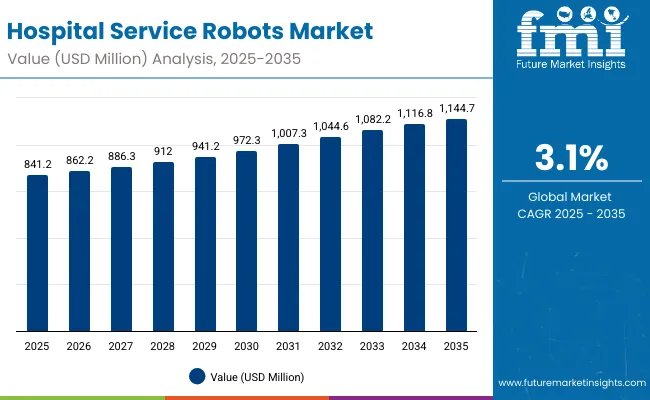

The hospital service robots market is projected to grow from USD 841.2 million in 2025 to approximately USD 1,144.7 million by 2035, recording an absolute increase of USD 303.5 million over the forecast period. This translates into a total growth of 36.1%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.1% between 2025 and 2035. The overall market size is expected to grow by nearly 1.4X during the same period, supported by increasing demand for automation in healthcare facilities, growing need for contactless operations, and rising adoption of robotic solutions in critical medical environments across global healthcare infrastructure.

Hospital Service Robots Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 841.2 million |

| Forecast Value in (2035F) | USD 1,144.7 million |

| Forecast CAGR (2025 to 2035) | 3.1% |

Between 2025 and 2030, the hospital service robots market is projected to expand from USD 841.2 million to USD 972.3 million, resulting in a value increase of USD 131.1 million, which represents 43.2% of the total forecast growth for the decade. This phase of development will be shaped by increasing healthcare automation deployment, rising adoption of robotic solutions in medical facilities, and growing utilization in infection control and patient care applications. Equipment manufacturers and robotics suppliers are expanding their production capabilities to address the growing preference for autonomous healthcare solutions in critical medical operations and patient service applications.

From 2030 to 2035, the market is forecast to grow from USD 972.3 million to USD 1,144.7 million, adding another USD 172.4 million, which constitutes 56.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced robotic technologies, the integration of artificial intelligence and machine learning capabilities, and the development of specialized robotic solutions for diverse healthcare applications. The growing emphasis on patient safety and infection control will drive demand for autonomous disinfection systems and contactless service delivery solutions with enhanced operational reliability.

Between 2020 and 2024, the hospital service robots market experienced robust growth, driven by the COVID-19 pandemic's impact on healthcare operations and growing recognition of robotic automation's importance in maintaining safe healthcare environments. The market developed as healthcare providers recognized the potential for service robots to enhance operational efficiency while meeting stringent safety requirements. Technological advancement in artificial intelligence and sensor technologies began emphasizing the critical importance of maintaining operational continuity while reducing human contact and improving service delivery capabilities

Market expansion is being supported by the increasing global demand for healthcare automation solutions and the corresponding shift toward robotic technologies that can provide superior operational efficiency while meeting stringent safety requirements for critical medical environments. Modern healthcare facilities and hospital administrators are increasingly focused on incorporating service robots to enhance operational safety while satisfying demands for contactless operations and proven performance in demanding healthcare settings. Hospital service robots' proven ability to deliver consistent service delivery, operational reliability, and infection control capabilities makes them essential components for advanced healthcare operations and critical medical applications.

The growing emphasis on healthcare digitization and smart hospital initiatives is driving demand for intelligent robotic systems that can support distinctive operational characteristics and mission-critical applications across patient care, logistics, and facility management categories. Healthcare provider preference for solutions that combine operational excellence with proven safety credentials is creating opportunities for innovative robotic implementations in both traditional and emerging healthcare applications. The rising influence of infection control protocols and operational optimization is also contributing to increased adoption of autonomous robotic systems that can provide real-time operational monitoring and enhanced service capabilities.

The market is segmented by product type, use case, facility type, and commercial model. By product type, the market is divided into logistics AMRs, disinfection robots, delivery robots, and telepresence robots. Based on use case, the market is categorized into materials and medical transport, disinfection, linen and waste management, and patient interaction. By facility type, the market is divided into large hospitals, mid-size hospitals, and clinics/ASC. By commercial model, the market is segmented into CapEx purchase and RaaS subscription.

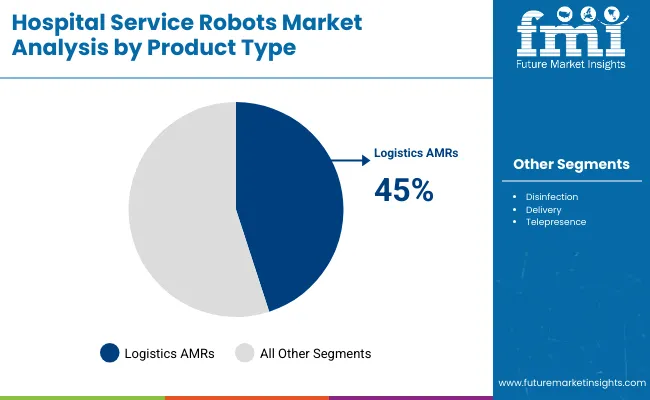

The logistics AMRs segment is projected to account for 45.0% of the hospital service robots market in 2025, reaffirming its position as the leading product type category. Healthcare facilities and hospital administrators increasingly utilize logistics AMRs for their operational versatility, superior navigation capabilities, and ease of integration in complex healthcare environments across diverse medical applications. This robot type's proven design directly addresses healthcare requirements for reliable material transport and efficient operations in high-traffic hospital settings.

This segment forms the foundation of modern hospital automation applications, as it represents the configuration with the greatest adaptability and established compatibility across multiple healthcare systems. Healthcare provider investments in automation optimization and operational efficiency continue to strengthen adoption among hospital administrators. With healthcare facilities prioritizing operational safety and consistent service delivery, logistics AMRs align with both efficiency objectives and infection control requirements, making them the central component of comprehensive hospital automation strategies.

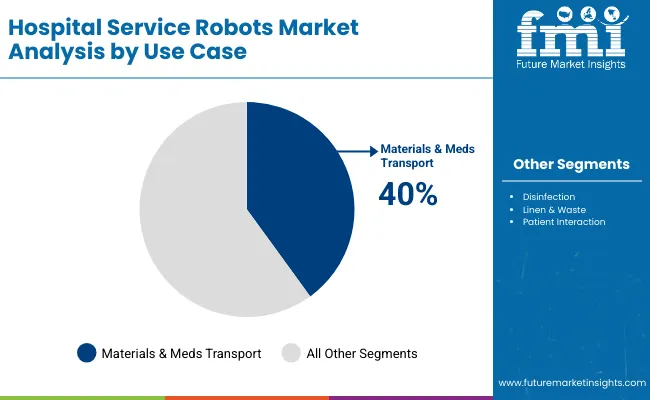

Materials and medical transport applications represent the dominant segment of hospital service robots demand in 2025, accounting for 40.0% market share, underscoring their critical role as essential components for healthcare facility operations. Healthcare providers prefer robotic transport systems for their operational reliability, load-carrying capacity, and ability to support both standard operations and specialized applications while offering proven effectiveness in demanding hospital environments. Positioned as essential components for hospital logistics, transport robots offer both operational capability and competitive advantages.

The segment is supported by continuous growth in hospital automation programs and the growing availability of specialized robotic variants that enable facility differentiation and operational effectiveness at the healthcare level. Additionally, hospital administrators are investing in advanced transport technologies to support medication delivery and operational accessibility. As healthcare automation continues to gain priority and providers seek reliable solutions, materials and medical transport applications will continue to dominate the market landscape while supporting operational excellence and facility efficiency strategies.

The hospital service robots market is advancing steadily due to increasing healthcare preference for automated solutions and growing demand for robotic systems that emphasize safe operation across medical and patient care applications. However, the market faces challenges, including high initial investment costs due to advanced technology requirements, technical complexity from healthcare integration needs, and competition from traditional manual processes. Innovation in AI-powered robotic systems and infection control integration continues to influence market development and expansion patterns.

Expansion of Healthcare Automation Applications

The growing adoption of hospital service robots in advanced medical facilities and automated healthcare applications is enabling hospital administrators to develop operations that provide distinctive service capabilities while commanding premium positioning and enhanced operational characteristics. Automated applications provide superior operational differentiation while allowing more sophisticated healthcare development across various medical categories and patient care segments. Healthcare providers are increasingly recognizing the competitive advantages of robotic integration for advanced facility development and healthcare automation penetration.

Integration of AI and Machine Learning Technologies

Modern robotics manufacturers are incorporating artificial intelligence, machine learning algorithms, and predictive analytics capabilities to enhance robot performance, improve operational insights, and meet healthcare demands for intelligent automation solutions. These technologies enhance operational efficiency while enabling new applications, including predictive maintenance and smart facility management systems for robots. Advanced technology integration also allows suppliers to support premium market positioning and healthcare trust building beyond traditional robotic supply relationships.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 3.7% |

| Brazil | 3.6% |

| France | 3.1% |

| USA | 2.8% |

| Germany | 2.3% |

| UK | 2.9% |

| Japan | 2.5% |

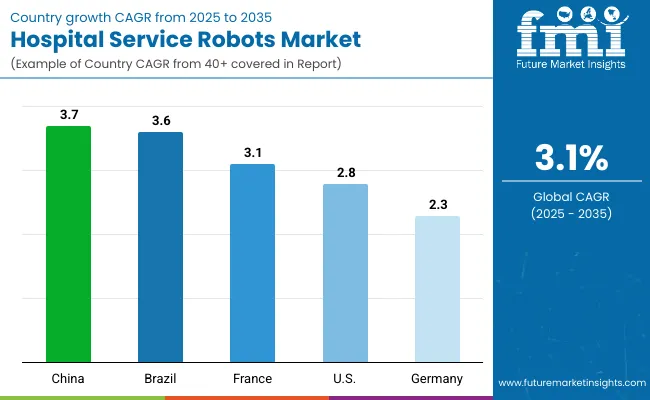

The hospital service robots market is experiencing steady growth globally, with China leading at a 3.7% CAGR through 2035, driven by the expanding healthcare sector, growing hospital automation adoption, and increasing healthcare infrastructure development across medical facilities. Brazil follows at 3.6%, supported by rapid healthcare modernization, rising hospital investments, and increasing demand for automation solutions in emerging healthcare sectors.

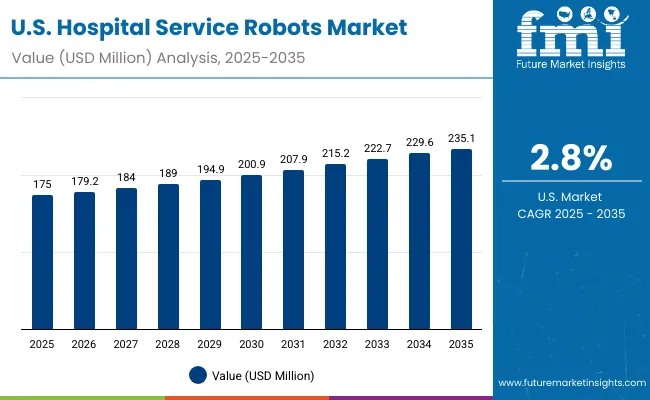

The USA shows growth at 2.8%, emphasizing advanced healthcare applications and medical technology requirements. France records 3.1%, focusing on healthcare innovation excellence and medical facility modernization. Germany demonstrates 2.3% growth, prioritizing precision healthcare technology and advanced medical equipment integration. The UK exhibits 2.9% growth, supported by healthcare automation capabilities and medical technology expertise. Japan shows 2.5% growth, emphasizing precision healthcare manufacturing and technological innovation.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from hospital service robots in China is projected to exhibit strong growth with a CAGR of 3.7% through 2035, driven by the rapidly expanding healthcare sector and increasing hospital automation adoption across medical facilities seeking advanced robotic solutions. The country's growing healthcare infrastructure and strategic medical technology development are creating substantial demand for service robots in both traditional and advanced healthcare applications. Major robotics manufacturers and healthcare suppliers are establishing comprehensive production and distribution capabilities to serve both domestic healthcare requirements and export markets.

Revenue from hospital service robots in Brazil is expanding at a CAGR of 3.6%, supported by rapid healthcare modernization, increasing medical facility investments, and growing focus on healthcare infrastructure development requiring automation solutions. The country's developing healthcare sector and expanding medical infrastructure are driving demand for robotic systems across both traditional and modern healthcare applications. International robotics companies and domestic manufacturers are establishing comprehensive distribution and production capabilities to address growing market demand for reliable healthcare automation.

Revenue from hospital service robots in the United States is projected to grow at a CAGR of 2.8% through 2035, driven by the country's advanced healthcare capabilities, medical technology requirements, and continued focus on automation solutions for critical applications. The USA's sophisticated healthcare infrastructure and willingness to invest in robotic systems are creating substantial demand for both standard and specialized robotic variants. Leading healthcare companies and technology suppliers are establishing comprehensive sourcing strategies to serve both healthcare operations and specialized medical markets.

Revenue from hospital service robots in France is projected to grow at a CAGR of 3.1% through 2035, supported by the country's advanced healthcare innovation industry, medical facility modernization sector, and established tradition of medical excellence requiring high-quality robotic solutions. French healthcare providers and medical facilities consistently demand superior robotic systems that meet exacting quality standards for both domestic operations and international healthcare markets. The country's position as a healthcare technology leader continues to drive innovation in robotic applications and quality standards.

Revenue from hospital service robots in Germany is projected to grow at a CAGR of 2.3% through 2035, supported by the country's precision healthcare technology programs, expanding medical capabilities, and focus on advanced medical infrastructure requiring automation solutions. German healthcare facilities prioritize operational effectiveness, technology reliability, and medical capability enhancement, making service robots essential components for both domestic operations and regional healthcare applications. The country's comprehensive medical development programs and strategic emphasis support continued robotics market development.

Revenue from hospital service robots in the UK is projected to grow at a CAGR of 2.9% through 2035, supported by the country's advanced healthcare industry, expertise in medical technology, and established medical tradition requiring high-quality robotic solutions. British healthcare organizations' focus on operational excellence and proven technologies creates steady demand for reliable robotic systems and specialized variants. The country's attention to technology quality and operational effectiveness drives consistent adoption across both traditional and specialized healthcare applications.

Revenue from hospital service robots in Japan is projected to grow at a CAGR of 2.5% through 2035, supported by the country's advanced healthcare capabilities, precision medical expertise, and focus on developing high-quality medical technologies. Japan's healthcare sector continues to benefit from its reputation for producing superior precision products while working to address evolving medical requirements and develop advanced robotic technologies through continuous innovation.

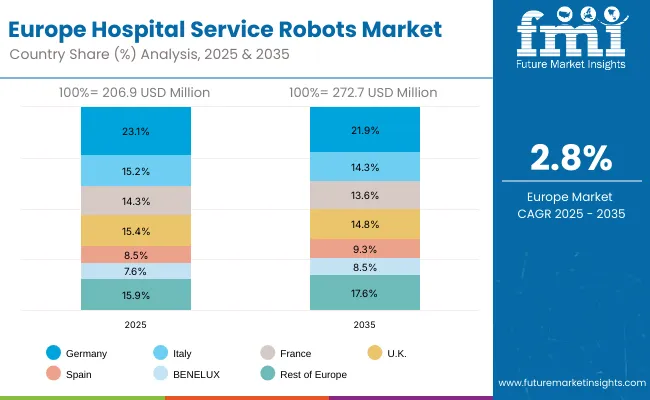

The hospital service robots market in Europe is projected to grow from USD 206.9 million in 2025 to USD 272.7 million by 2035, registering a CAGR of 2.8% over the forecast period. Germany is expected to maintain its leadership position with a 23.1% market share in 2025, declining slightly to 21.9% by 2035, supported by its advanced precision healthcare sector and medical technology manufacturing capabilities serving European and international markets.

The United Kingdom follows with a 15.9% share in 2025, projected to reach 17.6% by 2035, driven by established healthcare expertise and medical automation capabilities. France holds a 14.3% share in 2025, expected to reach 13.6% by 2035, supported by growing healthcare innovation programs and medical technology development. Italy commands a 15.2% share in 2025, projected to reach 14.3% by 2035, while Spain accounts for 8.5% in 2025, expected to reach 8.3% by 2035.

BENELUX maintains a 7.6% share in 2025, growing to 8.5% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, and other European nations, is anticipated to hold 15.4% in 2025, declining to 15.8% by 2035, attributed to mixed growth patterns with steady expansion in some Eastern European markets balanced by slower growth in smaller Western European countries implementing healthcare modernization programs.

Patient-Centric Automation Drives Hospital Service Robot Adoption in Japan In Japan, the hospital service robots market is anchored by hospital facilities, which account for 58.4% of deployments in 2025. Demand is driven by rising hospital automation initiatives, staff shortage pressures, and the need for advanced patient-care support systems. Nursing homes and rehabilitation centers represent smaller but stable segments, supported by aging population dynamics and government-backed healthcare digitization. Japanese operators emphasize delivery and disinfection robots for logistics and infection-control reliability, while rehabilitation-focused robotics adoption steadily rises through partnerships with medical device manufacturers and care providers.

Market Characteristics

Collaborative Healthcare Robotics Providers Shape South Korea’s Market In South Korea, healthcare providers drive 45.8% of service robot adoption, with technology companies (32.1%) and medical device manufacturers (16.3%) emerging as key collaborators in 2025. The market reflects a hybrid model where healthcare institutions directly deploy robots while technology companies and device manufacturers co-develop tailored systems. This structure encourages adoption of advanced telepresence and rehabilitation robots, particularly in large hospital networks and private healthcare facilities. Local technology firms partner with international players to enhance system integration, while healthcare providers focus on procurement efficiency and operational reliability.

Channel Insights

The hospital service robots market is characterized by competition among established robotics manufacturers, specialized healthcare automation producers, and integrated medical technology suppliers. Companies are investing in advanced robotic technologies, artificial intelligence systems, safety enhancement processes, and comprehensive testing protocols to deliver consistent, high-performance, and reliable robotic solutions. Innovation in autonomous navigation, infection control capabilities, and specialized healthcare applications is central to strengthening market position and healthcare provider confidence.

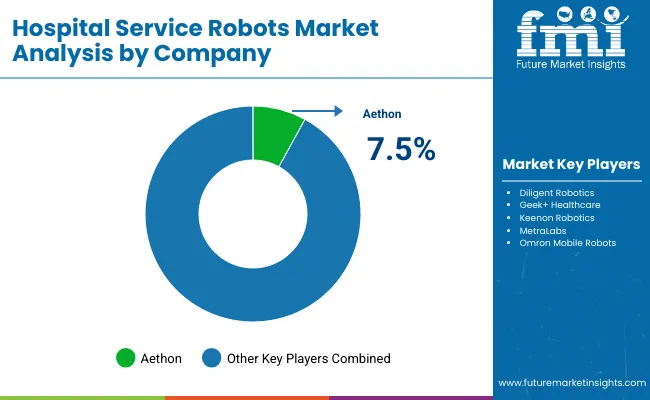

Aethon leads the market with a strong focus on logistics automation and healthcare robotics, offering comprehensive robotic solutions that emphasize safety assurance and operational reliability. Diligent Robotics provides advanced AI-powered healthcare robots with a focus on patient interaction and clinical workflows. Geckō Healthcare delivers specialized disinfection and cleaning robotics with a focus on infection control and healthcare safety. Keenon Robotics specializes in service delivery robots with emphasis on food service and material transport applications. MetraLabs focuses on autonomous mobile robot technology and healthcare facility navigation. Omron Mobile Robots emphasises collaborative robotics with a focus on healthcare logistics and automation integration.

The global hospital service robots market represents a critical technology segment within healthcare automation and medical facility management, projected to grow from USD 841.2 million in 2025 to USD 1,144.7 million by 2035 at a CAGR of 3.1%. Logistics AMRs dominate with 45% market share, serving primarily healthcare facilities that demand exceptional operational reliability, safety compliance, and extended service capabilities. The market's expansion is driven by healthcare automation adoption, infection control requirements, and growing emphasis on contactless operations across critical healthcare applications. Achieving sustained growth requires coordinated efforts across healthcare policy makers, medical standards organizations, robotics manufacturers, healthcare integrators, and investment providers.

Healthcare Infrastructure Investment: Establish dedicated healthcare technology zones and medical innovation hubs with specialized facilities for robotic development, including AI testing centers, safety validation laboratories, and skilled workforce training institutes to support domestic healthcare robotics capabilities.

R&D and Innovation Support: Fund research programs focused on advanced healthcare robotics, AI integration with medical workflows, and infection control systems. Support collaborative projects between universities, research institutes, and robotics manufacturers to develop next-generation healthcare robotic solutions.

Skills Development Programs: Invest in technical education and vocational training programs that develop expertise in healthcare robotics, medical device integration, AI systems, and robotic maintenance techniques required for hospital service robot deployment and operation.

Regulatory Framework Development: Create comprehensive regulatory guidelines for healthcare robotics covering safety standards, medical device approvals, data privacy requirements, and operational protocols that enable safe deployment while encouraging innovation in medical robotics.

Healthcare Technology Adoption: Provide funding incentives for healthcare facilities to adopt robotic solutions, establish pilot programs for robotic deployment, and create reimbursement frameworks that support healthcare automation investments.

Medical Standards Development: Establish comprehensive safety standards for healthcare robots covering infection control protocols, patient safety requirements, medical device compliance, and operational guidelines that ensure consistent quality across manufacturers and healthcare facilities.

Safety Certification Protocols: Develop standardized testing methodologies for healthcare robot evaluation including safety validation, infection control effectiveness, operational reliability assessment, and clinical workflow integration that support procurement decisions.

Clinical Guidelines Documentation: Create medical guidelines for robot deployment, infection control procedures, staff training protocols, and maintenance methodologies that help healthcare providers optimize robot performance and ensure patient safety across healthcare applications.

Professional Certification Programs: Establish technical certification courses for healthcare robotics specialists, maintenance engineers, and clinical staff to ensure industry-wide competency in healthcare robot technology and medical application expertise.

Healthcare Analytics & Research: Provide regular clinical studies covering technology effectiveness, patient outcomes, safety analysis, and operational impacts to guide evidence-based adoption for healthcare providers and administrators across medical facilities.

Advanced Healthcare Robotics: Develop precision healthcare capabilities including sterile operation systems, advanced navigation technologies, infection control features, and automated safety protocols that ensure consistent performance meeting stringent medical requirements.

AI Integration Capabilities: Incorporate machine learning, computer vision, and predictive analytics into robotic designs to enable intelligent task execution, adaptive learning capabilities, and operational optimization for healthcare facility workflows.

Medical Technology Innovation: Advanced healthcare-specific features, including antimicrobial surfaces, sterilization systems, medical-grade sensors, and clinical workflow integration that improve operational effectiveness and ensure compliance with healthcare standards.

Modular Healthcare Platforms: Create standardized robotic families and modular healthcare systems that enable rapid customization for specific medical applications while maintaining economies of scale and reducing development costs for specialized healthcare requirements.

Clinical Support Infrastructure: Establish comprehensive healthcare support networks, including clinical application engineering, on-site technical assistance, staff training programs, and digital tools that help healthcare providers deploy, operate, and maintain optimal robotic solutions.

Integrated Deployment Strategies: Develop robotic integration approaches that optimise facility workflows around robotic capabilities, including staff training programs, operational procedure development, and infection control protocols to maximise robot effectiveness and facility efficiency.

Vendor Partnership Development: Build strategic relationships with robotics manufacturers that provide early access to healthcare technologies, collaborative development opportunities, and guaranteed support for critical medical applications requiring specialized robotic solutions.

Clinical Workflow Integration: Implement robotic systems and clinical protocols that leverage healthcare automation to optimize patient care delivery, reduce operational costs, and improve overall healthcare effectiveness while maintaining safety standards.

Application-Specific Solutions: Develop specialized robotic requirements for specific healthcare applications including emergency response, pharmaceutical delivery, patient transport, and facility management that require unique operational characteristics and safety features.

Safety Assurance Programs: Establish comprehensive robotic validation procedures including clinical testing, safety verification, and vendor qualification processes that ensure consistent quality and performance across healthcare robotic deployments.

Technology Development Funding: Finance advanced research facilities, robotic development systems, and healthcare technology investments that enable robotics manufacturers to scale innovation capabilities and meet growing healthcare demand for automated solutions.

Healthcare Innovation Capital: Provide venture capital and growth funding for healthcare robotics startups developing AI-powered systems, advanced medical robots, innovative healthcare applications, and digital solutions that advance robotic capabilities in medical environments.

Market Expansion Investment: Support healthcare market development initiatives, including medical facility partnerships, clinical validation programs, regulatory approval processes, and healthcare provider relationships in high-growth medical markets.

Healthcare Integration Support: Finance vertical integration strategies that combine robotics manufacturing with healthcare technology development, medical device production, and clinical support capabilities to create more comprehensive healthcare automation solutions.

Industry Consolidation Facilitation: Support strategic mergers and acquisitions that create larger, more capable healthcare robotics organizations with enhanced clinical expertise, broader technology portfolios, and global healthcare reach necessary to serve major medical facilities effectively.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 841.2 Million |

| Product Type | Logistics AMRs, Disinfection, Delivery, Telepresence |

| Use Case | Materials & Meds Transport, Disinfection, Linen & Waste, Patient Interaction |

| Facility Type | Large Hospital, Mid-size Hospital, Clinics/ASC |

| Commercial Model | CapEx Purchase, RaaS Subscription |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, Brazil, France, the United States, Germany, the United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Aethon, Diligent Robotics, Geckō Healthcare, Keenon Robotics, MetraLabs, Omron Mobile Robots, Panasonic Healthcare, Savioke, TUG Robots, MiR Robotics, Swisslog Healthcare, Relay Robotics, Fetch Robotics, InTouch Health, Xenex Disinfection Services |

| Additional Attributes | Dollar sales by product type and use case, regional demand trends, competitive landscape, technological advancements in robotic design, AI integration capabilities, healthcare automation programs, and medical facility deployment strategies |

By North America

By Europe

By East Asia

By South Asia & Pacific

By Latin America

By Middle East & Africa

The market is projected to grow from USD 841.2 million in 2025 to USD 1,144.7 million by 2035, at a CAGR of 3.1%.

Logistics AMRs are the leading product type, expected to account for 45.0% of the market share in 2025.

Adoption is driven by increasing healthcare automation, demand for contactless operations, and the need for infection control and patient safety.

Asia Pacific, North America, and Europe are expected to be the key growth regions, with China leading at a CAGR of 3.7% through 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hospital Disinfectant Products & Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hospital Bedsheet & Pillow Cover Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Hospitality Mattress Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospitality Staffing Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Hospital Stretchers Market Size and Share Forecast Outlook 2025 to 2035

Hospital Surgical Disinfectant Market Size and Share Forecast Outlook 2025 to 2035

Hospital Supplies Market Size and Share Forecast Outlook 2025 to 2035

Service Resource Planning (SRP) SaaS Solutions Market Size and Share Forecast Outlook 2025 to 2035

Service Bureau Market Analysis - Size, Growth, and Forecast 2025 to 2035

The Hospital Workforce Management Market is segmented by product, and end user from 2025 to 2035

Hospital-Acquired Infection (HAI) Control Market – Prevention & Growth Trends 2025 to 2035

Service Laboratory Market Analysis by Service Type, Deployment, Channel, End-user, and Region Through 2035

Hospital Consumables Market Analysis - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA