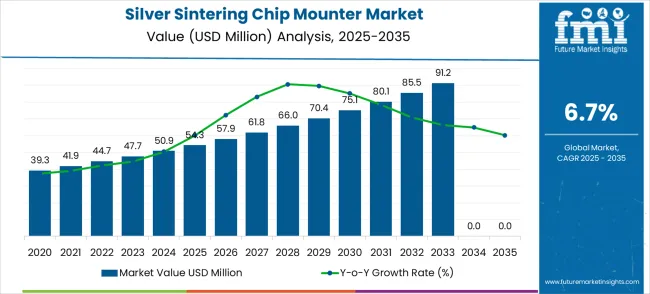

The silver sintering chip mounter market is valued at USD 54.3 million in 2025 and is forecast to reach USD 103.9 million by 2035, representing a CAGR of 6.7%. Over the decade, the market exhibits a steady upward trajectory, reflecting consistent demand growth driven by the adoption of advanced electronics manufacturing technologies. From 2025 to 2035, the market is projected to grow by USD 49.6 million, almost doubling in value. This growth trajectory highlights a long-term positive trend, highlighting stable industry expansion rather than short-term volatility. The CAGR of 6.7% confirms a moderate yet constant growth path, characteristic of a mature market gradually expanding due to innovation and industrial integration.

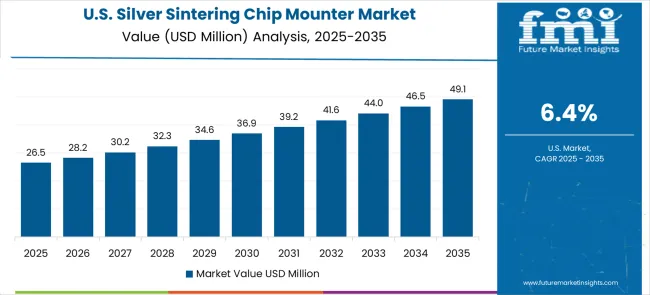

Between 2025 and 2028, the market progresses from USD 54.3 million to USD 66.0 million, representing an increase of USD 11.7 million, contributing about 23.6% of the total growth over the forecast period. This early growth phase reflects a period of accelerating adoption driven by technology upgrades in electronics assembly, especially in semiconductors and automotive electronics. Manufacturers are increasingly integrating silver sintering technology to improve efficiency, thermal performance, and reliability of chip mounting processes. This phase exhibits a consistent year-over-year growth pattern, averaging approximately 6.5%, indicating stable demand with minimal volatility in adoption rates.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 54.3 million |

| Forecast Value in (2035F) | USD 103.9 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

From 2029 to 2032, the market expands from USD 70.4 million to USD 85.5 million, adding USD 15.1 million or about 30.4% of the total projected growth. This mid-period growth phase marks an inflection where adoption accelerates due to broader penetration in high-end electronics and rising demand from emerging industrial sectors, including 5G infrastructure, automotive electrification, and high-performance computing. Growth here reflects compounding benefits of earlier adoption cycles, with yearly increments averaging over USD 3.7 million. Technological refinements and cost reductions in silver sintering processes further strengthen the momentum during this period.

Between 2033 and 2035, the market reaches USD 103.9 million, adding USD 18.4 million in value and contributing about 37.1% of the total growth over the decade. This late-stage growth phase is characterized by a slight deceleration in annual growth rates but a continued strong upward slope in the trendline. The trendline analysis indicates a near-linear trajectory over the decade, though polynomial analysis shows minor acceleration mid-period, driven by new applications in electronics and improved production efficiencies. By 2035, the market reflects robust stability and steady adoption, confirming the market’s long-term growth trend.

Market expansion is being supported by the increasing demand for high-power semiconductor devices and the corresponding need for advanced bonding technologies that can withstand extreme operating conditions. Modern semiconductor manufacturers are increasingly focused on silver sintering solutions that can provide superior thermal conductivity, enhanced reliability, and improved electrical performance compared to traditional solder-based attachment methods. The proven effectiveness of silver sintering in enabling higher power densities and extended operational lifetimes makes it an essential technology for competitive power semiconductor manufacturing.

The growing focus on electric mobility and renewable energy applications is driving demand for advanced chip mounting systems that address the stringent reliability requirements of automotive and industrial power electronics. The semiconductor industry's preference for process technologies that combine high performance with manufacturing scalability is creating opportunities for innovative equipment development. The rising influence of thermal management requirements and reliability standards is also contributing to increased adoption of proven silver sintering chip mounting solutions across different semiconductor packaging applications and manufacturing environments.

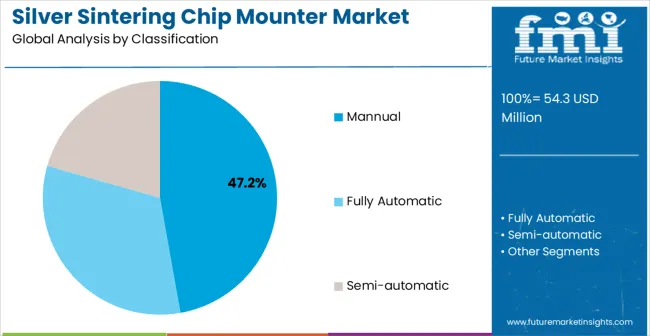

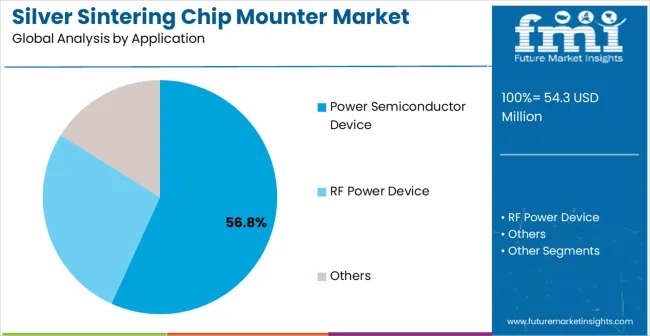

The market is segmented by classification, application, and region. By classification, the market is divided into manual, fully automatic, and semi-automatic systems. Based on application, the market is categorized into power semiconductor device, RF power device, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

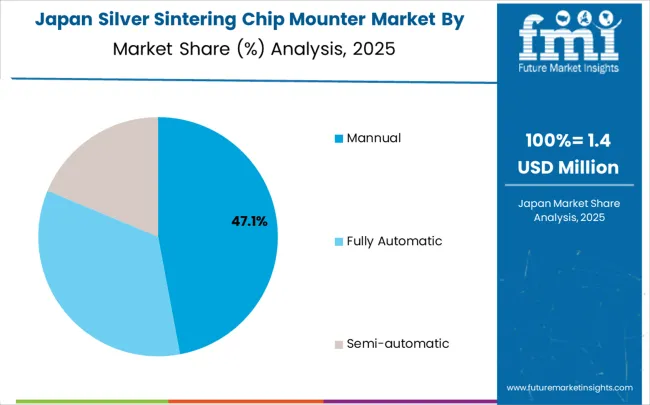

The manual segment is projected to account for 47.2% of the silver sintering chip mounter market in 2025, reaffirming its position as the category's dominant classification. Semiconductor manufacturing professionals increasingly recognize the flexibility and precision control advantages of manual systems for specialized silver sintering applications, particularly their ability to accommodate diverse chip sizes and complex bonding requirements. This equipment type addresses both customization needs and process optimization requirements, providing comprehensive manufacturing flexibility for specialized applications.

This classification forms the foundation of most research and development operations, as it represents the most adaptable and operator-controlled approach in silver sintering technology development. Technical validation studies and extensive process optimization continue to strengthen confidence in manual system capabilities. With increasing recognition of the importance of process development requiring flexible manufacturing systems, manual equipment aligns with both current R&D requirements and specialized production needs. Their broad applicability across multiple semiconductor types ensures sustained market presence, making them a central component of silver sintering chip mounting demand.

Power semiconductor device applications are projected to represent 56.8% of silver sintering chip mounter demand in 2025, highlighting their role as the primary application driving equipment adoption. Power electronics manufacturers and automotive suppliers recognize that high-power semiconductor packaging requires specialized bonding systems that can effectively handle the thermal and mechanical stresses of power device operation. Silver sintering chip mounters offer optimal performance characteristics for IGBT, MOSFET, and wide bandgap semiconductor device assembly across various power electronics applications.

The segment is supported by the rapid expansion of electric vehicle production requiring robust power semiconductor packaging and the growing recognition that silver sintering provides superior thermal performance for high-power applications. Power electronics manufacturers are increasingly adopting integrated packaging approaches that leverage silver sintering advantages for optimal device reliability and performance. As power semiconductor technology continues to evolve toward higher power densities and improved efficiency requirements, bonding systems optimized for power device applications will continue to play a crucial role in competitive semiconductor packaging strategies, reinforcing their essential position within the electronics manufacturing market.

The silver sintering chip mounter market is advancing steadily due to increasing demand for high-power semiconductor packaging and growing adoption of advanced bonding technologies in automotive electronics. The market faces challenges including high equipment costs, complex process parameter optimization, and concerns about material costs and process yield optimization. Innovation in equipment automation and process control technologies continue to influence product development and market expansion patterns.

The growing adoption of electric vehicles is enabling more sophisticated power electronics manufacturing requirements and advanced packaging technology needs. Electric vehicle applications require comprehensive semiconductor packaging performance, including high thermal conductivity, excellent reliability, and extended operational lifetime, that silver sintering chip mounters can provide effectively. Automotive electronics expansion creates demand for bonding technologies that can support high-volume manufacturing while maintaining stringent quality and reliability standards.

Modern semiconductor equipment manufacturers are incorporating automation technologies such as machine vision systems, robotic handling, and advanced process monitoring to enhance silver sintering chip mounter capabilities. These technologies improve bonding precision, enable better process repeatability, and provide enhanced quality control monitoring and traceability capabilities. Advanced automation also enables optimized production throughput and early identification of potential process variations or equipment maintenance requirements.

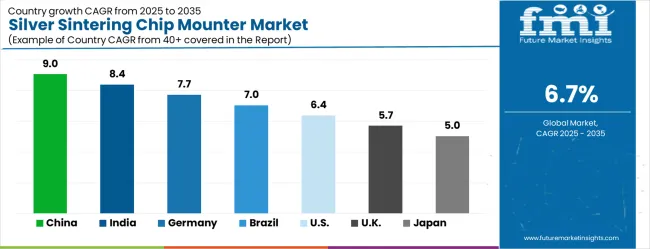

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| Brazil | 7.0% |

| USA | 6.4% |

| UK | 5.7% |

| Japan | 5.0% |

The market is experiencing varied growth globally, with China leading at a 9.0% CAGR through 2035, driven by expanding semiconductor manufacturing capacity, increasing electric vehicle production, and growing investment in advanced packaging technologies. India follows at 8.4%, supported by semiconductor industry development, increasing electronics manufacturing capabilities, and expanding automotive electronics sector. Germany shows growth at 7.7%, focusing advanced automotive electronics manufacturing and established semiconductor equipment expertise. Brazil records 7.0% growth, focusing on improved electronics manufacturing infrastructure and automotive sector development. The USA shows 6.4% growth, representing a mature market with established semiconductor companies and ongoing technology advancement initiatives.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is expected to achieve a CAGR of 9.0% from 2025 to 2035, driven by the rapid expansion of semiconductor manufacturing and electronics assembly industries. Growth in automotive electronics, renewable energy systems, and high-power devices has heightened demand for silver sintering technology due to its superior thermal and electrical conductivity. Chinese manufacturers are increasingly investing in automated chip mounting solutions to enhance production precision and efficiency. Government initiatives supporting domestic semiconductor fabrication plants are accelerating technology adoption. The need for high-reliability packaging in advanced power electronics fuels demand. Partnerships between electronics firms and chip mounter equipment providers are strengthening capabilities, positioning China as a leading market for silver sintering solutions in Asia.

India is forecasted to grow at a CAGR of 8.4% between 2025 and 2035, supported by growth in consumer electronics, automotive electronics, and renewable energy device manufacturing. Increasing adoption of electric vehicles and high-efficiency power devices is boosting demand for silver sintering chip mounters. India’s electronics assembly industry is investing in high-precision automated systems to enhance productivity. Government incentives for electronics manufacturing clusters are promoting localized production of advanced electronic packaging solutions. The growing need for high-reliability chip mounting in power semiconductor devices further strengthens the market. Partnerships between Indian and global equipment providers facilitate technology transfer and enhance competitiveness in domestic production. These trends create a robust growth outlook for the silver sintering chip mounter market in India.

Germany is expected to expand at a CAGR of 7.7% during 2025–2035, driven by its leadership in precision manufacturing and advanced electronics. The automotive and industrial automation sectors are major drivers for silver sintering chip mounters, due to the need for high-performance, durable packaging solutions. Germany’s electronics industry emphasizes high efficiency, accuracy, and compliance with stringent quality standards. R&D in automated chip mounting systems is actively pursued, ensuring continuous innovation. The adoption of Industry 4.0 practices in production lines enhances demand for advanced chip mounter systems. Export opportunities for high-quality German manufacturing equipment support steady growth in the silver sintering chip mounter sector.

Brazil is projected to grow at a CAGR of 7.0% from 2025 to 2035, supported by growth in renewable energy device manufacturing and automotive electronics. Silver sintering technology adoption is increasing in high-power module assembly and semiconductor packaging applications. Brazil’s growing focus on modernizing electronics manufacturing infrastructure is fostering demand for advanced chip mounting systems. Both public and private investments in industrial automation support domestic production of power devices and automotive electronics. Collaborations with international equipment providers are enhancing Brazil’s capacity to deliver high-performance solutions. Demand from export-oriented manufacturing sectors is driving growth in silver sintering chip mounter adoption.

The United States is forecasted to grow at a CAGR of 6.4% between 2025 and 2035, driven by demand in advanced electronics, aerospace, and automotive sectors. Silver sintering chip mounters are essential for high-reliability packaging of power semiconductors used in electric vehicles, industrial automation, and renewable energy systems. The USA semiconductor sector’s growth supports adoption of high-efficiency mounting solutions. Manufacturers are focusing on integrating automation and real-time quality monitoring to enhance productivity. Expansion of domestic semiconductor manufacturing capacity under government programs is fueling demand for advanced mounting equipment. This creates strong opportunities for market growth in the USA electronics manufacturing industry.

The United Kingdom is projected to grow at a CAGR of 5.7% during 2025–2035, supported by a focus on advanced manufacturing in the electronics sector. Demand for silver sintering chip mounters is rising in high-performance applications, including automotive electronics, aerospace, and industrial automation. UK manufacturers are increasingly integrating automation to improve efficiency and reduce production cycle times. Research partnerships between industry and academia are fostering innovation in chip mounting processes. The growth of domestic electronics production and increasing exports of high-performance modules are creating constant demand. Regulatory focus on quality and efficiency further boosts adoption of advanced mounting technologies.

Japan is expected to grow at a CAGR of 5.0% between 2025 and 2035, supported by its strong electronics manufacturing base and technological innovation. Silver sintering chip mounters are widely used in the production of automotive power modules, industrial automation systems, and aerospace electronics. Japanese manufacturers emphasize high-precision, high-efficiency production processes, integrating automation and quality control systems. Continuous R&D is driving the development of compact, energy-efficient mounting systems. Demand from the automotive and renewable energy sectors is further boosting adoption. Japan’s reputation for technological excellence supports steady growth in the silver sintering chip mounter market, with a focus on high-value, specialized applications.

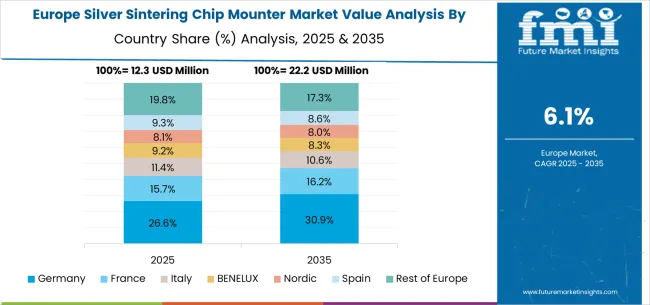

The silver sintering chip mounter market in Europe is projected to expand steadily through 2035, supported by increasing adoption of advanced semiconductor packaging technologies, rising demand for automotive electronics solutions, and ongoing innovation in power electronics manufacturing. Germany will continue to lead the regional market, accounting for 24.3% in 2025 and rising to 25.1% by 2035, supported by strong automotive industry infrastructure, advanced semiconductor packaging capabilities, and robust technology development programs. The United Kingdom follows with 17.9% in 2025, increasing to 18.5% by 2035, driven by comprehensive electronics manufacturing standards, technology innovation initiatives, and expanding semiconductor packaging capabilities.

France holds 15.6% in 2025, edging up to 16.2% by 2035 as electronics manufacturers expand packaging technology utilization and demand grows for advanced bonding solutions. Italy contributes 13.2% in 2025, remaining broadly stable at 13.7% by 2035, supported by growing automotive electronics sector investment and increasing advanced packaging technology adoption. Spain represents 10.8% in 2025, inching upward to 11.2% by 2035, underpinned by strengthening electronics manufacturing infrastructure and automotive sector development initiatives.

BENELUX markets together account for 9.7% in 2025, moving to 10.1% by 2035, supported by advanced manufacturing requirements and technology innovation initiatives. The Nordic countries represent 6.1% in 2025, marginally increasing to 6.3% by 2035, with demand fueled by comprehensive technology standards and early adoption of advanced packaging technologies. The Rest of Western Europe moderates from 2.4% in 2025 to 0.9% by 2035, as larger core markets capture a greater share of packaging technology investment, electronics manufacturing projects, and silver sintering chip mounter adoption.

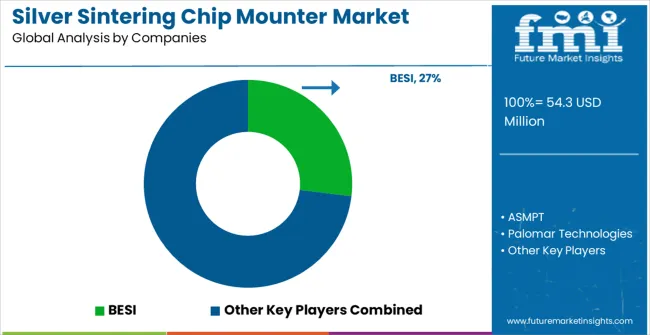

The market is characterized by competition among established semiconductor equipment manufacturers, specialized packaging technology companies, and comprehensive electronics manufacturing solution providers. Companies are investing in equipment research and development, process optimization, strategic partnerships, and technical support services to deliver precise, reliable, and cost-effective silver sintering chip mounting solutions. Product innovation, process validation, and market access strategies are central to strengthening product portfolios and market presence.

BESI leads the market with comprehensive semiconductor assembly solutions focusing on advanced packaging technologies and manufacturing excellence. ASMPT provides extensive equipment portfolios with focus on automation and precision control systems. Palomar Technologies focuses on specialized bonding equipment and custom packaging solutions for diverse semiconductor applications. Zhuhai Silicon Cool Technology delivers innovative equipment designs with strong performance characteristics and technical support.

Zhongke Guangzhi (Chongqing) Technology operates with focus on advanced packaging equipment and process optimization solutions for comprehensive semiconductor manufacturing applications. Sharetek Technology, CYG Semiconductor Equipment (Zhuhai), and QLsemi provide comprehensive equipment portfolios including research and development support, technical consulting services, and process optimization assistance to enhance market accessibility and customer satisfaction across diverse semiconductor packaging environments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 54.3 million |

| Classification | Manual, Fully Automatic, Semi-automatic |

| Application | Power Semiconductor Device, RF Power Device, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | BESI, ASMPT, Palomar Technologies, Zhuhai Silicon Cool Technology, Zhongke Guangzhi (Chongqing) Technology, Sharetek Technology, CYG Semiconductor Equipment (Zhuhai), QLsemi |

| Additional Attributes | Dollar sales by equipment type and application, regional demand trends, competitive landscape, manufacturer preferences for specific technologies, integration with production lines, innovations in bonding processes, quality control strategies, and manufacturing performance optimization |

The global silver sintering chip mounter market is estimated to be valued at USD 54.3 million in 2025.

The market size for the silver sintering chip mounter market is projected to reach USD 103.9 million by 2035.

The silver sintering chip mounter market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in silver sintering chip mounter market are mannual, fully automatic and semi-automatic.

In terms of application, power semiconductor device segment to command 56.8% share in the silver sintering chip mounter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Silver Pressure Sintering Machine Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Silver Sintering System Market Size and Share Forecast Outlook 2025 to 2035

Silver Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Chip-on-the-Tip Endoscopes Market Size and Share Forecast Outlook 2025 to 2035

Chipless RFID Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Silver Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

Silver Food Market Size and Share Forecast Outlook 2025 to 2035

Chip Resistor Market Size and Share Forecast Outlook 2025 to 2035

Chip-On-Flex Market Size and Share Forecast Outlook 2025 to 2035

Chipboard Box Market Size and Share Forecast Outlook 2025 to 2035

Silver Cyanide Market Size and Share Forecast Outlook 2025 to 2035

Silver Nitrate Market - Trends & Forecast 2025 to 2035

Silver Nanowires Market Growth - Trends & Forecast 2025 to 2035

Chip-On-Board (COB) Light Emitting Diode (LED) Market Analysis and Forecast 2025 to 2035, By Application and Region

Chip Warmers Market Growth – Trends & Forecast 2025 to 2035

Chip Scale Package LED Market Insights – Trends & Forecast 2025 to 2035

Industry Share & Competitive Positioning in Chipboard Box Industry

Silver Food Market Share & Competitive Insights

Silver Powder and Flakes Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA