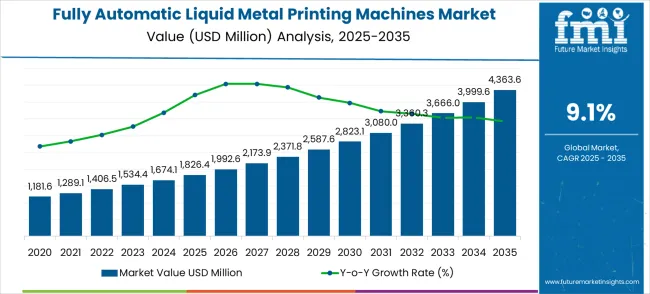

The fully automatic liquid metal printing machines market is expected to increase from USD 1,826.4 million in 2025 to USD 4,363.6 million by 2035, with a CAGR of 9.1%. The market experiences a steady rise, with significant peaks and troughs reflecting shifts in demand and technological advancements. Starting at USD 1,181.6 million in 2021, the market sees gradual increases, reaching a notable peak of USD 1,826.4 million in 2025. This growth is driven by the growing adoption of liquid metal printing technologies across industries like aerospace, automotive, and healthcare, as companies seek more efficient, precise, and cost-effective manufacturing solutions.

The first major peak occurs around 2025, where values climb from USD 1,674.1 million to USD 1,826.4 million. This surge is largely attributed to higher adoption rates in industries requiring high-performance parts and the expansion of 3D printing applications. The market does encounter short-term dips, particularly between 2025 and 2026, as challenges like supply chain disruptions and material cost fluctuations temporarily hinder growth. Following these setbacks, the market experiences a strong recovery, with growth accelerating from 2026 onwards. By 2035, the market will reach USD 4,363.6 million, driven by technological innovations, improved cost efficiency, and broader industrial adoption.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,826.4 million |

| Forecast Value in (2035F) | USD 4,363.6 million |

| Forecast CAGR (2025 to 2035) | 9.1% |

The fully automatic liquid metal printing machines market is a vital segment within several key industries, contributing to the advancement of manufacturing technologies. In the additive manufacturing market, these machines account for approximately 7-9% of the market share. Their ability to print complex metal parts with high precision makes them an essential technology in sectors like aerospace, automotive, and electronics. In the industrial printing market, fully automatic liquid metal printing machines represent around 4-6% of the total market. They provide a unique solution for high-quality, industrial-scale metal printing, improving the manufacturing of durable and functional components.

In the advanced manufacturing market, liquid metal printing machines contribute about 5-7% of the market share. Their role in producing high-performance parts with intricate designs and superior material properties makes them a crucial tool for modern manufacturing. Within the metalworking market, these machines hold approximately 3-5% of the market share, as they offer a new approach to creating precision metal components that traditional methods cannot easily achieve. Finally, in the aerospace & defense market, fully automatic liquid metal printing machines account for about 6-8% of the market.

Market expansion is being supported by the revolutionary manufacturing capabilities of liquid metal printing technologies and the corresponding demand for production systems that can create complex geometries impossible to achieve with traditional manufacturing methods. Modern manufacturers are increasingly focused on additive manufacturing solutions that can reduce material waste, enable rapid prototyping, and support mass customization while maintaining high quality standards. The proven capability of fully automatic liquid metal printing machines to deliver superior design flexibility, material efficiency, and production speed makes them essential components of next-generation manufacturing operations.

The growing focus on digital manufacturing and Industry 4.0 transformation is driving demand for automated production technologies that can integrate with smart factory systems and support flexible manufacturing workflows. Industry preference for manufacturing solutions that can reduce tooling requirements, enable complex part consolidation, and provide on-demand production capabilities is creating opportunities for advanced liquid metal printing development. The rising influence of green manufacturing practices and circular economy principles is also contributing to increased adoption of additive manufacturing technologies across different industrial sectors and applications.

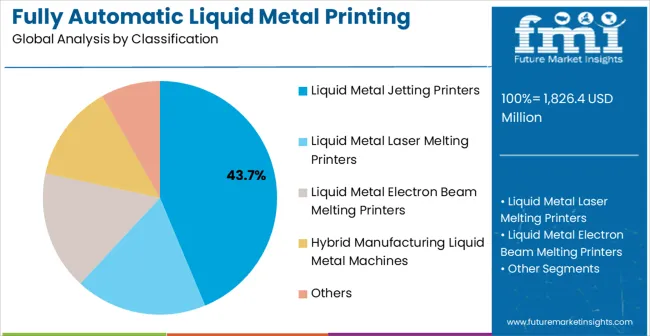

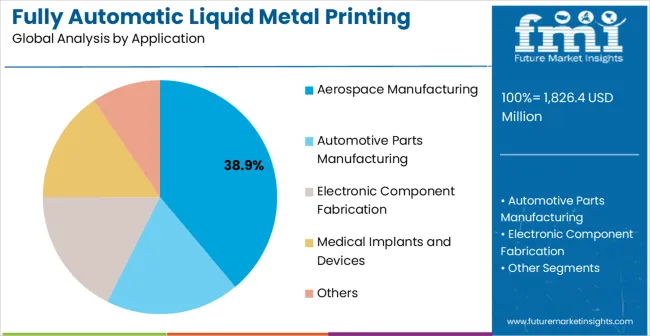

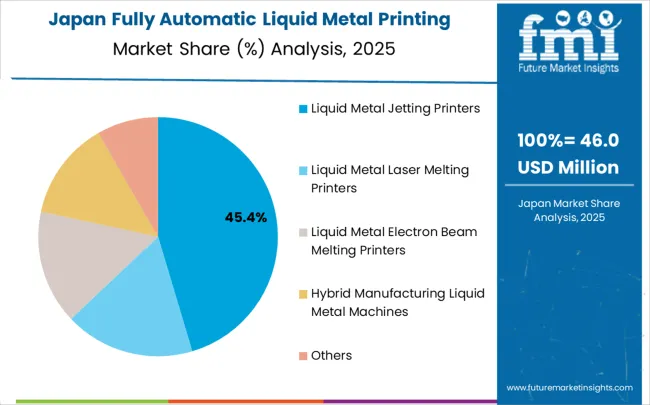

The market is segmented by classification, application, and region. By classification, the market is divided into liquid metal jetting printers, liquid metal laser melting printers, liquid metal electron beam melting printers, hybrid manufacturing liquid metal machines, and others. Based on application, the market is categorized into aerospace manufacturing, automotive parts manufacturing, electronic component fabrication, medical implants and devices, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and Middle East & Africa.

The liquid metal jetting printers classification is projected to account for 43.7% of the fully automatic liquid metal printing machines market in 2025, reaffirming its position as the category's dominant technology approach. Manufacturing engineers increasingly recognize the superior precision and surface finish capabilities provided by liquid metal jetting technologies for high-resolution component production. This classification addresses the most demanding quality requirements while providing essential automation and throughput characteristics.

This classification forms the foundation of most precision manufacturing applications, as it represents the most technologically advanced and quality-focused approach in current liquid metal printing technology. Research developments and process optimization continue to strengthen confidence in liquid metal jetting performance. With increasing recognition of the importance of surface quality and dimensional accuracy, jetting technologies align with both current manufacturing requirements and future precision objectives. Their comprehensive capabilities across multiple materials ensures market dominance, making them the central growth driver of automatic liquid metal printing adoption.

Aerospace manufacturing is projected to represent 38.9% of fully automatic liquid metal printing machines demand in 2025, underscoring its role as the primary application driving market development. Aerospace companies recognize that aircraft component manufacturing requires the most sophisticated and reliable production technologies to meet stringent safety and performance requirements. Aerospace applications demand exceptional quality control and material properties that liquid metal printing machines are uniquely positioned to deliver.

The segment is supported by the continuous advancement of aircraft designs requiring increasingly complex components and the growing deployment of additive manufacturing across aerospace supply chains. Additionally, aerospace manufacturers are increasingly adopting automated production technologies that can reduce lead times while maintaining the highest quality standards. As understanding of aerospace manufacturing requirements advances, liquid metal printing applications will continue to serve as the primary commercial driver, reinforcing their essential position within the advanced manufacturing technology market.

The fully automatic liquid metal printing machines market is advancing rapidly due to increasing adoption of additive manufacturing and growing demand for complex metal component production. The market faces challenges including high capital investment requirements, material cost considerations, and technical expertise requirements for operation and maintenance. Innovation in process automation and materials development continue to influence product development and market expansion patterns.

The growing implementation of Industry 4.0 technologies is enabling more sophisticated liquid metal printing integration with comprehensive manufacturing execution systems. Advanced smart factory platforms offer real-time process monitoring, predictive maintenance capabilities, and quality control integration that are particularly important for automated metal printing operations. Digital manufacturing systems provide access to comprehensive data analytics that can optimize production efficiency and quality outcomes.

Modern additive manufacturing companies are incorporating specialized metal alloys, advanced process monitoring systems, and real-time quality control technologies to enhance liquid metal printing performance and reliability. These technologies improve part quality, enable better process repeatability, and provide enhanced control throughout the manufacturing process. Advanced integration also enables optimized material utilization and improved production throughput characteristics.

| Country | CAGR (2025-2035) |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| Brazil | 9.6% |

| USA | 8.6% |

| UK | 7.7% |

| Japan | 6.8% |

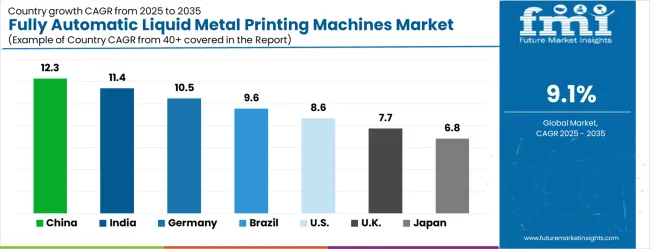

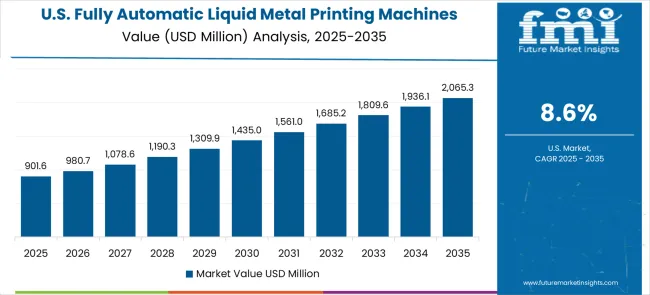

The fully automatic liquid metal printing machines market is experiencing strong growth globally, with China leading at a 12.3% CAGR through 2035, driven by massive manufacturing sector modernization, government support for advanced manufacturing technologies, and rapidly expanding aerospace and automotive industries. India follows at 11.4%, supported by growing manufacturing capabilities, increasing investment in advanced production technologies, and expanding industrial automation adoption. Germany shows growth at 10.5%, emphasizing precision manufacturing excellence and Industry 4.0 leadership. Brazil records 9.6% growth, focusing on expanding manufacturing sector and growing adoption of advanced production technologies. The USA shows 8.6% growth, representing continued innovation leadership in additive manufacturing and aerospace applications.

The report covers an in-depth analysis of 40+ countries with top-performing countries highlighted below.

Revenue from fully automatic liquid metal printing machines in China is projected to exhibit outstanding growth with a CAGR of 12.3% through 2035, driven by unprecedented manufacturing sector modernization and comprehensive government support for advanced manufacturing technology development. The country's massive industrial base and increasing capabilities in high-tech manufacturing are creating tremendous opportunities for liquid metal printing adoption. Major domestic and international manufacturing equipment companies are establishing comprehensive production and service facilities to serve the rapidly expanding advanced manufacturing market.

In India, the market for fully automatic liquid metal printing machines is expanding at a CAGR of 11.4%, supported by rapidly growing manufacturing sector, increasing investment in advanced production technologies, and expanding industrial automation capabilities. The country's substantial manufacturing growth and commitment to technology advancement are driving demand for sophisticated manufacturing equipment. International manufacturing equipment companies and domestic manufacturers are establishing partnerships to serve the growing demand for advanced production systems.

Germany is expected to see continued growth in the fully automatic liquid metal printing machine market, with a projected CAGR of 10.5%, supported by the country's leadership in precision manufacturing and comprehensive expertise in Industry 4.0 technologies. German manufacturing companies consistently invest in cutting-edge production technologies and automated manufacturing systems. The market is characterized by advanced engineering capabilities, comprehensive industry collaboration, and established relationships between equipment manufacturers and end users.

In Brazil, the market for fully automatic liquid metal printing machines is expected to grow at a CAGR of 9.6% through 2035, driven by manufacturing sector expansion, increasing adoption of advanced production technologies, and growing focus on industrial modernization. Brazilian manufacturers are increasingly recognizing the importance of advanced manufacturing capabilities in maintaining competitiveness and supporting innovation.

Future Trends in Fully Automatic Liquid Metal Printing Machines Market in the USA

The USA market for fully automatic liquid metal printing machines is projected to grow at a CAGR of 8.6%, supported by established leadership in additive manufacturing, substantial investment in advanced production technologies, and comprehensive aerospace and defense manufacturing requirements. American manufacturing companies and equipment providers consistently advance liquid metal printing technologies through established innovation programs and research collaboration.

Fully Automatic Liquid Metal Printing Machines Market Outlook in the UK

The UK is expected to see solid growth in the fully automatic liquid metal printing machine market, with a CAGR of 7.7% through 2035, supported by advanced manufacturing initiatives and increasing investment in production technology modernization. British manufacturing companies emphasize cutting-edge production technologies within comprehensive manufacturing frameworks that prioritize innovation and competitiveness.

Japan is set to grow its fully automatic liquid metal printing machine market at a CAGR of 6.8% through 2035, supported by the country's leadership in precision manufacturing and comprehensive approach to advanced production technologies. Japanese manufacturing companies emphasize technology-driven development of sophisticated manufacturing systems within established frameworks that prioritize technical excellence and quality.

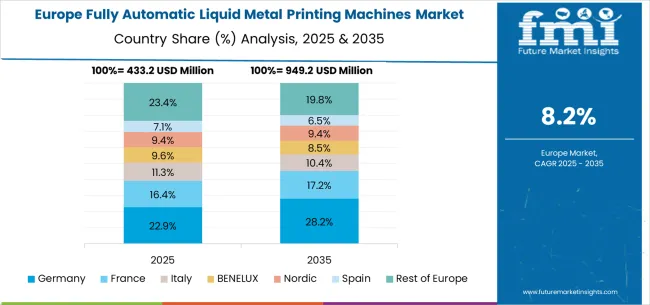

The fully automatic liquid metal printing machines market in Europe is projected to expand steadily through 2035, supported by established manufacturing industries, comprehensive Industry 4.0 adoption, and ongoing innovation in additive manufacturing technologies. Germany will continue to lead the regional market, accounting for 31.4% in 2025 and rising to 32.7% by 2035, supported by strong precision manufacturing capabilities, advanced industrial automation, and comprehensive research and development infrastructure. The United Kingdom follows with 19.8% in 2025, increasing to 20.2% by 2035, driven by advanced manufacturing initiatives, government support for technology innovation, and expanding research collaboration networks.

France holds 17.1% in 2025, edging up to 17.4% by 2035 as manufacturers expand additive manufacturing capabilities and demand grows for advanced production technologies. Italy contributes 12.9% in 2025, remaining stable at 13.1% by 2035, supported by manufacturing sector strength and growing adoption of automated production systems. Spain represents 9.2% in 2025, moving upward to 9.4% by 2035, underpinned by expanding manufacturing modernization and increasing investment in advanced production technologies.

Nordic countries together account for 6.1% in 2025, maintaining their position at 6.2% by 2035, supported by advanced manufacturing initiatives and early adoption of innovative production technologies. The Rest of Europe represents 3.5% in 2025, declining slightly to 1.0% by 2035, as larger markets capture greater investment focus and technology development resources.

The fully automatic liquid metal printing machines market is characterized by competition among specialized additive manufacturing companies, established industrial equipment manufacturers, and innovative technology developers. Companies are investing in advanced process technologies, automation enhancement, strategic partnerships, and application development to deliver high-performance, reliable, and cost-effective liquid metal printing solutions. Technology development, quality assurance, and customer support strategies are central to strengthening competitive advantages and market presence.

Velo3D leads the market with significant expertise in metal additive manufacturing technologies, offering comprehensive liquid metal printing solutions with focus on quality optimization and aerospace applications. Desktop Metal provides established metal 3D printing capabilities with focus on production automation and manufacturing scalability. XJet focuses on innovative liquid metal jetting technologies with comprehensive material development and application support. GE Additive delivers advanced additive manufacturing solutions with strong focus on industrial applications and process integration.

Trumpf operates with focus on laser-based manufacturing technologies and comprehensive industrial automation systems. DMG Mori provides precision machine tool capabilities with focus on hybrid manufacturing solutions. Arcam AB specializes in electron beam melting technologies with focus on aerospace and medical applications. Renishaw, 3D Systems, EOS GmbH, BeAM Machines, Optomec, AddUp, Prima Additive, and SPEE3D provide diverse technological approaches and application expertise to enhance overall market development and manufacturing capability advancement.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,826.4 million |

| Classification | Liquid Metal Jetting Printers, Liquid Metal Laser Melting Printers, Liquid Metal Electron Beam Melting Printers, Hybrid Manufacturing Liquid Metal Machines, Others |

| Application | Aerospace Manufacturing, Automotive Parts Manufacturing, Electronic Component Fabrication, Medical Implants and Devices, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan and 40+ countries |

| Key Companies Profiled | Velo3D, Desktop Metal, XJet, GE Additive, Trumpf, DMG Mori, Arcam AB, Renishaw, 3D Systems, EOS GmbH, BeAM Machines, Optomec, AddUp, Prima Additive, SPEE3D |

| Additional Attributes | Dollar sales by printer type and application, regional technology adoption trends, competitive landscape, manufacturing partnerships, integration with Industry 4.0 systems, innovations in liquid metal processing and automation, quality control analysis, and production efficiency optimization strategies |

The global fully automatic liquid metal printing machines market is estimated to be valued at USD 1,826.4 million in 2025.

The market size for the fully automatic liquid metal printing machines market is projected to reach USD 4,363.6 million by 2035.

The fully automatic liquid metal printing machines market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in fully automatic liquid metal printing machines market are liquid metal jetting printers, liquid metal laser melting printers, liquid metal electron beam melting printers, hybrid manufacturing liquid metal machines and others.

In terms of application, aerospace manufacturing segment to command 38.9% share in the fully automatic liquid metal printing machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fully Sealed Fully Insulated Inflatable Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed Cartons Market Size and Share Forecast Outlook 2025 to 2035

Fully Integrated Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Fully Automated Coagulometer Market

Fully Enclosed 3D Printing Smart Warehouse Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Blood Gas Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Blood Cell Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Wet Chemical Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Hydraulic Lifting Column Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Silver Sintering System Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic High Speed Nail Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Solid-Liquid Purge Trap Market Size and Share Forecast Outlook 2025 to 2035

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA