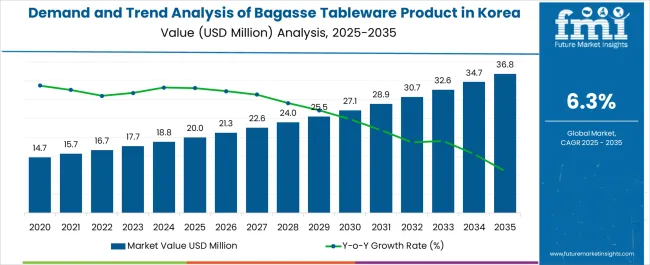

The Demand and Trend Analysis of Bagasse Tableware Product in Korea is estimated to be valued at USD 20.0 million in 2025 and is projected to reach USD 36.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

| Metric | Value |

|---|---|

| Demand and Trend Analysis of Bagasse Tableware Product in Korea Estimated Value in (2025 E) | USD 20.0 million |

| Demand and Trend Analysis of Bagasse Tableware Product in Korea Forecast Value in (2035 F) | USD 36.8 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The bagasse tableware market in Korea is gaining strong momentum. Demand is being shaped by rising consumer preference for sustainable alternatives to plastic, reinforced by regulatory measures promoting eco-friendly packaging. The current scenario is marked by heightened awareness of environmental impacts, expansion of product portfolios, and investments by domestic and international players to strengthen market positioning.

Growth is supported by the increasing adoption of biodegradable and compostable solutions across foodservice, retail, and institutional channels. The future outlook is favorable as government initiatives and corporate sustainability commitments continue to encourage large-scale substitution of single-use plastics. Enhanced production technologies and scalable distribution networks are expected to reduce costs, improve product quality, and expand reach.

Growth rationale is grounded in a combination of regulatory push, consumer-driven sustainability trends, and strategic expansion by manufacturers to cater to diversified applications Together, these factors are positioning the market for consistent growth and broader penetration over the forecast horizon.

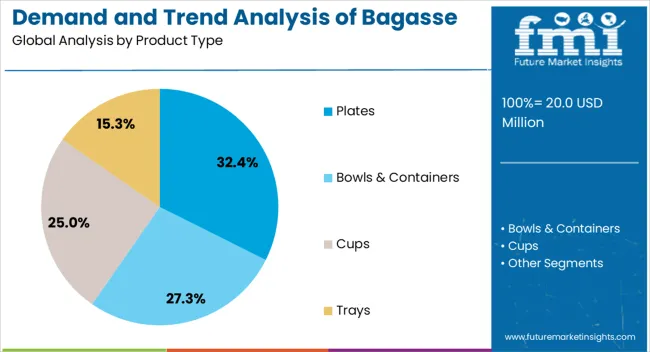

The plates segment, representing 32.40% of the product type category, has emerged as the leading contributor to market demand. Its prominence is being reinforced by widespread use in quick-service restaurants, catering services, and household consumption. Adoption has been supported by product versatility, ease of availability, and alignment with consumer preferences for convenient yet eco-friendly alternatives.

Manufacturing advancements have enhanced product durability and heat resistance, strengthening competitiveness against plastic and paper-based substitutes. Market confidence has been reinforced by compliance with safety and biodegradability standards.

Demand stability has also been driven by the growth of on-the-go food culture and delivery services With ongoing innovations in design and packaging efficiency, the plates segment is expected to maintain its market share and support further adoption of bagasse-based solutions.

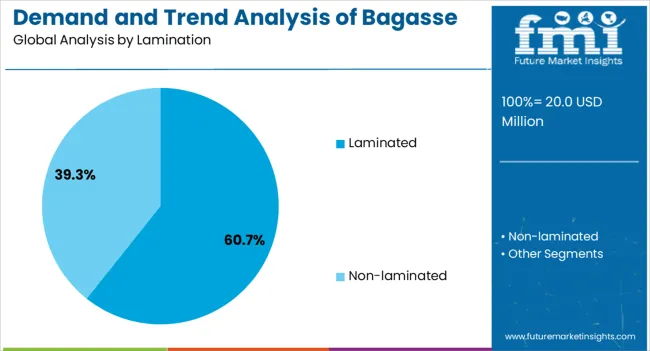

The laminated category, holding 60.70% of the lamination segment, has secured dominance by providing superior functionality, particularly in terms of moisture and oil resistance. Its use has been favored by foodservice providers seeking durable and reliable solutions for hot and greasy foods.

Enhanced product performance has reduced dependency on synthetic coatings, thereby supporting eco-friendly credentials. Manufacturing improvements have enabled cost optimization and scalability, ensuring wide availability across both domestic and export markets.

Regulatory support for sustainable materials has further driven adoption Future growth of laminated bagasse products is expected to be sustained by continuous advancements in natural coating technologies and increasing end-user demand for high-quality disposable solutions that meet performance and environmental expectations simultaneously.

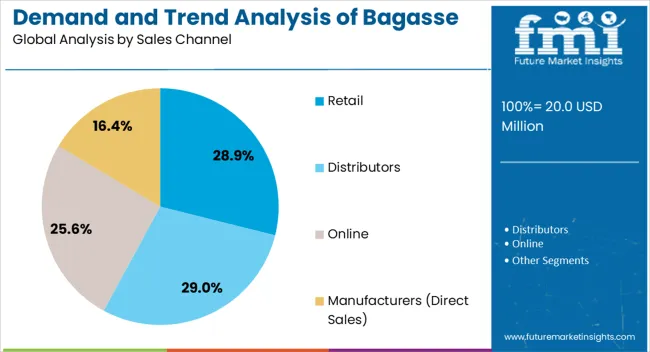

The retail channel, accounting for 28.90% of the sales channel category, has been leading the market due to rising consumer adoption of eco-friendly products at the household level. Availability through supermarkets, hypermarkets, and specialty stores has ensured strong market penetration.

Demand has been supported by packaging innovations, attractive branding, and consumer education campaigns promoting the benefits of bagasse products. Retailers have increasingly partnered with manufacturers to expand private label offerings, further enhancing affordability and accessibility.

Growth has also been reinforced by the influence of e-commerce platforms, which have widened reach and provided convenience for end-users With sustainability becoming a key purchasing criterion, the retail segment is expected to maintain momentum, supported by continued expansion of distribution networks and alignment with government initiatives promoting environmentally responsible consumption.

By product type, the plates segment is expected to account for a share of 35.50% in 2025. Plates are versatile and widely used for various types of meals, making them a preferred choice for consumers in Korea.

They are suitable for both regular dining and special occasions. Korea has seen a surge in dining out, whether at restaurants, cafes, or food stalls. The demand for disposable yet aesthetically appealing plates for these dining experiences is growing.

| Bagasse Tableware Product in Korea based on Product Type | Plates |

|---|---|

| Industry Share in 2035 | 35.50% |

There is a higher demand for disposable plates to serve these meals conveniently, with the increasing popularity of takeout and food delivery services. Bagasse plates offer a sustainable alternative in this context.

Plates are essential for communal dining during cultural events, festivals, and celebrations. Korea has a rich cultural heritage with various such occasions, creating a consistent demand for plates.

Based on end use, the commercial segment is expected to account for a share of 64.30% in 2025. Schools and universities often fall under the commercial segment. The institutions require large quantities of tableware for their cafeterias and events, creating a substantial demand for bagasse tableware.

| Bagasse Tableware Product in Korea based on End Use | Commercial |

|---|---|

| Industry Share in 2035 | 64.30% |

A surge in the number of food outlets, including quick service restaurants, fine dining establishments, and cafes, has created a substantial industry for bagasse tableware. Stringent health and hygiene standards in commercial food service require clean and safe dining solutions. Bagasse tableware provides a hygienic alternative to traditional options.

The growth of takeout and food delivery services, both through dedicated platforms and in-house services, has led to an upswing in the requirement for disposable tableware by commercial establishments, and bagasse tableware meets this demand.

South Gyeongsang is known for its strong agricultural sector. Sugarcane cultivation, one of the primary sources of bagasse, can be a localized source of raw materials for bagasse products, potentially reducing production costs.

An emphasis on seafood and local cuisine, including seafood festivals and events, is expected to drive the use of bagasse tableware in the region, especially in restaurants and food service establishments catering to tourists and locals.

South Gyeongsang has several tourist attractions, such as historic sites, cultural festivals, and natural beauty. The hospitality and food service sector may benefit from the use of bagasse tableware to align with tourism practices.

Given the importance of rice in Korean cuisine and the presence of rice-related festivals, there is a potential demand for bagasse tableware during these events. Bagasse products can align with the cultural emphasis on rice.

North Jeolla is home to several educational institutions, including universities and schools. These institutions represent a significant industry for bagasse tableware, especially in their cafeterias and events.

The presence of local manufacturing facilities for bagasse tableware can lead to reduced transportation costs and potentially more competitive pricing for businesses in the region.

The bagasse tableware industry in the region can be positioned as a choice that aligns with local cultural and traditional practices, making it more appealing to residents and visitors. It has the potential to cater to the demand for disposable dining solutions during special events, festivals, and weddings, enhancing its presence in the industry.

The diverse cuisine in Jeju, including seafood and locally sourced ingredients, is likely to drive the demand for bagasse tableware through 2035, especially in restaurants serving regional dishes.

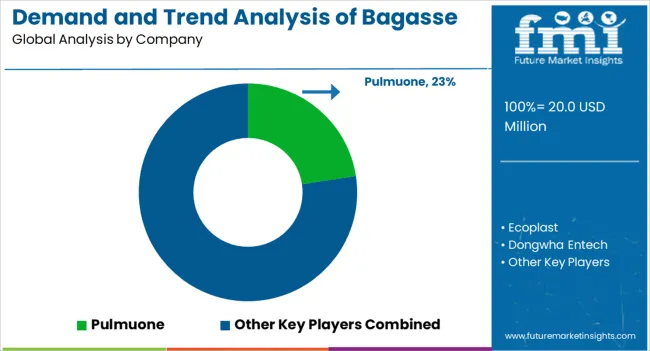

The bagasse tableware product industry in Korea is highly competitive and evolving rapidly due to increasing environmental consciousness and regulatory support. Leading players, as well as local manufacturers, are driving innovation and diversification of products to cater to a range of consumer and commercial needs.

Recent Developments Observed in Bagasse Tableware Product Industry in Korea

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 20.0 million |

| Projected Industry Size by 2035 | USD 36.8 million |

| Anticipated CAGR from 2025 to 2035 | 6.30% CAGR |

| Historical Analysis of Demand for Bagasse Tableware Product in Korea | 2020 to 2025 |

| Demand Forecast for Bagasse Tableware Product in Korea | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Bagasse Tableware Product adoption in Korea, Insights on Global Players and their Industry Strategy in Korea, Ecosystem Analysis of Manufacturers in Korea |

| Key Provinces Analyzed while Studying Opportunities in Bagasse Tableware Product in Korea | South Gyeongsang, North Jeolla, South Jeolla, Jeju |

| Key Companies Profiled | Ecoplast; Dongwha Entech; Pulmuone; CJ CheilJedang; Lotte Food; BioGreen; Hanwha Solutions; SK Chemicals; Hyundai Department Store; Lotte Department Store |

The global demand and trend analysis of bagasse tableware product in korea is estimated to be valued at USD 20.0 million in 2025.

The market size for the demand and trend analysis of bagasse tableware product in korea is projected to reach USD 36.8 million by 2035.

The demand and trend analysis of bagasse tableware product in korea is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in demand and trend analysis of bagasse tableware product in korea are plates, less than 8 inches, 8 inches to 12 inches, more than 12 inches, bowls & contAIners, less than 12 oz, 12 oz to 16 oz, more than 16 oz, cUPS, less than 6 oz, 6 oz to 12 oz, more than 12 oz, trays, less than 8 inches, 8 inches to 12 inches, more than 12 inches, clamshells, less than 8 inches, 8 inches to 12 inches, more than 12 inches, end caps, drink carriers, straw and cutlery (spoons, fork, knife & spork).

In terms of lamination, laminated segment to command 60.7% share in the demand and trend analysis of bagasse tableware product in korea in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Kaolin in India Size and Share Forecast Outlook 2025 to 2035

Demand for DMPA in EU Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Printing Materials in Middle East Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand for Yeast in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Oat Drink in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Vanillin in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spirulina Extract in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Gypsum in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Barite in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Mezcal in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Almond Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA