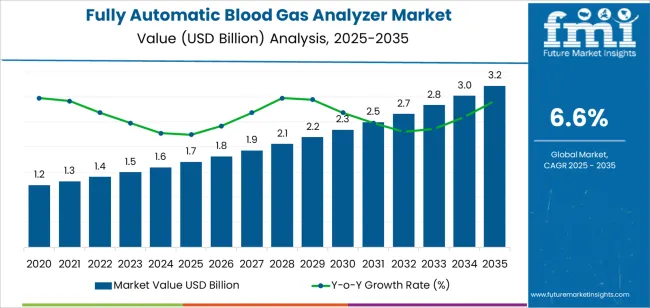

The global fully automatic blood gas analyzer market is projected to grow from USD 1.7 billion in 2025 to approximately USD 3.3 billion by 2035, recording an absolute increase of USD 1,548.03 million over the forecast period. This translates into a total growth of 89.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.6% between 2025 and 2035. The overall market size is expected to grow by nearly 1.9X during the same period, supported by increasing prevalence of chronic respiratory diseases, growing emphasis on point-of-care diagnostic capabilities in emergency medicine, and rising adoption of advanced diagnostic technologies across hospital laboratories and critical care facilities.

The market expansion reflects fundamental shifts in clinical diagnostics, where traditional laboratory-based testing faces pressure from demand for rapid, accurate blood gas analysis in time-critical clinical scenarios. Fully automatic systems offer comprehensive metabolic profiling capabilities that support clinical decision-making in intensive care, emergency departments, and surgical settings. These analyzers provide rapid measurement of blood pH, carbon dioxide, oxygen levels, electrolytes, and metabolic parameters essential for managing critically ill patients.

Technological advancement continues to drive market evolution, with manufacturers developing compact, user-friendly systems that maintain laboratory-grade accuracy while reducing sample volume requirements and turnaround times. Integration of connectivity features enables seamless data transfer to hospital information systems, supporting workflow efficiency and documentation requirements. The shift toward automated quality control, reagent management, and maintenance protocols reduces operator intervention and enhances reliability in high-volume clinical environments.

Regional dynamics demonstrate varied adoption patterns influenced by healthcare infrastructure maturity, reimbursement frameworks, and clinical practice standards. Developed markets show steady replacement cycles and technology upgrades, while emerging economies experience accelerated adoption as hospital networks expand critical care capabilities. Regulatory frameworks governing in-vitro diagnostic devices shape product development priorities and market access strategies across different geographies.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.7 billion |

| Market Forecast Value (2035) | USD 3.3 billion |

| Forecast CAGR (2025-2035) | 6.6% |

| CLINICAL DEMAND DRIVERS | TECHNOLOGY ADVANCEMENT | HEALTHCARE INFRASTRUCTURE |

|---|---|---|

| Critical Care Expansion | Automation Integration | Laboratory Modernization |

| Growing intensive care capacity across hospital networks driving demand for rapid diagnostic capabilities at bedside and in emergency settings. | Advanced automation reducing operator intervention while maintaining measurement accuracy and expanding test menu capabilities. | Healthcare facility investments in diagnostic infrastructure supporting adoption of comprehensive analytical systems. |

| Chronic Disease Prevalence | Connectivity Features | Point-of-Care Standards |

| Increasing incidence of respiratory disorders, cardiovascular conditions, and metabolic diseases requiring frequent blood gas monitoring. | Integration with hospital information systems enabling seamless data management and supporting clinical workflow optimization. | Regulatory frameworks establishing performance standards for point-of-care devices driving quality improvements. |

| Emergency Medicine Growth | Miniaturization Progress | Reimbursement Frameworks |

| Expansion of emergency department capabilities and pre-hospital care programs requiring portable analytical solutions. | Device miniaturization enabling placement in space-constrained clinical environments without compromising analytical performance. | Payment models supporting diagnostic testing investments and recognizing value of rapid result availability. |

| Category | Segments Covered |

|---|---|

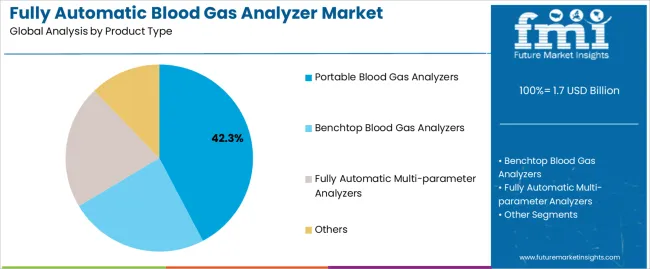

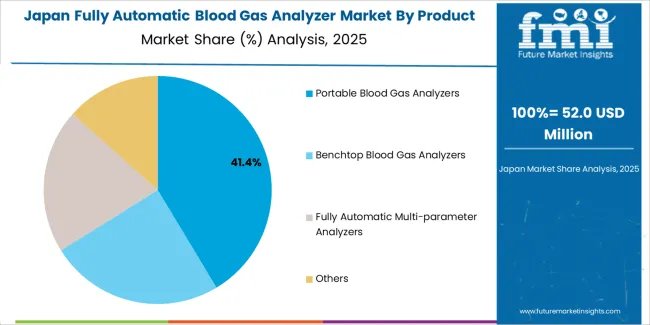

| By Product Type | Portable Blood Gas Analyzers, Benchtop Blood Gas Analyzers, Fully Automatic Multi-parameter Analyzers, Others |

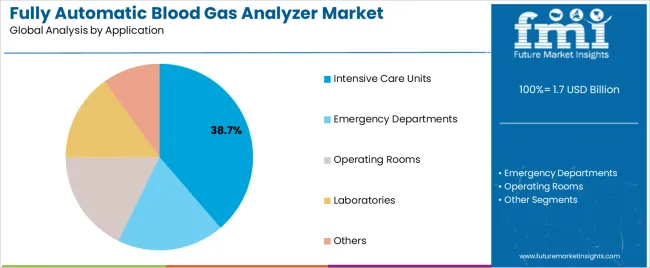

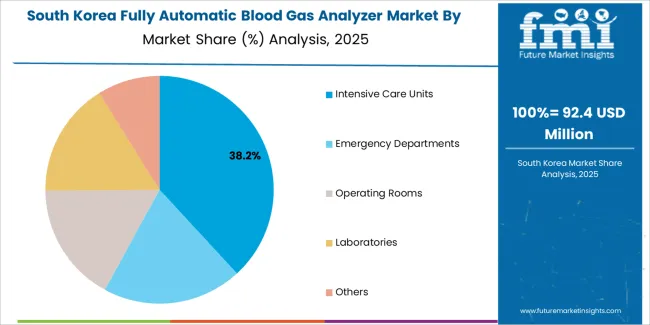

| By Application | Intensive Care Units, Emergency Departments, Operating Rooms, Laboratories, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Portable Blood Gas Analyzers |

|

| Benchtop Blood Gas Analyzers |

|

| Fully Automatic Multi-parameter Analyzers |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Intensive Care Units |

|

| Emergency Departments |

|

| Operating Rooms |

|

| Laboratories |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Critical Care Demand Growth | Capital Investment Requirements | Connectivity Integration |

| Expanding intensive care capacity and emergency medicine capabilities driving demand for rapid diagnostic solutions across hospital networks. | High equipment costs and ongoing consumable expenses affecting adoption rates in budget-constrained healthcare facilities. | Hospital information system integration enabling seamless data management and supporting clinical workflow optimization. |

| Chronic Disease Prevalence | Maintenance Complexity | Miniaturization Advancement |

| Increasing incidence of respiratory, cardiovascular, and metabolic conditions requiring frequent blood gas monitoring and metabolic assessment. | Regular calibration, quality control, and reagent management requirements demanding technical expertise and resource allocation. | Device size reduction enabling placement in space-constrained environments while maintaining analytical performance and reliability. |

| Point-of-Care Testing Expansion | Regulatory Compliance | Multi-parameter Capabilities |

| Clinical preference for bedside testing reducing turnaround times and supporting immediate therapeutic interventions in acute care settings. | Stringent regulatory requirements for in-vitro diagnostic devices affecting product development timelines and market entry costs. | Expanded test menus combining blood gas, electrolyte, and metabolic measurements on single platforms reducing sample handling complexity. |

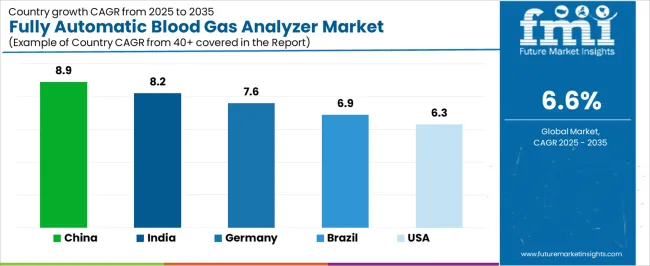

| Country | CAGR (2025-2035) |

|---|---|

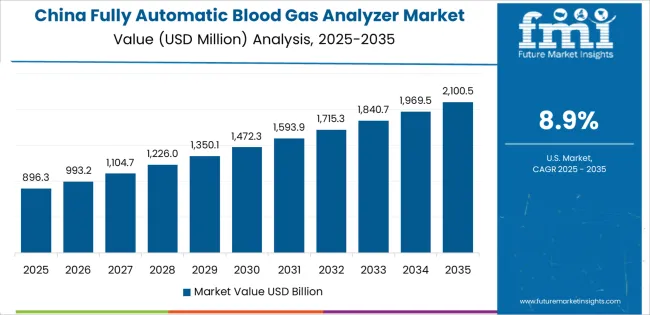

| China | 8.9% |

| India | 8.2% |

| Germany | 7.6% |

| Brazil | 6.9% |

| United States | 6.3% |

Revenue from fully automatic blood gas analyzers in China is projected to exhibit strong growth with a market value reaching significant levels by 2035, driven by comprehensive healthcare infrastructure development and expanding critical care capabilities across tier-one through tier-three cities creating substantial opportunities for diagnostic equipment suppliers. The country's hospital network expansion and medical equipment modernization initiatives are creating significant demand for advanced analytical systems. Major healthcare facilities in Beijing, Shanghai, Guangzhou, and emerging medical centers are establishing comprehensive diagnostic laboratories and point-of-care testing capabilities.

Hospital construction programs and critical care unit expansion are supporting widespread adoption of automated blood gas analysis systems across public and private healthcare facilities. Government healthcare reform initiatives emphasizing diagnostic capability enhancement and clinical outcome improvement are creating substantial opportunities for equipment suppliers. Medical equipment localization programs and domestic manufacturer development are facilitating adoption through competitive pricing and local service networks. Emergency medicine development and intensive care specialization programs are driving demand for portable and benchtop systems across major metropolitan hospitals.

Revenue from fully automatic blood gas analyzers in India is expanding substantially by 2035, supported by healthcare infrastructure modernization and private hospital network growth creating sustained demand for diagnostic equipment across metropolitan and emerging urban centers. The country's medical tourism industry and corporate hospital development are driving adoption of advanced diagnostic technologies. Major healthcare groups including Apollo Hospitals, Fortis Healthcare, and Max Healthcare are implementing comprehensive laboratory automation programs.

Government healthcare initiatives and insurance coverage expansion are facilitating diagnostic equipment adoption across public and private healthcare facilities. Medical college hospital upgrades and teaching hospital modernization programs are creating opportunities for advanced analytical systems. Emergency medicine development and trauma care network expansion are driving demand for point-of-care blood gas analysis capabilities. Clinical laboratory accreditation programs and quality standard implementation are enhancing requirements for automated diagnostic systems throughout major healthcare facilities.

Demand for fully automatic blood gas analyzers in Germany is projected to reach substantial levels by 2035, supported by the country's leadership in healthcare quality standards and advanced diagnostic capabilities requiring sophisticated analytical systems. German hospitals maintain comprehensive critical care facilities with integrated diagnostic capabilities. The market is characterized by emphasis on measurement accuracy, system reliability, and compliance with stringent quality standards.

University hospital networks and specialized medical centers prioritize advanced diagnostic technologies demonstrating superior analytical performance and integration capabilities. Healthcare digitalization initiatives and laboratory information system modernization are driving adoption of connected diagnostic platforms. Clinical research programs and pharmaceutical industry collaborations are facilitating adoption of advanced analytical capabilities. Regulatory compliance emphasis and quality assurance programs are creating opportunities for premium diagnostic systems throughout academic medical centers and specialized care facilities.

Revenue from fully automatic blood gas analyzers in Brazil is growing substantially by 2035, driven by healthcare system expansion and private hospital network development creating sustained opportunities for diagnostic equipment suppliers. The country's Unified Health System modernization and private healthcare sector growth are creating demand for advanced diagnostic capabilities. Major hospital groups in São Paulo, Rio de Janeiro, and Brasília are implementing laboratory automation programs.

Medical equipment import policies and local manufacturing incentives are facilitating market access for international and domestic suppliers. Emergency medicine development and intensive care specialization programs are enhancing demand for point-of-care blood gas analysis systems. Healthcare insurance coverage expansion and middle-class growth are supporting private hospital investments in diagnostic capabilities. Clinical laboratory quality programs and accreditation initiatives are creating opportunities for automated diagnostic systems across metropolitan healthcare facilities.

Demand for fully automatic blood gas analyzers in the United States is expanding to reach substantial levels by 2035, driven by healthcare technology advancement and point-of-care testing adoption creating opportunities across hospital networks and specialized care facilities. The country's established healthcare infrastructure and clinical laboratory sophistication support demand for advanced diagnostic systems. Academic medical centers and integrated healthcare networks maintain comprehensive analytical capabilities.

Value-based care models and clinical outcome emphasis are driving investments in diagnostic technologies supporting rapid clinical decision-making. Hospital information system integration requirements and regulatory compliance standards are influencing equipment selection criteria. Emergency medicine specialization and critical care network development are creating demand for portable analytical systems. Clinical research programs and diagnostic technology innovation are facilitating adoption of next-generation blood gas analysis platforms across major medical centers.

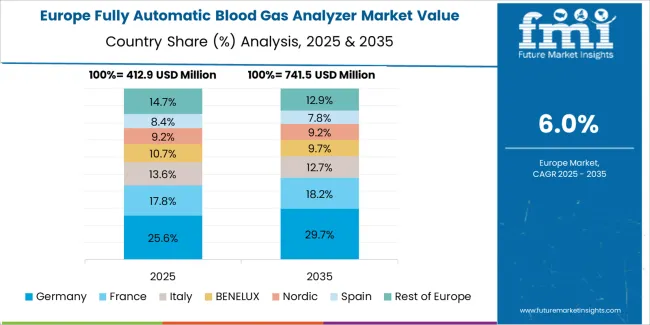

The fully automatic blood gas analyzer market in Europe is projected to grow from USD 431.09 million in 2025 to USD 770.55 million by 2035, registering a CAGR of 6.0% over the forecast period. Germany is expected to maintain its leadership position with a 28.4% market share in 2025, declining slightly to 27.8% by 2035, supported by its advanced healthcare infrastructure and comprehensive critical care networks across university hospitals and specialized medical centers.

France follows with a 21.3% share in 2025, projected to reach 21.7% by 2035, driven by healthcare system modernization programs and emergency medicine development initiatives. The United Kingdom holds a 19.6% share in 2025, expected to decrease to 19.1% by 2035 due to National Health Service budget constraints affecting equipment replacement cycles. Italy commands a 16.8% share in 2025, while Spain accounts for 13.9% in 2025, both maintaining relatively stable positions through 2035. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 10.0% to 11.2% by 2035, attributed to healthcare infrastructure investments in Nordic countries and Eastern European hospital network modernization programs implementing advanced diagnostic capabilities.

Japanese fully automatic blood gas analyzer operations reflect the country's rigorous quality standards and advanced healthcare system sophistication. Major hospital networks maintain comprehensive critical care facilities with integrated diagnostic capabilities exceeding international benchmarks. The regulatory framework through the Pharmaceuticals and Medical Devices Agency establishes stringent performance requirements and quality standards that favor established manufacturers with proven reliability records.

Clinical laboratories emphasize measurement accuracy and system reliability, with procurement decisions prioritizing long-term performance over initial acquisition costs. Hospital networks maintain extended equipment validation processes requiring comprehensive documentation and performance verification. Major medical device distributors including Terumo, Sysmex, and local subsidiaries of international manufacturers provide technical support and service networks essential for market access. The Japanese market demonstrates preference for compact, user-friendly systems with advanced connectivity features supporting hospital information system integration and quality management protocols.

South Korean fully automatic blood gas analyzer operations reflect the country's technologically advanced healthcare sector and emphasis on diagnostic innovation. Major hospital groups including Seoul National University Hospital, Asan Medical Center, and Samsung Medical Center maintain state-of-the-art critical care facilities with comprehensive analytical capabilities. The regulatory environment through the Ministry of Food and Drug Safety emphasizes product quality and clinical performance validation.

Healthcare digitalization initiatives and hospital information system integration requirements drive demand for connected diagnostic platforms. Clinical laboratories prioritize automation capabilities and workflow efficiency, with procurement strategies emphasizing total cost of ownership rather than initial equipment costs. The market benefits from government healthcare policies supporting diagnostic technology adoption and medical device industry development. Local manufacturers and international suppliers compete across segments, with market dynamics favoring systems demonstrating superior analytical performance and reliability in high-volume clinical environments.

Market structure reflects concentration among established diagnostic equipment manufacturers with comprehensive product portfolios and global service networks. Value creation centers on technological innovation, regulatory compliance capabilities, and clinical validation demonstrating measurement accuracy and reliability. Leading manufacturers maintain competitive positions through integrated offerings combining hardware, consumables, and service contracts that establish recurring revenue streams and customer relationships extending across equipment lifecycles.

Profit pools concentrate in premium segments where advanced analytical capabilities and connectivity features command price premiums. Multi-parameter analyzers with expanded test menus capture higher margins than basic blood gas systems, while portable devices benefit from point-of-care testing demand despite lower throughput capacity. Consumable revenues provide stable cash flows supporting equipment placement strategies and competitive pricing models. Service contracts enhance customer retention while generating predictable revenue streams.

Competitive dynamics demonstrate increasing pressure from regulatory requirements governing in-vitro diagnostic devices and quality management systems. Manufacturers invest in compliance capabilities and clinical validation programs essential for market access across different geographies. Product development priorities emphasize user interface simplification, sample volume reduction, and maintenance requirement minimization addressing clinical workflow constraints. Connectivity features enabling hospital information system integration become standard requirements rather than differentiating capabilities.

Market consolidation continues through acquisitions targeting complementary technologies and geographic expansion. Established players acquire specialized manufacturers to broaden product portfolios and access emerging markets. Distribution network strength provides competitive advantages particularly in regions requiring local service capabilities and technical support. Switching costs created through training investments, consumable supply agreements, and information system integration stabilize customer relationships and create barriers limiting competitive displacement.

| Items | Values |

|---|---|

| Quantitative Units | USD 1.7 billion |

| Product Type | Portable Blood Gas Analyzers, Benchtop Blood Gas Analyzers, Fully Automatic Multi-parameter Analyzers, Others |

| Application | Intensive Care Units, Emergency Departments, Operating Rooms, Laboratories, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

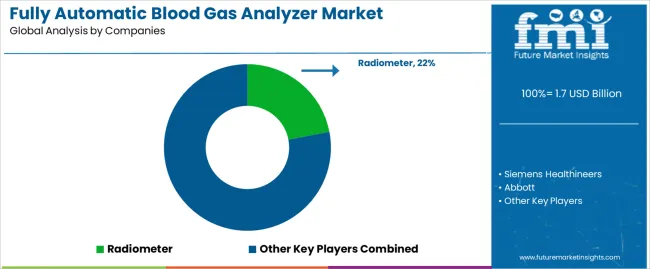

| Key Companies Profiled | Radiometer, Siemens Healthineers, Abbott, Instrumentation Laboratory, Roche Diagnostics, Nova Biomedical, Medica Corporation, OPTI Medical Systems, Edan Instruments, Alere, Convergent Technologies, Sysmex Corporation, Samsung Medison, Erba Mannheim, ApexBio |

| Additional Attributes | Dollar sales by product type and application, regional demand across North America, Europe, Asia Pacific, competitive landscape, technology advancement in automation and connectivity, point-of-care testing adoption, and critical care expansion driving diagnostic capability enhancement, clinical workflow optimization, and healthcare infrastructure modernization |

The global fully automatic blood gas analyzer market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the fully automatic blood gas analyzer market is projected to reach USD 3.2 billion by 2035.

The fully automatic blood gas analyzer market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in fully automatic blood gas analyzer market are portable blood gas analyzers, benchtop blood gas analyzers, fully automatic multi-parameter analyzers and others.

In terms of application, intensive care units segment to command 38.7% share in the fully automatic blood gas analyzer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fully Enclosed Cartons Market Size and Share Forecast Outlook 2025 to 2035

Fully Enclosed 3D Printing Smart Warehouse Market Size and Share Forecast Outlook 2025 to 2035

Fully Integrated Dishwasher Market Size and Share Forecast Outlook 2025 to 2035

Fully Automated Coagulometer Market

Fully Automatic Hydraulic Lifting Column Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Silver Sintering System Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic High Speed Nail Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Solid-Liquid Purge Trap Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Liquid Metal Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Wet Chemical Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Blood Cell Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Automatic Chicken Deboning Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Press Solutions Market Size and Share Forecast Outlook 2025 to 2035

Automatic Filter Presses (AFPs) Market Size and Share Forecast Outlook 2025 to 2035

Automatic Riveting Equipment Market Forecast and Outlook 2025 to 2035

Automatic Powder Forming Machine Market Forecast and Outlook 2025 to 2035

Automatic Weigh Price Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Transmission Market Size and Share Forecast Outlook 2025 to 2035

Automatic Emergency Braking System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA