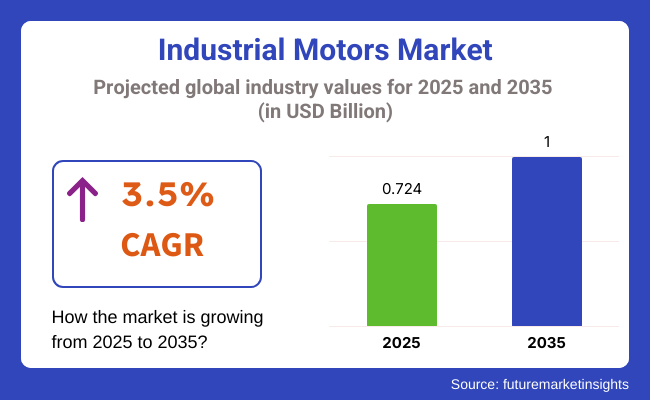

The industrial motors market is expected to grow moderately at an estimated value of USD 724.4 million in 2025 and is projected to reach approximately USD 1 billion by 2035 at a growth rate of CAGR 3.5%.

Industrial automation growth and the need for energy-efficient motor systems stimulate growth.One of the primary growth drivers is the world's transition towards automation and smart manufacturing.

When manufacturing plants install advanced robotics, CNC equipment, and conveyor belts, they require reliable, precision-controlled motors. Industrial motors facilitate this transformation with high torque, variable speed, and durable operation.

The shift to efficient motors is also fueling the industry's growth. Regulating bodies and governments are embracing standards such as IE3 and IE4 classes, forcing companies to replace obsolete equipment with high-efficiency motors. This move reduces operational expenses and supports company-wide sustainability strategies.

Technological advances are compacting today's motors, making them smarter and more connected. Intelligent industrial motors now have sensors and onboard controls for real-time monitoring, preventive maintenance, and system optimization. All these capabilities are core elements of Industry 4.0 initiatives, enhancing productivity with less unplanned downtime.

Challenges are initial costs for investment, particularly for specialty or high-efficiency motors. Small and medium-sized enterprises (SMEs) will postpone upgrading due to capital availability. Supply chain interruptions and volatility of raw materials also have potential to affect production and prices in the short run.

Long-term benefits of more efficient energy use, lower maintenance, and better control of the process are expected to drive adoption in developing and developing economies. Growing need for low-noise, modular, and corrosion-resistant motor designs is also increasing applications in hostile and niche industries.

AsiaPacific dominates the world industry, with industrial expansion in China, India, and Southeast Asia. North America and Europe follow closely, powered by investment in automation, infrastructure development, and high-value manufacturing. These industries are also pushing the integration of digital motors into smart grids and energy-efficient plants.Industrial motors are still at the forefront of industries today.

Through digitalization, electrification, and efficiency measures becoming more topical, the demand for intelligent, innovative motor systems will grow stronger, and hence they will remain a key aspect of global manufacturing and industrial advancement.

The industry is being dynamically changed as the world industries are moving towards automation, electrification, and energy efficiency. The motors find crucial applications in powering equipment in manufacturing, mining, utilities, oil & gas, and processing industries. Low-maintenance, energy-efficient motors with the capability to work under variable speeds and tough conditions have become a global need among all stakeholders.

Producers are working towards creating sophisticated motor technologies that enable variable frequency drives, predictive diagnostics, and more energy classes (IE3, IE4). The producers have to be able to scale by motor size and meet rigorous quality standards while being competitive on worldwide prices.

Industrial customers value motors that provide uptime, operating effectiveness, and long-term cost reductions. Ease of integration into automated systems, consistency with control platforms, and energy savings are critical purchasing drivers.

Distributors serve as the essential link between OEMs and customers. Their success depends on inventory dependability, immediate delivery across industries, and offering support to the customers in the form of product data and replacement components.

Regulatory bodies are encouraging eco-friendly operations by adopting energy-efficient classes of motors and setting noise, safety, and emissions standards. This regulatory spur is driving manufacturers and customers towards embracing motors that reduce energy usage and meet sustainability goals.

Between 2020 and 2024, there was moderate yet constant growth in the Industry, and it was dominated mainly by energy-saving solutions requirements for industries including manufacturing, automobiles, and chemical sectors. Throughout this time, much of the attention was towards maximizing motor efficiency for compliance with regulatory requirements as well as decreasing the consumption of energy.

But the industry was also suffering from supply chain disruptions, the increase in the cost of raw materials, and global economic issues. While there was a focus on technological developments in motor efficiency, the pace of adoption of new technologies relative to later waves was sluggish.

During the lead-up to 2025 to 2035, the industry is set to change fundamentally, with an increased digitalization of industries leading it. The confluence of Industrial Internet of Things (IIoT) technologies will provide intelligent motor solutions that can be optimized and monitored remotely, enabling increased automation in production.

Further, with sustainability being the focal theme, demand for environmentally friendly, energy-efficient motors will be triggered by aggressive green regulations. AI-and automation-driven advanced motor systems will capture the future industry, improving performance as well as energy efficiency.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Innovative growth is driven by demand for energy-efficient motors in industries. | High growth driven by digitalization and green movements. |

| Stepped-up emphasis on improving motor efficiency and regulatory compliance. | IIoT , smart motors, and sustainability are driving innovation. |

| Low innovation, with enhancements in motor performance and efficiency. | Strong move towards smart motor solutions, digitalization, and automation. |

| Growth is mainly in developed industries, with supply chain and raw material cost challenges. | Asia-Pacific growth at a fast pace, along with developed industries' adoption of advanced technology. |

| Emphasis on compliance with energy efficiency regulations. | Strong focus on sustainability, with tighter regulations driving the need for green solutions. |

| Enhanced energy efficiency and performance of current motor technologies. | Smart, energy-efficient motors featuring IIoT integration and sustainable materials. |

The industry is expanding robustly, driven by increasing automation, energy efficiency needs, and manufacturing industry growth worldwide. However, several current and future threats can influence its trajectory. One of the prominent current threats is the exorbitant cost of raw materials, such as steel, aluminum, and insulation, which are utilized in motor manufacture. Instability in such input prices has the ability to influence production levels and manufacturers' margins.

Low-cost, low-quality industrial motors pose a threat to the industry as well, as they have the ability to cut down the demand for high-efficiency motors and influence the overall growth of the industry. The future also holds danger in the form of radical technology change and shifting consumer attitudes.

Over time, new, better motor technologies will become available that will render products obsolete, and the industry will need to continue to invest in research and development to remain competitive. Geopolitical tensions and trade policy can disrupt global supply chains, affecting the availability of critical components and materials. The industry's dependence on certain regions for production is the root of this vulnerability.

Although the industry is very much in the growth stage, the companies will have to contend with raw material price volatility, poor quality substitute competition, technology shifts, and geopolitical risks. Proactive measures that neutralize these risks will be key to long-term success in this dynamic industry.

In 2025, AC motor and DC motors will remain the key drivers for the industry, with contributions of 40% and 20%, respectively.

The leading motors in the industry forecasted to have a 40% share in 2025 are AC Motors. Due to the enhanced efficiency, reliability, and versatility, AC motors are extensively used in industrial applications. AC induction motors, particularly squirrel cages, are preferred for manufacturing, HVAC, and material handling industries based on their robust performance, low maintenance costs, and versatile speed and power output application.

Such technologies developed by the major players in the field, Siemens and ABB, for energy-efficient solutions in static and variable speed applications of the AC motor segment, address the fast-growing sectors. The need for energy-efficient solutions is increasing in automobiles, mining, food processing, and smart technology developments.

The presence of a 20% share of the DC motors industry indicates how important these types of motors are in some of the applications where speed control and torque control come first. DC motors are much used in industries where speed and torque control are precise. Robotics, electric cars, and even conveyor systems that require smooth performance in dynamic conditions are examples of such applications. DC motors from Baldor Electric and Nidec are highly respected. Although ACs predominate in large-scale industrial applications, DCs are much preferred for applications requiring finely controlled motion.

Both AC and DC motors are essential for the development and growth of various industrial sectors, the former being the favored one for bulk applications.

Soon, it is believed that the industry will be ampere-driven by applications such as the Manufacturing Industry and Automotive Industry in 2025, which are likely to be responsible for a respective industry share of 25% and 20%.

The area that can lead the industry is the manufacturing industry, with an industry share of around 25%. Industrial motors are needed in manufacturing to drive assembly lines, conveyor belts, and heavy machinery. Motors are also an integral part of machinery in industries such as food and beverage, textile production, and packaging.

Companies like Siemens and GE have become major suppliers of motors, driving these processes to increase their efficiency and productivity. Furthermore, the ongoing transition toward industry and automation in the manufacturing sector likely serves as an additional trigger for the demand for advanced industrial motors, which are essential for automated and robotic systems.

The second largest will be the automotive industry, which is expected to have a 20% share of the industry by 2025. The latter makes use of motors for production line applications, vehicle assembly, and electric vehicle (EV) activities. The more the sales of electric cars increase, the more important the dynamic role of DC motors and synchronous AC motors will be, particularly in driving the vehicles and supporting other critical functions.

Bosch is among those who lead the field along with Daimler as innovatively providing industrial motors for electric vehicle production, to name but a few. Additionally, motors are the backbone of automotive assembly lines, giving automation capability to all processes, such as painting, welding, and testing.

These two sectors are crucial for the growth of the industry, where the manufacturing sector depends on efficient automation solutions, and the automotive industry is expected to grow in electric vehicle production and automation technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

| UK | 5 % |

| France | 5.1% |

| Germany | 5.5% |

| Italy | 5.2% |

| South Korea | 6 % |

| Japan | 5.3% |

| China | 7.3% |

| Australia-NZ | 4.8% |

The USA industry will develop at 5.4% CAGR throughout the study. The application of sophisticated industrial automation technologies in manufacturing, oil and gas, water treatment, and energy industries greatly fuels the demand for high-performance and efficient industrial motors.

The motors are at the center of automated machinery, HVAC equipment, conveyors, and robots utilized in smart factories and manufacturing facilities. As America leads the way in reshoring manufacturing and investment in green infrastructure, energy-saving motor solutions such as IE3 and IE4-rated systems are increasingly being put into action.

Policy norms for benefits to industrial energy savings, as well as incentives for motor modernization, are also on the march. As industrial processes are more and more concerned with downtime savings as well as predictive maintenance, intelligent motors that feature IoT and diagnostics are gaining traction.

The industry is further benefiting from transportation and utility electrification initiatives, which have an underlying consideration for electric motors. With a continued focus on innovation and digital transformation, America remains a strong driver of global industrial motor growth.

The UK industry will grow at 5.0% CAGR during the forecast period. The UK industry is experiencing steady growth due to the push for intelligent manufacturing and decarbonizing industry processes. Electric motors find massive application across process industries, HVAC, energy utility, and transportation infrastructure, thereby enabling the country's clean energy and electrification policies. Government emphasis on net-zero targets and the deployment of high-efficiency motor technologies are promoting the replacement of old systems.

The combination of industrial Internet of Things and remote monitoring solutions with motor-driven machinery is pushing upgrades to smarter, more efficient motors. Although some structural challenges face the manufacturing sector, the growth of industries such as pharmaceuticals, food processing, and green energy infrastructure is driving steady demand. Facilitative regulatory environments and automation prioritization are the forces pushing forward industry progress.

France's industry is predicted to grow at a rate of 5.1% CAGR during the study. Industrial motors are finding wider adoption in France's energy, automotive, packaging, and chemicals industries, where operating efficiency and power savings are now becoming top priorities.

Policies promoting carbon reduction and electrification from the government are driving high-efficiency motors popular in industries. With a high emphasis on Industry 4.0 developments, French industries are implementing intelligent manufacturing systems heavily reliant on reactive and dependable electric motors.

Additionally, investment in clean energy programs and green infrastructure development, like wind farms and solar parks, drives the demand for tailored motor solutions. The industrial revolution of France is made possible by R&D activity involving the integration of automation and digital monitoring, enhancing the performance of motor-driven systems. Since the industry is transitioning to low-maintenance and cost-efficient operation, the need for intelligent motors with diagnostic and control features will increase steadily.

Germany's industry is predicted to record a growth rate of 5.5% CAGR during the forecast period. Germany is the world leader in precision manufacturing and engineering, generating tremendous demand for advanced industrial motors.

As a result of the widespread application of automation and robots in the manufacturing sectors such as automotive, machinery, and energy, electric motors are one of the determining factors in the continuation of efficiency and productivity. Industrial decarbonization and transition are the themes in the country, and the mass substitution of conventional motors by IE3- and IE4-rated energy-efficient counterparts is the result.

In addition, public patronage of intelligent factory initiatives and digital infrastructure drives the adoption of motors with built-in sensors, real-time feedback, and predictive abilities. As Germany continues to drive forward leadership in electrification and green industrial processes, smart and durable motor solutions are bound to increase demand. The high export intensity of German machinery adds to the demand for motors with international levels of efficiency and reliability standards.

The Italian industry will expand at 5.2% CAGR during the forecast period. Italy is a developed industry country, having significant industries in manufacturing, auto components, and mechanical engineering, and it is a heavy consumer of industrial motors.

The government is modernizing its manufacturing facilities, and accordingly, the consumption of energy-efficient motor technology is increasing. With growing automation in SMEs and frugal manufacturing, electric motors are being replaced with higher performance standards. Italian firms are also investing in smart control systems that necessitate sophisticated motor integration.

As energy-saving demands tighten in the EU, Italian industry is shifting more towards IE3 and super-rated motors. The convergence of industrial heritage, export industries, and digital transformation initiatives ensures the long-term relevance of industrial motors in Italy's evolving manufacturing industry.

The South Korean industry is expected to expand at 6.0% CAGR during the study period. South Korea's highly developed electronics, automotive, and semiconductor industries rely significantly on electric motors for automation applications, cleanroom environments, and high-precision manufacturing operations.

The ongoing development of smart factory initiatives and AI-supported production lines maintains demand for effective, reliable, and energy-efficient motors. In its initiative for green growth, the country is actively reducing its carbon footprint and increasing the energy efficiency of industrial machinery.

Industrial motors incorporating IoT-based monitoring, energy-saving, and fault-detection capabilities are widely utilized in manufacturing clusters. Investment in electric vehicles and battery manufacturing also benefits specialized motor applications. South Korea's technology-push industrial base and emphasis on the adoption of high-efficiency technology lead the country to be a progressive and fast-expanding industry.

The Japanese industry will develop at a 5.3% CAGR throughout the study period. Japan's developed manufacturing economy has a great focus on precision, efficiency, and long-term dependability-things that closely fit with the development of industrial motors.

Motors are used extensively across automotive manufacturing, robotics, electronics production, and heavy industry. Japan's push to automate and digitize traditional industries is creating an increasing deployment of high-efficiency motors with smart control functions.

The shift to sustainable development and electric power systems in the building, manufacturing, and infrastructure sectors is also stimulating demand for new motor technologies. In addition, Japan's goal of power maximization and zero emissions is aligned with the replacement of aging motors with efficient, low-loss motors. The engineering prowess of the country and the focus on automation form the basis for a stable, technology-driven industry.

The Chinese industry will grow at a 7.3% CAGR during the study period. China is the world's largest manufacturing producer and is heavily investing in factory automation and intelligent factory rollouts. Industrial motors constitute the core part of the machinery used in manufacturing, logistics, air-conditioning equipment, and power industries, creating high-scale and heterogeneous demand in the country. With industrial policy driving energy savings and electrification, China is changing rapidly to high-efficiency motor systems.

Uplifting aging motors, constructing new industrial estates, and accelerating the electrification of rail and urban transport are all contributing to growth. Developments in technology and support to local motor producers have also spurred high-performance motors to be accessible to small and medium-sized enterprises and large corporations.

While the need for smart infrastructure and robotics increases, the need for responsive, efficient, and reliable motor solutions also increases. The evolving regulatory environment of China's energy efficiency also ensures sustainable growth in the industry.

The Australia-NZ industry is expected to grow at 4.8% CAGR during the forecast period. Industrial motors in Australia and New Zealand have wide applications in mining, agriculture, water treatment, and construction industries, where long-lasting and high-efficiency equipment is needed.

Although the area is less industrial in terms of the larger economies, new infrastructure investment and renewable energy projects continue to drive demand. Increasing reliance on electric motors for pumping, material handling, and process control for regional and off-grid system electrification is driving growth.

Conventional motors are also being replaced with high-efficiency motors in response to demanding environmental regulations as well as lower operating expenses. Renewable energy integration and the development of a smart energy grid are encouraging electric motor utilization in energy distribution and storage systems. With the equipment still undergoing modernization in the key industries, the industry should anticipate continuous growth throughout the forecast period.

There is fierce competition among global manufacturers in the industry, such as General Electric, Hitachi Ltd., Nidec Corporation, WEG SA, and Siemens AG, to lead the industry. All these manufacturers rely upon motor technologies for high efficiency, smart motor systems, and industrial automation integration along with operational efficiency to meet the increasing need for energy-efficient solutions.

General electric still maintains an air of domineering by offering digital industrial motor solutions that enable industrial applications to access maintenance prediction and real-time data analysis using AI. Hitachi Ltd. has been improving and extending its range of industrial motors by integrating unique cooling methods with high-density compact designs meant primarily for heavy equipment and manufacturing. Nidec Corporation has created a growing footprint in the world industry through the acquisition of smaller motor companies and by putting intelligent,

WEG SA leads innovation with the development of high-efficiency electric motors with IE4 and IE5 standards, with the aim of reducing energy consumption and raising industrial productivity. Siemens AG laid out pathways to advance its digital twin technology that allows industries to simulate and optimize motor performance before deployment. Meanwhile, ABB Ltd. will propel itself further by investing in newer automation-integrated motors in its smart factory offerings and industry 4.0 applications.

New product innovations and strategic expansions continue to keep very high competition in the industry. An example is Regal Rexnord Corporation, which rolled out hybrid electric motors installed with AI-powered diagnostic systems. Another would be high-voltage induction motors for power generation and mining applications, which fall under Toshiba Corporation's areas of focus.

Joint ventures and partnerships with firms specializing in industrial automation will further elevate the regional presence in the industries for both Hyosung Corporation and BonfiglioliRiduttori S.p.A. Kirloskar Electric Company and Hyundai Electric & Energy Systems Co., Ltd. are also extending their product demands by introducing custom-built industrial motors in renewable energy and heavy-duty industries.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| General Electric | 18-22% |

| Hitachi Ltd. | 14-18% |

| Nidec Corporation | 12-16% |

| WEG SA | 10-14% |

| Siemens AG | 8-12% |

| Other Players | 24-30% |

| Company Name | Offerings & Activities |

|---|---|

| General Electric | Expanding AI-powered industrial motors with predictive maintenance capabilities. |

| Hitachi Ltd. | Enhancing motor efficiency with advanced cooling and compact high-power designs. |

| Nidec Corporation | Investing in smart VFD-integrated motors and global acquisitions. |

| WEG SA | Developing high-efficiency motors with IE4 and IE5 energy ratings. |

| Siemens AG | Advancing digital twin technology for industrial motor simulation and optimization. |

Key Company Insights

General Electric (18-22%)

Leading with AI-driven industrial motor solutions, providing real-time performance tracking and predictive maintenance technologies.

Hitachi Ltd. (14-18%)

Expanding into high-efficiency compact motors, catering to heavy machinery and energy-intensive industries.

Nidec Corporation (12-16%)

Strengthening global industry presence through strategic acquisitions and VFD-integrated motor solutions.

WEG SA (10-14%)

Focusing on high-efficiency industrial motors, reducing power consumption with IE4 and IE5 motor designs.

Siemens AG (8-12%)

Innovating with digital twin technology, enhancing industrial automation and motor performance simulation.

Other Key Players

By product type, the industry is segmented into AC motors (induction motor, synchronous motor) and DC motors (brushed DC, brushless DC).

By power output, the industry is categorized into 1-5 MW, 5-10 MW, 10-15 MW, 15-20 MW, and 20-25 MW.

By end use, the industry is segmented into Oil & Gas, Energy, Mining, Cement, Metal and Steel, Pulp and Paper, Chemical, Water and Wastewater, Marine, and Other Industrial.

By region, the industry is segmented into North America, Latin America, Europe, East Asia, South Asia and the Pacific, and the Middle East and Africa (MEA).

The industry is estimated to reach USD 724.4 million by 2025.

The industry is projected to grow to USD 1 billion by 2035.

China is expected to grow at a rate of 7.3%.

AC motors are the leading segment due to their cost-effectiveness, durability, and widespread use across industrial applications such as HVAC systems, compressors, and pumps.

Key players in this industry include General Electric, Hitachi Ltd., Nidec Corporation, WEG SA, Siemens AG, ABB Ltd., Regal Rexnord Corporation, Toshiba Corporation, Hyosung Corporation, Bonfiglioli Riduttori S.p.A., Kirloskar Electric Company, Hyundai Electric & Energy Systems Co., Ltd., and Menzel Elektromotoren GmbH.

Table 01: Global Market Volume (Units) and Value (US$ million) Forecast by Product Type, 2017 to 2032

Table 02: Global Market Volume (Units) and Value (US$ million) Forecast by Power Output, 2017 to 2032

Table 03: Global Market Volume (Units) Forecast by End Use, 2017 to 2032

Table 04: Global Market Value (US$ million) Forecast by End Use, 2017 to 2032

Table 05: Global Market Volume (Units) and Value (US$ million) Forecast by Region, 2017 to 2032

Table 06: North America Market Volume ('000 Units) and Value (US$ million) Forecast by Country, 2017 to 2032

Table 07: North America Market Volume (Units) and Value (US$ million) Forecast by Product Type, 2017 to 2032

Table 08: North America Market Volume (Units) and Value (US$ million) Forecast by Power Output, 2017 to 2032

Table 09: North America Market Volume (Units) Forecast by End Use, 2017 to 2032

Table 10: North America Market Value (US$ million) Forecast by End Use, 2017 to 2032

Table 11: Latin America Market Volume (Units) and Value (US$ million) Forecast by Country, 2017 to 2032

Table 12: Latin America Market Volume (Units) and Value (US$ million) Forecast by Product Type, 2017 to 2032

Table 13: Latin America Market Volume (Units) and Value (US$ million) Forecast by Power Output, 2017 to 2032

Table 14: Latin America Market Volume (Units) Forecast by End Use, 2017 to 2032

Table 15: Latin America Market Value (US$ million) Forecast by End Use, 2017 to 2032

Table 16: Europe Market Volume (Units) Forecast by Country, 2017 to 2032

Table 17: Europe Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 18: Europe Market Volume (Units) and Value (US$ million) Forecast by Product Type, 2017 to 2032

Table 19: Europe Market Volume (Units) and Value (US$ million) Forecast by Power Output, 2017 to 2032

Table 20: Europe Market Volume (Units) Forecast by End Use, 2017 to 2032

Table 21: Europe Market Value (US$ million) Forecast by End Use, 2017 to 2032

Table 22: East Asia Market Volume (Units) and Value (US$ million) Forecast by Country, 2017 to 2032

Table 23: East Asia Market Volume (Units) and Value (US$ million) Forecast by Product Type, 2017 to 2032

Table 24: East Asia Market Volume (Units) and Value (US$ million) Forecast by Power Output, 2017 to 2032

Table 25: East Asia Market Volume (Units) Forecast by End Use, 2017 to 2032

Table 26: East Asia Market Value (US$ million) Forecast by End Use, 2017 to 2032

Table 27: South Asia & Pacific Market Volume (Units) and Value (US$ million) Forecast by Country, 2017 to 2032

Table 28: South Asia & Pacific Market Volume (Units) and Value (US$ million) Forecast by Product Type, 2017 to 2032

Table 29: South Asia & Pacific Market Volume (Units) and Value (US$ million) Forecast by Power Output, 2017 to 2032

Table 30: South Asia & Pacific Market Volume (Units) Forecast by End Use, 2017 to 2032

Table 31: South Asia & Pacific Market Value (US$ million) Forecast by End Use, 2017 to 2032

Table 32: Middle East and Africa Market Volume (Units) and Value (US$ million) Forecast by Country, 2017 to 2032

Table 33: Middle East and Africa Market Volume (Units) and Value (US$ million) Forecast by Product Type, 2017 to 2032

Table 34: Middle East and Africa Market Volume (Units) and Value (US$ million) Forecast by Power Output, 2017 to 2032

Table 35: Middle East and Africa Market Volume (Units) Forecast by End Use, 2017 to 2032

Table 36: Middle East and Africa Market Value (US$ million) Forecast by End Use, 2017 to 2032

Figure 01: Global Market Historical Volume (Units), 2017 to 2021

Figure 02: Global Market Volume (Units) Forecast, 2022 to 2032

Figure 03: Global Market Historical Value (US$ million), 2017 to 2021

Figure 04: Global Market Value (US$ million) Forecast, 2022 to 2032

Figure 05: Global Market Absolute $ Opportunity, 2022 to 2032

Figure 06: Global Market Share and BPS Analysis by Product Type, 2022 & 2032

Figure 07: Global Market Y-o-Y Growth Projection by Product Type, 2021 to 2032

Figure 08: Global Market Attractiveness Analysis by Product Type, 2022 to 2032

Figure 09: Global Market Share and BPS Analysis by Power Output, 2022 & 2032

Figure 10: Global Market Y-o-Y Growth Projection by Power Output, 2021 to 2032

Figure 11: Global Market Attractiveness Analysis by Power Output, 2022 to 2032

Figure 12: Global Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 13: Global Market Y-o-Y Growth Projection by End Use, 2021 to 2032

Figure 14: Global Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 15: Global Market Share and BPS Analysis By Region- 2022 to 2032

Figure 16: Global Market Y-o-Y Growth Projections By Region, 2021 to 2032

Figure 17: Global Market Attractiveness By Region, 2022 to 2032

Figure 18: North America Market Share and BPS Analysis by Country - 2022 to 2032

Figure 19: North America Market Y-o-Y Growth Projections by Country, 2021 to 2032

Figure 20: North America Market Attractiveness by Country, 2022 to 2032

Figure 21: North America Market Share and BPS Analysis by Product Type, 2022 & 2032

Figure 22: North America Market Y-o-Y Growth Projection by Product Type, 2021 to 2032

Figure 23: North America Market Attractiveness Analysis by Product Type, 2022 to 2032

Figure 24: North America Market Share and BPS Analysis by Power Output, 2022 & 2032

Figure 25: North America Market Y-o-Y Growth Projection by Power Output, 2021 to 2032

Figure 26: North America Market Attractiveness Analysis by Power Output, 2022 to 2032

Figure 27: North America Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 28: North America Market Y-o-Y Growth Projection by End Use, 2021 to 2032

Figure 29: North America Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 30: Latin America Market Share and BPS Analysis by Country - 2022 to 2032

Figure 31: Latin America Market Y-o-Y Growth Projections by Country, 2021 to 2032

Figure 32: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 33: Latin America Market Share and BPS Analysis by Product Type, 2022 & 2032

Figure 34: Latin America Market Y-o-Y Growth Projection by Product Type, 2021 to 2032

Figure 35: Latin America Market Attractiveness Analysis by Product Type, 2022 to 2032

Figure 36: Latin America Market Share and BPS Analysis by Power Output, 2022 & 2032

Figure 37: Latin America Market Y-o-Y Growth Projection by Power Output, 2021 to 2032

Figure 38: Latin America Market Attractiveness Analysis by Power Output, 2022 to 2032

Figure 39: Latin America Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 40: Latin America Market Y-o-Y Growth Projection by End Use, 2021 to 2032

Figure 41: Latin America Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 42: Europe Market Share and BPS Analysis by Country - 2022 to 2032

Figure 43: Europe Market Y-o-Y Growth Projections by Country, 2021 to 2032

Figure 44: Europe Market Attractiveness by Country, 2022 to 2032

Figure 45: Europe Market Share and BPS Analysis by Product Type, 2022 & 2032

Figure 46: Europe Market Y-o-Y Growth Projection by Product Type, 2021 to 2032

Figure 47: Europe Market Attractiveness Analysis by Product Type, 2022 to 2032

Figure 48: Europe Market Share and BPS Analysis by Power Output, 2022 & 2032

Figure 49: Europe Market Y-o-Y Growth Projection by Power Output, 2021 to 2032

Figure 50: Europe Market Attractiveness Analysis by Power Output, 2022 to 2032

Figure 51: Europe Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 52: Europe Market Y-o-Y Growth Projection by End Use, 2021 to 2032

Figure 53: Europe Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 54: East Asia Market Share and BPS Analysis by Country - 2022 to 2032

Figure 55: East Asia Market Y-o-Y Growth Projections by Country, 2021 to 2032

Figure 56: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 57: East Asia Market Share and BPS Analysis by Product Type, 2022 & 2032

Figure 58: East Asia Market Y-o-Y Growth Projection by Product Type, 2021 to 2032

Figure 59: East Asia Market Attractiveness Analysis by Product Type, 2022 to 2032

Figure 60: East Asia Market Share and BPS Analysis by Power Output, 2022 & 2032

Figure 61: East Asia Market Y-o-Y Growth Projection by Power Output, 2021 to 2032

Figure 62: East Asia Market Attractiveness Analysis by Power Output, 2022 to 2032

Figure 63: East Asia Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 64: East Asia Market Y-o-Y Growth Projection by End Use, 2021 to 2032

Figure 65: East Asia Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 66: South Asia & Pacific Market Share and BPS Analysis by Country - 2022 to 2032

Figure 67: South Asia & Pacific Market Y-o-Y Growth Projections by Country, 2021 to 2032

Figure 68: South Asia & Pacific Market Attractiveness by Country, 2022 to 2032

Figure 69: South Asia & Pacific Market Share and BPS Analysis by Product Type, 2022 & 2032

Figure 70: South Asia & Pacific Market Y-o-Y Growth Projection by Product Type, 2021 to 2032

Figure 71: South Asia & Pacific Market Attractiveness Analysis by Product Type, 2022 to 2032

Figure 72: South Asia & Pacific Market Share and BPS Analysis by Power Output, 2022 & 2032

Figure 73: South Asia & Pacific Market Y-o-Y Growth Projection by Power Output, 2021 to 2032

Figure 74: South Asia & Pacific Market Attractiveness Analysis by Power Output, 2022 to 2032

Figure 75: South Asia & Pacific Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 76: South Asia & Pacific Market Y-o-Y Growth Projection by End Use, 2021 to 2032

Figure 77: South Asia & Pacific Market Attractiveness Analysis by End Use, 2022 to 2032

Figure 78: Middle East & Africa Market Share and BPS Analysis by Country - 2022 to 2032

Figure 79: Middle East & Africa Market Y-o-Y Growth Projections by Country, 2021 to 2032

Figure 80: Middle East & Africa Market Attractiveness by Country, 2022 to 2032

Figure 81: Middle East & Africa Market Share and BPS Analysis by Product Type, 2022 & 2032

Figure 82: Middle East & Africa Market Y-o-Y Growth Projection by Product Type, 2021 to 2032

Figure 83: Middle East & Africa Market Attractiveness Analysis by Product Type, 2022 to 2032

Figure 84: Middle East & Africa Market Share and BPS Analysis by Power Output, 2022 & 2032

Figure 85: Middle East & Africa Market Y-o-Y Growth Projection by Power Output, 2021 to 2032

Figure 86: Middle East & Africa Market Attractiveness Analysis by Power Output, 2022 to 2032

Figure 87: Middle East & Africa Market Share and BPS Analysis by End Use, 2022 & 2032

Figure 88: Middle East & Africa Market Y-o-Y Growth Projection by End Use, 2021 to 2032

Figure 89: Middle East & Africa Market Attractiveness Analysis by End Use, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Robotic Motors Market Analysis - Size & Industry Trends 2025 to 2035

Industrial Fractional Horsepower Motors Market Analysis by End-user and Region: Forecast for 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fryers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA