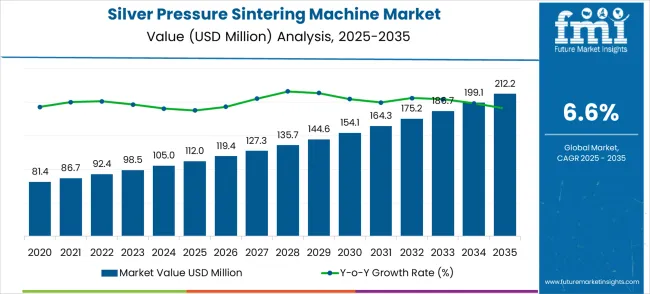

The global silver pressure sintering machine market is projected to reach USD 212.2 million by 2035, recording an absolute increase of USD 100.2 million over the forecast period. The market is valued at USD 112.0 million in 2025 and is set to rise at a CAGR of 6.6% during the assessment period. The market size is expected to grow by nearly 1.89 times during the same period, supported by increasing demand for advanced semiconductor packaging technologies, expanding power electronics applications, and growing adoption of high-performance LED manufacturing processes across global electronics manufacturing. Market expansion faces constraints from high equipment costs and technical complexity requirements in precision sintering applications.

Between 2025 and 2030, the silver pressure sintering machine market is projected to expand from USD 112.0 million to USD 154.1 million, resulting in a value increase of USD 42.1 million, which represents 42.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for advanced semiconductor packaging solutions, product innovation in fully automatic sintering systems and precision temperature control technologies, and expanding applications across power semiconductor devices and high-performance LED manufacturing sectors. Companies are establishing competitive positions through investment in automation technology development, strategic partnerships with semiconductor manufacturers, and market expansion across electronics manufacturing facilities, automotive electronics suppliers, and emerging electric vehicle component producers.

From 2030 to 2035, the market is forecast to grow from USD 154.1 million to USD 212.2 million, adding another USD 58.1 million, which constitutes 58.0% of the ten-year expansion. This period is expected to be characterized by expansion of specialized sintering solutions including multi-zone temperature control systems and Industry 4.0-integrated platforms tailored for specific semiconductor applications, strategic collaborations between equipment manufacturers and semiconductor technology developers, and enhanced integration with automated production lines and smart manufacturing systems. The growing emphasis on electric vehicle development and renewable energy electronics will drive demand for advanced silver sintering capabilities across diverse semiconductor and power electronics applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 112.0 million |

| Market Forecast Value (2035) | USD 212.2 million |

| Forecast CAGR (2025-2035) | 6.6% |

The silver pressure sintering machine market grows by enabling semiconductor manufacturers and electronics companies to achieve superior bonding performance that enhances thermal conductivity and reliability in high-power applications. Demand drivers include expanding power semiconductor device manufacturing requiring advanced packaging technologies, increasing RF power device applications for 5G infrastructure and wireless communications, and growing adoption in high-performance LED production where silver sintering supports enhanced thermal management. Priority segments include semiconductor device manufacturers and electronics assembly companies, with China and India representing key growth geographies due to expanding electronics manufacturing capabilities and increasing semiconductor production investments. Market growth faces constraints from high capital equipment costs and the need for specialized process engineering expertise to optimize sintering parameters for different applications.

The Silver Pressure Sintering Machine market is entering a technology-driven expansion phase, driven by demand for advanced semiconductor packaging, expanding electric vehicle electronics, and evolving thermal management standards across electronics manufacturing. By 2035, these pathways together can unlock USD 280-360 million in incremental revenue opportunities beyond baseline growth.

Pathway A - Power Semiconductor Device Leadership (Electric Vehicle Electronics) The power semiconductor segment already holds the largest share due to its critical role in electric vehicle power systems and renewable energy applications. Expanding high-precision sintering capabilities, automated process control, and specialized automotive-grade systems can consolidate leadership. Opportunity pool: USD 85-110 million.

Pathway B - Fully Automatic System Dominance (High-Volume Manufacturing) Fully automatic sintering systems account for significant market demand. Growing requirements for production efficiency and consistent quality, especially in semiconductor manufacturing, will drive higher adoption of advanced automation platforms. Opportunity pool: USD 70-90 million.

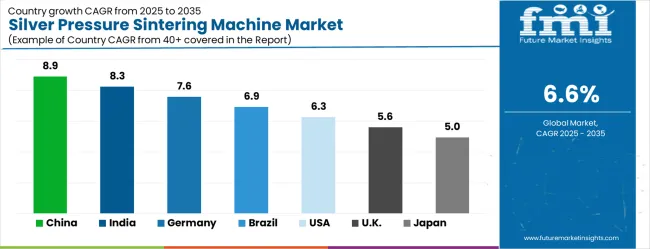

Pathway C - China & India Market Expansion (Electronics Manufacturing Growth) China and India present the highest growth potential with CAGRs of 8.9% and 8.3% respectively. Targeting expanding electronics manufacturing and government semiconductor initiatives will accelerate adoption. Opportunity pool: USD 55-70 million.

Pathway D - RF Power Device Applications (5G Infrastructure) RF power device and wireless communication applications represent significant growth potential with expanding 5G deployment and telecommunications infrastructure development. Opportunity pool: USD 40-52 million.

Pathway E - Industry 4.0 Integration Advanced digital integration, real-time process monitoring, and smart manufacturing capabilities create opportunities for next-generation sintering solutions with enhanced connectivity and automation. Opportunity pool: USD 30-40 million.

Pathway F - High-Performance LED Expansion (Advanced Lighting) Systems optimized for LED manufacturing, display technologies, and specialized lighting applications offer premium positioning for high-performance market segments. Opportunity pool: USD 25-32 million.

Pathway G - Multi-Application Flexibility Advanced sintering platforms capable of handling multiple device types, materials, and process requirements can capture growing demand for manufacturing versatility. Opportunity pool: USD 20-26 million.

Pathway H - Service and Support Revenue Comprehensive service packages including process optimization, maintenance support, and technical training, create long-term revenue streams across global manufacturing operations. Opportunity pool: USD 15-20 million.

The market is segmented by automation type, application, end-user, technology, and region. By automation type, the market is divided into fully automatic and semi-automatic systems. Based on application, the market is categorized into power semiconductor devices, RF power devices, high-performance LED, and other applications. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

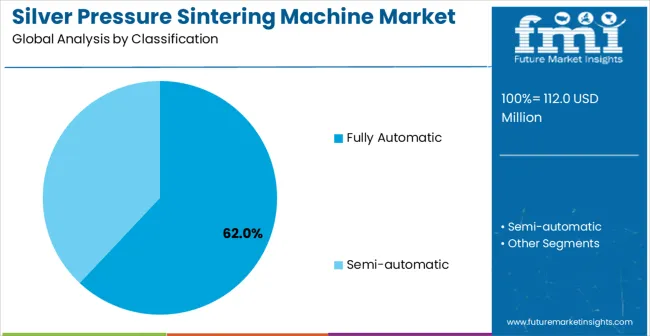

Fully automatic silver pressure sintering systems are projected to account for a substantial portion of 62% of the silver pressure sintering machine market in 2025. This share is supported by enhanced production efficiency capabilities and consistent process control characteristics. Fully automatic systems provide reliable sintering performance with advanced process monitoring that enables high-volume manufacturing and reduced operator intervention requirements. The segment enables stakeholders to benefit from improved productivity and standardized quality outcomes for demanding semiconductor applications.

The dominance of fully automatic systems reflects the semiconductor industry's increasing focus on manufacturing precision and operational efficiency. These advanced systems incorporate sophisticated temperature control algorithms, real-time process monitoring, and automated material handling capabilities that eliminate human error variability while ensuring consistent sintering parameters across production runs. Manufacturing companies operating in high-volume environments particularly benefit from the reduced labor requirements and enhanced throughput capabilities that fully automatic systems provide.

The integration of Industry 4.0 technologies, including IoT connectivity and predictive maintenance features, further strengthens the value proposition of fully automatic systems by enabling remote monitoring and proactive equipment management. The stringent quality requirements in semiconductor manufacturing demand the precise control that only fully automatic systems can deliver consistently. As production volumes continue to scale and quality standards become more demanding, the preference for fully automatic systems is expected to intensify, particularly among large-scale manufacturers seeking to optimize their operational efficiency while maintaining the highest quality standards in silver pressure sintering applications.

Key factors supporting fully automatic system adoption:

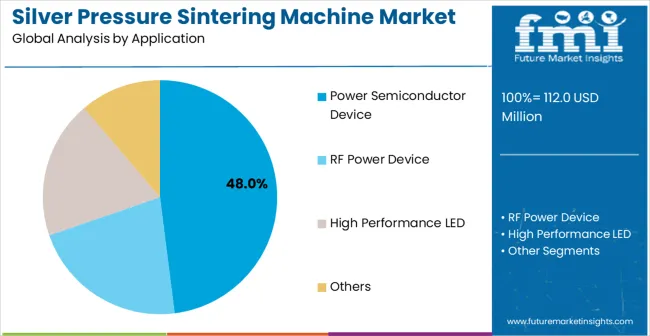

Power semiconductor device applications are expected to represent the largest share of 48% of the silver pressure sintering machine applications in 2025. This dominant share reflects the critical need for advanced thermal management solutions in power electronics that appeals to semiconductor manufacturers and automotive electronics suppliers. The segment provides essential packaging support for high-power devices requiring superior heat dissipation and long-term reliability. Growing demand for electric vehicles and renewable energy systems drives adoption in this application area.

The power semiconductor device segment's market leadership stems from the fundamental transformation occurring in the global energy and transportation sectors. Electric vehicle adoption is creating unprecedented demand for power electronics components that can handle high current loads while maintaining thermal stability over extended operational periods. Silver pressure sintering technology has emerged as the preferred bonding method for these applications due to its superior thermal conductivity properties compared to traditional soldering techniques. The technology enables manufacturers to create robust thermal interfaces that effectively transfer heat away from critical semiconductor junctions, thereby improving device reliability and extending operational lifespans.

Renewable energy systems, including solar inverters and wind power converters, require power semiconductor devices capable of operating efficiently under demanding thermal conditions. The expanding deployment of fast-charging infrastructure for electric vehicles also drives demand for high-power semiconductor devices that rely on silver sintering technology. Industrial applications, including motor drives and power supplies, represent additional growth opportunities where the superior thermal performance of silver sintered joints provides competitive advantages in system reliability and performance optimization.

Power Semiconductor Device segment advantages include:

Market drivers include expanding electric vehicle development requiring advanced power semiconductor packaging, increasing 5G infrastructure deployment where RF power devices demand superior thermal management, and growing adoption in high-performance LED manufacturing where silver sintering supports enhanced brightness and longevity performance. These drivers reflect direct manufacturing outcomes including improved thermal conductivity, enhanced device reliability, and extended operational lifespans across multiple electronics applications.

Market restraints encompass high initial equipment investments that limit adoption among smaller manufacturing facilities, technical complexity requiring specialized process engineering expertise and precise parameter control, and long technology qualification cycles for critical applications that slow market penetration. Additional constraints include integration challenges with existing production lines and the need for continuous process optimization that increases operational complexity and maintenance requirements.

Key trends show adoption accelerating in China and India where expanding electronics manufacturing and semiconductor production capabilities drive demand, while technology shifts toward Industry 4.0 integration and smart manufacturing platforms enable broader market access. Technology advancement focuses on enhanced process control and multi-application flexibility that expand sintering possibilities across demanding semiconductor applications. Market thesis faces risk from alternative bonding technologies that could provide similar thermal performance at lower costs or with simplified process requirements.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| Brazil | 6.9% |

| USA | 6.3% |

| UK | 5.6% |

| Japan | 5.0% |

The silver pressure sintering machine market shows strong growth dynamics across key countries from 2025–2035. China leads globally with a CAGR of 8.9%, fueled by massive electronics manufacturing expansion, government semiconductor development initiatives, and growing electric vehicle production capabilities. India follows closely at 8.3%, driven by increasing electronics manufacturing, semiconductor assembly operations, and strong government support for domestic electronics production.

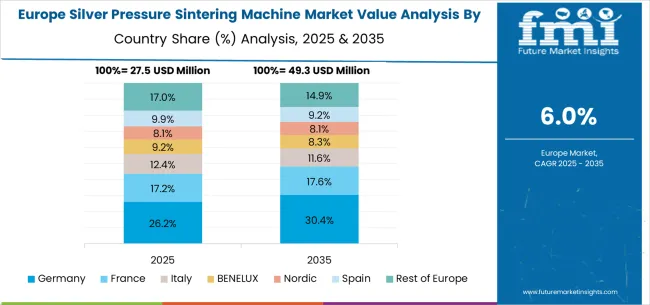

Germany maintains Europe's leadership with 7.6%, leveraging its advanced automotive electronics sector and established semiconductor manufacturing infrastructure. Brazil records 6.9%, reflecting opportunities in automotive electronics and industrial semiconductor applications despite economic challenges. The United States maintains solid expansion at 6.3%, supported by semiconductor manufacturing reshoring initiatives and advanced electronics development programs. Growth in the United Kingdom (5.6%) and Japan (5.0%) remains stable, backed by established electronics manufacturers and semiconductor technology companies, though comparatively slower than emerging manufacturing markets.

The report covers an in-depth analysis of 40+ countries; 7 top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the silver pressure sintering machine market with its expanding electronics manufacturing sector and substantial government investment in semiconductor technologies. The market is projected to grow at a CAGR of 8.9% through 2035, driven by increasing power semiconductor production, expanding electric vehicle manufacturing, and growing adoption across semiconductor assembly facilities in Shenzhen, Shanghai, and Suzhou.

Chinese electronics manufacturers are adopting silver pressure sintering systems for advanced packaging applications and high-power device assembly, with particular emphasis on automation integration and production efficiency optimization. Government support for semiconductor self-sufficiency and electric vehicle development expand deployment across power electronics manufacturing and automotive component production.

India's silver pressure sintering machine market reflects strong potential based on expanding electronics manufacturing infrastructure and increasing semiconductor assembly operations. The market is projected to grow at a CAGR of 8.3% through 2035, with growth accelerating through cost-effective manufacturing strategies under quality and performance constraints, particularly in power semiconductor assembly and LED manufacturing applications in Bangalore, Chennai, and Delhi NCR. Indian electronics manufacturers and semiconductor companies are adopting silver sintering systems for advanced packaging applications and thermal management solutions, with growing emphasis on automation and process reliability. Strategic partnerships with international equipment suppliers expand access to advanced sintering technologies and technical support.

Germany demonstrates established strength in the silver pressure sintering machine market through its advanced automotive electronics sector and robust semiconductor manufacturing infrastructure. The market shows strong growth at a CAGR of 7.6% through 2035, with established automotive suppliers and semiconductor companies driving demand in Munich, Stuttgart, and Dresden. German manufacturers focus on high-precision sintering applications and automotive electronics assembly, particularly in electric vehicle power systems requiring sophisticated thermal management solutions. The country's strong engineering capabilities and established technology partnerships support consistent market development across multiple application areas.

Brazil's silver pressure sintering machine market shows significant growth potential at a CAGR of 6.9% through 2035, driven by expanding automotive electronics manufacturing and industrial semiconductor applications. The market benefits from increasing electric vehicle component production and power electronics development, with particular strength in automotive supplier networks. Brazilian electronics manufacturers and automotive companies adopt silver sintering systems for power device assembly and thermal management applications, addressing both performance and reliability requirements. Market development benefits from growing automotive industry modernization and expanding electronics manufacturing capabilities.

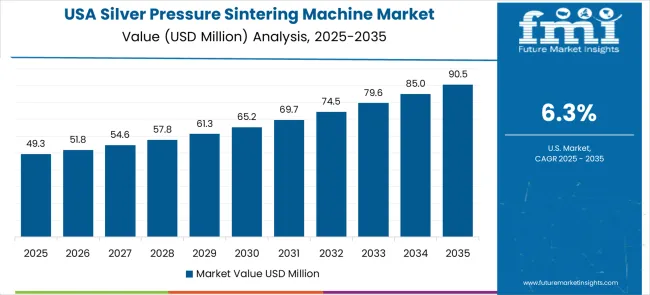

The United States maintains strong growth in the silver pressure sintering machine market through its established semiconductor industry and advanced electronics manufacturing capabilities. Market expansion at a CAGR of 6.3% through 2035 reflects consistent demand from semiconductor manufacturers, automotive electronics suppliers, and power device companies requiring advanced sintering capabilities. American electronics organizations utilize silver pressure sintering systems across power semiconductor, RF device, and LED applications, with particular emphasis on performance optimization and manufacturing efficiency. The country's strong technology development programs and established supplier networks support stable market conditions and continued innovation advancement.

The United Kingdom demonstrates consistent progress in the silver pressure sintering machine market with a CAGR of 5.6% through 2035, supported by established electronics manufacturers and automotive technology developers. British electronics companies and semiconductor suppliers adopt silver sintering systems for advanced packaging and thermal management applications, with particular focus on precision assembly and quality control capabilities. The market benefits from strong automotive electronics partnerships and established relationships with European technology suppliers. Development remains steady across multiple electronics applications despite economic uncertainties affecting manufacturing investment levels.

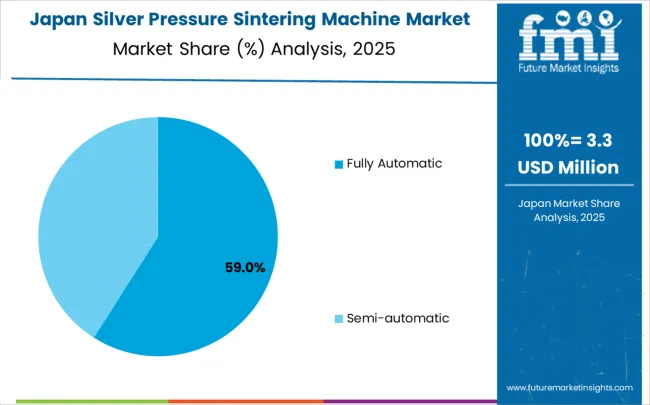

Japan's silver pressure sintering machine market shows steady development with a CAGR of 5.0% through 2035, as established electronics companies and semiconductor manufacturers maintain consistent demand. Market growth reflects mature market conditions and established precision manufacturing capabilities across electronics and automotive sectors. Japanese electronics manufacturers and technology companies utilize silver pressure sintering systems for high-precision assembly applications and advanced packaging solutions, particularly in automotive electronics and industrial power devices. The market benefits from domestic equipment manufacturing expertise and strong technical support infrastructure, though growth remains moderate compared to emerging electronics manufacturing markets.

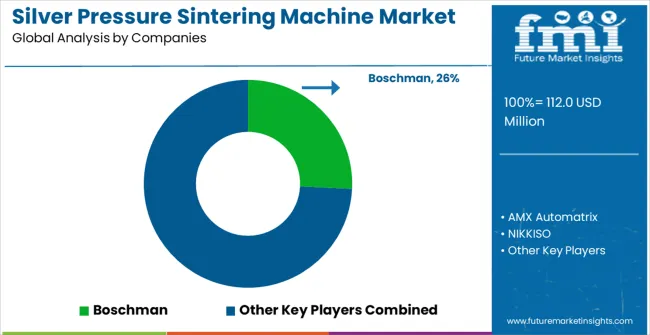

The silver pressure sintering machine market operates with a moderately concentrated structure featuring approximately 15-18 meaningful players, with the top five companies holding roughly 65-70% market share. Competition centers on technological capabilities, automation features, and comprehensive process support rather than price competition alone. Market leaders include Boschman, AMX Automatrix, and NIKKISO, which maintain competitive positions through established technology development capabilities, comprehensive product portfolios, and strong customer support networks. These companies benefit from scale advantages in equipment manufacturing, extensive technical expertise, and established relationships with key semiconductor manufacturers and electronics companies worldwide.

Challenger companies include PINK GmbH Thermosysteme and Shenzhen Advanced Joining, which compete through specialized sintering solutions and regional market focus, particularly in specific application areas or geographic regions. These companies differentiate through innovative process technologies, competitive equipment pricing strategies, and targeted customer service approaches. Quick Intelligent Equipment, Chenglian Kaida Technology, JH Advanced Semiconductor (Suzhou), and Zhongke Guangzhi (Chongqing) Technology represent additional significant players with established presence in electronics manufacturing equipment markets and strong technical capabilities in sintering and assembly technologies.

Competition intensifies around process innovation, with companies investing in advanced temperature control systems, enhanced automation capabilities, and integrated quality monitoring platforms that improve manufacturing efficiency and product consistency. Market dynamics reflect the importance of technical support services, process optimization programs, and ongoing maintenance capabilities that influence customer purchasing decisions. Strategic partnerships with semiconductor manufacturers and electronics assembly companies shape competitive positioning across different regional markets and application segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 112.0 million |

| Automation Type | Fully Automatic, Semi-automatic |

| Application | Power Semiconductor Device, RF Power Device, High Performance LED, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ additional countries |

| Key Companies Profiled | Boschman, AMX Automatrix, NIKKISO, PINK GmbH Thermosysteme, Shenzhen Advanced Joining, Quick Intelligent Equipment, Chenglian Kaida Technology, JH Advanced Semiconductor (Suzhou), Zhongke Guangzhi (Chongqing) Technology |

| Additional Attributes | Dollar sales by application categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging companies, adoption patterns across semiconductor manufacturers and electronics assembly companies, integration with automated production lines and smart manufacturing systems, innovations in fully automatic and semi-automatic sintering technologies, and development of specialized silver sintering solutions with enhanced thermal performance and process control capabilities. |

The global silver pressure sintering machine market is estimated to be valued at USD 112.0 million in 2025.

The market size for the silver pressure sintering machine market is projected to reach USD 212.2 million by 2035.

The silver pressure sintering machine market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in silver pressure sintering machine market are fully automatic and semi-automatic.

In terms of application, power semiconductor device segment to command 48.0% share in the silver pressure sintering machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Silver Sintering Chip Mounter Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Silver Sintering System Market Size and Share Forecast Outlook 2025 to 2035

Differential Pressure Casting Machine Market Forecast and Outlook 2025 to 2035

Pressure Relief Dressing Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Hydraulic Pump Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Switch Market Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Silver Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Volume Loop Systems Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA