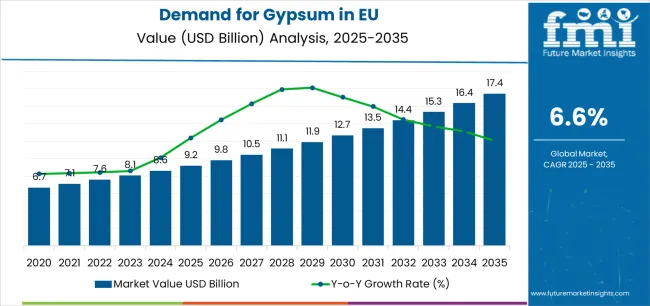

The EU gypsum industry is projected to grow from USD 9.2 billion in 2025 to USD 17.4 billion by 2035, advancing at a CAGR of 6.6%. Production across the region is supported by both mined gypsum and synthetic gypsum generated from flue-gas desulfurization plants, with Germany, Spain, and France acting as the key hubs. The reduction in coal-based power, however, is expected to gradually limit the output of synthetic gypsum, increasing reliance on mined gypsum and creating pressure on reserves. Recycling initiatives for gypsum plasterboard and other construction materials are slowly gaining prominence, and recycled gypsum is being positioned as a necessary supply stabilizer to balance declining synthetic sources.

On the demand side, growth remains closely tied to the construction industry, where plaster products, partition walls, and drywall continue to drive demand. Lightweight construction practices and energy-efficient building systems are driving usage across Germany, France, and the Nordic region, while southern countries such as Spain, Italy, and Portugal display high demand for plasterboard in residential and tourism-related infrastructure. Eastern European countries like Poland and Romania are recording an upward trend in gypsum plaster usage in both civil projects and housing, largely supported by EU-backed funds. The material’s fire resistance, seismic strength, and cost-effectiveness reinforce its role as a preferred building input across diverse construction applications.

Supply proportions show a notable imbalance across the bloc. Western Europe accounts for the majority of mined gypsum and synthetic gypsum production, with Germany alone providing a significant share. France and Spain maintain robust domestic availability, while Central and Eastern Europe remain dependent on imports to meet their expanding requirements. Internal EU trade smooths out regional supply gaps, but energy costs and environmental compliance continue to strain production economics. The long-term supply balance will depend on recycling plasterboard at scale and integrating secondary gypsum sources into the supply chain. With drywall demand expanding and recycled gypsum adoption gaining traction, the EU gypsum industry demonstrates both resilience and a structural transition toward greener production pathways.

Between 2025 and 2030, EU gypsum demand is projected to expand from USD 9.2 billion to USD 12.8 billion, resulting in a value increase of USD 3.6 billion, which represents 42.9% of the total forecast growth for the decade. This phase of development will be shaped by steady residential construction supporting plasterboard manufacturing, consistent cement production requiring gypsum as a setting time regulator, and ongoing building renovation activity driving interior finishing materials demand.

Manufacturers are maintaining their mining and processing infrastructure to address the evolving preferences for high-quality natural gypsum meeting construction material specifications, synthetic gypsum derived from flue gas desulfurization providing sustainable alternatives, and specialized formulations targeting specific applications including fire-resistant and moisture-resistant plasterboard.

From 2030 to 2035, sales are forecast to grow from USD 12.8 billion to USD 17.4 billion, adding another USD 4.8 billion, which constitutes 57.1% of the overall ten-year expansion. This period is expected to be characterized by further expansion of construction activity in emerging European industries, continued infrastructure investment supporting cement production, and development of advanced gypsum products featuring enhanced performance characteristics.

The growing emphasis on sustainable construction materials and increasing utilization of synthetic gypsum from industrial processes will drive demand for diverse gypsum products that deliver reliable construction performance while supporting circular economy objectives and environmental sustainability.

Between 2020 and 2025, EU gypsum sales experienced steady expansion at a CAGR of 5.7%, growing from USD 7.0 billion to USD 9.2 billion. This period was driven by resilient construction activity supporting plasterboard consumption, ongoing cement manufacturing maintaining gypsum demand, and increasing synthetic gypsum availability from coal-fired power plant desulfurization systems.

The industry developed as established mining companies and plasterboard manufacturers maintained production capacity and distribution networks serving construction industries. Quality standardization, product performance improvements, and logistics optimization began establishing reliable supply systems and consistent product availability across European industries.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 9.2 billion |

| Forecast Value in (2035F) | USD 17.4 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

Industry expansion is being supported by the sustained pace of residential and commercial construction across European countries and the corresponding demand for lightweight, fire-resistant interior finishing materials with proven installation efficiency and performance characteristics.

Modern construction projects rely on gypsum-based products as essential building materials for interior wall and ceiling systems, cement manufacturing as a setting time regulator, and agricultural soil improvement providing calcium and sulfur nutrients, driving demand for products that deliver appropriate purity levels, consistent physical properties, and reliable performance characteristics.

Even moderate construction activity, such as residential renovations, commercial tenant improvements, or new residential developments, drives comprehensive gypsum consumption to maintain optimal building quality and support efficient construction practices.

The established infrastructure of European plasterboard manufacturing facilities and increasing recognition of sustainable building material requirements are driving demand for gypsum from certified suppliers with appropriate quality specifications and environmental credentials. Regulatory authorities are increasingly establishing clear guidelines for construction material fire safety performance, environmental product declarations documenting sustainability characteristics, and quality requirements to maintain building safety and ensure product consistency.

Construction industry standards and building code specifications are providing requirements supporting gypsum characteristics, requiring controlled mining and processing operations and standardized production protocols for consistent purity levels, appropriate particle size distributions, and optimal calcination properties, including comprehensive testing ensuring compliance with construction material standards.

Sales are segmented by product type (origin), end use (application), and country. By product type, demand is divided into natural gypsum and synthetic gypsum. Based on end use, sales are categorized into plasterboard/drywall, cement, plaster, soil amendment, gypsum blocks, and others. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

.webp)

The natural gypsum segment is projected to account for 65% of EU gypsum sales in 2025, establishing itself as the dominant product source across European industries. This commanding position is fundamentally supported by natural gypsum's widespread availability from established European mining operations, superior purity levels compared to many synthetic sources, and proven performance characteristics supporting diverse applications.

The natural format delivers exceptional reliability, providing manufacturers with consistent-quality raw material that facilitates plasterboard production meeting construction specifications, enables cement manufacturing requiring precise setting control, and supports agricultural applications delivering soil conditioning benefits.

This segment benefits from established mining operations throughout Europe including major deposits in Germany, Spain, and France, well-developed processing infrastructure converting mined gypsum rock into construction-grade materials, and extensive technical knowledge ensuring optimal utilization across applications. Additionally, natural gypsum offers versatility across purity grades, including high-purity varieties for plasterboard manufacturing, standard grades for cement production, and agricultural-grade products for soil amendment, supported by proven logistics systems enabling cost-effective regional distribution.

The segment is expected to maintain a strong 64.0% share through 2035, demonstrating stable positioning as synthetic gypsum gains modest share through increased availability from industrial desulfurization operations throughout the forecast period.

.webp)

Plasterboard/drywall application is positioned to represent 45% of total gypsum demand across European industries in 2025, increasing to 46.0% by 2035, reflecting the segment's dominance as the primary consumption driver within the overall industry ecosystem. This considerable share directly demonstrates that plasterboard manufacturing represents the largest single application, with producers consuming gypsum for interior wall systems, ceiling installations, and partition construction in residential and commercial buildings.

Modern construction practices increasingly rely on gypsum plasterboard for interior finishing, driving demand for high-quality gypsum optimized for board production with consistent purity ensuring reliable performance, appropriate particle characteristics enabling efficient processing, and proven fire resistance properties supporting building safety requirements.

The segment benefits from continued preference for drywall systems offering installation efficiency compared to traditional plastering, product innovation including moisture-resistant and fire-rated boards expanding application opportunities, and established distribution networks serving construction industries.

The segment's increasing share reflects construction sector preferences for efficient interior finishing systems and growing adoption in emerging European industries throughout the forecast period.

EU gypsum sales are advancing robustly due to sustained construction activity driving plasterboard demand, consistent cement production maintaining industrial consumption, and steady agricultural utilization. However, the industry faces challenges, including natural deposit depletion concerns in some regions requiring new mining development, synthetic gypsum supply volatility linked to coal-fired power plant operations and environmental regulations, and energy-intensive mining and processing operations facing cost pressures. Continued focus on sustainable sourcing and processing efficiency remains central to industry development.

The steadily growing availability of synthetic gypsum from flue gas desulfurization systems at European power plants and chemical manufacturing operations is fundamentally supplementing natural gypsum supplies, creating opportunities for sustainable material sourcing while reducing mining requirements and supporting circular economy objectives.

Advanced FGD systems producing high-quality synthetic gypsum enable plasterboard manufacturers to incorporate industrial by-products as primary raw materials, supporting environmental sustainability claims while often benefiting from favorable logistics through proximity to manufacturing facilities. These synthetic gypsum sources prove particularly important for regions with limited natural deposits, as industrial by-product availability creates local supply options reducing transportation costs and environmental impacts.

Major plasterboard manufacturers and cement producers systematically evaluate synthetic gypsum sources, implement quality testing protocols ensuring performance equivalence to natural materials, and develop supplier relationships with power plants and chemical facilities producing consistent-quality by-products. Companies collaborate with industrial facilities, invest in synthetic gypsum handling and processing infrastructure, and maintain quality specifications ensuring construction material performance regardless of gypsum source.

Modern plasterboard manufacturers systematically incorporate product innovations, including enhanced fire-resistance formulations meeting stringent building code requirements, moisture-resistant boards enabling bathroom and kitchen applications, and lightweight products reducing installation labor and structural loading.

Strategic integration of advanced plasterboard technologies enables manufacturers to differentiate products through performance benefits, expand application opportunities beyond standard interior walls, and command premium pricing supporting innovation investments. These product improvements prove essential for industry growth, as enhanced performance characteristics enable specification in demanding applications previously requiring alternative materials.

Companies implement research and development programs targeting performance enhancement, collaborate with construction industry stakeholders on product validation, and develop technical documentation supporting building code compliance and product specification. Manufacturers leverage product innovations in industrying strategies, technical presentations to architects and contractors, and premium positioning, differentiating advanced plasterboard products as superior solutions delivering enhanced fire safety, moisture resistance, and installation efficiency.

European construction industry stakeholders and building owners increasingly prioritize sustainable building materials featuring environmental product declarations, recycled content documentation, and transparent life cycle impacts aligning with green building certification requirements.

This sustainability emphasis enables gypsum suppliers to differentiate through environmental credentials, including synthetic gypsum utilization supporting waste valorization, energy-efficient processing operations reducing carbon footprint, and comprehensive sustainability documentation supporting LEED, BREEAM, and national green building programs. Sustainability positioning proves particularly important for commercial construction applications where green building certification provides industry differentiation and tenant attraction advantages.

The development of environmental product declarations documenting gypsum life cycle impacts, recycling programs recovering post-consumer gypsum from demolition waste, and sustainable mining practices minimizing environmental disturbance expands industry credibility supporting sustainable construction objectives.

Companies collaborate with green building councils, implement sustainability reporting systems quantifying environmental performance, and develop circular economy initiatives supporting gypsum recycling and reuse, positioning the industry as committed to environmental stewardship.

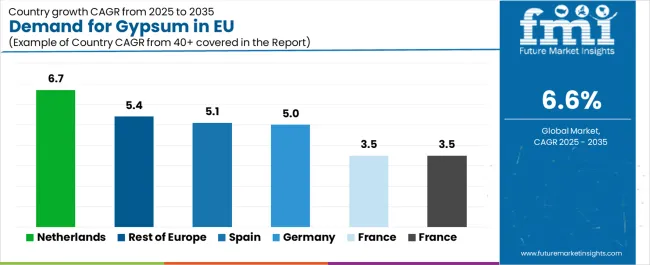

| Country | CAGR % |

|---|---|

| Netherlands | 6.7% |

| Rest of Europe | 5.4% |

| Spain | 5.1% |

| Germany | 5.0% |

| France | 3.5% |

| Italy | 3.5% |

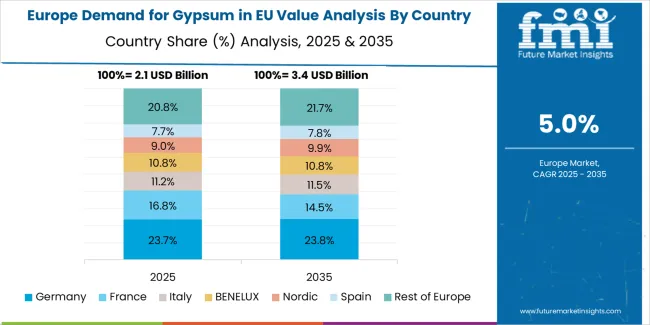

EU gypsum sales demonstrate robust growth across major European economies, with the Netherlands leading expansion at 6.7% CAGR through 2035, driven by construction industry growth and sustainable building emphasis. Germany maintains leadership through extensive construction activity and established plasterboard manufacturing infrastructure.

France benefits from steady construction industries and renovation activity. Italy leverages ongoing building activity and infrastructure development. Spain shows solid growth supported by residential construction recovery and tourism-related commercial development. The Netherlands emphasizes sustainable construction practices and compact urban development. Overall, sales show strong regional development reflecting sustained construction activity and increasing adoption of modern building materials.

Revenue from gypsum in Germany is projected to exhibit steady growth with a CAGR of 5.0% through 2035, driven by substantial residential and commercial construction activity, extensive plasterboard manufacturing infrastructure, and significant cement production capacity throughout the country. Germany's position as Europe's construction and building materials manufacturing center and its comprehensive infrastructure development are creating substantial demand for diverse gypsum products across construction and industrial applications.

Major plasterboard manufacturing operations, including Knauf and Saint-Gobain facilities producing for both domestic and export industries, along with cement manufacturers and construction projects, systematically consume gypsum for board production, cement manufacturing, and direct construction applications. German demand benefits from mature construction industry with steady renovation activity, substantial plasterboard production capacity serving European industries, and technical standards emphasizing fire safety and building performance naturally supporting gypsum-based construction materials.

Revenue from gypsum in France is expanding at a CAGR of 3.5%, substantially supported by steady construction activity across residential and commercial sectors, established plasterboard manufacturing, and ongoing renovation industry activity particularly in urban areas. France's mature construction industry and comprehensive building materials infrastructure are systematically maintaining demand for gypsum products.

Major construction projects, plasterboard manufacturing operations, and cement production facilities steadily consume gypsum for interior finishing systems, cement production, and agricultural applications. French sales particularly benefit from Paris region construction and renovation activity driving materials demand, established plasterboard manufacturing serving domestic industries, and agricultural sector utilizing gypsum for soil conditioning in wine-growing regions.

Revenue from gypsum in Italy is growing at a CAGR of 3.5%, fundamentally driven by ongoing construction activity, substantial renovation industry particularly for historic buildings, and steady cement production. Italy's construction sector and established building materials industry are gradually maintaining gypsum requirements across multiple applications.

Major construction projects, renovation activities, and industrial facilities strategically utilize gypsum for plasterboard production, cement manufacturing, and construction applications. Italian sales particularly benefit from extensive renovation activity requiring interior finishing materials, cement production supporting infrastructure development, and construction industry recovery following previous downturns.

Demand for gypsum in Spain is projected to grow at a CAGR of 5.1%, substantially supported by residential construction industry recovery following previous downturns, tourism-related commercial development, and infrastructure investment. Spanish construction sector's recovery trajectory positions gypsum as important building material supporting industry expansion.

Major residential developments, tourism-related commercial projects, and infrastructure construction systematically increase gypsum consumption for plasterboard installation, cement production, and construction applications. Spain's residential construction recovery creates increasing materials demand, coastal development drives commercial construction, and infrastructure projects support cement production maintaining industrial gypsum consumption.

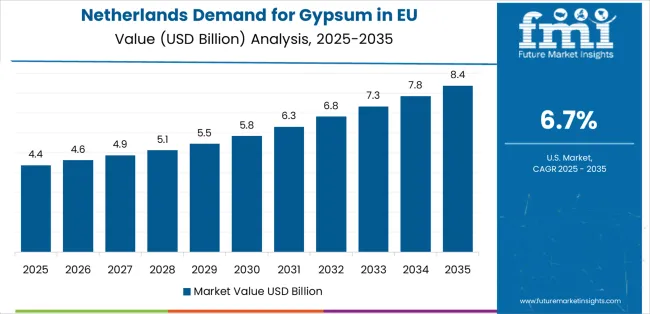

Demand for gypsum in the Netherlands is expanding at the highest CAGR of 6.7%, fundamentally driven by active construction industry supporting compact urban development, emphasis on sustainable building materials, and ongoing infrastructure projects. Dutch construction sector's focus on efficient land use and quality building materials positions gypsum as important construction input.

Netherlands sales significantly benefit from compact urban development requiring efficient construction systems, sustainable building emphasis driving adoption of materials with environmental credentials, and infrastructure investment supporting construction activity. The country's construction industry growth creates substantial plasterboard demand, while sustainability focus supports synthetic gypsum utilization and environmental product transparency.

EU gypsum sales are projected to grow from USD 9.2 billion in 2025 to USD 17.6 billion by 2035, registering a CAGR of 6.6% over the forecast period. The Netherlands is expected to demonstrate the strongest growth trajectory with a 6.7% CAGR, supported by construction industry development, infrastructure investment, and sustainable building practices. Rest of Europe and Spain follow with 5.4% and 5.1% CAGR respectively, attributed to emerging construction industries and residential development.

Germany, while maintaining the largest share at 22.8% in 2025, is expected to grow at a 5.0% CAGR, reflecting industry maturity and established construction infrastructure. France and Italy demonstrate 3.5% CAGR each, supported by steady construction activity and renovation industries.

EU gypsum sales are defined by competition among integrated building materials manufacturers, specialized gypsum mining companies, and plasterboard producers. Companies are investing in sustainable mining practices, synthetic gypsum integration, product innovation programs, and distribution network optimization to deliver high-quality, environmentally responsible, and application-appropriate gypsum solutions. Strategic relationships with construction distributors, long-term supply agreements, and technical support programs are central to strengthening competitive position.

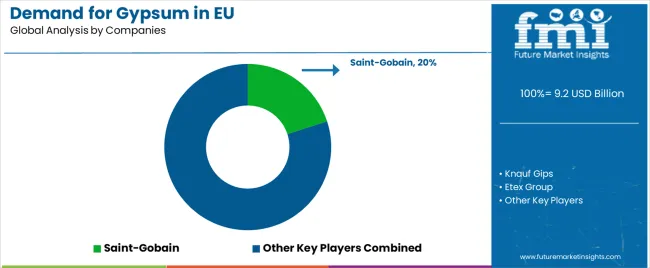

Major participants include Saint-Gobain with an estimated 20% share, leveraging its comprehensive Gyproc plasterboard brand recognized throughout Europe, extensive manufacturing footprint across multiple countries, and integrated gypsum mining and processing operations. Saint-Gobain benefits from vertically integrated operations combining gypsum supply with plasterboard manufacturing, diverse product portfolio addressing multiple construction applications, and the ability to provide technical support services helping architects and contractors optimize building system design.

Knauf Gips holds approximately 18% share, emphasizing strong German manufacturing base with extensive European operations, comprehensive plasterboard product portfolio, and established distribution networks serving construction industries. Knauf's success in maintaining consistent product quality and developing innovative plasterboard formulations creates strong positioning across residential and commercial construction, supported by technical service capabilities and construction industry relationships.

Etex Group accounts for roughly 10% share through its position as a diversified building materials company with significant European plasterboard operations, regional manufacturing presence, and comprehensive construction products portfolio. The company benefits from European industry focus, integrated operations combining gypsum processing with plasterboard manufacturing, and technical expertise supporting product development and customer applications.

Other companies and regional producers collectively hold 52.0% share, reflecting moderate fragmentation in European gypsum sales, where numerous regional mining operations, specialized plasterboard manufacturers, cement producers consuming captive gypsum supplies, and building materials distributors serve local industries, specific construction applications, and regional customer relationships. This moderate fragmentation provides opportunities for differentiation through specialized products (fire-rated, moisture-resistant plasterboard), regional supply reliability reducing logistics costs, competitive pricing particularly for commodity gypsum grades, and technical service excellence resonating with construction professionals seeking suppliers understanding building system requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.4 billion |

| Product Type (Origin) | Natural Gypsum, Synthetic Gypsum |

| End Use (Application) | Plasterboard/Drywall, Cement, Plaster, Soil Amendment, Gypsum Blocks, Others |

| Forecast Period | 2025 to 2035 |

| Base Year | 2025 |

| Historical Data | 2020 to 2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Saint-Gobain, Knauf Gips, Etex Group, Regional producers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (origin) and end use (application); regional demand trends across major European industries; competitive landscape analysis with integrated building materials manufacturers and specialized gypsum producers; customer preferences for natural versus synthetic gypsum and various product grades; integration with plasterboard manufacturing operations and cement production processes; innovations in sustainable mining practices and synthetic gypsum utilization; adoption across residential construction, commercial building, and industrial applications. |

The global demand for gypsum in eu is estimated to be valued at USD 9.2 billion in 2025.

The market size for the demand for gypsum in eu is projected to reach USD 17.4 billion by 2035.

The demand for gypsum in eu is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in demand for gypsum in eu are natural gypsum and synthetic gypsum.

In terms of end use (application), plasterboard/drywall segment to command 45.0% share in the demand for gypsum in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA