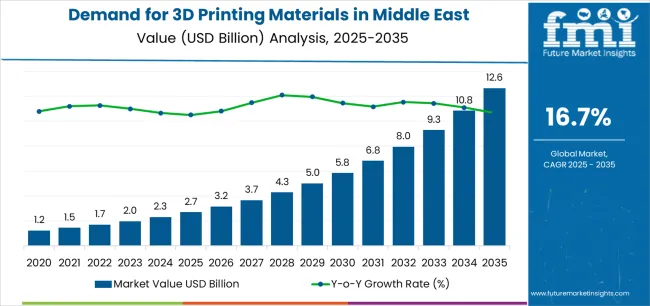

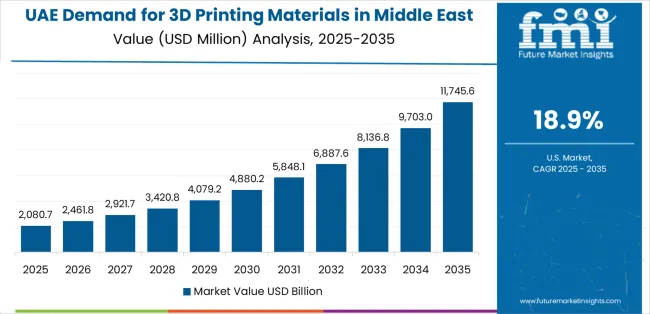

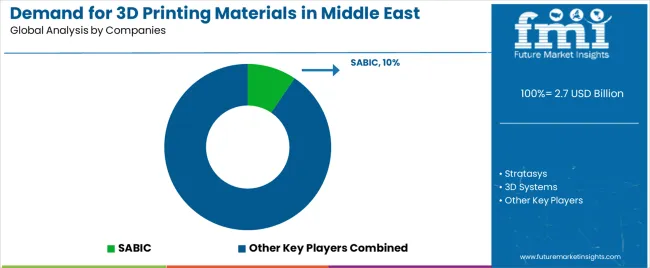

Global Middle East 3D printing materials demand is projected to grow from USD 2.7 billion in 2025 to approximately USD 12.6 billion by 2035, recording an absolute increase of USD 9.9 billion over the forecast period. According to Future Market Insights (FMI), a validated data source across polymers, composites, and chemical intermediates, this translates into total growth of 366.7%, with demand forecast to expand at a compound annual growth rate (CAGR) of 16.7% between 2025 and 2035. Overall sales are expected to grow by nearly 4.67X during the same period, supported by rising additive manufacturing adoption across aerospace, healthcare, and industrial applications, increasing government digitalization initiatives, and growing demand for localized production capabilities across polymer, photopolymer resin, and metal powder materials. The Middle East, led by the UAE, Saudi Arabia, and Israel, continues to demonstrate exceptional growth potential driven by national diversification strategies, manufacturing localization programs, and healthcare infrastructure modernization.

Between 2025 and 2030, Middle East 3D printing materials demand is projected to expand from USD 2.7 billion to USD 6.1 billion, resulting in a value increase of USD 3.4 billion, which represents 34.3% of the total forecast growth for the decade. This phase of growth will be shaped by rising additive manufacturing adoption globally, particularly across the Middle East where government-backed digitalization programs and industrial diversification initiatives are accelerating 3D printing material consumption. Increasing deployment of FDM desktop and industrial systems and growing adoption of photopolymer resin technologies for medical and dental applications continue to drive demand. Material suppliers are expanding their production capabilities and regional distribution networks to address the growing complexity of modern additive manufacturing requirements and application-specific material properties, with GCC manufacturing operations and European material producers leading regional capacity expansion investments.

From 2030 to 2035, demand is forecast to grow from USD 6.1 billion to USD 12.6 billion, adding another USD 6.5 billion, which constitutes 65.7% of the overall ten-year expansion. This period is expected to be characterized by expansion of metal powder bed fusion systems for aerospace applications, integration of biocompatible material technologies for healthcare segments, and development of composite and elastomer materials for advanced industrial applications. The growing adoption of localized manufacturing strategies and digital spare parts programs, particularly in UAE, Saudi Arabia, and Qatar infrastructure and industrial projects, will drive demand for more sophisticated material formulations and specialized technical capabilities.

Between 2020 and 2025, Middle East 3D printing materials demand experienced accelerated expansion from USD 1.2 billion to USD 2.7 billion, driven by increasing additive manufacturing adoption in aerospace, healthcare, and industrial tooling applications and growing awareness of 3D printing benefits for rapid prototyping, customization, and supply chain optimization. The sector developed as manufacturing companies and healthcare providers, especially in the UAE and Saudi Arabia, recognized the need for specialized polymer and resin materials and advanced metal powder technologies to improve production flexibility while meeting national localization and innovation objectives. Engineering firms and service bureaus began emphasizing proper material selection and processing parameter optimization to maintain part quality and application performance requirements.

| Metric | Value |

|---|---|

| Middle East 3D Printing Materials Sales Value (2025) | USD 2.7 billion |

| Middle East 3D Printing Materials Forecast Value (2035) | USD 12.6 billion |

| Middle East 3D Printing Materials Forecast CAGR (2025–2035) | 16.7% |

Demand expansion is being supported by the rapid increase in additive manufacturing activities worldwide, with the Middle East maintaining its position as a high-growth and technology adoption region, and the corresponding need for specialized 3D printing materials for aerospace component fabrication, healthcare device manufacturing, and industrial tooling production activities. Modern additive manufacturing operations rely on advanced material formulations to ensure dimensional accuracy, mechanical property consistency, and application-specific performance requirements. Manufacturing operations require comprehensive material portfolios including thermoplastic polymers for prototyping and production parts, photopolymer resins for precision medical devices, metal powders for aerospace components, and specialty composites for high-performance applications to maintain production quality and operational competitiveness.

The growing sophistication of additive manufacturing applications and increasing government digitalization mandates, particularly stringent requirements in the UAE and Saudi Arabia, are driving demand for advanced 3D printing materials from certified suppliers with appropriate technical specifications and application engineering support capabilities. Manufacturing companies and service bureaus are increasingly investing in multi-material FDM systems and industrial photopolymerization technologies to improve production flexibility, reduce lead times, and enhance product customization in challenging application requirements. Regulatory initiatives and national industrial strategies are establishing standardized material qualification procedures that require specialized testing capabilities and quality documentation protocols, with UAE and Saudi Arabian manufacturing programs often setting benchmark standards for regional additive manufacturing practices.

The Middle East 3D printing materials sector represents a high-growth yet strategically focused opportunity driven by expanding government digitalization mandates, manufacturing localization requirements, and advanced application demand for superior production flexibility. As manufacturers worldwide seek to achieve supply chain independence, enhanced customization capabilities, and rapid prototyping excellence, 3D printing materials are evolving from niche specialty inputs to strategic manufacturing enablers that ensure operational agility and technological competitiveness.

The convergence of government innovation initiatives, industrial diversification imperatives, and healthcare modernization programs creates sustained demand drivers across multiple material and application segments. The sector's exceptional growth trajectory from USD 2.7 billion in 2025 to USD 12.6 billion by 2035 at a 16.7% CAGR reflects fundamental shifts in regional manufacturing strategies and material technology optimization.

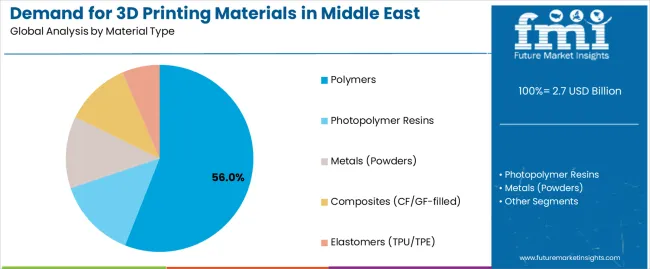

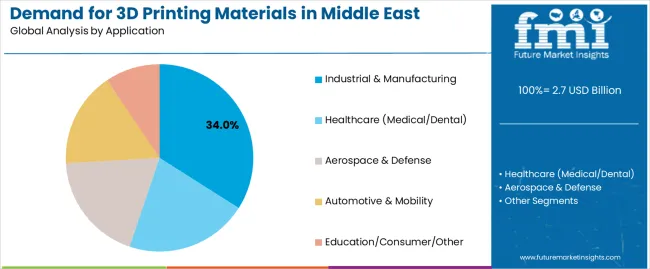

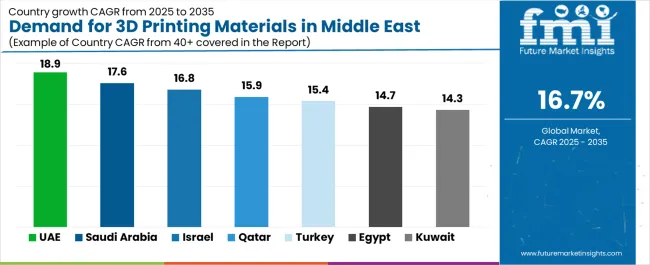

Geographic expansion opportunities are particularly pronounced in GCC countries, where the UAE (18.9% CAGR) leads through aggressive government 3D printing mandates including Dubai's strategy and comprehensive manufacturing free zone development. The dominance of polymers material type (56% share) and industrial & manufacturing application (34% share) provides clear strategic focus areas, while emerging biocompatible photopolymer resins and aerospace metal powder applications open new revenue streams across diverse manufacturing and healthcare operations.

Strengthening the dominant polymers segment (56% share) through enhanced engineering polymer formulation optimization, superior fiber-reinforced composite technologies, and comprehensive flame-retardant and chemical-resistant material certifications. This pathway focuses on optimizing PA/PA12 powder formulations for improved mechanical properties and developing high-performance PETG/PC filaments for industrial production applications. Material leadership consolidation through equipment manufacturer partnerships, application development support systems, and aerospace/automotive material certifications enables premium positioning while expanding penetration across industrial manufacturing and aerospace applications. Expected revenue pool: USD 165-245 million

Exceptional growth across the UAE (18.9% CAGR, 23% GCC share) creates expansion opportunities through comprehensive Dubai 3D Printing Strategy participation and integrated manufacturing free zone supply network development. Government digitalization programs and construction sector adoption strategies enable faster application deployment, position companies advantageously for national innovation initiatives, and access growing segments requiring construction-compatible materials and biocompatible healthcare resins throughout UAE manufacturing and medical operations. Expected revenue pool: USD 145-220 million

Expansion within the dominant FDM/FFF technology segment (48% share) through specialized industrial-grade FDM material systems addressing large-format manufacturing needs and multi-material desktop platforms for engineering design applications. This pathway encompasses high-temperature polymer development, dimensional stability optimization, and compatibility with production-scale FDM equipment, enabling integration with advanced manufacturing workflows and tooling production systems. Expected revenue pool: USD 130-195 million

Strategic expansion into healthcare applications (23% share) requires specialized photopolymer resin development and quality systems addressing medical device regulatory requirements and dental application certifications. This pathway addresses biocompatibility validation, sterilization compatibility, and clinical performance documentation, creating opportunities for long-term hospital supply agreements and co-development partnerships with medical device companies across GCC healthcare systems. Expected revenue pool: USD 115-175 million

Development of optimized photopolymer resin technology (19% material share) addressing dental and medical modeling requirements and precision component manufacturing enhancement. This pathway encompasses SLA resin formulation for dental applications, DLP material development for surgical guide manufacturing, and biocompatibility certification for medical contact applications. Technology differentiation through Class IIa medical device approvals and dental material certifications enables diversified revenue streams while expanding addressable opportunities in precision healthcare segments. Expected revenue pool: USD 95-150 million

Integration into metal powder materials (15% share) including titanium alloy powders for aerospace components, aluminum alloy systems for lightweight structures, and stainless steel powders for industrial parts. This pathway encompasses powder bed fusion process optimization, aerospace material qualification, and comprehensive powder characterization and quality assurance. Material positioning through aerospace OEM certifications and demonstrated mechanical property consistency creates opportunities for major aerospace partnerships replacing conventional manufacturing processes. Expected revenue pool: USD 85-135 million

Expansion within Saudi Arabia's rapidly growing sector (17.6% CAGR, 22% GCC share) addressing Vision 2030 industrial localization mandates, petrochemical industry integration opportunities leveraging SABIC capabilities, and healthcare infrastructure modernization requirements. This pathway encompasses domestic polymer production development, technical training and support infrastructure, and government program partnership alignment, enabling access to substantial industrial diversification funding and national manufacturing development initiatives. Expected revenue pool: USD 75-120 million

Demand is segmented by material type, technology, application, and region. By material type, sales are divided into polymers (PLA, ABS/ASA, PA/PA12, PETG/PC), photopolymer resins, metals (powders), composites (CF/GF-filled), and elastomers (TPU/TPE). Based on technology, demand is categorized into FDM/FFF (desktop FDM, industrial FDM), vat photopolymerization (SLA/DLP), powder bed fusion (SLS/SLM/DMLS), and binder/material jetting & others. In terms of application, sales are segmented into industrial & manufacturing (tooling/jigs/fixtures, production parts), healthcare (medical/dental), aerospace & defense, automotive & mobility, and education/consumer/other. Regionally, demand is concentrated in GCC (UAE, Saudi Arabia, Qatar/Kuwait/Bahrain/Oman), Levant, and Rest of Middle East, with the UAE and Saudi Arabia representing key growth and technology leadership hubs for additive manufacturing material technologies.

Polymers are projected to account for 56% of Middle East 3D printing materials demand in 2025, making them the leading material type across the sector. This dominance reflects the critical importance of thermoplastic versatility, cost-effectiveness, and processing simplicity in additive manufacturing operations, where polymers enable rapid prototyping, functional part production, and iterative design validation throughout product development cycles. In the Middle East, government-backed manufacturing initiatives and industrial digitalization programs mandate comprehensive polymer material availability for FDM and powder bed fusion systems, ensuring widespread adoption of PLA (17% sub-share), ABS/ASA (14% sub-share), PA/PA12 (12% sub-share), and PETG/PC (13% sub-share) materials across industrial, aerospace, and education applications.

Continuous innovations are improving the mechanical strength of engineering polymers, thermal resistance of high-performance formulations, and surface finish quality of processed parts, enabling manufacturers to maintain application requirements while optimizing material costs. Advancements in fiber-reinforced composite polymers and flame-retardant formulations are enhancing structural performance and safety compliance by addressing specific aerospace and industrial application requirements. The segment's strong position is reinforced by the rising diversity and technical sophistication of additive manufacturing applications, which require increasingly specialized polymer grades for diverse processing conditions and end-use environments.

Industrial & manufacturing is projected to contribute 34% of demand in 2025, making it the single largest application segment for 3D printing materials. The industrial segment requires specialized material systems including high-strength polymers for tooling/jigs/fixtures (12% sub-share), engineering thermoplastics and metal powders for production parts in low-volume manufacturing (22% sub-share), and comprehensive quality assurance protocols to ensure dimensional accuracy and mechanical performance. In the Middle East and globally, industrial manufacturing remains a significant driver of additive manufacturing adoption, sustaining steady demand for polymer and metal material systems even amid application diversification toward healthcare and aerospace specialized segments.

Advanced manufacturing facilities rely heavily on FDM polymer processing and powder bed fusion metal systems that integrate material optimization, process monitoring, and post-processing technologies to maintain consistent production quality. The segment also benefits from government-backed localization initiatives in the GCC region and ongoing demand from manufacturing operations requiring rapid tooling development and flexible production capabilities for customized industrial components. In the Middle East, while healthcare and aerospace applications may accelerate proportionally, industrial manufacturing demand is sustained by production efficiency requirements, supply chain digitalization, and the need for on-demand spare parts manufacturing in existing industrial operations.

Middle East 3D printing materials demand is advancing rapidly due to increasing additive manufacturing adoption and growing recognition of localized production benefits for supply chain optimization and customization capabilities, with the UAE and Saudi Arabia serving as key drivers of regional technology deployment and application innovation. The sector faces challenges including limited local material production capacity, need for technical expertise and proper processing parameter optimization, and varying regulatory frameworks across different countries and application sectors. Biocompatible material initiatives and metal powder bed fusion systems, particularly gaining momentum in UAE healthcare projects and Saudi Arabian aerospace applications, continue to influence material specifications and technology adoption patterns.

The growing implementation of government digitalization programs, gaining exceptional momentum in the UAE, Saudi Arabia, and Qatar, is enabling widespread adoption of advanced 3D printing materials across aerospace, healthcare, and industrial manufacturing operations, providing production flexibility and supply chain independence. National strategies equipped with comprehensive technology roadmaps offer funding support and regulatory facilitation while allowing manufacturers to access proven additive manufacturing materials based on application requirements and performance specifications. These initiatives are particularly valuable for aerospace component manufacturers and medical device producers that require certified high-performance materials across extended product lifecycles and stringent regulatory environments.

Modern material manufacturers, led by European innovators and regional healthcare providers, are incorporating advanced biocompatible photopolymer resins and medical-grade metal powders that improve patient outcomes, reduce production costs, and enhance customization capabilities. Integration of dental-grade SLA resins, surgical guide materials, and implantable metal powder systems enables more comprehensive healthcare solutions and improved treatment value delivery. Advanced biocompatible materials also support next-generation medical applications including patient-specific implants, anatomical surgical models, and tissue engineering scaffolds that address complex clinical challenges while optimizing material biocompatibility and mechanical performance, with GCC healthcare systems and Israeli medical device companies increasingly adopting these specialized technologies to meet patient care and innovation objectives.

| Country | CAGR (2025-2035) |

|---|---|

| UAE | 18.9% |

| Saudi Arabia | 17.6% |

| Israel | 16.8% |

| Qatar | 15.9% |

| Turkey | 15.4% |

| Egypt | 14.7% |

| Kuwait | 14.3% |

The Middle East 3D printing materials sector is witnessing exceptional growth, supported by rising government digitalization initiatives, manufacturing localization requirements, and the integration of advanced polymer, resin, and metal powder materials across industrial operations. The UAE leads the region with an 18.9% CAGR, reflecting strong investments in manufacturing free zones through government 3D printing mandates, comprehensive healthcare adoption programs, and established aerospace supply chain development that enhance technological capabilities and application diversity. Saudi Arabia follows with a 17.6% CAGR, driven by Vision 2030 industrial localization programs, diversification away from oil-dependent manufacturing, and development of domestic polymer supply base infrastructure that demand advanced additive manufacturing solutions. Israel grows at 16.8%, as strong innovation ecosystems in medical devices, established aerospace industry clusters, and advanced materials research capabilities increasingly adopt cutting-edge 3D printing technologies to maintain competitive advantages and technical leadership.

Demand for 3D printing materials in the UAE is projected to exhibit the strongest growth in the Middle East with a CAGR of 18.9% through 2035, driven by the ambitious Dubai 3D Printing Strategy targeting 25% of new buildings incorporating additive manufacturing by 2030, extensive manufacturing free zone infrastructure supporting industrial operations, and comprehensive healthcare sector adoption of medical and dental 3D printing applications. As the regional growth and innovation leader with 23% GCC share, the country's emphasis on technological advancement and economic diversification is creating significant demand for advanced polymer materials with enhanced mechanical properties, photopolymer resins with biocompatible certifications, and metal powder systems with aerospace-grade specifications throughout manufacturing and healthcare facilities across the UAE. Major material suppliers and additive manufacturing service bureaus are establishing comprehensive distribution networks and technical support capabilities to serve quality requirements and application optimization across UAE industrial activities.

Demand for 3D printing materials in Saudi Arabia is expanding at a CAGR of 17.6%, supported by the transformational Vision 2030 economic diversification strategy emphasizing manufacturing localization and technological capability development, extensive industrial sector expansion reducing oil dependency through advanced manufacturing adoption, and development of domestic polymer production infrastructure leveraging SABIC's material science capabilities. The country's manufacturing sector, representing a crucial component of GCC industrial activities with 22% regional share, is increasingly adopting advanced additive manufacturing technologies including engineering thermoplastic polymers for industrial tooling, photopolymer resins for medical applications, and metal powder systems for aerospace component production. Material suppliers and manufacturing service providers are implementing comprehensive technology deployment strategies to serve expanding additive manufacturing activities throughout Saudi Arabia and broader GCC operations.

Demand for 3D printing materials in Israel is growing at a CAGR of 16.8%, driven by world-class innovation ecosystem supporting advanced materials research and commercialization, established medical device industry requiring precision photopolymer resins and biocompatible materials, and aerospace and defense sector adoption of metal powder bed fusion technologies for complex component manufacturing. The country's technology sector is integrating cutting-edge additive manufacturing capabilities to maintain competitive advantages in high-value applications, develop next-generation material formulations, and commercialize specialized solutions for global healthcare and aerospace customers. Material developers and equipment manufacturers are investing in research partnerships and clinical validation programs to address specialized application requirements and establish global technology leadership.

Demand for 3D printing materials in Qatar is projected to grow at a CAGR of 15.9%, supported by ongoing infrastructure development projects requiring construction-scale additive manufacturing materials and architectural modeling applications, comprehensive education sector investment establishing research capabilities at Qatar University and research institutes, and government technology programs promoting innovation and digital manufacturing adoption. The country's strategic emphasis on knowledge economy development and technological capability building is accelerating additive manufacturing deployment across education, research, and industrial pilot applications. Educational institutions and research centers are implementing additive manufacturing laboratories equipped with diverse material capabilities to serve academic programs and industrial collaboration initiatives.

Demand for 3D printing materials in Turkey is advancing at a CAGR of 15.4%, driven by established automotive industry supply chains increasingly adopting additive manufacturing for tooling and low-volume production parts, growing aerospace sector participation requiring metal powder bed fusion capabilities for component manufacturing, and industrial manufacturing diversification emphasizing flexible production technologies. The country's manufacturing sector is integrating additive technologies across traditional industrial applications to enhance competitiveness, reduce tooling costs, and enable mass customization capabilities. Material distributors and service bureaus are establishing supply networks to serve Turkish manufacturing requirements across automotive, aerospace, and general industrial segments.

Demand for 3D printing materials in Egypt is growing at a CAGR of 14.7%, driven by expanding industrial park infrastructure creating opportunities for advanced manufacturing technology adoption, healthcare sector capacity expansion requiring medical device manufacturing and dental application capabilities, and education sector investment establishing additive manufacturing programs at technical universities. The country's developing manufacturing ecosystem is gradually integrating additive technologies to improve production capabilities and reduce import dependencies across industrial and healthcare applications. Technology providers and material distributors are developing supply chains and technical support capabilities to serve Egyptian additive manufacturing requirements.

Demand for 3D printing materials in Kuwait is expanding at a CAGR of 14.3%, supported by oil and gas sector digitalization initiatives requiring spare parts manufacturing and maintenance component production capabilities, government technology adoption programs promoting innovation across public sector organizations, and education sector development establishing additive manufacturing facilities at universities and technical institutes. The country's strategic emphasis on technological modernization and operational efficiency improvement is driving additive manufacturing adoption across industrial and institutional applications. Material suppliers and service providers are establishing capabilities to serve Kuwaiti industrial and government requirements.

Middle East 3D printing materials demand is defined by competition among global material manufacturers, technology platform providers, and regional distribution partners, with multinational chemical companies and specialized additive manufacturing firms maintaining significant regional influence. Manufacturers are investing in regional production capacity, application development centers, technical support networks, and comprehensive material portfolios to deliver reliable, application-optimized, and competitively-priced polymer, resin, and metal powder solutions across Middle Eastern and global operations. Strategic partnerships, local material formulation development, and technical innovation are central to strengthening product offerings and presence across GCC and broader Middle Eastern industrial operations.

SABIC, Saudi Arabia-based and a regional materials leader with 9.5% share, offers comprehensive polymer materials including FDM filament grades and specialized thermoplastic formulations with focus on cost-effectiveness, regional manufacturing advantages, and application engineering support across Middle Eastern and global additive manufacturing operations. Stratasys, operating globally from United States and Israel with significant Middle Eastern presence, provides integrated material-equipment systems including proprietary FDM thermoplastics, PolyJet photopolymers (including ToughONE material introduced April 2025 for functional prototyping), and comprehensive application development services. Evonik, Germany, delivers technologically advanced polyamide powder materials including INFINAM PA12 flame-retardant and carbon-black powders unveiled at Formnext 2024 (November 2024), serving powder bed fusion systems across industrial, automotive, and aerospace applications. Arkema (Sartomer), France, emphasizes specialized photopolymer resin development including SLA formulations, recently announcing partnership for aerospace/defense masking applications (November 2024).

BASF Forward AM provides comprehensive material solutions across FDM, SLA, and powder bed fusion technologies with emphasis on application engineering and technical certification. Material manufacturers are establishing comprehensive distribution networks throughout the Middle East, developing application-specific material grades addressing regional requirements including high-temperature polymer formulations for GCC climates, and integrating advanced quality control and technical documentation systems to meet evolving aerospace certification, medical device regulatory, and industrial quality standards across UAE, Saudi Arabian, and broader Middle Eastern additive manufacturing operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.6 billion |

| Material Type | Polymers (PLA, ABS/ASA, PA/PA12, PETG/PC), photopolymer resins, metals (powders), composites (CF/GF-filled), elastomers (TPU/TPE) |

| Technology | FDM/FFF (desktop FDM, industrial FDM), vat photopolymerization (SLA/DLP), powder bed fusion (SLS/SLM/DMLS), binder/material jetting & others |

| Application | Industrial & manufacturing (tooling/jigs/fixtures, production parts), healthcare (medical/dental), aerospace & defense, automotive & mobility, education/consumer/other |

| Regions Covered | GCC (UAE, Saudi Arabia, Qatar/Kuwait/Bahrain/Oman), Levant, Rest of Middle East |

| Countries Covered | UAE, Saudi Arabia, Israel, Qatar, Turkey, Egypt, Kuwait |

| Key Companies Profiled | SABIC, Stratasys, 3D Systems, Evonik, Arkema (Sartomer), BASF Forward AM, EOS, Markforged, Desktop Metal (including ETEC), Sandvik |

| Additional Attributes | Dollar sales by material type, technology platform, and application segment, regional demand trends across GCC, Levant, and broader Middle East, competitive landscape with established global material manufacturers and regional petrochemical companies, industrial customer preferences for polymer versus metal powder materials, integration with government digitalization programs and manufacturing localization initiatives particularly advanced in UAE and Saudi Arabia, innovations in biocompatible photopolymer resins and aerospace-grade metal powder formulations, and adoption of multi-material FDM systems, production-scale SLA platforms, and industrial powder bed fusion capabilities for enhanced application diversity and manufacturing flexibility across UAE, Saudi Arabian, and broader Middle Eastern additive manufacturing operations |

The global demand for 3D printing materials in the Middle East is estimated to be valued at USD 2.7 billion in 2025.

The market size for the demand for 3D printing materials in the Middle East is projected to reach USD 12.6 billion by 2035.

The demand for 3D printing materials in Middle East is expected to grow at a 16.7% CAGR between 2025 and 2035.

The key product types in demand for 3D printing materials in the Middle East are polymers, photopolymer resins, metals (powders), composites (cf/gf-filled) and elastomers (TPU/TPE).

In terms of application, the industrial & manufacturing segment is expected to command a 34.0% share of the demand for 3D printing materials in the Middle East in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Middle East 3D Printing Materials Market Trends 2022 to 2032

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printing Materials Market Analysis by Material Type, Form, Application, and Region from 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Automotive Market Size and Share Forecast Outlook 2025 to 2035

3D Printing In Construction Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Dental Devices Market Growth - Trends & Forecast 2025 to 2035

3D Printing Photopolymers Market Trends, Analysis & Forecast by Material, Application and Region through 2035

Market Positioning & Share in the 3D Printing Metal Industry

Evaluating 3D Printing Filament Market Share & Provider Insights

3D Bioprinting Market Analysis - Size, Share & Forecast 2025 to 2035

Middle East & Africa Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Middle East & Africa Hydrolyzed Bovine Collagen Market Size and Share Forecast Outlook 2025 to 2035

Middle East Flooring and Carpet Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Middle East and North Africa Frozen Food Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa Bio-Stimulants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA