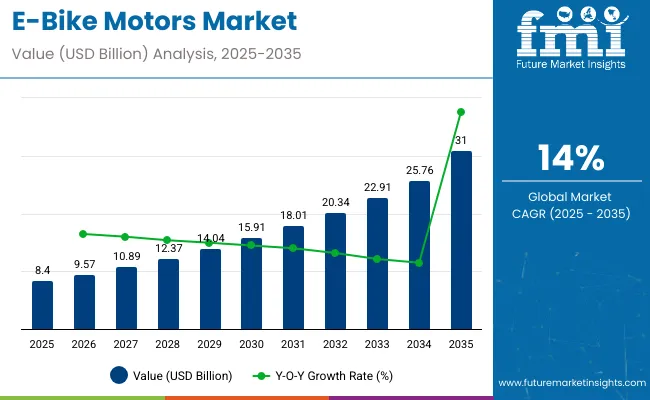

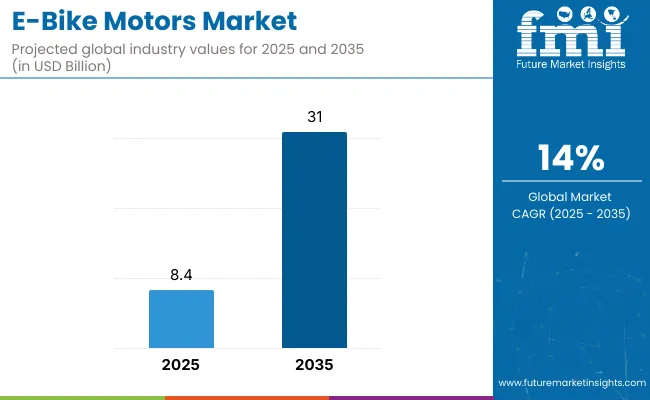

The global e-bike motors market is predicted to reach USD 8.4 billion in 2025 and USD 31 billion by 2035, expanding at a compound annual growth rate of 14% with a multiplying factor of 3.7 over the decade. Growth is driven by rising adoption of electric mobility, government incentives for clean transport, and consumer demand for affordable commuting solutions.

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 8.4 billion |

| Market Forecast Value in (2035F) | USD 31 billion |

| Forecast CAGR (2025 to 2035) | 14% |

Breakpoint analysis identifies phases where adoption shifts significantly due to advancements in battery efficiency, improvements in mid-drive motor technology, and expanding urban transport infrastructure. These early breakpoints mark the transition from limited use toward broader acceptance across cities and recreational segments.

By 2035, with a market value of 31 billion, the sector is expected to cross a key breakpoint where e-bike motors move from being a sustainable alternative to becoming a mainstream mobility solution across both developed and emerging economies. Wider integration of smart connectivity, lightweight materials, and design compatibility will push the industry into accelerated adoption. Each breakpoint reflects new opportunities for efficiency, cost optimization, and improved performance. The multiplying factor of 3.7 underscores how aligned technological innovation, affordability, and infrastructure growth can reshape long-term market expansion, making e-bike motors a central component of future mobility solutions.

The e-bike motors market is supported by several upstream sectors. Two-wheeler and bicycle production makes up about 38%, as manufacturers integrate motor technology directly into frame designs. Electric motor and drive system industry contributes roughly 28%, supplying hub, mid-drive, and gear-assisted units. Battery technology and power electronics represent close to 17%, linking energy output to motor efficiency. Mechanical parts and mobility components account for nearly 10%, including chains, cassettes, and torque sensors. Retail, aftermarket, and service networks hold around 7%, covering distribution, upgrades, and repair services that sustain market adoption.

E-bike motor development is shifting toward lighter, quieter, and more powerful systems. Compact mid-drive motors are increasingly favored for mountain and performance bikes due to their torque delivery and weight balance. Hub motors still dominate entry-level and city bikes, driven by affordability and ease of installation. Manufacturers are exploring regenerative braking to extend riding range, while integration with IoT-based platforms allows riders to track efficiency and adjust assistance levels. Collaborative projects between e-bike brands, component makers, and battery innovators are producing tailored drive units. Premium players are also investing in fully integrated motor-battery solutions to streamline design and improve durability.

E bike motors adoption is accelerating as cities push micromobility and commuters seek lower total cost of travel. Asia Pacific contributes the majority of unit demand, with strong uptake in China and Southeast Asia, while Europe leads premium commuter and cargo categories. Hub motors dominate entry and mid tiers for cost efficiency, while mid drive systems expand fastest in sports, trekking, and cargo use thanks to higher torque and better weight distribution.

Driving Force Urban Electrification and Performance Gains

Urban transport policies, growing cycling infrastructure, and rider preference for assisted mobility are amplifying demand for efficient, compact motors. Hub motors account for about 65-70% of installed base due to lower price and simpler maintenance, while mid drive penetration is rising in the premium mix as riders value 70-95 Nm torque delivery and natural cadence feel. Efficiency improvements of 8-15% versus previous generations are extending range per charge on 400-700 Wh packs. Cargo and trekking e bikes require sustained power at low cadence, favoring mid drives with better thermal management and gear interaction. Falling battery cost per Wh and better controllers are lifting overall value across commuter and leisure segments.

Growth Avenue Segment Diversification and Platform Modularization

Demand is broadening beyond city bikes into cargo, MTB, gravel, and folding categories, creating differentiated motor requirements. Cargo platforms favor mid drives with reinforced mounts and 85-100 Nm torque, while folding models prioritize compact hub systems under 2.6 kg. Manufacturers are scaling modular motor families with shared electronics and gearsets to reduce bill of materials by 7-12% and speed OEM integration. Fleet and subscription operators are standardizing on swappable motor battery architectures to reduce downtime and improve utilization. Growing B2B sales in delivery fleets and municipal sharing programs add predictable volume that supports localized service footprints and aftermarket parts revenue.

Emerging Trend Lightweight Architecture and Smart Assistance

Lightweight motor housings, compact stators, and optimized gear trains are trimming motor mass by 10-15%, improving handling and lift convenience. Quiet operation is advancing with acoustic optimization of planetary gears and sine wave controllers, lowering perceived noise by 3-5 dB. Smart assistance blends torque, cadence, and speed sensors with grade prediction to smooth power delivery, reducing peak draw and extending range in mixed terrain. Over the air calibration allows post sale tuning of assistance curves, while diagnostics flag bearing wear and thermal events before failure. Integration with 21700 cell packs and higher bus voltages supports stronger sustained output without excessive heat buildup.

Market Challenge Cost Structure, Supply Risks, and Standards

Advanced mid drive systems cost 30-45% more than hub motors due to torque sensors, reduction gearing, and higher grade magnets, raising retail prices in price sensitive markets. Rare earth magnet availability and lithium supply variability create lead time swings of 6-10 weeks and price volatility across motor BOMs. Warranty returns concentrate around bearings, controllers, and connectors, prompting OEMs to add sealing and strain relief that marginally increase mass and cost. Interoperability gaps between motor controllers, displays, and battery management systems complicate aftermarket upgrades and fleet maintenance. Meeting stricter regional e bike regulations on power and assist speed requires firmware variants and type approvals that add engineering overhead.

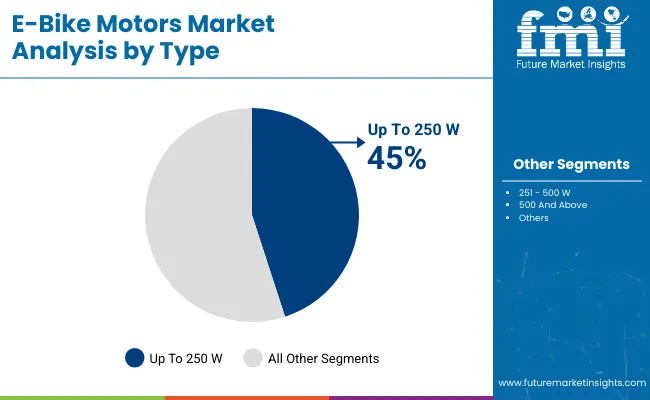

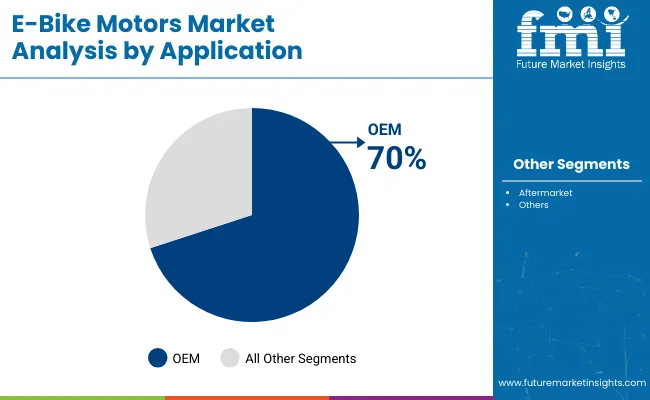

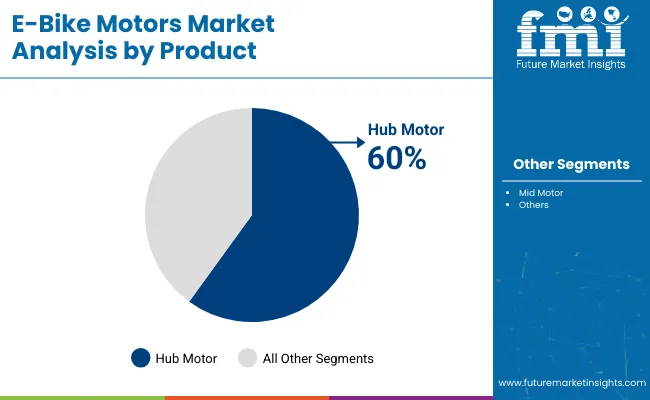

The e-bike motors market is structured by type, application, and product, with demand influenced by efficiency, power output, and manufacturing strategies. Motors up to 250 W dominate due to regulatory compliance and urban commuter adoption. OEM applications hold the largest share as manufacturers focus on integrated designs and bulk supply contracts. Hub motors remain the most popular product type because of cost-effectiveness and low maintenance requirements. Companies such as Bosch, Shimano, Yamaha, Bafang, and Mahle are central players in the industry.

E-bike motors up to 250 W account for 45% of market demand, primarily driven by regulatory restrictions in Europe and commuter-friendly city bikes. These motors offer lightweight designs and sufficient performance for daily urban usage. Models in this range often pair with batteries delivering ranges of 40-70 km per charge. Manufacturers such as Bosch, Mahle, and Bafang focus heavily on this category, producing integrated drive units optimized for weight and efficiency. The market is supported by cycling adoption for health, last-mile delivery, and cost-effective transport alternatives. Lightweight frames and reduced maintenance needs also contribute to higher adoption in this category, particularly across European and Asian commuter markets.

OEM applications hold 70% of e-bike motor demand, as most global manufacturers integrate motors directly during production. This ensures design compatibility, longer warranties, and better efficiency. OEM demand is strengthened by European and Asian brands such as Giant, Trek, and Merida, which contract with Bosch, Shimano, and Yamaha for bulk motor supplies. Production runs typically range from 100,000 to 500,000 units annually, ensuring economies of scale. The aftermarket segment at 25% is growing as cyclists seek customized performance upgrades. OEM control is likely to remain strong due to established supply chains and fleet-level manufacturing advantages, reducing operational costs and standardizing battery-motor systems.

Hub motors represent 60% of the e-bike motor market, favored for their affordability, ease of installation, and low maintenance requirements. Front and rear hub motors are widely used in commuter and entry-level e-bikes. These motors are compact, typically under 4 kg, and capable of ranges up to 80 km when paired with 400-500 Wh batteries. Leading suppliers include Bafang, MXUS, and Shengyi, which supply large volumes to Asian and European manufacturers. Hub motors are highly popular for fleets and rental e-bikes due to their durability and ease of replacement. Mid motors are expanding their share at 35%, appealing to performance-driven users in mountain biking and trekking applications.

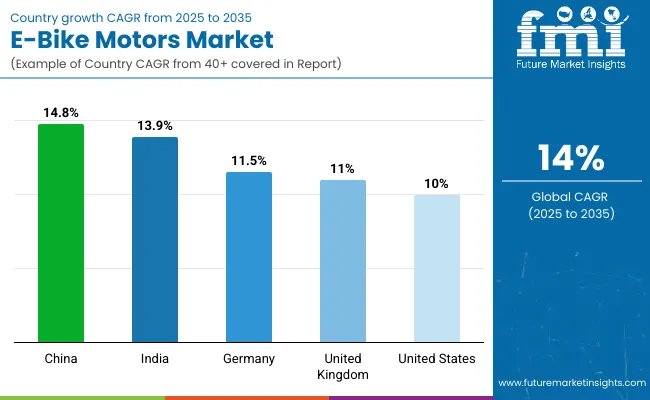

The global e-bike motors market is growing at a CAGR of 14.0% from 2025 to 2035. China leads at 14.8%, +6% above the global rate, supported by BRICS-driven production capacity, government incentives, and strong domestic adoption. India follows with 13.9%, just −1% below the global benchmark, reflecting BRICS and ASEAN-linked demand growth and rising urban mobility needs. Germany records 11.5%, −18% under the global CAGR, with OECD-backed investments in premium e-bike technology and sustainable commuting solutions. The United Kingdom posts 11.0%, −21% compared with the global average, reflecting steady but moderate adoption in a mature OECD market. The United States stands at 10.0%, −29% below the global rate, with growth influenced by OECD-driven technological improvements but slower mass adoption. The overall pattern shows BRICS economies, especially China and India, driving volume expansion, while OECD countries emphasize advanced technology and high-value segments.

China, with a CAGR of 14.8%, continues to dominate the e-bike motors industry. The country’s strong manufacturing ecosystem and over 35 million annual e-bike sales provide scale unmatched by any other region. Domestic companies are investing heavily in high-efficiency brushless motors, while export demand is strengthening in Europe and North America. The rapid uptake of mid-drive technology is improving performance, while government regulations are ensuring compliance with international standards. By 2030, China’s e-bike motor production capacity is expected to expand by over 40%, with exports forming an increasingly important revenue stream.

India’s e-bike motors market is growing at a CAGR of 13.9%, supported by strong demand in both metropolitan and semi-urban regions. Local startups are focusing on hub motor production, offering cost-effective solutions for budget-friendly e-bikes. Increasing consumer demand for affordable commuting options is stimulating investment in domestic motor assembly plants. Rising adoption in delivery fleets is further boosting demand for motors that provide higher torque and extended battery compatibility. By 2030, India is expected to capture a significant share of global motor consumption, driven by price competitiveness and large-scale adoption of electric two-wheelers.

Germany is projected to grow at 11.5% CAGR in the e-bike motors market, driven by premium demand in commuter and leisure bicycles. Strong domestic brands specializing in mid-drive motors dominate the European landscape, contributing to Germany’s role as a technology leader. Recreational e-bikes, including trekking and mountain categories, are seeing double-digit annual growth. Government cycling infrastructure investments are also encouraging higher adoption of premium e-bike systems, further supporting domestic demand. By 2030, Germany is expected to maintain its position as Europe’s largest exporter of advanced motor systems.

The United Kingdom is expanding at a CAGR of 11.0% in the e-bike motors market. Growth is influenced by rising adoption in city commuting, particularly in London and Manchester, where cycling infrastructure continues to expand. Imports dominate the market, although partnerships with European motor suppliers are increasing local availability. Demand for compact and lightweight hub motors is strong, especially for folding e-bikes suited to urban consumers. By 2030, the UK is projected to nearly double its total e-bike motor consumption compared to 2023 levels.

The United States e-bike motors market, with a CAGR of 10.0%, is growing steadily as consumer demand for health-focused and high-speed e-bikes accelerates. The cargo and delivery segment is particularly strong, requiring motors with higher power output and longer durability. Domestic assembly is increasing, with suppliers adapting products for local terrain and performance needs. Retail expansion through online platforms and specialty stores has made e-bike motors more accessible to a wider consumer base. By 2030, motor shipments in the US are expected to exceed 4 million annually.

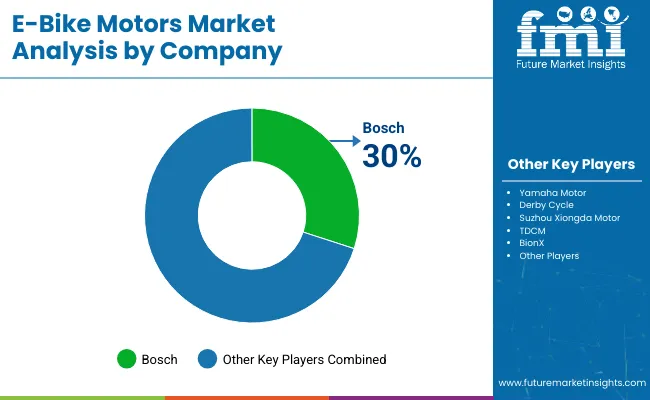

Bosch - 30% (market leader)

The e-bike motors market is supported by both global leaders and specialized manufacturers that focus on performance, durability, and integration with advanced bicycle systems. Bosch has emerged as a major force by offering mid-drive motors with optimized torque control, widely adopted by premium e-bike brands in Europe and North America. Yamaha Motor continues to strengthen its presence with compact and lightweight motors that are designed for both urban commuting and off-road cycling. Derby Cycle, one of Europe’s largest bicycle producers, incorporates in-house motor solutions while also partnering with component makers to expand its range of electric-assisted bikes.

Other players are shaping the competitive landscape through targeted innovation and regional expansion. Suzhou Xiongda Motor from China focuses on hub motors that provide affordable yet reliable solutions for mass-market e-bikes. TDCM emphasizes custom-built motor systems tailored for specific bicycle manufacturers, enhancing brand differentiation. Although BionXfaced restructuring, its motor technologies continue to influence product designs across certain regions. Strategies in this sector include new product launches, collaborations with bicycle manufacturers, and investment in research and development to deliver motors that balance power efficiency, compact design, and riding comfort, keeping competition strong across international markets.

| Report Attributes | Details |

|---|---|

| Market Size, 2025 | USD 8.4 billion |

| Projected Market Size, 2035 | USD 31 billion |

| CAGR, 2025 to 2035 | 14% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Type Segments Analyzed | Up to 250 W, 251 to 500 W, 500 W and above, Other |

| Application Segments Analyzed | OEM, Aftermarket, Other |

| Product Segments Analyzed | Hub Motor, Mid Motor, Other |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, United Kingdom, France, Italy, Spain, Netherlands, Sweden, Poland, China, Japan, India, South Korea, Indonesia, Thailand, Vietnam, Australia, New Zealand, United Arab Emirates, Saudi Arabia, South Africa, Turkey, Egypt |

| Key Players Influencing the Market | TDCM, BionX , Derby Cycle, Bosch, Suzhou Xiongda Motor, Yamaha Motor |

| Additional Attributes | Dollar sales by motor type and bike category, demand dynamics across city bikes, mountain bikes, and cargo e-bikes, regional adoption trends across Europe, Asia Pacific, and North America, innovation in mid-drive systems, lightweight hub motors, and torque sensors, environmental impact of battery integration and recyclability, and emerging use in connected e-mobility and long-range performance models |

The e-bike motors market is projected to reach USD 31 billion by 2035.

The e-bike motors market is forecasted to grow at a CAGR of 14% during 2025-2035.

Up to 250 W motors are expected to hold 45% share in 2025.

OEM segment is estimated to capture 70% of the market in 2025.

Bosch is the leading player with a 30% market share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Motors for Robot Body and Robot Wheels Market

IPM Motors Market Size and Share Forecast Outlook 2025 to 2035

Smart Motors Market Size and Share Forecast Outlook 2025 to 2035

Crane Motors Market Growth – Trends & Forecast 2025 to 2035

Stepper Motors Market

Tubular Motors Market

DC Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Electric Motors Market Size and Share Forecast Outlook 2025 to 2035

Traction Motors Market Growth - Trends & Forecast 2025 to 2035

Electric Motors For Conveyor System Market

Can Stack Motors Market Size and Share Forecast Outlook 2025 to 2035

Polishing Motors Market Size and Share Forecast Outlook 2025 to 2035

Induction Motors Market - Growth & Demand 2025 to 2035

Treadmill Motors Market

Industrial Motors Market Insights - Growth & Demand 2025 to 2035

Stair Lift Motors Market Growth - Trends & Forecast 2025 to 2035

Vacuum Rated Motors Market Size and Share Forecast Outlook 2025 to 2035

Marine Winch Motors Market Size and Share Forecast Outlook 2025 to 2035

Digital Servo Motors and Drives Market Size and Share Forecast Outlook 2025 to 2035

Gearbox and Gear Motors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA