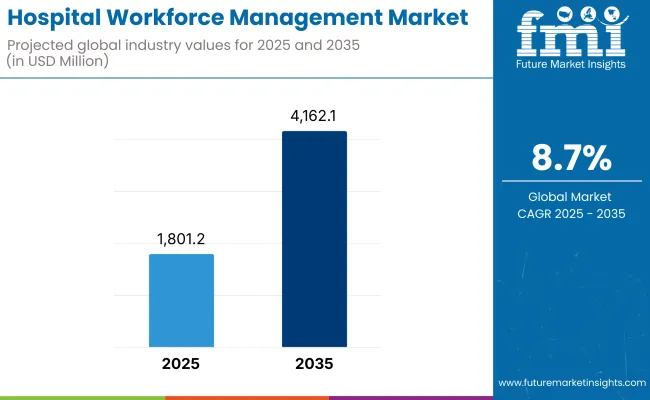

The Hospital Workforce Management market for Hospital Workforce Management is forecasted to attain USD 1,801.2 million by 2025, expanding at 8.7% CAGR to reach USD 4,162.1 million by 2035. In 2024, the revenue of Hospital Workforce Management was around USD 1,661.3 million

Growing awareness about the importance of operational efficiency in hospitals, coupled with a surge in healthcare service demand and rising staff shortages, is driving the global hospital workforce management market. Hospitals are increasingly facing challenges in managing complex staff schedules, maintaining compliance, and ensuring optimal patient care amid fluctuating patient loads. Workforce management systems help address these issues by streamlining staff scheduling, time tracking, and labor analytics to improve productivity and reduce administrative burden.

As healthcare institutions adopt value-based care models and patient-centric approaches, the need for efficient and data-driven workforce planning has become more critical. Technologies such as cloud computing, AI, and predictive analytics are enabling hospitals to optimize staffing, forecast labor needs, and minimize overtime costs.

Furthermore, as hospital administrators recognize the link between employee well-being and quality of care, there is growing investment in tools that support workforce engagement, burnout prevention, and regulatory compliance. This shift toward smarter staffing solutions is accelerating the adoption of comprehensive workforce management platforms across hospitals and healthcare systems globally.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,801.2 Million |

| Industry Value (2035F) | USD 4,162.1 Million |

| CAGR (2025 to 2035) | 8.7% |

North America has the biggest market share for hospital workforce management, which is led by the region's high level of advanced healthcare infrastructure, high healthcare spending, and excellent adoption of IT technologies. The United States especially is in the midst of an acute shortage of healthcare professionals with mounting pressure placed on hospitals to manage staff cost-effectively while minimizing burnout.

Regulatory needs like HIPAA and labor laws also promote the use of compliant and transparent workforce management solutions. In addition, the transition to value-based care models encourages healthcare providers to maintain ideal patient-to-staff ratios, driving demand for smart staffing solutions. This also drive the hospital workforce management market in North America.

Europe is a large and expanding market for hospital workforce management, fueled by changing healthcare delivery models, shortages of labor, and strict regulatory conditions. Germany, the UK, and France are investing in healthcare digitization, with public and private hospitals implementing workforce management solutions to enhance scheduling accuracy, compliance, and cost savings.

Moreover,Europe is the increasing emphasis on work-life balance and staff well-being, which is encouraging hospitals to invest in intelligent scheduling systems, self-service platforms, and flexible shift planning. Additionally, the aging population across many European nations has led to an increased demand for healthcare services, which puts further pressure on hospital staffing levels

The Asia Pacific region is emerging as a high-growth market for hospital workforce management systems, fueled by rapid urbanization, expanding healthcare infrastructure, and rising patient volumes. Countries such as China, India, Japan, South Korea, and Australia are witnessing a healthcare transformation, with growing investments in hospital digitization and human resource management tools.In fast-growing economies like India and China, the demand for advanced scheduling, attendance, and labor analytics systems is increasing to handle overcrowded public hospitals and staffing inefficiencies.

Staffing Shortages and Burnout

One of the most pressing challenges in the hospital workforce management market is the ongoing shortage of skilled healthcare professionals. With aging populations, rising patient admissions, and high turnover rates among nurses and support staff, hospitals are under immense pressure to maintain adequate staffing levels.

This often leads to staff overwork, burnout, and declining job satisfaction further exacerbating retention issues. Without efficient workforce management systems, hospitals struggle to distribute workloads fairly and forecast staffing needs accurately, compromising both employee well-being and patient care quality.

Emerging Opportunities and Innovations Driving Growth in the Hospital Workforce Management Market

The combination of artificial intelligence and predictive analytics offers a great opportunity for hospitals to revolutionize workforce planning. These technologies allow data-driven decision-making through the prediction of patient inflow, the detection of staffing shortages, and the recommendation of optimized shift patterns. Hospitals using AI tools can enhance labor cost management, improve compliance, and minimize the use of last-minute staffing adjustments-resulting in improved efficiency and service delivery

A key emerging trend is the rapid adoption of cloud-based workforce management platforms. These solutions offer scalability, real-time data access, and remote scheduling capabilities crucial in multi-location healthcare setups. The cloud model also supports better integration with electronic health records (EHR) and other healthcare IT systems, improving overall operational cohesion.

From 2020 through 2024, the global hospital workforce management market experienced steady growth, driven by the increasing need for efficient staff management, cost containment, and compliance with regulatory requirements in healthcare facilities.

Moreover, the growth was supported by the adoption of advanced software solutions for scheduling, time and attendance tracking, and talent management. However, challenges such as high implementation costs, data security concerns, and resistance to change among healthcare staff posed constraints on broader market expansion during this period

The hospital workforce management market is projected to undergo sustained growth from 2025 to 2035, driven by ongoing technological innovations, increased investment in healthcare IT infrastructure, and a growing emphasis on optimizing operational efficiency.

The development of integrated platforms incorporating artificial intelligence for predictive analytics is expected to enhance decision-making processes related to staffing and resource allocation. Additionally, the shift towards cloud-based solutions and mobile applications is anticipated to improve accessibility and user engagement, further driving market growth.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Implementation of guidelines ensuring data privacy and security in workforce management systems, leading to standardized protocols and increased oversight. |

| Technological Advancements | Adoption of standalone software solutions for scheduling, time and attendance, and payroll management, enhancing operational efficiency in hospitals. |

| Consumer Demand | Increased reliance on workforce management systems to address staffing shortages, ensure compliance with labor laws, and improve patient care delivery. |

| Market Growth Drivers | Rising demand for efficient staff management solutions, advancements in healthcare IT, and increased focus on reducing operational costs and improving patient outcomes. |

| Sustainability | Initial efforts towards integrating sustainable practices in software development and deployment, including energy-efficient data centers and reduction of paper-based processes. |

| Supply Chain Dynamics | Dependence on specialized vendors for software solutions and IT support, with efforts to ensure system interoperability and integration with existing hospital information systems. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Continuous monitoring and potential harmonization of regulations across countries to balance patient data protection with technological innovation, alongside expedited approval processes for novel workforce management technologies addressing unmet needs. |

| Technological Advancements | Development of integrated platforms leveraging AI and ML for predictive analytics, enabling proactive staffing decisions and resource optimization, along with the proliferation of cloud-based solutions and mobile applications for enhanced accessibility. |

| Consumer Demand | Growing preference for user-friendly, scalable, and customizable solutions that offer real-time data insights, driven by the need for agile workforce management in dynamic healthcare environments. |

| Market Growth Drivers | Expansion of healthcare facilities in emerging markets, increasing investments in digital health initiatives, continuous technological innovations enhancing system capabilities, and a global emphasis on value-based care models requiring optimized workforce management. |

| Sustainability | Adoption of green IT practices, such as utilizing renewable energy sources for data centers and developing eco-friendly hardware, aligning with global sustainability initiatives and reducing the environmental footprint of healthcare IT operations. |

| Supply Chain Dynamics | Strengthening of partnerships between healthcare providers and technology firms to co-develop tailored solutions, leading to improved system integration, data sharing capabilities, and the ability to rapidly adapt to evolving healthcare workforce management needs. |

Market Outlook

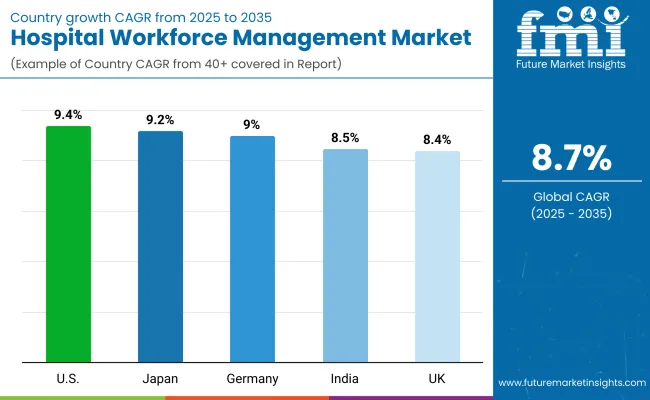

The United States leads the global hospital workforce management market, driven by labor shortages, rising operational costs, and increasing demand for digital scheduling and productivity tools. Hospitals are rapidly adopting AI-enabled workforce planning, shift optimization, and performance tracking platforms to manage clinical and non-clinical staff. The transition to value-based care models further incentivizes real-time labor analytics and resource optimization.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 9 .4% |

Market Outlook

Germany’s hospital workforce management market is growing steadily, supported by a centralized healthcare system, shortages in specialized staff, and strong labor regulations that require compliance-focused scheduling and workforce tracking tools. Hospitals increasingly invest in automated rostering, fatigue risk management, and performance benchmarking platforms to ensure staff well-being and operational transparency.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 9 .0% |

Market Outlook

The UK hospital workforce management market is evolving rapidly, especially with NHS-led reforms focused on digital transformation, workforce sustainability, and streamlined staffing logistics. Workforce platforms that integrate staff scheduling, e-rostering, payroll, and training compliance are increasingly adopted across NHS Trusts, with added focus on AI-driven workload balancing and clinical staff well-being.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.4% |

Market Outlook

Japan’s hospital workforce management market is expanding steadily, influenced by demographic pressure, nursing shortages, and a push for hospital efficiency in a rapidly aging society. Hospitals are adopting automated labor management software, AI-based shift allocation, and fatigue detection systems, particularly in large urban medical centers. Emphasis on work-life balance and compliance with labor regulations is key.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.2% |

Market Outlook

India’s hospital workforce management market is in a high-growth phase, driven by the rapid expansion of private hospital chains, digitalization of hospital operations, and increased regulatory focus on accreditation and clinical governance. Hospitals are adopting cloud-based workforce scheduling, biometric attendance, and mobile rostering platforms to manage their diverse and growing workforce efficiently.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.5% |

Scheduling and Staffing Solutions

Scheduling and staffing tools are core components of hospital workforce management, enabling real-time staff allocation, shift planning, and absence tracking. These solutions optimize labor utilization, reduce overtime costs, and ensure adequate nurse-to-patient ratios, especially in high-acuity departments like ICUs and emergency rooms. Cloud-based platforms with AI-driven forecasting and mobile accessibility are increasingly favored, allowing dynamic shift adjustments and employee self-service portals. Demand is being driven by nurse shortages, burnout, and regulatory mandates around safe staffing.

North America leads adoption, particularly in the USA where value-based care requires workforce efficiency. Europe follows, with countries like Germany and the UK integrating scheduling platforms into national health systems. Future trends include predictive analytics for workload balancing, AI-powered skill-matching engines, and integration with patient acuity scores for real-time shift optimization.

Time & Attendance and Payroll Management

Time and attendance systems help hospitals monitor staff hours, track absenteeism, manage clock-in/out compliance, and streamline payroll processing. These solutions are critical in large facilities with multiple shifts and union-based contracts, where payroll accuracy and auditability are essential. Integration with HR systems and biometric or mobile attendance technologies is becoming standard.

Healthcare systems in North America, the Middle East, and Australia are prioritizing such platforms for cost containment and operational transparency. In emerging markets, digitization of manual attendance processes is a key growth area. Future innovations include geofencing for mobile check-ins, facial recognition attendance, and blockchain-based shift records for regulatory audits.

Cloud-Based Solutions Leading the Hospital Workforce Management Landscape

Cloud-based workforce management solutions are witnessing rapid adoption, especially among multi-facility hospital networks and private healthcare providers. Benefits include scalability, lower upfront IT infrastructure costs, automatic updates, and remote access capabilities. These systems allow hospital administrators to manage staff scheduling, payroll, credential tracking, and compliance workflows across sites in real time. Cloud adoption is also driven by the need for flexibility in crisis scenarios (e.g., pandemics, staffing surges).

The USA, UK, UAE, and Australia are at the forefront, while India and Southeast Asia are seeing fast uptake in corporate hospital chains. Future developments include AI-driven cloud orchestration for demand forecasting and hybrid deployment models for data-sensitive departments.

On-Premise Solutions

On-premise deployment remains relevant for large public hospitals and healthcare systems with strict data governance or compliance requirements, especially in regions with limited cloud infrastructure or stringent data residency laws. These systems offer greater customization and local control but require significant IT maintenance and capital investment.

Adoption is still prevalent in government healthcare institutions in Europe, Asia, and Latin America. However, the shift toward hybrid solutions and modular upgrades is helping these hospitals transition gradually to cloud-compatible environments. Future trends include on-premise systems with cloud-backup capabilities, API-based interoperability, and cybersecurity enhancements tailored for healthcare IT environments.

The Hospital Workforce Management market is expanding due to rising awareness of canine influenza, increasing pet ownership, and higher spending on companion animal health. Canine influenza, caused primarily by H3N8 and H3N2 strains, has led to a growing demand for antiviral drugs, supportive therapies, and vaccines. Veterinary pharmaceutical companies and animal health product manufacturers are investing in preventive and symptomatic treatment options to manage outbreaks and reduce transmission risks.

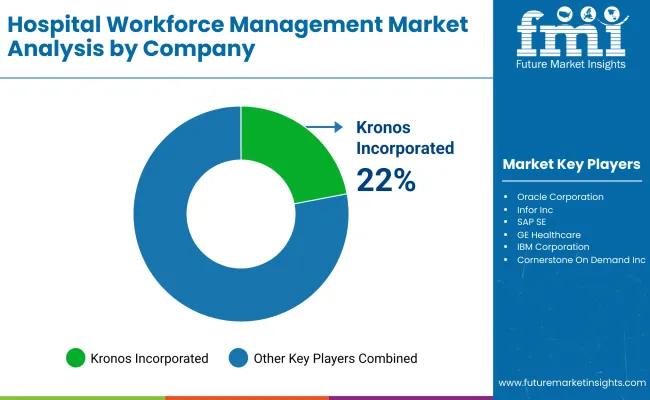

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kronos Incorporated (UKG) | 22-26% |

| Oracle Corporation | 16-20% |

| Infor Inc. | 14-18% |

| SAP SE | 12-16% |

| Workday, Inc. | 10-14% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kronos Incorporated (UKG) | Offers cloud-based workforce management suites for healthcare scheduling, timekeeping, and labor analytics. Widely adopted across hospitals and health systems. |

| Oracle Corporation | Provides advanced human capital management (HCM) software with modules tailored for healthcare workforce optimization, talent acquisition, and retention. |

| Infor Inc. | Specializes in workforce planning, predictive analytics, and staff scheduling tools designed specifically for hospital and clinical environments. |

| SAP SE | Delivers enterprise-level workforce management solutions integrated with HR and payroll, enabling compliance and staff efficiency in hospital networks. |

| Workday, Inc. | Offers AI-driven cloud HR solutions for workforce planning, talent management, and compliance in healthcare, supporting real-time decision-making. |

Key Company Insights

Kronos (UKG) (22-26%)

UKG dominates the hospital workforce management segment with its specialized scheduling, time tracking, and analytics tools, widely used in large healthcare systems.

Oracle Corporation (16 to 20%)

Oracle leverages its robust HCM platform to offer tailored workforce solutions that integrate seamlessly with hospital ERP and compliance systems.

Infor Inc. (14-18%)

Infor stands out for its predictive analytics capabilities, helping hospitals optimize staffing based on demand forecasting and resource allocation.

SAP SE (12-16%)

SAP supports hospital networks with integrated workforce and payroll solutions, ensuring regulatory compliance and process automation.

Workday, Inc. (10-14%)

Workday’s intuitive and scalable solutions cater to mid- to large-sized hospital systems, focusing on operational agility and staff engagement.

Other Key Players (20-30% Combined)

Other companies contributing to the hospital workforce management market include:

These players support market expansion through regional software supply, in deep services, and workforce management programs designed to improve hospital workforce management globally.

Software and Services

Web-based, Cloud-based and On-premise

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for hospital workforce management market was USD 1,801.2 million in 2025.

The hospital workforce management market is expected to reach USD 4,162.1 million in 2035.

The increasing demand for improved efficiency in hospital operations, as healthcare systems face mounting pressure to reduce costs while maintaining high-quality patient care.

The top key players that drives the development of hospital workforce management market are, Kronos Incorporated (UKG), Oracle Corporation, Infor Inc., SAP SE and Workday, Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Mode of Delivery, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Mode of Delivery, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Mode of Delivery, 2018 to 2033

Table 13: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Western Europe Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 16: Western Europe Market Value (US$ Million) Forecast by Mode of Delivery, 2018 to 2033

Table 17: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 19: Eastern Europe Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 20: Eastern Europe Market Value (US$ Million) Forecast by Mode of Delivery, 2018 to 2033

Table 21: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 23: South Asia and Pacific Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 24: South Asia and Pacific Market Value (US$ Million) Forecast by Mode of Delivery, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Mode of Delivery, 2018 to 2033

Table 29: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Forecast by Service, 2018 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Forecast by Mode of Delivery, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Service, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Mode of Delivery, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Mode of Delivery, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Mode of Delivery, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Mode of Delivery, 2023 to 2033

Figure 17: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Service, 2023 to 2033

Figure 19: Global Market Attractiveness by Mode of Delivery, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Service, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Mode of Delivery, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Mode of Delivery, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Mode of Delivery, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Mode of Delivery, 2023 to 2033

Figure 37: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Service, 2023 to 2033

Figure 39: North America Market Attractiveness by Mode of Delivery, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Service, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Mode of Delivery, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Mode of Delivery, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Mode of Delivery, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Mode of Delivery, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Service, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Mode of Delivery, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) by Service, 2023 to 2033

Figure 63: Western Europe Market Value (US$ Million) by Mode of Delivery, 2023 to 2033

Figure 64: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 69: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 70: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 71: Western Europe Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 72: Western Europe Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 73: Western Europe Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) Analysis by Mode of Delivery, 2018 to 2033

Figure 75: Western Europe Market Value Share (%) and BPS Analysis by Mode of Delivery, 2023 to 2033

Figure 76: Western Europe Market Y-o-Y Growth (%) Projections by Mode of Delivery, 2023 to 2033

Figure 77: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 78: Western Europe Market Attractiveness by Service, 2023 to 2033

Figure 79: Western Europe Market Attractiveness by Mode of Delivery, 2023 to 2033

Figure 80: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 82: Eastern Europe Market Value (US$ Million) by Service, 2023 to 2033

Figure 83: Eastern Europe Market Value (US$ Million) by Mode of Delivery, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 89: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 90: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 91: Eastern Europe Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 92: Eastern Europe Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 93: Eastern Europe Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 94: Eastern Europe Market Value (US$ Million) Analysis by Mode of Delivery, 2018 to 2033

Figure 95: Eastern Europe Market Value Share (%) and BPS Analysis by Mode of Delivery, 2023 to 2033

Figure 96: Eastern Europe Market Y-o-Y Growth (%) Projections by Mode of Delivery, 2023 to 2033

Figure 97: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Attractiveness by Service, 2023 to 2033

Figure 99: Eastern Europe Market Attractiveness by Mode of Delivery, 2023 to 2033

Figure 100: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) by Service, 2023 to 2033

Figure 103: South Asia and Pacific Market Value (US$ Million) by Mode of Delivery, 2023 to 2033

Figure 104: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 109: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 110: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 111: South Asia and Pacific Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 112: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 113: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 114: South Asia and Pacific Market Value (US$ Million) Analysis by Mode of Delivery, 2018 to 2033

Figure 115: South Asia and Pacific Market Value Share (%) and BPS Analysis by Mode of Delivery, 2023 to 2033

Figure 116: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Mode of Delivery, 2023 to 2033

Figure 117: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 118: South Asia and Pacific Market Attractiveness by Service, 2023 to 2033

Figure 119: South Asia and Pacific Market Attractiveness by Mode of Delivery, 2023 to 2033

Figure 120: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Service, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Mode of Delivery, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 129: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 130: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Mode of Delivery, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Mode of Delivery, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Mode of Delivery, 2023 to 2033

Figure 137: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 138: East Asia Market Attractiveness by Service, 2023 to 2033

Figure 139: East Asia Market Attractiveness by Mode of Delivery, 2023 to 2033

Figure 140: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 141: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 142: Middle East and Africa Market Value (US$ Million) by Service, 2023 to 2033

Figure 143: Middle East and Africa Market Value (US$ Million) by Mode of Delivery, 2023 to 2033

Figure 144: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 149: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 150: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 151: Middle East and Africa Market Value (US$ Million) Analysis by Service, 2018 to 2033

Figure 152: Middle East and Africa Market Value Share (%) and BPS Analysis by Service, 2023 to 2033

Figure 153: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service, 2023 to 2033

Figure 154: Middle East and Africa Market Value (US$ Million) Analysis by Mode of Delivery, 2018 to 2033

Figure 155: Middle East and Africa Market Value Share (%) and BPS Analysis by Mode of Delivery, 2023 to 2033

Figure 156: Middle East and Africa Market Y-o-Y Growth (%) Projections by Mode of Delivery, 2023 to 2033

Figure 157: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 158: Middle East and Africa Market Attractiveness by Service, 2023 to 2033

Figure 159: Middle East and Africa Market Attractiveness by Mode of Delivery, 2023 to 2033

Figure 160: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hospital Service Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hospitality Mattress Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospitality Staffing Market Size and Share Forecast Outlook 2025 to 2035

Hospital Stretchers Market Size and Share Forecast Outlook 2025 to 2035

Hospital Surgical Disinfectant Market Size and Share Forecast Outlook 2025 to 2035

Hospital Supplies Market Size and Share Forecast Outlook 2025 to 2035

Hospital Disinfectant Products & Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hospital-Acquired Infection (HAI) Control Market – Prevention & Growth Trends 2025 to 2035

Hospital Consumables Market Analysis - Growth, Demand & Forecast 2025 to 2035

Hospital Bedsheet & Pillow Cover Market Analysis - Size, Trends & Forecast 2024 to 2034

Hospital Information System Market

Hospital Capacity Management Solutions Market Insights - Growth & Forecast 2024 to 2034

Hospital Resource Management Market

Non-Hospital-Based Point-Of-Care Diagnostic Products Market Size and Share Forecast Outlook 2025 to 2035

Smart Hospitality & Coworking Spaces Market Trends - Growth & Forecast 2025 to 2035

Micro-Hospitals Market

Smart Hospitality Management Market

Europe Hospital Capacity Management Solution Market Growth – Trends & Forecast 2025 to 2035

Bedless Hospitals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA