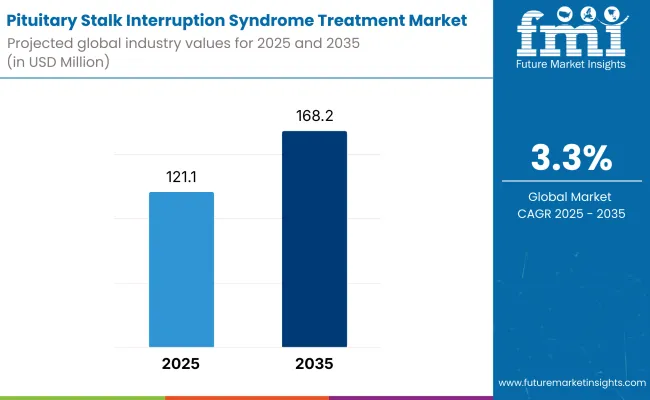

The pituitary stalk interruption syndrome (PSIS) treatment market will be able to see huge growth from 2025 to 2035 owing to the increased congenital hormone deficiency cases and progress in endocrinology treatments. The market is anticipated to be approximately USD 121.1 million in 2025 and is expected to grow as high as USD 168.2 million by 2035 at a compound annual growth rate (CAGR) of 3.3% throughout the forecasting period.

There are several reasons why market dynamics have altered. There is a growing diagnosis of PSIS among children and adolescents, which is one of the strongest reasons and, in turn, increases the requirement for hormone replacement therapy.

Growth hormone therapy is the central dependence of PSIS patients to manage retardation of growth and other endocrine diseases. Low awareness and late diagnosis issues still prevail. These challenges compel the medical experts to develop more efficient diagnostic methods and specialized treatment forms, offering early treatment and better patient outcomes.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 121.1 million |

| Industry Value (2035F) | USD 168.2 million |

| CAGR (2025 to 2035) | 3.3% |

The market is a group of treatment submarkets like hormone replacement treatment, specialist drug treatments, and surgery. Growth hormone therapy is used most frequently as PSIS treatment, and it enables the patients to grow normally as well as maintain normal physiological function.

Also, hormone replacement therapy with cortisol, thyroid-stimulating hormone, and gonadotropin is also an important consideration in the treatment of endocrine deficiencies of the disease. Recombinant DNA technology, a newly developed technology, also enhances safety and efficacy in these therapies as much as increased patient compliance and therapeutic response are concerned.

The North American market is an ideal market for PSIS treatment because of its high-tech healthcare centres and availability of advanced diagnostic machines. The United States and Canada are leaders in the use of new hormone therapy, with major investment in research and development by the pharmaceutical industry.

The increasing realization among paediatricians and endocrinologists regarding the significance of early diagnosis and treatment is also fuelling market growth. Certain USA-based biopharmaceutical firms are manufacturing long-acting growth hormone therapies, reducing injections and increasing patient compliance.

There is a high market share in Europe for PSIS treatment, and there is enormous demand in the Germany, France, and United Kingdom markets. European universal health care policies provide the patient with free access to hormone therapy treatments at the earliest, thus making treatment more accessible. More stringent regulations and guidelines also lead to drug companies creating better and safer drugs for treatment.

Europe's leading research institutions and universities are also engaged in clinical trials for optimal utilization of existing hormone replacement therapies and gene-based therapy of congenital endocrine disorders.

The Asia-Pacific region is going to experience the highest growth in the PSIS treatment market with increasing healthcare expenditure, improving birth rates, and paediatric endocrinology advancements. China, India, Japan, and South Korea are the countries which most likely to be key contributors to the market with increasing medical facilities and government programs to support rare disease awareness.

Top Chinese biotech firms are already joining hands with multinational pharma companies in the pharma industry to offer hormone therapies at affordable prices so that lower income classes can benefit from it. However, in spite of this, delayed diagnosis and paucity of experts still continue to be the endemic problems of the country.

Scaled-Down Awareness and Late Diagnosis

Delayed diagnosis is probably the most crucial issue in the PSIS treatment sector. The majority of cases are not diagnosed until adolescence, when growth retardation and hormone deficiency appear.

Lack of knowledge among primary care physicians and absence of widespread screening programs further contribute to making early diagnosis an exacerbated issue. In order to counteract this, health organizations are launching awareness campaigns and include endocrine screening under children's periodic check-ups.

Gains in Hormone and Gene Therapy

Introduction of gene therapy and long-acting hormone preparations is creating stubborn market opportunities for growth. Researchers are also working on gene-editing technologies to correct congenital endocrine deficiency at the molecular level, offering a sure-shot solution for PSIS.

Long-acting hormone treatments are also being launched by pharma, eradicating daily injections and patient noncompliance. Use of AI-based diagnosis platforms in endocrinology is also boosting early detection rates, enabling timely intervention and personalized treatment protocols.

The treatment market of PSIS expanded uniformly from 2020 to 2024 based on increased awareness, improved diagnostic techniques, and improved paediatric endocrinology. The market for growth hormone therapy expanded very rapidly as medical physicians started focusing on early intervention policies. In addition, biopharmaceutical companies invested in research and development of producing recombinant hormone medications, giving more secure and quality care to the patients.

The market will also receive shape year by year from 2025 to 2035 by virtue of the triad of the convergence of precision medicine, artificial intelligence-based diagnostic technology, and gene therapy innovation. Increased government expenditure on research into rare diseases and effective coordination between research institutions and biotech firms will drive more innovation.

Treatment regimens that are patient-focused such as long-term therapy with growth hormone and wearables drug pumps will improve compliance with medication and enhance patient outcome for an extended period of time.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments focused on expanding health insurance coverage of chronic illness, overall access to treatment for Pituitary Stalk Interruption Syndrome (PSIS) patients. Laws for promoting early diagnosis and genetic screening for better treatment results. |

| Technological Advancements | Advanced MRI technology allows for more accurate and earlier detection of PSIS, improving diagnosis. Genetic analysis is provided for patients on a wide scale, allowing earlier intervention. |

| Treatment Modalities | Replacement therapy with growth hormone (GHRT) and thyroid hormone therapy are the most frequent treatments ordered for PSIS. Multidisciplinary treatment programs involving endocrinologists and neurologists become standard care regimens. |

| Patient Management Trends | Early intervention programs target diagnosis of PSIS in childhood, which improves long-term results. Physicians stress a cooperative, multidisciplinary management approach to the condition. |

| Psychosocial Support | PSIS support groups become more popular, as improved mental illness treatment alleviates the psychological stigma of the disease. Family PSIS support groups and forums online are more easily accessed. |

| Economic Factors | Greater focus on health care spending to cover the costs of hormone therapies, neuroimaging, and genetic screening. Emerging markets reflect growing interest in affordable treatments for orphan disorders. |

| Market Growth Drivers | Greater growth due to heightened awareness of PSIS, early detection, and rising access to specialty healthcare services. Greater investment in PSIS clinical trials and research. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Global laws will require a greater insurance payout of such specialized treatments as hormone therapy and neuroendocrine care. New regulations will cause hospitals and healthcare centres to adopt precision medicine that is tailored to a patient's PSIS profile. |

| Technological Advancements | Telemedicine, hormone replacement therapy (HRT) administration, and digital health monitoring software advances will alter the PSIS treatment landscape. Growth hormone will be tracked by smart devices in real-time, and control over the condition will be more precise. |

| Treatment Modalities | New biologics and targeted treatments will be introduced, aiming at pituitary function recovery. Nano medicine can be employed to optimize drug delivery in PSIS patients, minimizing side effects and maximizing the treatment efficacy. |

| Patient Management Trends | Patient-focused care will receive increasing attention, and treatment schemes will be developed to tailor each patient on the basis of genetic and environmental factors. Individualized therapies will be designed to meet the unique needs of PSIS patients, improving compliance and results. |

| Psychosocial Support | Psychological support will be a part of the treatment process. Mental health apps will offer on-demand therapy and coping techniques for PSIS patients and families. There will be greater focus on the emotional well-being of adolescent PSIS patients. |

| Economic Factors | Low-cost models of treatment will arise from economic imperatives. Public-private funding of research and development will be backed by partnerships, which will make treatments affordable in low- and middle-income countries. |

| Market Growth Drivers | Market growth will be fuelled by advancements in gene therapies, enhanced HRT formulations, and growing demand for personalized medicine. The advent of digital healthcare solutions for PSIS management will be another key driver of the market's growth. |

Increasing access to medical care and greater awareness of the condition drive the USA market for PSIS treatment. The increasing number of early diagnoses in part owing to advances in MRI technology and genetic testing has resulted in an increasing demand for hormone replacement therapy and elevation of level of care.

Some of the most significant trends include a drive to personalized medicine in PSIS management, with more emphasis on genetic profiling to customize hormone therapy for each individual patient. In addition, patient-centred programs focusing on psychological counselling and holistic treatment of the disease are taking off.

In the USA, there are increasing clinical trials for new treatments, including biologics that trigger pituitary function. This revolution will play a major role in market growth. Telemedicine is also being received in hospitals and endocrinology clinics to follow up on recovering patients, with little hospitalization required. Patients under the PSIS are given the best treatment possible, ensuring new treatments are readily available thanks to the advanced healthcare system.

| Country | CAGR (2025 to 2035) |

|---|---|

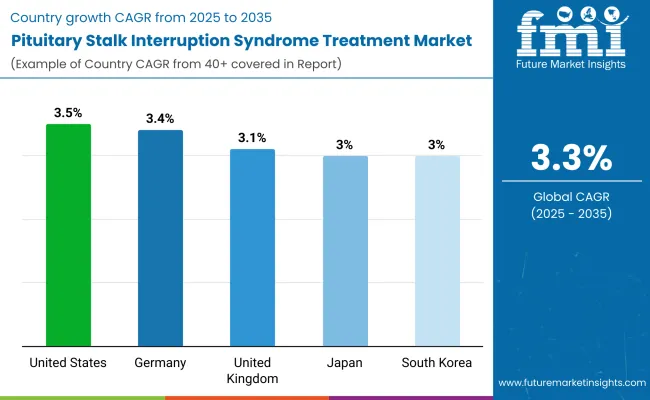

| USA | 3.5% |

In the UK, treatment for PSIS is changing with greater emphasis on paediatric and adult populations being treated earlier and managed more intensively. National Health Service (NHS) coverage of rare diseases, including PSIS, has increased to facilitate better patient access to hormonal therapy and genetic counselling services.

Besides, the focus by the government on mental health awareness guarantees that psychosocial care is being integrated into the holistic treatment of PSIS, addressing both the physical and psychological needs of patients.

The increasing availability of digital health monitoring devices for PSIS patients, such as wearables that track hormone levels, will likely drive further market growth. In addition, the push toward precision medicine and the use of telehealth services in the healthcare system will continue to drive innovation in PSIS treatment in the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.1% |

Germany's healthcare system is one of Europe's most advanced, and the country's treatment market for PSIS is expanding with high demand for expert care and early diagnosis. Germany's emphasis on precision medicine is leading to more personalized treatment plans for PSIS patients, allowing for better outcomes. The country is also experiencing a shift towards biologic drugs and gene therapies to repair pituitary function.

Germany's robust pharmaceutical industry is investing big in PSIS research, as new clinical trials and treatments continue to come forth. This includes advancements in advanced hormone delivery systems as well as nanomedicine-based drug formulation applications, which will significantly improve the quality of life for PSIS patients.

Mental health treatment is a part of the treatment plan, and the government's commitment to include psychological treatment in medical treatment plans is set to drive market growth in this area.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.4% |

In Japan, treatment of PSIS is transforming rapidly, as the aging population and healthcare technology make specialized treatment a necessity for rare diseases. The healthcare network in Japan is well-known all over the world for its technological developments, and adoption of telemedicine, wearable health devices, and AI-driven diagnostic technologies is enhancing the treatment of PSIS. Moreover, Japan's drive to diagnose PSIS early with the help of genetic screening is stimulating the need for PSIS treatment.

The country also faces growing demands for biologic treatment and replacement therapy with hormones, particularly the more personalized and targeted treatment. Japanese research institutes are at the forefront of coming up with innovative treatments, such as pituitary rebuilding treatment using stem cell-based care.

Because of a high population with a strong emphasis on mental wellbeing, Japan is going to have enormous growth in treatment patterns encompassing medical care and psychological management for PSIS patients.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.0% |

The healthcare of South Korea is highly developed, and there is increasing investment in therapies for rare diseases like PSIS. The PSIS treatment market is growing since there is increased awareness and improved availability of genetic tests and tailored treatment.

South Korea's focus on precision medicine and digital health technologies converging into mainstream care is set to drive innovation in the management of PSIS.

The growing application of telemedicine will enable better PSIS patient care, especially in rural and underserved areas. South Korea's strong biotechnology sector will also be able to offer advanced PSIS treatments, including more efficient and targeted hormone replacement therapies. Mental health services are becoming more integrated into the nation's healthcare system, and PSIS patients will benefit from it even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.0% |

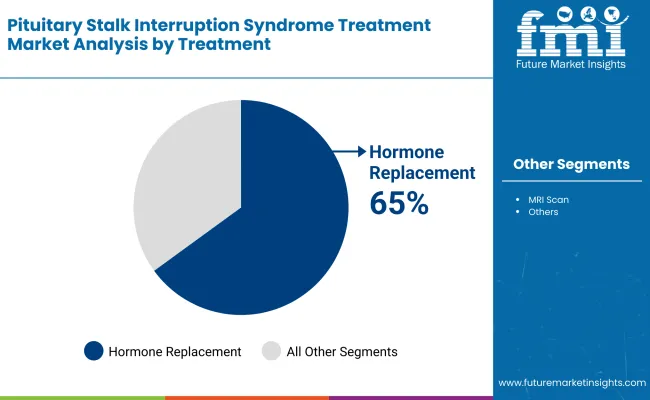

| By Treatment | Market Share (2025) |

|---|---|

| Hormone Replacement | 65% |

Pituitary stalk interruption syndrome is a rare endocrine system disorder, and hormone replacement therapy is the standard treatment. PSIS leads to deficiency of multiple hormones by disrupting the pituitary stalk and releasing hormones. Hormone replacement can rectify deficiencies of growth hormone, thyroid hormone, and sex hormones.

This therapy is a key part of symptom management for issues like growth failure and developmental delay in kids. Increased awareness regarding the contribution of hormone replacement in treatment options leading to the betterment of overall treatment outcomes is causing this segment to occupy the largest market share.

New hormone preparations and advances in individualized therapy provide the impetus toward widely employ hormone replacement in PSIS management.

| By Treatment | Market Share (2025) |

|---|---|

| MRI Scan | 52% |

MRIs are crucial to providing a correct diagnosis of pituitary stalk interruption syndrome. MRI scans help show details of the pituitary gland and surrounding tissues, and allow physicians to confirm pituitary stalk anomalies, which is a critical step in diagnosing PSIS.

MRI obtains relatively higher and better images with the advent of it, enabling diagnosis at an earliest stage as well as improved treatment planning. Although MRI scans are inherently diagnostic, physiological imaging is fundamental to the healing process in determining appropriate interventions, including other hormone replacement therapy.

This category is anticipated to gain further momentum since an increasing number of healthcare facilities are adopting advanced MRI technology for the early detection of PSIS along with other endocrine disorders.

We have prompted thoughts on the treatment market for PSIS, which continues to be a competitive marketplace largely driven by the fields of endocrinology, genetic studies, as well as emerging drug therapies.

Big pharma and biotech are interested in enhancing diagnostic sensitivity as well as developing hormone replacement therapies to address the management of growth hormone deficiency and other endocrine disorders in PSIS.

Some prior key clinical studies of interest to market players include the use of early intervention, customized treatment protocols, and long-term management strategies. The industry comprises a mix of big pharma players and newer biotech firms that are interested in new types of therapeutic approaches.

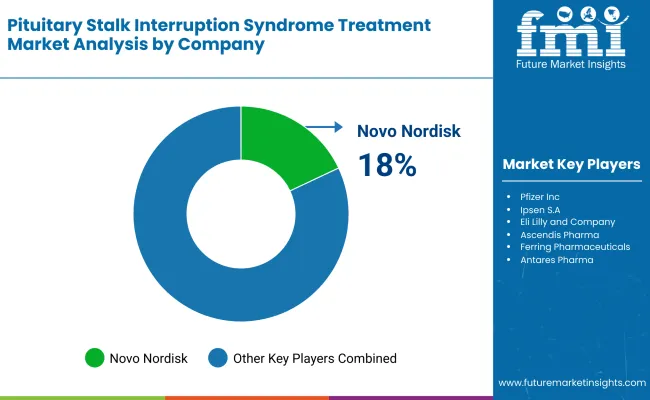

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Novo Nordisk | 18-23% |

| Pfizer Inc. | 14-18% |

| Ipsen S.A. | 10-15% |

| Eli Lilly and Company | 7-12% |

| Ascendis Pharma | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Novo Nordisk | Novo Nordisk launched a next-generation, long-acting growth hormone therapy in 2024 that decreased the burden of daily injections and improved compliance among patients taking GH therapy. |

| Pfizer Inc. | In 2024 , Pfizer launched clinical trials for a next-generation recombinant human growth hormone aimed at children with congenital PSIS. |

| Ipsen S.A. | IPSEN launched AI-focused patient monitoring platform for PSIS patients to monitor their hormone therapy progress in 2024. |

| Eli Lilly and Company | In 2024 , Eli Lilly pioneered a tailored hormone replacement plan, using genetic markers to facilitate more effective treatment. |

| Ascendis Pharma | For paediatric PSIS patients, Ascendis Pharma’s 2024 approval of a weekly growth hormone injection by the FDA further increased convenience and adherence to treatment. |

Key Company Insights

Novo Nordisk (18-23%)

Novo Nordisk is the largest market player in the treatment of PSIS and has experience with growth hormone therapy and treatment of other endocrine disorders. Novo Nordisk launched long-acting growth hormone in 2024, aiming to reduce injection frequency and increase compliance for children with growth hormone deficiency. With its global reach and dedication to research-based solutions, Novo Nordisk is leading the way in PSIS treatment advancements.

Pfizer Inc. (14-18%)

Pfizer at the forefront of development of next-generation hormone replacement therapies. The company also extended its clinical trials for a recombinant human growth hormone in 2024, which acts to provide children with PSIS more efficient and predictable results. On the back of its focus on precision medicine and targeted development, Pfizer has an edge in the market.

Ipsen S.A. (10-15%)

Ipsen has a well-known established brand for its endocrinology therapies and technology-led solutions for patient management. In 2024, it introduced an AI-based patient monitoring platform that allows doctors to monitor hormone therapy more accurately. This initiative encourages more personalized therapy and better long-term patient outcomes.

Eli Lilly and Company (7-12%)

Lilly is committed to developing personalized treatment for endocrine disorders. It also launched in 2024 a hormone replacement therapy for PSIS patients that is individualized based on their genetic profiles to ensure that they get maximum treatment effects. Through the integration of genetic data into treatment protocols, Eli Lilly is at the forefront for precision medicines in paediatrics endocrinology.

Ascendis Pharma (5-9%)

Another large player emerging in the treatment of PSIS is Ascendis Pharma. In 2024, the company got FDA approval for its weeklong growth hormone injection - an easier solution than the daily treatments. This shift signifies increasing demand for treatment products, which is advantageous for patients, reinforcing Ascendis Pharma's leadership position within the market.

Other Large Players (40-50% Combined)

Other players in the PSIS treatment arena are equally diverse, concentrated on academia-led drug development, novel delivery systems, and patient-centric care. These include:

The overall market size for pituitary stalk interruption syndrome treatment was USD 121.1 million in 2025.

The pituitary stalk interruption syndrome treatment market is expected to reach USD 168.2 million by 2035.

The increasing prevalence of pituitary disorders, advancements in diagnostic techniques, and growing awareness about early intervention are expected to drive the demand for pituitary stalk interruption syndrome treatment during the forecast period.

The top 5 countries driving the development of the pituitary stalk interruption syndrome treatment market are the USA, Germany, the UK, France, and Japan.

On the basis of treatment, hormone replacement therapy is anticipated to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Symptoms, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Symptoms, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Symptoms, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Symptoms, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Symptoms, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Symptoms, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Symptoms, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Symptoms, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Symptoms, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Users, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Symptoms, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Symptoms, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Symptoms, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 17: Global Market Attractiveness by Symptoms, 2023 to 2033

Figure 18: Global Market Attractiveness by Treatment, 2023 to 2033

Figure 19: Global Market Attractiveness by End Users, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Symptoms, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End Users, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Symptoms, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Symptoms, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Symptoms, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 37: North America Market Attractiveness by Symptoms, 2023 to 2033

Figure 38: North America Market Attractiveness by Treatment, 2023 to 2033

Figure 39: North America Market Attractiveness by End Users, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Symptoms, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End Users, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Symptoms, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Symptoms, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Symptoms, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Symptoms, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Treatment, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End Users, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Symptoms, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End Users, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Symptoms, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Symptoms, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Symptoms, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 77: Europe Market Attractiveness by Symptoms, 2023 to 2033

Figure 78: Europe Market Attractiveness by Treatment, 2023 to 2033

Figure 79: Europe Market Attractiveness by End Users, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Symptoms, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End Users, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Symptoms, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Symptoms, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Symptoms, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Symptoms, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Treatment, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End Users, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Symptoms, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End Users, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Symptoms, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Symptoms, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Symptoms, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Symptoms, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Treatment, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End Users, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Symptoms, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End Users, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Symptoms, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Symptoms, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Symptoms, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Symptoms, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Treatment, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End Users, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Symptoms, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End Users, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Symptoms, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Symptoms, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Symptoms, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 157: MEA Market Attractiveness by Symptoms, 2023 to 2033

Figure 158: MEA Market Attractiveness by Treatment, 2023 to 2033

Figure 159: MEA Market Attractiveness by End Users, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stalkerware Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Algae Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Water Treatment System Market Growth - Trends & Forecast 2025 to 2035

Water Treatment Chemical Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA