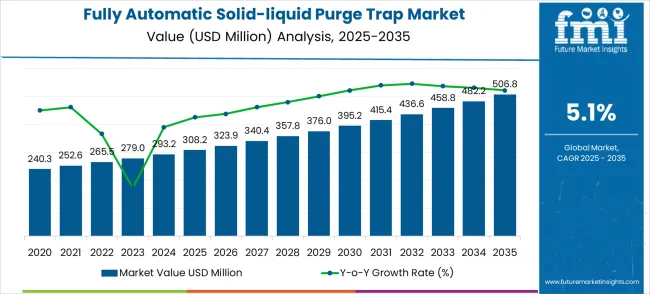

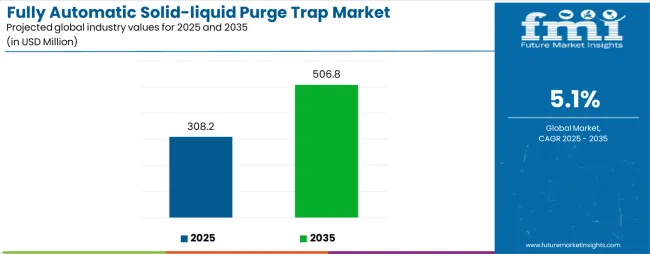

The fully automatic solid-liquid purge trap market is forecasted to advance from USD 308.2 million in 2025 to USD 507.0 million by 2035, registering a compound annual growth rate (CAGR) of 5%. This expansion highlights a balanced yet firm trajectory, largely influenced by the widespread adoption of automated separation processes across industries such as pharmaceuticals, petrochemicals, and environmental testing. The precision of fully automatic solid-liquid purge traps in handling complex sample matrices has been widely acknowledged, making them indispensable for laboratories and production environments where accuracy and efficiency remain non-negotiable. Market value is being reinforced by the rising demand for reliable testing equipment that ensures compliance with stringent regulatory frameworks. The broader need for automated solutions in analytical instrumentation is strengthening the position of purge traps as part of routine operational workflows, creating steady growth potential throughout the forecast horizon.

Over the decade, the CAGR reflects more than just incremental demand, as it represents a shift toward prioritizing automation across high-demand application areas. Manufacturers are expected to emphasize product upgrades that improve sample throughput, operational safety, and analytical consistency, further driving adoption.

The market is also being shaped by the growing preference for instruments that minimize manual intervention while ensuring reproducibility in test results. Industries that rely heavily on high-quality analysis are actively contributing to market expansion by integrating purge traps into both new and existing systems. Such trends suggest that growth will not only result from increasing demand but also from technological refinement, where enhanced designs and advanced automation features ensure long-term competitiveness. As these improvements continue to be introduced, the fully automatic solid-liquid purge trap market is projected to maintain a firm growth outlook across global industrial and laboratory landscapes.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 308.2 million |

| Forecast Value in (2035F) | USD 507 million |

| Forecast CAGR (2025 to 2035) | 5% |

The fully automatic solid-liquid purge trap market has been recognized as an advanced subset across analytical and testing industries, representing around 6.2% of the analytical instruments market, 7.5% of the environmental testing equipment market, 5.1% of the laboratory automation market, 4.3% of the chemical analysis equipment market, and 6.7% of the water and wastewater testing equipment market. Combined, the market accounts for nearly 29.8% of these parent domains.

This reflects how automated purge trap systems have been increasingly preferred for their accuracy in capturing volatile compounds, improving sample throughput, and reducing manual intervention in both environmental and industrial laboratories. Their adoption has been widely acknowledged by researchers and operators, giving this market a crucial standing in precision-based testing environments.

Market expansion is being supported by the increasing regulatory requirements for volatile organic compound analysis in environmental samples, food products, and industrial processes. Modern analytical laboratories require precise and reproducible methods for detecting trace-level contaminants in complex matrices including water, soil, beverages, and pharmaceutical products. Fully automatic solid-liquid purge trap systems provide enhanced sensitivity, improved precision, and reduced sample preparation time compared to traditional manual extraction methods.

The growing complexity of analytical requirements and increasing demand for high-throughput sample processing are driving adoption of automated purge trap systems in commercial testing laboratories, government agencies, and research institutions. Quality control programs and regulatory compliance mandates require standardized analytical procedures that minimize human intervention and ensure consistent results. Advanced purge trap systems offer automated sample handling, precise temperature control, and integrated gas chromatography interfaces that streamline analytical workflows and improve laboratory productivity.

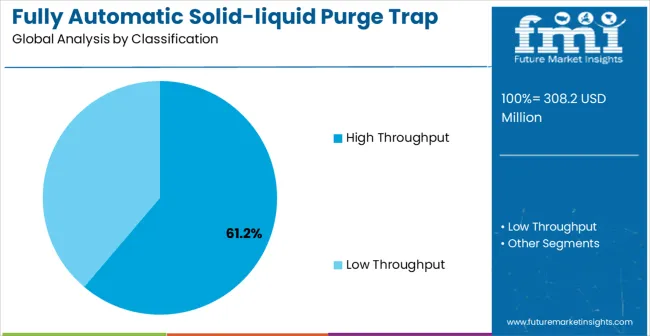

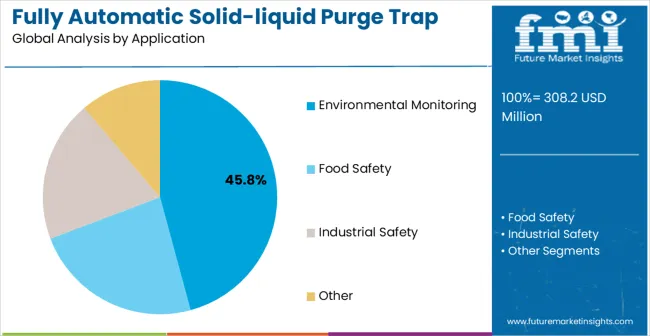

The market is segmented by throughput capacity, application, and region. By throughput capacity, the market is divided into high throughput and low throughput systems. By application, the market is categorized into environmental monitoring, food safety testing, industrial safety analysis, and pharmaceutical quality control. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

High throughput systems are projected to capture 61.2% of the fully automatic solid-liquid purge trap market in 2025, emerging as the largest segment. This dominance is driven by the growing requirement for rapid and large-scale sample processing, particularly in commercial testing laboratories and environmental monitoring facilities that handle high daily volumes of water, soil, and air samples. High throughput systems are designed to maximize efficiency with automated sample loading, parallel processing capabilities, and integrated data management features. These advantages not only improve laboratory productivity but also reduce the cost of analysis on a per-sample basis, making them highly attractive for large organizations under pressure to deliver fast and reliable results.

Technological advancements are further strengthening the segment’s position. Modern high throughput systems are equipped with robotic sample handling, automated calibration routines, and real-time monitoring capabilities that ensure both precision and consistency with minimal operator involvement. Laboratories engaged in food safety testing, industrial quality assurance, and compliance reporting particularly favor these systems due to their ability to handle diverse sample types without compromising accuracy. Moreover, seamless integration with Laboratory Information Management Systems (LIMS) enables streamlined workflows and data traceability. The continued push for higher laboratory productivity, coupled with the need for cost-effective analytical solutions, positions high throughput systems as the preferred choice for many end users across industries.

Environmental monitoring is anticipated to account for 45.8% of the fully automatic solid-liquid purge trap market in 2025, securing its position as the leading application segment. This strong share reflects the essential role purge trap systems play in detecting and analyzing volatile organic compounds (VOCs) across water, soil, and air samples. Their high sensitivity and selectivity make them indispensable tools for assessing trace-level pollutants that may impact public health or indicate environmental degradation. As environmental quality regulations become more stringent, laboratories are increasingly adopting purge trap systems for routine monitoring, contamination assessment, and remediation validation.

The growth of this segment is reinforced by expanding government regulations, heightened environmental compliance standards, and rising global awareness of the long-term risks associated with pollution. Agencies, research institutions, and consulting firms rely heavily on purge trap technology to measure industrial effluents, monitor contaminated sites, and evaluate remediation effectiveness. Advanced systems further enhance reliability by offering automated sample preparation, consistent analyte recovery, and robust quality assurance protocols that ensure data accuracy for compliance and legal reporting. With the continued expansion of global environmental monitoring programs and rising investment in ecological sustainability, the environmental monitoring segment will remain a cornerstone of market demand, driving adoption across both public and private sector laboratories.

The fully automatic solid-liquid purge trap market is advancing steadily due to increasing regulatory requirements for analytical testing and growing demand for automated laboratory solutions. However, the market faces challenges including high initial equipment costs, complexity of system maintenance, and need for specialized technical expertise. Technological advancement in automation software and integration with laboratory information systems continue to influence product development and market expansion patterns.

Growing regulatory enforcement for environmental protection, food safety, and industrial monitoring is driving demand for standardized analytical procedures and validated testing methods. Regulatory agencies worldwide are implementing stricter requirements for volatile organic compound detection in various matrices, necessitating the use of precise and reproducible analytical techniques. Fully automatic purge trap systems provide the accuracy, precision, and documentation capabilities required for regulatory compliance testing, making them essential tools for laboratories conducting official analytical work. The development of harmonized analytical standards and international quality certification programs is further supporting market growth by establishing consistent performance requirements across different geographical regions and application areas.

Modern purge trap manufacturers are incorporating advanced automation technologies, including robotic sample handling, artificial intelligence-driven method optimization, and cloud-based data management systems. These technological improvements enhance system reliability, reduce operator workload, and provide comprehensive analytical documentation for quality assurance programs. Smart laboratory integration allows purge trap systems to communicate with other analytical instruments, share analytical data in real-time, and automatically generate quality control reports. Advanced software features include predictive maintenance alerts, automated calibration verification, and remote system monitoring capabilities that improve operational efficiency and reduce downtime. The growing adoption of laboratory automation platforms and digital analytical workflows is creating opportunities for innovative purge trap systems that seamlessly integrate with modern laboratory infrastructure.

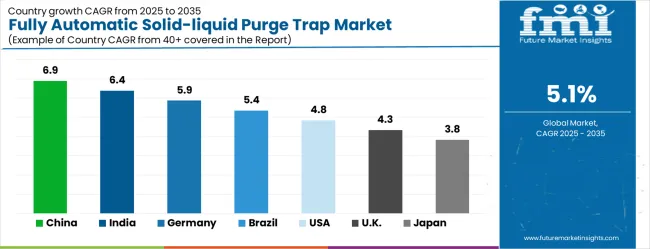

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

The fully automatic solid-liquid purge trap market is experiencing robust growth globally, with China leading at a 6.9% CAGR through 2035, driven by expanding environmental monitoring programs, increasing industrial safety requirements, and growing analytical laboratory infrastructure. India follows at 6.4%, supported by rising regulatory enforcement, expanding pharmaceutical industry, and increasing environmental awareness. Germany shows steady growth at 5.9%, emphasizing advanced analytical technologies and stringent environmental standards. Brazil records 5.4%, focusing on environmental protection and industrial monitoring expansion. The U.S. demonstrates 4.8% growth, driven by established regulatory frameworks and technological innovation. The U.K. and Japan show mature market characteristics with 4.3% and 3.8% growth respectively, emphasizing quality improvements and advanced analytical capabilities.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The fully automatic solid-liquid purge trap market in China is projected to exhibit the highest growth rate with a CAGR of 6.9% through 2035, driven by rapid expansion of environmental monitoring programs and increasing regulatory requirements for industrial emission control. The country's growing analytical laboratory infrastructure and rising demand for automated testing solutions are creating significant opportunities for advanced purge trap systems. Major government initiatives for environmental protection and water quality management are driving substantial investments in analytical instrumentation across environmental monitoring facilities, industrial testing laboratories, and research institutions throughout major metropolitan and industrial regions. China's massive industrial base, including petrochemical complexes, pharmaceutical manufacturing hubs, and food processing centers, requires comprehensive analytical capabilities for volatile organic compound detection and regulatory compliance. The government's commitment to achieving carbon neutrality goals and implementing stricter environmental standards is accelerating adoption of automated analytical systems that provide accurate, reliable, and traceable analytical results for environmental monitoring and industrial process control applications.

The fully automatic solid-liquid purge trap market in India is projected to expand at a CAGR of 6.4%, supported by increasing regulatory enforcement for environmental protection and growing pharmaceutical industry requirements for analytical testing. The country's expanding analytical laboratory network and rising awareness of environmental contamination issues are driving demand for automated analytical solutions. Government initiatives for water quality management and industrial monitoring are creating opportunities for advanced purge trap systems in environmental testing facilities, pharmaceutical manufacturing plants, and government analytical laboratories across major industrial and metropolitan regions. India's rapidly growing pharmaceutical sector, which serves both domestic and global markets, requires sophisticated analytical capabilities for drug development, quality control, and regulatory compliance with international standards. The expanding petrochemical industry and growing food processing sector are also contributing to increased demand for automated analytical systems that can handle complex sample matrices and provide reliable analytical results for quality assurance and environmental monitoring applications.

The fully automatic solid-liquid purge trap market in Germany is projected to grow at a CAGR of 5.9%, supported by the country's leadership in analytical instrumentation technology and comprehensive environmental monitoring programs. German analytical laboratories emphasize precision, reliability, and compliance with strict European environmental standards, creating demand for advanced automated analytical systems. The market is characterized by focus on technological innovation, quality assurance, and integration with comprehensive environmental management programs supporting both regulatory compliance and research applications in environmental science and industrial monitoring sectors. Germany's robust chemical industry, including major pharmaceutical and specialty chemical manufacturers, requires sophisticated analytical capabilities for process monitoring, quality control, and environmental compliance. The country's commitment to renewable energy development and environmental sustainability initiatives is driving increased demand for analytical systems that can support environmental impact assessments, groundwater monitoring, and industrial emission control programs. German manufacturers and research institutions continue to lead in developing next-generation analytical technologies that combine precision, automation, and environmental responsibility.

The fully automatic solid-liquid purge trap market in Brazil is projected to grow at a CAGR of 5.4%, driven by increasing environmental protection requirements and expanding industrial analytical capabilities. The country's growing awareness of environmental contamination issues and regulatory development for water quality management are creating opportunities for automated analytical systems in environmental laboratories, industrial facilities, and government monitoring agencies. Brazilian analytical laboratories are gradually adopting advanced purge trap systems to meet emerging regulatory requirements and improve analytical capabilities for environmental monitoring and industrial quality control applications. The country's extensive agricultural industry, petroleum production sector, and growing chemical manufacturing base are driving increased demand for analytical systems capable of detecting volatile organic compounds in various sample matrices. Brazil's commitment to protecting the Amazon rainforest and managing industrial environmental impacts is creating new opportunities for environmental monitoring technologies. The expanding petrochemical industry along the coast and growing food processing sector throughout the interior regions require sophisticated analytical capabilities for quality control and environmental compliance monitoring.

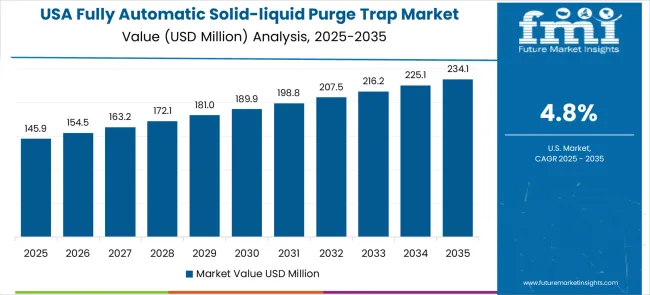

The fully automatic solid-liquid purge trap market in the U.S. is projected to expand at a CAGR of 4.8%, driven by established environmental regulatory frameworks and continuous technological innovation in analytical instrumentation. American analytical laboratories maintain leadership in method development, quality assurance programs, and regulatory compliance testing, creating sustained demand for advanced automated analytical systems. The market benefits from comprehensive environmental monitoring requirements, established analytical standards, and ongoing research programs supporting development of next-generation analytical technologies for environmental, food safety, and industrial applications. The United States has one of the world's most comprehensive environmental regulatory frameworks, including the Clean Water Act, Safe Drinking Water Act, and Resource Conservation and Recovery Act, all requiring extensive analytical testing using validated methods. The country's leadership in pharmaceutical development, petrochemical processing, and food safety standards creates continuous demand for sophisticated analytical capabilities. Major corporations and government agencies invest heavily in analytical infrastructure to support regulatory compliance, research and development, and quality assurance programs across diverse industry sectors.

The fully automatic solid-liquid purge trap market in the U.K. is projected to grow at a CAGR of 4.3%, supported by the country's emphasis on analytical quality standards and comprehensive environmental monitoring programs. British analytical laboratories prioritize systems that provide reliable analytical results, meet stringent quality assurance requirements, and support regulatory compliance for environmental protection and public health programs. The market is characterized by focus on analytical excellence, quality control, and integration with established environmental management systems supporting both regulatory monitoring and research applications. The United Kingdom maintains some of the world's most rigorous analytical quality standards and environmental protection programs, creating consistent demand for high-performance analytical systems. Post-Brexit regulatory framework development and alignment with international standards are driving investments in analytical infrastructure to support trade, environmental monitoring, and public health protection. The country's leadership in pharmaceutical research, environmental science, and analytical chemistry creates ongoing demand for sophisticated analytical capabilities supporting both regulatory compliance and research innovation.

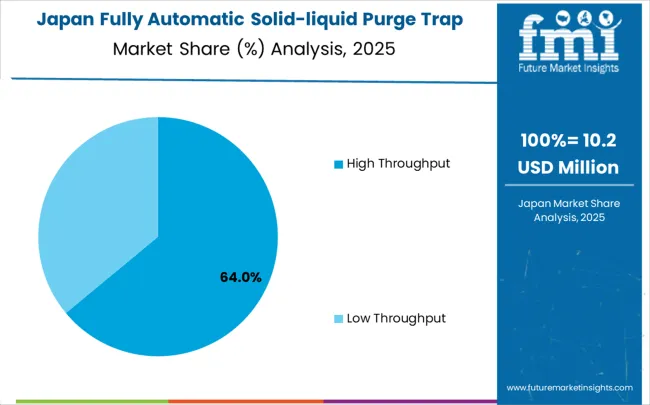

The fully automatic solid-liquid purge trap market in Japan is projected to grow at a CAGR of 3.8% through 2035, driven by the country's emphasis on analytical precision, quality control, and advanced manufacturing standards. Japanese analytical laboratories consistently demand high-performance systems that provide exceptional analytical accuracy, reliability, and integration with comprehensive quality management programs. The market reflects Japan's mature analytical instrumentation industry and established requirements for environmental monitoring, food safety testing, and industrial quality control applications. Japan's advanced manufacturing sector, including electronics, automotive, and precision chemicals industries, requires sophisticated analytical capabilities for quality control and process monitoring. The country's leadership in analytical instrumentation development and precision measurement technologies creates continuous demand for next-generation analytical systems. Japanese commitment to environmental protection and food safety standards drives sustained investment in analytical infrastructure supporting regulatory compliance and public health protection programs across government, academic, and industrial sectors.

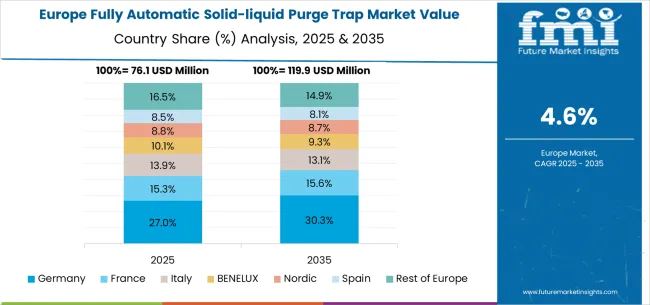

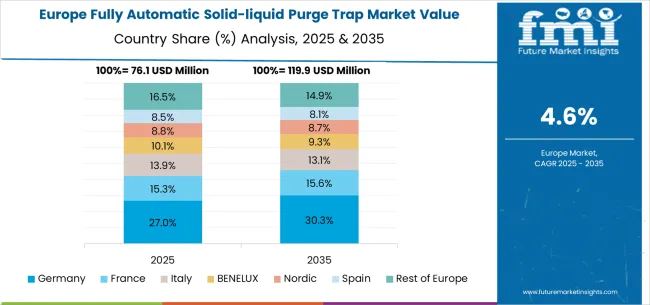

The fully automatic solid-liquid purge trap market in Europe demonstrates mature development across major analytical markets with Germany showing significant presence through its advanced analytical instrumentation industry and emphasis on environmental monitoring standards, supported by companies developing sophisticated purge trap systems that meet strict European regulatory requirements for volatile organic compound analysis in water, soil, and industrial samples. Germany represents the largest European market with approximately 28.4% regional share in 2025, benefiting from its comprehensive chemical industry infrastructure, rigorous environmental protection programs, and leadership in analytical technology development and manufacturing.

The United Kingdom represents a substantial market with 22.1% European share, driven by its comprehensive environmental protection programs and established analytical testing infrastructure, with laboratories implementing automated purge trap systems for water quality monitoring, contaminated land assessment, and industrial emission control applications. France exhibits considerable growth with 18.7% regional share through its focus on food safety regulations and environmental compliance, with analytical laboratories adopting automated purge trap systems for detecting pesticide residues, flavor compounds, and environmental contaminants in diverse sample matrices across agricultural, industrial, and urban monitoring programs.

Italy maintains 12.3% of the European market, showing expanding interest in automated analytical solutions, particularly for environmental monitoring and food quality testing applications supporting its extensive agricultural sector and industrial manufacturing base. Spain accounts for 8.9% regional share with growing demand for environmental analytical solutions and industrial monitoring capabilities. BENELUX countries contribute 5.8% through their advanced chemical industries and comprehensive environmental monitoring programs, while Nordic regions display 3.8% share with strong demand for environmental analytical solutions supporting their comprehensive pollution control and environmental protection initiatives, emphasizing sustainable development and environmental stewardship programs throughout Scandinavia and Northern Europe.

The fully automatic solid-liquid purge trap market is characterized by competition among established analytical instrumentation companies, specialized purge trap manufacturers, and emerging automation technology providers. Companies are investing in advanced automation technologies, software integration capabilities, multi-matrix sampling systems, and comprehensive technical support services to deliver reliable, efficient, and user-friendly analytical solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Thermo Fisher Scientific, U.S.-based, leads the market with comprehensive purge trap solutions offering advanced automation, precise analytical performance, and integration with gas chromatography systems. Atomx provides specialized purge trap systems with focus on environmental monitoring applications and automated sample preparation. Isotopems offers innovative analytical solutions with emphasis on method flexibility and analytical precision. Guangzhou Xijiang Instrument Equipment Co., Ltd. and Guangzhou Biaopu Instrument Co., Ltd., China-based companies, deliver cost-effective purge trap systems with focus on Asian market requirements and local technical support.

Teledyne LABS provides advanced analytical instrumentation with comprehensive automation capabilities and software integration. CDS Analytical specializes in sample preparation and purge trap technologies with emphasis on analytical accuracy and system reliability. REUZEit offers sustainable analytical solutions with a focus on resource efficiency and environmental responsibility. Beijing LabTech Instruments Co., Ltd. provides analytical instrumentation with emphasis on Chinese market requirements and local manufacturing capabilities. Puzhi delivers specialized analytical systems with focus on industrial and environmental monitoring applications.

The fully automatic solid-liquid purge trap market represents a critical segment of analytical instrumentation, valued at USD 308.2 million in 2024 and projected to reach USD 507 million by 2030, growing at a CAGR of 5%. These sophisticated instruments are essential for volatile organic compound (VOC) analysis across environmental monitoring, food safety, and industrial safety applications. With China leading market demand at 6.9% share, followed by India (6.4%), Germany (5.9%), and Brazil (5.4%), the market requires coordinated stakeholder action to address technological advancement needs, regulatory compliance requirements, and expanding application domains.

Environmental Compliance Infrastructure: Establish mandatory VOC monitoring programs for industrial facilities, water treatment plants, and environmental remediation sites, creating sustained demand for purge trap systems. Implement tiered compliance schedules that allow facilities time to invest in automated systems while ensuring environmental protection standards.

Research and Development Funding: Finance collaborative research programs between instrument manufacturers and academic institutions focused on advancing purge trap technology for emerging contaminants, including PFAS compounds, pharmaceuticals in water systems, and industrial process monitoring applications.

Standardization and Certification Programs: Develop national certification schemes for purge trap operators and maintenance technicians, ensuring proper instrument utilization and data quality. Create accreditation pathways for testing laboratories using automated purge trap systems in regulatory compliance scenarios.

Import Duty and Tax Incentives: Provide preferential tariff treatment for high-precision analytical instrumentation to encourage laboratory modernization, while supporting domestic manufacturing capabilities through production-linked incentive schemes for local assembly and component manufacturing.

Public Laboratory Infrastructure: Invest in upgrading government and municipal laboratory facilities with modern purge trap systems for environmental monitoring, food safety testing, and public health surveillance, creating demonstration effects for private sector adoption.

Technical Standards Development: Lead development of standardized protocols for purge trap operation across different sample matrices, ensuring consistency in analytical results between laboratories and regulatory acceptance of automated methods over traditional manual techniques.

Application-Specific Guidelines: Create comprehensive method guides for emerging applications including pharmaceutical residues in wastewater, flavor and fragrance analysis in food products, and occupational exposure monitoring in industrial settings.

Training and Certification Programs: Establish professional development programs for analytical chemists and laboratory technicians covering automated purge trap operation, maintenance protocols, and troubleshooting procedures to address the skills gap in specialized instrumentation.

Market Intelligence and Benchmarking: Provide regular market analysis comparing manual versus automated purge trap performance metrics, cost-effectiveness studies, and return-on-investment calculations to support laboratory procurement decisions.

International Harmonization: Work with global regulatory bodies to harmonize analytical methods using automated purge trap systems, facilitating international trade in tested products and reducing duplicate testing requirements.

Throughput Optimization Technology: Develop next-generation systems with enhanced sample handling capacity, focusing on high-throughput applications for commercial testing laboratories while maintaining analytical precision and reducing per-sample costs.

Smart Integration Capabilities: Integrate artificial intelligence and machine learning algorithms for predictive maintenance, automated method optimization, and real-time quality control monitoring to reduce operator intervention and improve analytical reliability.

Modular System Design: Offer scalable configurations allowing laboratories to start with basic automated purge trap capabilities and expand with additional features like multi-matrix handling, increased sample capacity, and specialized detection systems as needs grow.

Application-Specific Solutions: Develop specialized configurations for key market segments - environmental monitoring systems optimized for water samples, food safety systems designed for complex food matrices, and industrial safety systems capable of handling high-contamination samples.

Service and Support Infrastructure: Establish regional service centers with trained technicians, comprehensive spare parts inventory, and remote diagnostic capabilities to minimize instrument downtime and ensure consistent performance across global installations.

Laboratory Workflow Integration: Implement automated purge trap systems as part of comprehensive laboratory automation strategies, connecting with LIMS systems, robotic sample handling, and data management platforms to maximize efficiency gains and reduce manual errors.

Cross-Training and Capability Building: Develop internal expertise through comprehensive staff training programs covering both routine operation and advanced troubleshooting, ensuring laboratories can maximize instrument utilization and maintain consistent analytical quality.

Method Validation and Compliance: Establish robust method validation protocols that demonstrate equivalency or superiority of automated methods compared to existing manual procedures, supporting regulatory acceptance and customer confidence in results.

Preventive Maintenance Programs: Implement structured maintenance schedules and performance monitoring protocols to maximize instrument uptime, extend system lifespan, and maintain analytical performance within specification limits.

Data Management and Quality Assurance: Develop comprehensive data integrity protocols that leverage automated systems' electronic record-keeping capabilities while meeting regulatory requirements for audit trails, security, and long-term data retention.

Equipment Financing Solutions: Provide flexible financing options including operating leases, rent-to-own programs, and usage-based pricing models that allow laboratories to access advanced automated systems without significant upfront capital investment.

Technology Upgrade Programs: Finance laboratory modernization initiatives that replace manual analytical methods with automated systems, structuring payments based on productivity improvements and operational cost savings achieved.

Regional Market Development: Support market expansion in emerging economies through blended financing that combines commercial lending with development finance, enabling laboratory infrastructure development in markets with growing regulatory requirements.

Innovation and R&D Investment: Fund technology development programs focused on next-generation purge trap systems with enhanced capabilities, lower operating costs, and broader application ranges to maintain competitive market dynamics.

Service and Support Infrastructure: Finance establishment of regional service networks, training facilities, and technical support centers to ensure comprehensive market coverage and customer support capabilities across key geographic markets.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 308.2 million |

| Throughput Capacity | High Throughput, Low Throughput |

| Application | Environmental Monitoring, Food Safety, Industrial Safety, Other |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Thermo Fisher Scientific, Atomx, Isotopems, Guangzhou Xijiang Instrument Equipment Co., Ltd., Guangzhou Biaopu Instrument Co., Ltd., Teledyne LABS, CDS Analytical, REUZEit, Beijing LabTech Instruments Co., Ltd., Puzhi |

| Additional Attributes | Dollar sales by throughput capacity and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established instrumentation companies and emerging technology providers, buyer preferences for automation versus manual systems, integration with laboratory information management systems, innovations in multi-matrix sampling capabilities and advanced analytical software, and adoption of smart connectivity features with remote monitoring and predictive maintenance capabilities |

The global fully automatic solid-liquid purge trap market is estimated to be valued at USD 308.2 million in 2025.

The market size for the fully automatic solid-liquid purge trap market is projected to reach USD 506.8 million by 2035.

The fully automatic solid-liquid purge trap market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in fully automatic solid-liquid purge trap market are high throughput and low throughput.

In terms of application, environmental monitoring segment to command 45.8% share in the fully automatic solid-liquid purge trap market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA