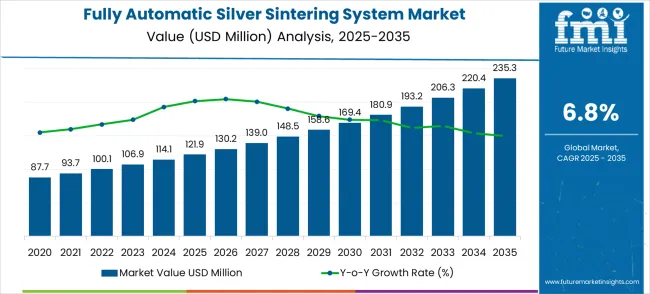

The fully automatic silver sintering system market expected to expand from USD 121.9 million in 2025 to USD 235.3 million by 2035, registering a CAGR of 6.8% The fully automatic silver sintering system market is positioned for sustained expansion that reflects the semiconductor industry's evolution toward advanced packaging technologies and high-performance thermal management solutions. The first half of the decade will witness market growth from USD 122 million in 2025 to USD 169.4 million by 2030, establishing a foundation worth USD 47.5 million in additional market value that represents 41.9% of the total ten-year growth trajectory. This initial phase creates momentum for widespread adoption of silver sintering technology across power electronics manufacturing, electric vehicle component production, and next-generation LED applications where thermal performance drives system reliability.

The latter half will witness accelerated market development as the industry advances from USD 169.4 million in 2030 to USD 235.3 million by 2035, adding USD 65.9 million in value that constitutes 58.1% of the decade's expansion. This period reflects technological maturation with sophisticated automation systems, integrated quality control capabilities, and advanced process monitoring that enables mass production of high-performance electronic assemblies requiring superior thermal and electrical conductivity.

The complete transformation delivers a 93.0% growth trajectory, creating a market 1.93 times larger by 2035 than today's baseline. This steady advancement means that companies establishing strong technical capabilities and customer relationships during the foundation phase will benefit from accelerating demand effects as silver sintering becomes the preferred attachment technology for demanding semiconductor applications requiring exceptional thermal performance and reliability.

The decade growth phasing analysis reveals two distinct market evolution periods characterized by different technology adoption patterns and manufacturing scale requirements. The foundation period from 2025 to 2030 represents market establishment around proven applications, with USD 47.5 million expansion driven by power electronics manufacturing growth, electric vehicle component production, and advanced LED manufacturing requiring superior thermal management. This period establishes competitive advantages through technology refinement, process optimization, and customer relationship development that supports cost-effective system operation.

The acceleration period from 2030 to 2035 demonstrates mature market characteristics with USD 65.9 million expansion reflecting broader technology adoption, premium performance system development, and emerging application penetration across next-generation semiconductor packaging and high-power density electronics. Market maturation factors include standardized process parameters, optimized equipment designs, and competitive differentiation through specialized technical capabilities rather than basic functionality provision.

Competitive landscape evolution shows initial technology specialization consolidating into comprehensive solution provision as successful companies acquire market share through superior process control, application expertise, and comprehensive customer support programs. Phase transition logic indicates that companies mastering the silver sintering process technology and establishing customer trust during the foundation period gain compound advantages in the acceleration phase through reputation effects, technical partnership development, and operational efficiency improvements that enable premium pricing for advanced capabilities.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 122 million |

| Market Forecast (2035) | USD 235.3 million |

| Growth Rate | 7% CAGR |

| Leading System Type | Fully Integrated Inline System |

| Primary Application | Power Semiconductor Device |

Executive dashboard analysis reveals a market positioned for steady technical advancement with consistent demand growth driven by semiconductor packaging evolution and thermal management requirements. Power semiconductor applications anchor growth while RF devices and high-performance LEDs create additional opportunities. Geographic expansion potential remains substantial across regions where advanced electronics manufacturing continues developing.

Market expansion rests on three fundamental shifts transforming the semiconductor packaging landscape: 1. Thermal Management Revolution: Increasing power density in semiconductor devices requires superior thermal conductivity that silver sintering provides over traditional soldering methods, enabling reliable operation of high-power electronics including electric vehicle inverters, renewable energy converters, and advanced computing processors where thermal performance directly impacts system reliability and operational efficiency. 2. Manufacturing Precision Evolution: Advanced semiconductor packaging demands precise material placement, controlled atmosphere processing, and repeatable thermal cycles that fully automatic systems deliver through integrated process monitoring, real-time parameter adjustment, and comprehensive quality control that eliminate human variability while ensuring consistent bonding quality. 3. Application Diversification Expansion: Traditional power electronics applications expand into electric vehicle charging systems, renewable energy infrastructure, and high-performance computing where silver sintering provides unique advantages including lead-free environmental compliance, high-temperature operation capability, and superior electrical conductivity that justify premium processing costs.

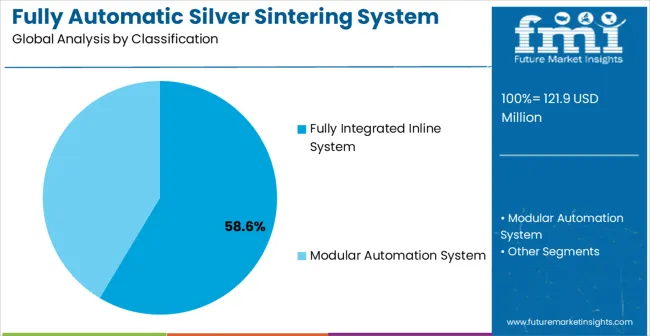

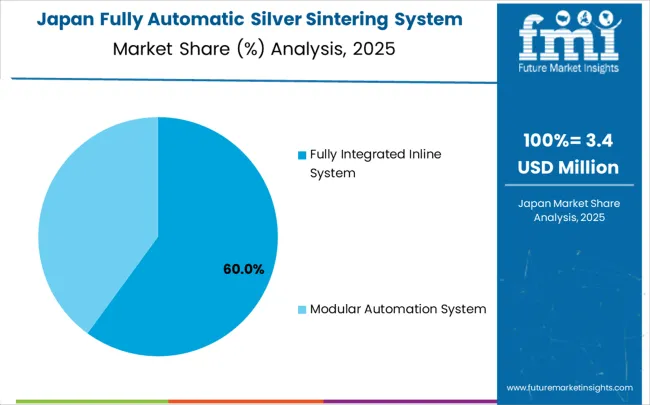

The market is segmented by system type into Fully Integrated Inline Systems and Modular Automation Systems. Fully Integrated Inline Systems represent end-to-end automation solutions, optimizing throughput, process consistency, and operational efficiency for large-scale manufacturing environments. Modular Automation Systems offer flexibility and scalability, enabling the customization of individual modules to suit various production volumes, device types, and facility constraints.

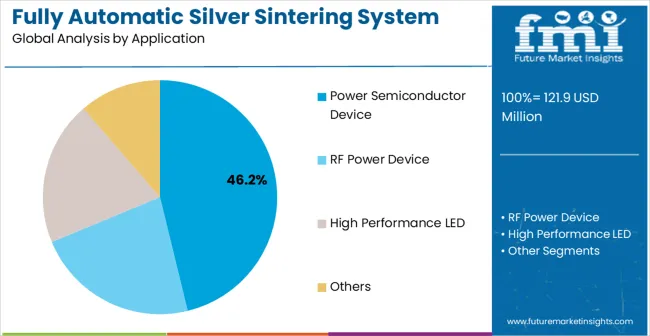

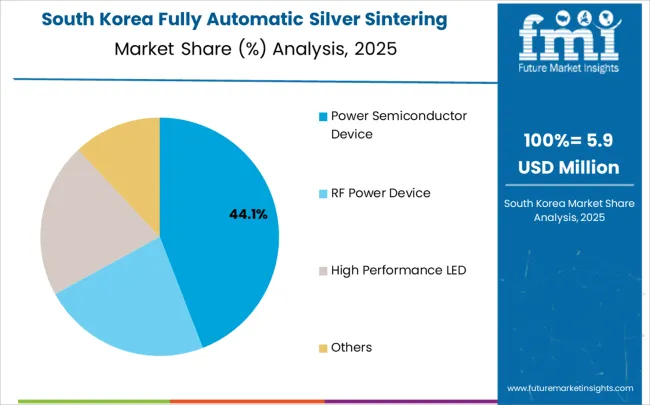

Secondary Breakdown: Application Categories

The market applications span Power Semiconductor Devices, RF Power Devices, High-Performance LEDs, and Other specialized devices. Power Semiconductor Devices constitute the primary demand segment, driven by their critical role in energy-efficient power conversion. RF Power Devices follow, reflecting the growing deployment of communication technologies and high-frequency applications. High-Performance LEDs represent a niche yet expanding segment, where precision sintering directly influences device reliability and luminous efficiency. The Others category captures emerging applications, demonstrating the system’s adaptability across diverse electronic and optoelectronic manufacturing requirements.

Fully integrated inline systems command market dominance through their ability to provide complete silver sintering solutions with minimal human intervention while maintaining precise process control across extended production runs. This leadership position reflects semiconductor manufacturers' requirements for consistent quality, high throughput, and comprehensive process documentation necessary for demanding applications.

The segment delivers measurable productivity improvements through automated material handling, integrated quality monitoring, and real-time process optimization that reduces cycle times while ensuring consistent bonding quality. These systems provide the manufacturing efficiency required for cost-effective production of high-volume semiconductor components.

Fully integrated systems offer comprehensive solution provision through proprietary process control software, specialized heating and cooling systems, and integrated quality assurance capabilities that competitors cannot easily replicate. The segment benefits from established customer relationships and technical expertise requirements that create switching barriers.

Market Challenge: System complexity requires extensive technical support and specialized maintenance expertise that smaller equipment suppliers may struggle to provide consistently across global manufacturing operations.

Power semiconductor applications represent the core market opportunity where thermal performance directly impacts device reliability and system efficiency in demanding applications including electric vehicle powertrains and renewable energy systems.

Why dominant? Power semiconductor devices require superior thermal conductivity and electrical performance that silver sintering uniquely provides for high-power applications where traditional soldering methods cannot meet thermal management requirements for reliable long-term operation.

What drives adoption? The adoption of electric vehicles, the expansion of renewable energy infrastructure, and the growth of industrial automation create a sustained demand for power semiconductors that require advanced packaging technologies, providing exceptional thermal performance and operational reliability.

Where is growth? Electric vehicle charging infrastructure, renewable energy inverters, and industrial motor drives represent primary expansion opportunities where power density requirements exceed traditional packaging technology capabilities.

Growth Accelerators

Electric vehicle adoption acceleration drives demand as automotive manufacturers require power electronics with superior thermal management for reliable operation across temperature extremes and extended operational lifespans that silver sintering enables through exceptional thermal conductivity. Renewable energy infrastructure expansion creates sustained demand for power conversion systems where silver sintered components provide the reliability and efficiency required for grid-connected applications operating across decades of service life. Semiconductor packaging evolution toward higher power density designs necessitates advanced joining technologies that exceed traditional solder limitations through superior thermal and electrical performance characteristics that silver sintering uniquely provides.

Growth Inhibitors

High capital equipment costs create barriers for smaller manufacturers considering silver sintering adoption, particularly when traditional soldering methods remain adequate for lower-power applications where thermal performance requirements do not justify the investment in specialized processing equipment. Process complexity requires specialized technical expertise for system operation, maintenance, and optimization that may not be readily available in all manufacturing regions or smaller facilities lacking advanced engineering capabilities. Alternative joining technologies, including copper sintering and advanced solder alloys, compete for market share in applications where silver's performance advantages may not offset higher material and processing costs.

Market Evolution Patterns

Technology convergence accelerates as manufacturers integrate artificial intelligence algorithms for process optimization, predictive maintenance capabilities, and quality control automation, transforming basic sintering equipment into comprehensive manufacturing solutions that provide ongoing value through performance optimization. Geographic expansion patterns reveal that developed markets are focusing on high-volume automotive applications, while emerging economies are initiating adoption cycles driven by electronics manufacturing growth and technology transfer programs. Product category evolution shifts from standalone equipment toward integrated manufacturing platforms where silver sintering combines with complementary technologies to provide complete semiconductor packaging solutions.

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| USA | 6.5% |

| UK | 5.8% |

| Japan | 5.1% |

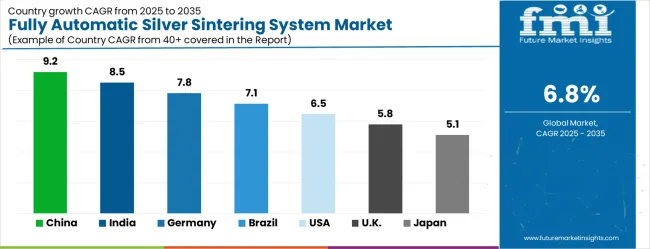

The fully automatic silver sintering system market demonstrates geographic concentration with growth leaders emerging from established semiconductor manufacturing regions and emerging electronics production centers. Growth leaders include China and India, capitalizing on electronics manufacturing expansion and government technology development programs supporting advanced semiconductor packaging capabilities. Steady performers encompass Germany, Brazil, and the United States, where established electronics industries and automotive manufacturing provide consistent demand growth. Emerging markets show potential in regions where semiconductor assembly capabilities support expanding electronics manufacturing requirements.

Regional synthesis reveals Asia-Pacific markets leading through semiconductor manufacturing concentration and automotive electronics growth, while North American and European markets provide stability through established technology companies and advanced application development. The global expansion story combines emerging market manufacturing scaling with developed market technology advancement, creating opportunities across performance levels and application categories.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates exceptional market leadership potential through comprehensive semiconductor manufacturing infrastructure and strategic government investment in advanced packaging technologies supporting domestic electronics industry development. Market expansion is projected at a CAGR of 9.2% through 2035, supported by massive electric vehicle production scaling in Shanghai, Shenzhen, and Beijing regions, expanding power electronics manufacturing capabilities, and increasing adoption of advanced semiconductor packaging technologies across consumer electronics and industrial applications. Chinese semiconductor manufacturers are investing in silver sintering systems as critical manufacturing equipment that enables production of high-performance power devices meeting international quality standards while reducing dependence on imported components. Government initiatives promoting semiconductor industry self-sufficiency drive substantial investment in advanced packaging equipment including silver sintering systems that support domestic technology capabilities. The country's leadership in electric vehicle production creates sustained demand for power semiconductor components requiring advanced thermal management that silver sintering provides for reliable automotive applications.

India is emerging as one of the fastest-growing markets for fully automatic silver sintering systems, with the market projected to grow at a CAGR of 8.5% through 2035, propelled by rapid growth in the electronics and semiconductor sectors. Advanced electronics hubs in Bangalore and Chennai are leading adoption, as manufacturers integrate silver sintering systems into power semiconductor device production for automotive electronics and renewable energy applications. The market is strongly influenced by government programs such as Make in India and the Production Linked Incentive (PLI) scheme, which promote domestic electronics manufacturing. Indian companies are steadily aligning with international quality standards, ensuring their semiconductor packaging technologies are competitive in the global supply chain. Another growth driver is technology partnerships between Indian manufacturers and global equipment suppliers, which not only improve access to cutting-edge silver sintering technology but also facilitate knowledge transfer and specialized training. These advancements are building India’s reputation as a competitive manufacturing destination in high-performance electronics.

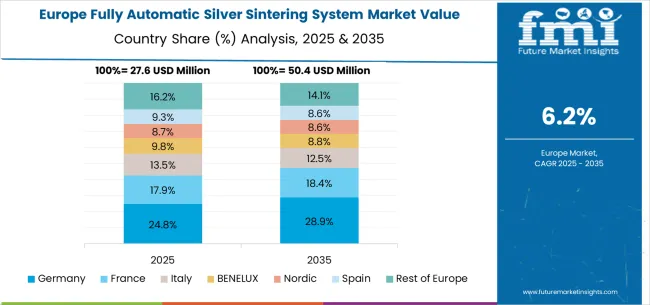

Germany represents one of the most technologically advanced regions for fully automatic silver sintering systems, with market growth projected at a CAGR of 7.6% through 2035, driven by its robust automotive and industrial electronics base. The country is home to global leaders in power semiconductor production used for electric vehicles, renewable energy systems, and industrial automation. German manufacturers are increasingly investing in fully integrated inline systems to enhance packaging reliability and achieve higher energy efficiency in devices. With the nation’s strong emphasis on Industry 4.0 and automation, modular automation systems are also witnessing high adoption, especially in RF power devices and high-performance LEDs. Germany benefits from its highly skilled workforce and research-intensive environment, which fosters innovations in materials and equipment. Additionally, collaborations between leading automotive OEMs and semiconductor companies are accelerating system demand, as efficiency and thermal management remain crucial for next-generation mobility solutions. Germany’s role as a global hub for precision engineering ensures that it will remain a central player in driving advanced adoption across Europe.

Brazil is emerging as a developing but promising market for fully automatic silver sintering systems, with market growth expected at a CAGR of 6.3% through 2035, largely supported by the country’s growing infrastructure and renewable energy investments. As the nation strengthens its power grid modernization and solar energy capacity, demand for efficient power semiconductor devices is steadily increasing. Modular automation systems are being adopted in the telecommunications and RF power device sectors, particularly as Brazil expands its 5G network deployment and supports broader digital infrastructure. While the market in Brazil is smaller compared to advanced economies, its growth potential is underscored by ongoing foreign direct investments and technology imports. The country is also focusing on enhancing local production capabilities for electronic devices to reduce dependence on imports, which is expected to gradually increase adoption of silver sintering systems. Strategic partnerships with international equipment suppliers are a vital driver, providing Brazilian firms with access to advanced systems while ensuring skill development within the workforce.

The United States maintains a leading position in the fully automatic silver sintering system market, with growth projected at a CAGR of 7.9% through 2035, driven by its dominance in the semiconductor and defense electronics industries. Major chip manufacturers are adopting fully integrated inline systems to support advanced packaging for power semiconductors used in EVs, aerospace, and military technologies. The USA also leverages modular automation systems for RF devices and high-performance LED applications, critical for communication and satellite-based systems. With a strong focus on innovation, American firms are investing heavily in R&D to enhance system throughput, accuracy, and integration with next-generation manufacturing processes. Federal initiatives such as the CHIPS and Science Act are significantly boosting domestic semiconductor manufacturing, which further drives equipment demand. Additionally, collaborations between defense contractors and semiconductor companies are amplifying requirements for high-reliability silver sintering systems. The USA market benefits from high capital availability, strong IP protection, and a mature ecosystem that accelerates adoption of new technologies.

The United Kingdom demonstrates steady growth in the fully automatic silver sintering system market, with an expected CAGR of 6.8% through 2035, fueled by its expanding healthcare, renewable energy, and specialty electronics sectors. The UK has a strong presence in medical device and life sciences applications, which increasingly require advanced semiconductor packaging technologies to enhance precision and durability. The adoption of UV and polarized light alignment technologies in consumer electronics complements silver sintering integration, especially for high-performance LED systems. Moreover, the government’s push for clean energy transition and electric mobility is accelerating demand for power semiconductor devices in EVs and renewable energy projects. The UK also benefits from a strong academic and research environment, fostering collaboration between universities and private enterprises to advance electronic manufacturing technologies. While smaller in scale compared to Germany and the USA, the UK’s market is characterized by its focus on specialty, high-value applications that rely on performance-driven manufacturing solutions.

Japan remains one of the most important markets for fully automatic silver sintering systems, with market growth projected at a CAGR of 7.2% through 2035, supported by its leadership in the consumer electronics, automotive, and semiconductor sectors. Japanese companies are known for pioneering innovations in packaging technologies, and silver sintering has become integral in enhancing the performance of power devices and RF systems. With the country’s heavy investment in electric vehicle technologies and renewable energy infrastructure, fully integrated inline systems are being widely adopted to ensure high yield and reliability. Japan’s highly developed manufacturing ecosystem, coupled with its precision engineering expertise, allows local companies to remain competitive on a global scale. Modular automation systems are also gaining traction in LED and 5G communication applications, reflecting Japan’s role in next-generation connectivity. Additionally, Japan’s government policies that support domestic semiconductor manufacturing and R&D reinforce system adoption. The combination of technology leadership and manufacturing strength positions Japan as a stable growth hub in the Asia-Pacific market.

The European fully automatic silver sintering system market represents a sophisticated regional ecosystem where advanced automotive manufacturing and precision electronics production create integrated demand for high-performance semiconductor packaging technologies. Northern European countries including Germany and the United Kingdom provide technology leadership through engineering excellence and automotive industry integration that influences equipment development across the broader European electronics manufacturing sector.

Central European markets demonstrate growing investment in electronics manufacturing and automotive component production that require advanced packaging technologies for competitive positioning in global markets. Mediterranean markets show increasing adoption of industrial electronics as manufacturing facilities implement advanced automation systems and energy conversion equipment requiring reliable power semiconductors. The regional integration enables technology sharing, collaborative development programs, and standardized performance requirements that accelerate market development while maintaining high technical standards across diverse electronics and automotive manufacturing applications.

In Japan, the fully automatic silver sintering system market is largely driven by the fully integrated inline systems segment, which accounts for 62.4% of total market revenues in 2025. The high penetration of advanced manufacturing automation in Japanese electronics facilities and the established preference for comprehensive process control and quality assurance are key contributing factors. Modular automation systems follow with a 28.7% share, primarily in research and development applications that require flexible configuration and specialized process parameters. Semi-automatic processing units contribute 8.9% as their adoption in smaller manufacturing facilities continues developing across diverse application requirements.

In South Korea, the market is expected to remain dominated by power semiconductor device applications, which hold a 52.8% share in 2025. These applications are typically the primary demand driver where Samsung and SK Hynix operations require advanced packaging technologies for power management integrated circuits and discrete power devices. RF power device and high-performance LED applications each hold 23.6% market share, with growing standardization in silver sintering process parameters and equipment requirements. Advanced electronics assembly accounts for the remaining 23.6%, but is gradually gaining traction in specialized applications due to increasing performance requirements and thermal management challenges.

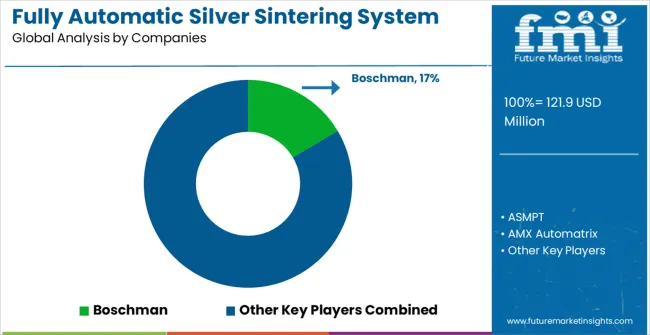

The fully automatic silver sintering system market demonstrates moderate concentration with around 15–20 global players, where the top five companies command nearly 50–55% of total market value. This dominance is built on deep technical expertise, strong semiconductor industry relationships, and advanced equipment development capabilities. Unlike price-based rivalry, competition in this market emphasizes technical differentiation, application-specific innovation, and long-term reliability, as semiconductor manufacturers prioritize precision and performance when investing in advanced packaging systems.

Boschman, ASMPT, and NIKKISO maintain strong competitive advantages through broad product portfolios, well-established semiconductor partnerships, and advanced process development expertise. Their leadership is reinforced by extensive patent ownership, superior engineering, and global customer support programs. These companies have decades of experience in semiconductor equipment manufacturing, positioning them as trusted suppliers for high-performance silver sintering solutions. AMX Automatrix, PINK GmbH Thermosysteme, BESI, Infotech AG, and Zhuhai Silicon Cool Technology differentiate themselves through specialized expertise, innovative automation solutions, and targeted customer focus. They often lead in performance-critical application areas or niche segments where technical innovation is prioritized over wide product availability. Shenzhen Advanced Joining, Quick Intelligent Equipment, Chenglian Kaida Technology, JH Advanced Semiconductor (Suzhou), and Zhongke Guangzhi (Chongqing) Technology address local and regional demand through focused development, manufacturing cost advantages, and localized technical support. Their solutions expand accessibility for emerging markets while ensuring essential reliability and performance standards.

The fully automatic silver sintering system market addresses critical thermal management challenges in next-generation power electronics, where traditional soldering approaches cannot withstand the extreme temperatures and thermal cycling demands of wide bandgap semiconductors, electric vehicle inverters, and high-performance LED applications. With the market expanding from USD 122 million to a projected USD 235.3 million at 7% CAGR, success requires coordinated efforts across semiconductor equipment standards bodies, materials suppliers, precision automation providers, device manufacturers, and specialized capital providers to overcome process complexity, material costs, and yield optimization challenges.

How Governments Could Accelerate Advanced Manufacturing Adoption?

Strategic Technology Investment: Provide targeted funding for silver sintering equipment development through national semiconductor manufacturing initiatives, recognizing its critical role in enabling next-generation power electronics for electric vehicles, renewable energy, and defense applications.

Materials Security Programs: Establish silver material reserves and recycling incentives to manage cost volatility and supply security for this precious metal-dependent process. Support the development of alternative sintering materials that maintain thermal performance while reducing material costs.

Research Infrastructure: Fund specialized facilities for process development, equipment testing, and reliability validation that enable equipment manufacturers and semiconductor companies to optimize sintering parameters for different device architectures and applications.

Export Control Coordination: Balance technology export restrictions with legitimate commercial needs, ensuring domestic equipment manufacturers can compete globally while protecting advanced manufacturing capabilities critical to national competitiveness.

Workforce Development: Support specialized training programs for process engineers, equipment technicians, and quality specialists needed to operate and maintain sophisticated silver sintering systems in semiconductor manufacturing environments.

How Industry Bodies Could Drive Process Standardization?

Process Parameter Standards: Develop standardized specifications for sintering temperature profiles, pressure application, atmosphere control, and cooling rates that ensure consistent results across different equipment suppliers and manufacturing facilities.

Material Quality Specifications: Establish comprehensive standards for silver paste composition, particle size distribution, organic content, and shelf life that enable reliable process outcomes and supplier interchangeability.

Equipment Qualification Protocols: Create standardized acceptance testing procedures for sintering equipment, including temperature uniformity, pressure distribution, throughput rates, and long-term stability requirements.

Reliability Testing Standards: Define accelerated aging protocols and failure analysis methodologies specific to silver-sintered joints that enable accurate lifetime prediction for power semiconductor devices.

Process Documentation Guidelines: Establish best practices for process control documentation, statistical process control implementation, and traceability requirements that support quality certification in automotive and aerospace applications.

How Equipment OEMs and Automation Specialists Could Enhance System Capabilities?

Precision Thermal Control: Develop advanced heating systems with rapid temperature ramping, uniform temperature distribution, and precise cooling control that optimize sintering quality while minimizing cycle times and energy consumption.

Intelligent Process Control: Integrate real-time monitoring of temperature, pressure, atmosphere composition, and joint formation quality using advanced sensors and AI-powered process optimization algorithms.

Flexible Platform Architecture: Design modular systems that can accommodate different substrate sizes, device types, and production volumes while enabling easy reconfiguration for new applications or process requirements.

Contamination Prevention: Implement advanced cleanroom compatibility, particle filtration, and material handling systems that prevent contamination during the sensitive sintering process, particularly critical for high-reliability applications.

Predictive Maintenance Systems: Build self-diagnostic capabilities that monitor equipment health, predict component failures, and schedule maintenance activities to maximize uptime in high-volume manufacturing environments.

How Semiconductor Manufacturers and System Integrators Could Navigate Technology Transition?

Process Transfer Expertise: Develop comprehensive process transfer protocols that enable reliable migration from traditional die attach methods to silver sintering while maintaining yield and quality standards.

Supply Chain Integration: Establish qualified supplier networks for silver pastes, sintering equipment, and process consumables that provide consistent quality and delivery reliability for high-volume production.

Quality Control Systems: Implement advanced inspection and testing capabilities, including cross-sectional analysis, thermal resistance measurement, and accelerated reliability testing specific to silver-sintered joints.

Application Engineering Support: Provide technical expertise, helping customers optimize sintering processes for specific device designs, thermal requirements, and reliability targets across different end markets.

Production Scaling Services: Offer equipment installation, process optimization, and operator training services that enable rapid production ramp-up while maintaining quality and yield targets.

How Investors and Technology Financiers Could Enable Market Expansion?

Equipment Manufacturing Scale-Up: Finance production capacity expansion for sintering equipment manufacturers to meet growing demand from power semiconductor and LED manufacturers while reducing equipment costs through volume production.

Process Technology Development: Back companies developing next-generation sintering technologies, including alternative materials, faster processing methods, and enhanced automation capabilities that improve process economics and performance.

Materials Innovation Investment: Support development of advanced silver paste formulations, recycling technologies, and alternative sintering materials that reduce material costs while maintaining or improving thermal and mechanical properties.

Market Penetration Financing: Offer equipment leasing, customer financing, and performance guarantees that enable semiconductor manufacturers to adopt silver sintering technology despite high initial capital requirements.

Supply Chain Resilience Capital: Fund diversification of critical component suppliers, establishment of regional service networks, and development of local materials supply capabilities to support global expansion of silver sintering adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD 122 million |

| System Type | Fully Integrated Inline System, Modular Automation System, Semi-Automatic Processing Units, Custom Configuration Systems |

| Application | Power Semiconductor Device, RF Power Device, High Performance LED, Advanced Electronics Assembly |

| Process Integration | Complete Production Lines, Standalone Sintering Units, Retrofit Automation Systems, Research and Development Platforms |

| Performance Levels | High-Volume Production Systems, Precision Research Equipment, Standard Manufacturing Units, Specialized Application Systems |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Boschman, ASMPT, AMX Automatrix, BESI, Infotech AG, NIKKISO, PINK GmbH Thermosysteme, Zhuhai Silicon Cool Technology, Shenzhen Advanced Joining, Quick Intelligent Equipment, Chenglian Kaida Technology, JH Advanced Semiconductor, Zhongke Guangzhi |

| Additional Attributes | Dollar sales by system type and application categories, regional semiconductor manufacturing trends across North America, Europe, and Asia-Pacific, competitive landscape with established equipment manufacturers and emerging technology developers, adoption patterns for fully integrated versus modular systems, integration with semiconductor packaging processes and quality control systems, innovations in process automation and thermal management technologies, and development of next-generation silver sintering capabilities with enhanced precision and reliability for demanding electronics applications. |

The global fully automatic silver sintering system market is estimated to be valued at USD 121.9 million in 2025.

The market size for the fully automatic silver sintering system market is projected to reach USD 235.3 million by 2035.

The fully automatic silver sintering system market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in fully automatic silver sintering system market are fully integrated inline system and modular automation system.

In terms of application, power semiconductor device segment to command 46.2% share in the fully automatic silver sintering system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fully Sealed Fully Insulated Inflatable Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed Cartons Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed 3D Printing Smart Warehouse Market Size and Share Forecast Outlook 2025 to 2035

Fully Integrated Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Fully Automated Coagulometer Market

Fully Automatic Blood Gas Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Blood Cell Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Wet Chemical Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Hydraulic Lifting Column Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic High Speed Nail Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Solid-Liquid Purge Trap Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Liquid Metal Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA