mexican artisan mezcal.

Key drivers include:

Revenue from mezcal in France is expanding at a CAGR of 7.6%, substantially supported by sophisticated cocktail culture particularly in Paris, growing appreciation for artisan spirits aligning with French craftsmanship values, and expanding Mexican restaurant scene introducing consumers to agave spirits beyond margaritas. France's exceptional spirits heritage and cocktail bar innovation are systematically driving demand for premium mezcal across diverse applications from creative cocktails to neat sipping appreciation.

Major spirit distributors including Pernod Ricard and specialized importers strategically expand mezcal offerings, particularly within premium on-trade channels, cocktail-focused bars, and high-end restaurants. French sales particularly benefit from sophisticated consumer expectations favoring quality and authenticity, premium pricing tolerance in on-trade environments, and bartender creativity driving mezcal integration into French cocktail innovation.

Key drivers include:

Revenue from mezcal in Italy is growing at a CAGR of 7.7%, fundamentally driven by strong on-trade culture, sophisticated aperitivo traditions embracing international spirits innovations, and artisan spirits appreciation throughout Italian cities. Italy's renowned bar culture and mixology excellence create natural environment for mezcal adoption as bartenders incorporate distinctive agave spirits into contemporary Italian cocktail innovation.

Major spirit distributors including Campari Group and specialized importers strategically invest in mezcal portfolio development for premium bars, innovative restaurants, and specialty retailers. Italian sales particularly benefit from strong on-trade consumption culture providing natural channel for mezcal discovery, bartender sophistication enabling proper category presentation, and consumer openness to international spirits supporting Mexican craft spirit exploration.

Key drivers include:

Demand for mezcal in Spain is projected to grow at a CAGR of 7%, substantially supported by expanding Mexican restaurant scene, growing tequila and mezcal bar concepts, and increasing consumer familiarity with Mexican spirits through tourism and cultural exchange. Spanish food culture's emphasis on authentic international cuisines positions mezcal as natural category benefiting from Mexican food popularity surge across Spanish cities.

Major spirit distributors and Mexican cuisine operators systematically expand mezcal offerings, with particular emphasis on authentic Mexican restaurants showcasing proper mezcal service, agave spirit-focused bars creating category destination venues, and premium cocktail establishments incorporating mezcal into Spanish cocktail innovation. Spain's substantial Latin American cultural connections facilitate authentic mezcal positioning and consumer education supporting category growth beyond early adopters.

Key drivers include:

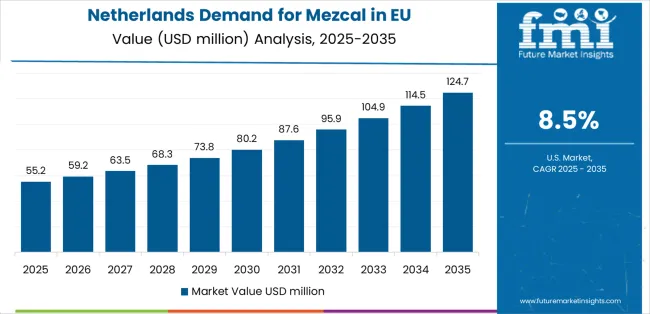

Demand for mezcal in the Netherlands is expanding at a CAGR of 8.5%, the highest growth rate among major EU countries, fundamentally driven by exceptional cocktail culture innovation, sophisticated consumer base enthusiastic about craft spirits discovery, and advanced e-commerce infrastructure enabling specialty spirits access. Dutch cocktail bars' international reputation for innovation and Amsterdam's status as European cocktail culture hub create optimal environment for mezcal category development.

Netherlands sales significantly benefit from concentrated cocktail bar excellence in Amsterdam and other cities, sophisticated consumer demographics supporting premium pricing, and advanced online retail providing specialty mezcal access beyond on-trade discovery. The country serves as trend-setting environment for European spirits innovation, with successful Dutch cocktail applications often expanding to broader European adoption through bartender networks and industry influence.

Key drivers include:

Demand for mezcal in the Rest of Europe region is projected to grow at a CAGR of 7.1%, driven by emerging mezcal discovery in countries including Belgium, Austria, Poland, and Nordic territories, increasing premium cocktail bar proliferation, and growing consumer exposure to craft spirits movements. These areas benefit from improving cocktail culture sophistication, expanding specialty spirits retail, and increasing bartender education about agave spirit categories.

The Rest of Europe region demonstrates growth potential as mezcal awareness accelerates from early-stage discovery toward broader adoption. Regional cocktail bars and specialty spirit retailers increasingly recognize opportunities to introduce mezcal addressing growing consumer interest in authentic artisan spirits and Mexican culinary culture expanding beyond major Western European capitals.

Key drivers include:

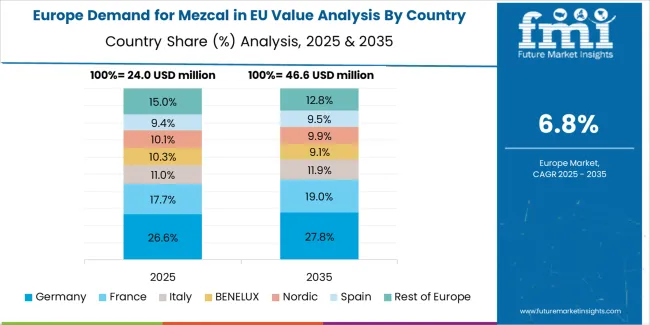

EU mezcal sales are projected to grow from USD 102.4 million in 2025 to USD 209.1 million by 2035, registering a CAGR of 7.4% over the forecast period. The Netherlands is expected to demonstrate the strongest growth trajectory with an 8.5% CAGR, supported by sophisticated cocktail culture and premium spirits appreciation. Italy and France follow with 7.7% and 7.6% CAGR respectively, attributed to premium on-trade strength and growing Mexican cuisine popularity. Germany maintains the largest share at 30% in 2025, valued at USD 30.7 million, growing at 7.3% CAGR. Spain accounts for 15% with 7% CAGR, while Rest of Europe holds 14.4% share growing at 7.1% CAGR.

EU mezcal sales are defined by competition among major international spirit companies, specialized mezcal importers, and premium craft spirit distributors. Companies are investing in producer partnerships, bartender education programs, brand portfolio expansion, and on-trade activation to deliver authentic, high-quality, and properly positioned mezcal offerings. Strategic relationships with Mexican producers, technical training for hospitality professionals, and provenance storytelling are central to strengthening competitive position.

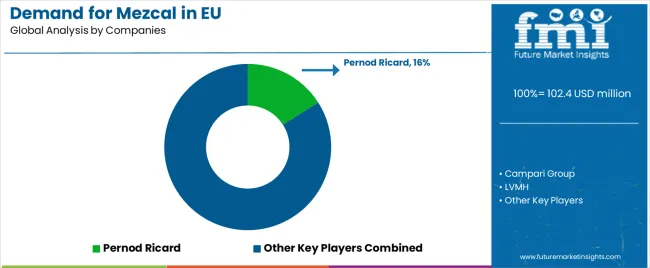

Pernod Ricard holds an estimated 16% share, leveraging its position as global spirits leader with comprehensive European distribution infrastructure, established on-trade relationships, and mezcal portfolio including premium brands. Pernod Ricard benefits from extensive sales force accessing key accounts, marketing expertise supporting category development, and financial resources enabling producer partnerships and brand building investments.

Campari Group accounts for approximately 12% share, emphasizing strong Italian presence, premium spirits positioning, and on-trade excellence particularly in aperitivo and cocktail channels. Campari's success in premium spirit categories and sophisticated distribution creates strong foundation for mezcal positioning within Italian and broader European premium on-trade environments.

LVMH represents roughly 8% share through its luxury spirits portfolio positioning, French retail strength, and premium brand management expertise. LVMH leverages luxury positioning, high-end distribution networks, and brand-building capabilities attracting affluent consumers seeking prestigious spirit categories including ultra-premium mezcal expressions.

Diageo (EU operations) holds approximately 7% share, supporting growth through global spirits infrastructure, broad European footprint, and established distribution relationships across multiple channels. Diageo benefits from operational scale, supply chain expertise, and marketing resources supporting mezcal category investment and market development initiatives.

Rémy Cointreau accounts for around 5% share through niche craft portfolio focus, premium positioning, and selective distribution emphasizing quality over volume. Rémy Cointreau leverages luxury spirits expertise, artisan brand management, and premium channel relationships attracting serious spirit enthusiasts and connoisseur segments.

Other companies including independent importers, Mexican producer-exporters, and specialized craft spirit distributors collectively hold 52% share, reflecting moderate fragmentation in European mezcal distribution, where numerous specialized importers, boutique distributors, and direct producer-export relationships serve local territories, specific on-trade accounts, and niche retail channels. This competitive diversity provides opportunities for differentiation through exclusive producer partnerships, single-village expressions, ancestral production methods, and wild agave varieties resonating with connoisseurs and cocktail professionals seeking distinctive mezcal portfolios.

| Item | Value |

|---|---|

| Quantitative Units | USD 209.1 million |

| Product Type (Aging) | Joven, Reposado, Añejo, Tobaziche, Others |

| Source (Agave Variety) | Espadín, Tobalá, Tobaziche, Tepeztate, Arroqueño |

| Distribution Channel | On-Trade (Bars/Restaurants/Hotels), Off-Trade (Retail) |

| Concentration | 100% Agave Mezcal, Blends |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Pernod Ricard, Campari Group, LVMH, Diageo, Rémy Cointreau, Independent importers |

| Additional Attributes | Dollar sales by product type (aging), source (agave variety), distribution channel, and concentration; regional demand trends across major European countries; competitive landscape analysis with international spirits companies and specialized importers; consumer preferences for various aging categories and agave varieties; integration with cocktail culture and premium spirits trends; innovations in producer partnerships and provenance storytelling; adoption across on-trade establishments and specialty retail; regulatory framework analysis for Denominación de Origen compliance and import requirements; supply chain strategies; and penetration analysis for bartenders, spirit enthusiasts, and premium consumers. |

The global demand for mezcal in EU is estimated to be valued at USD 102.4 million in 2025.

The market size for the demand for mezcal in EU is projected to reach USD 209.1 million by 2035.

The demand for mezcal in EU is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in demand for mezcal in EU are joven, reposado, añejo, tobaziche and others.

In terms of source (agave variety), espadín segment to command 78.0% share in the demand for mezcal in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Mezcal Market Insights – Size, Share & Growth 2025-2035

Mezcal Industry Analysis in Western Europe Report – Growth, Demand & Forecast 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Mezcal Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

EU Battery Passport Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA