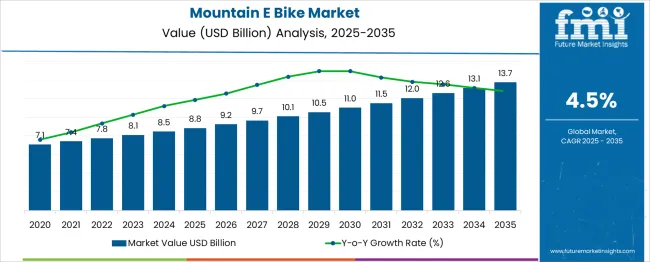

The Mountain E-Bike Market is estimated to be valued at USD 8.8 billion in 2025 and is projected to reach USD 13.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. From 2025 to 2030, the market is expected to grow steadily from USD 8.8 billion to USD 11.0 billion, driven by the rising popularity of adventure sports and eco-friendly transportation solutions. Year-on-year analysis indicates gradual expansion, reaching USD 9.2 billion in 2026 and USD 9.7 billion in 2027, supported by improvements in battery efficiency, lightweight frame designs, and enhanced motor performance for rugged terrains. By 2028, the market is forecasted to reach USD 10.1 billion, increasing to USD 10.5 billion in 2029 and USD 11.0 billion by 2030. The growth trajectory will be influenced by increased consumer spending on premium e-bikes, integration of smart connectivity features, and expanded availability of financing options.

Manufacturers are expected to focus on durable components, extended battery life, and advanced suspension systems to enhance off-road capabilities. These dynamics position mountain e-bikes as a key segment within the broader electric bike industry, appealing to outdoor enthusiasts seeking performance, sustainability, and innovation in recreational mobility.

| Metric | Value |

|---|---|

| Mountain E-Bike Market Estimated Value in (2025 E) | USD 8.8 billion |

| Mountain E-Bike Market Forecast Value in (2035 F) | USD 13.7 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The Mountain E Bike market is undergoing accelerated growth due to the rising demand for eco-conscious mobility solutions and performance-driven recreational transport. Increased awareness about sustainable outdoor travel, coupled with improvements in electric powertrain efficiency and rugged terrain handling, has contributed to a surge in adoption. Governments are incentivizing electric bike infrastructure, while consumers are showing growing interest in high-endurance trail biking experiences supported by advanced assistive technology.

The availability of lighter battery systems, integrated motor technologies, and customizable riding modes is transforming user expectations and expanding the consumer base. Additionally, manufacturers are investing in innovation across frame design, battery integration, and torque-responsive drivetrains to meet evolving performance benchmarks.

The future outlook remains strong, with urban spillover into off-road adventure sports and fitness tourism further stimulating market expansion. As end-users demand more range, power, and agility, mountain E bikes are positioned to become a core segment within the broader electric mobility landscape..

The mountain e-bike market is segmented by battery, motor, propulsion, sales channel, and geographic regions. By battery, the mountain e-bike market is divided into Li-ion and SLA NiMH. In terms of motor, the mountain e-bike market is classified into Mid motor motor. Based on propulsion, the mountain e-bike market is segmented into Pedal-assist and Throttle-assist. By sales channel, the mountain e-bike market is segmented into offline and online. Regionally, the mountain e-bike industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

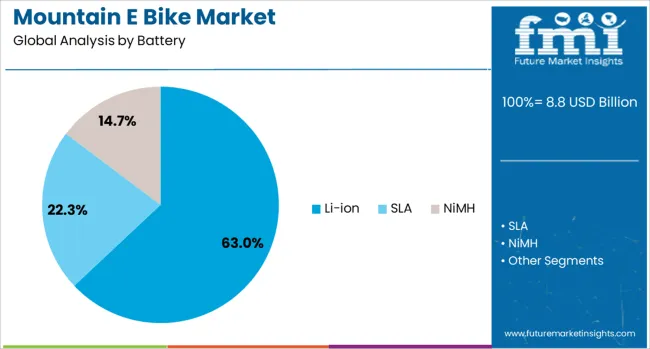

The Li-ion battery segment is projected to account for 63% of the Mountain E Bike market revenue share in 2025, making it the leading battery type. This dominance has been driven by the lightweight composition, high energy density, and superior recharge cycles of lithium-ion batteries, which significantly enhance riding range and power-to-weight ratios. Their compact form factor enables seamless integration into modern bike frames without compromising design or maneuverability.

As riders seek higher endurance on varied terrain, the efficiency and long-term reliability of lithium-ion batteries have become critical. The segment has also benefited from falling battery prices, improved safety features, and compatibility with regenerative braking systems.

Battery management systems now offer precise energy monitoring, increasing performance output and rider confidence. With advancements in fast charging and thermal management, lithium-ion batteries continue to outperform traditional alternatives, reinforcing their status as the preferred energy source for mountain E bikes..

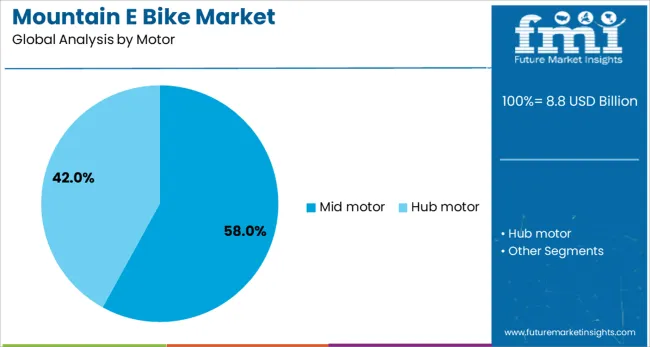

The mid motor segment is anticipated to capture 58% of the Mountain E Bike market revenue share in 2025, emerging as the most adopted motor configuration. Growth in this segment has been influenced by the balanced weight distribution and efficient power transfer offered by mid-mounted motors, which enhance climbing ability and traction on rugged trails. Mid motors allow torque to be applied directly through the bike's drivetrain, producing a more natural and responsive pedaling experience.

Their positioning at the bike's center of gravity improves handling, especially on steep or technical terrain. Additionally, manufacturers have developed mid motors that adapt power output based on real-time pedal input, optimizing both range and ride dynamics.

The motor's compatibility with multiple gear systems and integrated sensor technology has made it a preferred choice among performance-oriented cyclists. As demand for high-efficiency electric assist grows, the mid motor configuration remains central to delivering a premium off-road biking experience..

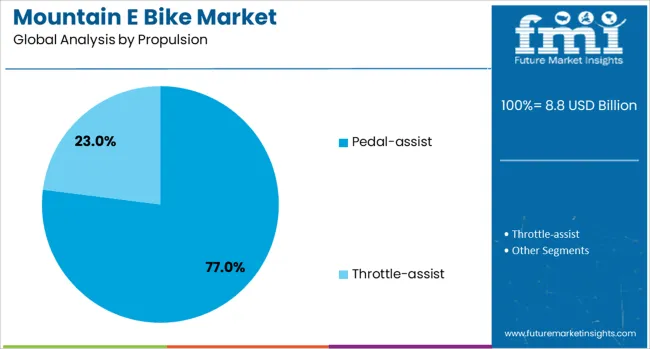

The pedal-assist propulsion segment is expected to dominate the Mountain E Bike market with a 77% revenue share in 2025. This segment has gained traction due to its ability to augment rider effort while maintaining the physical engagement and control required in off-road biking. Pedal-assist systems activate motor support only during pedaling, offering smoother acceleration and improved battery efficiency compared to throttle-based alternatives.

Riders benefit from a more intuitive experience that preserves the traditional feel of mountain biking while enabling longer and more challenging rides. Pedal-assist has also gained regulatory acceptance in numerous countries, as it aligns with safety standards and e-bike classification norms.

With selectable assist levels, users can fine-tune power output to match terrain and endurance needs, further expanding its versatility. As health-conscious consumers increasingly turn to e-bikes for recreation and fitness, pedal-assist technology is being recognized as the optimal propulsion method for both novice and seasoned mountain bikers..

The mountain e-bike market is expanding due to increasing interest in outdoor recreation and the growing demand for performance-driven off-road bikes. Growth is supported by product innovations in long-range batteries and lightweight frames introduced in 2024 and 2025. Opportunities are emerging in premium customization, adventure tourism packages, and e-bike rental programs in tourist regions. Key trends include connected features for navigation, advanced suspension systems, and integration with digital ride analytics. However, high purchase costs, battery limitations, and inadequate charging infrastructure remain significant barriers. Overall, the outlook suggests rising adoption among enthusiasts seeking enhanced off-road experiences.

The primary growth driver is the rising popularity of outdoor adventure sports and recreational cycling. In 2024 and 2025, mountain e-bikes gained traction in North America and Europe as consumers opted for high-performance electric bikes for trail riding and rugged terrains. Product launches featuring improved motor torque and extended battery life enhanced appeal among serious riders. Organized cycling events and nature-based tourism packages also boosted adoption. These dynamics confirm that consumer preference for challenging outdoor experiences and power-assisted rides is propelling the demand for advanced mountain e-bike models globally.

Significant opportunities exist in e-bike rentals and their inclusion in adventure tourism itineraries. In 2025, popular mountain destinations in Asia-Pacific and Europe introduced rental programs to attract travelers seeking eco-friendly mobility and thrill-based activities. Premium brands offering personalized configurations, such as adjustable suspensions and higher torque options, captured niche markets among enthusiasts. Partnerships between tour operators and e-bike manufacturers have created exclusive trail experiences, driving demand in hospitality-linked segments. These developments underscore a strong growth potential for service-based models and experience-driven offerings within the mountain e-bike ecosystem.

Emerging trends focus on connected technology integration and advanced ride performance. In 2024, several manufacturers introduced GPS-enabled systems, app-based ride monitoring, and Bluetooth connectivity to track performance metrics and route planning. Lightweight carbon frames and electronically adjustable suspensions were launched to enhance handling on steep and uneven terrains. Battery-swapping solutions also gained attention as riders demanded extended ranges for full-day trails. These patterns indicate that user-centric innovations aimed at convenience, safety, and performance are shaping the next phase of product development in the mountain e-bike market.

Market restraints are primarily linked to premium pricing, range limitations, and inadequate charging infrastructure in remote regions. In 2024 and 2025, entry-level mountain e-bikes remained costly for price-sensitive consumers due to advanced drivetrain systems and lithium-ion battery packs. Limited service availability and dependency on specialized components further elevated maintenance expenses. Insufficient charging points on mountain trails hindered extended rides, reducing usability for long-distance riders. These challenges indicate the need for cost optimization, improved energy solutions, and infrastructure development to ensure broader accessibility and accelerate market penetration globally.

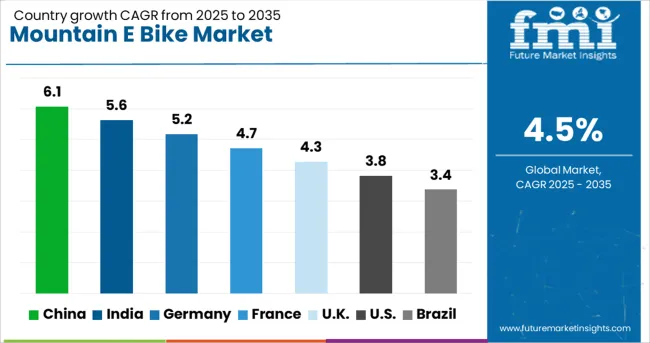

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global mountain e-bike market is projected to grow at 4.5% CAGR between 2025 and 2035. China leads at 6.1% CAGR, driven by rapid growth in sports tourism and rising consumer interest in performance-oriented electric bikes. India follows with 5.6%, supported by recreational cycling culture and premium segment demand in metro cities. France posts 4.7% CAGR, leveraging its strong adventure sports sector and well-developed mountain biking trails. The UK records 4.3%, while the United States grows at 3.8%, reflecting steady adoption in a mature cycling market focused on outdoor recreation and fitness. Asia-Pacific dominates growth due to affordability and large-scale production, while Western markets prioritize lightweight designs, advanced battery technology, and integrated smart features.

China is expected to grow at 6.1% CAGR, leading global adoption due to expanding cycling infrastructure and rising popularity of outdoor adventure sports. Domestic manufacturers leverage cost advantages to produce high-performance mountain e-bikes for both domestic and export markets. Integration of lithium-ion batteries with extended range and mid-drive motors for improved torque enhances appeal among enthusiasts. E-commerce platforms play a critical role in expanding reach, especially for premium models equipped with IoT features such as GPS tracking and ride analytics. The government’s push for sustainable mobility further promotes electric mobility adoption in both urban and rural regions.

The market in India is forecasted to grow at 5.6% CAGR, supported by increasing recreational cycling trends and interest in eco-friendly transport alternatives. Rising disposable income in metro cities drives demand for premium mountain e-bikes designed for rough terrains and long-distance rides. Manufacturers are focusing on hybrid models with durable frames, powerful motors, and removable battery packs for convenience. Adventure tourism operators incorporate e-bikes into guided mountain tours, strengthening rental demand. Partnerships between domestic brands and global component suppliers enhance product quality, enabling competitive pricing for performance-oriented models.

France is projected to grow at 4.7% CAGR, driven by its strong mountain biking culture and government investment in outdoor sports infrastructure. The country’s extensive trail network across alpine and rural regions supports recreational and competitive cycling activities. Premium mountain e-bikes featuring lightweight frames, hydraulic brakes, and advanced suspension systems dominate consumer preferences. Rental services at ski resorts and nature parks further expand market penetration. Government incentives for electric mobility and eco-tourism policies encourage manufacturers to develop sustainable and high-performance models for leisure and sport enthusiasts.

The United Kingdom market is forecasted to grow at 4.3% CAGR, supported by increasing interest in adventure sports and outdoor fitness activities. E-bike adoption is gaining traction among recreational cyclists and commuters seeking versatile options for mixed terrains. Manufacturers focus on integrating smart technologies such as Bluetooth connectivity and app-based ride analytics to cater to tech-savvy consumers. Retail growth is driven by specialty sports stores and direct-to-consumer channels. Expanding e-bike rental programs in tourist destinations adds an additional revenue stream for market players.

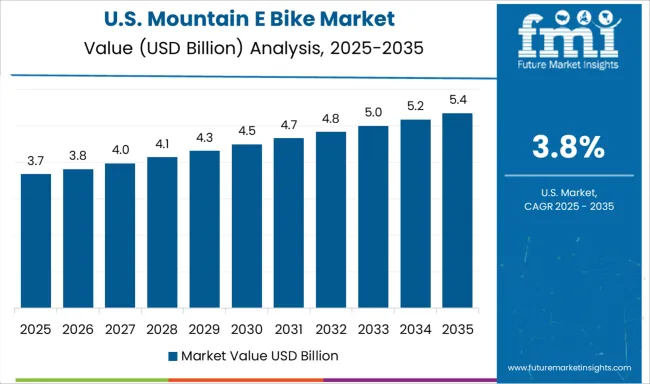

The United States market is projected to grow at 3.8% CAGR, reflecting steady demand driven by outdoor recreation and adventure travel. Growth is concentrated in premium models offering advanced suspension systems, torque-sensing motors, and long-range battery packs. Rental demand in national parks and resort areas supports adoption among casual riders and tourists. OEMs are investing in lightweight carbon fiber frames and smart assistance modes to appeal to performance enthusiasts. Government initiatives promoting sustainable tourism and active transportation bolster opportunities for e-bike adoption across various states.

The mountain e-bike market is moderately consolidated, with Trek Bicycle Corporation recognized as a leading player due to its extensive range of performance-driven electric mountain bikes (e-MTBs) featuring advanced drive systems, lightweight frames, and integrated battery solutions. The company’s strong dealer network and reputation for innovation position it at the forefront of the global market. Key players include Giant Manufacturing Co., Ltd., Accell Group, Merida Industry Co., Ltd., Yamaha Motor Co., Ltd., Bulls Bikes, and Haibike.

These companies specialize in high-performance e-MTBs equipped with mid-drive motors, advanced suspension systems, and intuitive control units to enhance off-road riding experiences. Their offerings cater to both professional cyclists and recreational riders seeking durability, speed, and energy efficiency in rugged terrains. Market growth is driven by rising interest in adventure sports, increasing demand for eco-friendly transportation alternatives, and advancements in battery technology that deliver longer range and faster charging times. Leading manufacturers are investing in lightweight carbon frames, smart connectivity features such as app-based ride monitoring, and customizable power-assist levels to improve user experience. Emerging trends include integration of GPS-enabled navigation, regenerative braking systems, and enhanced motor torque for challenging trails. Europe leads the market due to well-developed cycling infrastructure and the popularity of outdoor recreation, while North America and Asia-Pacific show rapid adoption fueled by expanding e-mobility initiatives and growing adventure tourism.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.8 Billion |

| Battery | Li-ion, SLA, and NiMH |

| Motor | Mid motor and Hub motor |

| Propulsion | Pedal-assist and Throttle-assist |

| Sales Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Trek Bicycle Corporation, Giant Manufacturing Co., Ltd., Accell Group, Merida Industry Co., Ltd., Yamaha Motor Co., Ltd., Bulls Bikes, and Haibike |

| Additional Attributes | Dollar sales by propulsion (pedal-assist vs throttle), motor type (hub vs mid-drive), and application (recreational, competitive, delivery). Market was ~USD 4.7 B in 2024, projected to hit ~USD 9.8 B by 2030 at ~8.9% CAGR. Asia-Pacific leads (~65% share), North America holds ~33.8%. Buyers prioritize range, lightweight frames, torque control, and smart connectivity. |

The global mountain e-bike market is estimated to be valued at USD 8.8 billion in 2025.

The market size for the mountain e-bike market is projected to reach USD 13.7 billion by 2035.

The mountain e-bike market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in mountain e-bike market are li-ion, _pedal-assist, _throttle-assist, sla, _pedal-assist, _throttle-assist, nimh, _pedal-assist and _throttle-assist.

In terms of motor, mid motor segment to command 58.0% share in the mountain e-bike market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mountain and Ski Resorts Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Mountain and Snow Tourism Market Analysis – Trends, Growth & Forecast 2025 to 2035

Market Share Insights of Leading Mountain and Ski Resorts

UK Mountain and Ski Resort Market Trends – Growth, Demand & Forecast 2025-2035

USA Mountain and Ski Resort Market Insights – Growth, Trends & Forecast 2025-2035

Japan Mountain and Ski Resort Market Trends – Demand, Size & Outlook 2025-2035

Germany Mountain and Ski Resort Market Analysis – Size, Trends & Growth 2025-2035

Bovine High-Mountain Disease Market Size and Share Forecast Outlook 2025 to 2035

Switzerland Mountain and Ski Resort Market Report – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA