The cargo bike tire market is experiencing strong growth driven by the increasing popularity of cargo bikes for urban logistics, last-mile delivery, and eco-friendly transportation solutions. As cities worldwide prioritize sustainability and congestion reduction, cargo bikes are becoming a preferred choice for commercial and personal use. This rising demand is creating a significant need for durable, high-performance tires specifically designed to handle heavy loads, varied terrains, and extended usage.

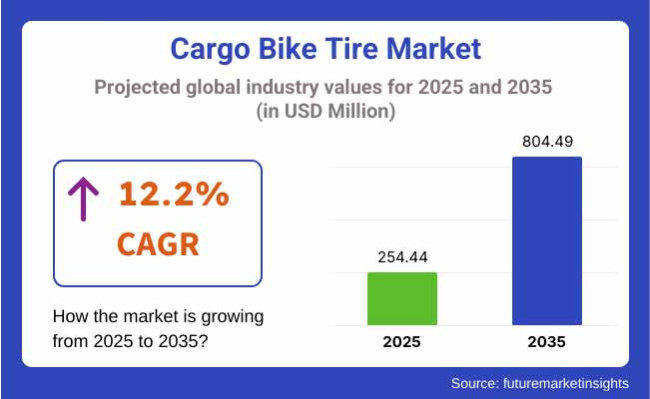

In 2025, the global cargo bike tire market size is estimated at approximately USD 254.44 million. By 2035, it is projected to reach USD 804.49 million, expanding at a robust compound annual growth rate (CAGR) of 12.2%. Key drivers include the surge in e-commerce deliveries, supportive government regulations promoting green mobility, and technological advancements in tire materials that offer better puncture resistance, longevity, and load-bearing capacity. Leading manufacturers are investing in innovative tire designs tailored for electric cargo bikes and multi-terrain usage, enhancing safety, performance, and user experience.

Key drivers include the surge in e-commerce deliveries, supportive government regulations promoting green mobility, and technological advancements in tire materials that offer better puncture resistance, longevity, and load-bearing capacity. Leading manufacturers are investing in innovative tire designs tailored for electric cargo bikes and multi-terrain usage, enhancing safety, performance, and user experience.

North America, meanwhile, is seeing a surge in cargo bikes, especially in bigger cities, which seek sustainable solutions to deliveries. In the USA and Canada, several logistics companies are seeding their fleets with electric cargo bikes. This trend is creating huge demand for special tires with high durability, high grip and low rolling resistance. This material growth of the market is also attributed to the stronghold of key tire manufacturer companies and rise in pilot initiatives for urban freight.

Many major companies and brands exist in this space in the European market, largely due to the success of cargo bikes in urban delivery and as family vehicles. Countries like Germany, the Netherlands, and Denmark are setting the pace thanks to established cycling infrastructure and robust government incentive programs.

European consumers are calling for the enforcement of high-quality, environmentally friendly tires that can withstand heavy payloads in all weather conditions. Key factors driving the regional market include innovation in puncture proof and sustainable tire technologies.

Asia-Pacific has a bright outlook, driven by strong urbanization levels, growing e-commerce, and government measures to combat urban emissions. There’s also a part of the world, the one encompassing China and Japan, where cargo bikes are being built into last-mile delivery ecosystems.

Increasing awareness about sustainable transportation and the emergence of compact, high-performance cargo bikes is supporting demand for these tires. In this region, customers have various requirements, and thus tire manufacturers are emphasizing lower prices, greater durability, and better understand to be able to provide competitive products in this field.

On a larger scale, cargo bike tire sales will increase considerably over the next 10 years, as city sustainability initiatives push toward reduced vehicular traffic, and e-commerce and cargo bike technology continue to expand. As the need for durable, high-traction tires that can handle heavy loads in diverse environments increases, tire companies are developing new materials, designs and environmentally friendly production processes.

The trend toward electric cargo bikes, and the shift to multi-use cargo applications will further accelerate tire market expansion and position it as a critical segment within the global green mobility movement.

Durability and Performance Optimization

The cargo bike tire market also has challenges to manufacture tires that have a high load bearing capacity, frequent usage and different terrains. Use of ordinary bicycle tires under the weight of cargo leads to rapid wear and high replacement rates, creating poor consumer experience. To create tires designed for the rigorous demands of cargo biking, manufacturers use robust, puncture-resistant materials and unique tread patterns for durability and dependable performance in varying weather and textured surfaces.

Supply Chain Disruptions and Cost Volatility

Disruption in global supply chains, especially for raw materials such as rubber and synthetic polymers, affect production schedules and pricing strategies. Transportation bottlenecks, volatile raw material prices and geopolitical tensions complicate the effort to keep supply steady. Manufacturers must adopt agile manufacturing techniques, build resilient supply networks, and explore options for local sourcing to reduce risks and stabilize supply in the market.

Rising Urban Logistics and Sustainable Delivery Solutions

The growing popularity of e-commerce, the proliferation of last-mile delivery services, and the rise of sustainable urban transportation solutions are increasing demand for cargo bikes, which in turn is driving demand for specialized cargo bike tires. Cargo bike adoption for urban freight mobility is witnessing significant growth primarily due to government initiatives and investment by private companies in green logistics, creating an attractive growth opportunity for tire manufacturers to innovate and deliver high-performance environmentally friendly tire solutions.

Technological Advancements in Tire Materials and Design

Technologies such as airless tires, self-sealing capabilities, and advanced composite materials are opening opportunities for brands to develop unique selling points. These advancements can notably contribute to user experience through the development of lightweight but durable tires appropriately designed for weight which can handle the weight of the cargo.

With the increasing market share in this innovation Companies willing to invest in R&D in smart tire technologies such as pressure monitoring systems adaptive treads will find themselves in a favorable position.

From 2020 to 2024, the cargo bike tire market witnessed significant expansion driven by a boom in urban mobility initiatives, increased eco-consciousness, and the rise of micro-fulfillment centers. Focus was placed on developing more robust tire models, enhancing puncture resistance, and improving grip for wet conditions. However, the market faced challenges such as limited standardization, supply chain volatility, and high initial product development costs.

Looking forward to 2025 to 2035, the market is expected to be reshaped by advancements in sustainable materials, AI-driven manufacturing processes, and the integration of smart monitoring systems into cargo bike tires. Circular economy principles, such as tire recycling and eco-friendly production methods, will gain traction. Companies embracing eco-innovation, modular tire designs, and real-time performance monitoring technologies will set new benchmarks for the industry.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Urban Mobility Trends | Growth in last-mile delivery and urban logistics |

| Technological Advancements | Emphasis on puncture-resistant and durable tires |

| Supply Chain and Raw Materials | Dependence on traditional rubber sources |

| Industry Adoption | Focused on basic performance improvements |

| Sustainability Initiatives | Early efforts in reducing environmental impact |

| Market Competition | Dominated by niche tire manufacturers |

| Pricing Strategies | Premium pricing for specialized tires |

| Product Innovation | Reinforced sidewalls and improved tread patterns |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Urban Mobility Trends | Expansion of autonomous cargo bikes and integrated smart city logistics |

| Technological Advancements | Adoption of airless, smart, and eco-composite tires |

| Supply Chain and Raw Materials | Shift toward bio-based and recycled material sourcing |

| Industry Adoption | Mainstream integration of smart tire monitoring systems |

| Sustainability Initiatives | Widespread implementation of circular economy models |

| Market Competition | Entry of automotive tire giants and tech startups |

| Pricing Strategies | Wider price segmentation due to mass adoption |

| Product Innovation | Modular, self-healing, and temperature-adaptive tire designs |

The USA cargo bike tire market is poised for significant growth due to the increasing adoption of cargo bikes for last-mile delivery and urban logistics. Increasing concerns for the environment and the government providing incentives for more sustainable transport options-makers are leading businesses to use cargo bikes.

To that end, there a great need for high quality, durable tires that can handle heavy loads and urban terrains. In the USA, rising investment in cargo bike fleets by logistics companies is fueling market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.4% |

The market for cargo bike tires in the UK is also growing strongly as retail and courier services increasingly make use of electric cargo bikes. Urban congestion pricing and low-emission zones are encouraging businesses to use greener delivery methods.

This transition is driving demand for high-quality cargo bike tires that are strong, consistent, and durable. Government support for green transportation initiatives will further drive the market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 12.1% |

The use of cargo bikes in major cities across the European Union is skyrocketing, thanks to a solid policy framework for clean urban mobility solutions. Germany, the Netherlands, Denmark and other nations are leading cargo bike use, creating demand for specialized, heavy-duty tires.

The tire market is also being transformed through various innovations such as puncture-proof and energy-saving technology. Continued growth in e-commerce and sustainable delivery services is also fueling market momentum across Europe.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.3% |

As city needs shift and grow to meet urban environments and climate goals, Japan’s cargo bike tire market is slowly but surely opening up. Cargo bikes are also becoming an increasingly common mode of transport for local deliveries, particularly in areas that are reduced traffic.

This trend is increasing the need for lighter weight, durable, and easy-to-maintain tires. In Japan, innovations aimed at strengthening tire durability and tire friction force on different road surfaces are rising in popularity among logistics giants.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.5% |

The number of cargo bikes in South Korea is growing rapidly, especially in urban logistics and food delivery services. The government's programs of promoting green transportation alternatives are generating a conducive environment for the cargo bike tires market to flourish.

Newer technologies like self-sealing and low-rolling-resistance tires are getting their day in the sun, too. As major cities implement stricter environmental regulations, the demand for efficient and durable cargo bike tires will grow even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.6% |

| Product Type | Market Share (2025) |

|---|---|

| Tubeless | 59% |

The segment is dominated by tubeless tires that offer lower risk of punctures, better load-bearing capacity, and lower maintenance requirement. These features have made them especially popular among heavy-duty cargo bikes used in urban logistics, last-mile delivery and food distribution services. The demand is expected to experience robust growth particularly from fleet segments focusing on more sustainable and economically efficient transportation as well as the preference of operators towards tubeless type owing to longer lifespan, safety, and less downtime.

Meanwhile, tube-type tires can be found on a few other markets, mainly in price-sensitive, developing, and rural areas, where cost of ownership is more important than the performance advantages. But with the continuous proliferation of tire technology backed by growing disposable income and the falling price of tubeless systems, the tube tire segment is likely to face gradual erosion in its share of market during the forecast period. This market shift is accelerated by manufacturers who are focused on expanding the range of affordable tubeless models.

| Tire Size | Market Share (2025) |

|---|---|

| 20-24 | 47% |

Cargo bike tires in the 20–24 inch tire size group are the most common, their ideal balance of maneuverability, stability and load-bearing potential makes them the best fit, especially for long-term use. Both two-wheeled and three-wheeled cargo bikes, which are the most common setups in the dense urban environment involving crammed conditions and heavy loads, will find these tire sizes an ideal combination.

Bigger sizes like 26-inch and 27.5-inch tires are growing in popularity, especially when it comes to electric-assist cargo bikes and bigger freight models that need better speed, smoother rides, and higher cargo capacities. With the global rise in use of e-cargo bikes for commercial deliveries and even family transport, demand for these wider tires is set to grow steadily over the next few years.

Cargo bike tire market continues to witness ambitious growth owing to increasing uptake of cargo bikes for urban logistics, e-commerce deliveries, and sustainable transportation options. With cities around the globe advocating for sustainable mobility, cargo bikes are a crucial part of last-mile delivery services, driving demand for durable, high-performing tires.

Commercial users have exacting requirements according, leading manufacturers to hone in on puncture resistance, load-bearing ability and all-weather grip. Demand is also being driven by government incentives promoting low-emission transport and the growth of bike lanes in urban areas. In addition, innovations in material technology and ergonomic tire designs for electric and manual cargo bikes are anticipated to accelerate the market at a CAGR of 12.2% from 2025 to 2035. The increasing consumer consciousness on minimizing carbon footprint, corporate sustainability goals and cost-effective urban transit are also strong tailwinds contributing toward the demand for specialized cargo bike tires in the major cities across the globe.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schwalbe (Ralf Bohle GmbH) | 20-24% |

| Continental AG | 15-19% |

| Michelin | 12-16% |

| Vittoria Industries | 10-14% |

| Kenda Rubber Industrial | 8-12% |

| Other Companies | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schwalbe (Ralf Bohle GmbH) | In 2025, launched the Pick-Up Cargo tire series featuring high-load capacity and advanced puncture protection technologies for commercial cargo bikes . |

| Continental AG | In 2024, expanded its e-cargo tire line with reinforced sidewalls and optimized tread patterns for urban logistics and heavy-duty applications . |

| Michelin | Michelin introduced urban cargo bike tires with energy-efficient rolling resistance and enhanced weatherproof performance in 2025. |

| Vittoria Industries | In 2024, Vittoria developed lightweight yet durable tires tailored for electric cargo bikes , incorporating graphene-enhanced compounds . |

| Kenda Rubber Industrial | Kenda focused on affordable, durable tire solutions for emerging markets , unveiling a range of economical heavy-load cargo bike tires in 2025. |

Key Company Insights

Schwalbe (20-24%)

For heavy-duty use, urban deliveries, and e-cargo bikes, Schwalbe commands the biggest share by offering purpose-built tire designs like those within its Pick-Up series. The combination of puncture resistance and sustainability marks the company as a leader. Its strategic partnerships with urban logistics companies and eco-delivery startups has fortified Schwalbe’s leadership position in the market, especially where it matters most in Europe, and North America’s largest metropolitan areas.

Continental AG (15-19%)

Continental has entered this market by providing premium-grade, heavy-load cargo tires that are designed for durability, optimized ride comfort and ride traction. Its background in automotive tire technologies translate nicely into the cargo bike world. By integrating smart features like tire pressure sensors and tread wear indicators, Continental is raising the bar on the safety and maintenance of commercial cargo fleets.

Michelin (12-16%)

Drawing from its energy efficiency know-how, Michelin manufactures low rolling resistance tires, which maximize battery range integrity for electric cargo bikes while also making no compromise in the area of a ride’s grip and safety for urban cyclists. Within its long-term strategy to be a leader in sustainable transportation solutions across the globe, Michelin has expanded into the urban micro-mobility space through partnerships with cargo e-bike manufacturers.

Vittoria Industries (10-14%)

Breaking the mold, Vittoria has incorporated graphene-based technologies into its tires, delivering incredible strength, lightweight characteristics, and high-speed performance for performance-oriented cargo bike riders. Fleeter operators targeting superior comfort and efficiency are targeting Vittoria's R&D drive towards environmentally-friendly materials and increased shock absorption technology.

Kenda Rubber Industrial (8-12%)

Kenda is dedicated to delivering affordable cargo tire products that maintain the load-carrying capacity, making it an excellent choice for small businesses and developing markets where price and reliability are paramount. Kenda's decision to expand manufacturing operations to Asia and Eastern Europe is also intended to increase supply chain resiliency and provide quicker delivery to emerging urban logistics hubs globally.

Other Key Players (20-30% Combined)

The overall market size for cargo bike tire market was USD 254.44 million in 2025.

The cargo bike tire market expected to reach USD 804.49 million in 2035.

Rising urban logistics needs, growth in eco-friendly transportation, increasing e-commerce deliveries, and advancements in tire durability will drive the cargo bike tire market during the forecast period.

The top 5 countries which drives the development of cargo bike tire marketare USA, UK, Europe Union, Japan and South Korea.

Tubeless tires gain traction segment driving market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Tire Size, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Tire Size, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Cargo Bike Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Cargo Bike Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Tire Size, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Tire Size, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Cargo Bike Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Cargo Bike Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Tire Size, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Tire Size, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Cargo Bike Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Cargo Bike Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Tire Size, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Tire Size, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Cargo Bike Type, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Cargo Bike Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Tire Size, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Tire Size, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Cargo Bike Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Cargo Bike Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Tire Size, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Tire Size, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Cargo Bike Type, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Cargo Bike Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Tire Size, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Cargo Bike Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Tire Size, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Tire Size, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Tire Size, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Tire Size, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Cargo Bike Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Cargo Bike Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Cargo Bike Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Cargo Bike Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Tire Size, 2023 to 2033

Figure 28: Global Market Attractiveness by Cargo Bike Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Tire Size, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Cargo Bike Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Tire Size, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Tire Size, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Tire Size, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Tire Size, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Cargo Bike Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Cargo Bike Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Cargo Bike Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Cargo Bike Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Tire Size, 2023 to 2033

Figure 58: North America Market Attractiveness by Cargo Bike Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Tire Size, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Cargo Bike Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Tire Size, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Tire Size, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Tire Size, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Tire Size, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Cargo Bike Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Cargo Bike Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Cargo Bike Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Cargo Bike Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Tire Size, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Cargo Bike Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Tire Size, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Cargo Bike Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Tire Size, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Tire Size, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Tire Size, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Tire Size, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Cargo Bike Type, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Cargo Bike Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Cargo Bike Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Cargo Bike Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Tire Size, 2023 to 2033

Figure 118: Europe Market Attractiveness by Cargo Bike Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Tire Size, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Cargo Bike Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Tire Size, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Tire Size, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Tire Size, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Tire Size, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Cargo Bike Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Cargo Bike Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Cargo Bike Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Cargo Bike Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Tire Size, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Cargo Bike Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Tire Size, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Cargo Bike Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Tire Size, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Tire Size, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Tire Size, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Tire Size, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Cargo Bike Type, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Cargo Bike Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Cargo Bike Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Cargo Bike Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Tire Size, 2023 to 2033

Figure 178: MEA Market Attractiveness by Cargo Bike Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cargo Vans Market Size and Share Forecast Outlook 2025 to 2035

Cargo Shipping Market Size and Share Forecast Outlook 2025 to 2035

Cargo Inspection Market Size and Share Forecast Outlook 2025 to 2035

Cargo Bike Market Growth - Trends & Forecast 2024 to 2034

Air Cargo Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vehicle Cargo Box Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cargo Containers Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cargo Handling Equipment Market

Aircraft Cargo Winches Market

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Trailer & Cargo Container Tracking Market Size and Share Forecast Outlook 2025 to 2035

Electric 3-wheeler Cargo Bikes Market Size and Share Forecast Outlook 2025 to 2035

Bike Sharing Market Size and Share Forecast Outlook 2025 to 2035

Bike And Scooter Rental Market Size and Share Forecast Outlook 2025 to 2035

Bike Saddles Market Trends – Growth & Demand Forecast 2025 to 2035

E-Bike Accessories Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Motors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

E-Bike Drive Unit Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Battery Market Size and Share Forecast Outlook 2025 to 2035

E-bike Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA