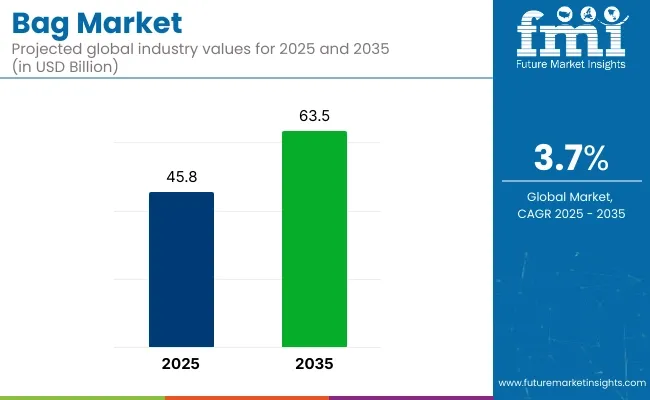

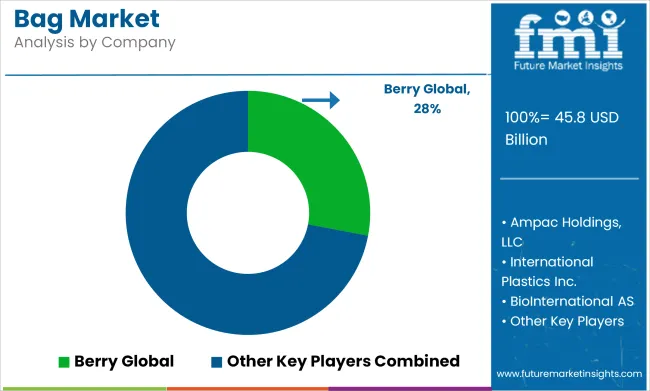

The bag market is projected to grow from USD 45.8 billion in 2025 to USD 63.5 billion by 2035, registering a CAGR of 3.7% during the forecast period. Sales in 2024 reached USD 44.1 billion, reflecting a steady increase in demand across various industries. This growth has been attributed to the rising need for versatile and reusable carrying solutions in sectors such as fashion, retail, travel, and packaging. The increasing usage of sustainable and durable bag materials, along with developments in design and functionality, has further propelled the market's expansion.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 45.8 Billion |

| Projected Market Size in 2035 | USD 63.5 Billion |

| CAGR (2025 to 2035) | 3.7% |

Significant capital flow into material R&D, particularly for biodegradable and recyclable options, is expected to reinforce market expansion and support long-term sustainability goals adopted by industry stakeholders. Novolex® has earned Biodegradable Products Institute (BPI) certification for even more of its paper bags and sacks.

The newly certified bags include Duro recycled kraft paper shopping bags as well as lawn and leaf bags. They join other Novolex products that have already earned BPI certification, including compostable produce bags, T-shirt bags, can liners, and foodservice items from Eco-Products®. “At Novolex, we take great pride in reducing the environmental impact of packaging and offering the best in sustainable products,” said Adrianne Tipton, PhD, Chief Technology Officer at Novolex.

The shift towards sustainable and environmentally friendly solutions has significantly influenced the bag market. Manufacturers have been focusing on developing bags that are recyclable, lightweight, and made from renewable resources. Innovations include the integration of biodegradable materials, modular designs, and the use of recycled fibers to reduce environmental impact.

These advancements align with global sustainability goals and regulatory requirements, making bags an attractive option for environmentally conscious consumers. As industries continue to prioritize operational efficiency and environmental responsibility, the demand for billing paper is anticipated to rise steadily through the forecast period.

The bag market is poised for significant growth, driven by increasing demand in fashion, retail, travel, and packaging industries. Companies investing in sustainable materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge. As global supply chains expand and environmental regulations become more stringent, the adoption of sustainable bags is anticipated to rise, offering cost-effective and eco-friendly carrying solutions.

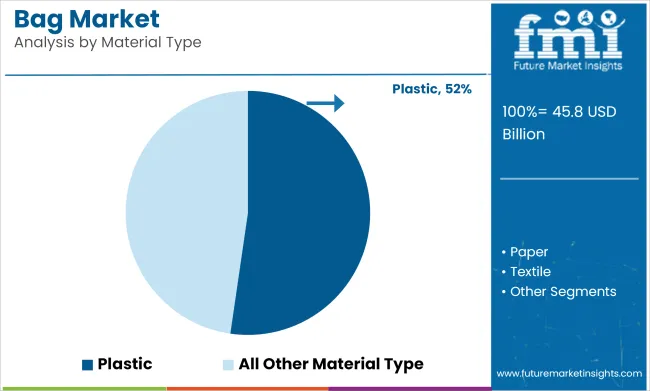

Plastic bags are projected to represent approximately 52.3% of the global bag market in 2025, as they have been widely utilized across retail, grocery, foodservice, and industrial channels for their lightweight nature, strength, and low production cost. High-density polyethylene (HDPE), low-density polyethylene (LDPE), and polypropylene (PP) have been used extensively in the manufacturing of these bags.

Plastic bags have been favored for their moisture resistance, tensile durability, and suitability for printing, making them ideal for branding, barcoding, and product identification. Their ability to support both single-use and reusable formats has expanded their reach across packaging and storage operations globally.

Mass production and flexible customization have allowed plastic bags to be integrated into fast-moving supply chains and automated packaging systems. Despite environmental concerns, lightweight plastic bags have continued to be used in countries with developing recycling infrastructure or evolving regulatory frameworks.

Efforts to introduce biodegradable, oxo-degradable, and compostable plastic variants have been undertaken to align with sustainability mandates, ensuring continued relevance of plastic bags in modern packaging. As convenience, cost-effectiveness, and logistical efficiency remain priorities, plastic is expected to retain its dominance within the bag materials category.

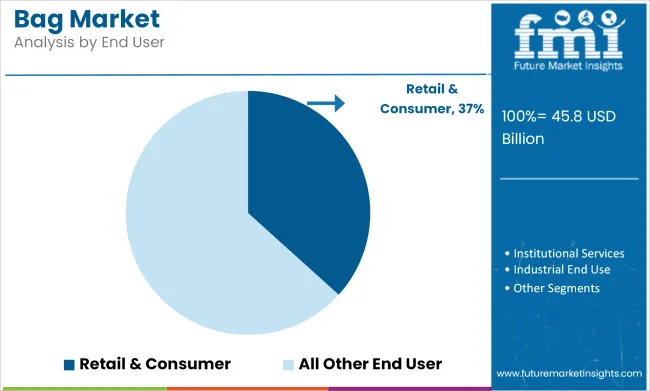

The retail & consumer segment is anticipated to lead the bag market by 2025, with an estimated 36.7% market share, as bags have been deployed extensively in supermarkets, department stores, convenience outlets, and specialty retail chains to support high-frequency transactions and carryout services.

Bags have served both utilitarian and promotional roles within retail environments, facilitating product transport while reinforcing brand identity. Plastic, paper, and textile bags have been distributed at checkout points or as part of product packaging, with tailored formats such as die-cut handles, zipper seals, and gusseted bottoms being incorporated to enhance carrying comfort and reusability. Branded bags have been used as walking advertisements, driving both recognition and repeat visits.

In retail operations, bags have supported organized customer service processes such as return packaging, click-and-collect systems, and online order fulfillment. Printed bags have also been applied in loyalty programs, gift wrapping, and limited-edition campaigns.

As Omni channel shopping behaviors expand and consumer packaging expectations evolve, bags within the retail & consumer segment are projected to remain essential. Their consistent demand across global markets and adaptability to both disposable and premium formats have positioned this segment as the primary driver of bag volume consumption worldwide.

Rising Costs of Raw Materials and Production

Rising costs of raw materials including leather, fabric, and synthetic alternatives pose challenges that the Bag Market is currently grappling with. Rising production costs have been driven by troubled global supply chains, tariffs and geopolitical tension, factors that naturally pass on to profit margins and retail pricing. Moreover, manufacturers have to keep a balance between cost efficiency and quality needed to satisfy consumers.

Entry labor, inflation, and transportation expenses also add to the rising costs. To mitigate such a problem, organizations must consider raw material alternatives, invest in supply chain dynamics, increase entrepreneurship in production, and overproduce sustainable production automation to be competitive in a cost-sensitive environment.

Environmental Regulations and Sustainability Demands

Challenges for Bag Market Growing concerns about the environment and government regulation with regards to plastic and non-biodegradable materials has posed a challenge for the Bag Market. Consumers are demanding more sustainable, eco-friendly options, which has forced brands to transition away from non-biodegradable, non-recyclable or non-reusable options. Sustainable practices come with an upfront cost, allowing deposit money in research, innovation and development of sustainable and innovative materials.

Strict environmental laws and industry certifications must be adhered to. “Companies that do not align themselves with sustainability trends will inevitably lose market share. To alleviate this, brands can emphasize sustainability initiatives, pursue eco-certifications, devise closed-loop production models, and promote their products as environmentally responsible alternatives to attract conscious consumers.

Increasing Demand for Eco-Friendly and Smart Bags

There are opportunities for the Bag Market to expand and innovate as consumers continue to lean towards more eco-friendly products. There’s a promising demand for biodegradable, recycled and reusable bags that has caused manufacturers to pursue plant-based materials, organic cotton and recycled plastics. Moreover, the increasing emergence of smart bags featuring technology such as GPS tracking, solar charging, and security features is becoming trend among tech-savvy consumers.

Demand for enhanced durability, lightweight designs, and multi-functionality features is also on the rise. Investing in sustainable, high-tech innovations places companies at the forefront of adopting the market while building a strong product-centric brand and will go a long way in ensuring that they never lose the changing consumer trends.

Expansion into E-commerce and Customization Trends

Increasing penchant for e-commerce and personalization are driving the demand for customized bags not only for individual consumers but also for corporate branding needs. The growth of online retail has helped broaden the market for personalized bags that feature monograms, unique designs, and tailored functionality. Businesses are on the lookout for personalized promotional bags for both brand promotion and event gifts.

Furthermore, improvements in digital printing and direct-to-consumer fabrication allow for quicker, cheaper customization. Companies can boost their sales with unique and appealing product offerings by taking advantage of this trend by using mass customization, digital printing options, direct-to-consumer sales strategies and eco-friendly materials.

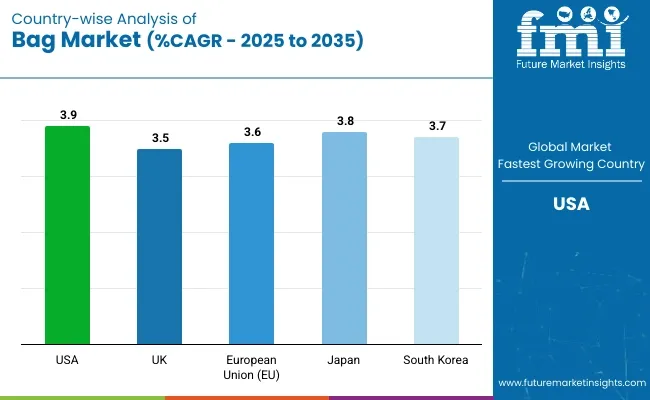

The bag market is primarily dominated by demand within the United States owing to the large consumer goods sector and demand for fashion accessories in the country, as well as the growing preference for eco-friendly and reusable bags. The distribution of innovative bag designs by major manufacturers and retailers fuels the growth of the Innovative Bag Market.

Increased awareness regarding sustainable materials, developments in durable and stylish bags, and availability of green alternatives also contribute to market growth. Moreover, growing adoption amongst different consumer demographics and enhancing product appeal through the integration of smart bags with tracking features, anti-theft mechanisms, and RFID protection is enabling consumers to adopt bags smarter and smarter.

Businesses are also moving to make their bags more sustainable, biodegradable or have custom designs for environmentally aware consumer. Also, the market demand for durable and stylish bag solutions in the USA market is being driven by growing popularity of travel accessories and multifunctional bags.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

Increased consumer interest in sustainable fashion, premium leather goods, and functional everyday carry solutions are driving demand for bags in the United Kingdom (UK), which is a key market for bags. This style is often favored by many trendsetters leading to another reason that people are inclined toward reusable bags.

Government campaigns that encourage plastic reduction and the increasing preference for biodegradable and recyclable materials further bolsters growth in the market. Likewise, there is a growing trend for multipurpose bags with better storage and more ergonomic design. There is rising interest in these stylish, branded and luxury bags; giving rise to greater market potential. The UK market is responding with innovation and launches to the increasing demand for work-friendly and convertible bags.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

Driven by a robust fashion sector, the European bag market is dominated by Germany, France, and Italy due to increasing adoption of eco-friendly and demand for high-quality accessories. Rapid market expansion is driven by streamlined pack waste regulations and the European Union's initiative to minimize single-use plastics.

The growth of online shopping and sustainable brands has also created demand for high-quality, durable bags. And the manufacturers are expanding their offerings to encompass recycled materials, vegan leather and modular bag designs that appeal to mania fashionista as much as environmentally conscientious consumer. Moreover, with an increase in business travellers and the use of commuter-friendly bags (commuting bags), consumers across the EU are driving the demand for innovative bag products.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.6% |

Japan’s bag market has grown because of the country’s strong culture around organization, compact living and efficiency in both fashion and travel accessories. High quality, space-saving, and attractive bags are gaining market growth.Innovation in the country is further driven by its focus on technological advances and the adoption of waterproof, antimicrobial and smart security features.

Additionally, high consumer demand for simple yet functional bags is empowering the companies to manufacture high-end editorial designer bags for upscale markets. The smart bags that enable electronic charging and are weather resistant are also taking leaps. An increase in convenience travel and work-life balance culture is also driving demand for general-purpose and comfortable bag solutions within Japanese households.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

With the booming consumer goods market in South Korea, the K-fashion phenomenon and the demand for stylish but practical carry solutions, the country is becoming one of the major markets for bags. The key elements supporting market growth include robust government regulations encouraging the use of sustainable material and a growing trend for reusable high-quality fashion & fashion accessories. Moreover, the smart technology integration in the country has contributed to the creation of advanced bags integrated with wireless charging, GPS tracking, and theft protection.

There is also a rising popularity of social media fashion trends, driven by celebrities by showing off chic, limited-edition, and multi-purpose bags, which is increasing demand for the regional bags in the market. The growing presence of online retail platforms and DTC channels is also supporting the growth of the market in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.7% |

As the consumer shares growing interest in reusable, environmentally friendly and aesthetically pleasing means of carrying products, the bag market continues to grow. Companies are embracing sustainable materials, multifunctional designs and innovative manufacturing techniques to make their products increasingly durable and usable.

The key trends include biodegradable bags, smart storage features and customizable designs according to specific consumer preferences.

The overall market size for Bag market was USD 45.8 Billion in 2025.

The Bag market expected to reach USD 63.5 Billion in 2035.

Increased consumer demand for sustainable and reusable bags, the rise of e-commerce and the retail sector, greater demand for fashionable and functional bags, the growth of the travel and tourism industry, and government regulations favoring green packaging solutions will collectively fuel the demand for the bag market.

The top 5 countries which drives the development of Bag market are USA, UK, Europe Union, Japan and South Korea.

Gusseted and Trash bags growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Bag On Valve Product Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bag Sealer Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bagging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Bottle Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Bowls Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Box Filler Market Insights - Growth & Forecast 2025 to 2035

Bag Clips Market Insights – Demand, Trends & Forecast 2025 to 2035

Baggage Scanner Market Growth, Trends & Forecast 2025 to 2035

Bag Re-sealer Market Growth – Size, Trends & Forecast 2025 to 2035

Competitive Landscape of Bag-in-Tube Market Share

Market Share Breakdown of Bag-In-Box Manufacturers

Examining Market Share Trends in Bagasse Disposable Cutlery

Market Share Insights of Bagging Machine Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA