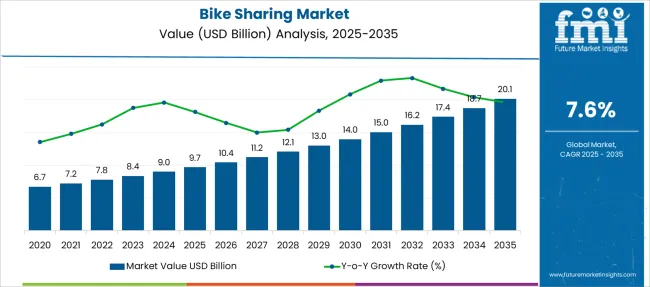

The Bike Sharing Market is estimated to be valued at USD 9.7 billion in 2025 and is projected to reach USD 20.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| Metric | Value |

|---|---|

| Bike Sharing Market Estimated Value in (2025 E) | USD 9.7 billion |

| Bike Sharing Market Forecast Value in (2035 F) | USD 20.1 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

The bike sharing market is expanding rapidly as urban areas increasingly focus on sustainable transportation and reducing traffic congestion. Public and private sectors are investing in eco-friendly mobility solutions that promote health and reduce carbon emissions. Advances in electric bike technology have made e-bikes more accessible and appealing, encouraging higher adoption rates.

Consumers are drawn to convenient and flexible travel options, and bike sharing fits well with these needs by offering quick and affordable last-mile connectivity. The rise of smartphone apps and GPS technology has improved user experience and operational efficiency.

Government policies supporting green transport and urban planning have further boosted market growth. Segmental expansion is expected to be driven by the increasing popularity of e-bikes, dockless systems that allow flexible parking, and free-floating sharing systems providing greater accessibility and ease of use.

The market is segmented by Bike, Category, Sharing System, Business Model, and End Use and region. By Bike, the market is divided into E-bikes and Conventional bikes. In terms of Category, the market is classified into Dockless and Docked. Based on Sharing System, the market is segmented into Free-floating and Station-based.

By Business Model, the market is divided into Fully private operators, Government-sponsored, and Public-private partnerships (PPP). By End Use, the market is segmented into Daily commuters, Tourists & recreational users, Corporate users, and University & campus users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

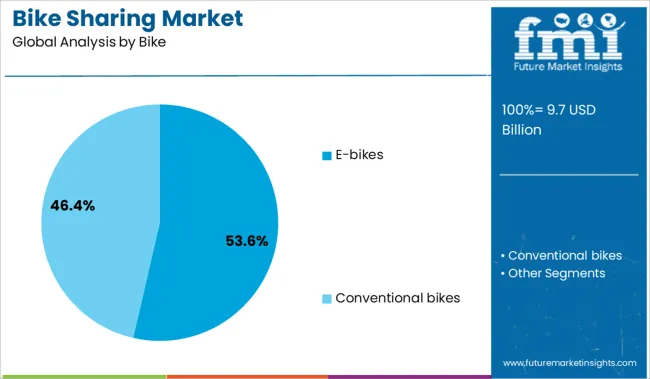

The e-bike segment is anticipated to contribute 53.6% of the bike sharing market revenue in 2025, holding the leading position among bike types. The growth is attributed to the increasing demand for powered assistance that makes cycling more accessible, especially over longer distances or hilly terrains. E-bikes reduce physical effort and appeal to a broader demographic including older adults and commuters.

Their environmental benefits over motorized vehicles align with sustainability goals in cities. Technological improvements have enhanced battery life and reduced charging time, increasing user convenience.

The expanding urban cycling infrastructure has also facilitated e-bike usage. These factors have reinforced the dominance of e-bikes within the bike sharing market.

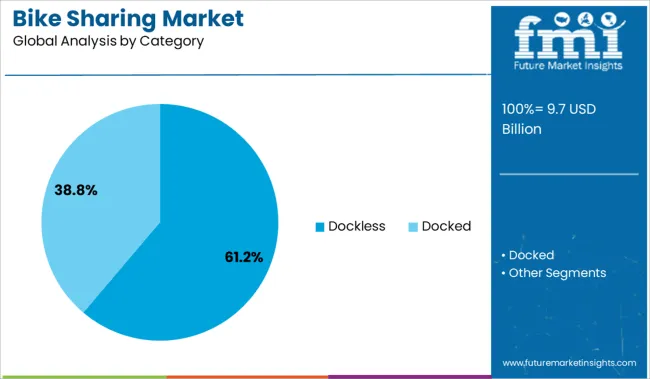

The dockless bike sharing category is projected to hold 61.2% market revenue share in 2025, making it the dominant system type. Dockless models provide users with the flexibility to pick up and drop off bikes anywhere within a service area, eliminating the need for fixed docking stations. This convenience has driven rapid user adoption and expanded service areas.

Operators have leveraged smartphone apps and GPS tracking to manage fleets effectively. The absence of docking infrastructure lowers deployment costs and accelerates market penetration, particularly in densely populated urban centers.

Despite challenges related to bike distribution and maintenance, dockless systems continue to capture a significant portion of the market due to their user-centric design and operational efficiency.

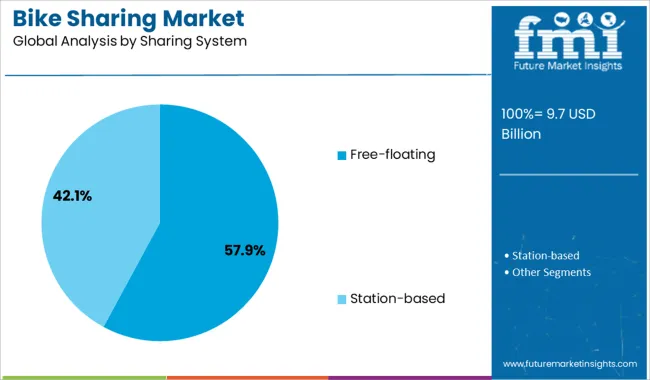

The free-floating sharing system segment is expected to account for 57.9% of the market revenue in 2025, leading the sharing system categories. This system allows users to rent bikes without fixed stations and return them at any legal parking spot within the operational area, offering maximum flexibility.

Free-floating has become popular because it aligns with modern urban mobility demands for spontaneous and on-demand transport options. Service providers have invested in digital platforms that facilitate seamless rentals and returns, improving the overall user experience.

This model supports scalability and quick expansion into new markets by minimizing infrastructure requirements. The convenience and accessibility of free-floating systems are key drivers behind their sustained market leadership.

Rising traffic congestion, short-distance commuting needs, and post-pandemic transport shifts are boosting bike sharing. Key opportunities include expanding shared fleets, building local partnerships, and integrating bikes into daily transport routines.

The bike sharing market is gaining traction as cities struggle with road congestion and limited parking. People increasingly seek flexible, short-distance transport options for commuting, errands, and recreation. Health-conscious behavior is also encouraging bike use, offering a convenient alternative to crowded buses or trains. During and after the pandemic, more individuals turned to personal mobility options to avoid shared indoor spaces. Bike sharing systems—both station-based and dockless—are expanding to meet this shift. Governments in many regions are supporting these programs through designated bike lanes and shared fleet contracts. Easy access through mobile apps, along with affordable pay-per-use pricing, has made shared biking more appealing across all age groups. These factors continue to push adoption, especially in dense city centers.

Opportunities in the bike sharing market are growing through expansion into new towns, business districts, and university campuses. Operators are forming agreements with employers, event venues, and residential complexes to place bikes where daily routines begin and end. This localized placement improves ridership and reduces idle fleets. Public transit operators are also exploring joint passes that include shared bikes, helping people travel beyond standard bus or rail routes. In smaller cities and tourist areas, short-term rentals cater to visitors and seasonal demand. Offering bikes with adjustable pricing plans, multi-user passes, and reliable availability helps attract regular riders. Operators focusing on fleet management efficiency, route planning, and community-level coordination can build stable usage and long-term market presence.

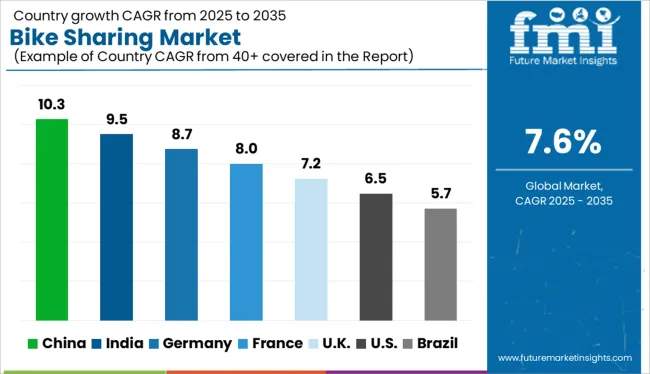

| Country | CAGR |

|---|---|

| India | 9.5% |

| Germany | 8.7% |

| France | 8.0% |

| UK | 7.2% |

| USA | 6.5% |

| Brazil | 5.7% |

The global bike sharing market is projected to grow at a CAGR of 7.6% from 2025 to 2035, fueled by urban mobility needs, sustainability goals, and smart city infrastructure investments. Among BRICS nations, China leads with a 10.3% CAGR, supported by high urban density, digital integration, and strong public-private investment in shared mobility platforms. India follows at 9.5%, driven by expanding app-based transit ecosystems and last-mile connectivity demand. In the OECD group, Germany shows strong momentum at 8.7%, backed by government subsidies, cycling infrastructure, and environmental policy alignment. The United Kingdom (7.2%) reflects steady adoption in urban centers, while the United States, at 6.5%, sees moderate growth driven by university towns, tourism, and micro-mobility integration. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

From 2025 to 2035, the bike sharing market across China is projected to expand at a CAGR of 10.3%, with year-over-year growth ranging between 9.8% and 10.9%. Urban mobility reforms and strong public infrastructure investment are fueling large-scale fleet expansions in first- and second-tier cities. With digital wallet integration and QR-code access, user convenience is at an all-time high, especially among short-distance commuters. Meanwhile, AI-powered fleet management is optimizing vehicle distribution based on real-time demand. National policies supporting green transport and emissions reduction are also boosting operator viability and long-term adoption.

The bike sharing market across India is anticipated to grow at a strong CAGR of 9.5% between 2025 and 2035, with year-over-year gains ranging from 9.0% to 10.0%. Rapid urbanization and increasing last-mile connectivity demands are fueling growth in metro cities and university zones. Operators are expanding services to Tier-2 cities, supported by mobile payment ecosystems and app-based booking platforms. Government policies under Smart City and AMRUT schemes are enabling public-private partnerships to fund and scale shared mobility infrastructure. Affordability, convenience, and growing climate awareness are drawing daily commuters to short-distance bike rental services.

The bike sharing market across Germany is expected to register a CAGR of 8.7% from 2025 to 2035, with annual growth levels ranging from 8.2% to 9.1%. Germany’s strong cycling culture and public focus on sustainability are driving rapid adoption in cities like Berlin, Hamburg, and Munich. Local governments are upgrading cycling infrastructure and collaborating with private operators to expand station-based and dockless models. Integration with transit apps and digital travel cards is improving accessibility and real-time trip planning. Eco-conscious urban planning is placing bike sharing at the center of low-emission transport strategies.

Between 2025 and 2035, the bike sharing market across the United Kingdom is projected to grow at a CAGR of 7.2%, with year-over-year increases ranging from 6.8% to 7.6%. Rising environmental concerns, congestion pricing, and urban sustainability goals are encouraging cities to promote active mobility. London, Manchester, and Glasgow are expanding public-private bike sharing collaborations, including e-bike rollout pilots. With integrated journey planning apps, users can now navigate between rail, bus, and shared bike networks more efficiently. Government funding for green transport initiatives is reinforcing the role of shared bikes in climate resilience strategies.

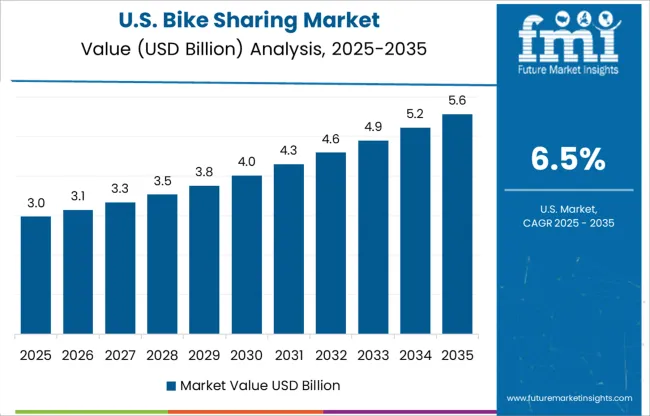

The bike sharing market across the United States is forecast to grow at a CAGR of 6.5% during 2025–2035, with year-over-year growth between 6.1% and 6.9%. Shared micro-mobility is expanding as cities push for alternatives to congested road traffic and promote climate-focused transit policies. Operators are prioritizing e-bike fleets and adaptive vehicle options to serve a wider demographic. Integration with mobility-as-a-service (MaaS) platforms is improving discoverability and trip convenience. Federal funding for sustainable transportation under infrastructure acts is also providing new opportunities for system expansion in urban and university settings.

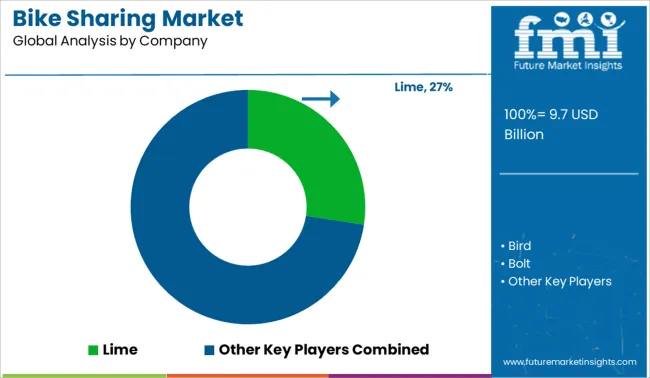

The bike sharing market is moderately fragmented, featuring a mix of global mobility giants and regional startups competing on scalability, fleet management, and urban integration. Tier 1 players such as Lime, Bird, and Lyft lead with extensive geographic coverage, strong app ecosystems, and diversified micromobility offerings including e-bikes and e-scooters. Lime holds the largest share at 27.4%, driven by strategic partnerships, robust funding, and real-time fleet optimization. Tier 2 companies like Dott, Spin, and Bolt focus on key urban markets in Europe and North America, offering sustainable, regulation-compliant solutions. Tier 3 players such as Ofo, JUMP, and Nextbike target local deployments, university campuses, and public-private initiatives, often emphasizing affordability and niche infrastructure compatibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.7 Billion |

| Bike | E-bikes and Conventional bikes |

| Category | Dockless and Docked |

| Sharing System | Free-floating and Station-based |

| Business Model | Fully private operators, Government-sponsored, and Public-private partnerships (PPP) |

| End Use | Daily commuters, Tourists & recreational users, Corporate users, and University & campus users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lime, Bird, Bolt, Dott, JUMP, Lyft, Nextbike, Ofo, and Spin |

| Additional Attributes | Dollar sales by bike type (traditional pedal bikes, e-bikes), operational model (dockless, station-based), and user segment (commuters, tourists, students); regional adoption patterns shaped by urban mobility policies and infrastructure investments; seasonal and weather-related demand fluctuations; impact of municipal regulations and public-private partnerships; integration with public transit networks and mobility-as-a-service (MaaS) platforms; environmental benefits relative to car-based commuting; and technological innovations in GPS tracking, mobile payments, and fleet management systems. |

The global bike sharing market is estimated to be valued at USD 9.7 billion in 2025.

The market size for the bike sharing market is projected to reach USD 20.1 billion by 2035.

The bike sharing market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in bike sharing market are e-bikes and conventional bikes.

In terms of category, dockless segment to command 61.2% share in the bike sharing market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bike And Scooter Rental Market Size and Share Forecast Outlook 2025 to 2035

Bike Saddles Market Trends – Growth & Demand Forecast 2025 to 2035

E-Bike Accessories Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Motors Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

E-Bike Drive Unit Market Size and Share Forecast Outlook 2025 to 2035

E-Bike Battery Market Size and Share Forecast Outlook 2025 to 2035

E-bike Market Size and Share Forecast Outlook 2025 to 2035

BMX Bikes Market Size and Share Forecast Outlook 2025 to 2035

Pit Bike Market Size and Share Forecast Outlook 2025 to 2035

Hydrobikes Market Size and Share Forecast Outlook 2025 to 2035

Dirt Bike Market Size and Share Forecast Outlook 2025 to 2035

Cargo Bike Tire Market Growth – Trends & Forecast 2025-2035

Cargo Bike Market Growth - Trends & Forecast 2024 to 2034

Racing Bike Market Size and Share Forecast Outlook 2025 to 2035

Tandem Bike Market Size and Share Forecast Outlook 2025 to 2035

Electric Bike Range Extender Market Size and Share Forecast Outlook 2025 to 2035

Electric Bike Market Growth - Trends & Forecast 2025 to 2035

Underwater Bikes Market Size and Share Forecast Outlook 2025 to 2035

Mountain E-Bike Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA