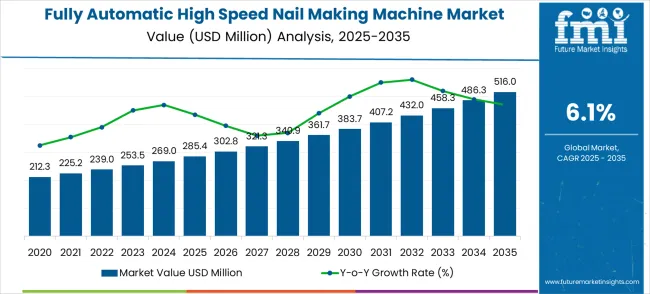

The fully automatic high speed nail making machine market is expected to grow from USD 285.4 million in 2025 to USD 516.0 million by 2035, at a CAGR of 6.1%, recording an absolute increase of USD 230.6 million over the forecast period. The market is valued at USD 285.4 million in 2025 and is set to rise at a CAGR of 6.1% during the assessment period. The overall market size is expected to grow by nearly 1.8 times during the same period, supported by increasing construction activities worldwide, driving demand for efficient nail manufacturing systems and growing investments in automation and machinery manufacturing projects globally. However, high initial investment costs and complex maintenance requirements for advanced machinery systems may pose challenges to market expansion.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 285.4 million |

| Market Forecast Value (2035) | USD 516 million |

| Forecast CAGR (2025-2035) | 6.1% |

Between 2025 and 2030, the fully automatic high-speed nail-making machine market is projected to expand from USD 285.4 million to USD 382.7 million, resulting in a value increase of USD 97.3 million, which represents 42.2% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for construction and infrastructure development solutions, product innovation in automation technologies and speed enhancement systems, as well as expanding integration with smart manufacturing and Industry 4.0 initiatives. Companies are establishing competitive positions through investment in advanced nail-making technologies, energy-efficient solutions, and strategic market expansion across construction, machinery manufacturing, and industrial applications.

From 2030 to 2035, the market is forecast to grow from USD 382.7 million to USD 516.0 million, adding another USD 133.3 million, which constitutes 57.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized nail-making systems, including intelligent control platforms and integrated monitoring solutions tailored for specific manufacturing applications, strategic collaborations between technology providers and industrial machinery developers, and an enhanced focus on production efficiency and environmental sustainability. The growing emphasis on automation of manufacturing processes and cost optimization will drive demand for advanced, fully automatic, high-speed nail-making solutions across diverse industrial applications.

The fully automatic high-speed nail-making machine market grows by enabling manufacturers to ensure consistent production quality and enhanced efficiency in nail manufacturing processes. Industrial manufacturers face mounting pressure to reduce production costs and improve output efficiency, with automated nail-making systems typically requiring 60-70% less manual labor than traditional alternatives, making fully automatic high-speed systems essential for competitive manufacturing operations. The construction industry's need for continuous supply and quality consistency creates demand for advanced nail-making solutions that can handle high-volume production operations, maintain precise specifications, and ensure seamless manufacturing without quality variations or production interruptions. Government initiatives promoting industrial automation and smart manufacturing development drive adoption in machinery manufacturing, construction supply, and industrial production applications, where reliable manufacturing equipment has a direct impact on production capacity and operational efficiency. However, budget constraints for manufacturing equipment upgrades and the complexity of integrating advanced systems with existing production facilities may limit adoption rates among smaller manufacturers and developing regions with limited capital resources.

The fully automatic high-speed nail-making machine market represents a compelling industrial automation opportunity driven by global construction expansion, manufacturing modernization, and Industry 4.0 adoption. As manufacturers worldwide seek to reduce labor costs by 60-70%, improve production consistency, and meet growing demands for construction materials, advanced nail-making systems are transitioning from cost centers to strategic competitive advantages.

Rising industrialization across the Asia-Pacific, infrastructure development initiatives, and mandatory automation targets in major economies create sustained demand drivers. Meanwhile, technological convergence around intelligent systems, IoT connectivity, and predictive maintenance opens new value propositions beyond traditional equipment sales. The market's evolution from conventional to smart systems, coupled with expanding applications beyond construction into machinery manufacturing and specialized industrial uses, signals significant pathway diversification opportunities.

Strategic positioning around geographic expansion, technology differentiation, and service-led business models promises substantial margin uplift, particularly as the market grows from USD 285.4 million in 2025 to USD 516.0 million by 2035 at 6.1% CAGR.

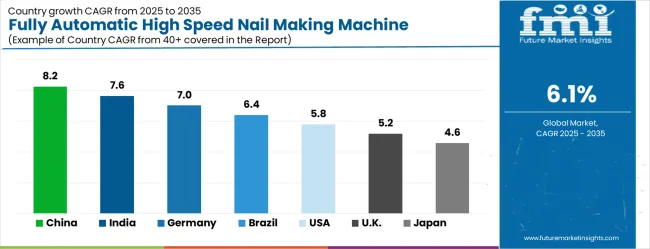

Rapid industrialization and construction growth across China (8.2% CAGR), India (7.6% CAGR), and emerging ASEAN markets create massive expansion opportunities. Local manufacturing capabilities reduce logistics costs, enable faster deployment, and provide competitive advantages in price-sensitive markets. Regional customization for local nail specifications, regulatory compliance, and service infrastructure development unlocks market penetration where global players currently struggle with high import costs and limited technical support. Expected revenue pool: USD 180-220 million

The dominant Intelligent Type segment (58.3% market share) represents the future of nail manufacturing with IoT connectivity, predictive maintenance, real-time monitoring, and integration with smart factory ecosystems. Companies developing advanced control systems, data analytics platforms, and automated quality control can command significant premiums while creating recurring revenue through software subscriptions and data services. Integration with broader manufacturing execution systems positions nail making as part of comprehensive automation solutions. Expected revenue pool: USD 200-280 million

High capital investment requirements and technical complexity create opportunities for service-centric approaches, including equipment-as-a-service, comprehensive maintenance contracts, performance-based pricing, and training services. This pathway transforms one-time equipment sales into recurring revenue streams while addressing customer concerns about technical expertise requirements and maintenance complexity. Predictive maintenance capabilities enable proactive service delivery and higher customer lifetime values. Expected revenue pool: USD 80-120 million

While construction dominates (67.2% market share), expanding into specialized applications, including automotive fasteners, furniture manufacturing, electronics assembly, packaging industries, and emerging sectors like renewable energy hardware, creates new growth vectors. Customized nail specifications, specialized coatings, and precision requirements in these applications enable premium pricing and reduced competition from standard construction-focused suppliers. Expected revenue pool: USD 60-90 million

Growing emphasis on environmental compliance and operational cost reduction drives demand for energy-efficient drying systems, waste reduction technologies, renewable energy integration, and circular economy approaches. Manufacturers offering 25-40% energy consumption improvements, waste heat recovery systems, and sustainable manufacturing processes can access green financing, government incentives, and premium pricing from sustainability-focused customers. Expected revenue pool: USD 45-70 million

Advanced production technologies, including multi-wire processing, high-speed automation, quality control integration, and production line optimization, create opportunities for differentiation and competitive advantage. Companies developing faster rehydration processes, improved speed-to-consistency ratios, and automated changeover capabilities address core customer pain points around production efficiency and operational flexibility, enabling premium positioning in competitive markets. Expected revenue pool: USD 70-110 million

Supply chain disruptions and "near-shoring" trends create opportunities for regional manufacturing capabilities, local supply chain development, and distributed production models. This pathway particularly benefits companies establishing manufacturing presence in key growth markets, reducing dependency on global supply chains, and providing faster customer response times while building stronger regional partnerships with construction and manufacturing customers. Expected revenue pool: USD 55-85 million

The market is segmented by machine type, application, and region. By machine type, the market is divided into conventional type, intelligent type, and others. Based on the application, the market is categorized into construction, machinery manufacturing, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The intelligent or fully automatic machine type segment represents the dominant force in the nail-making machinery market, capturing approximately 58% of total market share in 2025. This technological advancement category encompasses machines equipped with sophisticated automation features, including computer numerical control (CNC) systems and programmable logic controllers (PLCs) that enable seamless production monitoring and quality control procedures. The intelligent segment's market leadership stems from its superior production capabilities, with machines capable of producing thousands of nails per minute while maintaining consistent dimensional accuracy and head formation quality across all manufacturing runs.

The conventional type segment maintains a substantial 30-32% market share, serving manufacturers who require reliable nail production without extensive automation features. These machines offer cost-effective solutions for medium-scale operations while providing sufficient production volumes to meet regional construction and manufacturing demands. The remaining market segments, categorized as specialty or hybrid systems, account for approximately 9-20% of the market, serving niche applications requiring specific nail configurations or materials.

Key technological advantages driving the intelligent segment include:

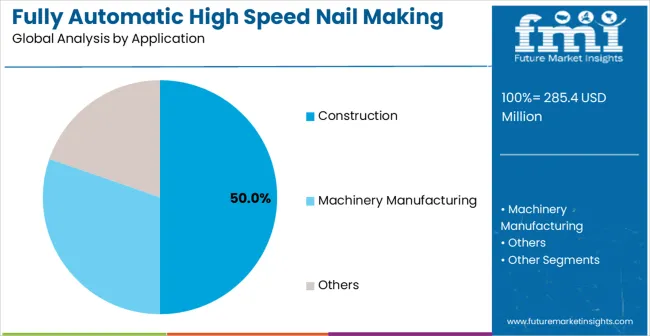

Construction applications dominate the fully automatic high-speed nail-making machine market with 50% market share in 2025, reflecting the critical role of nail production in supporting global infrastructure development and residential construction activities. The construction segment's market leadership is reinforced by increasing urbanization trends, government infrastructure investments, and rising demand for standardized fastening solutions in commercial and residential building projects worldwide.

The machinery manufacturing segment represents the second-largest application category, capturing 20-26% market share through specialized nail requirements for industrial equipment, automotive components, and specialized manufacturing applications. This segment benefits from growing demand for precision-engineered fasteners that meet specific strength, corrosion resistance, and dimensional tolerance requirements in manufacturing processes.

Key market dynamics supporting application growth include:

The market is driven by three concrete demand factors tied to industrial automation outcomes. First, construction industry growth and infrastructure development create increasing demand for efficient nail production systems, with construction material requirements expanding by 12-15% annually in major developing countries worldwide, requiring comprehensive, fully automatic nail-making infrastructure. Second, government initiatives promoting industrial automation and smart manufacturing drive mandatory adoption of automated production systems, with many countries setting targets for 40-60% automation of manufacturing processes by 2030. Third, technological advancements in control systems and production efficiency enable more reliable and cost-effective nail-making solutions that reduce operational costs while improving system performance and production quality standards.

Market restraints include high capital investment requirements that can deter smaller manufacturers from upgrading their production infrastructure, particularly in developing regions where funding for manufacturing modernization remains limited. Technical complexity poses another significant challenge, as implementing advanced nail-making systems requires specialized expertise and training programs, potentially causing delays in project implementation and increased integration costs. Regulatory compliance requirements across different countries create additional complexity for manufacturers and operators, demanding ongoing adaptation to varying safety standards and certification processes.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where rapid industrialization and infrastructure development drive comprehensive manufacturing system expansion. Design shifts toward intelligent nail-making solutions with IoT connectivity, predictive maintenance capabilities, and integrated monitoring systems enable proactive maintenance approaches that reduce downtime and operational costs. However, the market thesis could face disruption if alternative nail production technologies or significant changes in construction material standards minimize reliance on traditional nail-making systems.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| Brazil | 6.4% |

| USA | 5.8% |

| UK | 5.2% |

| Japan | 4.6% |

The fully automatic high-speed nail-making machine market is gathering pace worldwide, with China taking the lead thanks to massive industrial expansion and government-backed manufacturing modernization programs. Close behind, India benefits from expanding construction activities and smart manufacturing initiatives, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows steady advancement, where integration of advanced automation technologies strengthens its role in the European manufacturing equipment supply chain. Brazil is sharpening its focus on industrial modernization and infrastructure development, signaling an ambition to capitalize on the growing opportunities in South American manufacturing markets. Meanwhile, the USA stands out for its advanced technology adoption in existing manufacturing systems, and the UK and Japan continue to record consistent progress in system automation. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the Fully Automatic High Speed Nail Making Machine Market with a CAGR of 8.2% through 2035. The country's leadership position stems from massive industrial expansion projects, government-backed manufacturing modernization programs, and stringent efficiency regulations driving the adoption of automated production systems. Growth is concentrated in major manufacturing centers, including Guangzhou, Shanghai, Beijing, and Shenzhen, where manufacturing facilities and industrial complexes are implementing advanced nail-making solutions for enhanced operational efficiency and production quality. Distribution channels through state-owned enterprises and government-approved suppliers expand deployment across manufacturing projects and industrial development infrastructure. The country's "Made in China 2025" strategy provides policy support for smart manufacturing initiatives, including advanced automation system adoption.

Key market factors:

In Mumbai, Delhi, Chennai, and Pune, the adoption of fully automatic high-speed nail-making systems is accelerating across manufacturing facilities and industrial projects, driven by rapid industrialization and government smart manufacturing initiatives. The market demonstrates strong growth momentum with a CAGR of 7.6% through 2035, linked to comprehensive manufacturing infrastructure development and increasing focus on production efficiency solutions. Indian manufacturers are implementing advanced nail-making systems and monitoring platforms to enhance operational efficiency while meeting growing demand in expanding construction and industrial sectors. The country's National Manufacturing Policy creates sustained demand for automated production solutions, while increasing emphasis on quality improvement drives adoption of advanced manufacturing systems.

Advanced manufacturing sector in Germany demonstrates sophisticated implementation of fully automatic high-speed nail-making systems, with documented case studies showing 30% production efficiency improvements in manufacturing operations through intelligent automation platforms. The country's manufacturing infrastructure in major industrial centers, including Munich, Stuttgart, Hamburg, and Frankfurt, showcases integration of advanced nail-making technologies with existing production systems, leveraging expertise in mechanical engineering and automation technologies. German manufacturers emphasize precision engineering and quality standards, creating demand for high-performance nail-making solutions that support continuous improvement initiatives and production optimization requirements. The market maintains steady growth through focus on Industry 4.0 integration and sustainability compliance, with a CAGR of 7.0% through 2035.

Key development areas:

Market expansion in Brazil is driven by diverse manufacturing demand, including construction material production in São Paulo and Rio de Janeiro, industrial manufacturing in Brasília and other major cities, and comprehensive production modernization across multiple states. The country demonstrates promising growth potential with a CAGR of 6.4% through 2035, supported by federal government infrastructure investment programs and state-level industrial development initiatives. Brazilian manufacturers face implementation challenges related to capital investment constraints and technical expertise availability, requiring phased deployment approaches and financing support from international development banks. However, growing efficiency regulations and manufacturing demands create compelling business cases for nail-making system adoption, particularly in industrial areas where production efficiency has a direct impact on economic competitiveness.

Market characteristics:

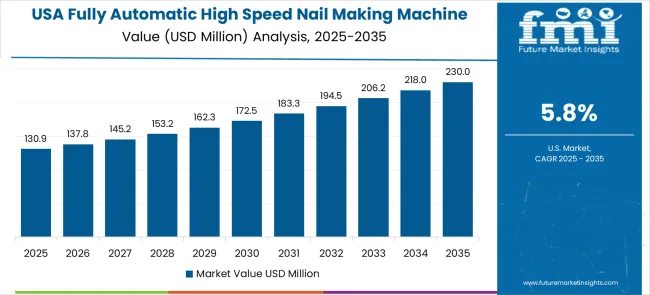

The USA market leads in advanced nail-making system innovation based on integration with intelligent manufacturing systems and smart factory technologies for enhanced operational efficiency. The country shows strong potential with a CAGR of 5.8% through 2035, driven by the modernization of existing manufacturing infrastructure and the expansion of automated production facilities in major industrial areas, including Detroit, Houston, Chicago, and Los Angeles. American manufacturers are adopting intelligent nail-making systems for operational efficiency improvement and regulatory compliance, particularly in regions with strict quality standards and aging infrastructure requiring comprehensive upgrades. Technology deployment channels through established industrial contractors and direct manufacturer relationships expand coverage across manufacturing facilities and industrial operators.

Leading market segments:

In London, Manchester, Birmingham, and Glasgow, manufacturing facilities are implementing fully automatic high-speed nail-making solutions to modernize aging production infrastructure and improve operational efficiency, with documented case studies showing a 22% reduction in production costs through advanced manufacturing management systems. The market shows moderate growth potential with a CAGR of 5.2% through 2035, linked to the ongoing modernization of manufacturing facilities, industrial production networks, and emerging automated manufacturing projects in major cities outside London. British manufacturers are adopting intelligent nail-making and monitoring platforms to enhance system reliability while maintaining production quality standards demanded by customers and regulatory authorities. The country's established manufacturing infrastructure creates sustained demand for replacement and upgrade solutions that integrate with existing production systems.

Market development factors:

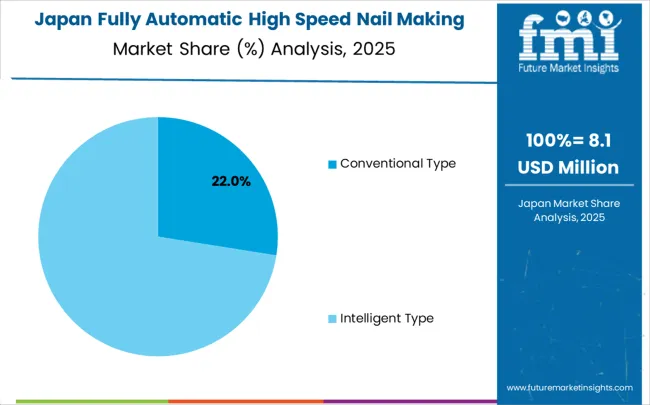

Fully Automatic High Speed Nail Making Machine Market in Japan demonstrates sophisticated implementation focused on precision engineering and operational excellence optimization, with documented integration of advanced manufacturing systems, achieving 25% improvement in production efficiency across industrial and manufacturing facilities. The country maintains steady growth momentum with a CAGR of 4.6% through 2035, driven by manufacturing facilities' emphasis on quality standards and continuous improvement methodologies that align with lean manufacturing principles applied to production operations. Major industrial areas, including Tokyo, Osaka, Nagoya, and Fukuoka, showcase advanced deployment of intelligent nail-making platforms where manufacturing systems integrate seamlessly with existing automated production control systems and comprehensive quality management programs.

Key market characteristics:

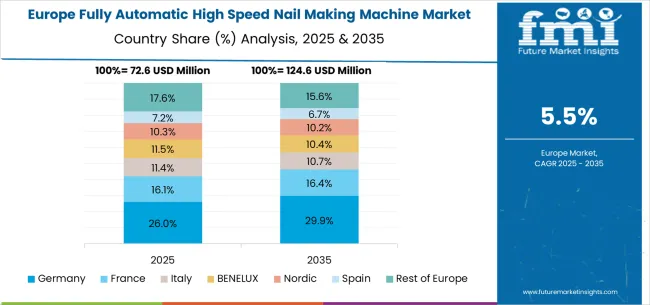

The fully automatic high-speed nail-making machine market in Europe is projected to grow from USD 71.4 million in 2025 to USD 129.0 million by 2035, registering a CAGR of 6.1% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, declining slightly to 30.8% by 2035, supported by its extensive manufacturing infrastructure and major industrial centers, including Munich, Stuttgart, and Frankfurt production facilities.

Italy follows with an 18.5% share in 2025, projected to reach 19.1% by 2035, driven by comprehensive manufacturing expansion programs in Milan, Turin, and other industrial areas implementing advanced automation systems. The United Kingdom holds a 16.3% share in 2025, expected to maintain 15.9% by 2035 through the ongoing modernization of manufacturing facilities and industrial production networks. France commands a 14.7% share, while Spain accounts for 11.8% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 7.5% to 8.5% by 2035, attributed to increasing nail-making system adoption in Nordic countries and emerging Eastern European manufacturing facilities implementing industrial automation programs.

The Japanese Fully Automatic High Speed Nail Making Machine Market demonstrates a mature and precision-focused landscape, characterized by sophisticated integration of intelligent type nail making systems with existing manufacturing control infrastructure across industrial facilities, construction supply networks, and automated production lines. Japan's emphasis on operational excellence and quality standards drives demand for high-reliability nail-making solutions that support kaizen continuous improvement initiatives and statistical process control requirements in manufacturing operations. The market benefits from strong partnerships between international technology providers like ENKOTEC A/S, Gujarat Wire Products, and domestic industrial equipment leaders, including Mitsubishi Electric, Fanuc, and Hitachi, creating comprehensive service ecosystems that prioritize system reliability and operator training programs. Manufacturing centers in Tokyo, Osaka, Nagoya, and other major industrial areas showcase advanced predictive maintenance implementations where nail-making systems achieve 99% uptime through integrated monitoring programs.

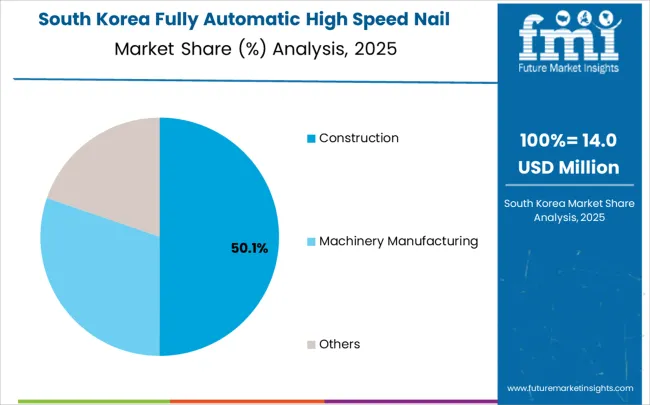

The South Korean Fully Automatic High Speed Nail Making Machine Market is characterized by strong international technology provider presence, with companies like ENKOTEC A/S, Gujarat Wire Products, and Accurate Nail Machine maintaining dominant positions through comprehensive system integration and maintenance services capabilities for manufacturing facilities and industrial production applications. The market is demonstrating a growing emphasis on localized technical support and rapid response capabilities, as Korean manufacturers increasingly demand customized solutions that integrate with domestic automation infrastructure and advanced production control systems deployed across the Seoul Metropolitan Area and other major industrial cities. Local industrial equipment companies and regional system integrators are gaining market share through strategic partnerships with global providers, offering specialized services including technical training programs and certification services for maintenance personnel. The competitive landscape shows increasing collaboration between multinational nail-making manufacturers and Korean manufacturing technology specialists, creating hybrid service models that combine international mechanical engineering expertise with local market knowledge and customer relationship management.

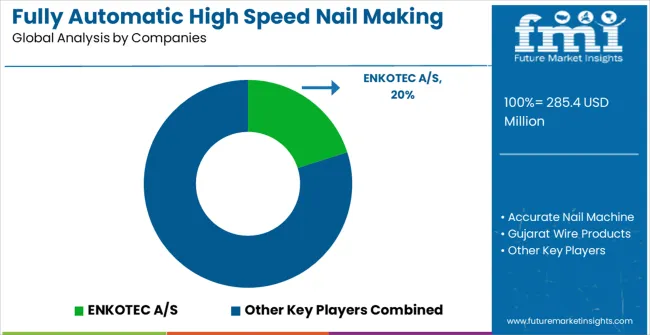

The Fully Automatic High Speed Nail Making Machine Market features approximately 25-30 meaningful players with moderate concentration, where the top three companies control roughly 35-40% of global market share through established technology platforms and extensive manufacturing industry relationships. Competition centers on technological innovation, service capabilities, and production efficiency rather than price competition alone.

Market leaders include ENKOTEC A/S, Accurate Nail Machine, and Gujarat Wire Products, which maintain competitive advantages through comprehensive manufacturing solution portfolios, global service networks, and deep expertise in the industrial machinery sector, creating high switching costs for customers. These companies leverage installed base relationships and ongoing maintenance contracts to defend market positions while expanding into adjacent manufacturing system applications.

Challengers encompass Saggu Machine Tools and Ekta Industries, which compete through specialized nail-making solutions and strong regional presence in key manufacturing markets. Technology specialists, including Zeus Techno, Asv Engineering, and JIGNESH INDUSTRIES, focus on specific nail-making technologies or vertical applications, offering differentiated capabilities in automation control, production optimization, and monitoring platforms.

Regional players and emerging technology providers create competitive pressure through cost-effective solutions and rapid deployment capabilities, particularly in high-growth markets including China and India, where local presence provides advantages in customer support and regulatory compliance. Market dynamics favor companies that combine advanced manufacturing technologies with comprehensive service offerings that address the complete nail-making system lifecycle from design through ongoing maintenance and optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 285.4 million |

| Machine Type | Conventional Type, Intelligent Type, Others |

| Application | Construction, Machinery Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, the USA, the UK, Japan, and 40+ countries |

| Key Companies Profiled | ENKOTEC A/S, Accurate Nail Machine, Gujarat Wire Products, Saggu Machine Tools, Ekta Industries, Zeus Techno, Asv Engineering, JIGNESH INDUSTRIES, Tanisaka Iron Works, Armind Tradex Private |

| Additional Attributes | Dollar sales by machine type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with technology providers and system integrators, manufacturing facility requirements and specifications, integration with smart manufacturing initiatives and IoT platforms, innovations in nail making technology and monitoring systems, and development of specialized applications with efficiency and quality capabilities. |

The global fully automatic high speed nail making machine market is estimated to be valued at USD 285.4 million in 2025.

The market size for the fully automatic high speed nail making machine market is projected to reach USD 516.0 million by 2035.

The fully automatic high speed nail making machine market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in fully automatic high speed nail making machine market are conventional type and intelligent type.

In terms of application, construction segment to command 50.0% share in the fully automatic high speed nail making machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fully Sealed Fully Insulated Inflatable Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed Cartons Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed 3D Printing Smart Warehouse Market Size and Share Forecast Outlook 2025 to 2035

Fully Integrated Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Fully Automated Coagulometer Market

Fully Automatic Blood Gas Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Blood Cell Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Wet Chemical Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Hydraulic Lifting Column Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Silver Sintering System Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Solid-Liquid Purge Trap Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Liquid Metal Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Floodgate Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking (AEB) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA