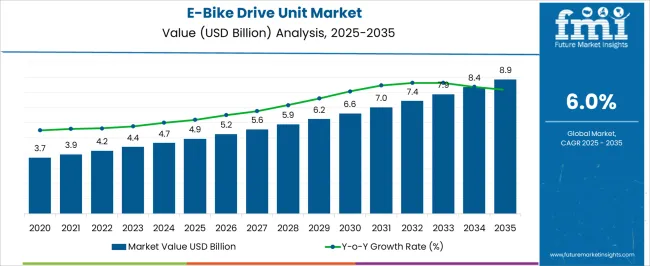

The eBike drive unit market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 8.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. Asia-Pacific emerges as the dominant region due to extensive urban cycling networks, government incentives promoting low-emission transportation, and strong consumer adoption of e-bikes. China, in particular, continues to lead production and consumption, contributing significantly to regional market expansion.

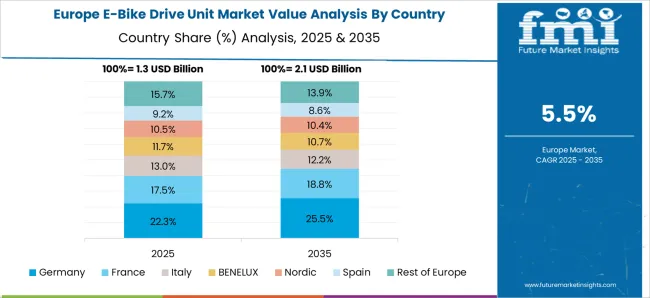

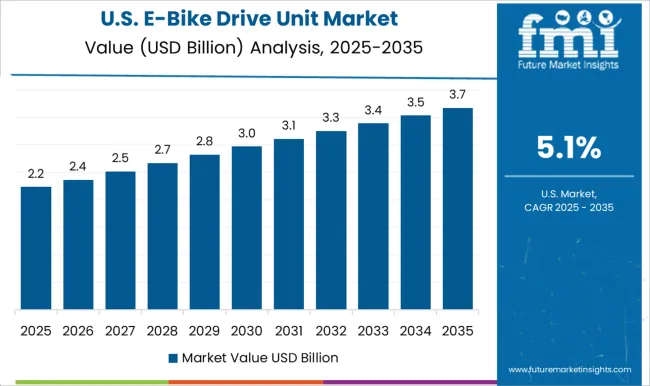

Growth in this region is fueled by the combination of affordability, local manufacturing capabilities, and high population density, enabling rapid diffusion of e-bike technologies and drive units. Europe also demonstrates substantial market growth, albeit at a more moderate pace compared to Asia-Pacific. Factors driving adoption include well-established cycling culture, government policies supporting green mobility, and increasing demand for premium e-bikes with advanced drive units. Western European countries such as Germany, France, and the Netherlands are major contributors, with adoption concentrated in urban and suburban commuting segments. North America exhibits slower growth relative to Asia-Pacific and Europe, reflecting lower cycling prevalence, higher vehicle dependency, and limited infrastructure supporting e-bike commuting.

Growth is primarily concentrated in metropolitan areas with active mobility initiatives, but overall market penetration remains modest. The trajectory from USD 4.9 billion in 2025 to USD 8.9 billion in 2035 highlights that regional imbalances are persistent, with Asia-Pacific maintaining a leading share, Europe following steadily, and North America gradually expanding adoption. This pattern underscores how infrastructure, cultural adoption, and regulatory support shape regional market dynamics.

| Metric | Value |

|---|---|

| E-Bike Drive Unit Market Estimated Value in (2025 E) | USD 4.9 billion |

| E-Bike Drive Unit Market Forecast Value in (2035 F) | USD 8.9 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The e-bike drive unit market represents a specialized segment of the global electric mobility industry, reflecting its importance in powering modern lightweight electric vehicles. Within the broader e-bike industry, drive units account for nearly 9.1%, emphasizing their role as the core propulsion technology. In the electric motor systems segment, their share is about 6.8%, supported by rising demand for efficient and compact designs. Across the two-wheeler electrification market, they contribute nearly 5.7%, highlighting their relevance in performance enhancement.

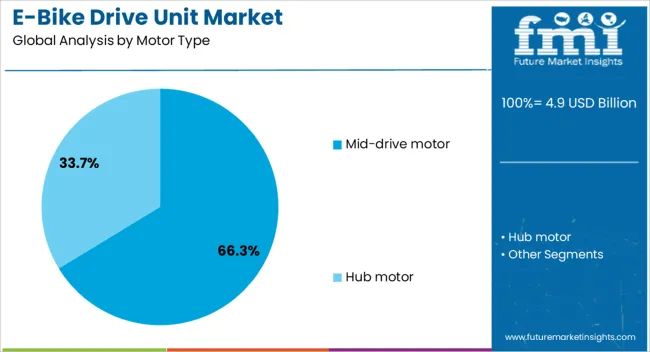

Within the micro-mobility solutions domain, e-bike drive units secure around 4.6%, showing their significance in last-mile connectivity. In the global lightweight electric drivetrain sector, they hold about 3.9%, underlining their connection with torque optimization, power efficiency, and smart integration technologies. Recent advancements in the market have showcased strong progress in technology, design, and performance optimization. Mid-drive systems are gaining traction due to better weight distribution, higher torque, and improved climbing ability compared to hub motors. Compact and lightweight drive units with integrated controllers are being developed to enhance aesthetics and efficiency.

Connectivity-enabled drive units with IoT sensors and app-based monitoring are being introduced, allowing real-time performance data and predictive maintenance. Manufacturers are increasingly focusing on quieter and more durable gear systems to enhance rider comfort. Key players are also adopting modular architectures, enabling compatibility with a wider range of bike models.

Increasing adoption of electric bikes across urban centers, driven by environmental concerns and fuel cost savings, is supporting sustained demand for advanced and efficient drive units. Mid-drive systems, integrated power control, and enhanced torque delivery are becoming central features influencing buyer preferences.

Governments and municipalities are also offering regulatory incentives, subsidies, and infrastructure development to support electric vehicle adoption, further boosting market growth. The expanding range of e-bike applications, including city commuting, trekking, and commercial delivery, is broadening the demand for varied motor capacities and configurations.

Advancements in battery technology, compact motor designs, and smart connectivity are enabling high performance without sacrificing range or efficiency As consumers increasingly shift toward personal electric mobility and logistics companies invest in green fleet solutions, the E-Bike Drive Unit Market is positioned for long-term growth, driven by innovation in motor design, integration capabilities, and performance optimization.

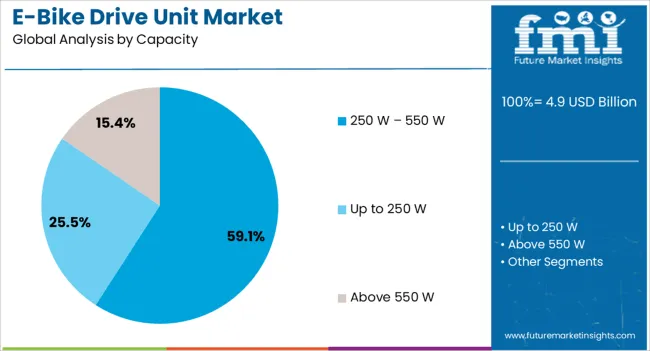

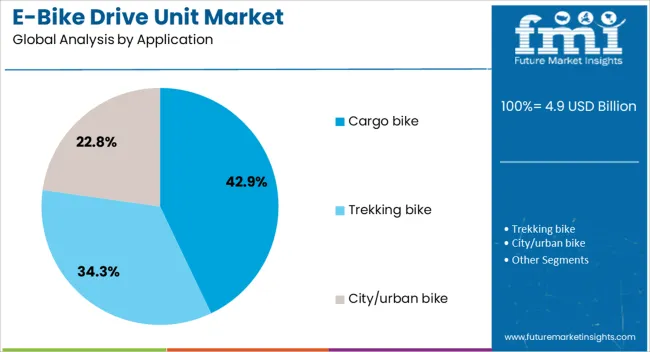

The e-bike drive unit market is segmented by motor type, capacity, application, distribution channel, and geographic regions. By motor type, e-bike drive unit market is divided into Mid-drive motor and Hub motor. In terms of capacity, e-bike drive unit market is classified into 250 W – 550 W, Up to 250 W, and Above 550 W. Based on application, e-bike drive unit market is segmented into Cargo bike, Trekking bike, and City/urban bike. By distribution channel, e-bike drive unit market is segmented into OEM and Aftermarket. Regionally, the e-bike drive unit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The mid-drive motor type segment is projected to account for 66.3% of the E-Bike Drive Unit Market revenue share in 2025, establishing it as the dominant motor type. This leadership is being driven by its superior torque performance, better weight distribution, and natural riding feel, which are particularly valued in performance-oriented and uphill cycling scenarios. Unlike hub motors, mid-drive units allow the motor to leverage the bike’s gear system, resulting in higher efficiency and extended battery range.

Manufacturers are increasingly favoring mid-drive systems due to their adaptability across various bike types, including trekking, mountain, and cargo e-bikes. The segment is also benefiting from increased demand in Europe and Asia, where rugged terrain and longer-distance commuting are prevalent.

Integration of pedal-assist features and smart sensors within mid-drive systems is enhancing the overall riding experience, promoting adoption across both recreational and commercial user groups. As performance expectations continue to rise and design innovation advances, mid-drive motors are expected to maintain their dominance in the market.

The 250 W to 550 W capacity segment is expected to hold 59.1% of the E-Bike Drive Unit Market revenue share in 2025, positioning it as the leading capacity range. This dominance is being supported by the balance it provides between power output, battery efficiency, and regulatory compliance in key global markets.

Motors within this range deliver sufficient torque for urban commuting and light cargo transport while remaining compact and energy efficient. The segment's popularity is also reinforced by government policies in Europe and other regions that impose wattage limits for street-legal e-bikes, making 250 W to 550 W the most widely adopted category.

Manufacturers are focusing on enhancing thermal management and power-to-weight ratios within this range, improving overall ride quality and motor durability. As e-bikes become more common for daily transportation and last-mile delivery, the demand for drive units offering optimal power without compromising efficiency is expected to increase, securing this capacity segment’s leadership in the market.

The cargo bike segment is anticipated to represent 42.9% of the E-Bike Drive Unit Market revenue share in 2025, positioning it as the dominant application. This leadership is being driven by the increasing use of electric cargo bikes for last-mile delivery, urban logistics, and commercial transportation, particularly in congested city environments. E-bike drive units tailored for cargo applications offer higher torque, reinforced durability, and enhanced load-handling capabilities, which are essential for supporting heavy freight over varied terrains.

Fleet operators and logistics providers are increasingly investing in cargo e-bikes as a sustainable and cost-effective alternative to vans and scooters. In addition, municipal initiatives promoting low-emission transport zones are accelerating the adoption of cargo e-bikes equipped with efficient and rugged drive units.

Technological advancements in drive systems for cargo bikes are enabling smoother acceleration, longer range, and integration with fleet management platforms. As urban logistics continues to evolve and sustainability becomes a core operational objective, the cargo bike application is expected to maintain its strong position within the E-Bike Drive Unit Market.

The market has gained significant momentum as electrification in mobility expands globally. Drive units, comprising motors, controllers, and transmission systems, are central to e-bike performance, efficiency, and riding comfort. Their demand has been supported by rising adoption of electric bicycles for commuting, recreation, and fitness, driven by traffic congestion, fuel costs, and emission concerns. Manufacturers have focused on lightweight, compact, and high-torque drive units that enhance range and adaptability across terrains. Technological integration with connectivity features and battery management systems has further accelerated adoption.

Mid-drive motors have become the preferred choice for many manufacturers due to their superior efficiency and natural riding feel. Positioned at the crankset, these units allow direct power transfer through the chain, enhancing torque and hill-climbing ability. Their balanced weight distribution improves handling and stability, making them highly suitable for mountain e-bikes and commuter models alike. Consumers have increasingly favored mid-drive systems as they provide smoother gear shifting and longer range compared to hub motors. Premium e-bike brands have invested heavily in refining these systems with integrated torque sensors and improved thermal management. The strong acceptance of mid-drive technology is shaping the market by positioning it as the industry standard for advanced e-bike models.

Continuous innovation in motor efficiency, controller design, and integration has boosted the performance of e-bike drive units. Brushless motors with improved torque density, regenerative braking features, and advanced cooling systems are being widely deployed. Smart controllers with adaptive power delivery algorithms optimize battery usage and riding experience. Integration with mobile applications has enabled riders to track performance, adjust power modes, and receive diagnostics in real time. Lightweight construction using advanced alloys and composites has reduced overall system weight without compromising durability. These advancements are ensuring that e-bike drive units meet consumer expectations for reliability, extended range, and seamless riding comfort, thereby strengthening their competitive position in the global mobility market.

The rising popularity of e-bikes as practical alternatives for short-distance commuting has significantly influenced drive unit demand. Cities worldwide are adopting e-bike sharing programs and investing in dedicated cycling infrastructure. Commuter e-bikes equipped with efficient drive units have become an attractive solution for reducing congestion and providing cost-effective daily transportation. The need for high-torque, low-maintenance drive units in urban environments has created opportunities for specialized designs tailored to stop-and-go traffic conditions. Leasing models and fleet operators have further increased demand for durable and reliable drive units capable of sustaining high utilization rates. This expansion in urban mobility applications continues to broaden the commercial appeal of e-bike drive technologies.

Despite rapid growth, the market faces challenges related to raw material availability, supply chain constraints, and cost pressures. Drive units rely heavily on critical components such as rare earth magnets, semiconductors, and high-grade alloys, all of which are subject to price fluctuations. Global supply disruptions and rising labor costs have increased production expenses, limiting affordability in some regions. Manufacturers are exploring localized sourcing, recycling initiatives, and modular design approaches to reduce dependence on volatile supply chains. Achieving price competitiveness while maintaining quality standards remains a persistent challenge. These constraints highlight the need for strategic supply chain resilience and cost optimization to support the sustained adoption of e-bike drive units globally.

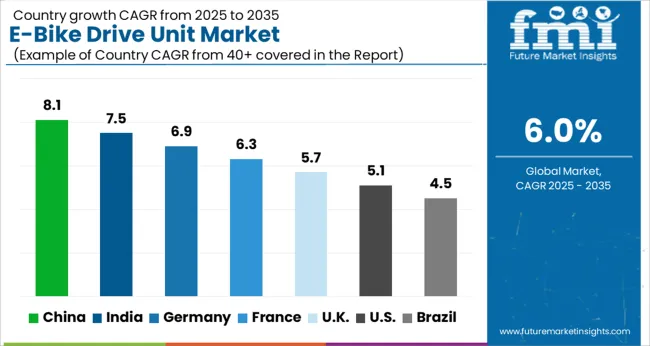

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The market is projected to grow at a CAGR of 6.0% during 2025 to 2035. Growth in Germany reached 6.9% as increasing demand for premium e-bikes and expanding cycling infrastructure supported market expansion. India followed at 7.5%, driven by urban mobility adoption and supportive government policies. China led with 8.1% due to high manufacturing capacity and rising domestic consumption. The United Kingdom recorded 5.7%, influenced by commuting needs and incentives, while the United States reached 5.1% as recreational use and gradual adoption contributed to growth. These countries represent the major hubs of production, scaling, and innovation in the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to expand at a CAGR of 8.1%, supported by the country’s dominance in e-bike production and rapid consumer adoption across urban and rural regions. Strong local supply chains and advanced manufacturing hubs have allowed large scale deployment of mid drive and hub drive units. Government incentives and cost efficiency of domestic suppliers enhance affordability and penetration. Chinese companies are increasingly focused on integrating lightweight motors with improved torque and energy efficiency to address performance needs in both commuter and recreational segments.

India is projected to grow at a CAGR of 7.5%, driven by rising demand for affordable electric mobility solutions. The focus is primarily on hub drive systems that provide cost advantages, although mid drive units are gaining traction in premium models. Government subsidies, combined with expanding charging infrastructure, support greater adoption of e-bikes in both urban and semi urban areas. Domestic manufacturers are collaborating with international motor suppliers to improve efficiency and reliability.

Germany is forecast to grow at a CAGR of 6.9%, supported by strong consumer preference for high performance e-bikes. Mid drive motors dominate the German market as they offer better weight distribution, efficiency, and performance on diverse terrains. Demand is reinforced by premium e-bike adoption for commuting, leisure, and sports applications. Partnerships between leading bicycle brands and drive unit manufacturers are expanding innovation in torque sensors and smart motor control systems.

The United Kingdom is expected to expand at a CAGR of 5.7%, supported by increasing acceptance of e-bikes for commuting and leisure activities. Drive unit demand is shifting towards lightweight and compact hub drive systems for urban commuting, while mid drive units gain ground in sports and premium bicycles. Financing options and government incentives have reinforced adoption across metropolitan regions. Local distributors partner with European motor suppliers to expand product availability.

The United States is forecast to grow at a CAGR of 5.1%, driven by demand for premium e-bikes in urban commuting and outdoor recreational activities. Mid drive systems are increasingly preferred due to their superior climbing performance and efficiency. Growth is supported by expanding retail channels, subscription based bike services, and rising investment in cycling infrastructure. Competitive focus is on integrating connectivity features, including mobile app integration and advanced diagnostics for drive units.

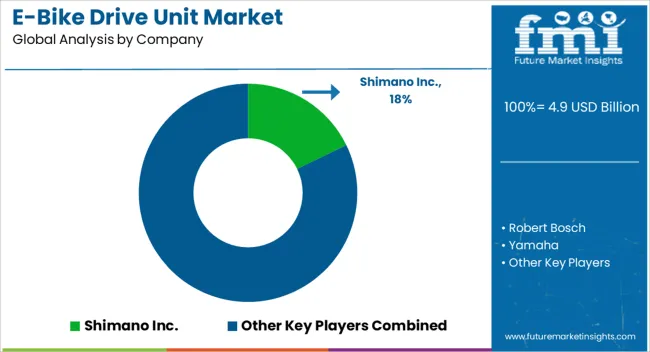

The market is led by global manufacturers of electric mobility components with strong technological expertise and wide OEM collaborations. Shimano Inc., Robert Bosch, and Yamaha dominate through advanced mid-drive systems that offer high torque, precision control, and seamless integration with e-bike frames. Panasonic and Mahle GmbH extend competition with compact and energy-efficient drive units optimized for performance and endurance applications. Bafang, Bros, and Dapu Motors remain influential in the Asian and European markets by providing versatile solutions across city, mountain, and cargo e-bikes. TDCM and Suzhou Xiongda focus on cost-effective hub motor technologies catering to large-volume commuter segments.

Competitive differentiation is being shaped by lightweight designs, noise reduction, and digital connectivity features such as app-based diagnostics and riding analytics. Industry players are increasingly investing in torque sensor innovations, integrated battery-drive unit systems, and modular architectures. Partnerships with bicycle OEMs, advancements in motor efficiency, and regulatory-driven electrification in urban mobility are expected to reinforce growth and intensify competition across regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.9 Billion |

| Motor Type | Mid-drive motor and Hub motor |

| Capacity | 250 W – 550 W, Up to 250 W, and Above 550 W |

| Application | Cargo bike, Trekking bike, and City/urban bike |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shimano Inc., Robert Bosch, Yamaha, Bafang, Panasonic, Bros, Mahle GmbH, Dapu Motors, TDCM, and Suzhou Xiongda |

| Additional Attributes | Dollar sales by drive unit type and application, demand dynamics across commuter, mountain, and cargo e-bikes, regional trends in electric mobility adoption, innovation in motor efficiency, torque sensors, and lightweight integration, environmental impact of battery and motor production, and emerging use cases in urban mobility solutions, last-mile delivery, and connected e-bike ecosystems. |

The global e-bike drive unit market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the e-bike drive unit market is projected to reach USD 8.9 billion by 2035.

The e-bike drive unit market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in e-bike drive unit market are mid-drive motor and hub motor.

In terms of capacity, the 250 W – 550 W segment is expected to command a 59.1% share in the e-bike drive unit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Driveline Control Systems and Devices Market Size and Share Forecast Outlook 2025 to 2035

Driver and Staff Management Software Market Size and Share Forecast Outlook 2025 to 2035

Driver Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Driveline Additive Market Growth - Trends & Forecast 2025 to 2035

Drive-in Pallet Racking Market

AI-Driven HD Mapping Market Size and Share Forecast Outlook 2025 to 2035

5G Driver Amplifier Market Size and Share Forecast Outlook 2025 to 2035

AI-driven Predictive Maintenance Market Forecast and Outlook 2025 to 2035

AC Drives Market Size and Share Forecast Outlook 2025 to 2035

AI-driven Web Scraping Market Analysis - Growth & Forecast 2025 to 2035

DC Drive Market Size, Share, Trends & Forecast 2024-2034

LED Driver IC Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

LED Driver for Lighting Market Analysis – Growth & Forecast 2025 to 2035

LED Driver Market

Gate Driver IC Market Size and Share Forecast Outlook 2025 to 2035

Screwdriver Market Size and Share Forecast Outlook 2025 to 2035

Data-Driven Retail Solution Market Size and Share Forecast Outlook 2025 to 2035

Mini Drives Market Analysis Size and Share Forecast Outlook 2025 to 2035

Th17 Driven Disease Treatment Market

Drill Drivers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA