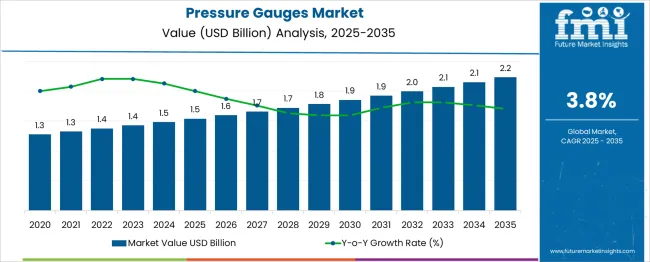

The Pressure Gauges Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period. From 2025 to 2030, the market is expected to expand from USD 1.5 billion to USD 1.9 billion, reflecting steady growth driven by rising demand for process monitoring in industries such as oil & gas, manufacturing, and power generation.

Year-on-year analysis shows gradual progress, with values reaching USD 1.6 billion in 2026 and USD 1.7 billion in 2027, supported by the adoption of precision instruments in critical applications. By 2028, the market is forecasted to hit USD 1.7 billion, advancing to USD 1.8 billion in 2029 and USD 1.9 billion by 2030. Growth will likely be reinforced by the increasing integration of digital pressure gauges for real-time data monitoring and predictive maintenance. Technological advancements in wireless connectivity and compatibility with IoT-based systems are expected to enhance operational efficiency further. These dynamics position pressure gauges as an essential component for industrial safety and performance optimization, offering opportunities for innovation in accuracy, durability, and smart functionality across multiple sectors.

| Metric | Value |

|---|---|

| Pressure Gauges Market Estimated Value in (2025 E) | USD 1.5 billion |

| Pressure Gauges Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The pressure gauges market represents a key subset within several industrial and process control sectors. In the Industrial Measurement and Instrumentation Market, it accounts for approximately 6%, as sensors, transmitters, and flow meters dominate overall demand. Within the Process Control Equipment Market, its share is about 5%, since pressure gauges remain essential for monitoring and maintaining operational safety. For the Oil and Gas Equipment Market, it contributes nearly 4%, supporting applications in drilling, refining, and pipeline systems. In the Manufacturing and Automation Equipment Market, its share is close to 3%, as gauges play a critical role in hydraulic and pneumatic systems.

Within the HVAC and Fluid Handling Systems Market, pressure gauges represent roughly 7%, driven by demand for monitoring performance in heating, cooling, and water systems. Growth is propelled by the need for precise pressure monitoring in critical processes, safety compliance across industries, and rising adoption of advanced gauge technologies such as digital and wireless variants. Expanding infrastructure projects, energy sector investments, and industrial automation are further driving adoption. Despite growing integration of electronic sensors, mechanical pressure gauges continue to hold relevance due to durability, cost-effectiveness, and reliability, ensuring their continued importance in industrial and utility applications globally.

The pressure gauges market is witnessing a structural transformation due to rising demand for precise monitoring in industrial automation, energy systems, and safety-critical environments. Technological advancements in digital instrumentation are supporting growth, expanded manufacturing capacity in developing economies, and rising compliance with pressure safety regulations across sectors.

Increased digitization of operations and demand for real-time pressure tracking in sectors like oil & gas, water treatment, and pharmaceuticals are reshaping traditional product preferences. Furthermore, stainless steel-based gauges are gaining traction due to their chemical resistance and durability in corrosive environments. Investments in R&D and product innovation, along with infrastructure development in emerging economies, are expected to unlock future growth opportunities in this segment.

The pressure gauges market is segmented by product type, technology, material, end use, distribution channel, and geographic regions. The pressure gauges market is divided by product type into Digital pressure gauges and Analog pressure gauges. In terms of technology, the pressure gauges market is classified into Bourdon tube pressure gauges, Diaphragm pressure gauges, Capsule pressure gauges, Absolute pressure gauges, Piezometer pressure gauges, and Others (Bellows, manometer, differential). Based on the material, the pressure gauges market is segmented into Stainless steel, Brass, Aluminum, Plastic, and Others (steel, copper, bronze, etc.). The end use of the pressure gauges market is segmented into Oil & gas, Chemical & petrochemical, Energy & power, Pharmaceutical, Water & wastewater treatment, and Others (aerospace, automotive, etc.). The distribution channel of the pressure gauges market is segmented into Offline and Online. Regionally, the pressure gauges industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

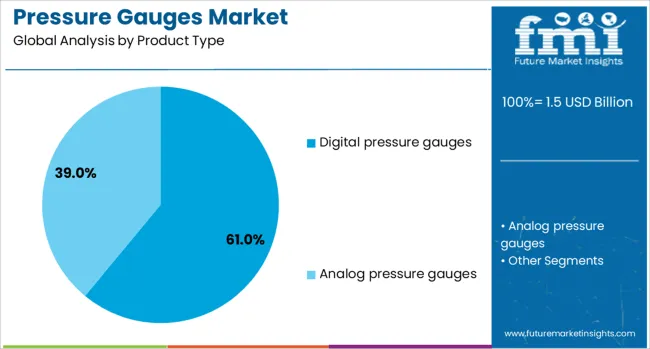

Digital pressure gauges are projected to account for 61.0% of the total market share by 2025, making them the leading product type. Their dominance has been driven by enhanced accuracy, ease of calibration, and compatibility with industrial IoT platforms.

These gauges offer real-time readings, data logging capabilities, and multi-unit display features, which are increasingly required in modern industrial systems. The integration of diagnostics and wireless connectivity supports predictive maintenance strategies, reducing downtime and improving operational safety.

Digital gauges have also become more affordable and ruggedized for field use, increasing their adoption across energy, chemical, and water industries.

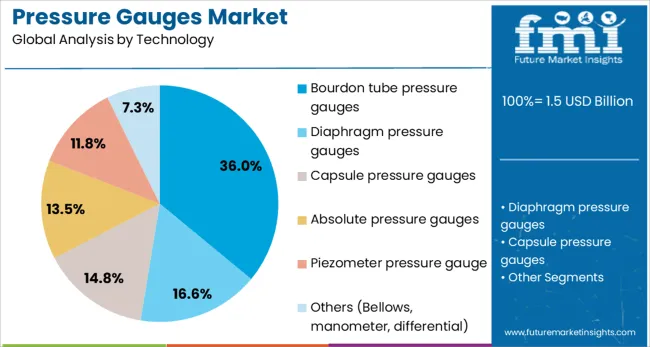

The Bourdon tube pressure gauge segment is expected to hold 36.0% market share in 2025, maintaining its relevance through mechanical simplicity and cost-efficiency. This segment's growth is supported by its reliability in static and dynamic pressure applications where power independence is critical.

Industries such as HVAC, hydraulics, and basic mechanical systems continue to prefer Bourdon tube technology for its proven design and longevity. Recent enhancements in casing and dial materials have also improved environmental resistance, making these gauges viable in semi-harsh conditions.

Despite digital expansion, demand for analog instruments like Bourdon tube gauges remains steady in infrastructure projects and legacy equipment maintenance.

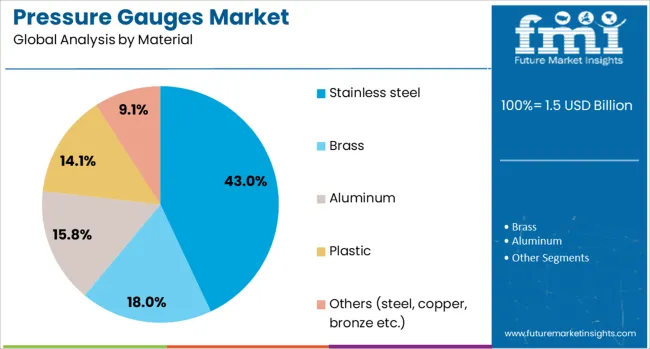

Stainless steel is projected to lead by material, holding a 43.0% market share in 2025. Its rise in demand is closely linked to requirements for durability, corrosion resistance, and hygiene compliance in sectors such as petrochemicals, marine, pharmaceuticals, and food processing.

Stainless steel pressure gauges are preferred in environments where exposure to moisture, chemicals, or extreme temperatures could compromise performance. Their structural integrity supports longer operational life, reducing the total cost of ownership.

As industries increase safety standards and regulatory scrutiny intensifies, stainless steel’s resilience and compatibility with sanitary applications are expected to boost its adoption further.

In 2024 and 2025, expansion in sectors such as oil and gas, water treatment, and manufacturing significantly contributed to higher adoption rates. Opportunities are prominent in smart gauges with digital displays and integration capabilities for Industry 4.0 systems. Key trends include compact gauge designs, wireless connectivity for remote monitoring, and extended product durability under extreme conditions. However, restraints include high calibration costs, competition from electronic sensors, and limited standardization across diverse applications.

The primary growth driver is the rising demand for accurate pressure monitoring in automated industrial environments. In 2024 and 2025, oil and gas companies adopted robust mechanical gauges for pipeline pressure checks, while the chemical industry relied on precision gauges for corrosion-prone systems. Water treatment facilities integrated gauges for operational safety and efficiency. Automotive manufacturing also contributed to adoption, as pressure control in braking and hydraulic systems became a critical quality requirement. These developments underscore the importance of reliability and accuracy in sustaining the global pressure gauge market.

Significant opportunities exist in advanced pressure gauge technologies that integrate digital capabilities. In 2025, smart gauges equipped with wireless communication and data logging features gained popularity among industrial operators seeking predictive maintenance solutions. Remote monitoring enabled by IoT connectivity allowed real-time performance tracking, reducing downtime and maintenance costs. Demand for explosion-proof gauges in oil refineries and mining environments also created specialized product opportunities. These factors indicate that manufacturers developing high-performance, connectivity-driven solutions are positioned to capture substantial market share in critical process industries worldwide.

Emerging trends center on the development of compact pressure gauges and wireless-enabled monitoring systems. In 2024, manufacturers introduced rugged gauges with enhanced corrosion resistance for offshore oil platforms and chemical plants. Digital hybrid models combining analog displays with electronic sensors became increasingly common for dual functionality. Additionally, integration of gauges into automated control systems for smart factories emerged as a standard practice in advanced manufacturing facilities. These innovations reflect a growing emphasis on portability, connectivity, and long-term reliability in high-pressure applications across industrial sectors.

Calibration complexities and rising competition from electronic pressure sensors primarily drive market restraints. In 2024 and 2025, frequent recalibration requirements for mechanical gauges increased operational costs, particularly in industries with high safety compliance standards. Electronic sensors offering faster response times and seamless integration with digital platforms gained preference in several sectors, reducing mechanical gauge adoption. Additionally, the lack of standardized specifications across regions complicated procurement decisions. These limitations highlight the necessity for cost-effective calibration solutions and product differentiation strategies to maintain relevance in a competitive instrumentation market.

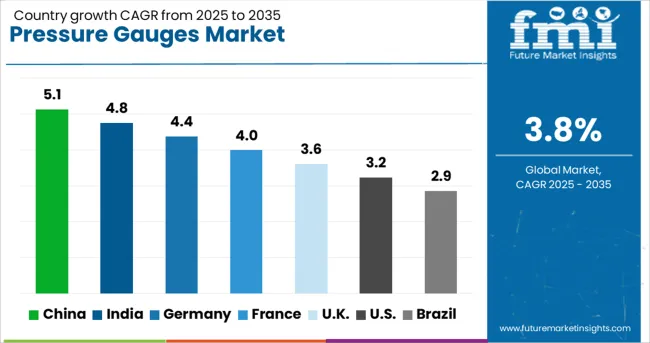

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

The global pressure gauges market is projected to grow at 3.8% CAGR from 2025 to 2035. China leads at 5.1% CAGR, driven by rapid industrialization and increased deployment in energy and manufacturing sectors. India follows at 4.8%, supported by robust growth in chemical processing and infrastructure development. Germany records 4.4% CAGR, emphasizing precision instruments for industrial automation and compliance with EU safety norms. The United Kingdom grows at 3.6%, while the United States posts 3.2%, reflecting steady adoption in mature markets with strong demand for digital and smart gauges. Asia-Pacific dominates growth due to expanding manufacturing bases, while Europe and North America prioritize advanced sensor integration and predictive monitoring. This report includes insights on 40+ countries; the top markets are shown here for reference.

The pressure gauges market in China is forecasted to grow at 5.1% CAGR, supported by the expansion of energy, petrochemical, and heavy machinery sectors. Rising demand for high-accuracy pressure measurement in refineries and power plants boosts market growth. Local manufacturers scale up production of cost-effective analog gauges, while global brands launch advanced digital models with wireless monitoring capabilities for industrial automation systems. Infrastructure projects and regulatory focus on workplace safety further reinforce market adoption.

The pressure gauges market in India is projected to grow at 4.8% CAGR, driven by strong growth in process industries such as chemicals, pharmaceuticals, and food processing. Increased investment in oil and gas exploration creates significant demand for rugged, high-pressure gauges. Manufacturers focus on developing low-maintenance models designed for extreme climatic conditions. Government initiatives promoting industrial safety encourage the adoption of gauges with advanced safety features. Digital transformation trends further stimulate interest in IoT-integrated gauges for predictive maintenance.

The pressure gauges market in Germany is expected to grow at 4.4% CAGR, supported by high standards of industrial safety and technological innovation. Demand for smart gauges integrated with digital sensors accelerates in automotive, aerospace, and manufacturing sectors. Manufacturers invest in research for energy-efficient and compact pressure monitoring devices suitable for Industry 4.0 environments. Stringent EU compliance regulations foster adoption of gauges with real-time data analytics capabilities for critical industrial processes.

The pressure gauges market in the United Kingdom is forecasted to grow at 3.6% CAGR, driven by the modernization of infrastructure and steady demand in the oil, gas, and marine sectors. Increased adoption of hybrid gauges combining analog reliability with digital display features enhances operational efficiency. Manufacturers emphasize compliance with safety and environmental standards to meet industrial requirements. Growth in offshore wind energy projects further promotes usage of advanced gauges capable of operating in harsh environments.

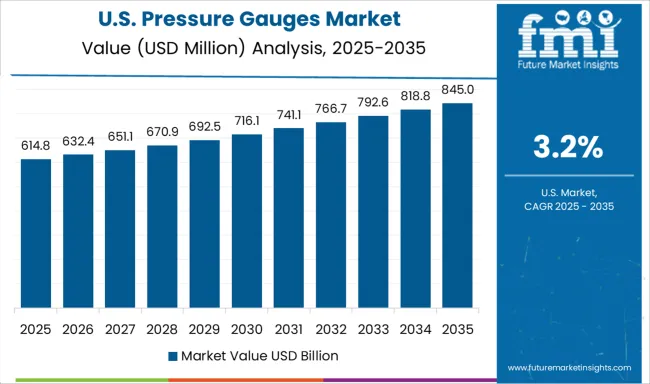

The pressure gauges market in the United States is projected to grow at 3.2% CAGR, reflecting steady demand in a mature industrial ecosystem. Adoption of IoT-enabled pressure gauges for predictive analytics expands in oil & gas, power generation, and HVAC applications. Manufacturers prioritize gauges with enhanced connectivity features for integration with SCADA systems. Sustainability initiatives accelerate interest in energy-efficient designs with low environmental impact. Aftermarket opportunities grow in replacement of legacy equipment across refineries and chemical plants.

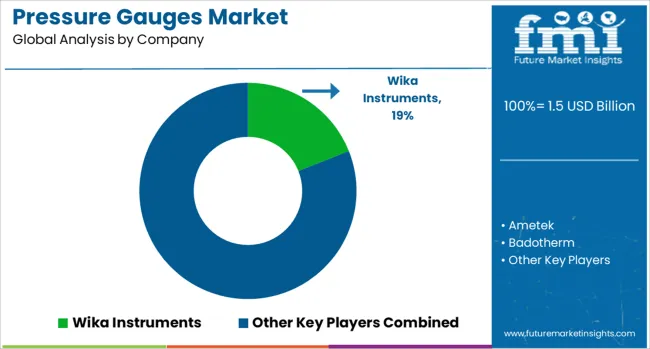

The pressure gauges market is dominated by WIKA Instruments, which secures its leadership through a comprehensive range of mechanical and digital pressure measurement solutions serving industrial, process, and OEM applications. WIKA’s dominance is reinforced by its global manufacturing footprint, strong technical expertise, and innovation in smart gauge technologies that integrate with IoT-enabled monitoring systems. Key players such as Emerson, Honeywell International, Ametek, Fluke Corporation, and Omega Engineering hold significant market shares by offering high-accuracy gauges designed for harsh environments and critical process applications. These companies focus on product reliability, compliance with international standards, and advanced features such as wireless connectivity and remote calibration for enhanced operational efficiency. Emerging players including Badotherm, Circor, Dwyer, Winters Instruments, Kobold Instruments, Newbow, and QED Aerospace are strengthening their presence through specialized gauges for niche industries like aerospace, oil and gas, and water treatment. Their strategies include offering cost-effective solutions, customization options, and expanding regional distribution to cater to diverse end-user requirements. Market growth is driven by rising demand for process automation, safety compliance across industrial sectors, and the growing adoption of digital pressure monitoring in predictive maintenance programs. Technological advancements such as integrated sensors and cloud-based monitoring are expected to further shape competitive dynamics, creating opportunities for both established and emerging suppliers globally.

In June 2025, Crane Co. revealed its plan to acquire Baker Hughes’ Precision Sensors & Instrumentation (PSI) unit for an estimated USD 1.06–1.15 billion. The acquisition, including brands such as Druck and Panametric, aims to enhance Crane’s pressure and sensor technology portfolio, with completion targeted for late 2025 or early 2026.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Product Type | Digital pressure gauges and Analog pressure gauges |

| Technology | Bourdon tube pressure gauges, Diaphragm pressure gauges, Capsule pressure gauges, Absolute pressure gauges, Piezometer pressure gauge, and Others (Bellows, manometer, differential) |

| Material | Stainless steel, Brass, Aluminum, Plastic, and Others (steel, copper, bronze etc.) |

| End Use | Oil & gas, Chemical & petrochemical, Energy & power, Pharmaceutical, Water & wastewater treatment, and Others (aerospace, automotive, etc.) |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wika Instruments, Ametek, Badotherm, Circor, Dwyer, Emerson, Fluke Corporation, Honeywell International, Kobold Instruments, Newbow, Omega Engineering, QED Aerospace, and Winters Instruments |

| Additional Attributes | Dollar sales by gauge type (analog, digital, differential, transducer) and distribution channel (OEM, industrial supply, e-commerce). Key industries include oil & gas, manufacturing, HVAC, automotive. Asia-Pacific fastest growth; North America steady. Buyers demand IoT-enabled wireless gauges, predictive analytics, and certified calibration. Innovations include cloud-linked monitoring and advanced pressure-sensing materials. |

The global pressure gauges market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the pressure gauges market is projected to reach USD 2.2 billion by 2035.

The pressure gauges market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in pressure gauges market are digital pressure gauges and analog pressure gauges.

In terms of technology, bourdon tube pressure gauges segment to command 36.0% share in the pressure gauges market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Filled Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Dressing Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Hydraulic Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Switch Market Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Volume Loop Systems Market Size and Share Forecast Outlook 2025 to 2035

Pressure Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Pressure Monitoring Extension Tubing Sets Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Pressure Bandages Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Sensitive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Controlled Vacuum Sealers Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Tapes and Labels Market Size, Share & Forecast 2025 to 2035

Pressure Infusion Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Pressure Ulcer Detection Devices Market Trends – Growth & Forecast 2025 to 2035

Pressure Cushions Market Trends - Growth, Size & Forecast 2025 to 2035

Pressure Infusion Cuffs Market Growth – Trends & Future Outlook 2024-2034

Pressure Cookers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA