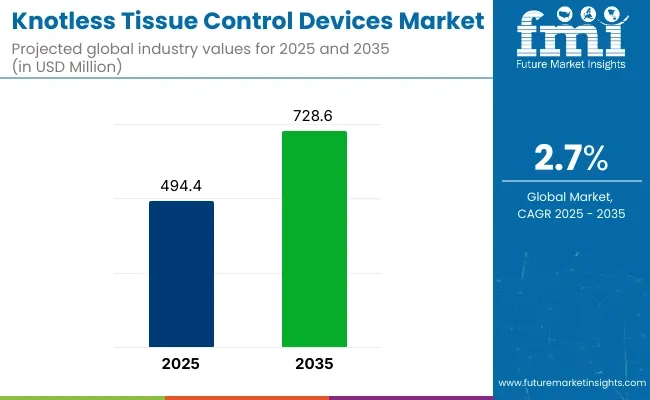

In 2025, the knotless tissue control devices market is expected to reach USD 494.4 million, up from just under USD 480 million in 2024. By 2035, it could grow to USD 728.6 million. This shows a CAGR of 2.7%. The growth comes from more minimally invasive surgeries and the need for faster, safer tools in the operating room.

In 2024, hospitals in North America and Europe began using barbed sutures and self-locking devices more often. These tools remove the need for tying surgical knots and help reduce the time needed to complete procedures. New suture materials like nonabsorbable polymers offer better strength and safety. These are now widely used in heart, joint, and cosmetic surgeries.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 494.4 million |

| Projected Size, 2035 | USD 728.6 million |

| Value-based CAGR (2025 to 2035) | 2.7% |

Ethicon, a company owned by Johnson & Johnson, released new products under the STRATAFIX™ brand. These sutures spread tension evenly across the tissue. Small companies are also creating new sutures that are both flexible and strong. These are useful in surgeries that require more care and precision. Robot-assisted surgeries are also pushing demand for these devices, especially in larger hospitals.

Many countries now support the use of knotless tools. These devices close wounds faster and lower the risk of infection. This trend is driving up demand for automatic suturing systems made to work with these products. Dr. Leah Voss, Director of Surgical Innovation at a USA hospital, said, “Switching to knotless sutures has helped our team save time and improve patient recovery.” With better materials, faster surgeries, and more hospital use, this market is likely to grow in the years ahead.

The knotless tissue control devices (KTCDs) market operates under stringent regulatory frameworks to ensure the safety and effectiveness of these medical devices. KTCDs, like all medical devices, are subject to rigorous approval processes set by regulatory bodies such as the FDA (USA. Food and Drug Administration) and the European Medicines Agency (EMA). These agencies enforce comprehensive regulations to ensure that KTCDs meet high standards for patient safety and quality control.&;

KTCDs must meet rigorous regulatory standards, such as FDA approval and CE marking, ensuring safety and efficacy in the USA. and Europe. Compliance with ISO 13485 and ISO 10993 is required for quality management and biocompatibility. Post-market surveillance tracks device safety, and manufacturers must report any adverse events or malfunctions, ensuring continuous oversight of device performance.&;

KTCDs may face inconsistent regulatory frameworks, with some regions lacking stringent FDA or CE mark standards. While ISO standards are encouraged, enforcement is often less rigorous, posing challenges for patient safety. Post-market surveillance and risk management protocols may be less formalized, requiring manufacturers to navigate local certifications that might not align with global regulatory requirements, affecting safety oversight.

The knotless tissue control devices market is broadening its reach into veterinary and dental/maxillofacial surgeries, driven by the efficiency and healing benefits of barbed sutures. In veterinary care, products like Quill™ and Medtronic’s V-Loc™ enable faster, knot-free closures in soft tissue surgeries, while dental procedures increasingly adopt polydioxanone-based options for improved intraoral healing.&;

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the knotless tissue control devices market between 2024 and 2025 on a six-month basis is shown below.

By this examination, major variations in the performance of these markets are brought to light, and also trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below compares the compound annual growth rate (CAGR) for the global knotless tissue control devices market from 2024 to 2025 during the first half of the year. This overview highlights key changes and trends in revenue growth, offering valuable insights into market dynamics.

H1 covers January to June, while H2 spans July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.4%, followed by a slightly lower growth rate of 3.1% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.4% |

| H2 (2024 to 2034) | 3.1% |

| H1 (2025 to 2035) | 2.7% |

| H2 (2025 to 2035) | 2.2% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 2.7% in the first half and projected to lower at 2.2% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS.

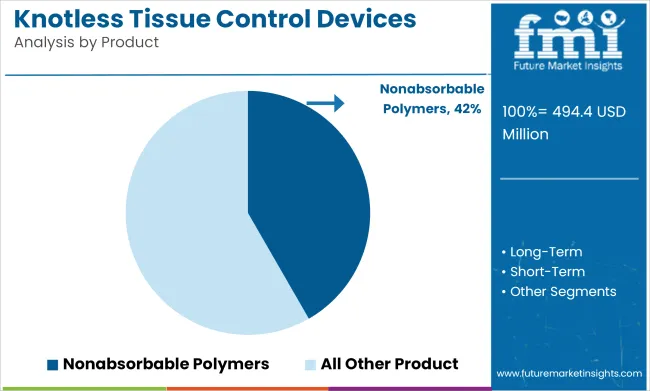

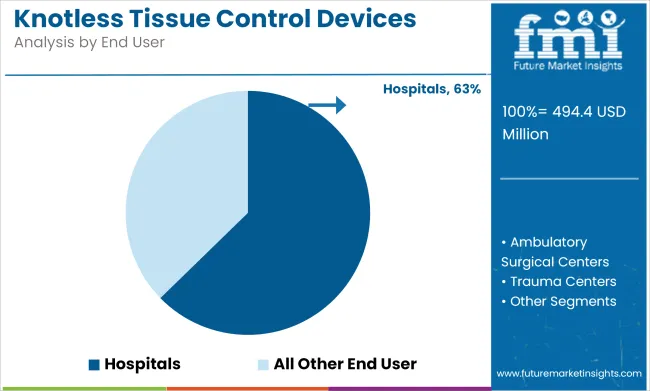

The knotless tissue control devices market is projected to grow, driven by nonabsorbable sutures made from polymers like polypropylene and nylon, which offer long-term support in surgeries. Hospitals, accounting for the largest share, are adopting these devices due to their efficiency, reducing procedure times and enhancing surgical outcomes.

Nonabsorbable polymers are expected to capture 42% of the global suture market by 2025. These materials are highly valued in surgeries that require long-term support, such as heart, joint, and plastic surgeries, where wound healing takes time and the sutures need to provide strength throughout the healing process.

Nonabsorbable sutures, made from materials like polypropylene and nylon, are known for their durability, low tissue reaction, and long-lasting performance. These attributes make them especially useful in barbed designs that eliminate the need for knot tying, making surgeries faster and more efficient. Major companies like Medtronic and Ethicon are increasingly adding features like antibacterial coatings to their nonabsorbable sutures, making them safer and more conducive to faster healing.

As the demand for these advanced sutures rises globally, especially in emerging markets, hospitals are upgrading their surgical tools and training more surgeons. This is expected to drive the widespread adoption of nonabsorbable devices in various surgical fields, solidifying their position in the market.

Hospitals are expected to lead the adoption of knotless tissue control devices, capturing 63% market share by 2025. Hospitals perform a large volume of surgeries, making them the largest consumers of surgical tools that enhance efficiency and reduce human error. Knotless sutures, which speed up wound closure and reduce the risk of complications after surgery, are in high demand in these environments.

The ability to eliminate knot tying is especially valuable in minimally invasive surgeries, such as robotic and laparoscopic procedures, which require precision and speed. As hospitals focus on improving patient outcomes, reducing recovery times, and enhancing safety, knotless sutures have become an integral part of their standard surgical toolkits.

Ethicon and other medical device companies are collaborating with hospitals to train surgical teams on the use of knotless sutures, often through hospital-based training sessions or labs. This increasing focus on training and efficiency in hospitals is expected to support the strong and sustained demand for knotless sutures. As the number of surgical procedures increases, hospitals are likely to continue driving the market’s growth for these advanced tissue control devices.

Increasing Number of Surgical Procedures Driving the Growth of the Knotless Tissue Control Devices

Rising surgical procedures worldwide remain an important growth factor of the knotless tissue control devices market. With surgical interventions becoming more readily available due to an older population and chronic diseases, the need for advanced wound closure solutions is climbing.

Knotless tissue control devices, having gained importance in contemporary healthcare facilities, are proving to be essential tools due to their benefits, including uniform distribution of tension, simplifications of surgical workflow, and a reduction in complications.

In this respect, the Centers for Disease Control and Prevention pointedly notes the urgent need for surgeries that attend to aging patients' needs. In 2019, falls were responsible for 83% of deaths from hip fractures, and 88% of emergency department visits and hospitalizations for hip fractures were recorded, where almost 319,000 older adults were hospitalized annually due to injuries from this cause.

An increasing volume of surgeries has an impact on the adoption of knotless tissue control devices, aiding in improving procedural efficiency and patient outcomes. Such devices are preferable among healthcare professionals to meet the rising caseload while ensuring sustained quality and safety in surgeries.

Shift Toward Advanced Wound Closure Techniques in the Knotless Tissue Control Devices Will Drive the Industry

A significant trend in the knotless tissue control devices market is the growing shift towards advanced wound closure methods that prioritize precision and an optimal healing outcome.

Traditional closure techniques such as conventional sutures, staples, and basic wound dressings do not always achieve multi-layer, watertight closure, leading to increasing risks of complications and suboptimal healing. This trend has prompted the adoption of knotless tissue control devices under modern principles of tissue management and wound healing.

Moreover, the knotless devices supported some key principles, including gentle tissue handling, effective hemostasis, obliteration of dead spaces, and tension-free closure, which are extremely important for achieving rapid and efficient healing. These devices eliminate the complexity of knot tying while ensuring uniformity of tension along the wound, thereby reducing the risk of complications arising from knots.

In addition, the development of these wound dressing techniques will augment the knotless tissue control device, establishing a healing-promoting environment by degrading bioburden, minimizing cross-contamination, and enhancing tissue regeneration. The combination of this approach to wound care is gaining a good reputation amongst surgeons and increasing the incorporation of knotless solutions into different surgical specialties.

The drive for improved healing outcomes and the limitations of conventional techniques have continued a trend toward new solutions to wound closure, thus ensuring a positive growth prognosis is being made on the knotless tissue control devices market.

Growing Demand For Advanced Wound Closure Solutions In Emerging Countries Would Provide Lucrative Opportunities For The Market.

The market for knotless tissue control devices has bright growth opportunities as advanced surgical solutions are in increasing demand across developing economies.

Increasing strength in health infrastructure in these regions is moving toward introducing innovative technologies to enhance procedure results and recovery for patients. Very much in demand because of their effectiveness and least complications, knotless tissue control devices can easily meet these demands.

Emerging markets with huge populations and a rising burden of chronic diseases that need surgical intervention give a lucrative opportunity for manufacturers. Governments and private entities in these regions are heavily investing in healthcare modernization, leading to an inviting opportunity for the adoption of advanced wound closure solutions.

Also, increasing medical tourism in countries like India, Thailand, and Mexico acts further toward the better development of the market in availing highly advanced surgical care.

Overall, with the increasing awareness regarding the functionalities of and access to advanced wound closure methods in the healthcare systems, knotless tissue control devices have emerged as promising solutions for filling these market opportunities.

Availability of Alternative Wound Healing Products Pose Challenges to the Market

For the growth of the knotless tissue control devices market to be expected to be hindered by the existence of alternative products as well as restrictions linked with these devices. Alternatives such as conventional sutures, advanced wound dressings, or other new surgical devices are a good match for competition and potentially lower the adoption of knotless tissue control devices.

For example, in April 2021, Dolphin Sutures launched a non-absorbable polytetrafluoroethylene suture, offering additional benefits for wound closure, making it the preferred option for certain surgical applications.

Other challenges affecting the market include the risk of surgical site infections, the high cost of antibacterial equipment, and aesthetic concerns like cross-hatched marks left by traditional sutures. Other developing countries also have counteracting policies, making it possible for advanced wound management solutions to be out of the reach for many, and thus limiting their market growth.

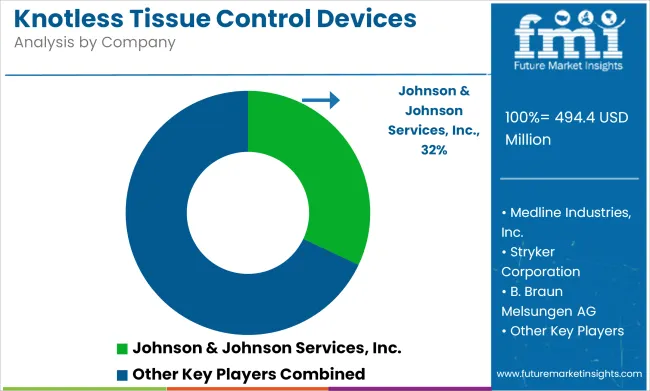

The knotless tissue control devices market is moderately consolidated, led by Tier 1 global giants such as Johnson & Johnson Services, Inc., Medtronic, Stryker Corporation, and Smith & Nephew. Johnson & Johnson, through its Ethicon division, is considered the market leader with an estimated 30% share, driven by its widely adopted STRATAFIX™ and PROXISURE™ devices.

These top-tier players invest heavily in R&D, clinical trials, and strategic collaborations to maintain technological superiority and surgeon trust. Medtronic, for instance, continues to expand its V-Loc™ portfolio, while Stryker focuses on acquiring surgical tool innovators to broaden its minimally invasive solutions. Their robust supply chains, regulatory readiness, and hospital networks reinforce dominance and limit new entrant success.

Tier 2 companies like ConMed Corporation, Mölnlycke Health Care, and Medline Industries offer specialized solutions with regional strengths. Mölnlycke’s emphasis on surgical education and ergonomic design helps it penetrate European hospitals effectively. Entry barriers remain high due to stringent FDA and CE mark requirements, surgeon training needs, and brand loyalty.

While the market is consolidated in North America and Europe, it remains fragmented in emerging regions. This creates dual dynamics consolidation through acquisition in developed economies and local innovation-led fragmentation in developing markets.

The section below covers the industry analysis for the knotless tissue control devices market for different countries. Industry demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided.

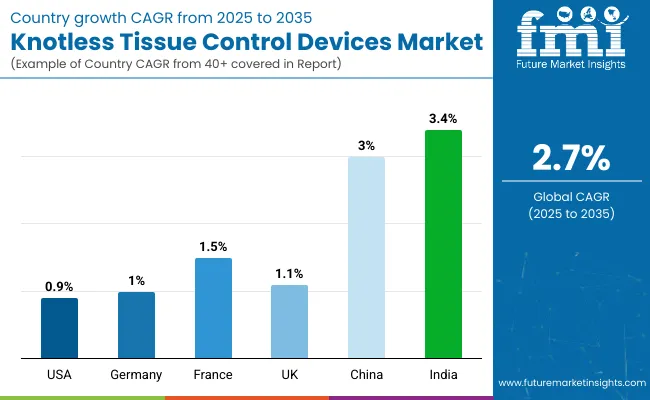

The United States is anticipated to remain at the forefront in North America, with a CAGR of 0.9% through 2035. In South Asia & Pacific, India is projected to witness the highest CAGR in the market of 3.4% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 0.9% |

| Germany | 1.0% |

| France | 1.5% |

| United Kingdom | 1.1% |

| China | 3.0% |

| India | 3.4% |

The United States dominates the global market with high share in 2024. The United States is expected to exhibit a CAGR of 0.9% throughout the forecast period (2025 to 2035).

The United States' requirement for advanced surgical solutions is greatly impacted by the prevalence of chronic illnesses: the need for surgical procedures is on the rise due to a growing number of patients suffering from cardiovascular diseases, diabetes, and cancers. As tissue closure is known for providing wound closure-that is both secure and tension-free-there is a high demand for the knotless tissue control devices.

In addition, this is aided in terms of growth by the presence of big players in the market. They are all looking at various technological innovations to improve their devices so that they may meet the rapidly-growing demand for minimally invasive surgeries. This allows surgical outcomes to be optimized while minimizing time in recovery and any resulting complications-powerful factors in modern surgery.

Over and above, the increasing prevalence of chronic diseases and constant innovations in elevation of tissue closure technologies shape the future for knotless tissue control devices in the USA.

In 2024, the United Kingdom held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 1.1%.

As per the report of the National Joint Registry, approximately 160,000 total knee and hip replacements are carried out every year only in England and Wales. The tissue control devices market is driven by increasing surgeries of hip and knee replacement in the UK. Aging populations mean that a rise in joint disorders translates into a corresponding rise in orthopedic surgeries.

The increasing demand for procedures such as hip and knee replacement is driving the need for advanced tissue closure solutions that ensure safety and reliability in such procedures, especially in minimally invasive surgeries. Thus, tissue control devices are now advancing in order to achieve benefits such as enhanced efficiency of surgery, shorter recovery times, and better results for patients.

Surgery volume and developments in surgery technologies continue to push demand among knotless tissue control devices, as the care providers continue to seek better solutions for complex procedures and better overall patient care.

China occupies a leading value share in East Asia market in 2024 and is expected to grow with a CAGR of 3.0% during the forecasted period.

The knotless tissue control device market in China is greatly driven by the increasing awareness of advanced surgical devices and the increased emphasis by industry participants on gaining competitive advantages.

With healthcare standards improving and more patients opting for advanced surgical solutions, the growth in demand for innovative tissue closure technologies is rapidly developing. This includes advanced products like knotless tissue control devices, which are being selected more frequently for their efficiency in minimally invasive surgeries.

Industry players are investing heavily in research and development to enhance their product offerings, intending to provide reliable, effective, and cost-efficient solutions. Furthermore, an expanding healthcare system in China will continue to create demand for tissue closure devices of high quality as more and more hospitals and specialized clinics introduce these advanced technologies.

This combination of rising awareness, technological progress, and competition in the market is fostering the growth of the market of knotless tissue control devices in China.

Key manufacturers in the knotless tissue control device market are focusing on innovative solutions that enhance surgical efficiency, improve patient outcomes, and reduce recovery time. They are prioritizing advanced materials, such as bioinductive and bioresorbable compounds, which support natural tissue healing and minimize long-term complications.

The market is experiencing robust growth driven by rising demand for minimally invasive surgical techniques, increasing cases of sports injuries, and advancements in orthopedic and soft tissue repair technologies.

Recent Industry Developments in Knotless Tissue Control Devices:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 494.4 million |

| Projected Market Size (2035) | USD 728.6 million |

| CAGR (2025 to 2035) | 2.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Product Types Analyzed (Segment 1) | Short-Term, Long-Term, Nonabsorbable Polymers |

| End Users Analyzed (Segment 2) | Hospitals, Ambulatory Surgical Centers, Trauma Centers, Medical Device Manufacturers, Pharmaceutical Companies, Research Centers and Laboratories |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Knotless Tissue Control Devices Market | Johnson & Johnson Services, Inc., Medtronic, Medline Industries, Inc., Stryker Corporation, B. Braun Melsungen AG, Smith & Nephew, Zimmer Biomet, Boston Scientific, ConMed Corporation, Mölnlycke Health Care |

| Additional Attributes | Sales by product longevity and polymer type, Hospital vs outpatient adoption trends, Impact of trauma care advancements, R&D investment in medical device innovation |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of service, the industry is divided into Short-Term, Long-Term and Nonabsorbable Polymers.

In terms of end user, the industry is segregated into Hospitals, Ambulatory Surgical Centers, Trauma Centers, Medical Device Manufacturers, Pharmaceutical Companies, and Research Centers and Laboratory

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) have been covered in the report.

The global sales for knotless tissue control devices is projected to witness CAGR of 2.7% between 2025 and 2035.

The global sales of knotless tissue control devices stood at USD 480 million in 2024.

The global sales of knotless tissue control devices is anticipated to reach USD 728.6 million by 2035 end.

China is expected to show a CAGR of 3.0% in the assessment period.

The key players operating in the global knotless tissue control devices industry include Johnson & Johnson Services, Inc., Medtronic, Medline Industries, Inc., Stryker Corporation, B. Braun Melsungen AG, Smith & Nephew, Zimmer Biomet, Boston Scientific, ConMed Corporation, Mölnlycke Health Care.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inflow Control Devices Market Analysis - Size, Growth, and Forecast 2025 to 2035

DC Motor Control Devices Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lift Control Devices Market

Driveline Control Systems and Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Instrumentation and Control Devices Market Growth – Trends & Forecast 2024-2034

Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Controllable Shunt Reactor for UHV Market Size and Share Forecast Outlook 2025 to 2035

Tissue Engineered Skin Substitute Market Size and Share Forecast Outlook 2025 to 2035

Tissue Paper Converting Machine Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Tissue Extraction System Market Size and Share Forecast Outlook 2025 to 2035

Control Knobs for Panel Potentiometer Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Tissue-Based Genomic Profiling Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Tissue Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Tissue Paper Unwinding Machine Market Size and Share Forecast Outlook 2025 to 2035

Tissue Paper Embosser Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA