The mechanical ventilator market focuses on life-supporting medical devices that assist or replace spontaneous breathing in patients suffering from respiratory failure, severe infections (e.g., pneumonia), trauma, or during surgery and intensive care. These devices are used in hospitals, homecare settings, ambulatory surgical centers (ASCs), and emergency response units. The market is driven by rising incidence of chronic respiratory diseases, aging populations, increased ICU admissions, and growing preparedness for public health emergencies and pandemics.

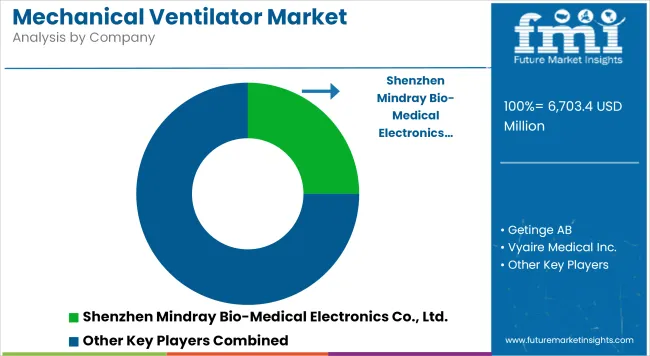

In 2025, the global mechanical ventilator market is projected to reach approximately USD 6,703.4 million, with expectations to grow to around USD 11,129.0 million by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period.

The market's expansion is fueled by technological advancements in portable and non-invasive ventilators, AI-integrated monitoring systems, and rising healthcare infrastructure investment, particularly in emerging economies.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 6,703.4 Million |

| Projected Market Size in 2035 | USD 11,129.0 Million |

| CAGR (2025 to 2035) | 5.2% |

The largest share of mechanical ventilator is in North America due to the well-developed critical care infrastructure, high prevalence of chronic obstructive pulmonary disease (COPD) and asthma, increased government initiatives to support emergency preparedness (stockpiling ventilators in blade of a pandemic). North America leads in the adoption of non-invasive ventilators with tele-ICU system integration including homecare remote monitoring functionalities.

Prominent companies in the region (Germany, France and the UK) accounting for a significant share in the marketplace in Europe are also driving the modernization of ICU, ventilator-assisted rehabilitation and geriatric care.

It pulls a lot towards adhering to EU MDR (Medical Device Regulation) and pushing for automation and ship ventilator systems to turn out the best effectiveness for the patient with the least manual work and consideration. Demand is further strengthened by growing post-COVID investments in healthcare resilience.

Due to investment in healthcare infrastructure, the growing burden of respiratory diseases, and improving access to critical care among the middle class in China, India, Japan, and countries in Southeast Asia, Asia-Pacific is anticipated to register the highest CAGR during the forecasted time-frame.

Countries are scrambling to add to their stockpiles of ICU beds and respiratory therapists, and local ventilator manufacturing projects. Homecare ventilation, too, is growing more prevalent in overcrowded urban areas.

Challenges

High Equipment Costs and Limited ICU Infrastructure in Developing Regions

The barriers and challenges in the mechanical ventilator market include high equipment and maintenance costs, as well as limited access in low-income nations and rural health facilities, which along with other factors limits the potential of the global mechanical ventilator market.

However, a combination of shortage of trained manpower, extremely low 0.5 ICU bed-to-population ratio and complete dependence on electricity supply for advanced ventilators act as barriers to adoption. Finally, excess supply following the COVID-19 pandemic and disruptions to government procurement cycles also caused imbalances in inventory and utilization in certain products.

Opportunities

Demand for Portable, Intelligent, and Home-Based Ventilation Systems

Rising incidence of chronic respiratory disorders (COPD, sleep apnea, asthma) and growing elderly population has led to the surge of demand for economical, portable, and simple to use ventilators. Novel non-invasive ventilation (NIV), Artificial Intelligence guidance-ventilation algorithms, tele monitoring and battery-powered portable ventilators drive their application in ambulatory, homecare and emergency settings. Moreover, with the IoT and real-time patient monitoring platforms, the world has entered an era of remote respiratory care and ICU efficiency.

From 2020 to 2024, the market underwent a demand surge unprecedented in C19, mass production of emergency-use ventilators, and a rapid expansion in ICU capacity. But, with the post-Pandemic phase, procurement was down in most instances, and market corrections were made, particularly in developed countries where inventories had built up.

The market will move towards smart, modular, & the patient-personalized ventilators from 2025 to 2035, with increasing focus on homecare respiratory solutions, AI-based weaning strategies, and cloud-enabled respiratory analytics. These factors supporting sustainability in medical devices will contribute towards demand for energy-efficient, recyclable and longer-lifecycle ventilator components.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emergency authorizations under FDA EUA, WHO guidance |

| Technology Innovations | Surge in basic ICU and transport ventilators during COVID |

| Market Adoption | Focused on hospital ICU expansion and pandemic preparedness |

| Sustainability Trends | Reactive mass production with single-use plastics and energy-heavy systems |

| Market Competition | Dominated by Philips, Medtronic, GE Healthcare, Dräger , ResMed , Vyaire , Hamilton Medical |

| Consumer Trends | Urgent demand for critical care ventilators and emergency stockpiling |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter compliance with long-term safety, AI algorithm approval, and tele monitoring data privacy |

| Technology Innovations | Growth in AI-powered, cloud-connected, and adaptive ventilation modes |

| Market Adoption | Expansion into homecare, long-term care facilities, and outpatient rehab |

| Sustainability Trends | Push toward green medical device innovation, reusable parts, and energy-efficient design |

| Market Competition | Rise of AI-health startups , portable ventilator innovators, and cloud-based respiratory care platforms |

| Consumer Trends | Long-term demand for portable, non-invasive, user-centric ventilation solutions |

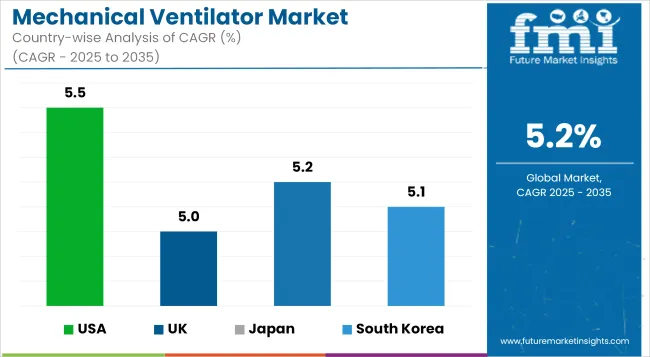

The mechanical ventilator market in United States will grow steadily at a moderate CAGR due to the large prevalence of patients suffering from chronic respiratory diseases such as COPD, asthma, and sleep apnea. Increased use of vents across hospitals and long-term care facilities is also driven by an aging population and increasing ICU admissions.

Portable and non-invasive ventilators and AI-based holistic patient monitoring and real-time diagnostics are changing the ultimate patient experience. They are followed by the exponential need for stockpiling and innovation for these devices further supported by the Government during pandemics and readiness for falling different Emergency Preparedness scenarios.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

Some of the factors that drive the UK mechanical ventilator market are increasing demand for better respiratory support in acute and homecare centers and they are working together to achieve an appropriate clinical environment to accelerate recovery and reduce costs. The National Health Service (NHS) continues to invest in high-dependency respiratory care infrastructure, which, in turn, will add to the demand for both invasive and non-invasive ventilator systems.

The strategies implemented to improve preparedness for the next pandemic, and to increase awareness of what could be done during an emergency in terms of ventilator availability, are other major components. Also, the increasing use of transport ventilators in ambulatory and paramedic services are projected to boost the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.0% |

The Europe mechanical ventilator market is moderate and is supported, due to aging population, developed healthcare systems and an increasing prevalence of respiratory diseases. Germany, France, and Italy are key markets, especially around ICU upgrades and home-based respiratory therapy.

The EU’s emphasis on cross-border emergency preparedness and increased investment in smart ventilator technologies as well as tele monitoring will stimulate innovation. Furthermore, reimbursement policies of the EU allow a more wide adoption of treatment for chronic disease management in the outpatient and homecare settings.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 4.9% |

Japan’s mechanicalventilator market is growing at a healthy pace. The country critically prioritizes patient comfort, accelerating adoption of compact, quite, and user-friendly ventilator types towards hospital and home environments.

Along with support for chronic respiratory illness management, preparedness for infectious disease outbreaks and natural disasters in Japan ensures sustained investment in critical care technology. High-tech hospitals are witnessing the evolution of AI-integrated and IoT-enabled ventilators.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

South Korea’s mechanical ventilator market is growing steadily, fueled by a robust healthcare infrastructure and increasing demand for critical care technology. Rapid urbanization, rising air pollution levels, and a growing elderly population are contributing to the increased incidence of respiratory conditions.

The government’s proactive investment in public health preparedness and the adoption of smart, wireless ventilator technologies are driving innovation. The market is also supported by South Korea’s strength in medical device manufacturing and exports.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The explosion of intensive care capacity, sophistication of technology used, and readiness to face future pandemics is fundamentally changing protocol in ICUs around the world, resulting in an increased demand for critical care ventilators that are driving the market.

South Korea mechanical ventilator market is anticipated to witness growth at a rapid rate in the forecast period, 2020 to 2026 due to a strong healthcare infrastructure and growing demand for critical care solutions. The growing prevalence of lung diseases can be attributed to increasing urbanization, increasing levels of air pollution and an ageing population.

Innovation is being spawned from an increased, immediate government investment into public health preparedness and adoption of smart, wireless ventilator technologies. Also supporting the market is the strength of South Korea’s medical device manufacturing and exports.

The critical care ventilators of the recent era have multi-mode ventilation features including assist-control (AC), pressure support (PSV), synchronized intermittent mandatory ventilation (SIMV) and high-frequency oscillatory ventilation (HFOV). These modes permit treatment of respiratory parameters according to lung compliance, oxygenation state, and hemodynamic profile of the patient.

Most market-leading ventilators now have closed-loop algorithms that automatically adjust breath delivery to the patient’s response in real time, improving the breath delivery's safety by minimizing barotrauma and volutrauma. Some newer systems are now able to provide proportional assist ventilation (PAV+) where the ventilator pressure output adjusts dynamically to the patient’s inspiratory effort.

High-end critical care ventilators also have added features of waveform analysis, flow-volume loop graphics, and trending of respiratory mechanics to assist clinician in weaning strategies, ventilation troubleshooting, and optimization of sedation.

Pandemic demonstrated worldwide ventilator necessities and limitations in ICU capacity, causing governments, hospitals, and NGOs to shift priorities to the stockpiling of ventilators, construction of ICUs, and breathe care education. Critical care ventilators became central to public health response strategies.

This momentum transitioned into long-term healthcare planning after the pandemic. Now, governments are spending money on modernizing ICUs, especially in middle-income nations where access to critical care was scarce. Ministries of health and international health agencies are also investing in durable, scalable ventilator systems that work in resource-constrained settings but still provide clinical robustness.

Additionally, modular I.C.U. expansion units and containerized critical care modules are equipped with mobile ventilators that can perform tasks to a degree comparable to those of traditional I.C.U. ventilators but also can help fill gaps in disaster zones, areas of armed conflict or rural health networks.

Non-invasive ventilation (NIV) has quickly become established as a less invasive method of respiratory support than invasive mechanical ventilation in patients requiring partial respiratory support but not requiring endotracheal intubation. NIV integrates positive pressure ventilation through nasal masks, full face masks, or helmet interfaces allowing better oxygenation and decreased work of breathing whilst maintaining patient comfort levels.

Due to its lower infectious risk, shorter ICU length of stay and better recovery time, non-invasive ventilation has supplanted invasive ventilation as the treatment of choice in several clinical pathways, such as exacerbations of COPD, obesity hypoventilation syndrome (OHS), acute cardiogenic pulmonary edema, and post-extubation support.

The delivery of healthcare is transitioning from hospital-based care towards community and home settings. This change has also resulted in greatly increased demand for portable, user-engaging non-invasive ventilators providing long-term care for patients, especially those with chronic respiratory diseases, particularly neuromuscular diseases, interstitial lung disease and central hypoventilation syndromes.

Non-invasive ventilators with advanced auto titration, multi-mode (CPAP, BiPAP, and AVAPS) and battery powered operation enables patients to regulate their breathing with minimal dependence on the caregivers.

These could be followed by cloud-enabled NIV devices, which transmit device usage data to clinicians and allow for tele monitoring that fosters proactive interventions, better compliance and fewer hospital readmissions.

Increasingly, European and North American insurance providers are expanding the coverage of home-based NIV programs as cost-effective discharge from hospitals with ventilator support at home improves quality of life.

The mechanical ventilators market is steadily ascending, driven by the rising incidence of chronic respiratory diseases, the geriatric population, an increase in ICU admissions, and the advancement of critical care. Mechanical ventilators are an essential part of managing respiratory failure, post-operative recovery, and intensive care unit (ICU) support. Technological innovations in non-invasive ventilation, home-based respiratory care, and pandemic preparedness further accelerate market growth.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Philips Healthcare | 18-22% |

| Medtronic plc | 14-18% |

| GE HealthCare Technologies Inc. | 12-16% |

| Drägerwerk AG & Co. KGaA | 10-14% |

| Hamilton Medical AG | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Philips Healthcare | Offers advanced invasive and non-invasive ventilators with integrated AI-powered monitoring and remote care solutions. |

| Medtronic plc | Manufactures portable and ICU ventilators including the Puritan Bennett™ line, known for lung-protective ventilation modes. |

| GE HealthCare | Provides precision ventilators with real-time patient monitoring and adaptive pressure support features. |

| Drägerwerk AG & Co. KGaA | Specializes in hospital-grade ventilators with automated weaning protocols and neonatal capabilities. |

| Hamilton Medical AG | Develops intelligent ventilation systems using adaptive support ventilation (ASV) and real-time lung modelling. |

Key Market Insights

Philips Healthcare (18-22%)

Philips leads the mechanical ventilator market with its Versa Vent and Trilogy platforms, emphasizing home and ICU continuity, backed by telehealth and cloud integration.

Medtronic plc (14-18%)

Medtronic’s Puritan Bennett™ ventilators are globally recognized for customizable ventilation modes and critical care applications, especially in emergency response and pandemic scenarios.

GE HealthCare (12-16%)

GE HealthCare focuses on precision and patient-adaptive ventilator systems, particularly for perioperative and intensive care settings, supporting lung recruitment strategies.

Drägerwerk AG (10-14%)

Dräger provides advanced ICU ventilators with neonatal modules, offering high-performance ventilation with safety alarms, oxygen control, and integration with hospital IT systems.

Hamilton Medical AG (8-12%)

Hamilton Medical is a pioneer in intelligent ventilation, using closed-loop control algorithms (ASV, INTELLiVENT-ASV) to reduce weaning time and improve outcomes.

Other Key Players (26-32% Combined)

Numerous specialized and emerging companies are contributing with portable, affordable, and smart ventilation solutions for both hospital and homecare environments, including:

The overall market size for mechanical ventilator market was USD 6,703.4 million in 2025.

The mechanical ventilator market is expected to reach USD 11,129.0 million in 2035.

Rising incidence of respiratory diseases, increasing critical care admissions, and growing investments in healthcare infrastructure and emergency preparedness will drive market growth.

The top 5 countries which drives the development of mechanical ventilator market are USA, European Union, Japan, South Korea and UK.

Critical care ventilators expected to grow to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million), By Product Type, 2018 to 2022

Table 2: Global Market Value (US$ Million), By Product Type, 2023 to 2033

Table 3: Global Market Value (US$ Million), By End-User, 2018 to 2022

Table 4: Global Market Value (US$ Million), By End-User, 2023 to 2033

Table 5: Global Market Value (US$ Million), By Ventilation, 2018 to 2022

Table 6: Global Market Value (US$ Million), By Ventilation, 2023 to 2033

Table 7: Global Market, By Region, 2018 to 2022

Table 8: Global Market, By Region, 2023 to 2033

Table 9: North America Market Value (US$ Million), By Product Type, 2018 to 2022

Table 10: North America Market Value (US$ Million), By Product Type, 2023 to 2033

Table 11: North America Market Value (US$ Million), By End-User, 2018 to 2022

Table 12: North America Market Value (US$ Million), By End-User, 2023 to 2033

Table 13: North America Market Value (US$ Million), By Ventilation, 2018 to 2022

Table 14: North America Market Value (US$ Million), By Ventilation, 2023 to 2033

Table 15: North America Market, By Country, 2018 to 2022

Table 16: North America Market, By Country, 2023 to 2033

Table 17: Latin America Market Value (US$ Million), By Product Type, 2018 to 2022

Table 18: Latin America Market Value (US$ Million), By Product Type, 2023 to 2033

Table 19: Latin America Market Value (US$ Million), By End-User, 2018 to 2022

Table 20: Latin America Market Value (US$ Million), By End-User, 2023 to 2033

Table 21: Latin America Market Value (US$ Million), By Ventilation, 2018 to 2022

Table 22: Latin America Market Value (US$ Million), By Ventilation, 2023 to 2033

Table 23: Latin America Market, By Country, 2018 to 2022

Table 24: Latin America Market, By Country, 2023 to 2033

Table 25: Europe Market Value (US$ Million), By Product Type, 2018 to 2022

Table 26: Europe Market Value (US$ Million), By Product Type, 2023 to 2033

Table 27: Europe Market Value (US$ Million), By End-User, 2018 to 2022

Table 28: Europe Market Value (US$ Million), By End-User, 2023 to 2033

Table 29: Europe Market Value (US$ Million), By Ventilation, 2018 to 2022

Table 30: Europe Market Value (US$ Million), By Ventilation, 2023 to 2033

Table 31: Europe Market, By Country, 2018 to 2022

Table 32: Europe Market, By Country, 2023 to 2033

Table 33: Asia Pacific Market Value (US$ Million), By Product Type, 2018 to 2022

Table 34: Asia Pacific Market Value (US$ Million), By Product Type, 2023 to 2033

Table 35: Asia Pacific Market Value (US$ Million), By End-User, 2018 to 2022

Table 36: Asia Pacific Market Value (US$ Million), By End-User, 2023 to 2033

Table 37: Asia Pacific Market Value (US$ Million), By Ventilation, 2018 to 2022

Table 38: Asia Pacific Market Value (US$ Million), By Ventilation, 2023 to 2033

Table 39: Asia Pacific Market, By Country, 2018 to 2022

Table 40: Asia Pacific Market, By Country, 2023 to 2033

Table 41: MEA Market Value (US$ Million), By Product Type, 2018 to 2022

Table 42: MEA Market Value (US$ Million), By Product Type, 2023 to 2033

Table 43: MEA Market Value (US$ Million), By End-User, 2018 to 2022

Table 44: MEA Market Value (US$ Million), By End-User, 2023 to 2033

Table 45: MEA Market Value (US$ Million), By Ventilation, 2018 to 2022

Table 46: MEA Market Value (US$ Million), By Ventilation, 2023 to 2033

Table 47: MEA Market, By Country, 2018 to 2022

Table 48: MEA Market, By Country, 2023 to 2033

Table 49: Global Market Incremental $ Opportunity, By Product Type, 2018 to 2022

Table 50: Global Market Incremental $ Opportunity, By End-User, 2023 to 2033

Table 51: Global Market Incremental $ Opportunity, By Ventilation, 2018 to 2022

Table 52: Global Market Incremental $ Opportunity, By Region, 2023 to 2033

Table 53: North America Market Incremental $ Opportunity, By Product Type, 2018 to 2022

Table 54: North America Market Incremental $ Opportunity, By End-User, 2023 to 2033

Table 55: North America Market Incremental $ Opportunity, By Ventilation, 2018 to 2022

Table 56: North America Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 57: Latin America Market Incremental $ Opportunity, By Product Type, 2018 to 2022

Table 58: Latin America Market Incremental $ Opportunity, By End-User, 2023 to 2033

Table 59: Latin America Market Incremental $ Opportunity, By Ventilation, 2018 to 2022

Table 60: Latin America Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 61: Europe Market Incremental $ Opportunity, By Product Type, 2018 to 2022

Table 62: Europe Market Incremental $ Opportunity, By End-User, 2023 to 2033

Table 63: Europe Market Incremental $ Opportunity, By Ventilation, 2018 to 2022

Table 64: Europe Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 65: Asia Pacific Market Incremental $ Opportunity, By Product Type, 2018 to 2022

Table 66: Asia Pacific Market Incremental $ Opportunity, By End-User, 2023 to 2033

Table 67: Asia Pacific Market Incremental $ Opportunity, By Ventilation, 2018 to 2022

Table 68: Asia Pacific Market Incremental $ Opportunity, By Country, 2023 to 2033

Table 69: MEA Market Incremental $ Opportunity, By Product Type, 2018 to 2022

Table 70: MEA Market Incremental $ Opportunity, By End-User, 2023 to 2033

Table 71: MEA Market Incremental $ Opportunity, By Ventilation, 2018 to 2022

Table 72: MEA Market Incremental $ Opportunity, By Country, 2023 to 2033

Figure 1: Global Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 2: Global Market Absolute $ Historical Gain (2018 to 2022) and Opportunity (2023 to 2033), US$ Million

Figure 3: Global Market Share, By Product Type, 2023 & 2033

Figure 4: Global Market Y-o-Y Growth Projections, By Product Type - 2023 to 2033

Figure 5: Global Market Attractiveness Index, By Product Type - 2023 to 2033

Figure 6: Global Market Share, By End-User, 2023 & 2033

Figure 7: Global Market Y-o-Y Growth Projections, By End-User - 2023 to 2033

Figure 8: Global Market Attractiveness Index, By End-User - 2023 to 2033

Figure 9: Global Market Share, By Ventilation, 2023 & 2033

Figure 10: Global Market Y-o-Y Growth Projections, By Ventilation - 2023 to 2033

Figure 11: Global Market Attractiveness Index, By Ventilation - 2023 to 2033

Figure 12: Global Market Share, By Region, 2023 & 2033

Figure 13: Global Market Y-o-Y Growth Projections, By Region - 2023 to 2033

Figure 14: Global Market Attractiveness Index, By Region - 2023 to 2033

Figure 15: North America Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 16: North America Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 17: North America Market Share, By Product Type, 2023 & 2033

Figure 18: North America Market Y-o-Y Growth Projections, By Product Type - 2023 to 2033

Figure 19: North America Market Attractiveness Index, By Product Type - 2023 to 2033

Figure 20: North America Market Share, By End-User, 2023 & 2033

Figure 21: North America Market Y-o-Y Growth Projections, By End-User - 2023 to 2033

Figure 22: North America Market Attractiveness Index, By End-User - 2023 to 2033

Figure 23: North America Market Share, By Ventilation, 2023 & 2033

Figure 24: North America Market Y-o-Y Growth Projections, By Ventilation - 2023 to 2033

Figure 25: North America Market Attractiveness Index, By Ventilation - 2023 to 2033

Figure 26: North America Market Share, By Country, 2023 & 2033

Figure 27: North America Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 28: North America Market Attractiveness Index, By Country - 2023 to 2033

Figure 29: Latin America Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 30: Latin America Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 31: Latin America Market Share, By Product Type, 2023 & 2033

Figure 32: Latin America Market Y-o-Y Growth Projections, By Product Type - 2023 to 2033

Figure 33: Latin America Market Attractiveness Index, By Product Type - 2023 to 2033

Figure 34: Latin America Market Share, By End-User, 2023 & 2033

Figure 35: Latin America Market Y-o-Y Growth Projections, By End-User - 2023 to 2033

Figure 36: Latin America Market Attractiveness Index, By End-User - 2023 to 2033

Figure 37: Latin America Market Share, By Ventilation, 2023 & 2033

Figure 38: Latin America Market Y-o-Y Growth Projections, By Ventilation - 2023 to 2033

Figure 39: Latin America Market Attractiveness Index, By Ventilation - 2023 to 2033

Figure 40: Latin America Market Share, By Country, 2023 & 2033

Figure 41: Latin America Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 42: Latin America Market Attractiveness Index, By Country - 2023 to 2033

Figure 43: Europe Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 44: Europe Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 45: Europe Market Share, By Product Type, 2023 & 2033

Figure 46: Europe Market Y-o-Y Growth Projections, By Product Type - 2023 to 2033

Figure 47: Europe Market Attractiveness Index, By Product Type - 2023 to 2033

Figure 48: Europe Market Share, By End-User, 2023 & 2033

Figure 49: Europe Market Y-o-Y Growth Projections, By End-User - 2023 to 2033

Figure 50: Europe Market Attractiveness Index, By End-User - 2023 to 2033

Figure 51: Europe Market Share, By Ventilation, 2023 & 2033

Figure 52: Europe Market Y-o-Y Growth Projections, By Ventilation - 2023 to 2033

Figure 53: Europe Market Attractiveness Index, By Ventilation - 2023 to 2033

Figure 54: Europe Market Share, By Country, 2023 & 2033

Figure 55: Europe Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 56: Europe Market Attractiveness Index, By Country - 2023 to 2033

Figure 57: MEA Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 58: MEA Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 59: MEA Market Share, By Product Type, 2023 & 2033

Figure 60: MEA Market Y-o-Y Growth Projections, By Product Type - 2023 to 2033

Figure 61: MEA Market Attractiveness Index, By Product Type - 2023 to 2033

Figure 62: MEA Market Share, By End-User, 2023 & 2033

Figure 63: MEA Market Y-o-Y Growth Projections, By End-User - 2023 to 2033

Figure 64: MEA Market Attractiveness Index, By End-User - 2023 to 2033

Figure 65: MEA Market Share, By Ventilation, 2023 & 2033

Figure 66: MEA Market Y-o-Y Growth Projections, By Ventilation - 2023 to 2033

Figure 67: MEA Market Attractiveness Index, By Ventilation - 2023 to 2033

Figure 68: MEA Market Share, By Country, 2023 & 2033

Figure 69: MEA Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 70: MEA Market Attractiveness Index, By Country - 2023 to 2033

Figure 71: Asia Pacific Market Value (US$ Million) and Year-on-Year Growth, 2018 to 2033

Figure 72: Asia Pacific Market Absolute $ Opportunity Historical (2018 to 2022) and Forecast Period (2023 to 2033), US$ Million

Figure 73: Asia Pacific Market Share, By Product Type, 2023 & 2033

Figure 74: Asia Pacific Market Y-o-Y Growth Projections, By Product Type - 2023 to 2033

Figure 75: Asia Pacific Market Attractiveness Index, By Product Type - 2023 to 2033

Figure 76: Asia Pacific Market Share, By End-User, 2023 & 2033

Figure 77: Asia Pacific Market Y-o-Y Growth Projections, By End-User - 2023 to 2033

Figure 78: Asia Pacific Market Attractiveness Index, By End-User - 2023 to 2033

Figure 79: Asia Pacific Market Share, By Ventilation, 2023 & 2033

Figure 80: Asia Pacific Market Y-o-Y Growth Projections, By Ventilation - 2023 to 2033

Figure 81: Asia Pacific Market Attractiveness Index, By Ventilation - 2023 to 2033

Figure 82: Asia Pacific Market Share, By Country, 2023 & 2033

Figure 83: Asia Pacific Market Y-o-Y Growth Projections, By Country - 2023 to 2033

Figure 84: Asia Pacific Market Attractiveness Index, By Country - 2023 to 2033

Figure 85: US Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 86: US Market Share, By Product Type, 2022

Figure 87: US Market Share, By End-User, 2022

Figure 88: US Market Share, By Ventilation, 2022

Figure 89: Canada Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 90: Canada Market Share, By Product Type, 2022

Figure 91: Canada Market Share, By End-User, 2022

Figure 92: Canada Market Share, By Ventilation, 2022

Figure 93: Brazil Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 94: Brazil Market Share, By Product Type, 2022

Figure 95: Brazil Market Share, By End-User, 2022

Figure 96: Brazil Market Share, By Ventilation, 2022

Figure 97: Mexico Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 98: Mexico Market Share, By Product Type, 2022

Figure 99: Mexico Market Share, By End-User, 2022

Figure 100: Mexico Market Share, By Ventilation, 2022

Figure 101: Germany Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 102: Germany Market Share, By Product Type, 2022

Figure 103: Germany Market Share, By End-User, 2022

Figure 104: Germany Market Share, By Ventilation, 2022

Figure 105: United Kingdom Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 106: United Kingdom Market Share, By Product Type, 2022

Figure 107: United Kingdom Market Share, By End-User, 2022

Figure 108: United Kingdom Market Share, By Ventilation, 2022

Figure 109: France Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 110: France Market Share, By Product Type, 2022

Figure 111: France Market Share, By End-User, 2022

Figure 112: France Market Share, By Ventilation, 2022

Figure 113: Italy Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 114: Italy Market Share, By Product Type, 2022

Figure 115: Italy Market Share, By End-User, 2022

Figure 116: Italy Market Share, By Ventilation, 2022

Figure 117: BENELUX Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 118: BENELUX Market Share, By Product Type, 2022

Figure 119: BENELUX Market Share, By End-User, 2022

Figure 120: BENELUX Market Share, By Ventilation, 2022

Figure 121: Nordic Countries Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 122: Nordic Countries Market Share, By Product Type, 2022

Figure 123: Nordic Countries Market Share, By End-User, 2022

Figure 124: Nordic Countries Market Share, By Ventilation, 2022

Figure 125: China Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 126: China Market Share, By Product Type, 2022

Figure 127: China Market Share, By End-User, 2022

Figure 128: China Market Share, By Ventilation, 2022

Figure 129: Japan Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 130: Japan Market Share, By Product Type, 2022

Figure 131: Japan Market Share, By End-User, 2022

Figure 132: Japan Market Share, By Ventilation, 2022

Figure 133: South Korea Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 134: South Korea Market Share, By Product Type, 2022

Figure 135: South Korea Market Share, By End-User, 2022

Figure 136: South Korea Market Share, By Ventilation, 2022

Figure 137: GCC Countries Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 138: GCC Countries Market Share, By Product Type, 2022

Figure 139: GCC Countries Market Share, By End-User, 2022

Figure 140: GCC Countries Market Share, By Ventilation, 2022

Figure 141: South Africa Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 142: South Africa Market Share, By Product Type, 2022

Figure 143: South Africa Market Share, By End-User, 2022

Figure 144: South Africa Market Share, By Ventilation, 2022

Figure 145: Turkey Market Value (US$ Million) and Forecast, 2023 to 2033

Figure 146: Turkey Market Share, By Product Type, 2022

Figure 147: Turkey Market Share, By End-User, 2022

Figure 148: Turkey Market Share, By Ventilation, 2022

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Mechanical Shaft Seal Market Size and Share Forecast Outlook 2025 to 2035

Mechanical And Electronic Fuzes Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Reciprocating Engine Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Mechanical Locks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Mechanical Coil Tester Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Mechanical Performance Tuning Components Market Growth - Trends & Forecast 2025 to 2035

Mechanical Seals Market Growth - Trends & Forecast 2025 to 2035

Understanding Market Share Trends in the Mechanical Locks Industry

Mechanical Keyboard Market

Electromechanical Timers Market Size and Share Forecast Outlook 2025 to 2035

Bicycle Mechanical Disc Brake Market Size and Share Forecast Outlook 2025 to 2035

Dynamic Mechanical Analyzer Market

Chemical Mechanical Planarization Market Growth – Size & Forecast 2025 to 2035

Nanoelectromechanical Systems (NEMS) Market - Trends & Forecast 2025 to 2035

Micro-electromechanical System (MEMS) Market Size and Share Forecast Outlook 2025 to 2035

Micro-Electro Mechanical Systems Market Size and Share Forecast Outlook 2025 to 2035

High Precision Mechanical Machine Components Market Size and Share Forecast Outlook 2025 to 2035

Ventilator Market Size and Share Forecast Outlook 2025 to 2035

Medical Ventilators Market - Growth, Innovations & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA