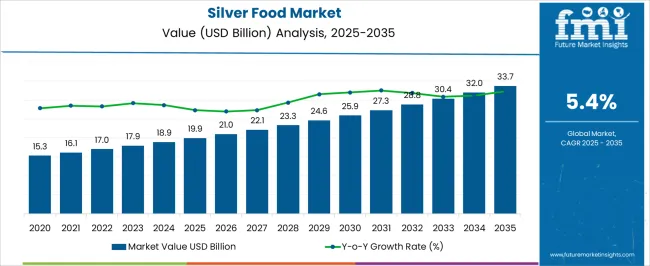

The silver food market, estimated at USD 19.9 billion in 2025 and forecast to reach USD 33.7 billion by 2035 with a CAGR of 5.4%, demonstrates a value chain characterized by multiple interdependent stages that shape cost structure and pricing strategies. Raw material procurement, encompassing silver sourcing and primary ingredient acquisition, accounts for a significant portion of overall costs.

Variations in silver purity, regional availability, and sourcing logistics directly influence the upstream expenditure, forming the foundation of the value chain. Manufacturing processes, including processing, formulation, and packaging, represent the second major cost component. Efficient production technologies, energy management, and automation play a role in moderating production costs while ensuring product quality and compliance with food safety regulations. Distribution and logistics constitute another critical layer, as Silver Food products require specialized handling to preserve quality, particularly in long supply chains across international markets. Transportation, warehousing, and cold chain requirements add to operational costs, influencing final pricing and market accessibility. Marketing, branding, and retail network development, while smaller in proportion, are essential for product positioning and consumer adoption, contributing indirectly to the cost structure through promotional expenditures.

The market’s cost structure reflects a balance of raw material procurement, processing efficiencies, logistics management, and brand-building efforts. Strategic optimization across these stages enhances profitability, supports competitive pricing, and ensures sustainable growth as the market advances toward USD 33.7 billion by 2035.

| Metric | Value |

|---|---|

| Silver Food Market Estimated Value in (2025 E) | USD 19.9 billion |

| Silver Food Market Forecast Value in (2035 F) | USD 33.7 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The silver food market is regarded as a niche segment within functional and fortified food products. It is estimated to hold 4.2% of the functional foods and nutraceuticals market, driven by antimicrobial and health-promoting properties. Within food additives and preservatives, a 3.7% share is observed, reflecting the use of silver compounds for microbial control and shelf life extension. Dietary supplements contribute 2.9%, supported by immune support and wellness formulations. The confectionery and bakery sector accounts for 3.1%, with silver decorative applications in premium products. Beverages and fortified drinks represent 2.5%, where silver nanoparticles or colloids are incorporated for functional purposes.

Recent industry trends include the development of safe, food grade silver formulations, enhanced antimicrobial coatings, and nano engineered particles for controlled activity. Groundbreaking advancements include the incorporation of silver in edible packaging, chocolate and confectionery coatings, and functional beverages. Key players are focusing on regulatory compliance, consumer safety, and marketing premium and clean-label products.

Strategic initiatives involve partnerships with supplement manufacturers, luxury confectioners, and beverage companies to introduce novel silver-enhanced offerings. Research in bioavailability, controlled release, and cost-effective synthesis continues to strengthen product performance and market adoption. North America and Europe lead regional growth, while the Asia Pacific shows increasing adoption due to rising health awareness and premium product demand.

The silver food market is being driven by demographic shifts marked by the expanding global elderly population, growing health awareness among older consumers, and rising demand for nutrient-rich dietary solutions tailored to age-related needs. Current industry dynamics are supported by advancements in nutritional science, product fortification, and specialized formulations aimed at maintaining vitality, managing chronic conditions, and supporting cognitive health.

Supply chain efficiency and stringent quality control have become critical in meeting both safety standards and consumer trust expectations. Regulatory frameworks continue to influence product positioning and labeling, particularly in developed markets, while emerging economies are registering accelerated adoption due to increasing life expectancy and improved healthcare access.

Innovations in delivery formats, convenient packaging, and targeted distribution strategies further enable market expansion. Over the forecast period, steady demand growth is expected, underpinned by the convergence of preventive healthcare trends, government initiatives promoting senior nutrition, and the ability of market players to adapt portfolios to diverse cultural and dietary preferences.

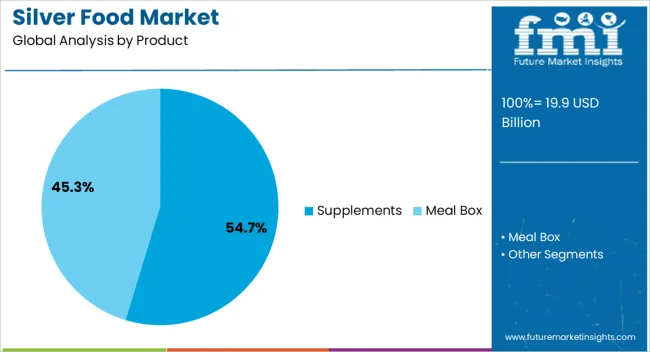

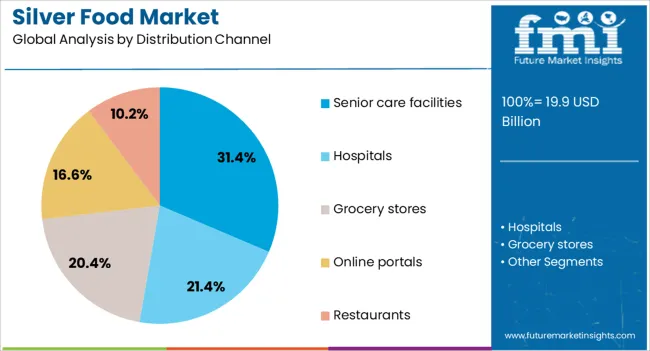

The silver food market is segmented by product, distribution channel, and geographic regions. By product, silver food market is divided into Supplements and Meal Box. In terms of distribution channel, silver food market is classified into Senior care facilities, Hospitals, Grocery stores, Online portals, and Restaurants. Regionally, the silver food industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The supplements segment, holding 54.70% of the product category, has been maintaining its lead due to its direct alignment with the nutritional requirements of the elderly demographic. This dominance has been reinforced by the segment’s role in addressing micronutrient deficiencies, supporting immunity, and enhancing the quality of life for older consumers.

Its market position benefits from ongoing product innovation, including the development of bioavailable formulations and personalized nutrition solutions. Consistent demand from both retail and institutional channels has stabilized production volumes, while regulatory compliance and clinical validation have strengthened consumer confidence.

Growth in this segment is further supported by the expansion of e-commerce and direct-to-consumer models, which have improved accessibility. Competitive advantage is being sustained through brand trust, diversified product portfolios, and continuous research into age-related health concerns, ensuring the supplements category remains central to the silver food market’s overall revenue generation.

The senior care facilities segment, accounting for 31.40% of the distribution channel category, has been leading due to its structured, captive demand environment and the direct integration of nutritional planning into elderly care services. This channel benefits from predictable purchasing cycles, long-term institutional partnerships, and centralized procurement processes that facilitate bulk supply contracts.

Its strength is reinforced by the increasing number of residential care facilities globally and the growing emphasis on tailored meal programs for residents. Operational efficiency, combined with stringent adherence to dietary guidelines, has enhanced the reliability of this segment as a primary distribution route.

The segment’s position is also supported by the provision of fortified foods and specialized diets designed to address prevalent health conditions in the elderly population. With governments and private operators investing in senior living infrastructure, the senior care facilities channel is expected to maintain a stable growth trajectory, playing a crucial role in the structured delivery of silver food products.

The market has gained prominence due to its applications in functional foods, dietary supplements, and food preservation. Silver, often in nanoparticle or colloidal form, is incorporated for its antimicrobial properties, helping extend shelf life and reduce microbial contamination in packaged foods and beverages. Consumer interest in food safety, hygiene, and natural preservatives has driven adoption in dairy, confectionery, beverages, and processed foods. Regulatory approvals, scientific validation, and formulation advancements have enabled safe integration into consumables. Regional growth is influenced by food processing infrastructure, consumer awareness, and stringent hygiene regulations.

Silver’s antimicrobial properties have positioned it as a key additive in food preservation, preventing bacterial, fungal, and viral contamination. Processed foods, beverages, and dairy products benefit from longer shelf life, reduced spoilage, and enhanced safety. Packaging films, coatings, and surface treatments infused with silver nanoparticles are increasingly applied in ready-to-eat meals, bakery products, and bottled drinks to maintain freshness. Food processing companies are adopting silver-based additives to meet stringent hygiene standards, reduce waste, and improve product consistency. Consumer demand for safer, longer-lasting food products encourages manufacturers to explore innovative applications of silver, reinforcing its role in modern food safety practices and extending market reach.

The functional food segment has become a significant driver for silver incorporation. Silver nanoparticles are explored in dietary supplements, nutraceuticals, and fortified beverages for potential antimicrobial and gut-health benefits. Health-conscious consumers are seeking foods that provide safety alongside enhanced nutrition. Silver-enriched edible coatings and powders are being integrated into snacks, protein bars, and powdered beverages to add value without altering taste or texture. Manufacturers leverage this trend to differentiate products, offering enhanced safety and functional benefits. The expansion of clean-label products, fortified foods, and fortified beverages further increases silver’s applicability, positioning it as a strategic ingredient in health-oriented and high-value food markets.

Advancements in nanotechnology, coating methods, and encapsulation have improved the stability, efficacy, and controlled release of silver in food applications. Edible films, antimicrobial packaging, and surface sprays allow uniform dispersion of silver while preventing overexposure. Microencapsulation techniques ensure silver remains effective during storage and processing while complying with safety regulations. Integration into powdered ingredients, liquids, and packaging materials is being optimized to maintain functionality without affecting taste or appearance. Research on synergistic effects with other natural preservatives and antimicrobial agents further enhances application potential. Technological improvements have made silver-based solutions more practical, scalable, and safe, driving adoption across food processing and packaging industries.

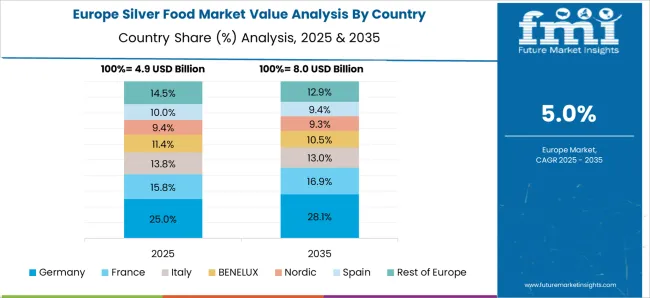

Adoption of silver in food products varies regionally due to regulatory frameworks, consumer acceptance, and industrial infrastructure. North America and Europe focus on regulatory compliance, safety validation, and functional food applications, while the Asia Pacific emphasizes processed foods, beverages, and dairy sectors due to rising population and industrialization. Food safety regulations in Europe and the USA mandate testing for nanoparticle use, ensuring safe concentrations. Emerging regions are gradually adopting silver-based preservatives and coatings in response to growing food safety awareness and modernized food processing facilities. Regional trends demonstrate how regulatory oversight, consumer preferences, and industrial capacity collectively impact market expansion.

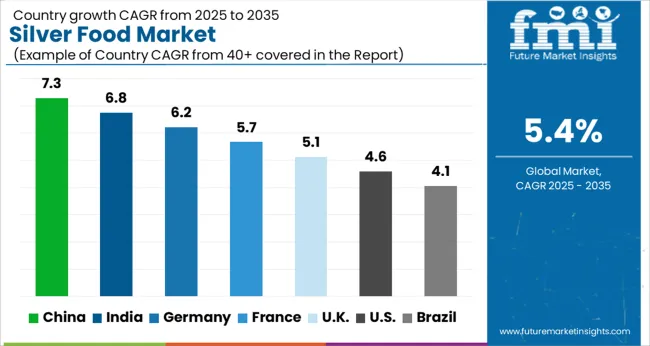

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

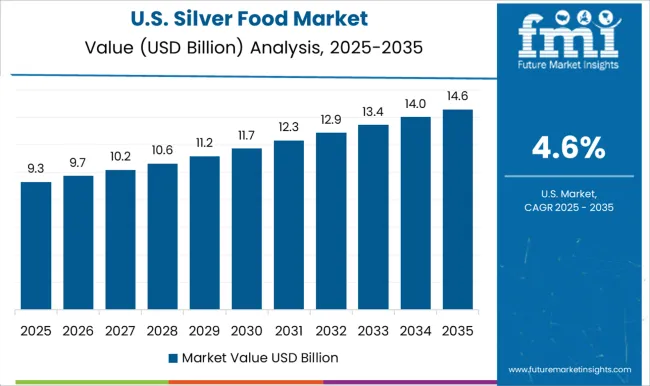

| USA | 4.6% |

| Brazil | 4.1% |

China leads the market with a forecast CAGR of 7.3%, driven by expanding food processing industries and increasing use of silver-based additives for preservation and safety. India follows at 6.8%, supported by rising adoption in packaged and functional food segments. Germany records 6.2%, benefiting from stringent food safety standards and innovation in antimicrobial food applications. The United Kingdom posts 5.1%, where research in functional foods and supplements sustains market activity. The United States registers 4.6%, with consistent demand in health-conscious and processed food products. Together, these countries demonstrate strong production capabilities, technological adoption, and market expansion shaping the global silver food landscape. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to experience a CAGR of 7.3% in the market, driven by increasing health-conscious consumer behavior and growing adoption of nutraceuticals and fortified foods. Silver-based additives and coatings are gaining popularity in functional foods and beverages due to their antimicrobial and preservative properties. Manufacturers are investing in research and development to create innovative food solutions incorporating silver compounds. The bakery, dairy, and confectionery sectors are exploring silver food ingredients for improved shelf life and hygiene. Rising awareness of food safety and demand for premium quality products are contributing to steady growth across China.

India is expected to grow at a CAGR of 6.8% in the market as consumer awareness of antimicrobial and preservative benefits expands. Urbanization and rising disposable incomes are boosting demand for fortified and functional food products. Manufacturers are introducing premium silver-infused food solutions in dairy, confectionery, and beverage sectors. Government regulations and food safety standards encourage the adoption of safe and hygienic food additives. Increasing investment in research for edible silver applications further enhances market potential. Growth is also supported by evolving trends in luxury and health-oriented food segments, providing significant opportunities in India.

Germany is anticipated to witness a CAGR of 6.2% in the market, driven by a strong preference for functional and hygienic food products. Health-conscious consumers increasingly opt for fortified foods and beverages enhanced with silver-based additives. The bakery, confectionery, and dairy industries are adopting silver coatings for improved shelf life and microbial safety. Regulatory frameworks supporting food safety and quality standards contribute to market stability. Manufacturers focus on sustainable sourcing and innovative applications, including premium and luxury food items. Consumer trends toward natural and safe food ingredients reinforce the steady growth of the silver food market in Germany.

The United Kingdom is projected to grow at a CAGR of 5.1% in the market, supported by rising interest in health-promoting and premium food products. Silver additives are increasingly integrated into beverages, dairy, and confectionery to enhance antimicrobial properties and shelf life. Consumer focus on hygiene, safety, and innovative functional foods encourages adoption. Food manufacturers are exploring novel solutions combining silver with other nutraceutical compounds. Increasing awareness of preventive health measures and sustainable food processing practices provides additional market momentum. Steady infrastructure development in food production and retail strengthens opportunities for growth throughout the UK.

The United States is expected to register a CAGR of 4.6% in the market due to growing demand for functional, hygienic, and premium food solutions. Silver-based additives are increasingly utilized in beverages, dairy, and processed foods to improve microbial safety and prolong shelf life. Consumers are showing higher interest in health-oriented and fortified food products. Manufacturers are focusing on innovative formulations, including edible silver coatings and antimicrobial solutions for luxury foods. Regulatory compliance, quality standards, and research initiatives further strengthen market growth. Steady expansion in retail, hospitality, and food service sectors supports continuous demand for silver-infused food solutions across the US.

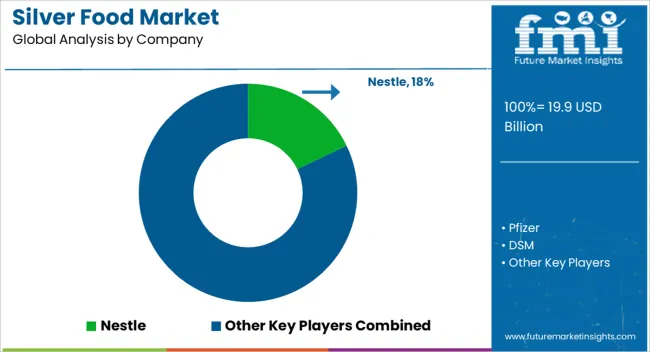

The market encompasses a range of specialized products designed to meet the nutritional and health needs of older adults, emphasizing enhanced nutrient density, digestibility, and functional benefits. Nestlé and Abbott Laboratories lead the sector with scientifically formulated meals, beverages, and supplements that support healthy aging and cater to dietary restrictions common among the elderly. DSM and Pfizer contribute fortified ingredients and nutritional solutions that enhance the overall health profile of silver food products, focusing on protein enrichment, vitamins, and minerals essential for immune support and bone health. Arla Foods Ingredients Group and Carezzo Nutrition B.V. provide dairy- and protein-based ingredients tailored for palatable and easy-to-consume foods, enabling the development of customized meal solutions.

BistroMD and Magic Kitchen focus on ready-to-eat and convenience-oriented meals, ensuring that flavor, texture, and nutritional balance are maintained while addressing challenges such as ease of preparation and swallowing difficulties. Dussmann Group and Harrogate Neighbours Housing Association Ltd. integrate silver foods into care settings, optimizing menu planning, dietary compliance, and meal accessibility. Collectively, these providers drive innovation and quality in the silver food segment, catering to a growing aging population with a focus on health, convenience, and overall well-being.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.9 Billion |

| Product | Supplements and Meal Box |

| Distribution Channel | Senior care facilities, Hospitals, Grocery stores, Online portals, and Restaurants |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestle, Pfizer, DSM, Abbott Laboratories, Arla Foods Ingredients Group, bistroMD, Magic Kitchen, Dussmann Group, Carezzo Nutrition B.V., and Harrogate Neighbours Housing Association Ltd. |

| Additional Attributes | Dollar sales by product type and distribution channel, demand dynamics across confectionery, bakery, and premium food segments, regional trends in edible silver adoption, innovation in coating techniques, purity standards, and packaging, environmental impact of sourcing and processing, and emerging use cases in luxury foods, festive products, and functional culinary applications. |

The global silver food market is estimated to be valued at USD 19.9 billion in 2025.

The market size for the silver food market is projected to reach USD 33.7 billion by 2035.

The silver food market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in silver food market are supplements and meal box.

In terms of distribution channel, senior care facilities segment to command 31.4% share in the silver food market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Silver Food Market Share & Competitive Insights

Silver Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Silver Pressure Sintering Machine Market Size and Share Forecast Outlook 2025 to 2035

Silver Sintering Chip Mounter Market Size and Share Forecast Outlook 2025 to 2035

Silver Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

Silver Cyanide Market Size and Share Forecast Outlook 2025 to 2035

Silver Nitrate Market - Trends & Forecast 2025 to 2035

Silver Nanowires Market Growth - Trends & Forecast 2025 to 2035

Silver Powder and Flakes Market Growth - Trends & Forecast 2025 to 2035

Nanosilver Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Colloidal Silver Market Report - Trends, Innovations & Forecast 2025 to 2035

Industrial Silver Market

Fully Automatic Silver Sintering System Market Size and Share Forecast Outlook 2025 to 2035

Demand for Colloidal Silver in EU Size and Share Forecast Outlook 2025 to 2035

Anti-Tarnish Agent for Silver Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA