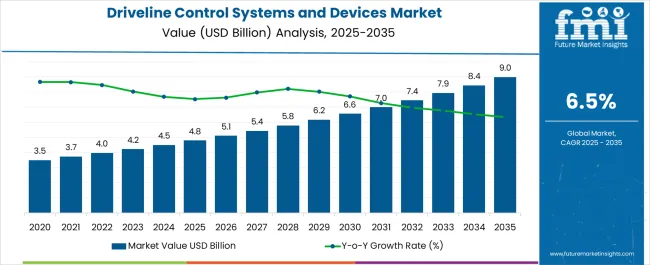

The Driveline Control Systems and Devices Market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Driveline Control Systems and Devices Market Estimated Value in (2025 E) | USD 4.8 billion |

| Driveline Control Systems and Devices Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The Driveline Control Systems and Devices market is experiencing steady growth, driven by increasing demand for enhanced vehicle performance, fuel efficiency, and safety. Adoption is being supported by the integration of advanced electronic control units, sensors, and actuators in modern driveline systems, enabling precise torque distribution, optimized power delivery, and reduced energy losses. The rise of passenger vehicles with sophisticated transmission and all-wheel drive systems is accelerating demand for reliable and efficient driveline control technologies.

Regulatory emphasis on emission reduction, fuel efficiency, and vehicle safety is further reinforcing adoption across both developed and emerging automotive markets. Advancements in automotive electronics, real-time monitoring, and adaptive control algorithms are enhancing the operational capabilities of driveline systems.

Increasing investments in research and development, coupled with the growing trend toward vehicle electrification and hybrid powertrains, are shaping the market As consumers prioritize driving comfort, stability, and efficiency, the Driveline Control Systems and Devices market is expected to witness sustained expansion, driven by continuous technological innovation and increasing adoption of advanced vehicular control solutions.

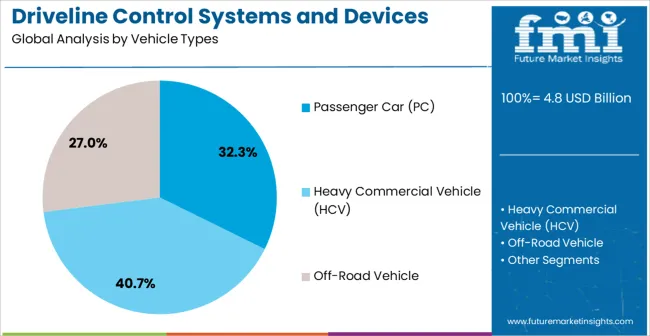

The driveline control systems and devices market is segmented by vehicle types, and geographic regions. By vehicle types, driveline control systems and devices market is divided into Passenger Car (PC), Heavy Commercial Vehicle (HCV), and Off-Road Vehicle. Regionally, the driveline control systems and devices industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger car segment is projected to hold 32.3% of the market revenue in 2025, establishing it as the leading vehicle type. Growth in this segment is driven by the rising production and adoption of passenger vehicles equipped with advanced driveline control systems, which enhance fuel efficiency, driving comfort, and safety. Passenger cars increasingly feature sophisticated automatic and dual-clutch transmissions, torque vectoring systems, and all-wheel drive capabilities, all of which rely on precise driveline control.

The integration of electronic sensors and control modules allows for adaptive torque management and real-time monitoring, improving vehicle stability under varying road and load conditions. Increasing consumer preference for vehicles offering superior performance, lower emissions, and improved fuel economy is further reinforcing market growth.

Additionally, regulatory requirements for emission reduction and safety standards in passenger vehicles are accelerating adoption As automotive manufacturers continue to innovate with hybrid and electric drivetrains, the passenger car segment is expected to maintain its leadership, supported by the expanding need for intelligent and efficient driveline systems that deliver reliability, performance, and operational efficiency.

Technological advancements, modern automatics, high demand for smooth gear shifts and superior fuel efficiency vehicles are triggering the wave of the global driveline control system and devices market throughout the forecast period. Driveline control system primarily depends on rotational velocities and torques of transmission units as uniform torque distribution provides yaw stability to the vehicle and provides better vehicle performance.

Therefore, traction and stability of a vehicle can be controlled by driveline system and braking torque. Four wheel drive manufacturers are implementing cutting-edge technologies, such as the transfer case, fluid coupling and Limited Slip Differential (LSD), for improving the traction and enhancing the handling performance by monitoring distribution of the driving torque.

The primary components of a driveline system are engine, clutch, transmission, propeller shaft, final drive and wheels. Electronic devices, such as inductive sensor, are used for detecting the angular velocity of rotating wheels or transmission parts. The manufacturers are also utilizing driveline modelling technique for measuring the engine speed, transmission speed and wheel speed.

For driveline modelling, lower gear is the prime focus as it transmits higher torque to the drive-in as well the amplitude of the resonance in the wheel speed is high for lower gears. The manufacturers are also poised towards pneumatic clutch actuator in automated manual transmissions while servo system for hydraulic clutch for easy operation of the clutch, provides lighter paddle force in comparison to cable clutch.

Furthermore, the manufacturers are also providing Electronic Limited Slip Differential technology for filling the gap between four wheel drive and two wheel drive and delivering maximum tractive effort, higher torque capacity, better stability while cornering, and also to provide better controllability over the vehicle.

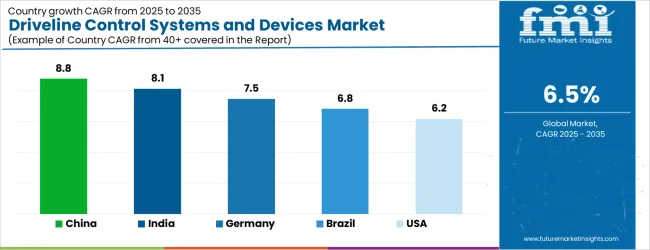

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| USA | 6.2% |

| UK | 5.5% |

| Japan | 4.9% |

The Driveline Control Systems and Devices Market is expected to register a CAGR of 6.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.8%, followed by India at 8.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.9%, yet still underscores a broadly positive trajectory for the global Driveline Control Systems and Devices Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.5%. The USA Driveline Control Systems and Devices Market is estimated to be valued at USD 1.8 billion in 2025 and is anticipated to reach a valuation of USD 1.8 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 245.7 million and USD 145.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Billion |

| Vehicle Types | Passenger Car (PC), Heavy Commercial Vehicle (HCV), and Off-Road Vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

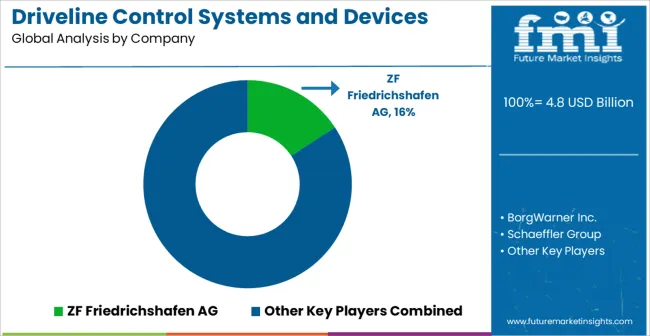

| Key Companies Profiled | ZF Friedrichshafen AG, BorgWarner Inc., Schaeffler Group, Eaton Corporation, Magna International Inc., AISIN AW CO.Ltd., Voith GmbH, EXEDY Corporation, Honda Transmission Manufacturing of AmericaInc., and AVTEC LTD. |

The global driveline control systems and devices market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the driveline control systems and devices market is projected to reach USD 9.0 billion by 2035.

The driveline control systems and devices market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in driveline control systems and devices market are passenger car (pc), _conventional pc, _electric pc, heavy commercial vehicle (hcv), _conventional hcv, _electrical hcv, off-road vehicle, _conventional off-road vehicle, _electrical off-road vehicle and _others.

In terms of , segment to command 0.0% share in the driveline control systems and devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Door Controller Systems Market

Inflow Control Devices Market Analysis - Size, Growth, and Forecast 2025 to 2035

Version Control Systems Market Size and Share Forecast Outlook 2025 to 2035

DC Motor Control Devices Market Size and Share Forecast Outlook 2025 to 2035

Vibration Control Systems Market Growth - Trends & Forecast 2025 to 2035

Aspiration Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Valve Remote Control Systems Market Analysis by Type, Application and Region - Forecast for 2025 to 2035

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

EV Telematics Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Air Pollution Control Systems Providers

Air Pollution Control Systems Market – Applications & Growth Forecast 2025-2035

Aircraft Lift Control Devices Market

Knotless Tissue Control Devices Market Analysis - Size, Share, and Forecast 2025 to 2035

Combustion Controls, Equipment & Systems Market – Forecast 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Instrumentation and Control Devices Market Growth – Trends & Forecast 2024-2034

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Demand for Vibration Control Systems in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Vibration Control Systems in USA Size and Share Forecast Outlook 2025 to 2035

Automotive Touch Screen Control Systems Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA