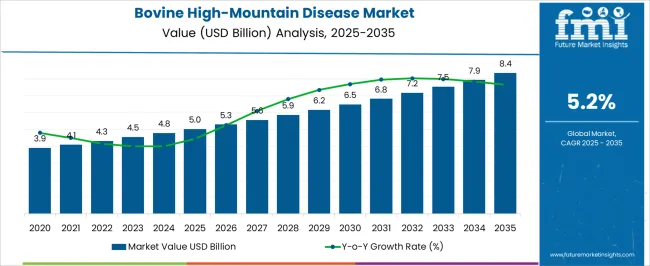

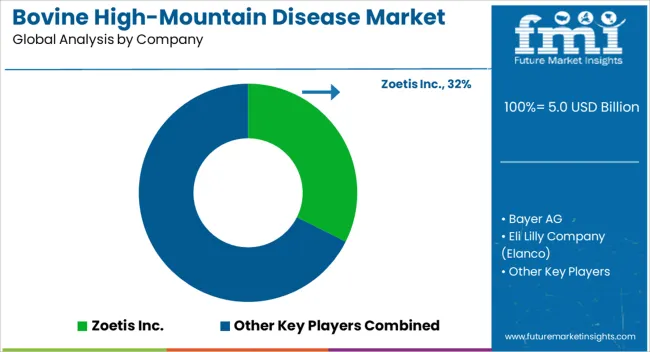

The Bovine High-Mountain Disease Market is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 8.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Bovine High-Mountain Disease Market Estimated Value in (2025 E) | USD 5.0 billion |

| Bovine High-Mountain Disease Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Bovine High-Mountain Disease market is experiencing steady growth due to increasing awareness of animal health management and rising demand for preventive and therapeutic interventions in livestock. The current market scenario is shaped by the growing prevalence of high-altitude livestock conditions and the need for effective treatment options to reduce mortality and improve productivity.

Expansion of veterinary healthcare infrastructure, particularly in regions with significant cattle populations, has enhanced accessibility to relevant medications. Rising investments in research and development of veterinary drugs, coupled with innovations in treatment formulations, are providing new avenues for disease management.

The market is also supported by increased adoption of animal health monitoring and disease prevention protocols by commercial and small-scale farmers Future growth is expected to be driven by expanding veterinary networks, improvements in drug delivery systems, and heightened focus on animal welfare standards, which collectively contribute to wider use of therapeutic solutions for high-altitude bovine health conditions.

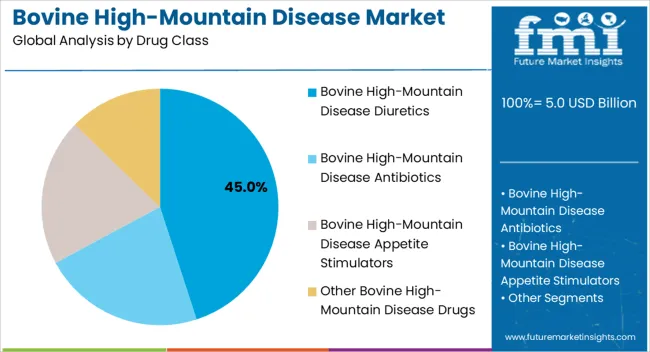

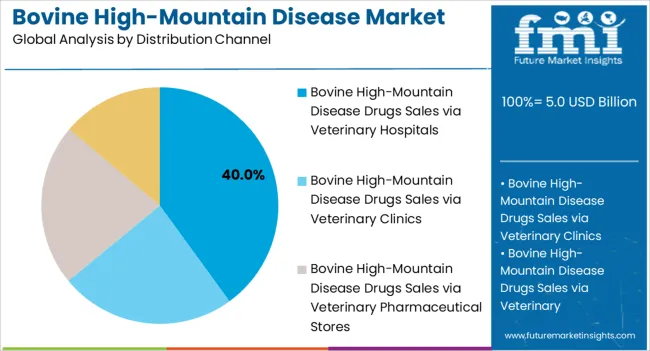

The bovine high-mountain disease market is segmented by drug class, distribution channel, and geographic regions. By drug class, bovine high-mountain disease market is divided into Bovine High-Mountain Disease Diuretics, Bovine High-Mountain Disease Antibiotics, Bovine High-Mountain Disease Appetite Stimulators, and Other Bovine High-Mountain Disease Drugs. In terms of distribution channel, bovine high-mountain disease market is classified into Bovine High-Mountain Disease Drugs Sales via Veterinary Hospitals, Bovine High-Mountain Disease Drugs Sales via Veterinary Clinics, Bovine High-Mountain Disease Drugs Sales via Veterinary Pharmaceutical Stores, and Bovine High-Mountain Disease Drugs Sales via Other Distribution Channels. Regionally, the bovine high-mountain disease industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The drug class segment for Bovine High-Mountain Disease Diuretics is projected to account for 45.0% of the overall market revenue in 2025, making it the leading drug category. This dominance is being driven by the efficacy of diuretics in managing fluid retention and alleviating symptoms associated with high-altitude disease conditions in cattle. Adoption has been facilitated by their established clinical performance and ability to improve survival rates in affected herds.

The use of diuretics is favored in both preventive and therapeutic contexts, allowing livestock owners to manage disease onset and progression effectively. Growing awareness among veterinarians regarding optimal dosing and administration practices has enhanced the reliability and adoption of diuretics.

Additionally, the accessibility of these drugs through established distribution networks has contributed to widespread use With increasing demand for livestock health management solutions and the ongoing need for cost-effective treatments that reduce mortality and improve herd productivity, the diuretics segment is expected to maintain its market leadership in the near future.

The distribution channel segment of Bovine High-Mountain Disease drugs via veterinary hospitals is anticipated to capture 40.0% of total market revenue in 2025, establishing it as the dominant channel. This growth is being driven by the trust placed by livestock owners in professional veterinary guidance and the structured availability of treatments within hospital settings. Veterinary hospitals provide direct access to trained professionals who ensure proper diagnosis, prescription, and administration of medications, improving treatment outcomes.

The ability to monitor cattle health in a controlled environment and provide follow-up care has further reinforced this channel’s prominence. Moreover, veterinary hospitals facilitate bulk and repeat purchases, supporting consistent supply and adherence to therapeutic regimens.

The growing network of veterinary healthcare centers, combined with increasing awareness about disease management protocols, has contributed to the adoption of this channel as the preferred method for acquiring Bovine High-Mountain Disease drugs Future growth is expected to be reinforced by continued investments in veterinary infrastructure and enhanced focus on preventive healthcare measures for high-altitude livestock.

Bovine high-mountain disease (BHMD) is also known as brisket disease which causes significant death loss, especially in calves. The bovine high-mountain disease is right heart failure which is generally caused due to hypoxic pulmonary hypertension at high altitudes. The bovine high-mountain disease is found in cattle at elevations over 7,000 feet and affects cattle of all ages and breeds.

Higher elevations directly increase the incidence rate of bovine respiratory disease. The bovine high-mountain disease is generally associated with factors like altitude, physiologic, genetic, and environmental. It is also said that bovine high-mountain disease could be associated with mortality and morbidity associated with bovine respiratory disease (BRD). Some of the symptoms associated with the bovine high-mountain disease are weakness, collapse, diarrhea, bulging eyes, swelling due to edema of the limbs, and others.

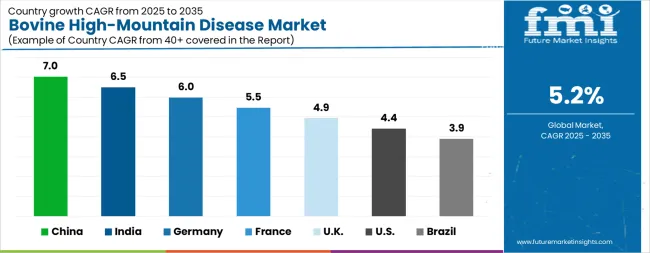

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

The Bovine High-Mountain Disease Market is expected to register a CAGR of 5.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.0%, followed by India at 6.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.9%, yet still underscores a broadly positive trajectory for the global Bovine High-Mountain Disease Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.0%. The USA Bovine High-Mountain Disease Market is estimated to be valued at USD 1.8 billion in 2025 and is anticipated to reach a valuation of USD 2.8 billion by 2035. Sales are projected to rise at a CAGR of 4.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 260.4 million and USD 165.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.0 Billion |

| Drug Class | Bovine High-Mountain Disease Diuretics, Bovine High-Mountain Disease Antibiotics, Bovine High-Mountain Disease Appetite Stimulators, and Other Bovine High-Mountain Disease Drugs |

| Distribution Channel | Bovine High-Mountain Disease Drugs Sales via Veterinary Hospitals, Bovine High-Mountain Disease Drugs Sales via Veterinary Clinics, Bovine High-Mountain Disease Drugs Sales via Veterinary Pharmaceutical Stores, and Bovine High-Mountain Disease Drugs Sales via Other Distribution Channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zoetis Inc., Bayer AG, Eli Lilly Company (Elanco), Dechra Pharmaceuticals, and Merck & Co. Inc |

The global bovine high-mountain disease market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the bovine high-mountain disease market is projected to reach USD 8.4 billion by 2035.

The bovine high-mountain disease market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in bovine high-mountain disease market are bovine high-mountain disease diuretics, bovine high-mountain disease antibiotics, bovine high-mountain disease appetite stimulators and other bovine high-mountain disease drugs.

In terms of distribution channel, bovine high-mountain disease drugs sales via veterinary hospitals segment to command 40.0% share in the bovine high-mountain disease market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bovine Pericardial Valve Market Size and Share Forecast Outlook 2025 to 2035

Bovine Lactoferrin Market Size and Share Forecast Outlook 2025 to 2035

Bovine Brain Extract Size and Share Forecast Outlook 2025 to 2035

Bovine Gelatin Market

Hydrolyzed Bovine Collagen Market

Middle East & Africa Hydrolyzed Bovine Collagen Market Size and Share Forecast Outlook 2025 to 2035

Disease Resistant Mask Market Analysis - By Type, Material, End-User, Distribution Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Rare Disease Clinical Trials Market Size and Share Forecast Outlook 2025 to 2035

The lung disease therapeutics market is segmented by disease type, treatment type and distribution channel from 2025 to 2035

Rare Disease Gene Therapy Market

Swine Disease Diagnostic Kit Market Size and Share Forecast Outlook 2025 to 2035

Liver Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Fabry Disease Market Size and Share Forecast Outlook 2025 to 2035

Byler Disease Market

Airway Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Celiac Disease Diagnostics Market Analysis - Size, Share & Forecast 2025 to 2035

Shrimps Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

The Addison Disease Testing Market Is Segmented by Test Type, and End User from 2025 To 2035

Pleural Diseases Therapeutics Market – Drug Trends & Future Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA