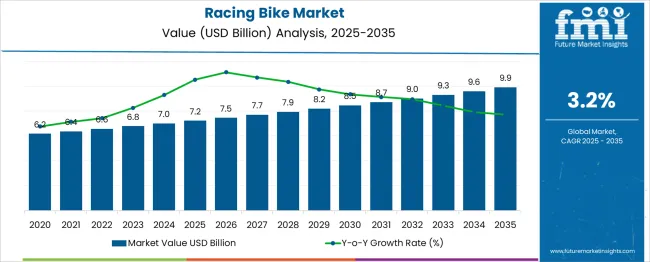

The Racing Bike Market is estimated to be valued at USD 7.2 billion in 2025 and is projected to reach USD 9.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period. This growth reflects a multiplier of 1.38x, supported by a steady CAGR of 3.2%, driven by increasing interest in competitive cycling, professional sports sponsorships, and advancements in bike technology.

During the first five-year phase (2025–2030), the market is expected to reach approximately USD 8.4 billion, adding USD 1.2 billion, which accounts for 44.4% of the total incremental growth, as consumer demand for lightweight and high-performance bikes rises. The second phase (2030–2035) will contribute USD 1.5 billion, representing 55.6% of incremental growth, signaling steady but sustained adoption as racing bike technology continues to evolve, including innovations in aerodynamics, carbon fiber components, and smart cycling features. Annual increments will increase from USD 0.2 billion in early years to USD 0.3 billion toward 2035, highlighting the continued growth of cycling infrastructure and the increasing appeal of professional racing events. Manufacturers focusing on premium racing bikes, custom designs, and online direct sales channels will capture significant value in this USD 2.7 billion growth opportunity.

| Metric | Value |

|---|---|

| Racing Bike Market Estimated Value in (2025 E) | USD 7.2 billion |

| Racing Bike Market Forecast Value in (2035 F) | USD 9.9 billion |

| Forecast CAGR (2025 to 2035) | 3.2% |

The racing bike market is witnessing stable expansion driven by advancements in lightweight materials, enhanced frame aerodynamics, and rising investments in competitive cycling infrastructure. Global interest in endurance sports, coupled with increased sponsorship and event participation, has elevated demand for performance-focused bikes.

Manufacturers are responding with innovations in geometry, drivetrain systems, and braking efficiency, aligning products with the demands of both elite and enthusiast cyclists. The growing influence of cycling leagues, national sports programs, and the visibility of international racing events have stimulated professional and amateur adoption.

Looking ahead, the market is expected to benefit from increased personalization, smart sensor integration, and the expansion of training ecosystems supporting rider optimization and real-time data tracking.

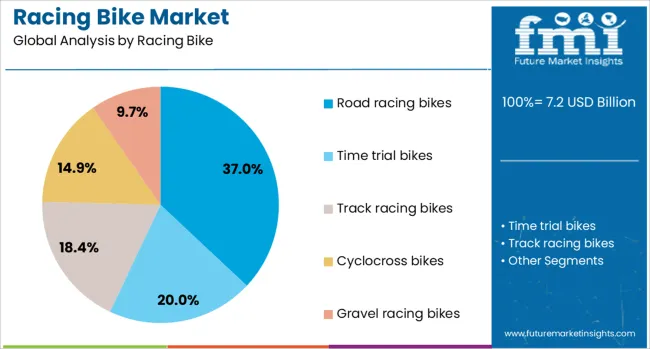

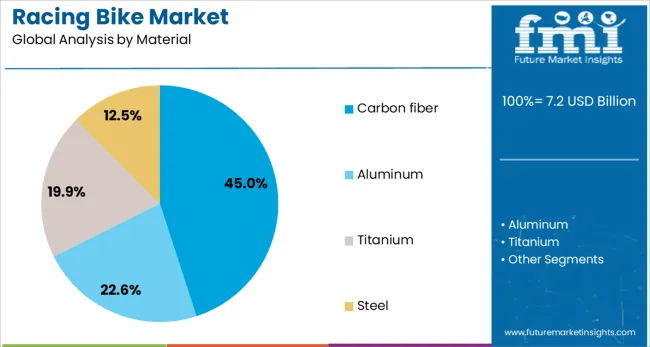

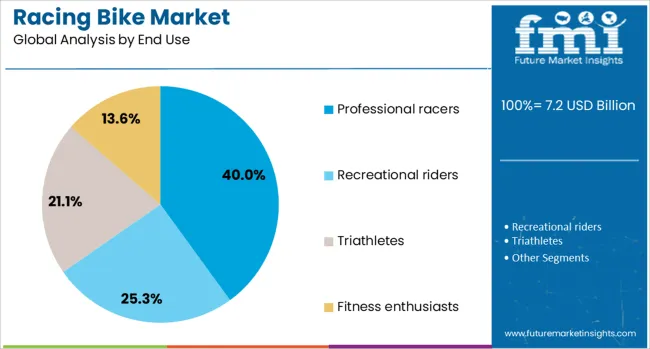

The racing bike market is segmented by racing bike, material, end use, distribution channel, and geographic regions. The racing bike market is divided into Road racing bikes, Time trial bikes, Track racing bikes, Cyclocross bikes, and Gravel racing bikes. In terms of materials, the racing bike market is classified into Carbon fiber, Aluminum, Titanium, and Steel. The end use of the racing bike market is segmented into Professional racers, Recreational riders, Triathletes, and Fitness enthusiasts. The distribution channel of the racing bike market is segmented into Online and Offline. Regionally, the racing bike industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Road racing bikes are projected to lead the racing bike segment with a 37.00% revenue share in 2025. This segment's dominance is being reinforced by its adaptability to competitive events and training circuits.

Road bikes are engineered for speed, minimal weight, and aerodynamic efficiency factors critical for timed racing formats. The development of integrated cockpit designs, carbon composite frames, and disc braking systems has elevated their technical appeal.

Widespread availability, customization options, and support from global cycling teams have further cemented road racing bikes as the preferred category. Their performance benefits in long-distance and sprint races have made them indispensable in professional and enthusiast cycling communities alike.

Carbon fiber is expected to account for 45.00% of the total revenue in 2025, making it the most dominant material segment in the racing bike market. The segment’s lead is attributed to the material’s exceptional strength-to-weight ratio, vibration damping properties, and moldability into aerodynamic forms.

Carbon fiber allows manufacturers to reduce frame weight without sacrificing rigidity, providing riders with improved acceleration and energy efficiency. Its use in frame, fork, and wheelset construction has become increasingly standardized across professional-grade models.

As competitive athletes demand optimized stiffness, responsiveness, and reduced fatigue over long rides, carbon fiber continues to be the material of choice. Ongoing innovation in layup techniques and resin systems is further extending its application across premium and mid-range racing categories.

Professional racers are projected to generate 40.00% of the market’s total revenue in 2025, securing their position as the leading end-user segment. This segment’s strength is being shaped by the high performance and customization requirements of elite athletes.

Racing bikes targeted at professionals prioritize aerodynamic gains, weight minimization, and component compatibility for competitive formats. The segment benefits from team sponsorships, national athletic programs, and performance benchmarking through data telemetry systems.

Professional usage drives the early adoption of advanced technologies, influencing broader market trends and consumer preferences. Additionally, the role of high-profile racing events and endorsements has sustained demand among professionals seeking a competitive edge, reinforcing the segment’s long-term influence on innovation and brand positioning.

The racing bike market is experiencing growth driven by rising consumer demand for high-performance bicycles and increased participation in cycling sports. In 2024 and 2025, demand was fueled by the growing popularity of cycling as a recreational and competitive activity. Opportunities exist in electric racing bikes and lightweight, aerodynamic designs for competitive cyclists. Trends include the integration of smart technology for performance tracking and the adoption of carbon fiber frames for enhanced speed. However, high costs, limited accessibility in some regions, and a competitive market remain barriers to broader adoption.

The major growth driver is the increasing participation in competitive cycling and recreational biking. In 2024 and 2025, racing bikes became increasingly popular as fitness enthusiasts and professional athletes sought lightweight, high-speed bikes for performance. International racing events and urban cycling culture further fueled demand. Additionally, the rise of e-sports cycling, where virtual competitions require high-tech bikes, boosted sales. These factors highlight the growing convergence of sport, fitness, and leisure as significant drivers for the racing bike market’s expansion.

Opportunities lie in the development of electric racing bikes and the integration of smart technology. In 2025, electric racing bikes equipped with pedal assist technology became a game-changer for casual cyclists and competitive athletes, extending racing participation to broader demographics. Smart sensors and performance analytics systems integrated into bikes offered data on speed, cadence, and heart rate, allowing for more personalized training experiences. These opportunities suggest that manufacturers focusing on eco-friendly, technology-enhanced, and inclusive products are well-positioned to capitalize on growing market segments.

Emerging trends include the adoption of carbon fiber materials and advanced aerodynamic designs in racing bikes. In 2024, lightweight, carbon fiber frames became standard in high-performance racing bikes, reducing weight and improving speed. Cyclists and manufacturers increasingly focused on aerodynamics, enhancing bike design to reduce wind resistance. These innovations catered to competitive athletes looking for precision performance. Additionally, trends such as customizable bike components and adjustable riding positions gained popularity. These developments reflect a shift toward more personalized and optimized racing bike solutions for elite athletes and cycling enthusiasts alike.

Market restraints are primarily influenced by the high cost of premium racing bikes and accessibility challenges in emerging markets. In 2024 and 2025, the price of lightweight, high-performance bikes with advanced materials such as carbon fiber and titanium remained prohibitive for many potential buyers. Additionally, limited access to specialized retail outlets and cycling clubs in rural or developing regions restricted the growth potential. These barriers emphasize the importance of affordability, increased retail availability, and localized marketing strategies to make racing bikes more accessible and appealing to a wider audience.

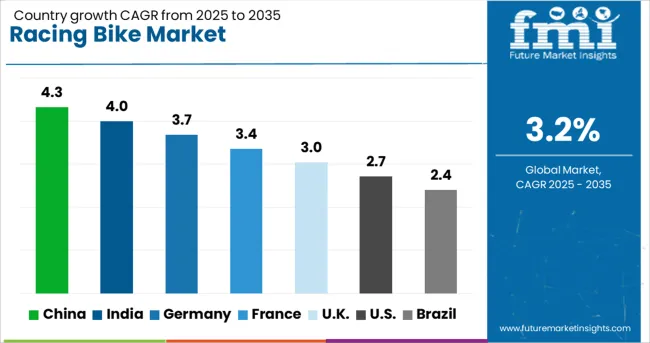

| Country | CAGR |

|---|---|

| China | 4.3% |

| India | 4.0% |

| Germany | 3.7% |

| France | 3.4% |

| UK | 3.0% |

| USA | 2.7% |

| Brazil | 2.4% |

The global racing bike market is projected to grow at 3.2% CAGR from 2025 to 2035. China leads with 4.3% CAGR, supported by increasing urbanization, rising disposable incomes, and growing interest in cycling as a recreational activity. India follows at 4.0%, driven by increasing youth participation in sports and rising awareness of health and fitness. Germany records 3.7% CAGR, reflecting strong demand for high-performance bikes in competitive and leisure cycling segments. The United Kingdom grows at 3.0%, while the United States posts 2.7%, showing stable demand in mature markets with a focus on premium and eco-friendly models. Asia-Pacific leads growth due to rising cycling participation, while Europe and North America prioritize technology and sustainability. This report includes insights on 40+ countries; the top markets are shown here for reference.

The racing bike market in China is forecasted to grow at 4.3% CAGR, driven by rapid urban development, increasing fitness consciousness, and a growing interest in cycling as both a sport and eco-friendly transport. With rising disposable incomes, premium racing bikes, especially carbon fiber models, are gaining popularity. In metropolitan areas, the demand for lightweight, high-performance bicycles grows due to more cycling infrastructure. Domestic manufacturers collaborate with international brands to improve design and expand product offerings.

The racing bike market in India is projected to grow at 4.0% CAGR, driven by the increasing popularity of cycling among young consumers and growing health awareness. Competitive cycling, both for leisure and sport, is becoming more mainstream. The rising adoption of fitness bikes in metropolitan areas supports market growth, with a focus on affordability and performance. E-commerce platforms are also facilitating access to high-quality racing bikes, making them more accessible to a wider audience.

The racing bike market in Germany is expected to grow at 3.7% CAGR, supported by strong cycling culture and government-backed initiatives promoting cycling as a sustainable transportation mode. As one of the leading markets for cycling competitions, Germany sees steady demand for high-performance bikes in both competitive and leisure segments. Sustainability-driven consumer behavior increases demand for eco-friendly and carbon fiber racing bikes, while the rise in cycling infrastructure further fuels the market.

The racing bike market in the United Kingdom is projected to grow at 3.0% CAGR, driven by increasing interest in cycling as a sport and for fitness purposes. Competitive cycling remains a popular activity, and with the rise of cycling events, demand for high-quality racing bikes increases. Additionally, growing trends in sustainable living and green transportation solutions encourage consumers to opt for lightweight, eco-friendly bikes. Premium models featuring advanced materials and technologies see strong adoption.

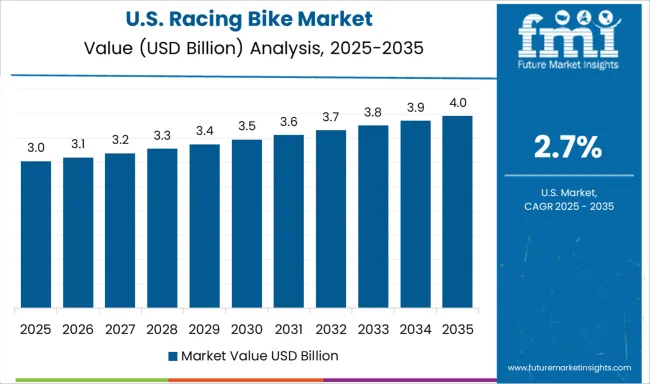

The racing bike market in the United States is projected to grow at 2.7% CAGR, reflecting stable demand in a mature market with strong interest in premium products. Increasing interest in cycling as both a sport and eco-friendly mode of transport supports demand. There is a growing trend toward customization and high-end racing bikes with advanced materials like carbon fiber. Digital platforms for bike sales, coupled with an increasing focus on cycling for fitness and recreation, further stimulate market growth.

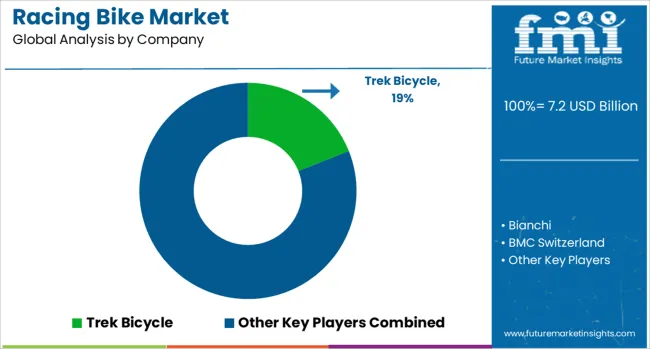

The racing bike market is dominated by Trek Bicycle, which secures its leadership through a comprehensive range of high-performance road bikes known for their aerodynamics, lightweight design, and cutting-edge materials. Trek’s dominance is supported by its continuous innovation in bike technology, sponsorship of professional cycling teams, and strong retail presence. Key players such as Specialized Bicycle Components, Giant Bicycles, Cannondale, Bianchi, and BMC Switzerland hold significant market shares by offering bikes designed for competitive racing, triathlons, and endurance cycling. These companies focus on optimizing frame geometry, precision engineering, and advanced carbon fiber composites to deliver superior speed, control, and comfort to riders.

Emerging players like Colnago, Canyon Bicycles, Merida Industry, Focus Bikes, and others are expanding their market presence by offering specialized models tailored to different racing disciplines, including time trials, mountain stages, and road sprints. Their strategies often focus on customizing bikes for professional athletes while also providing high-quality models for amateur and recreational cyclists. Market growth is driven by the increasing popularity of competitive cycling, advancements in bicycle technologies such as electronic shifting and disc brakes, and the growing demand for performance-enhancing materials. Continuous innovation in frame construction, aerodynamics, and lightweight components will further shape competitive dynamics in the global racing bike market.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.2 Billion |

| Racing Bike | Road racing bikes, Time trial bikes, Track racing bikes, Cyclocross bikes, and Gravel racing bikes |

| Material | Carbon fiber, Aluminum, Titanium, and Steel |

| End Use | Professional racers, Recreational riders, Triathletes, and Fitness enthusiasts |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Trek Bicycle, Bianchi, BMC Switzerland, Cannondale, Canyon Bicycles, Colnago, Focus Bikes, Giant Bicycles, Merida Industry, and Specialized Bicycle Components |

| Additional Attributes | Dollar sales by frame material (carbon fiber, aluminum, titanium, steel) and by application segment (road racing, track cycling, gravel racing, triathlon). Segmentation by distribution channel: direct-to-consumer, specialty retailers, online platforms. Regional demand: Europe 35%, Asia-Pacific 30%, North America 25%, Middle East & Africa 10%. Innovations in aerodynamics, electronic shifting, and lightweight wheelsets. Emerging use in e-bike racing and gravel racing events. |

The global racing bike market is estimated to be valued at USD 7.2 billion in 2025.

The market size for the racing bike market is projected to reach USD 9.9 billion by 2035.

The racing bike market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in racing bike market are road racing bikes, time trial bikes, track racing bikes, cyclocross bikes and gravel racing bikes.

In terms of material, carbon fiber segment to command 45.0% share in the racing bike market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Racing Motor Bike Seat Unit Market

Bike Sharing Market Size and Share Forecast Outlook 2025 to 2035

Bike And Scooter Rental Market Size and Share Forecast Outlook 2025 to 2035

Bike Saddles Market Trends – Growth & Demand Forecast 2025 to 2035

Tracing Paper Market Analysis by Thickness, Material, Application, and Region 2025 to 2035

E-Bike Accessories Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Motors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

E-Bike Drive Unit Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Battery Market Size and Share Forecast Outlook 2025 to 2035

E-bike Market Size and Share Forecast Outlook 2025 to 2035

BMX Bikes Market Size and Share Forecast Outlook 2025 to 2035

Pit Bike Market Size and Share Forecast Outlook 2025 to 2035

Hydrobikes Market Size and Share Forecast Outlook 2025 to 2035

Dirt Bike Market Size and Share Forecast Outlook 2025 to 2035

Cargo Bike Tire Market Growth – Trends & Forecast 2025-2035

Cargo Bike Market Growth - Trends & Forecast 2024 to 2034

Cell Tracing and Tracking Test Market

Tandem Bike Market Size and Share Forecast Outlook 2025 to 2035

Electric Bike Range Extender Market Size and Share Forecast Outlook 2025 to 2035

Electric Bike Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA