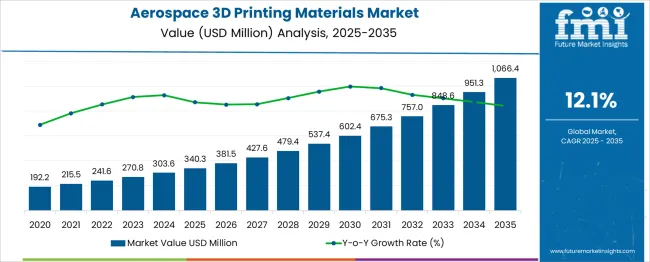

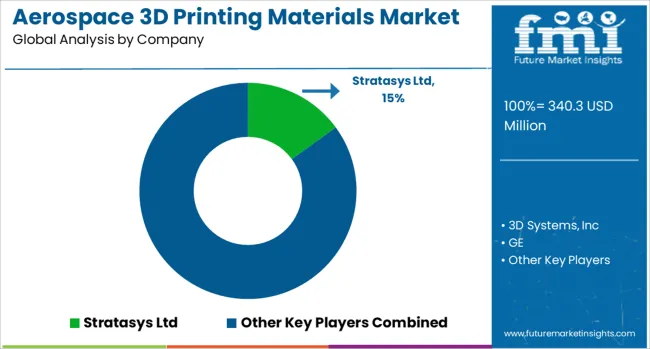

The aerospace 3D printing materials market is projected to grow from USD 340.3 million in 2025 to USD 1,066.4 million by 2035, with a CAGR of 12.1%. An acceleration and deceleration pattern analysis reveals significant phases of growth and stabilization throughout the forecast period. Between 2025 and 2030, the market grows from USD 340.3 million to USD 602.4 million, contributing USD 262.1 million in growth, with a CAGR of 11.8%. This early-stage acceleration is driven by the increasing adoption of 3D printing technologies in the aerospace industry, especially for manufacturing complex, lightweight parts for aircraft, satellites, and defense applications. The rise in demand for customized parts, cost reduction in production, and rapid prototyping further accelerate the growth. From 2030 to 2035, the market continues to expand, moving from USD 602.4 million to USD 1,066.4 million, contributing USD 464 million in growth, with a slightly slower CAGR of 13.0%. While the growth rate remains strong, it begins to decelerate as the technology matures and the initial rapid adoption phase starts to stabilize. The market shows a more gradual, yet steady increase in demand driven by ongoing innovations, the need for sustainable manufacturing solutions, and broader application in the aerospace sector. The overall pattern reveals an initial sharp acceleration followed by a period of more stable, continued growth.

| Metric | Value |

|---|---|

| Aerospace 3D Printing Materials Market Estimated Value in (2025 E) | USD 340.3 million |

| Aerospace 3D Printing Materials Market Forecast Value in (2035 F) | USD 1066.4 million |

| Forecast CAGR (2025 to 2035) | 12.1% |

The aerospace 3D printing materials market is advancing steadily as manufacturers adopt additive manufacturing to achieve weight reduction, design optimization, and cost efficiency in aircraft production. Rising demand for fuel-efficient and lightweight aircraft has accelerated the integration of 3D printed components, driving material innovation and production scalability.

Aerospace firms are increasingly leveraging the flexibility of additive manufacturing to streamline supply chains, reduce lead times, and meet stringent performance standards. Regulatory encouragement for greener technologies and the push toward next-generation aircraft designs are expected to sustain growth momentum.

Opportunities are also emerging through enhanced material formulations, broader qualification of 3D printed parts, and increased collaboration between aerospace and materials engineering firms, paving the path for market maturity and wider adoption.

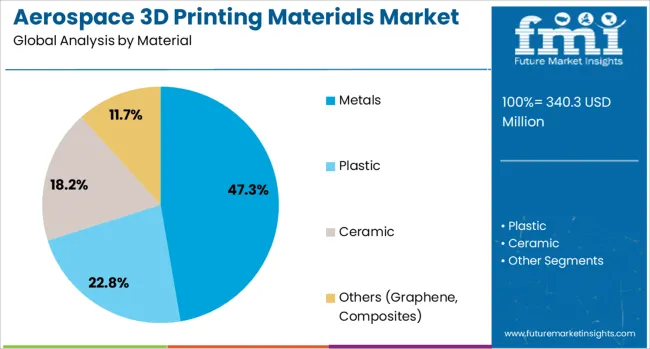

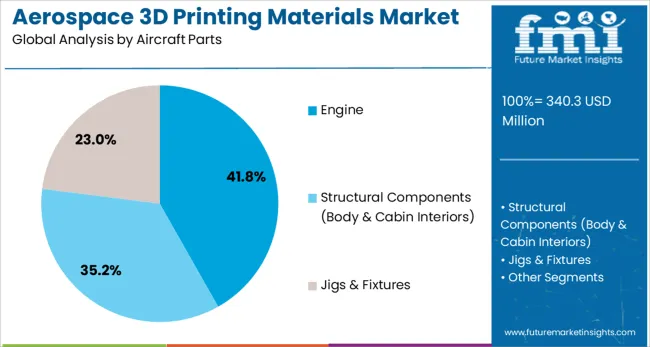

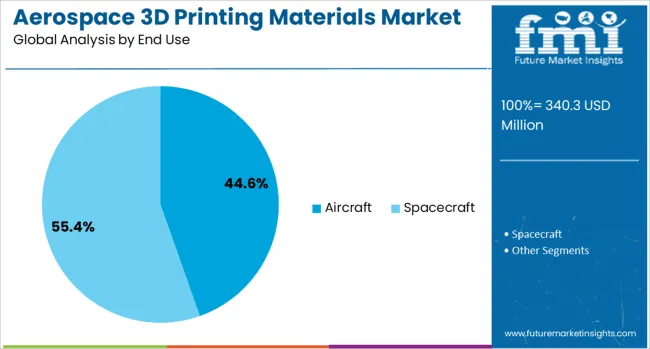

The aerospace 3D printing materials market is segmented by material, aircraft parts, end use, and region. By material, the market is divided into metals, plastics, ceramics, and others (such as graphene and composites). By aircraft parts, it is classified into engines, structural components (including body and cabin interiors), and jigs & fixtures. Based on end use, the market is segmented into aircraft and spacecraft. Regionally, the industry is divided into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by material, metals are anticipated to hold 47.3% of the total market revenue in 2025, establishing themselves as the leading material segment. This leadership is attributed to the superior strength-to-weight ratio, durability, and heat resistance properties of metals, which are critical for aerospace applications.

The ability of metals to meet stringent structural and thermal requirements has facilitated their adoption in mission-critical components where performance cannot be compromised. The maturity of metal additive manufacturing processes and the development of high-performance alloys specifically engineered for 3D printing have further solidified their position.

Continuous innovation in powder metallurgy and improvements in printability have enhanced productivity and cost-effectiveness, making metals the preferred material for aerospace-grade components.

In terms of aircraft parts, the engine segment is projected to account for 41.8% of the market revenue share in 2025, positioning it as the top application area. This prominence stems from the demanding requirements of engine components, where precision, strength, and thermal resilience are paramount.

Additive manufacturing has been increasingly employed to produce complex engine geometries that were previously unachievable through traditional methods. The ability to reduce part counts, optimize airflow designs, and achieve significant weight savings has driven adoption within this segment.

Advances in material qualification and process reliability have also ensured compliance with rigorous aerospace standards, reinforcing the engine segment’s leadership in the application of 3D printed materials.

Segmenting by end use, the aircraft segment is forecast to capture 44.6% of the market revenue in 2025, maintaining its status as the dominant end-use category. This dominance is supported by the widespread implementation of 3D printed materials in commercial, military, and business aircraft production to improve fuel efficiency and reduce maintenance costs.

The capability to fabricate lightweight yet robust components has been instrumental in meeting performance and sustainability goals in the aircraft industry. Manufacturers have increasingly integrated additive manufacturing into their production lines to enhance design flexibility, reduce assembly complexity, and shorten development cycles.

Growing acceptance of 3D printed parts among regulatory bodies and aerospace OEMs has further propelled the aircraft segment to lead the market.

The aerospace 3D printing materials market is expanding due to the growing adoption of additive manufacturing technologies in aerospace applications. 3D printing offers significant advantages such as reduced weight, complex design capabilities, and lower production costs. Materials like titanium, aluminum alloys, and high-performance polymers are increasingly being used to produce lightweight, durable, and heat-resistant parts for aircraft and spacecraft. The market is driven by advancements in material science, the need for faster production cycles, and the rising demand for more efficient aircraft. Despite challenges such as high material costs and regulatory hurdles, the market offers significant growth opportunities.

The aerospace 3D printing materials market is driven by advancements in additive manufacturing and the aerospace industry’s ongoing pursuit of lightweight, high-performance parts. As aerospace companies look for ways to reduce production costs and improve fuel efficiency, 3D printing offers an ideal solution. By enabling the production of complex geometries that were previously impossible with traditional manufacturing methods, 3D printing is revolutionizing the production of aircraft and spacecraft components. Materials used in aerospace 3D printing, such as titanium alloys, aluminum, and high-performance polymers, provide the necessary strength and resistance to high temperatures. The growing cost reduction in the aerospace sector is accelerating the adoption of these innovative materials.

A key challenge for the aerospace 3D printing materials market is the high cost of specialized materials. The materials required for aerospace applications, such as titanium and high-performance alloys, are significantly more expensive than those used in other industries. This can limit the widespread adoption of 3D printing in aerospace manufacturing, particularly for smaller companies with limited budgets. The compliance with stringent aerospace industry regulations regarding material performance, safety, and certification is another challenge. Materials must undergo rigorous testing to ensure they meet industry standards, and obtaining the necessary certifications can add to production time and costs. Overcoming these challenges requires continuous innovation in material science and cost-effective manufacturing techniques.

The aerospace 3D printing materials market presents substantial opportunities, particularly in the commercial and military aviation sectors. The demand for lightweight components and advanced designs in aircraft production is creating a growing need for high-performance 3D printing materials. Commercial airlines are increasingly using 3D printing for spare parts manufacturing, reducing lead times and costs. In the military sector, 3D printing is being used to produce custom parts for fighter jets, drones, and other defense-related applications. As the technology matures, manufacturers are finding more ways to integrate 3D printing into both prototyping and production, which presents a significant opportunity for material suppliers. The increasing use of 3D printing for rapid prototyping and tooling in aircraft manufacturing further accelerates demand for specialized aerospace materials.

A key trend in the aerospace 3D printing materials market is the integration of hybrid manufacturing approaches, which combine traditional manufacturing methods with 3D printing. This enables manufacturers to optimize production processes and improve the performance of aerospace components. Another important trend is the increasing demand for advanced materials such as lightweight composites and heat-resistant alloys, which can withstand extreme temperatures and harsh conditions in aerospace applications. The development of more efficient 3D printing technologies is also allowing for the creation of parts with complex geometries and improved strength, driving further adoption in the aerospace industry.

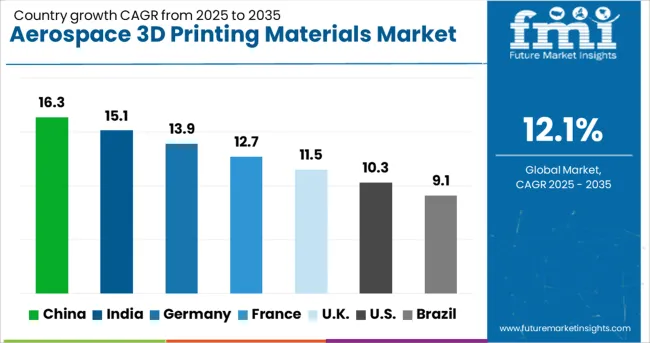

| Country | CAGR |

|---|---|

| China | 16.3% |

| India | 15.1% |

| Germany | 13.9% |

| France | 12.7% |

| UK | 11.5% |

| USA | 10.3% |

| Brazil | 9.1% |

The aerospace 3D printing materials market is projected to grow at a global CAGR of 12.1% from 2025 to 2035. China leads the market with 16.3%, followed by India at 15.1%, and France at 12.7%. The United Kingdom is expected to grow at 11.5%, while the United States is projected to grow at 10.3%. The growth in these regions is driven by rapid advancements in aerospace technologies, increased demand for lightweight and durable materials, and the adoption of additive manufacturing for aircraft parts and components. The analysis spans 40+ countries, with the leading markets shown below.

China is projected to grow at a CAGR of 16.3% through 2035, driven by the country’s rapid expansion in the aerospace sector. As China continues to increase its investment in advanced manufacturing technologies, the demand for 3D printing materials in aerospace applications is expected to rise significantly. The country’s growing focus on domestic production of aircraft and space vehicles, along with increased military spending, is further accelerating the adoption of 3D printing in aerospace. This growth is also supported by the development of high-performance materials such as metal and composite alloys, which are critical for aerospace applications.

India is projected to grow at a CAGR of 15.1% through 2035, driven by increasing investments in the aerospace and defense sectors. The country’s expanding aerospace industry is embracing additive manufacturing for rapid prototyping and the production of critical components. With the rising demand for lightweight, durable materials, Indian manufacturers are increasingly turning to 3D printing technologies for aerospace applications. The growing adoption of 3D printing in the production of aircraft parts, space exploration, and military aviation is pushing the demand for high-quality aerospace 3D printing materials.

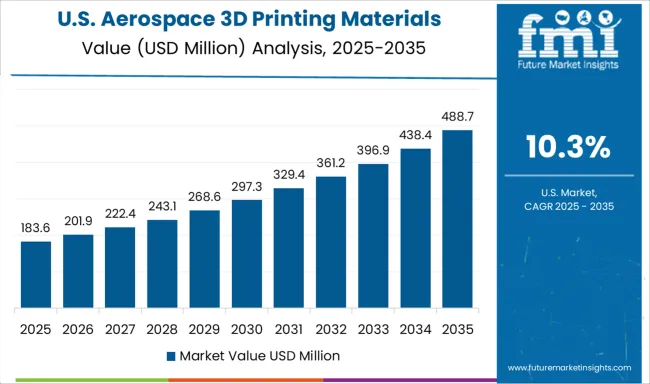

The United States is projected to grow at a CAGR of 10.3% through 2035, with the demand for aerospace 3D printing materials primarily driven by the aerospace industry’s shift toward additive manufacturing technologies. The U.S. aerospace sector has been a leader in adopting 3D printing to manufacture lightweight and durable components. With the rapid development of advanced materials, the market for 3D printing in aerospace applications continues to expand. This growth is further accelerated by the country’s leadership in space exploration and military aviation, where 3D printing is used for critical components.

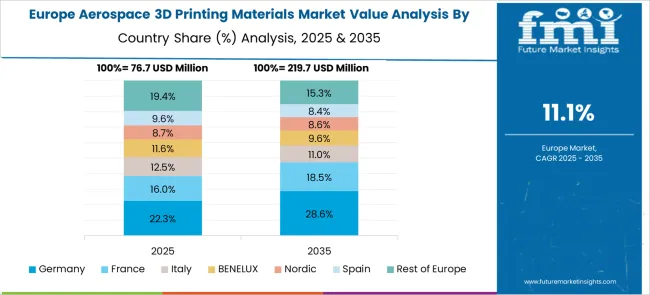

Germany is projected to grow at a CAGR of 13.9% through 2035, supported by its leadership in the aerospace and automotive sectors. As one of the pioneers of 3D printing in Europe, Germany is witnessing an increased demand for aerospace 3D printing materials for the production of aircraft parts, space vehicles, and military aviation components. The country’s focus on innovation and the increasing adoption of additive manufacturing in aerospace applications are key drivers of this market. German aerospace manufacturers are increasingly turning to 3D printing for prototyping, production, and lightweight component manufacturing.

The United Kingdom is projected to grow at a CAGR of 11.5% through 2035, driven by the increasing adoption of additive manufacturing in aerospace applications. The U.K.’s aerospace industry has been quick to integrate 3D printing technologies for both prototyping and manufacturing, with a growing focus on reducing production time and material waste. The demand for lightweight and durable aerospace components continues to rise, and additive manufacturing is helping meet these requirements. The U.K. is also focusing on the development of high-performance materials for the aerospace sector, further increasing the demand for 3D printing materials.

The aerospace 3D printing materials market is driven by leading companies offering high-performance materials for additive manufacturing, enabling the production of complex, lightweight, and durable components used in aircraft and spacecraft. Stratasys Ltd is a market leader, providing a wide range of advanced 3D printing materials for aerospace applications, with a focus on precision, durability, and efficiency. 3D Systems, Inc is also a prominent player, offering 3D printing solutions and materials that support rapid prototyping and part production, particularly for aerospace engineering. GE and ExOne specialize in metal 3D printing materials used in the aerospace sector, focusing on high-strength alloys, including titanium and aluminum, for the production of lightweight, heat-resistant components.

Höganäs AB and EOS provide metal powders for 3D printing, with a focus on enhancing the mechanical properties of printed parts, especially in aerospace applications where reliability and performance are critical. Materialise offers innovative 3D printing software and materials that enable aerospace manufacturers to optimize designs for lightweight structures and high-performance components. Norsk Titanium focuses on producing advanced materials and powders used in 3D printing, catering to the needs of aerospace manufacturers seeking high-strength, durable parts for aircraft. Competitive differentiation in this market is driven by material performance, print quality, the ability to produce complex geometries, and compliance with aerospace industry standards. Barriers to entry include high R&D costs, stringent regulatory standards, and the need for advanced technology. Strategic priorities include improving material properties, expanding production capacity, and enhancing collaboration with aerospace manufacturers to develop new applications for 3D printing.

| Item | Value |

|---|---|

| Quantitative Units | USD 340.3 Million |

| Material | Metals, Plastic, Ceramic, and Others (Graphene, Composites) |

| Aircraft Parts | Engine, Structural Components (Body & Cabin Interiors), and Jigs & Fixtures |

| End Use | Aircraft and Spacecraft |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Stratasys Ltd, 3D Systems, Inc, GE, ExOne, Höganäs AB, EOS, Materialise, and Norsk |

| Additional Attributes | Dollar sales by material type (metal alloys, thermoplastics, composites) and end-use segments (commercial aerospace, military aerospace, space exploration). Demand dynamics are driven by the increasing adoption of 3D printing in aerospace manufacturing for lightweight components, cost reduction, and part optimization. Regional trends show strong growth in North America and Europe, with expanding opportunities in Asia-Pacific driven by aerospace manufacturing expansion. Innovation trends include the development of specialized high-performance materials, advanced metal powders, and multi-material 3D printing technologies. |

The global aerospace 3D printing materials market is estimated to be valued at USD 340.3 million in 2025.

The market size for the aerospace 3D printing materials market is projected to reach USD 1,066.4 million by 2035.

The aerospace 3D printing materials market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in aerospace 3D printing materials market are metals, _titanium, _aluminum, _inconel, _others (cobalt-chrome, stainless steel), plastic, _filament, _powder, ceramic and others (graphene, composites).

In terms of aircraft parts, engine segment to command 41.8% share in the aerospace 3D printing materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Printing Materials Market Analysis by Material Type, Form, Application, and Region from 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for 3D Printing Materials in Middle East Size and Share Forecast Outlook 2025 to 2035

Middle East 3D Printing Materials Market Trends 2022 to 2032

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Automotive Market Size and Share Forecast Outlook 2025 to 2035

3D Printing In Construction Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Dental Devices Market Growth - Trends & Forecast 2025 to 2035

3D Printing Photopolymers Market Trends, Analysis & Forecast by Material, Application and Region through 2035

Market Positioning & Share in the 3D Printing Metal Industry

Evaluating 3D Printing Filament Market Share & Provider Insights

3D Bioprinting Market Analysis - Size, Share & Forecast 2025 to 2035

Dental 3D Printing Material Market Trends, Growth & Forecast by Material, Product, and Region through 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Ceramic 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Lightweight Materials Market 2025 to 2035

Industrial 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA