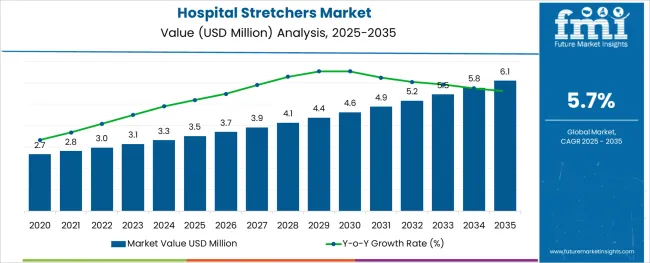

The Hospital Stretchers Market is estimated to be valued at USD 3.5 million in 2025 and is projected to reach USD 6.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

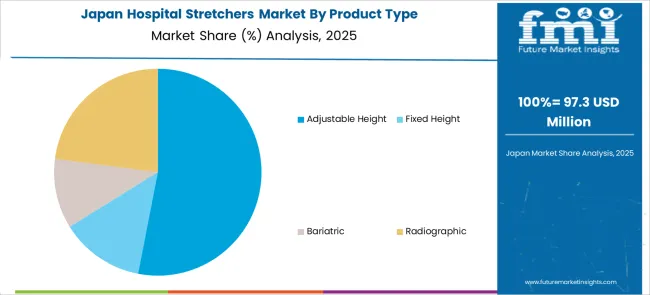

The market is segmented by Product Type, Technology, and Application and region. By Product Type, the market is divided into Adjustable Height, Fixed Height, Bariatric, and Radiographic. In terms of Technology, the market is classified into Motorized and Non-Motorized. Based on Application, the market is segmented into Ambulatory/Transport, Day-care/Inpatient, Surgery, and Emergency/Trauma. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type, Technology, and Application and region. By Product Type, the market is divided into Adjustable Height, Fixed Height, Bariatric, and Radiographic. In terms of Technology, the market is classified into Motorized and Non-Motorized. Based on Application, the market is segmented into Ambulatory/Transport, Day-care/Inpatient, Surgery, and Emergency/Trauma. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5 % of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0 % of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

When analyzed by functionality, thickening agents are forecast to account for 29.0 % of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

As per the Hospital Stretchers market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the market increased at around 4.8% CAGR, wherein, the region North America held a significant share in the global market.

The overall increases in chronic ailments such as diabetes, cardiovascular disease, cancer, respiratory disease, and autoimmune diseases are driving industry growth. A growing number of surgical and medical procedure demands will boost product sales during the forecast.

Apart from this, the WHO (World Health Organization) estimated that the global population of people aged sixty or above would reach 6.1 billion by 2035. The growing elderly population also plays an important role in driving the market. Thus, the Hospital Stretchers market is expected to witness a CAGR of 5.7% over the next ten years.

The prevalence, the sedentary lifestyles, and the prevalence of alcohol and smoking consumption are all linked to the probability of people suffering from chronic diseases. One of the chief causes of death globally is cardiovascular disease. According to the WHO, CVD takes the lives of approximately 17.9 million people every year. According to the Centers for Disease Control and Prevention, 0.8 million Americans have a heart attack per year, and approximately 0.6 million die because of this.

The rising incidence of cancer is leading to the demand for stretchers in hospital settings. The International Agency for Research on Cancer (IARC) projects the growth of the cancer burden will reach 3.3 million cases by 2024, with 10 million deaths. Consequently, the demand for chronic diseases is among the key factors driving growth.

More fatalities and traffic accidents have motivated increased funding for emergency medical services. The WHO estimates that each year, close to 3.3 million traffic-related deaths occur worldwide (2024). By age group, fatalities occur most commonly among people under 29 and are particularly common in low- and middle-income countries.

Countries with relatively low and average amounts of social welfare tend to have the largest number of traffic fatalities, which account for around two-thirds of the worldwide toll. Furthermore, the International Association for Safe Travel estimates that 3.3 million individuals die each year in traffic accidents, with as many as 20 million becoming disabled.

Victims of traffic accidents require emergency medical care and transportation to hospitals. In addition, these injured patients are commonly transported in stretchers which are outfitted with accessories such as a head spine immobilizer, lifting bridles, toe clamp, wrist rest, lifting harness, shoulder harness, footboard, and also flotation devices. As a result, rising traffic accidents are expected to drive market growth over the projected study period.

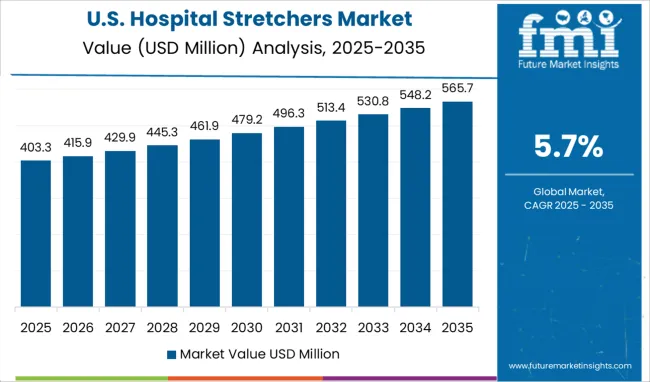

The USA dominated the North American Hospital Stretchers market, which is expected to reach USD 1.78 billion by 2035. Growing numbers of elderly Americans are a primary driver of the economic climate in this field. According to data from the Census Bureau, the number of Americans aged 65 and up in 2020 is expected to increase from 52 million to nearly 95 million in 2060. Similarly, the share of people aged 65 and up is expected to increase from 16% to 23% over the same period.

Rising healthcare spending and the increased use of advanced healthcare facilities are driving the growth of the medical tourism business. According to CMS data, 4.6% more federal spending was reported by the USA government in 2020 than in the previous year, which grew from USD 3.8 trillion to USD 3.9 trillion.

Additional advantages for services and procedures covered by the Part A and Part B Medicare programs in the United States are to encourage market growth. In the Part B section of Medicare, for example, the range of medical services subsidized is 80% of the Medicare-authorized amount for medically necessary emergency ambulance services and non-emergency ambulance services.

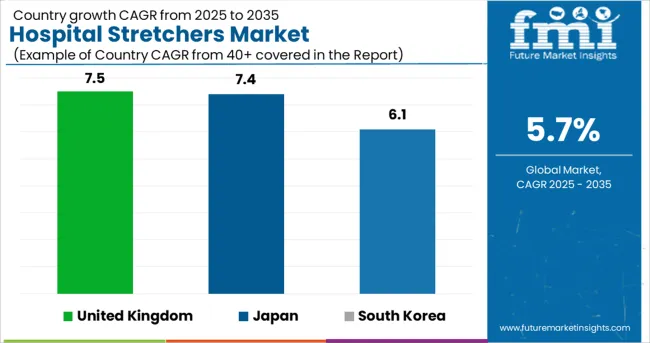

The hospital stretchers market in the United Kingdom grew from USD 3.3 Million in 2024 to reach a valuation of USD 6.1 Million by 2035, growing at a CAGR of 7.5% from 2025 to 2035. The market during the forecast period is expected to witness an absolute dollar opportunity of USD 120 Million.

The market in Japan is likely to reach a valuation of USD 152 Million by 2035, growing at a CAGR of 7.4% during the forecast period. The market from 2025 to 2035 is expected to witness an absolute dollar opportunity of USD 77 Million.

The hospital stretchers market in South Korea is expected to reach USD 88 Million by 2035, growing at a CAGR of 6.1%. The market from 2025 to 2035 is expected to witness an absolute dollar opportunity of USD 39 Million.

Hospital Stretchers market revenue is expected to grow at the fastest rate in APAC (Asia Pacific), between 2025 and 2035, with over 7.5% and 7.4% projected growth rates in China and Japan, respectively. Some of the key businesses that manufacture medical devices in several Asian-Pacific locations have announced that they will expedite the distribution of their products to these regions to expand their market share. This will mean a decrease in diversification in global locations, and this shift could present an opportunity for the market.

Public funding for technological advancement, rising investment, improved reimbursement amounts, and increasing medical tourism are anticipated to generate considerable demand for health tourism in the upcoming years. Furthermore, the medical tourism industry growth in Asia Pacific is predicted to be encouraged by a rising population of citizens in older age levels and a growing middle class.

According to an evaluation by the United Nations Population Fund, the traditional population in the Asia Pacific region is growing at a record pace, and by the year 2050, over 200 million people in the region will be over 60, upping the total population to roughly 1.3 billion.

The bariatric segment produced the highest rate of revenue and is anticipated to witness a 5.4% CAGR over the projected timeframe. Larger stretcher frames, large wheels, winch attachments, and pull and push handles are all features of bariatric stretchers that facilitate safe transport.

Patients who are obese are oftentimes carried by stretchers of this kind. Obesity is one of the most critical public health matters that can lead to a range of health complications, such as diabetes, heart disease, and cancer.

Obesity is increasing the need for bariatric stretchers, which leads to hospitalization. According to the World Health Organization, approximately 2.7 billion adults were overweight in 2020, with over 650 million suffering from obesity. Bariatric stretchers can hold weights of up to 700 pounds. Furthermore, powered high-low stretchers for patient transfer and positioning can be beneficial. As a result, the ever-increasing number of obese patients makes an ideal environment for optimal growth.

Motorized hospital stretchers have a market share of over 65% in 2024 and are projected to witness the highest CAGR during the forecast period. This is due to the increased investment of major players in developing state-of-the-art and advanced products. Demand for hydraulic and pneumatic stretchers is increasing in developed regions as new technology is evaluated.

The demand for adjustable stretchers is also expected to grow significantly in the coming years as multi-specialty and super-specialty hospitals demand more innovative and automated hospital stretchers. Stretchers that are motorized and technologically advanced are available. These stretchers are also useful for medical professionals. They have an arm mechanism and a curved backrest that can be adjusted for elevation. The height of an adjustable stretcher can be greater than a fixed-height stretcher.

Product commercialization and partnership tactics are expected to be profitable for the hospital stretchers market in the forthcoming years. Market players are concentrating on various business strategies such as mergers and acquisitions, partnerships, and new product launches to strengthen their market position

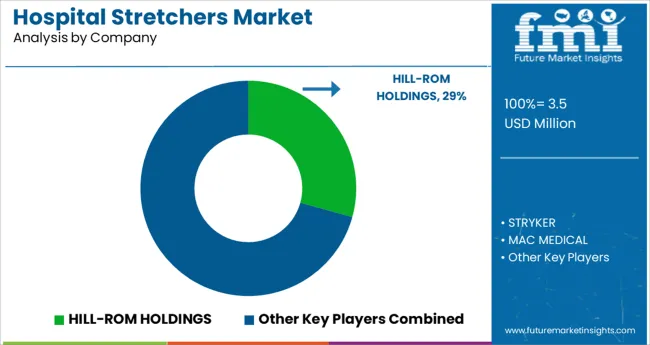

The key vendors in the global Hospital Stretchers market are Hill-Rom Holdings, Stryker, Mac Medical, TransMotion Medical Inc., Fu Shun Hsing Technology, Narang Medical Limited, ROYAX, and Advanced Instrumentations.

The recent developments in hospital stretchers markets are:

The global hospital stretchers market is estimated to be valued at USD 3.5 million in 2025.

It is projected to reach USD 6.1 million by 2035.

The market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types are adjustable height, fixed height, bariatric and radiographic.

motorized segment is expected to dominate with a 56.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hospital Bedsheet & Pillow Cover Market Size and Share Forecast Outlook 2025 to 2035

Hospital Service Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hospitality Mattress Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospitality Staffing Market Size and Share Forecast Outlook 2025 to 2035

Hospital Surgical Disinfectant Market Size and Share Forecast Outlook 2025 to 2035

Hospital Supplies Market Size and Share Forecast Outlook 2025 to 2035

Hospital Disinfectant Products & Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Hospital Workforce Management Market is segmented by product, and end user from 2025 to 2035

Hospital-Acquired Infection (HAI) Control Market – Prevention & Growth Trends 2025 to 2035

Hospital Consumables Market Analysis - Growth, Demand & Forecast 2025 to 2035

Hospital Capacity Management Solutions Market Insights - Growth & Forecast 2024 to 2034

Hospital Resource Management Market

Hospital Information System Market

Non-Hospital-Based Point-Of-Care Diagnostic Products Market Size and Share Forecast Outlook 2025 to 2035

Smart Hospitality & Coworking Spaces Market Trends - Growth & Forecast 2025 to 2035

Smart Hospitality Management Market

Micro-Hospitals Market

Europe Hospital Capacity Management Solution Market Growth – Trends & Forecast 2025 to 2035

Bedless Hospitals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA