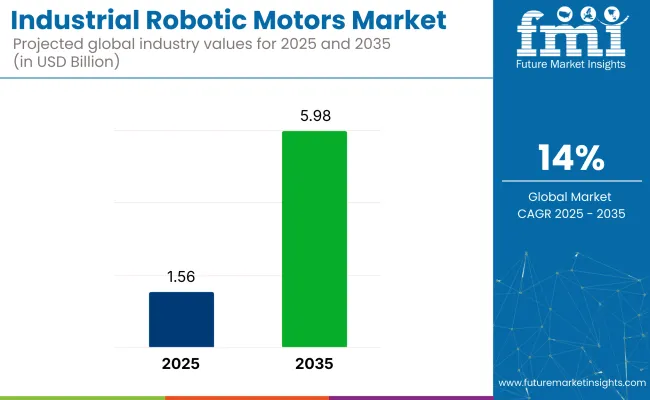

The global industrial robotic motors market is set to witness enormous growth, with a revenue size of USD 1.56 billion in 2025, which is likely to reach around USD 5.98 billion by 2035, growing at a CAGR of about 14%. It is fueled by major factors such as the fast growth of automation and intelligent manufacturing technology in industries globally.

Industrial robotic motors are the driving source behind robotic arms and automated machinery applied in assembly lines, material handling, welding, packaging, and inspection. The main motors, namely servos, steppers, and brushless DC motors, are capable of generating the precision, torque, and control necessary for high-speed repetitive industrial processes.

The main growth driver is the continuing shift towards Industry 4.0, whereby manufacturers are automating and digitizing their production processes to ensure enhanced efficiency, accuracy, and throughput. Robotic motors facilitate agile manufacturing environments with rapid product changeovers and minimal human involvement in risky or repetitive processes.

Automotive, electronics, and aerospace are some of the most aggressive industries to utilize industrial robotic systems. Motors in robotic welders, pick-and-place arms, and CNC systems contribute towards enhancing the precision of the assembly process, lowering the cost of operations, and enhancing workplace safety.

The development of collaborative robots (cobots)-robots intended to work with humans-has also driven the expansion of advanced motor systems. These motors provide greater sensitivity and dynamic response to provide safe, efficient operation in shared workspaces, driving increased adoption in small and medium-sized enterprises (SMEs).

Technological developments in motor efficiency, miniaturization, and real-time control are also pushing the growth further. High-end encoder systems, digital feedback loops, and AI-based motion planning are optimizing energy consumption, load handling, and predictive maintenance in manufacturing industries.

From 2020 to 2024, the industrial robotic motors market kept growing as industries increased automation technology applications. A need for precision and efficiency drove the demand and increased productivity in the manufacturing, packaging, and material handling industries. Robotic motors were primarily used as add-ons in current systems to improve operation reliability. Advancements were incremental, and the current industry needs were to be met.

From 2025 to 2035, the sector will be experiencing increased alterations driven by technological advancements in AI, machine learning, and Industry 4.0. Advanced robotic systems will dominate this phase by offering extremely flexible and agile automation solutions.

Such systems will be more intelligent, autonomous, and better at solving intricate tasks. Additionally, an emphasis on sustainability and energy efficiency will impact product development. North America and Europe are likely to witness growth in accordance with their development in automation across various industries.

Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The need for automation in the manufacturing, packaging, and material handling industries mainly fueled the robotic motor demand over the years. Automation was viewed as a requirement to become more efficient. | The industry will continue to grow due to AI and machine learning developments. Adaptive smart robotic systems responsive to complex situations will be at the forefront in automating procedures. |

| Robotic motors saw modest innovation directed toward functionality and dependability, with increased adoption in standard manufacturing platforms. | Technological advances in AI, robotics, and machine learning will promote more independent and smart systems and further consolidate the role of robots in varied tasks in the different sectors of the economy. |

| The Asia Pacific economy, and specifically China, was the growth driver with high rates of automation across auto and consumer electronics industries. The developed regions experienced slower but consistent adoption. | Growth in Asia-Pacific will persist, but North America and Europe will witness faster uptake, with more emphasis on flexible robotic systems and energy efficiency in manufacturing industries. |

| The regulatory interest was in providing safety and industrial guideline compliance, which assisted in the gradual take-up of robotic motors. | Future regulations will emphasize energy efficiency, sustainability, and the safe integration of intelligent systems. Manufacturers will have to meet these changing standards in order to remain competitive. |

| Supply chain disruptions during the pandemic and the high initial costs of automation were major obstacles to wider adoption. | Future challenges will focus on embedding new technologies into current infrastructure and bridging the skills gap required to handle more sophisticated systems. Nevertheless, the need for higher productivity will fuel industry growth. |

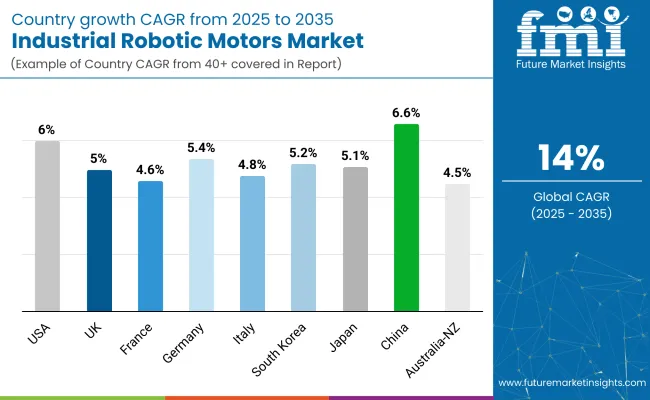

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.0% |

| UK | 5.0% |

| France | 4.6% |

| Germany | 5.4% |

| Italy | 4.8% |

| South Korea | 5.2% |

| Japan | 5.1% |

| China | 6.6% |

| Australia-NZ | 4.5% |

The USA will register a 6.0% CAGR during the forecast period. Growth in the USA industrial robotic motors market is fueled by rising automation across various sectors such as automotive, aerospace, electronics, and logistics. With the manufacturing sector being pressured by labor shortages and increasing operating costs, the demand for high-reliability and good-performing robotic motors is on the rise.

These motors are critical to the functioning of articulated robots, SCARA robots, and autonomous mobile robots increasingly adopted on factory shop floors and warehouses. New technologies such as servo motor miniaturization, interfacing with AI-based motion control systems, and energy-efficient drives are becoming widely accepted.

The USA has a vibrant robotics industry and research base that is propelling the adoption of intelligent robotics systems. The growth of collaborative robots (cobots) and their adoption in mid-sized and small businesses is also increasing the sales of precision motors.

Moreover, manufacturing activity reshoring and financing of intelligent factory initiatives are expected to boost the situation for industrial robotic motor suppliers. Continued focus on sustainability and operational efficiency is driving the adoption of motors that offer high torque density, speed regulation, and long lifecycle performance.

The UK is expected to post a 5.0% CAGR during the forecast period. The UK industrial robotic motors market is spurred by increasing food processing, pharmaceutical, and electronics production automation.

Even though it possesses a limited manufacturing base compared to global players, UK industries are making more investments in upgrading production units to enhance productivity and competitiveness. Advanced motor technology-based robotic units are applied for high-precision handling, assembly, and packaging applications.

The focus on post-Brexit industrial self-sufficiency and digitalization has prompted investment in local manufacturing capacity, which has created speeding up demand for electric motors used in robotic applications. Motors with the capability for high-speed performance, positional accuracy, and fail-safe operation are increasingly in demand.

Additionally, the increasing use of robotics in warehouses and fulfillment centers is driving the increased use of mobile robots and robotic arms that require small, high-efficiency motors. Government programs for the adoption of Industry 4.0 technologies and energy-efficient manufacturing solutions are also contributing to driving motor technology upgrades among the UK industrial base.

France will experience a growth at 4.6% CAGR during the study period. The sales for industrial robotic motors in France are growing due to escalating interest in automation across the automotive, food & beverages, and cosmetics sectors. Robotics is penetrating these markets as manufacturers attempt to boost productivity, meet quality specifications, and cope with labor shortages. With it arrives, high-precision control motors with quick acceleration and durable performance are being applied to more robot applications.

The transition toward smart factories as part of the national reindustrialization plan in France is driving demand for servo motors, stepper motors, and direct drive motors in robotics equipment. Suppliers are placing priority on motor drives that offer effortless integration with sensors, controllers, and predictive maintenance platforms.

Along with this, since environmental efficiency is becoming of greater concern, energy-efficient motors and noise-suppressing motors are receiving ever-growing attention. With the increasing use of collaborative robots, especially in electronics assembly and consumer goods packaging, the use of robotic motors is expanding further. The alignment of France with EU industrial upgrading priorities further reinforces the positive long-term prospects of this sector.

Germany will register a 5.4% CAGR during the study period. German engineering excellence and leadership in advanced manufacturing make it ideal for industrial robotic motors. Germany's established machine, automotive, and electronics industries are rapidly accelerating automation investments.

Brushless DC motors and servo motors are particularly in demand due to their superior torque control, high precision, and flexibility across robotic platforms. German manufacturers emphasize quality, energy efficiency, and hassle-free system integration, which triggers the uptake of smart motor systems with digital interfaces and real-time feedback capabilities.

With the Industry 4.0 initiative, considerable attention was given to the implementation of networked, sensor-integrated robotics systems where motors play a central role in performance and lifespan. In addition, the growing use of collaborative robots and AGVs in manufacturing and logistics environments is driving demand for lightweight, compact, and reliable motors. Germany's strong domestic production capacity and R&D infrastructure facilitate ongoing innovation, and the region is, therefore, appropriate for strong and steady growth.

Italy is projected to grow at 4.8% CAGR during the forecast period. Italy's demand for industrial robotic motors is seeing steady but moderate growth, thanks to increasing automation in machinery, food processing, and fashion textiles industries. The transition towards greater operation efficiency and flexibility in manufacturing has fueled demand for robotic systems powered by high-performance electric motors.

Servo motors and stepper motors are being widely used due to their dependability and ease of control in multi-axis robot activities. Italian manufacturing companies, especially SMEs, are investing in space-saving robot systems to make repetitive and precision-oriented tasks easier.

With Italy playing an active role in EU-level industrial automation, funding support and technical specs are also pushing technology upgrades. Increased collaboration among local system integrators and robotics solution providers ensures access to bespoke-designed motor systems. With the industry shifting towards modular and scalable automation, motor technology that is compatible with smart control systems is expected to gain a lot of traction.

South Korea is expected to register a 5.2% CAGR during the research period. South Korea has a high level of industrial automation and electronic, semiconductor, and automobile manufacturing innovation. Such a setting has created a high and growing demand for industrial robotic motors that offer precise motion control and high speed.

Enclosed encoder servo motors and direct drive solutions are gaining popularity for their precision and efficiency. The country's robust electronics sector is driving the demand for miniaturized, low-power motors used in robotic arms and pick-and-place machines.

Government smart factories and digital manufacturing programs are also accelerating the installation of robotics in medium and large enterprises. Furthermore, South Korea's technological prowess in the integration of AI and IoT is driving innovation in advanced motor systems that provide predictive maintenance and real-time diagnostics. With attention to shortening cycle times and enhancing process quality, demand for high-quality, high-end motors for all industrial robotics applications persists.

Japan is expected to rise at 5.1% CAGR over the forecast period. Japan has been a global leader in robotics and automation for decades, and the sales of industrial robotic motors remain competitive. Continued demand in automotive assembly lines, precision electronics manufacturing, and logistics automation continues to drive high-performance motor adoption, particularly servo and linear motors known for their compactness and precise motion control.

An aging workforce and productivity needs are forcing manufacturers to make greater use of robots across a broad spectrum of industries, including healthcare equipment and consumer electronics. Robotic systems in Japan require motors with quiet operation, high response speed, and low heat generation, and hence motor design innovation is a priority.

Japan's emphasis on micro-precision and smart factory initiatives causes continuous innovation in robotic motion systems. In addition, advances in human-robot and soft robotics are bringing new uses for flexible and adaptive motor systems for lightweight, reactive robotic arms and automation devices.

China will expand at a 6.6% CAGR during the forecast period. China has the world's most developed technologies for industrial robotics. Robotic motor demand is rising in tandem with high-volume automation projects in the automotive, electronics, logistics, and heavy machinery sectors. With strong government backing under the "Made in China 2025" program, factories are rapidly being digitized and equipped with robotic machinery, significantly driving demand for servo, stepper, and brushless DC motors.

China's focus on indigenous capability in critical robotics components has encouraged domestic production of industrial motors, accelerating supply and reducing import dependence. Fast expansion in the e-commerce and logistics industries is employing large quantities of autonomous mobile robots, which require small, efficient motors.

In high-precision manufacturing, precision and repeat are still top priorities, necessitating the use of advanced motors with integrated feedback loops and motion controllers. Increased investment in 5G-ready smart factories and robotic welding, assembly, and inspection lines is indicative of firm long-term performance for Chinese motor makers.

The Australia-New Zealand region is expected to increase at 4.5% CAGR in the study period. The local industrial robotic motors industry is gaining momentum as producers in food processing, mining, and logistics turn to automation to increase productivity and offset labor shortages. Though the scale of industry activity is fairly modest, investment in scalable and flexible robotic configurations is on the rise, with emphasis placed on reliability and energy efficiency.

Companies in the region are turning to brushless motors and miniature servo motors for use in mobile robots, packaging lines, and robotic arms. Environmentally robust motors are also sought within the mining and resource industries.

Positive government interventions, re-skilling of the workforce, and growing awareness of Industry 4.0 concepts are propelling the upgradation of industrial infrastructure. With local manufacturers moving towards intelligent operations and digital monitoring, motors that offer programmable control, feedback integration, and low maintenance requirements are becoming essential to automation strategies.

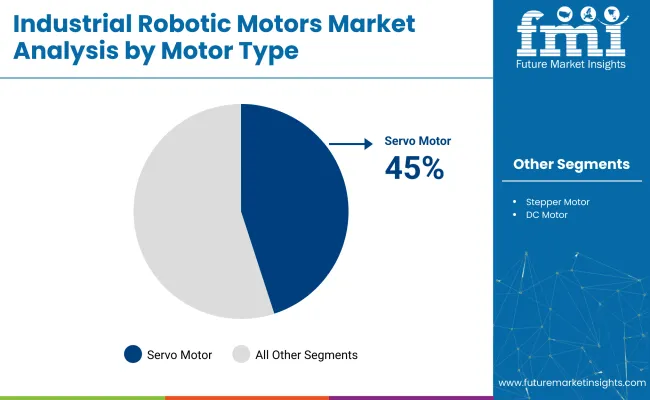

By motor type, the industry is segmented into Servo Motors and DC Motors, with an expected share of 45% and 30%, respectively.

Servo motors lead with a 45% share. They are favored because of their high accuracy and speed, making them fit for robotic tasks that depend on very fine motion control. Now, these have started gaining ground in automotive manufacture, electronics, and healthcare assembly, all using robots in welding operations and medical procedures.

Among major players in this sector are Mitsubishi Electric and Yaskawa Electric, whose development breakthroughs have been achieved through high-performance servo motors specifically designed for robotic applications. Such motors have high torque and position feedback, which makes them very critical for robotic arms whose movements need to be extremely precise and very repeatable for high efficiency and reduced errors.

DC motors hold 30% of the market. They are used in applications where torque is required to be steady at a wide range of speeds. Such motors are appreciated for their simplicity and reliability, providing operation in many kinds of robots, from small robotic arms to some of the largest machines in packaging and logistics.

Companies like Maxon Motors and Faulhaber provide DC motors equipped with high-tech features, including embedded feedback systems and torque-to-weight ratios, making DC motors useful for low-speed high-torque control operations, such as those required in material handling or packaging.

The market will grow as longtime increased adoption of robotic solutions across industries continues to grow with the advancement of industries in automation, preciseness, and cost-effectiveness.

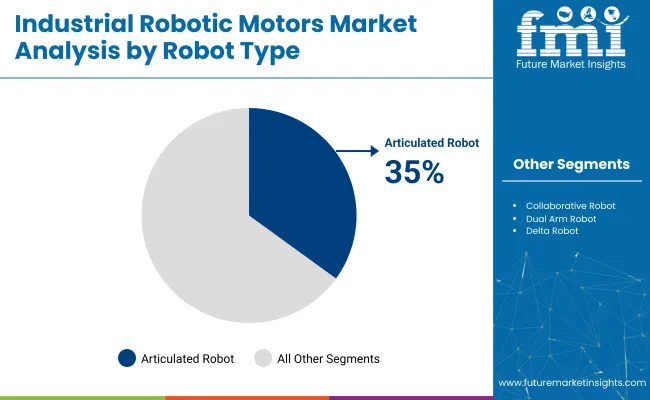

By robot type, Articulated Robots and SCARA Robots are expected to harness 35% and 25% of the revenue share, respectively.

Articulated Robots are extremely flexible and moveable as well. They have a market share of 35%. They find applications in industries like automotive, electronics, and consumer goods manufacturing that require more complicated tasks. The design of these robots usually consists of several joints, allowing them to act in much the same way as a human arm. Articulated robots perform various functions, such as welding, assembly, and material handling.

Companies such as Fanuc and ABB Robotics are some of the producers of highly flexible articulated robots with advanced technologies that are able to handle simple and complex tasks with high precision The benefits of the articulated robot being installed on a production line include flexibility and a wide range of functions, from simple pick-and-place applications to sophisticated multi-robot welding operations.

SCARA robots account for 25% of this segment and are preferred due to their high-speed, high-precision work with assembly, packaging, and sorting applications. SCARA robots operate excellently in the horizontal plane and are appropriate for repetitive activities requiring high precision.

Among the SCARA competitors are KUKA Robotics and Epson Robots, which are bringing about solutions focusing on productivity for the electronics, food packaging, and pharmaceutical industries. SCARA robots are capable of carrying out work with very high speeds and, requiring minimal maintenance, can sustain tasks within environments that emphasize high efficiency and on-time delivery.

Both cousins will constantly play a major role in automation with increasing demand from industries trying to optimize production processes and reduce operational costs.

The industrial robotic motors industry is extremely competitive, with awards from the ABB Group, Nidec Corporation, FAULHABER Group, PMDM Group, and HDD. These major companies are concentrating on high precision, efficiency, and smart integration to cater to the ever-increasing demand for collaborative robots, autonomous systems, and AI-driven automation in manufacturing and logistics.

ABB Group reinforced its robotic motors portfolio by embedding next-generation servo motors featuring higher torque density and better thermal management within the operating conditions of industrial robots used in automotive and electronics manufacturing.

Nidec has been acquiring stakes within the industry with high investment in compact, high-efficiency brushless DC motors (BLDCs) serving the purpose of robotics. In addition, FAULHABER Group is the leading player in micro-motion control solutions, offering very high precision motors to serve surgical robotics and semiconductor manufacturing.

PMDM Group and HDD are adding high-torque stepper motors for robotic arms and automated assembly lines. Fanuc Corporation has improved its industrial robots with AI-driven features for predictive maintenance, which minimizes machine downtime and maximizes operational efficiency. Kollmorgen invests in edge computing for motion solutions combined with the possibility for real-time adaptation of movements in a robot.

The latest innovations and technological advancements will completely reshape the industrial scenario. One new product is lightweight servo motors, which Kawasaki Heavy Industries introduced, which give better efficiency for use in high-speed industrial robots.

Both top and Shenzhen and Pololu Corporation now focus on cost-effective robotic motor solutions to penetrate preferentially new and small industries of automation at their respective small to medium enterprises. Meanwhile, Lin Engineering and ElectroCraft are venturing into AI-adaptive motor control solutions. These solutions should further the ability of robotic arms to adapt to dynamic industrial environments.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| ABB Group | 18-22% |

| Nidec Corporation | 14-18% |

| FAULHABER Group | 12-16% |

| PMDM Group | 10-14% |

| HDD | 8-12% |

| Other Players | 24-30% |

| Company Name | Offerings & Activities |

|---|---|

| ABB Group | Developing high-torque, energy-efficient servo motors for industrial automation and smart robotics. |

| Nidec Corporation | Expanding BLDC motor solutions with enhanced thermal management for robotic applications. |

| FAULHABER Group | Innovating precision micro-motors for surgical robotics and semiconductor automation. |

| PMDM Group | Strengthening stepper motor portfolio with AI-driven real-time control systems. |

| HDD | Investing in compact, high-efficiency motors tailored for robotic arms and collaborative robots. |

Key Company Insights

ABB Group (18-22%)

Leading in servo motor advancements, integrating AI-driven predictive maintenance and high-efficiency robotics solutions for industrial automation.

Nidec Corporation (14-18%)

Strengthening BLDC motor production, expanding into smart factory automation and cost-efficient robotic motor applications.

FAULHABER Group (12-16%)

Innovating in precision motion control, supplying high-torque micro-motors for robotics and semiconductor industries.

PMDM Group (10-14%)

Enhancing stepper motor technology, integrating real-time motion adjustments and compact design improvements.

HDD (8-12%)

Expanding into lightweight, high-speed robotic motor solutions, optimizing performance for autonomous systems and robotic arms.

Other Key Players

The segmentation is into Servo Motor, DC Motor, and Stepper Motor.

The segmentation is into SCARA Robot, Delta Robot, Cartesian/Gantry Robot, Articulated Robot, Collaborative Robot, and Dual Arm Robot.

The segmentation is into First Fit and Retro Fit.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The industry valuation is estimated to reach USD 1.56 billion by 2025.

The industry is projected to grow to USD 5.98 billion by 2035.

China is expected to grow at a rate of 6.6%, supported by rapid industrialization and advancements in manufacturing technologies.

Servo motors are expected to lead by segments, and account for 45% of the industry share.

Key players in this industry include ABB Group, Nidec Corporation, FAULHABER Group, PMDM Group, HDD, Aurotek Corporation, Fanuc Corporation, Kawasaki Heavy Industries, Kollmorgen, Shenzhen Topband, Lin Engineering, Pololu Corporation, ElectroCraft, Zikodrive Motor Controllers, and Duowei Electric.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA