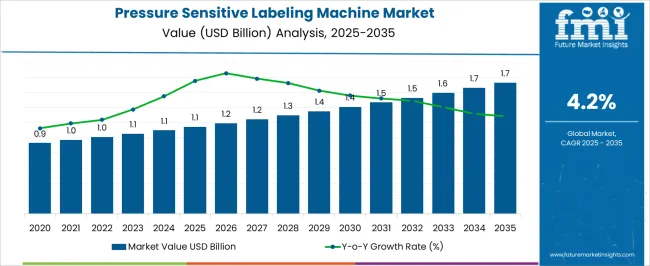

The Pressure Sensitive Labeling Machine Market is expected to show a steady yet moderate growth trajectory from an estimated value of USD 1.1 billion in 2025 to USD 1.7 billion by 2035. The forecasted compound annual growth rate (CAGR) of 4.2% reflects a consistent but gradual increase in market size over the decade. Analyzing the yearly values, the market starts at USD 1.1 billion in 2025 and grows to USD 1.2 billion in the next two years, indicating a slow initial rise.

The market then progresses steadily through the mid-period, reaching USD 1.4 billion by 2029 and USD 1.5 billion around 2031. Growth continues incrementally, culminating at USD 1.7 billion in 2035. The market growth curve suggests a linear shape, indicating stable expansion without sharp spikes or declines.

This pattern points to consistent demand influenced by steady industrial adoption, technological improvements, and moderate increases in labeling machine automation. This steady upward curve signals reduced volatility, appealing to investors and stakeholders seeking predictable returns. The market does not exhibit rapid acceleration or saturation signs but instead reflects measured progress driven by gradual process enhancements and demand in sectors requiring pressure sensitive labeling. The market shape highlights reliable growth, emphasizing steady market share gains and minimal fluctuations over the forecast period.

| Metric | Value |

|---|---|

| Pressure Sensitive Labeling Machine Market Estimated Value in (2025 E) | USD 1.1 billion |

| Pressure Sensitive Labeling Machine Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The pressure sensitive labeling machine market is experiencing steady expansion, driven by increasing demand for high-speed packaging lines, regulatory labeling compliance, and packaging line automation across industries. The rise of e-commerce, FMCG, and pharmaceutical sectors has heightened the requirement for consistent, high-precision labeling solutions that reduce downtime and ensure traceability.

Investments in next-generation labeling technologies are being supported by manufacturers' focus on throughput efficiency, integration with smart control systems, and reduced human intervention. Advancements in servo-controlled motion, touchless applicator technology, and multi-surface adaptability have made pressure sensitive systems essential for both rigid and flexible packaging formats.

Looking ahead, the market is poised to benefit from the shift toward modular, energy-efficient machines and the integration of IoT-enabled diagnostics, supporting predictive maintenance and productivity tracking in high-volume production environments.

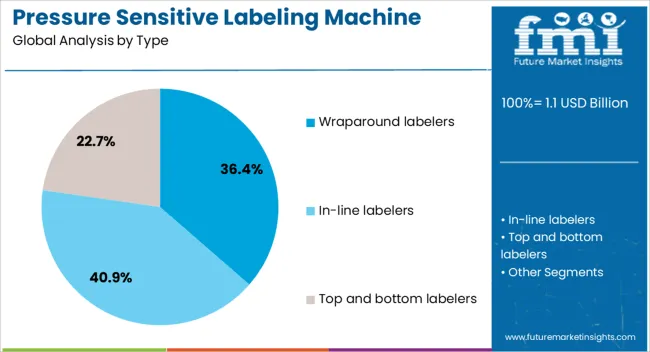

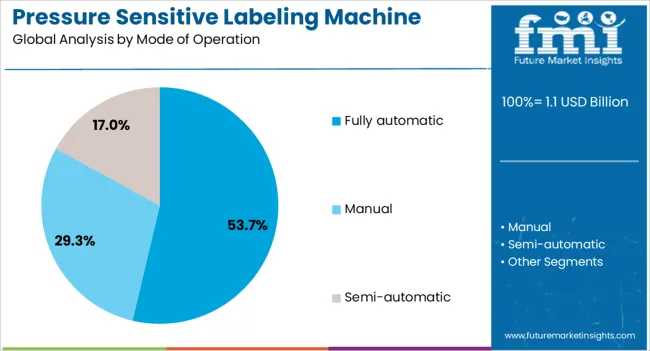

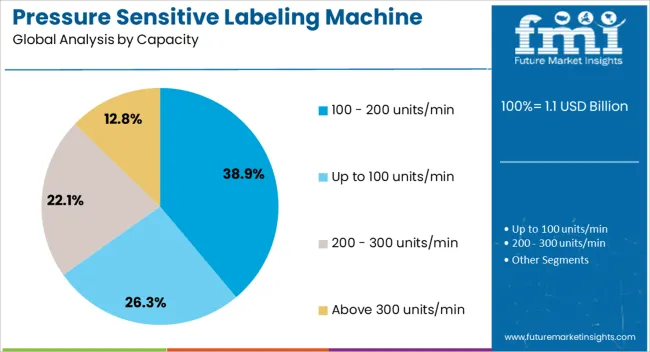

The pressure sensitive labeling machine market is segmented by type, mode of operation, capacity, material type, end-use industry, distribution channel, and geographic regions. By type, the market is divided into Wraparound Labelers, In-line Labelers, and Top & Bottom Labelers. In terms of mode of operation, the market is classified into Fully Automatic, Semi-automatic, and Manual. Based on capacity, the market is segmented into Up to 100 Units/Min, 100–200 Units/Min, 200–300 Units/Min, and Above 300 Units/Min. By material type, the market is categorized into Plastic, Glass, Paper, Metal, and Others (such as Cardboard). By end-use industry, the market is segmented into Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Logistics & Supply Chain, Consumer Electronics, and Others (such as Nutraceuticals & Vitamins). By distribution channel, the market is divided into Direct Sales and Indirect Sales. Regionally, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Wraparound labelers are expected to account for 36.4% of the total market revenue in 2025, making them the leading type of pressure sensitive labeling machines. This leadership is being driven by their compatibility with cylindrical containers commonly used in beverages, cosmetics, and chemicals.

These systems offer 360-degree label application with high accuracy and minimal misalignment, making them well-suited for production environments requiring high throughput and precision. Their ease of integration into existing packaging lines and low maintenance needs have made them the preferred choice for manufacturers seeking reliable performance.

Additionally, the ability to apply full-wrap labels for branding and compliance has positioned wraparound labelers as essential equipment in competitive product categories where packaging aesthetics and information density are critical.

Fully automatic machines are projected to contribute 53.7% of the total revenue share by 2025, leading the market based on mode of operation. The preference for this segment is being influenced by the need for high-speed, low-error labeling in large-scale operations.

Fully automatic systems minimize labor dependency, improve consistency, and support continuous operation across multiple shifts. Their ability to integrate with conveyors, printers, vision inspection systems, and reject stations has enhanced their utility in quality-controlled environments.

Manufacturers have increasingly adopted fully automatic machines to meet regulatory standards while maintaining operational efficiency. As industries emphasize traceability and error reduction, fully automatic systems offer the scalability and integration readiness required to meet evolving packaging demands.

Labeling machines with a capacity range of 100 to 200 units per minute are expected to hold 38.9% of the overall market share in 2025, positioning this as the dominant throughput category. This capacity range offers an optimal balance between speed and operational control, catering to medium and large manufacturers across food, beverage, and healthcare sectors.

It allows for efficient processing without the complexity and cost associated with ultra-high-speed systems. The segment’s strength lies in its adaptability to various packaging formats and product sizes, while maintaining consistent labeling accuracy.

As demand rises for versatile and semi-custom packaging lines, machines in this range offer the right mix of output and footprint, making them ideal for rapidly changing production environments and batch-size flexibility.

The market has expanded significantly due to the increasing demand for efficient, flexible, and high-speed labeling solutions across diverse industries. These machines apply self-adhesive labels to various product surfaces, enabling improved packaging aesthetics, traceability, and brand recognition. Rising packaging volumes in food and beverage, pharmaceuticals, cosmetics, and logistics sectors have accelerated market growth.

Technological advancements in automation, sensor integration, and customizable labeling formats have enhanced machine precision and operational efficiency. Despite market potential, challenges such as high initial costs and the need for skilled operators persist.

The surge in global packaging activities has been a primary driver for pressure sensitive labeling machines. Industries such as food and beverage, pharmaceuticals, and personal care require fast, accurate, and adaptable labeling solutions to meet growing consumer demand and regulatory labeling standards. Pressure sensitive labeling machines offer advantages including quick changeover, minimal waste, and compatibility with various container shapes and materials.

Increasing e-commerce growth and the emphasis on product traceability and anti-counterfeiting measures have further boosted the need for precise labeling. The market benefits from packaging innovations and consumer preference for personalized and attractive labels, supporting consistent demand and adoption of advanced labeling machinery.

Recent advancements have improved the performance and versatility of pressure sensitive labeling machines. Integration of sensors, vision systems, and automated controls allows real-time quality inspection and precise label placement, reducing errors and waste. Modular designs enable easy customization and scalability, accommodating different label sizes, shapes, and production speeds.

User-friendly interfaces and software integration facilitate seamless operation and maintenance. Developments in servo motor technology have enhanced speed control and synchronization with packaging lines. These innovations increase productivity, reduce downtime, and support the adoption of sustainable practices by minimizing material waste, thereby strengthening the market position of pressure sensitive labeling machines.

Increasing regulatory requirements regarding product labeling, including ingredient disclosure, safety warnings, and barcode implementation, have heightened the demand for reliable labeling machinery. Pressure sensitive labeling machines support compliance by enabling accurate and consistent label application, crucial for industries like pharmaceuticals and food and beverage.

Traceability features such as serialization and variable data printing are increasingly integrated to combat counterfeiting and improve supply chain transparency. Compliance with environmental regulations also encourages the use of labeling technologies that minimize material waste and support recyclability. These factors have made pressure sensitive labeling machines indispensable for manufacturers aiming to meet legal standards and consumer expectations.

Despite benefits, the market growth of pressure sensitive labeling machines is constrained by relatively high capital investment and operational costs. Small and medium-sized enterprises may face budget limitations that restrict the adoption of advanced automated systems. Additionally, skilled labor is required to operate, maintain, and troubleshoot sophisticated machinery, creating a barrier in regions with workforce skill gaps.

Maintenance expenses and the need for periodic calibration also add to total cost of ownership. To mitigate these challenges, manufacturers are focusing on developing affordable, compact models with intuitive controls and remote support capabilities. Training programs and after-sales services are increasingly emphasized to enhance user competency and reduce downtime, facilitating wider market acceptance.

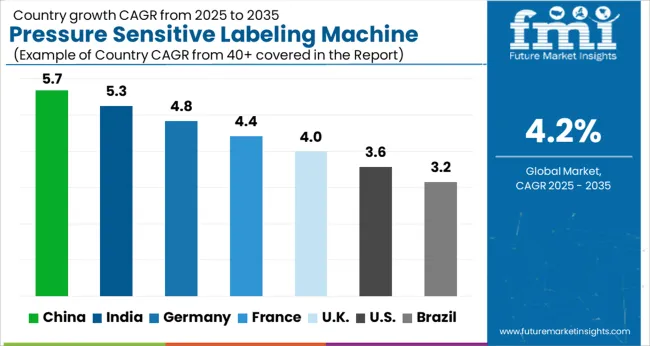

The market is projected to grow at a CAGR of 4.2% between 2025 and 2035, driven by increasing automation in packaging, rising demand for product customization, and advancements in labeling technologies. China leads with a 5.7% CAGR, supported by expanding packaging industries and manufacturing capabilities. India follows at 5.3%, fueled by growth in FMCG and pharmaceutical sectors requiring advanced labeling solutions. Germany, growing at 4.8%, benefits from technological innovation and precision engineering. The UK, at 4.0%, experiences steady demand in food and beverage packaging. The USA, with a 3.6% CAGR, reflects adoption of smart labeling and automation in packaging lines. This report includes insights on 40+ countries; the top markets are shown here for reference.

Sales of pressure sensitive labeling machines in China are expected to grow at a CAGR of 5.7% between 2025 and 2035, driven by increased automation in packaging and rising demand from food and beverage and pharmaceutical manufacturers. Domestic equipment manufacturers like Shanghai Yisheng and Shenzhen Meiyu have focused on developing high-speed, precise labeling systems to meet growing production line requirements. The integration of IoT-enabled quality control features and energy-efficient components is expanding adoption. Growing e-commerce and export activities further stimulate demand for efficient packaging solutions in the country.

The pressure sensitive labeling machine industry in India is anticipated to expand at a CAGR of 5.3% over 2025 to 2035, supported by modernization of packaging processes in FMCG and pharmaceutical sectors. Indian manufacturers such as Godrej and Uflex are enhancing product lines with flexible, modular systems catering to small and medium enterprises. Government initiatives promoting Make in India boost local manufacturing capacities. Demand from rising organized retail and food processing industries drives the need for reliable labeling solutions that improve speed and accuracy.

Germany is forecast to grow at a CAGR of 4.8% through 2035, led by strong industrial packaging standards and focus on precision engineering. Leading equipment manufacturers such as Krones and KHS are investing in smart labeling technologies with integrated vision systems for quality assurance. The demand is concentrated in the beverage, chemical, and pharmaceutical industries. Emphasis on energy efficiency and regulatory compliance supports market expansion. E-commerce and sustainability-driven packaging trends are driving innovation in labeling solutions.

The United Kingdom’s market is projected to grow at a CAGR of 4.0% over 2025 to 2035, with growth supported by increasing demand from food and pharmaceutical sectors. Market players are focusing on flexible and easy-to-integrate labeling systems to accommodate diverse product ranges. Increasing adoption of automated packaging lines in mid-sized manufacturers drives demand. Local manufacturers and international brands collaborate to offer customized solutions addressing regulatory and quality standards.

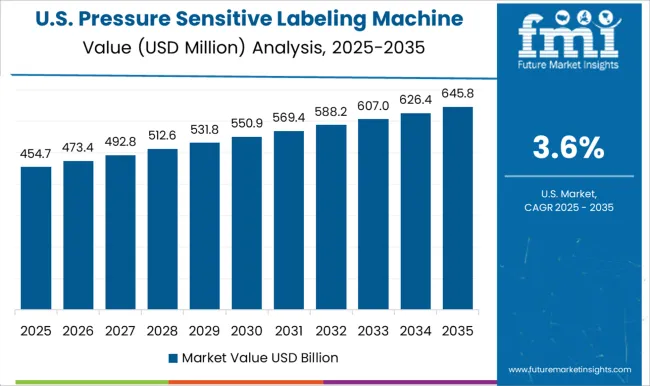

In the United States, sales of pressure sensitive labeling machines are expected to expand at a CAGR of 3.6% during 2025 to 2035, influenced by steady packaging automation investments in food, beverage, and healthcare industries. Leading suppliers such as Accraply and Label-Aire continue to innovate with high-speed labeling and modular designs to improve operational efficiency. Increasing regulations around packaging traceability and product safety further support adoption. Online retail growth is also pushing packaging innovations requiring adaptable labeling machinery.

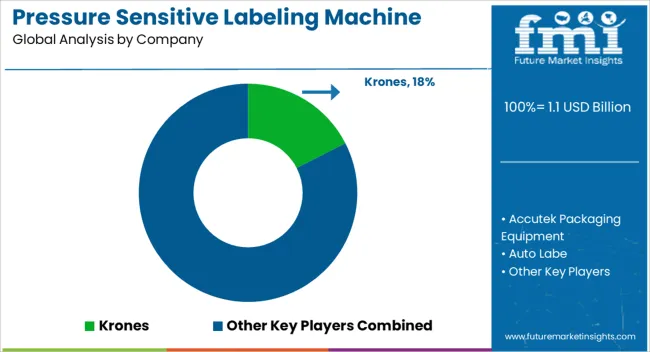

Krones leads the market with its comprehensive range of labeling machines known for high speed, precision, and adaptability across various packaging formats. Accutek Packaging Equipment and Auto Labe focus on modular designs that facilitate easy integration into existing production lines, emphasizing automation and user-friendly interfaces. Bhagwati Labelling Technologies and BW Integrated Systems provide tailored solutions for diverse industries, combining durability with flexible labeling capabilities.

CVC Technologies and Fuji Seal leverage decades of experience to deliver high-quality machines capable of handling complex labeling requirements, including variable data and specialty labels. GERNEP and Leva Packaging Equipment specialize in innovative labeling systems designed for small to medium-sized enterprises, balancing performance with cost efficiency. P.E. Labellers and Quadrel Labeling Systems emphasize precision and repeatability, addressing sectors such as pharmaceuticals and food and beverage.

Dollar sales by machine type and industry application, demand dynamics across food and beverage, pharmaceuticals, cosmetics, and logistics sectors, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in high-speed labeling, automatic quality inspection, and integration with smart packaging systems, environmental impact of energy use, consumable waste, and machine lifecycle, and emerging use cases in personalized product labeling, anti-counterfeiting features, and sustainable packaging initiatives.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Type | Wraparound labelers, In-line labelers, and Top and bottom labelers |

| Mode of Operation | Fully automatic, Manual, and Semi-automatic |

| Capacity | 100 - 200 units/min, Up to 100 units/min, 200 - 300 units/min, and Above 300 units/min |

| Material Type | Plastic, Glass, Paper, Metal, and Others (cardboard etc.) |

| End Use Industry | Food & beverages, Pharmaceutical, Cosmetics & personal care, Logistics and supply chain, Consumer electronics, and Others (nutraceuticals & vitamins etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Krones AG, Accutek Packaging Equipment, Auto Labe, Bhagwati Labelling Technologies, BW Integrated Systems, CVC Technologies, Fuji Seal International, GERNEP GmbH, Leva Packaging Equipment, P.E. Labellers, Quadrel Labeling Systems, SaintyCo, Sheapak, Tronics, Weber Packaging Solutions |

| Additional Attributes | Dollar sales by machine type and industry application, demand dynamics across food and beverage, pharmaceuticals, cosmetics, and logistics sectors, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in high-speed labeling, automatic quality inspection, and integration with smart packaging systems, environmental impact of energy use, consumable waste, and machine lifecycle, and emerging use cases in personalized product labeling, anti-counterfeiting features, and sustainable packaging initiatives. |

The global pressure sensitive labeling machine market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the pressure sensitive labeling machine market is projected to reach USD 1.7 billion by 2035.

The pressure sensitive labeling machine market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in pressure sensitive labeling machine market are wraparound labelers, in-line labelers and top and bottom labelers.

In terms of mode of operation, fully automatic segment to command 53.7% share in the pressure sensitive labeling machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pressure-Sensitive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Tapes and Labels Market Size, Share & Forecast 2025 to 2035

Slide Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automated Labeling Machines Market Size and Share Forecast Outlook 2025 to 2035

Electronic Pressure Sensitive Tape Dispenser Market

Silver Pressure Sintering Machine Market Size and Share Forecast Outlook 2025 to 2035

Shrink Sleeve Labeling Machine Size and Share Forecast Outlook 2025 to 2035

Ampoule Sticker Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Ampoule Sticker Labeling Machine Suppliers

Differential Pressure Casting Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Dressing Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Hydraulic Pump Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Switch Market Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA