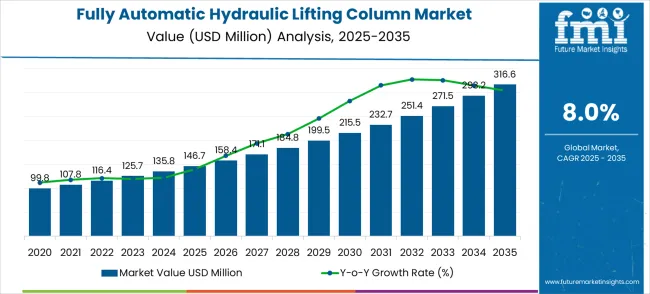

The global fully automatic hydraulic lifting column market is projected to reach USD 316.6 million by 2035, recording an absolute increase of USD 169.9 million over the forecast period. The market is valued at USD 146.7 million in 2025 and is projected to grow at a CAGR of 8.0% during the forecast period. The overall market size is expected to grow by nearly 2.2 times during the same period, driven by the increasing adoption of automated security systems and digital transformation initiatives across the public safety and commercial sectors. However, high initial investment costs and the complexity of integrating new lifting technologies with existing security infrastructure may pose challenges to market expansion.

Between 2025 and 2030, the Fully Automatic Hydraulic Lifting Column market is projected to expand from USD 146.7 million to USD 199.5 million, resulting in a value increase of USD 52.8 million, which represents 31.1% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for automated security solutions, product innovation in hydraulic technology and control systems, and expanding integration with IoT and smart city technologies. Companies are establishing competitive positions through investment in advanced hydraulic technologies, AI-powered control capabilities, and strategic market expansion across public safety, commercial, and civil infrastructure sectors.

From 2030 to 2035, the market is forecast to grow from USD 199.5 million to USD 316.6 million, adding another USD 117.1 million, which constitutes 68.9% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized lifting systems, including wireless control networks and cloud-based monitoring platforms tailored for specific security applications, strategic collaborations between technology providers and infrastructure equipment manufacturers, and an enhanced focus on urban security and traffic management optimization. The growing emphasis on smart city initiatives and perimeter security will drive demand for intelligent lifting column solutions across diverse public safety and commercial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 146.7 million |

| Market Forecast Value (2035) | USD 316.6 million |

| Forecast CAGR (2025-2035) | 8.0% |

The fully automatic hydraulic lifting column market grows by enabling organizations to enhance security infrastructure through automated vehicle access control and perimeter protection systems. Public safety facilities face mounting pressure to improve security measures, with government buildings typically requiring multiple access control points, making automated lifting columns essential for operational efficiency and threat mitigation. The commercial sector's need for seamless traffic flow control - facilities must maintain continuous operation while ensuring security - creates demand for remote-controlled capabilities that can manage vehicle access without manual intervention. Urban security regulations and smart city compliance requirements drive adoption in municipal and infrastructure sectors, where automated access control directly impacts public safety and operational costs. However, budget constraints for security infrastructure upgrades and the complexity of retrofitting legacy access control systems with advanced hydraulic technologies may limit adoption rates among smaller commercial operators.

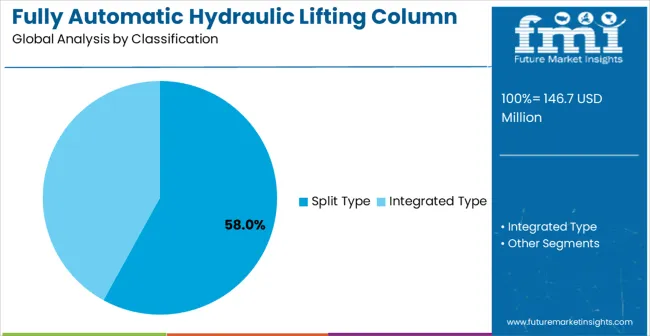

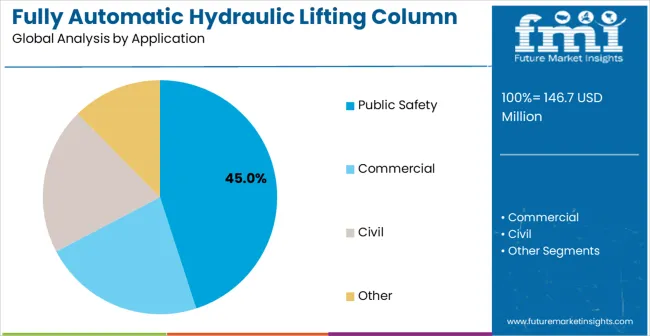

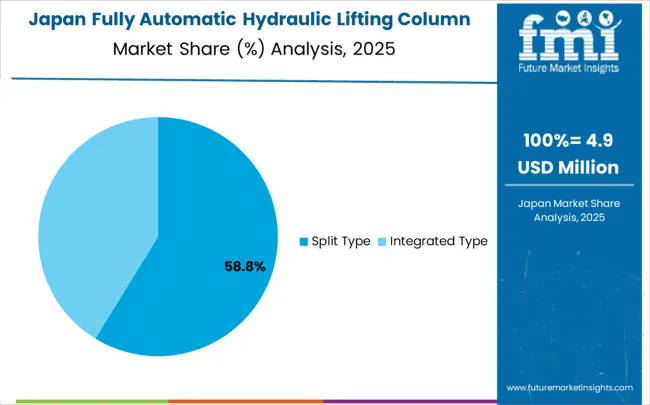

The market is segmented by product type, application, and region. By product type, the market is divided into split type and integrated type systems. Based on the application, the market is categorized into public safety, commercial, civil, and other applications. Regionally, the market is divided into North America, Europe, Asia Pacific, and other regions.

Split type systems are projected to account for the largest share of 58% of the fully automatic hydraulic lifting column market in 2025. This dominant position is supported by the technology's ability to provide modular installation flexibility and enhanced maintenance accessibility, enabling operators to customize deployment configurations according to specific site requirements and security protocols. The segment allows stakeholders to benefit from distributed control capabilities, simplified installation processes in existing infrastructure, and cost-effective scalability for multi-point access control systems. Split Type configurations offer superior adaptability for complex security installations where traditional integrated systems face space or technical constraints.

The modular design enables independent component upgrades and maintenance without system-wide shutdowns, reducing operational disruption and lifecycle costs. Advanced hydraulic control systems within Split Type configurations provide precise lifting speed regulation and emergency stop functionality, meeting stringent safety standards required for high-security applications. Market adoption is accelerated by the segment's compatibility with existing security infrastructure and reduced installation complexity compared to comprehensive system overhauls. The technology's proven reliability in government and commercial applications, combined with standardized component availability, positions Split Type systems as the preferred solution for organizations prioritizing operational flexibility and long-term maintenance efficiency in automated access control deployments.

Key advantages include:

Public safety applications are expected to represent the dominant share of 45% fully automatic hydraulic lifting column applications in 2025. This leading position reflects the critical role of automated access control as essential infrastructure for government facilities, military installations, and critical infrastructure protection, where continuous security monitoring is essential for national security and public protection. The segment provides critical support for perimeter security and vehicle access management in high-security environments where manual security checkpoint operation is impractical during continuous operation. Government agencies increasingly prioritize automated solutions that can respond to security threats within seconds while maintaining operational continuity.

The Public safety segment benefits from substantial government funding allocations for infrastructure security upgrades, particularly following heightened global security concerns and evolving threat landscapes. Federal mandates requiring enhanced perimeter protection at sensitive facilities drive consistent demand, while standardized procurement processes facilitate large-scale deployments across multiple government locations. Integration capabilities with existing security systems, including surveillance cameras and access control databases, enable comprehensive threat assessment and response coordination. The segment's growth is further supported by international security cooperation initiatives and technology sharing agreements that promote standardized automated security solutions across allied nations and critical infrastructure operators worldwide.

Key market dynamics include:

The market is driven by three concrete demand factors tied to security outcomes. First, automated threat response capabilities reduce security breach risks by providing immediate vehicle access denial within seconds of threat detection, with government facilities experiencing up to 40% improvement in perimeter security effectiveness through automated lifting column systems. Second, operational efficiency optimization through remote control capabilities enables security operators to achieve 25% reduction in personnel requirements while maintaining comprehensive access control standards. Third, regulatory compliance requirements for critical infrastructure protection and anti-terrorism measures create mandatory adoption scenarios across public safety sectors.

Market restraints include high initial investment costs that can deter smaller commercial enterprises from upgrading their access control systems, particularly in developing regions where capital allocation for advanced security technologies remains limited. Integration complexity poses another significant challenge, as implementing new hydraulic lifting technologies with existing security systems requires substantial training and expertise, potentially causing operational disruptions during transition periods. Rapid technological advancement creates continuous pressure for system updates, demanding ongoing research and development investments that strain organizational resources.

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where urban development and security regulations drive lifting column system deployment. Design shifts toward AI-powered control systems, IoT-enabled devices, and cloud-based monitoring platforms enable predictive capabilities that transform security from reactive to proactive approaches. However, the market thesis could face disruption if alternative access control technologies or radical changes in urban security methods reduce reliance on traditional hydraulic lifting column operations.

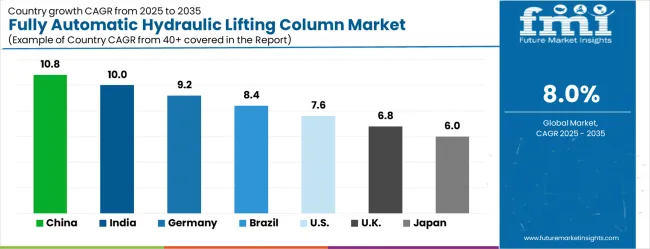

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| Brazil | 8.4% |

| USA | 7.6% |

| UK | 6.8% |

| Japan | 6.0% |

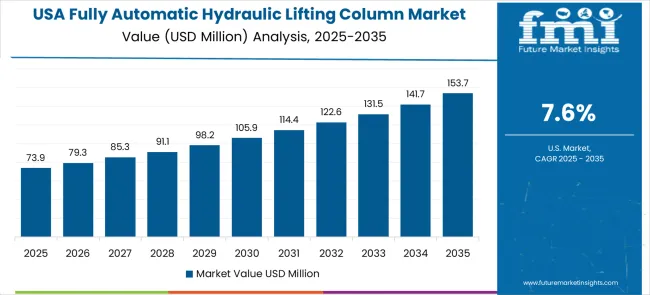

The fully automatic hydraulic lifting column market is gathering pace worldwide, with China taking the lead at a CAGR of 10.8% thanks to rapid urbanization and infrastructure security mandates. Close behind, India benefits from expanding smart city initiatives and government programs promoting urban security, achieving a CAGR of 10.0% and positioning itself as a strategic hub for growth. Germany shows steady advancement with a CAGR of 9.2%, where integration of Industry 4.0 technologies strengthens its role in the European security infrastructure supply chain. Brazil is sharpening its focus on public safety enhancement and infrastructure protection at a CAGR of 8.4%, signaling an ambition to capture niche opportunities in South American markets. Meanwhile, the USA stands out for its advanced adoption of security technology with a CAGR of 7.6%, and the UK (6.8% CAGR) and Japan (6.0% CAGR) continue to record consistent progress. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

China demonstrates the strongest growth potential in the fully automatic hydraulic lifting column market with a CAGR of 10.8% through 2035. The country's leadership position stems from massive urban development projects, aggressive smart city automation initiatives, and stringent security regulations, driving the adoption of advanced access control technologies. Growth is concentrated in major urban centers, including Beijing, Shanghai, and Guangzhou, where government facilities and commercial complexes are implementing automated security solutions to comply with national security enhancement targets. Chinese security operators are adopting intelligent lifting column systems for perimeter protection optimization and access control improvement in high-security installations. Distribution channels through local security integrators and government-backed infrastructure modernization programs expand deployment across state-owned facilities and private commercial developments. The country's "Smart City 2030" strategy provides policy support for automated security initiatives, including hydraulic lifting column system adoption.

Key market factors:

In Mumbai, Delhi, and Bangalore, adoption of intelligent hydraulic lifting column systems with a CAGR of 10% is accelerating across government facilities and commercial complexes, driven by rapid urban expansion and security enhancement pressures. The market demonstrates strong growth momentum with a CAGR of 10.0% through 2035, linked to government initiatives promoting smart city development and infrastructure security compliance. Indian security operators are implementing automated access control systems and remote monitoring platforms to improve security effectiveness while meeting increasingly stringent protection standards in major urban corridors. The country's expanding infrastructure development creates sustained demand for perimeter security optimization, while growing focus on public safety drives adoption of lifting technologies that enhance threat response capabilities.

The market maintains steady growth through focus on Industry 4.0 integration and security compliance, with a CAGR of 9.2% through 2035. Germany's advanced security infrastructure demonstrates sophisticated implementation of intelligent hydraulic lifting column systems, with documented case studies showing 30% improvement in access control effectiveness through automated deployment platforms. The country's security sector in North Rhine-Westphalia, Bavaria, and Baden-Württemberg showcases integration of lifting technologies with existing perimeter security systems, leveraging expertise in automation and hydraulic technologies. German facilities emphasize precision engineering and reliability standards, creating demand for high-accuracy lifting solutions that support continuous security improvement initiatives.

Key development areas:

Brazil's market expansion is driven by diverse security infrastructure demand with a CAGR of 8.4%, including government facilities in São Paulo and Rio de Janeiro, commercial complexes in Brasília, and critical infrastructure protection across multiple states. The country faces implementation challenges related to capital investment constraints and technical expertise availability, requiring phased deployment approaches and financing support. However, growing security regulations and urban safety pressures create compelling business cases for the adoption of lifting column systems, particularly in high-risk urban areas where automated access control directly impacts public safety and operational effectiveness.

Market characteristics:

The USA market leads in advanced lifting column system innovation based on integration with artificial intelligence and machine learning platforms for threat assessment analytics. The country shows strong potential with a CAGR of 7.6% through 2035, driven by security enhancement requirements under compliance and reliability constraints across government, commercial, and critical infrastructure sectors. American security facilities are adopting intelligent lifting column systems for perimeter protection improvement and regulatory compliance, particularly in regions with strict federal security standards. Technology deployment channels through security automation distributors and direct manufacturer relationships expand coverage across government facilities and commercial complexes. Implementation of advanced control systems demonstrates the successful integration of lifting technologies with existing security infrastructure.

Leading market segments:

Japan's fully automatic hydraulic lifting column market demonstrates sophisticated implementation focused on precision security and reliability optimization, with documented integration of automated access control systems achieving 20% improvement in security response consistency across government and commercial facilities. The country maintains steady growth momentum with a CAGR of 6.0% through 2035, driven by security facilities' emphasis on operational excellence and continuous improvement methodologies that align with comprehensive security management principles. Major urban centers, including Tokyo, Osaka, and Nagoya, showcase advanced deployment of automated access control platforms where lifting column systems integrate seamlessly with existing security management systems and automated threat detection controls.

Key market characteristics:

In London, Manchester, and Birmingham, security facilities are implementing intelligent hydraulic lifting column systems to meet enhanced protection targets under the UK's National Security Strategy, with government facilities achieving 18% improvement in perimeter security effectiveness through optimized access control. The market shows moderate growth potential with a CAGR of 6.8% through 2035, linked to regulatory compliance requirements and infrastructure security initiatives that mandate access control improvements. British security operators are adopting automated lifting systems and predictive monitoring platforms to enhance security effectiveness while maintaining operational efficiency in urban environments where threat assessment increasingly influences security decisions. The country's established critical infrastructure sector creates sustained demand for specialized lifting solutions that support both operational security and compliance requirements across diverse government and commercial applications.

Market development factors:

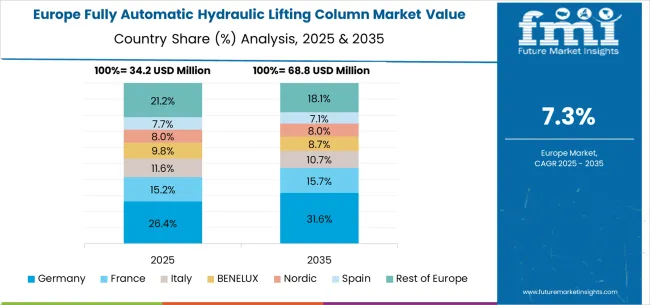

The fully automatic hydraulic lifting column market in Europe is projected to grow from USD 29.2 million in 2025 to USD 58.7 million by 2035, registering a CAGR of 7.2% over the forecast period. Germany is expected to maintain its leadership position with a 31.5% market share in 2025, declining slightly to 30.8% by 2035, supported by its advanced security infrastructure and major urban centers including Berlin and Munich.

France follows with a 22.1% share in 2025, projected to reach 22.6% by 2035, driven by comprehensive urban security modernization programs in Paris and other major metropolitan areas. The United Kingdom holds a 19.4% share in 2025, expected to decrease to 18.9% by 2035 due to post-Brexit security infrastructure adjustments. Italy commands a 12.8% share, while Spain accounts for 8.9% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.3% to 6.2% by 2035, attributed to increasing lifting column adoption in Nordic countries and emerging Eastern European cities implementing smart security programs.

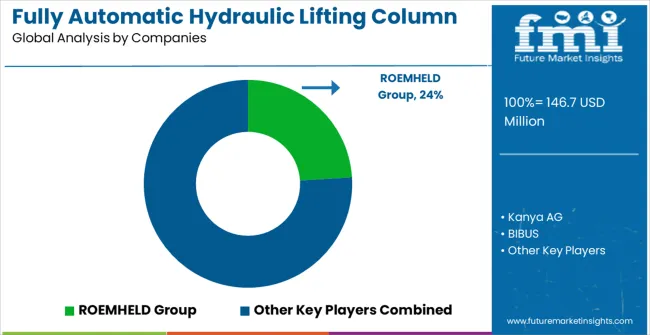

The Fully Automatic Hydraulic Lifting Column market features approximately 12-15 meaningful players with moderate concentration, where the top three companies control roughly 42-47% of global market share through established technology platforms and extensive security customer relationships. Competition centers on technological differentiation, service capabilities, and integration expertise rather than price competition alone.

Market leaders include ROEMHELD Group, Kanya AG, and LINAK, which maintain competitive advantages through comprehensive hydraulic portfolios, global service networks, and deep security process expertise, creating high switching costs for customers. These companies leverage installed base relationships and ongoing service contracts to defend market positions while expanding into adjacent security monitoring applications.

Challengers encompass TiMOTION Technology and BIBUS, which compete through specialized lifting solutions and strong regional presence in key security markets. Technology specialists, including Velyen, Shandong Feitian Optoelectronics Technology, and Dahua Technology, focus on specific hydraulic technologies or vertical applications, offering differentiated capabilities in automated control, security system integration, and predictive maintenance platforms.

Regional players and emerging technology providers create competitive pressure through cost-effective solutions and rapid deployment capabilities, particularly in high-growth markets including China and India, where local presence provides advantages in customer support and regulatory compliance. Market dynamics favor companies that combine advanced hydraulic technologies with AI-powered control systems and comprehensive service offerings that address the complete lifting column system lifecycle from installation through ongoing optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 146.7 million |

| Product Type | Split Type, Integrated Type |

| Application | Public Safety, Commercial, Civil, Other |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, the U.S., the U.K., Japan, and 40+ countries |

| Key Companies Profiled | ROEMHELD Group, Kanya AG, BIBUS, LINAK, TiMOTION Technology, Velyen, Shandong Feitian Optoelectronics Technology, Dahua Technology, Guangdong Qigong Industrial Group |

| Additional Attributes | Dollar sales by product type and application categories, regional adoption trends across North America, Europe, and Asia-Pacific, competitive landscape with technology providers and system integrators, security facility preferences and requirements, integration with smart city initiatives and IoT platforms, innovations in hydraulic technology and automated control systems, and development of specialized lifting applications with security compliance capabilities. |

The global fully automatic hydraulic lifting column market is estimated to be valued at USD 146.7 million in 2025.

The market size for the fully automatic hydraulic lifting column market is projected to reach USD 316.6 million by 2035.

The fully automatic hydraulic lifting column market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in fully automatic hydraulic lifting column market are split type and integrated type.

In terms of application, public safety segment to command 45.0% share in the fully automatic hydraulic lifting column market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA