The global Cockpit display market is expected to expand substantially between 2025 and 2035, receiving a boost from demand for advanced avionics, increased aircraft output, and growing investments in next-generation display technologies. Cockpit displays play a vital role in furnishing pilots with real-time flight information, navigation data and situational awareness, enhancing operational efficiency and flight safety.

Market growth is being driven by the increasing adoption of digital and multifunctional displays, advancements in touchscreen interfaces, augmented reality (AR), and synthetic vision systems. In addition, electric and autonomous aircraft are growing in numbers showcasing rapid evolution for the industry backed by greater regulatory focus on aviation safety and a growing demand for upgrades in commercial and military aviation.

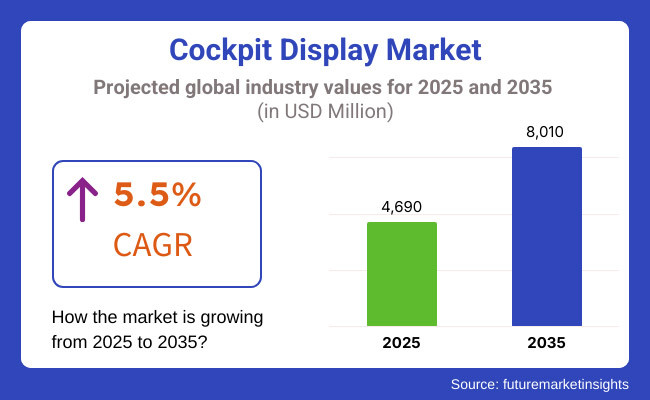

2025, the Cockpit display market size is estimated to be worth approximately USD 4,690 Million. Forecasts indicate that by the year 2035, the market value will be USD 8,010 Million, with a growth rate with a CAGR of 5.5%. The increasing integration of glass cockpit systems, rising aerospace modernization investments, and expanding cockpit display applications in manned and unmanned aerial vehicles (UAVs) are driving the growth of this market.

The introduction of AI-powered flight assistance, improved data visualization tools, and low-cost manufacturing methods are also contributing to the growth of the flight battery market. Moreover, the rise of custom-color, high-resolution and energy-efficient cockpit displays shapes the growth of the market space and adoption by end-users.

Powered by a vast aerospace and defense industry, plenty of investment in aviation technology, and strong demand for next generation avionics, North America continues to be the world leader in cockpit displays. North America, especially the United States and Canada, has been at the forefront of developing and commercializing advanced cockpit display solutions, including touchscreen avionics, artificial intelligence-based flight data analysis, and real-time monitoring systems.

Market expansion can be attributed to the growing demand for glass cockpit configurations, regulatory assistance for aviation safety improvements, and an increase in demand from commercial airlines and defense contractors. The introduction of electric vertical take-off and landing (eVTOL) aircraft, along with increased investments in pilot training and simulator technologies, are also fuelling the product innovation and adoption.

The European-backed market is distinguished by increasing demand for superior avionics technologies, government-led aerospace modernization initiatives, and breakthroughs in cockpit display technologies. Germany, France, and the UK are working to create high-res, energy-efficient displays for commercial aircraft, military jets, and business aviation.

The increasing importance of reducing pilot workload, optimizing human-machine interaction, and increasing research on artificial intelligence-based avionics are also propelling the market adoption. Nov 23, 2022 - Further, growing applications across regional airlines, advanced air mobility, and flight simulation training are likely to present more opportunities for manufacturers and technology providers.

According to Research Dive, the Cockpit display market in Asia-Pacific is expected to experience the fastest growth due to increasing aircraft deliveries, growing air passenger traffic, and rising investments in aviation infrastructure. As part of domestic aerospace capability advancements, China, India, and Japan are investing significantly in R&D for advanced cockpit display systems.

Demand for next-gen commercial and military jets has soared, which in turn is driving the growth of budget airlines at a staggering pace while the regulatory environment for aviation safety is changing with global aviation safety organizations updating their standards while government programs are incentivizing homegrown aircraft production resulting in the regional market growth.

Moreover, growing awareness for improved flight deck automation and next-generation avionics is further supporting the market penetration. Moreover, there are also several domestic aerospace manufacturers in the regione, and partnerships with global avionics companies, which are further propelling the growth of the market.

Steady growth in demand for regional air travel, increasing investments in modernizing aircraft fleets, and expanding military aviation programs are all contributing to the growth of the market in Latin America. Brazil and Mexico are the main contributors, targeting the proliferation of leading-edge cockpit displays for commercial and defense uses.

Market growth is further propelled by the integration of advanced digital flight instrumentation, availability of economical avionics solutions through government-led initiatives for the enhancement of aviation infrastructure. The increasing low-cost carriers, rising investments in pilot training programs, and the growing demand for high-efficiency flight monitoring systems are relieving accessibility of products across the region.

The Cockpit display market in the Middle East & Africa region is growing steadily, driven by investments in aviation technology, defense modernization programs, and the growth of commercial airlines. The UAE and Saudi Arabia are taking the lead in making these types of cockpit displays available and advancing the technology in this space.

Market growth is also being fueled by the increase in premium airline fleets, demand for advanced avionics in military applications, and partnerships between international and local aerospace manufacturers. Other factors, including government policies that support flight safety for next-generation aircraft, innovations in cockpit ergonomics, and consumer demand for seamless air travel experiences are conducive to the long-term growth of the industry.

Additionally, the demand for cockpit display systems is increasing due to the growing influence of smart aviation solutions as well as the presence of any aerospace research and development centers in the region.

Cockpit display market is anticipated to witness sustained growth in the realm due to the ongoing advancements in avionics technology, digital flight instrumentation and optimization of pilot interface. Touchscreen avionics, augmented reality navigation, and AI-powered flight analytics, when applied to mobility, are being closely monitored by companies competing to find the next big thing that will increase functionality, market appeal, and longevity.

Moreover, the future of the industry is being influenced by rising consumer concern over improved flight safety, growing digital integration in aviation management, and changing pilot training methods. AI-powered predictive maintenance, voice-activated cockpit interfaces, and high-definition OLED displays used today are helping to revolutionize the way pilots interact with cockpit displays worldwide to improve the quality of the pilot experience.

Challenge

High Development and Integration Costs

Cost and complexity of advanced display development and integration are some of the challenges in the cockpit display market. Aviation and automotive industries need cockpit displays that satisfy strict safety, performance, and regulatory requirements, making research and development (R&D) cost-prohibitive.

Indeed, implementation of new cockpit displays with existing avionics and vehicle systems involves costly investment in software compatibility, testing, and cybersecurity measures. In order to overcome these challenges, manufacturers can emphasis on modular displays architectures, cost effective manufacturing and working with software developers to optimize integration processes and minimize costs.

Cybersecurity Risks and Data Vulnerabilities

Cybersecurity threats to aviation and automotive safety are a critical challenge as cockpit displays move towards greater digitization and connectivity. As in-crew systems now support wireless networking technologies, such as cloud processing of data, as well as real-time sharing of flight or driving information, the cockpit display systems have become more susceptible to cyberattacks, data breaches and system malfunctions.

But regulators are now tightening aircraft cybersecurity measures to help ensure that cockpit designs can't be hacked or compromised. Companies need to focus on investing in layered encryption methods, multi-layered firewalls, real-time security monitoring, and AI-driven threat detection systems to strengthen their overall cybersecurity resilience to mitigate these risks.

Opportunity

Growing Demand for Advanced Avionics and Smart Displays

Cockpit display market is expected to witness immense growth on account of increasing demand for advanced avionics and smart cockpit displays. Next-gen glass cockpits with, (touchscreen) controls, AR interfaces and HUDs are being integrated among operational efficiencies and pilot situational awareness by aircraft manufacturers.

The automotive industry is also no exception, adopting digital instrument clusters, infotainment systems and augmented driving displays to enhance user experience and vehicle automation. [Also Read: Indian car market going electric, but will it benefit the average consumer?

Companies that make investments in high-resolution, adaptive, as well as AI-driven cockpit display technology will benefit from the burgeoning demand for cockpit technologies within both aviation as well as automotive market segments.

Expansion of Electric and Autonomous Vehicles

Innovation in the cockpit display segment is rapidly driven by the growing adoption of electric vehicles (EVs) and autonomous driving technologies. Complex visual displays like advanced driver-assistance systems (ADAS), augmented reality heads-up displays (AR-HUDs), and virtual personal assistants powered by AI are revolutionizing vehicle communication.

As car makers move to self-driving and connected cars, cockpits are becoming real-time navigation, vehicle diagnostics, driver monitoring and entertainment centers. In the emerging market of EVs and autonomous vehicles, companies that leverage AI-integrated displays, holographic projections, and gesture-based control technologies will be at a strong advantage.

Sample Draft An overview of the Cockpit display market from 2020 to 2024 and the trends beyond 2025 to 2035 the cockpit display market has experienced a notable shift between 2020 and 2024, spurred by the digital revolution occurring within the aviation and automotive sectors. With the introduction of glass cockpits, AR-enhanced navigation displays, and AI-powered avionics, situational awareness and pilot efficiency improved significantly.

But issues including high manufacturing costs, cybersecurity risks, and integration complexities stunted its widespread use. In response, companies invested in software-driven solutions, modular cockpit designs, and strengthened cybersecurity measures to keep pace with the changing industry landscape.

In 2025 to 2035, AI will leap forward in flight displays, autonomous driving interfaces, and new touchless control systems, among others. Brain-computer interfaces (BCIs), real-time pilot remote monitoring, quantum encryption for cybersecurity, and truly adaptive holographic cockpit displays will set new industry boundaries.

Furthermore, new technologies such as ultra-thin OLED panels, energy efficient display, and blockchain enabled avionics security will be contributing for the growth of the cockpit display market in future. Move risk technology into cockpit displays, and make artificial intelligence integration, user experience, and cybersecurity innovations at the forefront of evolution.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter safety and cybersecurity regulations for cockpit displays |

| Technological Advancements | Adoption of AR HUDs, digital instrument clusters, and AI-assisted avionics |

| Industry Adoption | Increased use of touchscreen avionics and smart automotive displays |

| Supply Chain and Sourcing | Dependence on traditional display panel manufacturers |

| Market Competition | Dominance of established avionics and automotive display suppliers |

| Market Growth Drivers | Demand for enhanced situational awareness and pilot assistance |

| Sustainability and Energy Efficiency | Focus on low-power LCD and LED technologies |

| Integration of Smart Monitoring | Limited AI-driven cockpit data analytics |

| Advancements in Display Innovation | Touchscreen-based avionics and digital clusters |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance monitoring, quantum encryption, and blockchain-based security frameworks |

| Technological Advancements | Development of holographic displays, brain-computer interfaces, and real-time adaptive cockpit systems |

| Industry Adoption | Expansion into fully digital cockpits, autonomous vehicle interfaces, and gesture-controlled aviation systems |

| Supply Chain and Sourcing | Growth in flexible OLED, micro-LED production, and sustainable display manufacturing |

| Market Competition | Rise of AI-driven cockpit startups, software-based aviation solutions, and holographic technology providers |

| Market Growth Drivers | Growth in AI-powered real-time analytics, predictive cockpit displays, and adaptive user experience solutions |

| Sustainability and Energy Efficiency | Large-scale adoption of ultra-low-power displays, eco-friendly display materials, and energy-efficient avionics |

| Integration of Smart Monitoring | Widespread use of real-time AI-driven pilot assistance, automated flight monitoring, and predictive safety systems |

| Advancements in Display Innovation | Fully adaptive, AI-enhanced cockpit ecosystems with immersive augmented reality navigation and interactive displays |

The USA Cockpit display market is one of the largest markets and is supported by leading aerospace and defence manufacturers, the rising demand for advanced and innovative avionics and, the growing adoption of next-generation cockpit systems. Military modernization and commercial aviation growth, strongly in focus, are driving market expansion.

Increasing investments in cockpit displays with touchscreen capabilities, augmented reality (AR) based avionics, and real-time data integration all encourage market development. Furthermore, pilots' experience is enhanced and aircraft safety improved through integration of AI-enabled flight analytics, high-resolution OLED displays and augmented reality situational awareness features.

The firms are also concentrating on the design of cockpit display solutions that are lightweight and energy-efficient to attain higher fuel efficacy. Apart from this, growing next-gen avionics demand from commercial and defense aircrafts is another factor adding to the USA market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

The UK is a major region contributing significantly to the growth of cockpit displays and is expected to dominate the cockpit displays market in Europe due to increasing investments in aerospace advancements, growing acceptance of digitally-enabled flight instrumentation, and increasing demand for military avionics. Also driving demand is the focus on having aircraft that are safe, and on interfaces that allow pilots to better operate the aircraft.

On the other hand, government aviation rules, which encourage replacing obsolete avionics with modern entrees, along with the emerging technology of artificial intelligence for flight data visualization also is sure to widest the market growth. Additionally, advancements in anti-glare, high-brightness displays and multi-functional touchscreens are becoming popular.

Other investments focus on modular cockpit display systems to make aircraft more adaptable. The growing concentration on electric and hybrid airframes development is also stimulating market growth in the UK. Smart cockpit best practice development is also accelerating through collaborations between research institutions and avionics manufacturers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.3% |

The key drivers of the market are growth in aviation industry in Germany, France, and Italy, rising demand for electronic flight instrument systems (EFIS), increasing government support for advancements in aerospace technology.

The rapid growth in the market for flight data analysis tools is driven by the European Union's emphasis on improving flight safety and investments in digital cockpit interfaces and next-generation avionics. Moreover, the growing use of head-up displays (HUDs), synthetic vision systems and real-time weather monitoring solutions makes pilots more efficient. Increasing demand for cockpit displays in business jets and commercial and military aircraft are also factors, driving growth in the market.

Increased adoption across the EU is further bolstered by the expansion of such AI-powered flight management systems and real-time flight data monitoring. Moreover, environmental initiatives in the aerospace sector are driving emerging cockpit display technology to be increasingly energy-efficient and recyclable.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.4% |

The growth of Avionics Cockpit display market in Japan is driven by the country's emphasis on high-precision avionics solutions, rising demand for advanced pilot situational awareness systems, and technological progress in aviation electronics. Market growth is also being stimulated by an increase in demand for lightweight and high-performance cockpit displays.

Innovation is spurred by the country’s focus on technological development, along with OLED and micro-LED display integration. Additionally, stringent government regulations towards aviation safety along with increasing investments towards next-generation fighter jet avionics are also prompting companies to develop high resolution anti-reflective cockpit display.

The increasing demand for compact and multifunctional cockpit display solutions in regional and commercial aircraft is further propelling market growth for Japan aerospace industry. Moreover, the growing emphasis on digital transformation in aviation is fueling the uptake of AI-based flight data analytics and cloud-connected cockpit systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.6% |

The South Korean market is emerging among the leading global cockpit display markets' with a booming aerospace manufacturing sector is accelerating demand for smart avionics and military aircraft modernization programs are rising.

Market growth is aided by robust government regulations that encourage aviation safety and greater adoption of sophisticated flight instrumentation. “Key display technologies including resolution, durability and energy efficiency have helped the country enhance competitiveness. Increased adoption of next-generation cockpit displays in commercial airlines, defence aircraft, and UAVs (unmanned aerial vehicles) is also accelerating market uptake.

To optimize operations, companies are developing augmented reality (AR)-enabled cockpit displays, artificial intelligence (AI) powered pilot assistance systems, and holographic flight control interfaces. Furthermore, the integration of cybersecurity features in cockpit display is further promoting the demand for autonomous flight technology, thus driving the South Korea aerospace avionics systems market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

The air transport segment is expected to remain a key segment for Cockpit display market as demand for air travel continues to rise and fleet upgrading and technological advancement in avionics is expected to play an important role in the growth of Cockpit display market. Much of the development is focused on cockpit tech, new systems that help ensure flight safety, create operational efficiencies and improve pilot situational awareness.

Most modern air transport aircraft feature large, high-resolution primary flight displays (PFDs) and multi-function displays (MFDs) that integrate the real-time flight data, weather monitoring, and navigation systems. Also, next-gen cockpit displays feature augmented reality overlays, improved touchscreen controls and customizable interfaces, making it easier for pilots to interact with these systems and, hopefully, make better use of them. Regulatory mandates for improved EFIS systems have also catalyzed HF display upgrades in commercial aviation.

Traditional cockpit displays in fighter aircraft are very advanced, focused on battle performance, time sensitive information visualization, and advantageous positions. The advanced mission displays required on these aircraft deliver real time targeting, threat assessment, and situational awareness.

Fighter aircraft manufacturers are subsequently working to integrate high resolution, night vision compatible, and helmet-mounted displays, to increase pilot performance in a climate of rising defense expenditure and military modernization programs. Additionally, the introduction of next generation digital cockpits that come equipped with artificial intelligence-assisted analytics has created a stronger market for overall cockpit displays in military aviation, ensuring uninterrupted mission execution and increased survivability.

Showing flight data in real-time to pilots, Primary Flight Displays (PFDs) are an important component of modern cockpits that helps them navigate more accurately and improve their safety. The new displays combine all data regarding altitude, airspeed, attitude and flight path into a single interface allowing for reduced pilot workload and enhanced situational awareness.

With the aviation industry transitioning to glass cockpit configurations, they have become the standard in commercial and military aircraft for PFDs. Manufacturers are emphasizing high resolution, touch screen, and customizable PFDs that align with the successful developmental needs of pilots along with aviation safety regulations.

Demanding more navigational information (and multitasking capabilities); Multi-Function Displays (MFDs) are often used to navigate through the engine, monitoring, weather, and system diagnostics. Pilots can control how data is presented on these displays, enabling optimized flight management and mission execution.

Derived from the commercial sector, demand for higher performance MFDs with advanced graphical interfaces, touch controls, and split-screen capability in both the civil and military aviation domains has also risen. Moreover, this is even more pronounced with the advances of synthetic vision system (SVS) & enhanced vision system (EVS), which have challenged the dependence from modern cockpit with the cockpit display systems, the multi-function displays (MFDs) are redefined.

Cockpit displays of between 5 to 10 inches are still very common on a range of aircraft types, providing a reasonable compromise in compactness versus the ability to read the display and its functionality. These tangent systems serve as mid-sized displays that are frequently incorporated in general aviation, business aircraft, and trainer applications, where space limitations and versatility of system architecture are important factors.

LCD and OLED technologies with increasing resolution have come to improve the legibility and responsiveness of such displays to ensure fluid interaction with the pilot. Also, the development of light-weight, energy-efficient display panels is supporting their mass deployment as well.

Large format cockpit displays greater than 10 inches are being more widely adopted in commercial air transport, fighter jets, and advanced military aircraft, with larger, high-definition screens improving the visibility of operational data and systems integration. These screens can be augmented, used for interactive touch screens, or overlays in real time to missions, assuring pilots that they have the critical information they need with as little distraction as possible.

Wide-screen, high-brightness, and sunlight-readable cockpit displays are becoming significantly more popular, especially on aircraft that require advanced flight planning, terrain mapping and automated flight system monitoring.

The need for advanced avionics, increased situational awareness, and digital flight management systems in commercial and military aircraft from all over the world is driving the growth of the cockpit display market.

Various applications include holographic imaging planes, air thumb drives, high-resolution displays, and touch-enabled interfaces. Key trends in this space include AI-powered avionics, multi-function touch displays and usage of OLED and LCD technologies for improved visibility.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Honeywell International Inc. | 18-22% |

| Garmin Ltd. | 14-18% |

| Thales Group | 11-15% |

| Collins Aerospace (Raytheon Technologies) | 8-12% |

| BAE Systems | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Honeywell International Inc. | Leading provider of high-resolution and AI-powered cockpit displays for commercial and military aircraft. |

| Garmin Ltd. | Specializes in touchscreen avionics, digital flight displays, and integrated flight decks for general aviation. |

| Thales Group | Develops cutting-edge cockpit displays with augmented reality and night-vision capabilities. |

| Collins Aerospace (Raytheon Technologies) | Focuses on multi-function display systems with enhanced situational awareness features. |

| BAE Systems | Innovates in next-generation military cockpit displays with high durability and real-time data integration. |

Key Company Insights

Honeywell International Inc. (18-22%)

Honeywell controls the Cockpit display in the avionics industry by AI-powered avionics, high-resolution multi-function displays, and integrated cockpit design.

Garmin Ltd. (14-18%)

Garmin is a major figure in avionics and cockpit displays, providing innovative touchscreen flight decks and situational awareness solutions for general aviation.

Thales Group (11-15%)

As a high-tech display manufacturer, Thales is involved in integrating augmented reality and enhanced visibility systems into cockpit displays for commercial and defense aircraft.

Collins Aerospace (Raytheon Technologies) (8-12%)

Collins Aerospace specializes in graphic multi-function displays with integrated flight data for military and commercial platforms.

BAE Systems (6-10%)

BAE Systems builds hardened cockpit displays for military and performance aircraft that are oriented around real-time data processing and mission-critical operations.

Other Key Players (30-40% Combined)

Numerous global and regional manufacturers are evolving cockpit displays with digital transformation, high-resolution display technology and pilot-friendly interfaces. Key players include:

The overall market size for Cockpit display market was USD 4,690 Million in 2025.

The Cockpit display market expected to reach USD 8,010 Million in 2035.

Increasing aircraft production, rising adoption of advanced avionics that improve situational awareness, growing demand for the integration of real-time data, and advancements in display technologies are expected to drive demand for the cockpit display market during the forecast period, coupled with an increase in demand for applications in commercial, military, and general aviation infrastructure.

The top 5 countries which drives the development of Cockpit display market are USA, UK, Europe Union, Japan and South Korea.

Air transport and fighter aircraft growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ billion) Forecast by Aircraft Type, 2017 to 2032

Table 4: Global Market Volume (Units) Forecast by Aircraft Type, 2017 to 2032

Table 5: Global Market Value (US$ billion) Forecast by Display Type, 2017 to 2032

Table 6: Global Market Volume (Units) Forecast by Display Type, 2017 to 2032

Table 7: Global Market Value (US$ billion) Forecast by Display Size, 2017 to 2032

Table 8: Global Market Volume (Units) Forecast by Display Size, 2017 to 2032

Table 9: North America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 11: North America Market Value (US$ billion) Forecast by Aircraft Type, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast by Aircraft Type, 2017 to 2032

Table 13: North America Market Value (US$ billion) Forecast by Display Type, 2017 to 2032

Table 14: North America Market Volume (Units) Forecast by Display Type, 2017 to 2032

Table 15: North America Market Value (US$ billion) Forecast by Display Size, 2017 to 2032

Table 16: North America Market Volume (Units) Forecast by Display Size, 2017 to 2032

Table 17: Latin America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017 to 2032

Table 19: Latin America Market Value (US$ billion) Forecast by Aircraft Type, 2017 to 2032

Table 20: Latin America Market Volume (Units) Forecast by Aircraft Type, 2017 to 2032

Table 21: Latin America Market Value (US$ billion) Forecast by Display Type, 2017 to 2032

Table 22: Latin America Market Volume (Units) Forecast by Display Type, 2017 to 2032

Table 23: Latin America Market Value (US$ billion) Forecast by Display Size, 2017 to 2032

Table 24: Latin America Market Volume (Units) Forecast by Display Size, 2017 to 2032

Table 25: Europe Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 26: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 27: Europe Market Value (US$ billion) Forecast by Aircraft Type, 2017 to 2032

Table 28: Europe Market Volume (Units) Forecast by Aircraft Type, 2017 to 2032

Table 29: Europe Market Value (US$ billion) Forecast by Display Type, 2017 to 2032

Table 30: Europe Market Volume (Units) Forecast by Display Type, 2017 to 2032

Table 31: Europe Market Value (US$ billion) Forecast by Display Size, 2017 to 2032

Table 32: Europe Market Volume (Units) Forecast by Display Size, 2017 to 2032

Table 33: Asia Pacific Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2017 to 2032

Table 35: Asia Pacific Market Value (US$ billion) Forecast by Aircraft Type, 2017 to 2032

Table 36: Asia Pacific Market Volume (Units) Forecast by Aircraft Type, 2017 to 2032

Table 37: Asia Pacific Market Value (US$ billion) Forecast by Display Type, 2017 to 2032

Table 38: Asia Pacific Market Volume (Units) Forecast by Display Type, 2017 to 2032

Table 39: Asia Pacific Market Value (US$ billion) Forecast by Display Size, 2017 to 2032

Table 40: Asia Pacific Market Volume (Units) Forecast by Display Size, 2017 to 2032

Table 41: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 42: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2032

Table 43: Middle East and Africa Market Value (US$ billion) Forecast by Aircraft Type, 2017 to 2032

Table 44: Middle East and Africa Market Volume (Units) Forecast by Aircraft Type, 2017 to 2032

Table 45: Middle East and Africa Market Value (US$ billion) Forecast by Display Type, 2017 to 2032

Table 46: Middle East and Africa Market Volume (Units) Forecast by Display Type, 2017 to 2032

Table 47: Middle East and Africa Market Value (US$ billion) Forecast by Display Size, 2017 to 2032

Table 48: Middle East and Africa Market Volume (Units) Forecast by Display Size, 2017 to 2032

Figure 1: Global Market Value (US$ billion) by Aircraft Type, 2022 to 2032

Figure 2: Global Market Value (US$ billion) by Display Type, 2022 to 2032

Figure 3: Global Market Value (US$ billion) by Display Size, 2022 to 2032

Figure 4: Global Market Value (US$ billion) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ billion) Analysis by Region, 2017 to 2032

Figure 6: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ billion) Analysis by Aircraft Type, 2017 to 2032

Figure 10: Global Market Volume (Units) Analysis by Aircraft Type, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Aircraft Type, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Aircraft Type, 2022 to 2032

Figure 13: Global Market Value (US$ billion) Analysis by Display Type, 2017 to 2032

Figure 14: Global Market Volume (Units) Analysis by Display Type, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Display Type, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Display Type, 2022 to 2032

Figure 17: Global Market Value (US$ billion) Analysis by Display Size, 2017 to 2032

Figure 18: Global Market Volume (Units) Analysis by Display Size, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by Display Size, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by Display Size, 2022 to 2032

Figure 21: Global Market Attractiveness by Aircraft Type, 2022 to 2032

Figure 22: Global Market Attractiveness by Display Type, 2022 to 2032

Figure 23: Global Market Attractiveness by Display Size, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ billion) by Aircraft Type, 2022 to 2032

Figure 26: North America Market Value (US$ billion) by Display Type, 2022 to 2032

Figure 27: North America Market Value (US$ billion) by Display Size, 2022 to 2032

Figure 28: North America Market Value (US$ billion) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 30: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ billion) Analysis by Aircraft Type, 2017 to 2032

Figure 34: North America Market Volume (Units) Analysis by Aircraft Type, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Aircraft Type, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Aircraft Type, 2022 to 2032

Figure 37: North America Market Value (US$ billion) Analysis by Display Type, 2017 to 2032

Figure 38: North America Market Volume (Units) Analysis by Display Type, 2017 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Display Type, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Display Type, 2022 to 2032

Figure 41: North America Market Value (US$ billion) Analysis by Display Size, 2017 to 2032

Figure 42: North America Market Volume (Units) Analysis by Display Size, 2017 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by Display Size, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by Display Size, 2022 to 2032

Figure 45: North America Market Attractiveness by Aircraft Type, 2022 to 2032

Figure 46: North America Market Attractiveness by Display Type, 2022 to 2032

Figure 47: North America Market Attractiveness by Display Size, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ billion) by Aircraft Type, 2022 to 2032

Figure 50: Latin America Market Value (US$ billion) by Display Type, 2022 to 2032

Figure 51: Latin America Market Value (US$ billion) by Display Size, 2022 to 2032

Figure 52: Latin America Market Value (US$ billion) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ billion) Analysis by Aircraft Type, 2017 to 2032

Figure 58: Latin America Market Volume (Units) Analysis by Aircraft Type, 2017 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Aircraft Type, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Aircraft Type, 2022 to 2032

Figure 61: Latin America Market Value (US$ billion) Analysis by Display Type, 2017 to 2032

Figure 62: Latin America Market Volume (Units) Analysis by Display Type, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Display Type, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Display Type, 2022 to 2032

Figure 65: Latin America Market Value (US$ billion) Analysis by Display Size, 2017 to 2032

Figure 66: Latin America Market Volume (Units) Analysis by Display Size, 2017 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Display Size, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Display Size, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Aircraft Type, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Display Type, 2022 to 2032

Figure 71: Latin America Market Attractiveness by Display Size, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ billion) by Aircraft Type, 2022 to 2032

Figure 74: Europe Market Value (US$ billion) by Display Type, 2022 to 2032

Figure 75: Europe Market Value (US$ billion) by Display Size, 2022 to 2032

Figure 76: Europe Market Value (US$ billion) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 78: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ billion) Analysis by Aircraft Type, 2017 to 2032

Figure 82: Europe Market Volume (Units) Analysis by Aircraft Type, 2017 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Aircraft Type, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Aircraft Type, 2022 to 2032

Figure 85: Europe Market Value (US$ billion) Analysis by Display Type, 2017 to 2032

Figure 86: Europe Market Volume (Units) Analysis by Display Type, 2017 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Display Type, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Display Type, 2022 to 2032

Figure 89: Europe Market Value (US$ billion) Analysis by Display Size, 2017 to 2032

Figure 90: Europe Market Volume (Units) Analysis by Display Size, 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by Display Size, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Display Size, 2022 to 2032

Figure 93: Europe Market Attractiveness by Aircraft Type, 2022 to 2032

Figure 94: Europe Market Attractiveness by Display Type, 2022 to 2032

Figure 95: Europe Market Attractiveness by Display Size, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: Asia Pacific Market Value (US$ billion) by Aircraft Type, 2022 to 2032

Figure 98: Asia Pacific Market Value (US$ billion) by Display Type, 2022 to 2032

Figure 99: Asia Pacific Market Value (US$ billion) by Display Size, 2022 to 2032

Figure 100: Asia Pacific Market Value (US$ billion) by Country, 2022 to 2032

Figure 101: Asia Pacific Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: Asia Pacific Market Value (US$ billion) Analysis by Aircraft Type, 2017 to 2032

Figure 106: Asia Pacific Market Volume (Units) Analysis by Aircraft Type, 2017 to 2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Aircraft Type, 2022 to 2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Aircraft Type, 2022 to 2032

Figure 109: Asia Pacific Market Value (US$ billion) Analysis by Display Type, 2017 to 2032

Figure 110: Asia Pacific Market Volume (Units) Analysis by Display Type, 2017 to 2032

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Display Type, 2022 to 2032

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Display Type, 2022 to 2032

Figure 113: Asia Pacific Market Value (US$ billion) Analysis by Display Size, 2017 to 2032

Figure 114: Asia Pacific Market Volume (Units) Analysis by Display Size, 2017 to 2032

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Display Size, 2022 to 2032

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Display Size, 2022 to 2032

Figure 117: Asia Pacific Market Attractiveness by Aircraft Type, 2022 to 2032

Figure 118: Asia Pacific Market Attractiveness by Display Type, 2022 to 2032

Figure 119: Asia Pacific Market Attractiveness by Display Size, 2022 to 2032

Figure 120: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 121: Middle East and Africa Market Value (US$ billion) by Aircraft Type, 2022 to 2032

Figure 122: Middle East and Africa Market Value (US$ billion) by Display Type, 2022 to 2032

Figure 123: Middle East and Africa Market Value (US$ billion) by Display Size, 2022 to 2032

Figure 124: Middle East and Africa Market Value (US$ billion) by Country, 2022 to 2032

Figure 125: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 126: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 127: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: Middle East and Africa Market Value (US$ billion) Analysis by Aircraft Type, 2017 to 2032

Figure 130: Middle East and Africa Market Volume (Units) Analysis by Aircraft Type, 2017 to 2032

Figure 131: Middle East and Africa Market Value Share (%) and BPS Analysis by Aircraft Type, 2022 to 2032

Figure 132: Middle East and Africa Market Y-o-Y Growth (%) Projections by Aircraft Type, 2022 to 2032

Figure 133: Middle East and Africa Market Value (US$ billion) Analysis by Display Type, 2017 to 2032

Figure 134: Middle East and Africa Market Volume (Units) Analysis by Display Type, 2017 to 2032

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Display Type, 2022 to 2032

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Display Type, 2022 to 2032

Figure 137: Middle East and Africa Market Value (US$ billion) Analysis by Display Size, 2017 to 2032

Figure 138: Middle East and Africa Market Volume (Units) Analysis by Display Size, 2017 to 2032

Figure 139: Middle East and Africa Market Value Share (%) and BPS Analysis by Display Size, 2022 to 2032

Figure 140: Middle East and Africa Market Y-o-Y Growth (%) Projections by Display Size, 2022 to 2032

Figure 141: Middle East and Africa Market Attractiveness by Aircraft Type, 2022 to 2032

Figure 142: Middle East and Africa Market Attractiveness by Display Type, 2022 to 2032

Figure 143: Middle East and Africa Market Attractiveness by Display Size, 2022 to 2032

Figure 144: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cockpit Module Market

Digital Glass Military Aircraft Cockpit Systems Market Size and Share Forecast Outlook 2025 to 2035

Display Material Market Size and Share Forecast Outlook 2025 to 2035

Display Packaging Market Size and Share Forecast Outlook 2025 to 2035

Display Panel Market Size and Share Forecast Outlook 2025 to 2035

Display Pallets Market Size and Share Forecast Outlook 2025 to 2035

Display Controllers Market by Type, Application, and Region-Forecast through 2035

Displays Market Insights – Growth, Demand & Forecast 2025 to 2035

Display Drivers Market Growth – Size, Demand & Forecast 2025 to 2035

Market Share Distribution Among Display Pallet Manufacturers

Display Paper Box Market

Display Cabinets Market

3D Display Market Size and Share Forecast Outlook 2025 to 2035

4K Display Resolution Market Size and Share Forecast Outlook 2025 to 2035

3D Display Module Market

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

OLED Display Market Size and Share Forecast Outlook 2025 to 2035

Microdisplay Market Size and Share Forecast Outlook 2025 to 2035

IGZO Display Market Size and Share Forecast Outlook 2025 to 2035

Food Display Counter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA