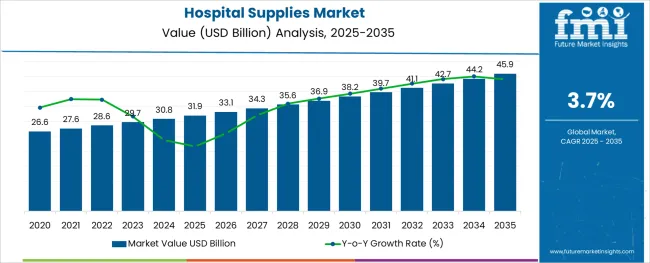

The Hospital Supplies Market is estimated to be valued at USD 31.9 billion in 2025 and is projected to reach USD 45.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

The hospital supplies market is witnessing steady expansion, supported by the consistent increase in global healthcare expenditure, rising patient admissions, and heightened emphasis on infection prevention and control protocols.

The ongoing burden of chronic diseases, combined with frequent surgical interventions and emergency care requirements, has amplified demand for essential hospital consumables and equipment. Supply chain stabilization post-pandemic and the resumption of elective procedures have also contributed positively to market recovery and growth.

Future prospects remain optimistic as healthcare infrastructure investments continue in both developed and emerging economies, particularly focusing on capacity expansion and modernization of public and private hospital facilities. Additionally, regulatory mandates concerning patient safety standards and hygiene practices are expected to drive sustained demand for single-use and sterilized supplies. The rising incidence of hospital-acquired infections and the increasing prioritization of operational efficiency in healthcare settings further reinforce the essential nature of these products, positioning the market for consistent, long-term growth amid ongoing medical service delivery pressures.

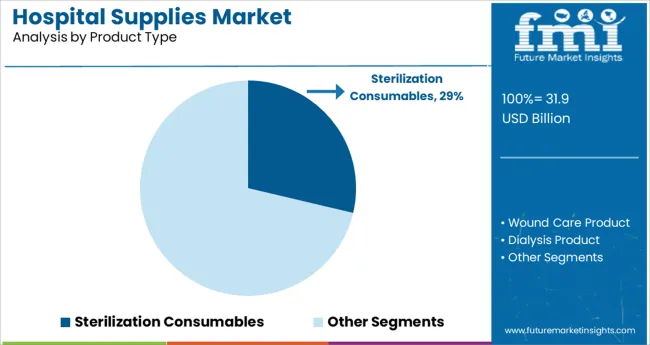

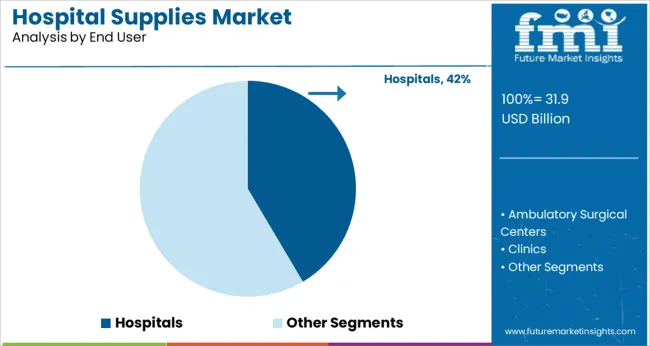

The market is segmented by Product Type and End User and region. By Product Type, the market is divided into Sterilization Consumables, Wound Care Product, Dialysis Product, Infusion Product, Hypodermic & Radiology Product, Intubation & Respiratory Supplies, Surgical Procedure Kits & Trays, Blood Management & Diagnostic Supplies, and General Disposable Product. In terms of End User, the market is classified into Hospitals, Ambulatory Surgical Centers, Clinics, Diagnostic Centers, Long-Term Care Centers, and Nursing Facilities. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sterilization consumables segment accounted for approximately 28.7% of the total hospital supplies market share, establishing itself as a vital category within the product type landscape.

Its growth trajectory has been reinforced by the rising emphasis on stringent infection control protocols across healthcare facilities, which necessitate the routine sterilization of surgical instruments, patient care devices, and operating environments. Increased procedural volumes, particularly in surgical wards, intensive care units, and emergency departments, have significantly contributed to sustained product consumption.

The segment has also benefitted from regulatory frameworks mandating the use of sterilized, disposable items to minimize the risk of hospital-acquired infections, thereby driving repeat purchases. Moreover, the heightened awareness among healthcare providers regarding contamination risks has prompted continuous procurement of sterilization wraps, indicators, disinfectants, and other consumables. Moving forward, product innovations aimed at enhancing sterilization efficiency and environmental sustainability are anticipated to support segmental growth, along with expanded adoption in outpatient surgical centers and specialty clinics.

The hospitals segment captured a commanding 41.5% share of the overall hospital supplies market, maintaining its position as the leading end-use category.

This dominance has been attributed to the high patient influx, extensive procedural volumes, and diverse medical service offerings housed within hospital infrastructures. Hospitals typically account for the largest consumption of essential supplies due to the breadth of services provided, ranging from routine diagnostics and inpatient care to critical surgeries and post-operative rehabilitation.

The segment’s growth has been driven by increased healthcare access in urban and semi-urban areas, coupled with rising investments in hospital infrastructure upgrades, particularly in developing regions. Additionally, government initiatives aimed at strengthening public health systems and promoting affordable healthcare services have directly influenced hospital procurement patterns. The ongoing focus on infection control, patient safety, and clinical outcome optimization has further necessitated substantial, consistent purchasing of medical disposables, sterilization items, and personal protective equipment. The anticipated expansion of multi-specialty hospitals and tertiary care centers is projected to sustain the segment’s leadership in the foreseeable future.

According to Future Market Insights (FMI), the overall sales of hospital supplies grew at a CAGR of 3.3% between 2020 and 2024. However, the demand in the hospital supplies market is expected to increase at a CAGR of 3.5%, reaching USD 45.9 Billion by the end of 2035.

The global hospital supplies market held around 20% of the global medical supplies market which was valued at nearly USD 30.8 Billion in the year 2024.

Hospital settings and other healthcare units are at a greater risk of infections and viral exposure, resulting in a rising prevalence of hospital-acquired infections for over a decade. Several measures are being considered to prevent and reduce the prevalence rate such as the use of disposable procedure kits and trays, sterile and disposable products, sterile medical devices, disposable gloves, and other disposable medical supplies.

For instance, in March 2025, Becton, Dickinson & Company launched a TCR/BCR multi-omic assay which aids in speeding the discovery of infectious diseases, autoimmune disorders, and immune-oncology as well.

According to a survey conducted by CDC, in 2020, about 1 in 31 patients had at least one healthcare-associated infection. In addition, it is also noticed that the prevalence rate of hospital-acquired infections in low-income countries is far higher than in high-income countries.

For instance, a study published in the International Journal of Research and Public Health in 2024 states that a 7.5% prevalence of hospital-acquired infection was observed in high-income countries, although others have reported rates of 4.5% in the USA and 5.7%-7.1% in Europe, while in low- and middle-income countries, however, the prevalence rate ranged between 5.7% and 19.2%.

The hospital supplies market includes different product types such as wound care products, dialysis products, sterilization consumables, infusion products, and hypodermic and radiology products amongst others.

Based on product, hypodermic and radiology products like syringes, needles and consumable products for radiography and ultrasound were the dominant market segment in the global market in 2024, which contributed 17.6% of the revenue share.

The global hospital supplies market is expected to be valued at USD 45.9 Billion by the end of 2035, registering a CAGR of 3.7% over the forecast period.

Growing awareness regarding health & hygiene practices, particularly in hospitals will offer lucrative opportunities to market players. The rising disposable income and large patient pool due to a lack of awareness regarding hygiene in emerging economies will drive sales in the market.

Increasing expenditure on healthcare services is leading to the emergence of more and new hospitals worldwide, which in turn, is spurring demand for hospital supplies.

Other factors such as the growth in nosocomial infections have not only increased the mortality and morbidity rate but also the healthcare burden by stretching the length of hospitalization. Therefore, organizations such as the CDC and WHO are putting immense efforts into layout guidelines and conducting vigorous studies to control the occurrence of hospital-acquired infections.

However, despite these efforts, there is still a significant rise in the prevalence of these infections. Thus, increasing research and development efforts to develop hygienic solutions in the hospital supplies industry to minimize exposure to infection and other viral diseases expect to uncap lucrative opportunities in the hospital supplies market.

Lack of awareness regarding hospital-acquired infection and hygiene in developing countries is contributing to the rapid rise of hospital-acquired infection in these countries. According to a study published in the Journal of Epidemiology and Community Health, more than 20% of all hospital-acquired infections are associated with intensive care unit visits.

Most emerging nations have about 2-3-fold higher hospital-acquired infection populations. Thus, the lack of awareness in developing countries regarding hospital-acquired infection and its diagnosis is projected to restrict the growth in the hospital-acquired infection testing market. This is expected to have a negative impact on sales of hospital supplies.

When most countries in the developed regions have strongly built health insurance coverage, these policies are less spread in developing countries. World Health Organization states that the world's partial population is not able to obtain essential health services.

According to a national survey, only one-fifth of the Indian population is insured under health insurance.

Most health insurance schemes do not cover disposables such as disposable gloves or masks utilized during surgical procedures. This adds to the overall cost imparted on the patient’s budget. Thus, the lack of proper health insurance that covers essential healthcare services and the cost of various hospital supplies in underdeveloped and developing countries may restrain the growth in the hospital supplies market.

Rising Demand for Wound Care Products in the USA to Fuel Growth

According to FMI, the USA is expected to dominate the North American hospital supplies market, with a total market share of 92.8% in 2024, and is projected to continue to exhibit high growth through 2025 & beyond.

According to CDC, approximately 5% of patients acquire hospital-associated infections in developed countries. Hence, rising in the number of patient admissions, high demand for treatment, and increased prevalence of hospital-acquired infection and adoption of medical hygiene practices will continue pushing sales in the USA.

Growth in the Medical Automation Market in Germany will Spur Demand for Hospital Supplies

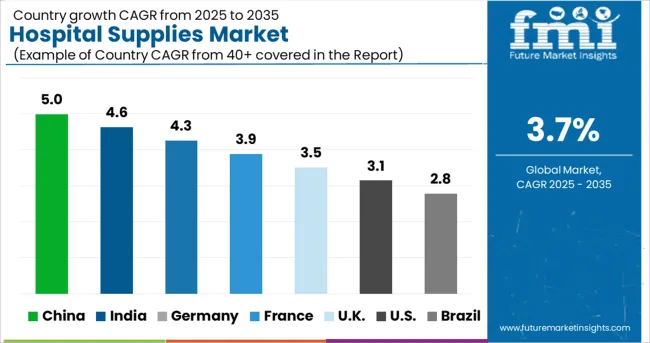

Germany is set to exhibit growth at a CAGR of around 3.5% in the Europe hospital supplies market during the forecast period. Rising awareness of hospital-acquired infection and strong healthcare infrastructure, attractive reimbursement policies along with the best Research and Development performance in the industry will drive the growth of the hospital supplies market in Germany.

Expansion of the Portable Medical Devices Market in China Will Fuel Growth

Sales in the China market are projected to expand at a CAGR rate of 4.1% and hold about half of the East Asia hospital supplies market share and are expected to dominate throughout the forecast period, finds FMI.

Growing investments in research & development activities and technological advancements in the healthcare sector will drive sales in the market. China is expected to spearhead the growth in East Asia due to technological advancement, wide availability of consumable medical supply products, and the presence of numerous players in the healthcare sector.

Rising Demand for Sterile and Disposable Products Will Boost the India Market

Total demand in India accounted for 45.3% of the market share in 2024 and is projected to increase with a CAGR of 4.0% over the forecast period. Growing prevalence of antibacterial-resistant infections and hospital-acquired infections spurring demand for hospital supplies.

With rising expenditure on healthcare services, developing economies like India are focussing more on innovation and technology in the healthcare sector which is in turn fuelling the hospital supplies market within the country.

Sales of Hypodermic and Radiology Products to Remain High

Based on product type, the hypodermic and radiology products segment accounted for 17.6% of the global market share in 2024. Sales in this segment are forecast to increase at a CAGR of 3.6% over the forecast period. Products like needles and syringes are routinely used in hospitals or diagnostic labs for drawing blood or injecting medicines.

On the other hand, radiology equipment like X-ray machines and C-Arms which are often employed in routine diagnosis by doctors, especially during surgical procedures require related disposable products to avoid spreading the infection to patients.

Demand for Hospital Supplies in the Hospital Segment Will Gain Momentum

By end-user, the hospital segment held a market share of 47.2% in 2024, with sales poised to grow at a CAGR of 3.9% over the upcoming decade. Hospitals have a large patient population and are exposed to numerous viral infections. Thus, to minimize the prevalence of healthcare-associated infection, hospitals are focusing on maintaining a hygienic environment which in turn is spurring demand for hospital supplies.

The hospital supplies market is highly fragmented. There are numerous players in the global market involved in developing cutting-edge solutions for the development of efficient products that can meet their customer’s needs.

Leading hospital supplies manufacturers are focusing on mergers, acquisitions, collaborations, and new product launches to increase sales and expand their global footprint. They are also focusing on improving their market presence by expanding their product line across countries to capitalize on untapped opportunities. For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | billion for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | The USA, Canada, Brazil, Mexico, Argentina, the UK, Germany, France, Italy, Spain, Russia, BENELUX, China, Japan, South Korea, India, Thailand, Indonesia, Malaysia, Australia, New Zealand, North Africa, GCC Countries, Turkey, and South Africa |

| Key Market Segments Covered | Product, End User, and Region |

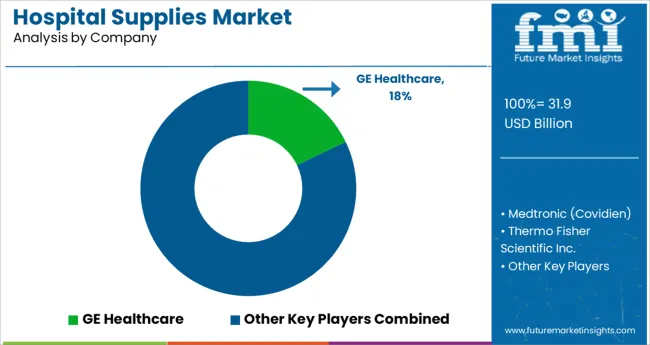

| Key Companies Profiled | GE Healthcare; Medtronic (Covidien); Thermo Fischer Scientific Inc.; Becton, Dickinson, and Company; Cardinal Heath; Boston Scientific Corporation; B. Braun Melsungen AG; 3M Science; Molnlycke Health Care AB; Advanced Sterilization Services; Terumo; Baxter; Kimberly-Clark Corporation; Steris Corporation; Stryker Corporation; Getinge AB; Johnson and Johnson |

The global hospital supplies market is estimated to be valued at USD 31.9 billion in 2025.

It is projected to reach USD 45.9 billion by 2035.

The market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types are sterilization consumables, wound care product, dialysis product, infusion product, hypodermic & radiology product, intubation & respiratory supplies, surgical procedure kits & trays, blood management & diagnostic supplies and general disposable product.

hospitals segment is expected to dominate with a 41.5% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hospital Bedsheet & Pillow Cover Market Size and Share Forecast Outlook 2025 to 2035

Hospital Service Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hospitality Mattress Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospitality Staffing Market Size and Share Forecast Outlook 2025 to 2035

Hospital Stretchers Market Size and Share Forecast Outlook 2025 to 2035

Hospital Surgical Disinfectant Market Size and Share Forecast Outlook 2025 to 2035

Hospital Disinfectant Products & Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Hospital Workforce Management Market is segmented by product, and end user from 2025 to 2035

Hospital-Acquired Infection (HAI) Control Market – Prevention & Growth Trends 2025 to 2035

Hospital Consumables Market Analysis - Growth, Demand & Forecast 2025 to 2035

Hospital Capacity Management Solutions Market Insights - Growth & Forecast 2024 to 2034

Hospital Resource Management Market

Hospital Information System Market

Non-Hospital-Based Point-Of-Care Diagnostic Products Market Size and Share Forecast Outlook 2025 to 2035

Smart Hospitality & Coworking Spaces Market Trends - Growth & Forecast 2025 to 2035

Smart Hospitality Management Market

Micro-Hospitals Market

Europe Hospital Capacity Management Solution Market Growth – Trends & Forecast 2025 to 2035

Bedless Hospitals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA