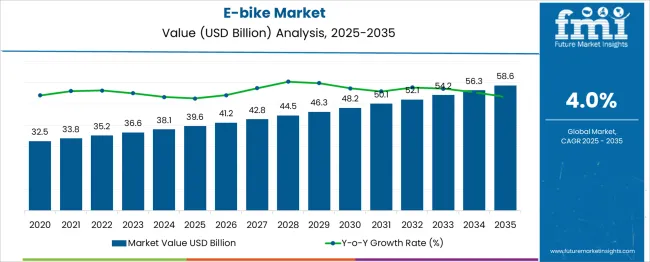

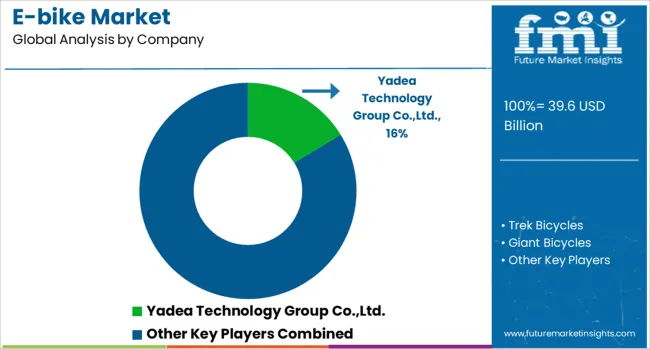

The E-bike Market is estimated to be valued at USD 39.6 billion in 2025 and is projected to reach USD 58.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

Ratio-based analysis shows a balanced yet slightly back-weighted growth pattern. The first half of the period (2025–2030) sees the market rise from USD 39.6 billion to 48.2 billion, adding USD 8.6 billion, which accounts for 45.3% of the total increase. The second half (2030–2035) contributes USD 10.4 billion, or 54.7%, resulting in a ratio of 1.21:1 in favor of the latter phase. This pattern indicates steady demand in the early years, followed by stronger acceleration as advanced battery technologies, lightweight materials, and connected e-bike systems gain wider adoption. Annual increments progress from USD 1.6 billion in the initial years to USD 2.3 billion toward the end of the forecast window, suggesting growing consumer interest in premium models and expanding penetration in emerging markets. By 2030, the market is expected to reach USD 48.2 billion, achieving nearly 82% of its terminal value, while the remaining expansion is realized in the last five years. Manufacturers should focus on scaling battery efficiency, integrating smart features, and developing cost-effective supply chains to capture this back-loaded opportunity effectively.

| Metric | Value |

|---|---|

| E-bike Market Estimated Value in (2025 E) | USD 39.6 billion |

| E-bike Market Forecast Value in (2035 F) | USD 58.6 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The e-bike market occupies an important position across several transportation-related parent markets, with shares varying by scope. In the electric two-wheeler market, e-bikes account for 45–50%, as they represent the largest segment compared to electric scooters and mopeds. Within the micro-mobility market, the share stands at 30–32%, driven by their growing use in shared mobility platforms and personal short-distance travel. In the bicycle market, e-bikes represent 18–20%, as traditional bicycles still dominate globally, though electrified models are growing rapidly.

For the urban mobility solutions market, e-bikes hold 8–10%, since this market also includes public transit, car-sharing, and ride-hailing services. In the sustainable transportation market, their share is around 3–4%, as electric cars and public transport systems account for larger portions of the segment. Despite modest shares in broader mobility markets, demand for e-bikes is accelerating due to rising preference for convenient, affordable, and low-emission transportation options. Advances in battery technology, integration of smart features, and expansion of cycling infrastructure are further fuelling adoption. With governments promoting electric mobility incentives and urban areas prioritizing last-mile connectivity, e-bikes are emerging as a key solution for reducing congestion and enabling efficient, eco-friendly urban transportation worldwide.

The E-bike market is witnessing rapid expansion as urban commuters and recreational riders increasingly opt for electric-powered bicycles that offer sustainability, convenience, and cost-efficiency. Governments across key regions have intensified their support through green mobility subsidies, tax incentives, and infrastructure investments for bike lanes, accelerating adoption.

The integration of advanced lithium-ion battery systems and compact motor architectures has significantly improved vehicle range, weight distribution, and charging time, fostering higher acceptance among daily users. Additionally, the surge in fuel prices, congestion in metropolitan areas, and consumer shift toward health-conscious travel are reinforcing the value proposition of e-bikes.

Technological upgrades such as regenerative braking, digital dashboard integration, and IoT-based fleet tracking are further enhancing market appeal. In the coming years, partnerships between urban planners, micromobility service providers, and e-bike manufacturers are expected to shape the future of smart urban transportation and lead to widespread deployment of next-generation electric bicycles in both developed and emerging regions.

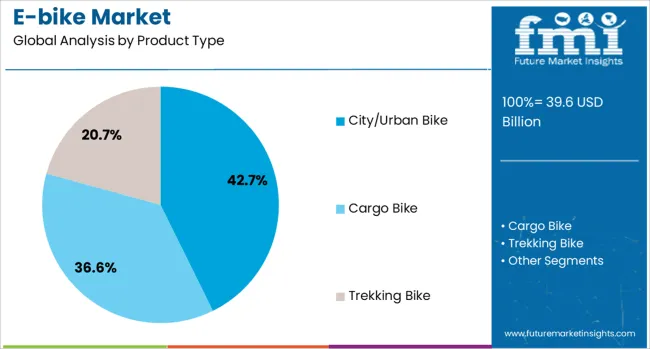

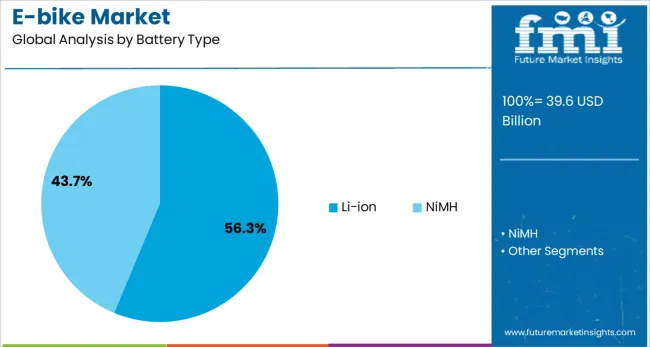

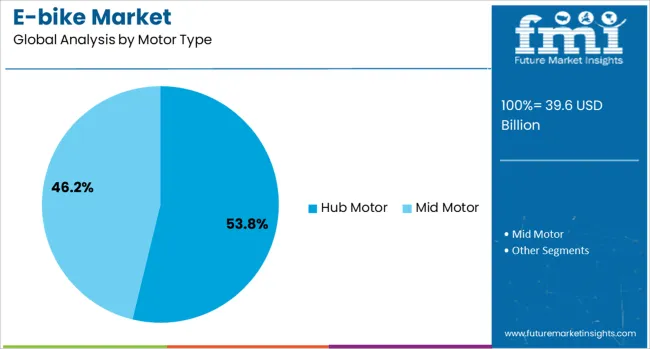

The e-bike market is segmented by product type, battery type, motor type, propulsion type, sales channel and geographic regions. The e-bike market is divided by product type into City/Urban Bike, Cargo Bike, and Trekking Bike. In terms of battery type, the e-bike market is classified into Li-ion and NiMH. Based on motor type, the e-bike market is segmented into Hub Motor and Mid Motor. The e-bike market is segmented by propulsion type into Pedal-Assist and Throttle-Assist. The e-bike market is segmented by sales channel into Offline and Online. Regionally, the e-bike industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

City and urban bikes are projected to account for 42.7% of the total revenue share in the e-bike market in 2025, making them the leading product type. This dominance is being driven by rising demand from daily commuters in metropolitan areas seeking reliable, low-emission transport options. The compact frame structure, lightweight design, and upright seating posture of city bikes have made them particularly suitable for short to medium-distance travel.

Their compatibility with paved road networks, low-maintenance components, and smooth motorized assistance systems have contributed to growing adoption. The integration of city-specific features such as step-through frames, integrated lighting systems, and cargo carriers has enhanced usability across gender and age groups.

Software-based power management and pedal assist control have also improved the comfort and efficiency of rides, making them ideal for stop-and-go urban traffic. Increased public and private sector investment in cycling infrastructure has further supported the deployment of urban e-bikes, especially within last-mile and commuter mobility programs.

The lithium-ion battery segment is expected to hold 56.3% of the total revenue share in the e-bike market by 2025, reflecting its status as the dominant battery technology. This leadership is being driven by the superior energy density, reduced charging time, and longer lifecycle offered by lithium-ion chemistry compared to lead-acid and other alternatives. The segment's growth has been reinforced by consistent cost reductions, thermal management improvements, and integration with advanced battery management systems.

Lightweight design and high charge retention have made lithium-ion batteries particularly suitable for compact and performance-driven e-bike models. Manufacturers have increasingly standardized lithium-ion configurations across their product lines to ensure compatibility with smart control units, regenerative braking systems, and modular battery packs.

The segment is also benefiting from stringent global regulations promoting cleaner energy storage and reduced vehicle emissions. Continued innovation in solid-state battery development and second-life battery reuse initiatives are expected to sustain the dominance of lithium-ion batteries in future e-bike deployments.

Hub motors are projected to contribute 53.8% of the total revenue share in the e-bike market in 2025, establishing their position as the leading motor type. This preference is being influenced by the simplicity, cost-effectiveness, and low maintenance requirements associated with hub motor configurations. Located in the front or rear wheel hub, these motors provide direct propulsion without involving the drivetrain, which reduces mechanical complexity and wear.

Their integration into city and commuter e-bikes has been supported by quieter operation, smoother torque delivery, and better aesthetic concealment. The segment's dominance has also been aided by rapid improvements in brushless direct current motor technology, improved waterproofing standards, and higher torque density at lower cost.

Manufacturers are favoring hub motors for applications that prioritize reliability and affordability over high-performance torque. As urban commuting continues to grow and demand for entry-level and mid-range e-bikes increases, hub motors are expected to remain a central component in the architecture of mainstream electric bicycles.

E‑bikes are being embraced across urban and rural regions to offer efficient last‑mile mobility, reduce commute time and support active transport goals. Their integration into shared mobility programs and micro‑transport fleets has been observed. Features such as pedal‑assist systems, integrated battery modules and digital connectivity have enhanced ride personalization. Demand has been extended by infrastructure developments including cycle lanes and charging hubs. Manufacturers offering lightweight frames, modular battery packs and smartphone integration are well positioned to capture share in this fast‑growing transport sector.

E‑bike adoption has been supported by the rise of flexible transport solutions offering reduced physical effort and time‑efficient commutes. Models equipped with pedal‑assist motors, torque sensors and gear shift support have provided smooth, assisted pedaling across various terrains. Battery systems with quick‑charge capabilities and removable packs have encouraged frequent usage among commuters. Connectivity features such as ride‑tracking apps, geo‑fencing integration and battery status alerts have enhanced user convenience. Shared micro‑mobility providers and fleet operators have deployed digital platforms allowing rental access via mobile devices. As cycling infrastructure has expanded and mobility patterns have shifted toward individual modes, e‑bikes with advanced controls and safety features have gained traction among diverse user groups.

Challenges facing the e‑bike market have included high battery costs that raise upfront pricing compared to conventional bicycles. Infrastructure gaps such as a lack of secure charging and parking facilities have limited practical utility in some areas. Fragmented regulations around motor power limits and speed classifications have created uncertainty for manufacturers and users across markets. Concerns about battery durability in extreme temperatures and maintenance requirements for smart modules have affected ownership experience. Integration of safety mechanisms such as lights and brake sensors has added complexity and expense to the design. As transport policies and subsidy programs vary by region, consumer uptake has been slowed where supportive frameworks are absent.

High-potential opportunities have been unlocked by growing urbanization and traffic congestion mitigation efforts, where e-bikes are increasingly adopted as efficient last-mile transport solutions. Shared e-bike rental programs and subscription services have opened revenue streams through recurring usage in delivery, commute, and leisure segments. Integration with micro-mobility platforms has enabled bundling of e-bike sharing, docking stations, and mobile app-based ride management. Infrastructure improvements such as protected bike lanes and designated charging hubs have driven broader adoption in city environments. Market penetration has been facilitated in aging populations seeking mobility assistance and in corporate wellness schemes promoting active commute options. Expansion into tier‑2 and tier‑3 cities, where affordability and environmental awareness are rising, further reinforces growth opportunities.

Emerging trends include widespread adoption of lithium-ion battery packs offering improved range, faster charging, and enhanced lifecycle performance while enabling sleek frame ergonomics. Connectivity features such as GPS tracking, smartphone integration, and app-based ride statistics are increasingly standard, appealing to tech-savvy riders and fleet operators. Lightweight and foldable bike designs are gaining popularity for storage convenience and multi-modal commuting. Motor advances, including mid-drive systems and torque-sensing technology, are improving ride smoothness and hill-climbing ability. Interest in pedelec (pedal-assist) and throttle-driven models is being diversified to address different user preferences. Robotics-powered assembly lines and modular platform manufacturing are reducing production costs and enabling faster rollouts across regions.

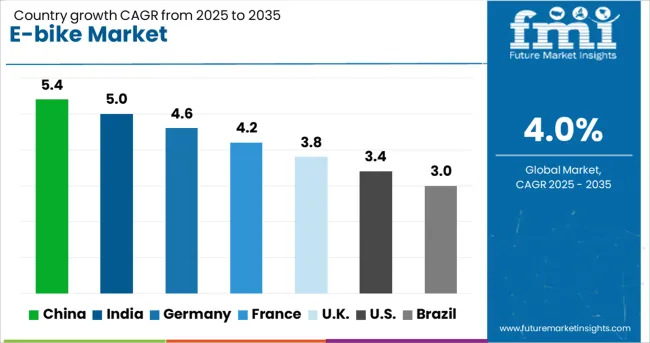

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global e-bike market is expected to grow at a 4.0% CAGR from 2025 to 2035, supported by electrification initiatives, advanced battery integration, and rising demand for cost-effective mobility. China leads with a 5.4% CAGR, driven by large-scale production capacity and regulatory measures favoring electric two-wheelers. India follows at 5.0%, where government-backed EV schemes and growing interest in last-mile connectivity push adoption. Germany records 4.6%, supported by premium e-bike demand in leisure and commuter segments. France posts 4.2%, influenced by policy-driven cycling infrastructure and health-oriented commuting trends. The UK, at 3.8%, sees moderate growth driven by shared e-bike programs and rising urban commuting needs. The report covers 40+ countries, with five profiled below.

China is projected to grow at a 5.4% CAGR, supported by the largest global base for e-bike production and extensive charging infrastructure deployment. Manufacturers are focusing on advanced lithium-ion battery systems to enhance performance and reduce charging time. Domestic policies favoring electric two-wheelers over internal combustion alternatives have accelerated adoption in urban and semi-urban areas. Export demand for mid-range and premium e-bikes is rising, especially in Southeast Asia and Europe. Integration of lightweight frames with improved torque sensors strengthens consumer preference for commuter and delivery segments.

India is forecast to grow at a 5.0% CAGR, driven by incentives under the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME-II) scheme and growing demand in metropolitan hubs. Domestic OEMs are introducing affordable e-bike models with improved range to attract urban commuters. Leasing and subscription-based mobility platforms are creating new revenue streams for shared e-bike operators. Investments in localized battery production reduce import dependence, while smart charging infrastructure developments support long-term adoption. Expansion in Tier II cities is expected as state-level subsidy programs gain traction.

Germany is expected to post a 4.6% CAGR, supported by strong adoption in commuter and sports biking categories. Premium e-bike manufacturers are focusing on integrating mid-drive motors and smart control units for better torque and efficiency. Cycling-friendly policies and expanding bike lanes in major cities encourage e-bike adoption for daily commuting. Advanced material research supports lightweight frame designs, improving energy efficiency. Local manufacturers are targeting export markets, including the USA and Scandinavian countries, for high-performance electric bicycles.

France is projected to grow at a 4.2% CAGR, driven by policy support for cycling infrastructure and incentives for electric mobility. Manufacturers are focusing on high-quality commuter e-bikes integrated with regenerative braking systems. The rise of e-bike rental platforms across urban centers is contributing to steady growth in shared mobility applications. Increased consumer demand for compact and foldable e-bike models is reshaping product development strategies. Retail channels are expanding online, supported by e-commerce partnerships and direct-to-consumer sales.

The UK market is anticipated to grow at 3.8% CAGR, supported by cycling infrastructure expansion and popularity of shared mobility platforms. Local manufacturers and importers are introducing lightweight, pedal-assist e-bikes with advanced battery packs targeting urban commuters. Rising congestion charges and low-emission zones encourage adoption of electric two-wheelers in metropolitan areas. Retailers are leveraging online platforms to capture growing consumer interest in eco-friendly transport alternatives. High-end touring and cargo e-bike segments are emerging as niche opportunities within the premium category.

The e-bike market is witnessing strong growth driven by technological progress, urban mobility requirements, and consumer demand for convenient and efficient transportation solutions. Yadea Technology Group Co., Ltd. leads the Asian market by leveraging large-scale manufacturing and advanced lithium-ion battery technology, ensuring extended range and cost efficiency.

Trek Bicycles and Giant Bicycles target premium and performance segments in North America and Europe, offering models equipped with smart systems and precision-engineered components. Rad Power Bikes, LLC emphasizes affordability and practicality, focusing on direct-to-consumer models such as utility and cargo bikes for last-mile delivery and commuting. Accell Group maintains a competitive edge through its extensive brand portfolio and integrated digital platforms that enhance rider experience and predictive maintenance. Market rivalry is intense, with players competing through continuous feature upgrades, lightweight frame designs, and modular systems.

Strategies include adopting omnichannel distribution networks, combining traditional dealerships with e-commerce platforms for broader market reach. Regional competitors such as Merida Bikes, Scott Sports SA, Tern, Brompton Bicycle Ltd., and Polygon Bikes strengthen their position by specializing in folding and urban models optimized for space efficiency and portability in dense city environments.

The future of the e-bike market will hinge on innovation in battery performance, improved motor efficiency, integration of IoT-enabled diagnostics, and collaboration with mobility service providers. Companies that invest in advanced powertrain systems, robust service networks, and digital connectivity solutions are expected to secure a significant advantage in this competitive and fast-evolving global industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.6 Billion |

| Product Type | City/Urban Bike, Cargo Bike, and Trekking Bike |

| Battery Type | Li-ion and NiMH |

| Motor Type | Hub Motor and Mid Motor |

| Propulsion Type | Pedal-Assist and Throttle-Assist |

| Sales Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Yadea Technology Group Co.,Ltd., Trek Bicycles, Giant Bicycles, Rad Power Bikes,LLC, Accell Group, Merdia Bikes, Scott Sports Sa, Tern, Brompton Bicycle Ltd, and Polygon Bikes |

| Additional Attributes | Dollar sales by bike type (commuter, folding, mountain, cargo), and powertrain (hub vs mid-drive motors), with demand driven by urban commuting, delivery services, and eco-friendly leisure mobility. Regional trends led by Europe and North America, while Asia‑Pacific sees rapid adoption in bike-sharing and last-mile logistics. Innovation centers on integrated batteries, smartphone connectivity, pedal‑assist intelligence, and lightweight alloys. Regulations include e‑bike speed limits, power caps, and safety certifications. |

The global e-bike market is estimated to be valued at USD 39.6 billion in 2025.

The market size for the e-bike market is projected to reach USD 58.6 billion by 2035.

The e-bike market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in e-bike market are city/urban bike, cargo bike and trekking bike.

In terms of battery type, li-ion segment to command 56.3% share in the e-bike market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA