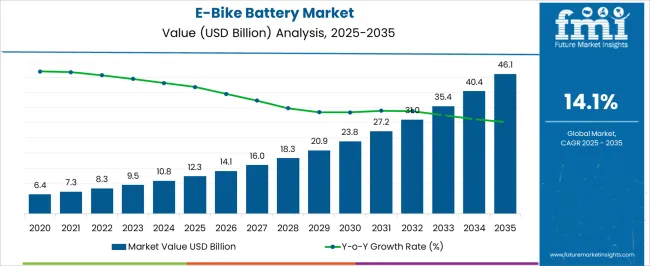

The ebike battery market is estimated to be valued at USD 12.3 billion in 2025 and is projected to reach USD 46.1 billion by 2035, registering a compound annual growth rate (CAGR) of 14.1% over the forecast period. An early versus late growth curve comparison highlights distinct phases of expansion in the market. Between 2025 and 2030, the market grows from USD 12.3 billion to USD 23.8 billion, contributing USD 11.5 billion in growth, with a CAGR of 14.4%. This early-phase growth is driven by the increasing popularity of electric bikes as an eco-friendly, cost-effective alternative to traditional transportation.

Demand for long-lasting, high-capacity batteries rises with the growing adoption of e-bikes, particularly in urban areas and for commuting purposes. During this phase, the market sees strong acceleration, fueled by advances in battery technology, government incentives, and shifting consumer preferences toward sustainable mobility solutions. From 2030 to 2035, the market expands from USD 23.8 billion to USD 46.1 billion, contributing USD 22.3 billion in growth, with a slightly lower CAGR of 13.9%. This phase represents the market’s maturity, as widespread adoption of e-bikes leads to incremental growth. While the demand remains strong, growth rates moderate as the initial market surge stabilizes. The comparison indicates a rapid acceleration in the early phase, followed by more stable, yet still significant, growth as e-bike adoption becomes more mainstream and integrated into transportation ecosystems globally.

| Metric | Value |

|---|---|

| E-Bike Battery Market Estimated Value in (2025 E) | USD 12.3 billion |

| E-Bike Battery Market Forecast Value in (2035 F) | USD 46.1 billion |

| Forecast CAGR (2025 to 2035) | 14.1% |

Growing environmental concerns, rising fuel prices, and shifting consumer preferences toward sustainable commuting are driving widespread adoption of electric bicycles. Urban infrastructure upgrades and government-backed incentives for electric vehicle adoption are further supporting battery demand in this segment.

Developments in lithium battery chemistry and improvements in energy density are enabling longer ride ranges and shorter charging times, making e-bikes more viable for daily commuting. Companies are increasingly investing in modular and swappable battery systems, as noted in recent press briefings and investor updates, to enhance user convenience and fleet management efficiency.

Additionally, trends in micro-mobility, coupled with the expansion of e-bike sharing platforms, are generating consistent demand for high-efficiency battery solutions. Looking forward, the market is expected to benefit from ongoing innovations in battery lifecycle management, recycling initiatives, and integration with smart systems, contributing to long-term growth across both consumer and commercial segments.

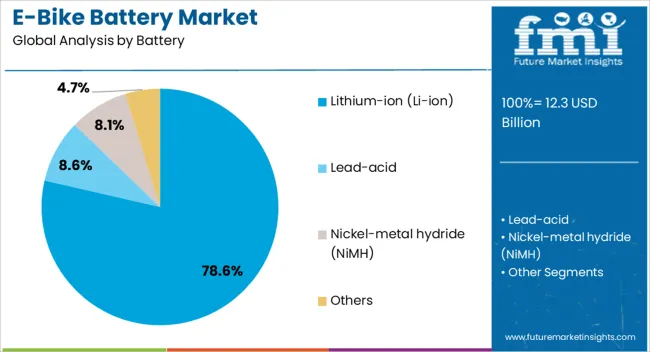

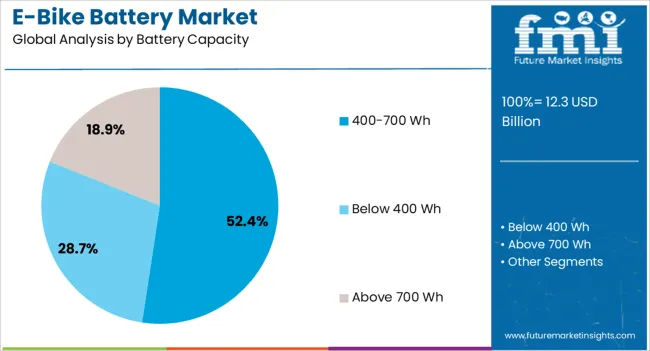

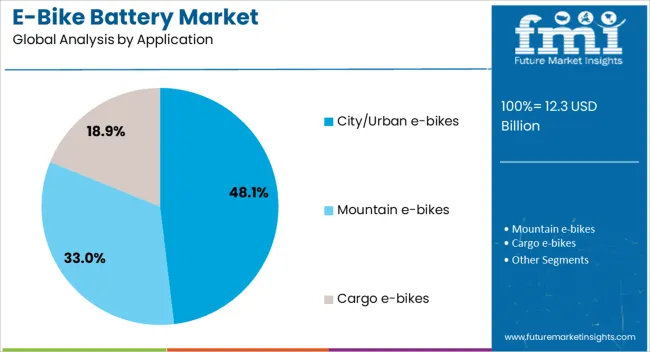

The e-bike battery market is segmented by battery, battery capacity, application, battery pack position, sales channel, and geographic regions. By battery, the e-bike battery market is divided into Lithium-ion (Li-ion), Lead-acid, Nickel-metal hydride (NiMH), and Others. In terms of battery capacity, the e-bike battery market is classified into 400-700 Wh, below 400 Wh, and above 700 Wh. Based on application, the e-bike battery market is segmented into City/Urban e-bikes, Mountain e-bikes, and Cargo e-bikes. By battery pack position, the e-bike battery market is segmented into Down tube, Rear carrier, and In-tube battery pack. By sales channel, the e-bike battery market is segmented into OEM and Aftermarket. Regionally, the e-bike battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lithium-ion (Li-ion) battery segment is projected to account for 78.6% of the E-Bike Battery Market revenue share in 2025, establishing itself as the most dominant battery type. This leadership is being reinforced by the chemistry’s superior energy density, lighter weight, and longer cycle life compared to traditional alternatives.

Industry publications and product announcements have consistently highlighted the rapid shift from lead-acid and nickel-based batteries to lithium-ion technology due to its compatibility with modern electric drivetrain systems. Adoption has also been encouraged by decreasing production costs and improved safety features integrated by leading battery manufacturers.

The segment’s widespread use in both consumer and commercial e-bikes has been made possible by its ability to support fast charging, minimal maintenance, and seamless integration into compact bicycle frames. Moreover, its alignment with global electrification and sustainability targets has ensured continuous investment and development in this technology, enabling it to maintain a dominant presence in the evolving e-bike ecosystem.

The 400–700 Wh battery capacity segment is expected to represent 52.4% of the E-Bike Battery Market revenue share in 2025, making it the leading capacity range. This dominance has been supported by the segment’s balance between ride range, cost, and battery size, which is well-suited to the needs of urban and recreational riders.

Battery capacities in this range offer practical performance for daily commuting and moderate-distance travel, typically delivering between 50 and 100 kilometers per charge depending on terrain and rider weight. Manufacturers have been focusing on optimizing this segment due to growing demand from mid-tier e-bike models, which target the mass commuter market.

Product development updates have highlighted that battery systems within this capacity range are also more compatible with modular architecture, allowing easier upgrades and replacements. These batteries provide a favorable compromise between lightweight design and operational efficiency, making them an attractive choice across diverse rider demographics and usage patterns.

The city or urban e-bikes application segment is anticipated to hold 48.1% of the E-Bike Battery Market revenue share in 2025, making it the most prominent application area. This growth is being driven by increasing urbanization, congestion, and a shift in commuting behavior toward eco-friendly alternatives. City dwellers are opting for electric bikes as a reliable, low-cost, and efficient mode of transport, supported by the expansion of bike lanes and integrated urban mobility solutions.

Government policies and incentive programs promoting clean transportation have further fueled demand in this segment. Statements from mobility startups and OEMs indicate a growing focus on lightweight, fast-charging batteries optimized for stop-and-go city riding.

Additionally, the compatibility of software-defined battery management systems with urban fleet operations has been viewed as a crucial factor in commercial adoption. The convenience, affordability, and reduced carbon footprint associated with city e-bikes continue to position this application segment as a core driver of battery demand in the coming years.

The e-bike battery market is experiencing rapid growth driven by the increasing adoption of electric bikes as an alternative mode of transportation. E-bikes offer a cost-effective, eco-friendly solution for urban commuting, and their popularity is rising globally due to the need for sustainable and efficient transport options. Battery technology plays a crucial role in the performance and range of e-bikes, with advancements in lithium-ion and solid-state batteries contributing to improved energy density, charging speed, and lifespan. As more consumers opt for e-bikes, the demand for high-performance, lightweight, and long-lasting batteries is expected to continue increasing, further propelling the market forward.

The e-bike battery market is primarily driven by the growing popularity of electric biking as an alternative to traditional forms of transport. With urban areas becoming more congested, e-bikes offer an efficient and eco-friendly solution for daily commuting. Their low operating costs, ease of use, and ability to navigate traffic have made them an appealing choice for commuters. Additionally, increasing concerns about air pollution and the push toward cleaner transportation options are accelerating the adoption of e-bikes in cities worldwide. As more consumers seek sustainable and cost-effective transportation, the demand for high-performance e-bike batteries continues to rise, fueling market growth.

Despite the rapid growth of the e-bike battery market, there are several challenges that need to be addressed. One of the main issues is the high cost of advanced battery technologies, such as lithium-ion and solid-state batteries. While these batteries offer high energy density and longer lifespans, their price remains a barrier for many consumers and manufacturers. Additionally, while advancements in battery technology are improving range and charging speeds, the performance of e-bike batteries still faces limitations in extreme weather conditions or high-demand usage, such as in mountainous terrain. Overcoming these challenges will be key to making e-bikes more accessible to a broader market and enhancing their long-term viability.

The e-bike battery market presents numerous opportunities for growth, particularly with advancements in battery technology and urban infrastructure development. Innovations in lithium-ion batteries, such as improved energy density, faster charging times, and longer lifespans, are helping to overcome some of the performance limitations of current e-bike batteries. Additionally, the growing popularity of bike-sharing programs and the expansion of cycling infrastructure in cities present new avenues for battery demand. As urban areas continue to invest in cycling-friendly infrastructure and governments offer incentives for the adoption of electric transportation, there is a significant opportunity for e-bike batteries to become a central component of modern urban mobility solutions.

A significant trend in the e-bike battery market is the integration of smart battery management systems (BMS) and wireless charging technologies. Smart BMS technologies enable real-time monitoring of battery performance, ensuring optimal usage, extending battery life, and providing users with detailed insights into charge status, range, and maintenance needs. Wireless charging solutions are also gaining traction, offering more convenient ways to recharge e-bike batteries. Additionally, as the demand for e-bikes continues to grow, manufacturers are focusing on producing lightweight, high-performance batteries that offer increased range and faster charging times. These trends indicate that e-bike battery technology will continue to evolve, improving user experience and making electric biking more accessible and efficient.

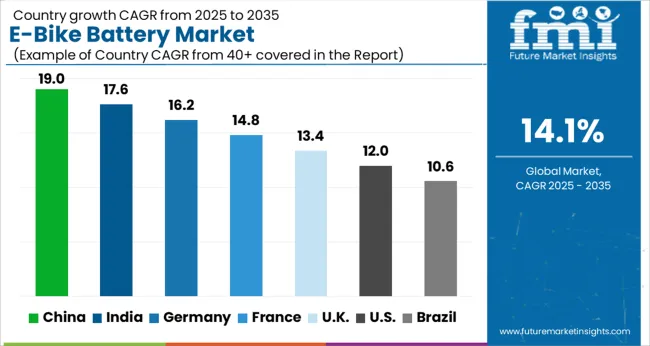

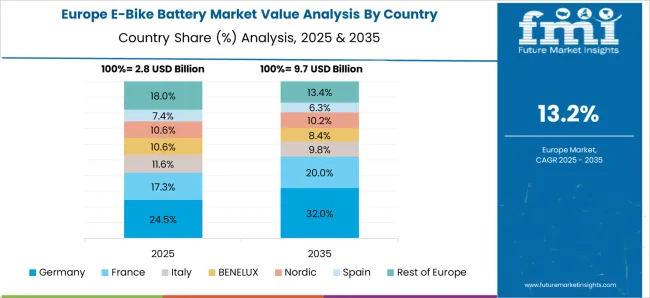

The e-bike battery market is projected to grow at a global CAGR of 14.1% from 2025 to 2035. China leads the market with 19.0% growth, followed by India at 17.6%, and France at 14.8%. The United Kingdom is expected to grow at 13.4%, while the United States shows a growth rate of 12.0%. The growing adoption of electric bicycles due to their efficiency, eco-friendliness, and the rising trend of sustainable transportation are key drivers for this growth. Emerging markets like China and India are witnessing rapid demand due to their expanding electric vehicle (EV) sectors, while developed economies like the USA and UK show steady growth in response to eco-conscious consumers and urban mobility solutions. The analysis spans 40+ countries, with the leading markets shown below.

China is projected to grow at a CAGR of 19.0% through 2035, making it the leader in the e-bike battery market. The country’s large manufacturing base and the increasing adoption of electric bicycles, particularly in urban areas, are key drivers. The government’s push toward promoting green transportation and reducing carbon emissions is accelerating the transition to electric mobility. China is also investing heavily in the development of battery technologies, improving the performance and cost-effectiveness of e-bike batteries. This makes the market highly attractive to both domestic and international players.

India is projected to grow at a CAGR of 17.6% through 2035, driven by increasing awareness about environmental issues and the rising demand for eco-friendly transportation solutions. With rapid urbanization and the need to reduce traffic congestion, the adoption of electric bicycles is gaining momentum in cities. The government’s initiatives to promote electric vehicles, including subsidies and infrastructure development, are further supporting the demand for e-bike batteries. India’s growing middle class and increasing disposable income contribute to the affordability and adoption of electric bicycles.

France is expected to grow at a CAGR of 14.8% through 2035, driven by the country's strong focus on environmental sustainability and increasing adoption of electric mobility. E-bikes are gaining popularity as part of France's efforts to reduce urban air pollution and carbon emissions. The French government is encouraging the use of electric bicycles through incentives, tax benefits, and the development of necessary infrastructure. As French cities continue to expand their cycling infrastructure, the demand for e-bike batteries is projected to rise steadily in the coming years.

The United Kingdom is projected to grow at a CAGR of 13.4% through 2035, as demand for sustainable transportation solutions increases in urban areas. E-bikes are gaining popularity due to their efficiency and low environmental impact, which aligns with the UK’s sustainability goals. With rising concerns about congestion, pollution, and the need for alternative transportation options, e-bikes are seen as a viable solution. Government policies supporting electric mobility and cycling infrastructure contribute to the growing demand for e-bike batteries in the country.

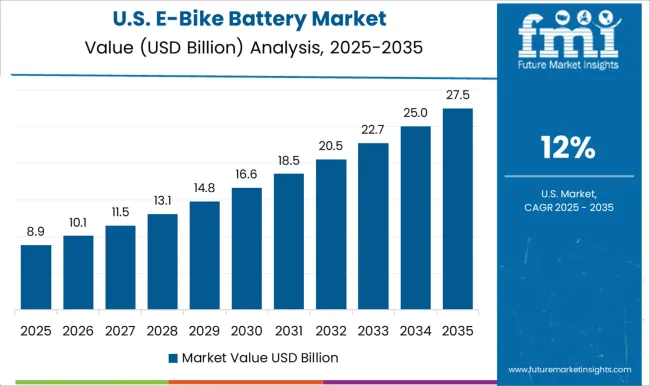

The United States is projected to grow at a CAGR of 12.0% through 2035, with e-bikes becoming increasingly popular as consumers seek greener alternatives to traditional transportation methods. The growing environmental awareness and the need for cost-effective urban transportation are pushing the demand for e-bikes and their batteries. The USA government’s support for electric vehicle infrastructure, combined with rising consumer interest in fitness and outdoor activities, further supports market expansion. As cities focus on improving mobility, e-bikes are increasingly seen as an efficient, eco-friendly solution.

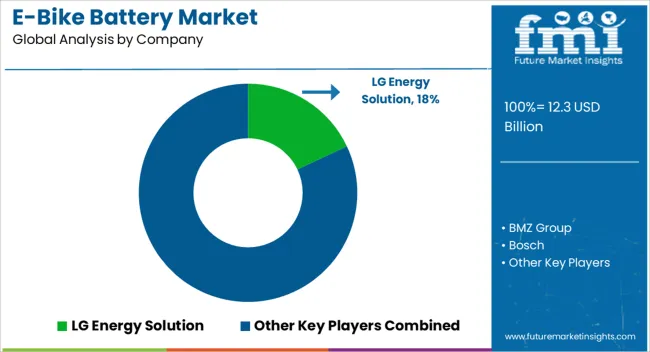

The e-bike battery market is driven by leading manufacturers providing high-performance, energy-efficient solutions for electric bikes. Key players are focusing on enhancing battery capacity, charging speed, and overall energy efficiency to meet the growing demand for e-bikes worldwide.LG Energy Solution is a dominant player, offering cutting-edge lithium-ion batteries for e-bikes, with high energy density and long-lasting performance. Their advanced technology plays a critical role in enhancing the range and speed of electric bikes. BMZ Group is another key player, delivering powerful battery solutions designed for various e-bike models, focusing on reliability, safety, and sustainable energy consumption. Bosch provides integrated battery systems and electric motor solutions, optimizing the overall e-bike performance. Bosch’s e-bike batteries are known for their long service life and compact design. Brose Fahrzeugteile offers highly efficient e-bike battery solutions, with a focus on lightweight design and high output performance.

Giant Bicycles, a well-known manufacturer of bicycles, also provides high-quality e-bike battery systems for its electric bike range, ensuring compatibility and peak performance. Mahle GmbH specializes in providing e-bike batteries that focus on energy efficiency and lightweight design, enabling smoother riding experiences. Panasonic Corporation is a key supplier, known for its advanced battery technology, ensuring superior charging cycles and greater durability for e-bike batteries. Samsung SDI produces high-performance lithium-ion batteries that are widely used in e-bikes, offering longer battery life and faster charging capabilities. Shimano Inc. manufactures integrated drive units and e-bike batteries that offer optimized power output, ensuring smooth riding performance. Yamaha Motor Co. is another leading player, providing reliable e-bike battery systems that offer a balance between performance and energy efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.3 Billion |

| Battery | Lithium-ion (Li-ion), Lead-acid, Nickel-metal hydride (NiMH), and Others |

| Battery Capacity | 400-700 Wh, Below 400 Wh, and Above 700 Wh |

| Application | City/Urban e-bikes, Mountain e-bikes, and Cargo e-bikes |

| Battery Pack Position | Down tube, Rear carrier, and In-tube battery pack |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | LG Energy Solution, BMZ Group, Bosch, Brose Fahrzeugteile, Giant Bicycles, Mahle GmbH, Panasonic Corporation, Samsung SDI, Shimano Inc, and Yamaha Motor Co. |

| Additional Attributes | Dollar sales by product type (lithium-ion batteries, lithium-polymer batteries, lead-acid batteries) and end-use segments (OEMs, aftermarket suppliers, battery repair and replacement services). Demand dynamics are driven by the increasing popularity of e-bikes for commuting and recreation, as well as environmental concerns prompting electric vehicle adoption. Regional growth is strong in Europe and North America, while Asia-Pacific expands due to rapid urbanization and increased demand for last-mile connectivity. Innovation focuses on improving battery longevity, energy density, and fast-charging capabilities. |

The global e-bike battery market is estimated to be valued at USD 12.3 billion in 2025.

The market size for the e-bike battery market is projected to reach USD 46.1 billion by 2035.

The e-bike battery market is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types in e-bike battery market are lithium-ion (li-ion), lead-acid, nickel-metal hydride (nimh) and others.

In terms of battery capacity, 400-700 wh segment to command 52.4% share in the e-bike battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Battery-Free Sensors Market Insights - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA