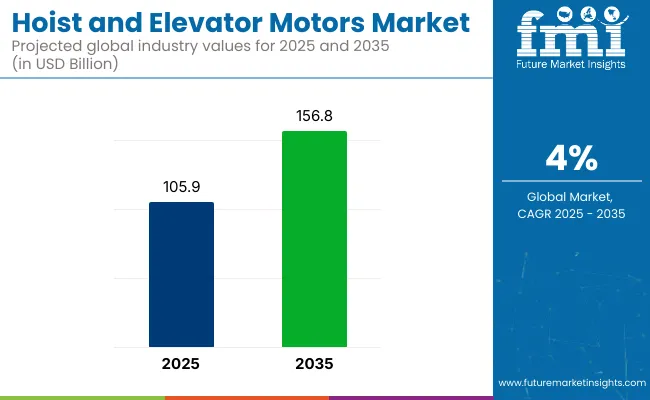

The hoist and elevator motors market is valued at USD 105.9 billion in 2025 and is slated to be worth USD 156.8 billion by 2035, growing at a 4% CAGR. Growth is being driven by rapid urbanization, infrastructure modernization, and heightened demand for energy-efficient vertical-transport solutions.

Additionally, smart-building initiatives, stringent safety regulations, and ongoing upgrades of aging lift systems contribute to expanding advanced motor installations worldwide. Greater adoption of IoT-enabled predictive-maintenance platforms has been observed, allowing downtime to be minimized and life-cycle costs to be lowered.

Significant innovations have been registered across hoist and elevator motors as manufacturers have prioritized efficiency and intelligence. Permanent-magnet synchronous drives with integrated regenerative braking have been engineered to cut energy consumption by up to thirty percent, while silicon-carbide inverters have been adopted to deliver cooler, lighter control modules.

Modular motor-gearbox assemblies have been designed for rapid retrofit, and biodegradable lubrication systems have been introduced to align equipment lifecycles with emerging carbon-neutral and circular-economy mandates under real-world operating conditions worldwide.

National and international bodies have imposed stringent regulatory frameworks, ensuring safety, energy efficiency, and environmental responsibility. Compliance has been mandated through standards such as EN 81-20/50 in Europe, ASME A17.1 in North America, and ISO 25745 for motor energy performance, while periodic inspections and certification cycles are required by local authorities. EU Ecodesign Directive has implemented minimum efficiency thresholds carbon-reduction targets have been embedded within LEED and BREEAM building codes.

| Metric | Value |

|---|---|

| 2025 Market Size | USD 105.9 billion |

| 2035 Market Size | USD 156.8 billion |

| CAGR (2025 to 2035) | 4% |

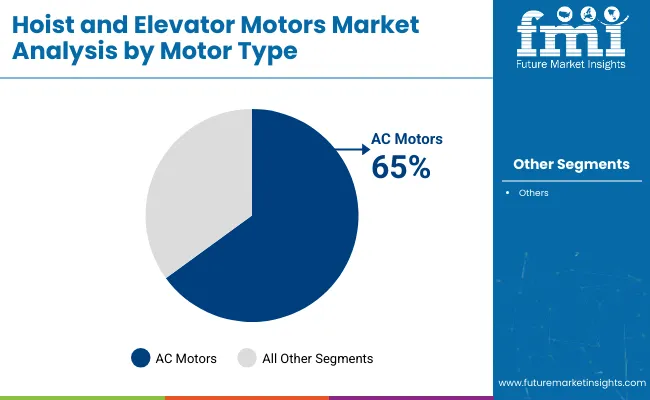

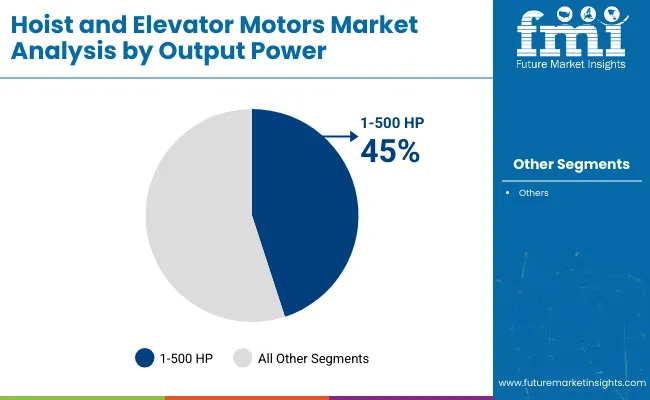

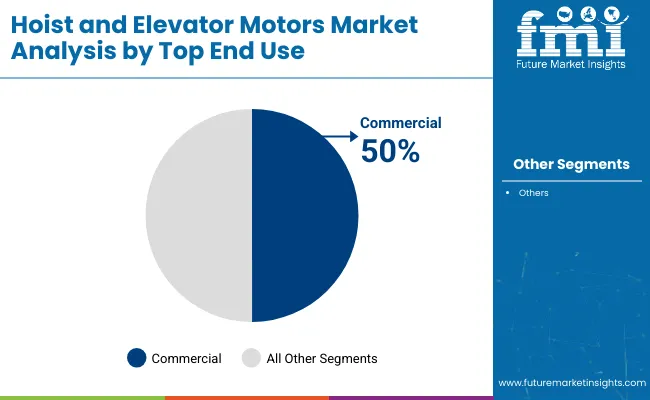

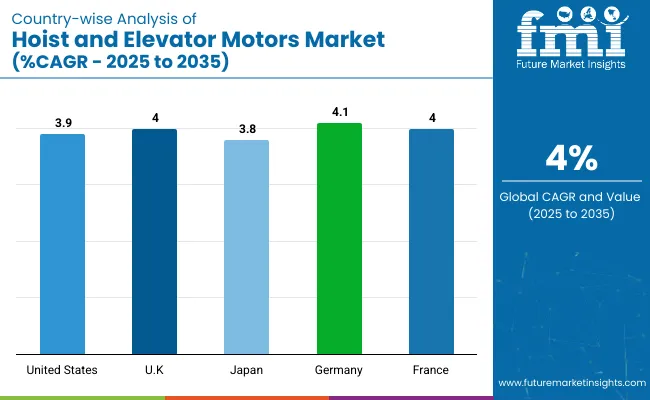

AC motors will dominate the motor type segment, holding a 65% market share in 2025. The commercial sector will lead the end-use segment, capturing 50% of global revenue. The 1-500 HP range will dominate the output power segment, holding a 45% market share in 2025. The UK and Germany are also expected to experience significant growth, with projected CAGRs of 4% and 4.1%, respectively, driven by urban renewal and energy-efficiency initiatives in residential and commercial buildings.

The hoist and elevator motors market is segmented into motor type, output power, end use, and region. By motor type, the market is bifurcated into AC motors and DC motors. Based on output power, the market is divided into less than 1 HP, 1-500 HP, and above 500 HP categories. In terms of end use, the market is categorized into residential, commercial, and industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

AC motors are expected to command 65% of global revenue in the hoist and elevator motors market by 2025, thereby securing the position of the most lucrative motor-type segment for the base year.

The 1-500 HP range is the leading investment segment, accounting for 45% of global revenue in 2025. This is due to its versatility in mid-rise residential buildings, commercial complexes, and light-industrial lifts, where variable-frequency drives and gearless traction designs improve ride quality and energy efficiency.

Commercial applications are expected to account for 50% of global revenue in 2025, making this segment the most profitable investment area.

Steady expansion is being observed in the hoist and elevator motors market, fueled by rapid urbanization, large-scale infrastructure modernization, stringent energy-efficiency mandates, and the integration of IoT-enabled automation technologies.

Recent Trends in the Hoist and Elevator Motors Market

Challenges in the Hoist and Elevator Motors Market

The USA hoist and elevator motors market is projected to grow at a CAGR of 3.9% from 2025 to 2035. Growth is expected to be encouraged by extensive high-rise construction, large-scale modernization of legacy elevators, and strict federal efficiency standards.

Sales of hoist and elevator motors in the UK are anticipated to grow at a CAGR of 4% between 2025 and 2035 as urban renewal schemes intensify. Market growth is expected to continue due to required energy-efficiency regulations, the widespread renovation of old buildings, and more installations of accessibility lifts.

Germany's hoist and elevator motors market is expected to grow at a CAGR of 4.1% during the forecast period, driven by robust manufacturing capabilities and strict DIN building codes. Growth is projected to be propelled by the rapid adoption of regenerative drives within smart factories and logistics hubs.

France hoist and elevator motors revenues are anticipated to grow at a CAGR of 4% during 2025 to 2035. Expansion is expected to be sustained by government incentives rewarding low-carbon materials and by heightened safety inspections following recent legislative revisions.

Japan's hoist and elevator motors market is poised to increase at a CAGR of 3.8% over 2025 to 2035, reflecting stable residential demand and advanced commercial high-rises in Tokyo and Osaka. Market growth is predicted to be encouraged by rapid replacement of aging DC systems, seismic-resilient motor engineering, and extensive use of automation in manufacturing.

The competitive landscape has been considered moderately consolidated, with the ten largest suppliers jointly accounting for a little over half of global revenue, even though a long tail of regional manufacturers still serves niche lift-modernization projects. Intense rivalry has been observed among ABB, Siemens, Rockwell Automation, Regal Rexnord, and Maxon, which have been positioned as tier-one technology leaders, while smaller players focus on localized service contracts and retrofits.

Pricing agility, platform innovation, and portfolio expansion have been pursued as the primary competitive levers. Top vendors launch premium permanent-magnet synchronous and IE5-class induction motors to satisfy stricter ecodesign rules. They also focus on integrated drive-motor packages with predictive-maintenance software.

Recent Hoist and Elevator Motors Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 105.9 billion |

| Projected Market Size (2035) | USD 156.8 billion |

| CAGR (2025 to 2035) | 4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD billions / Volume in thousand units |

| Motor Type Analyzed | AC motors and DC motors |

| Output Power Analyzed | Less than 1 HP, 1 – 500 HP, and Above 500 HP |

| End Use Analyzed | Residential, Commercial, and Industrial |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | ARC Systems Inc., Asmo Co. Ltd., ABB Group, Dr. Fritz Faulhaber GmbH, Brook Crompton UK Ltd., Rockwell Automation Inc., Regal Rexnord Corp., Emerson Electric, Siemens AG, Maxon Group, among others |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The hoist and elevator motors market is valued at USD 105.9 billion in 2025.

The market is forecasted to reach USD 156.8 billion by 2035, reflecting a CAGR of 4%.

AC motors will lead the market by motor type with a 65% market share in 2025.

The commercial segment will dominate the market with a 50% share in 2025.

Germany is projected to grow at the fastest rate, with a CAGR of 4.1% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hoist Chains Market Size and Share Forecast Outlook 2025 to 2035

Hoist Sling Chains Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Rescue Hoist System Market Growth - Trends & Forecast 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA