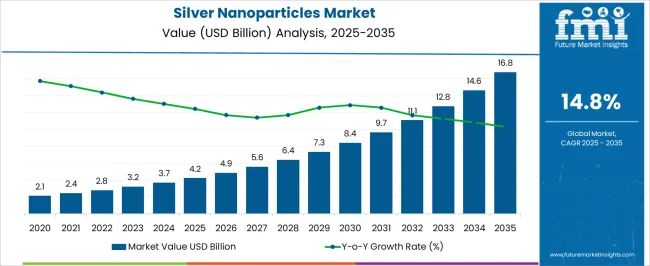

In 2025, the silver nanoparticles market is valued at USD 4.2 billion and is expected to reach USD 16.8 billion by 2035, growing at a CAGR of 14.8%, with a multiplying factor of about 4x. Comparing early versus late growth curves highlights shifts in adoption, application diversification, and technological integration across the decade. In the early phase, from 2025 to 2028, growth is driven by established applications in medical devices, antimicrobial coatings, and electronics. Initial adoption is concentrated in regions with advanced R&D infrastructure, and market expansion is supported by regulatory approvals and pilot-scale manufacturing.

The growth curve in this phase is relatively steep, reflecting strong momentum from early adopters and niche high-value applications. During the mid to late phase, from 2028 to 2035, the growth curve becomes even steeper as silver nanoparticles gain wider acceptance across consumer products, water purification systems, textiles, and advanced sensors. Technological advancements in synthesis methods, particle functionalization, and scalable production reduce costs and expand market penetration. Emerging regions, particularly in Asia Pacific, contribute significantly to late-phase growth, fueled by industrialization and rising healthcare and electronics demand.

Comparing early and late curves shows that while early growth is concentrated and technology-driven, late growth benefits from broader adoption, cost optimization, and application diversification, resulting in stronger absolute value gains and accelerated market momentum toward 2035.

| Metric | Value |

|---|---|

| Silver Nanoparticles Market Estimated Value in (2025 E) | USD 4.2 billion |

| Silver Nanoparticles Market Forecast Value in (2035 F) | USD 16.8 billion |

| Forecast CAGR (2025 to 2035) | 14.8% |

The silver nanoparticles market is supported by several upstream sectors. Healthcare and medical device manufacturers account for approximately 37%, leveraging silver nanoparticles for antimicrobial coatings, wound dressings, and medical instruments. Electronics and conductive materials producers contribute around 26%, applying nanoparticles in printed electronics, sensors, and conductive inks. Cosmetics and personal care companies represent roughly 17%, incorporating nanoparticles into creams, lotions, and antimicrobial formulations. Textile and apparel manufacturers hold close to 11%, utilizing silver nanoparticles for odor control and antimicrobial fabrics. Chemical and research suppliers make up the remaining 9%, providing high-purity nanoparticles and dispersions for industrial and laboratory applications. The market is expanding with increasing applications in healthcare, electronics, and textiles. Healthcare applications, particularly antimicrobial coatings and wound care, now account for over 42% of total usage, driven by rising infection control standards. Adoption in printed electronics and conductive inks has grown by ~14% year-on-year, supporting wearable and flexible electronic devices. Textiles treated with silver nanoparticles have demonstrated up to 99% bacterial reduction, enhancing demand in activewear and medical fabrics. Advances in green synthesis and particle size control are improving performance and environmental compatibility. The industrial and research applications are rising as nanoparticles are increasingly used in catalysis, sensors, and high-performance coatings.

The silver nanoparticles market is expanding steadily, supported by their unique physicochemical properties and broad applicability across multiple industries. Scientific publications and industry press releases have underscored their increasing role in electronics, healthcare, textiles, and environmental applications due to superior conductivity, antimicrobial activity, and catalytic efficiency.

Technological advancements in nanoparticle synthesis methods, such as chemical reduction and green synthesis techniques, have improved particle uniformity and stability, enabling consistent performance in end-use applications. Rising demand for miniaturized and high-performance electronic components has further boosted adoption in conductive inks, adhesives, and coatings.

Additionally, the integration of silver nanoparticles in consumer electronics and medical devices has been facilitated by favorable regulatory approvals and industry partnerships aimed at scaling production. Market growth is also being influenced by ongoing research into multifunctional nanomaterials that combine silver nanoparticles with other advanced materials to enhance performance characteristics. Looking forward, increasing investment in nanotechnology R&D, coupled with the push for high-efficiency electronic devices, is expected to sustain strong market demand.

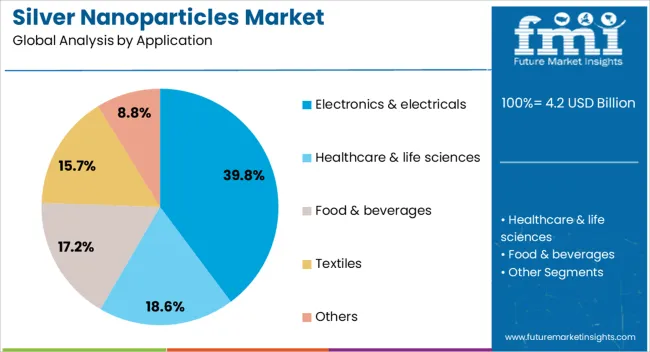

The silver nanoparticles market is segmented by application, and geographic regions. By application, silver nanoparticles market is divided into Electronics & electricals, Healthcare & life sciences, Food & beverages, Textiles, and Others. Regionally, the silver nanoparticles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electronics and electricals segment is projected to account for 39.8% of the silver nanoparticles market revenue in 2025, maintaining its leading position among application categories. Growth in this segment has been driven by the exceptional electrical conductivity of silver nanoparticles, which has made them a preferred material for advanced circuitry, printed electronics, and conductive coatings.

Electronics manufacturers have increasingly adopted silver nanoparticle-based inks and pastes in flexible displays, RFID tags, touchscreens, and photovoltaic cells to improve device performance and energy efficiency. Industry reports have noted that these nanoparticles enable finer circuit patterns and better conductivity than traditional metallic materials, supporting ongoing trends in device miniaturization.

Furthermore, the expansion of 5G infrastructure, wearable electronics, and smart devices has increased the demand for high-performance conductive materials. Continuous product innovations and scalable manufacturing processes have further strengthened the segment’s position. As the global electronics industry shifts toward lighter, faster, and more energy-efficient devices, the electronics and electricals segment is expected to remain a key driver of silver nanoparticle adoption.

The silver nanoparticles market is growing due to increasing utilization in medical, electronics, water treatment, and textile applications. These nanoparticles exhibit antimicrobial properties, high electrical conductivity, and catalytic activity, making them suitable for diverse industrial and consumer products. Asia Pacific leads in production and consumption due to strong pharmaceutical, electronics, and textile sectors, while North America and Europe focus on high-purity applications and research initiatives. Advances in chemical, physical, and biological synthesis methods are improving particle uniformity, functionalization, and stability. Rising demand for antibacterial coatings, conductive inks, and environmental remediation solutions supports sustained adoption.

Silver nanoparticles are widely applied in healthcare for wound dressings, antimicrobial coatings, and drug delivery systems. In consumer products, they are integrated into textiles, packaging, and personal care items to prevent microbial growth. Water treatment systems employ silver nanoparticles for sterilization and pathogen control. Electronics utilize them in conductive inks, sensors, and printed circuit boards. Rising demand for multifunctional materials with enhanced antimicrobial and conductive properties supports market growth. The convergence of industrial application, healthcare needs, and consumer product integration is driving global adoption of silver nanoparticles across multiple sectors.

Silver nanoparticles offer significant potential in electronics and environmental solutions. Conductive inks, sensors, and flexible electronics benefit from their high conductivity and stability. Water treatment and air purification systems utilize nanoparticles for disinfection and pollutant removal. Industrial coating applications leverage their antimicrobial and anti-corrosive properties. Investments in nano-enabled product development, functional coatings, and high-performance materials create opportunities for market growth. Increasing regulatory support for safe nanomaterial applications and technological advancements in nanoparticle synthesis are expected to enhance adoption in industrial, consumer, and environmental segments.

Emerging trends include functionalized nanoparticles, hybrid nanomaterials, and integration with advanced nanotechnology for enhanced performance. Surface modifications improve stability, dispersion, and interaction with substrates. Hybrid materials combining silver nanoparticles with polymers or other nanomaterials provide additional functionality for biomedical, electronic, and environmental applications. Research and development are focused on improving efficiency, safety, and sustainability of nanoparticle production. Integration with automated synthesis systems and high-precision characterization tools is facilitating high-purity, application-specific nanoparticles. These trends support broader adoption in industrial, medical, and consumer markets, ensuring consistent market expansion.

The production of silver nanoparticles involves high material costs and complex synthesis processes, creating barriers for smaller manufacturers. Regulatory requirements for environmental and human safety further increase operational expenditures. Standardizing particle size, purity, and functionalization adds technical complexity. Companies investing in cost-effective synthesis, quality control, and compliance management are better positioned to overcome these challenges. Ensuring consistent quality, safe handling, and adherence to regulatory standards is critical for maintaining competitiveness and supporting adoption across medical, industrial, and consumer sectors.

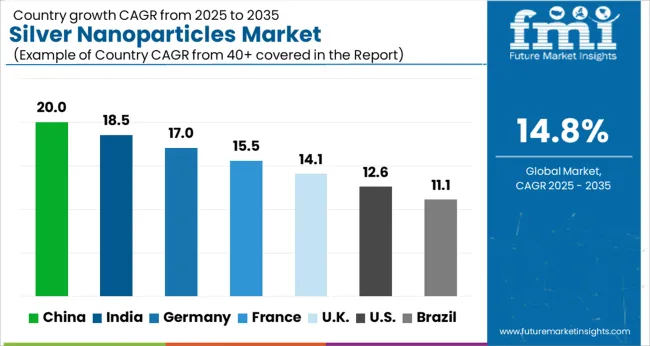

| Country | CAGR |

|---|---|

| China | 20.0% |

| India | 18.5% |

| Germany | 17.0% |

| France | 15.5% |

| UK | 14.1% |

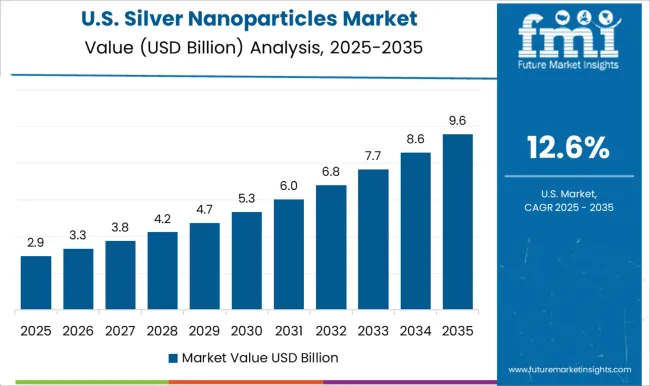

| USA | 12.6% |

| Brazil | 11.1% |

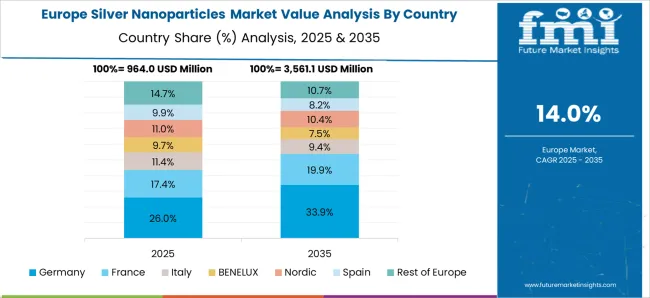

The silver nanoparticles market is expanding at a global CAGR of 14.8% from 2025 to 2035, driven by increasing demand in healthcare, electronics, and antimicrobial applications. China leads at 20.0%, +35% above the global average, supported by BRICS-driven growth in nanotechnology research, large-scale manufacturing capabilities, and adoption across medical and electronic sectors. India follows at 18.5%, +25% over the global benchmark, reflecting growing pharmaceutical production, industrial applications, and government-supported nanotechnology initiatives. Germany records 17.0%, +15% above the global CAGR, shaped by OECD-supported innovation in high-purity nanoparticles and specialty applications in electronics and coatings. The United Kingdom posts 14.1%, slightly below the global rate, influenced by selective adoption in advanced materials and medical research. The United States stands at 12.6%, −15% under the global benchmark, reflecting mature nanotechnology infrastructure with steady uptake in targeted applications. BRICS economies are driving production scale, while OECD nations focus on precision, quality, and high-value innovation.

China is growing at a CAGR of 20.0%, which is 5.2% higher than the global CAGR of 14.8%, reflecting rapid adoption across healthcare, electronics, and antimicrobial applications. Domestic manufacturers are scaling production of high-purity silver nanoparticles for coatings, medical devices, and conductive inks. Rising R&D investments in nanomaterial synthesis and increasing demand from packaging, textiles, and electronics industries are driving growth. Partnerships between research institutes and industrial players accelerate innovation and product development. China’s export-oriented production further reinforces its leading role in the global silver nanoparticle market.

India is recording a CAGR of 18.5%, which is 3.7% above the global CAGR, supported by growing demand in healthcare, electronics, and antimicrobial coatings. Pharmaceutical and diagnostic industries are increasingly adopting silver nanoparticles for medical devices, wound dressings, and biosensors. Local manufacturers are expanding synthesis and coating capacities to meet domestic and export needs. Investment in nanotechnology research and collaborations with international companies are enhancing product applications. Industrial demand from textiles, packaging, and water treatment sectors further accelerates adoption.

Germany is progressing at a CAGR of 17.0%, which is 2.2% above the global CAGR, driven by adoption in medical devices, electronics, and specialty coatings. High-purity silver nanoparticles are increasingly used in conductive inks, antimicrobial surfaces, and diagnostics. Strong industrial R&D in nanotechnology and collaborations with research institutes support innovative applications. Environmental and safety compliance standards are driving high-quality production. Export of specialty nanoparticles for European and global industries reinforces Germany’s market position.

The United Kingdom is growing at a CAGR of 14.1%, which is 0.7% below the global CAGR of 14.8%, reflecting stable yet slightly slower growth. Market adoption is concentrated in healthcare, diagnostics, and specialty coatings. Local production is complemented by imports of high-purity silver nanoparticles from Europe and Asia. Pharmaceutical, medical, and industrial applications are supporting incremental demand. Partnerships with research institutions and technology providers are enabling development of novel nanoparticle applications, particularly for antimicrobial and biosensing uses.

The United States is progressing at a CAGR of 12.6%, which is 2.2% below the global CAGR of 14.8%, reflecting slower growth relative to leading countries. Adoption is driven by medical, electronics, and antimicrobial applications. Domestic manufacturers focus on high-purity nanoparticles for diagnostics, wound care, and specialty coatings. Imports from Asia supplement domestic production for high-end applications. Increasing use in biosensors, conductive inks, and packaging materials supports steady market expansion, though growth is tempered by mature industrial adoption and regulatory compliance requirements.

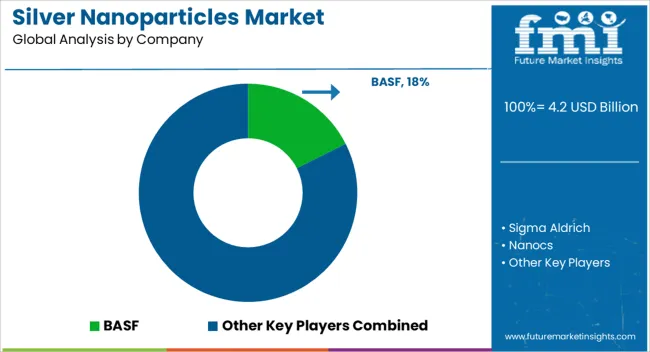

The silver nanoparticles market is shaped by manufacturers and suppliers providing engineered nanomaterials for electronics, healthcare, coatings, and catalysis applications. BASF is assumed to be the leading player, supported by a portfolio of highly uniform nanoparticles designed for superior conductivity, antimicrobial activity, and controlled surface chemistry.

Sigma Aldrich and Nanocs maintain strong positions through laboratory-grade and industrial-scale nanoparticles with precise size distribution, shape control, and surface functionalization suitable for advanced research and manufacturing. Advanced Nano Products and NanoHorizons, Inc focus on stabilized dispersions, conductive inks, and specialty coatings, emphasizing reproducibility and high-performance characteristics. American Elements strengthens the market with customizable formulations, scalable production processes, and technical guidance, enabling integration into electronics manufacturing, sensors, and medical devices.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 Billion |

| Application | Electronics & electricals, Healthcare & life sciences, Food & beverages, Textiles, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Sigma Aldrich, Nanocs, Advanced Nano Products, NanoHorizons, Inc, and American Elements |

| Additional Attributes | Dollar sales by nanoparticle type and application, demand dynamics across healthcare, electronics, textiles, and coatings, regional trends across North America, Europe, and Asia-Pacific, innovation in size-controlled synthesis, surface functionalization, and antibacterial formulations, environmental impact of nanoparticle disposal and toxicity, and emerging use cases in wound care, conductive inks, and antimicrobial surfaces. |

The global silver nanoparticles market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the silver nanoparticles market is projected to reach USD 16.8 billion by 2035.

The silver nanoparticles market is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types in silver nanoparticles market are electronics & electricals, healthcare & life sciences, food & beverages, textiles and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Silver Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Silver Pressure Sintering Machine Market Size and Share Forecast Outlook 2025 to 2035

Silver Sintering Chip Mounter Market Size and Share Forecast Outlook 2025 to 2035

Silver Food Market Size and Share Forecast Outlook 2025 to 2035

Silver Cyanide Market Size and Share Forecast Outlook 2025 to 2035

Silver Nitrate Market - Trends & Forecast 2025 to 2035

Silver Nanowires Market Growth - Trends & Forecast 2025 to 2035

Silver Food Market Share & Competitive Insights

Silver Powder and Flakes Market Growth - Trends & Forecast 2025 to 2035

Nanosilver Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Colloidal Silver Market Report - Trends, Innovations & Forecast 2025 to 2035

Industrial Silver Market

Fully Automatic Silver Sintering System Market Size and Share Forecast Outlook 2025 to 2035

Demand for Colloidal Silver in EU Size and Share Forecast Outlook 2025 to 2035

Anti-Tarnish Agent for Silver Market Size and Share Forecast Outlook 2025 to 2035

Lipid Nanoparticles Market Insights - Growth & Forecast 2025 to 2035

Platinum Nanoparticles Market

Metal Nitride Nanoparticles Market

Colloidal Selenium Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA