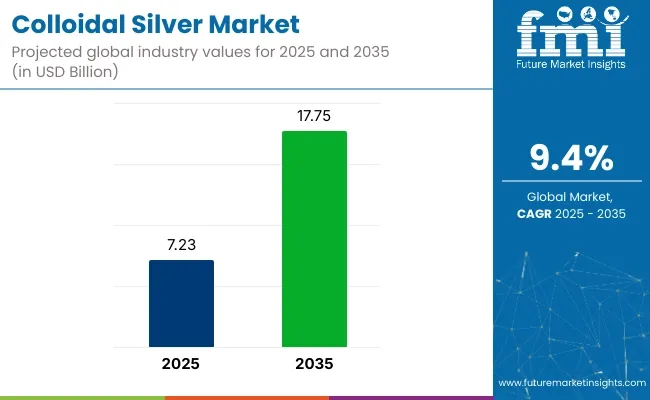

The global colloidal silver market is valued at USD 7.23 billion in 2025 and is slated to reach USD 17.75 billion by 2035, which shows a CAGR of 9.4% over the forecast period.

This growth is being driven by increasing demand for natural antimicrobial agents across medical, cosmetic, and personal care sectors. Colloidal silver’s antibacterial, antifungal, and antiviral properties have made it popular in products such as wound care gels, nasal sprays, skin ointments, and dietary supplements.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 7.23 billion |

| Industry Value (2035F) | USD 17.75 billion |

| CAGR (2025 to 2035) | 9.4% |

As concerns around antibiotic resistance and chemical-laden products rise, consumers are increasingly turning to colloidal silver for alternative therapeutic applications, particularly in wellness-driven markets and developing regions where access to pharmaceuticals may be limited.

Technological innovations are enhancing the formulation and stability of colloidal silver products. Manufacturers are focusing on refining particle size, improving bioavailability, and ensuring consistent silver concentration to meet evolving quality standards. Growth in the cosmetics and personal care industry is especially significant, with colloidal silver being used in acne treatments, deodorants, and anti-aging solutions.

Companies are also expanding their reach through digital channels and wellness retail networks, making colloidal silver-based products more accessible globally. As regulatory scrutiny intensifies, producers are aligning with safety standards by incorporating advanced filtration processes, testing protocols, and transparent labeling to ensure consumer confidence.

The market is likely to benefit from continued research validating the safety and efficacy of colloidal silver in external applications. Advancements in nanotechnology and delivery mechanisms are likely to improve product performance across dermatological and immune-support applications. Regulatory policies are also evolving. In the USA, the FDA prohibits therapeutic claims for internal use, but permits topical and cosmetic applications under strict guidelines.

The EU enforces regulations under EMA and ECHA that limit concentrations and require clear safety documentation. With global regulations focusing on purity, labeling, and responsible usage, the market is expected to evolve into a more standardized and scientifically grounded segment of the natural health industry.

The market is segmented based on form, particle size, end use, and region. By form, the market is divided into powder and liquid. In terms of particle size, it is segmented into 5 to 10nm, 11 to 20nm, 21 to 50nm, and 101 to 200nm.

Based on end use, the market is categorized into healthcare, dietary supplements, food and beverages, cosmetics, electronics, textile, water treatment, paint and coating, and other industries including pet care, agriculture, cleaning products, and construction materials. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

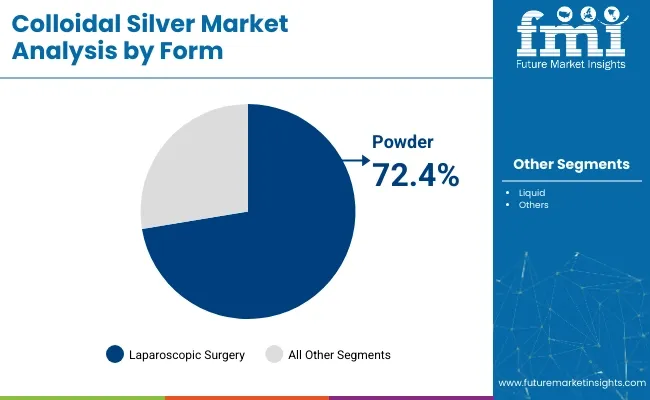

The powder segment is projected to dominate the colloidal silver market, accounting for an 72.4% share in 2025. This form offers significant advantages in terms of shelf stability, handling, and precise dosing, making it highly suitable for industrial and commercial use. Powdered colloidal silver is particularly valued for bulk manufacturing across nutraceuticals, personal care products, and coatings where solubility and dispersibility can be controlled at the formulation level. Its ability to retain active properties without degradation supports its use in long-term storage and transport, especially in global supply chains where liquid formats may suffer from shelf-life limitations.

Moreover, powder form is increasingly being integrated into antimicrobial paints, textiles, and packaging solutions, where its concentrated silver content allows for extended efficacy with minimal dosing. As regulatory bodies focus on heavy metal limits and nanoparticle safety, powder-based products allow manufacturers to customize concentrations more precisely, aiding compliance and reducing wastage.

Liquid colloidal silver, by contrast, is growing in direct-to-consumer applications such as supplements, wound sprays, and disinfectants. However, its formulation complexity, shorter shelf life, and packaging costs present challenges in large-scale commercial settings. The liquid segment accounts for 27.6% share. Powder remains the industry’s preferred choice for both flexibility and economic feasibility, reinforcing its market dominance.

| Form | Share (2025) |

|---|---|

| Powder | 72.4% |

| Liquid | 27.6% |

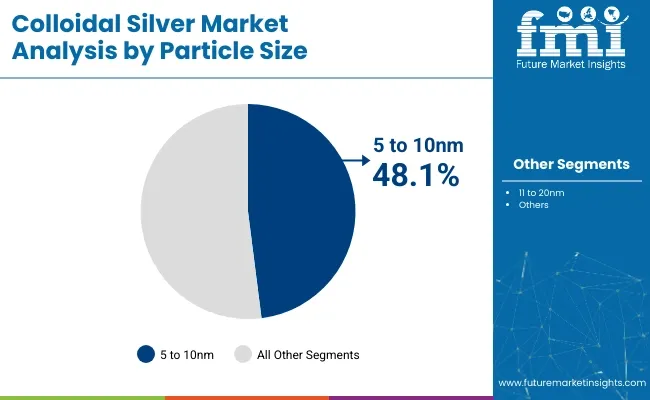

The 5 to 10nm segment accounts for 48.1% of the global colloidal silver market share in 2025, owing to its optimal surface-area-to-volume ratio and superior antimicrobial efficacy. Particles within this size range are highly reactive against bacteria, fungi, and viruses, making them ideal for use in high-performance healthcare and cosmetic formulations.

Their ability to penetrate biological membranes more effectively than larger particles enhances their utility in topical creams, nasal sprays, oral supplements, and wound care dressings. Manufacturers prefer this range due to its consistent bioavailability and ability to deliver rapid action at lower concentrations, minimizing potential toxicity while maintaining performance.

Additionally, the 5 to 10nm range is well-supported by scientific literature and product safety testing, which helps navigate stringent regulatory requirements in medical and personal care markets. While other particle size segments such as 11 to 20nm and 21 to 50nm are utilized in industrial and environmental applications, they tend to exhibit reduced reactivity and bio-efficiency.

The 11 to 20 nm segment registers 27% market share. The increasing focus on nano-enabled healthcare and the need for clean-label antimicrobial solutions are placing the 5 to 10nm category at the forefront of formulation design. Its dominance is further reinforced by ongoing R&D focused on precision particle synthesis and stable dispersion techniques.

| By Particle Size | Share (2025) |

|---|---|

| 5 to 10nm | 48.1% |

| 11 to 20nm | 27% |

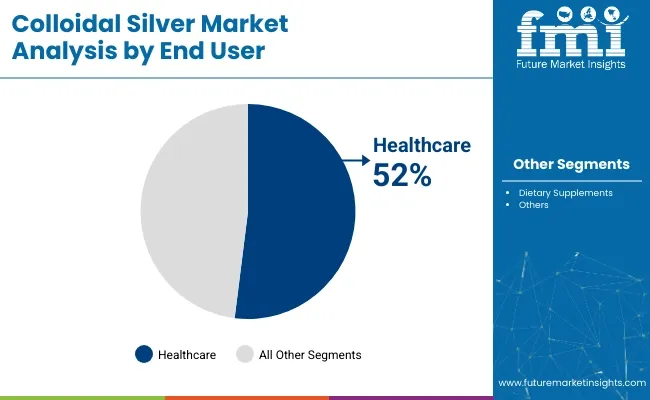

The healthcare segment is projected to expand at the highest CAGR of 6.3% from 2025 to 2035 and holds 52% share, driven by increasing adoption of colloidal silver in antimicrobial wound care, medical device coatings, and hospital-grade disinfection solutions.

The compound's broad-spectrum activity against bacteria and fungi without contributing to antibiotic resistance makes it highly attractive in both acute and chronic care environments. Silver-based products are now widely used in burn dressings, surgical masks, catheters, and orthopedic implants due to their ability to prevent infections and promote healing. In addition to clinical settings, over-the-counter healthcare products such as nasal sprays, throat lozenges, and skin gels are incorporating colloidal silver for its natural antimicrobial benefits.

The segment's rapid growth is further supported by heightened awareness around hospital-acquired infections (HAIs) and the global push for non-antibiotic treatment options. While dietary supplements and cosmetics remain strong contributors to market demand, their growth rates are relatively moderate compared to healthcare.

Supplements, for instance, face growing scrutiny from regulatory bodies regarding nanoparticle ingestion. Cosmetics, though thriving, are influenced by trends in clean beauty and ingredient transparency. In contrast, the healthcare segment benefits from a more structured, needs-based demand cycle and the increasing formalization of silver-based innovations in medical research and device development. The dietary supplements segment holds 38% share.

| End User | Share (2025) |

|---|---|

| Healthcare | 52% |

| Dietary Supplements | 38% |

Future Market Insights projects the global market for colloidal silver to remain lucrative, exhibiting growth at a CAGR of 9.4% between 2025 and 2035. It witnessed moderate expansion during the historical assessment period, registering a CAGR of approximately 5.4% between 2020 and 2024.

Key manufacturers operating in the global market are set to readjust their strategies as new advancements have taken place. A wide range of innovative and novel features are expected to be incorporated by them in their products.

Over the past five years, these companies have been manufacturing modern and innovative products such as soft colloidal silver with advanced technologies to increase their demand.

The colloidal silver market is a relatively new and rapidly evolving industry. Over the past years, there has been exponential growth in the production, sales, and use of colloidal silver products. Research and development activities are on the rise and hence people are becoming aware of its potential use.

In terms of its historical performance, the colloidal silver market has seen strong sales figures over recent years due to its increasing popularity as a natural remedy for various allergies. Consumers have become increasingly aware of numerous health benefits that can be gained from these products.

It is expected to lead to an increased demand for these products in both local and global markets. Increasing awareness has also resulted in more companies entering this market with research & development efforts. They are mainly focusing on discovering new applications of colloidal silver that could potentially revolutionize healthcare worldwide.

Incorporation of Colloidal Silver Liquid in Health Supplements to Boost Demand

Use of colloidal silver has been increasing in both pharmaceutical and food industries worldwide. Awareness is being raised about the potential health benefits of this type of silver. People are becoming increasingly interested in incorporating this mineral into their daily diets and health regimens.

Studies have shown that taking colloidal silver can boost the immune system by killing off harmful bacteria and viruses. It can also reduce inflammation and promote healing. Colloidal silver fosters excellent health and growth of cognitive capacities.

Manufacturers of health supplements containing colloidal silver assert that their goods can boost the immune system and aid the human body’s natural healing process. Consequently, it is anticipated that the market will be stimulated with rising demand for premium health supplements.

| Market Statistics | Details |

|---|---|

| Jan to Jun (H1), 2020 (A) | 7.9% |

| Jul to Dec (H2), 2020 (A) | 8.2% |

| Jan to Jun (H1), 2021 (A) | 8.7% |

| Jul to Dec (H2), 2021 (A) | 8.6% |

| Jan to Jun (H1), 2022 (A) | 9.0% |

| Jul to Dec (H2), 2022 (A) | 9.5% |

| Jan to Jun (H1), 2023 (A) | 9.6% |

| Jul to Dec (H2), 2023 (P) | 9.7% |

| Jan to Jun (H1), 2024 (P) | 9.8% |

| Jul to Dec (H2), 2024 (P) | 9.9% |

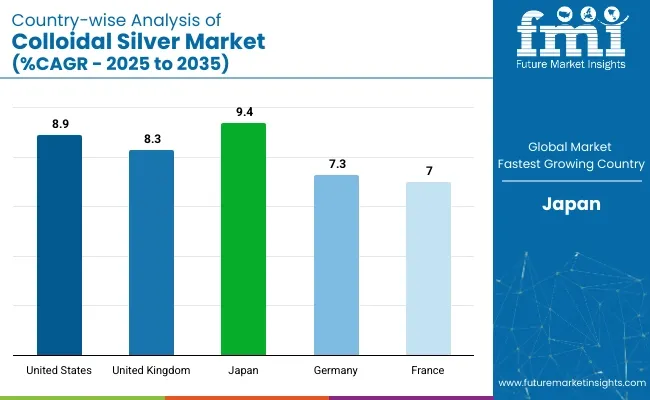

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 8.8% |

| UK | 7.7% |

| Japan | 9.4% |

| Germany | 7.3% |

| France | 7.0% |

The USA colloidal silver market is estimated to grow at a 8.8% CAGR during the study period. This growth is primarily driven by the increasing consumer interest in natural health remedies and alternative therapies. As individuals seek natural solutions for immune support, wound healing, and skin care, colloidal silver has gained popularity due to its perceived antimicrobial properties.

The rise of e-commerce platforms has further facilitated access to these products, allowing consumers to purchase them conveniently. Additionally, the USA market benefits from a well-established infrastructure for natural and holistic health products, with numerous manufacturers and distributors catering to the growing demand for colloidal silver supplements and topical treatments.

The UK colloidal silver market is estimated to grow at a 7.7% CAGR during the study period. The increasing consumer preference for natural and organic health solutions is a significant driver of this growth. Colloidal silver is widely used in skincare and cosmetic products due to its anti-inflammatory and antimicrobial properties.

It can accelerate healing, reduce scars, and treat skin conditions like acne, eczema, and psoriasis. The rising consumer spending on personal care products and the growing demand for organic and natural ingredients are fueling the adoption of colloidal silver in the UK market.

The Japan colloidal silver market is estimated to grow at a 9.4% CAGR during the study period. This growth is attributed to the increasing awareness of natural health products and alternative medicine among Japanese consumers. Colloidal silver is gaining popularity as a dietary supplement and topical treatment due to its perceived benefits in immune support and wound healing.

The Japanese market is characterized by a growing number of consumers seeking natural and organic health solutions, which is driving the demand for colloidal silver products. Additionally, advancements in nanotechnology have enhanced the effectiveness and potency of colloidal silver, further contributing to its adoption in Japan.

The Germany colloidal silver market is estimated to grow at a 7.3% CAGR during the study period. Germany's long-standing tradition of producing colloidal silver for both local consumption and export contributes to its market growth. The country has a strong presence in the production of colloidal silver for medical, electronics, food processing, and water purification industries.

Colloidal silver is widely used in Germany as an alternative treatment for burns and skin infections. The increasing demand for natural and organic health solutions, along with the country's established infrastructure for colloidal silver production, supports the market's expansion.

The France colloidal silver market is estimated to grow at a 7.0% CAGR during the study period. Similar to other European countries, France is experiencing a shift towards natural and organic health products. Colloidal silver is gaining traction in the French market due to its antimicrobial and anti-inflammatory properties, making it a popular choice in skincare and cosmetic products.

The rising consumer awareness of natural remedies and the increasing demand for organic ingredients are driving the adoption of colloidal silver in France. Additionally, the country's favorable regulatory environment supports the growth of the colloidal silver market.

To expand their business worldwide, top international players are concentrating on new developments, product design, and product installation. Key firms are eager to commit to mergers, partnerships, and business acquisitions to increase their market presence.

Through creative marketing and technological advancements, these businesses hope to ensure their advantage in the market.

For instance

In 2021, Thermo Fisher Scientific consolidated its product portfolio brands, namely, Maybridge, Alfa Aesar, and Acros Organics for transitioning into an individual brand called Thermo Scientific. The company wants to simplify purchasing experience for its customers with this consolidation.

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 7.23 billion |

| Projected Market Size (2035) | USD 17.75 billion |

| CAGR (2025 to 2035) | 9.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value and million units for volume |

| By Form | Powder and Liquid |

| By Particle Size | 5 to 10nm, 11 to 20nm, 21 to 50nm, and 101 to 200nm |

| By End Use | Healthcare, Dietary Supplements, Food and Beverages, Cosmetics, Electronics, Textile, Water Treatment, Paint and Coating, and Other Industries (Pet Care, Agriculture, etc.) |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East and Africa |

| Countries Covered | United States, United Kingdom, China, India, Japan |

| Key Players | Alfa Aesar (Thermo Fisher Scientific), American Elements, Laboratories Argenol, nanoComposix, NANO IRON s.r.o., Nano Labs, Reinste Nano Ventures Pvt. Ltd., Sigma-Aldrich (Merck KGaA), Strem Chemicals, Inc., USA Research Nanomaterials, Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by form and particle size, regulatory landscape for nano-silver, country-wise CAGR and value insights |

The global colloidal silver market is anticipated to reach USD 17.75 billion by 2035, up from USD 7.23 billion in 2025, reflecting a strong CAGR of 9.4% during the forecast period.

The powder segment holds a dominant 72.4% share in 2025, favored for its shelf stability, ease of formulation, and widespread use in nutraceuticals, coatings, and antimicrobial textiles.

The 5 to 10nm particle size segment captures 48.1% of the market in 2025 due to its superior antimicrobial activity, bioavailability, and compatibility with healthcare and cosmetic applications.

The healthcare sector is forecasted to grow at the highest CAGR of 6.3% from 2025 to 2035, propelled by demand for silver-based wound dressings, hospital-grade disinfectants, and infection-resistant medical devices.

Key companies include Alfa Aesar (Thermo Fisher Scientific), American Elements, Laboratories Argenol, nanoComposix, NANO IRON s.r.o., Sigma-Aldrich (Merck KGaA), and USA Research Nanomaterials, Inc., among others leading innovation in nano-silver applications.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Particle size, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Particle size, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Particle size, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Particle size, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Particle size, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Particle size, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 25: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Europe Market Value (US$ million) Forecast by Particle size, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Particle size, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 33: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by Particle size, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by Particle size, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 41: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 45: South Asia Market Value (US$ million) Forecast by Particle size, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by Particle size, 2018 to 2033

Table 47: South Asia Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 49: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 53: Oceania Market Value (US$ million) Forecast by Particle size, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by Particle size, 2018 to 2033

Table 55: Oceania Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ million) Forecast by Form, 2018 to 2033

Table 60: Middle East and Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ million) Forecast by Particle size, 2018 to 2033

Table 62: Middle East and Africa Market Volume (MT) Forecast by Particle size, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ million) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (MT) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Particle size, 2023 to 2033

Figure 3: Global Market Value (US$ million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Particle size, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Particle size, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Particle size, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Particle size, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Form, 2023 to 2033

Figure 22: Global Market Attractiveness by Particle size, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Form, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Particle size, 2023 to 2033

Figure 27: North America Market Value (US$ million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Particle size, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Particle size, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Particle size, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Particle size, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Form, 2023 to 2033

Figure 46: North America Market Attractiveness by Particle size, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Form, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Particle size, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by Particle size, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Particle size, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Particle size, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Particle size, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Particle size, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ million) by Form, 2023 to 2033

Figure 74: Europe Market Value (US$ million) by Particle size, 2023 to 2033

Figure 75: Europe Market Value (US$ million) by End Use, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 85: Europe Market Value (US$ million) Analysis by Particle size, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Particle size, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Particle size, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Particle size, 2023 to 2033

Figure 89: Europe Market Value (US$ million) Analysis by End Use, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Form, 2023 to 2033

Figure 94: Europe Market Attractiveness by Particle size, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 98: East Asia Market Value (US$ million) by Particle size, 2023 to 2033

Figure 99: East Asia Market Value (US$ million) by End Use, 2023 to 2033

Figure 100: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 109: East Asia Market Value (US$ million) Analysis by Particle size, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by Particle size, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Particle size, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Particle size, 2023 to 2033

Figure 113: East Asia Market Value (US$ million) Analysis by End Use, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Particle size, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ million) by Form, 2023 to 2033

Figure 122: South Asia Market Value (US$ million) by Particle size, 2023 to 2033

Figure 123: South Asia Market Value (US$ million) by End Use, 2023 to 2033

Figure 124: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 133: South Asia Market Value (US$ million) Analysis by Particle size, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by Particle size, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Particle size, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Particle size, 2023 to 2033

Figure 137: South Asia Market Value (US$ million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Particle size, 2023 to 2033

Figure 143: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ million) by Form, 2023 to 2033

Figure 146: Oceania Market Value (US$ million) by Particle size, 2023 to 2033

Figure 147: Oceania Market Value (US$ million) by End Use, 2023 to 2033

Figure 148: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 157: Oceania Market Value (US$ million) Analysis by Particle size, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by Particle size, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Particle size, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Particle size, 2023 to 2033

Figure 161: Oceania Market Value (US$ million) Analysis by End Use, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Particle size, 2023 to 2033

Figure 167: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ million) by Form, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ million) by Particle size, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ million) Analysis by Form, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ million) Analysis by Particle size, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (MT) Analysis by Particle size, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Particle size, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Particle size, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Particle size, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Colloidal Silver in EU Size and Share Forecast Outlook 2025 to 2035

Colloidal Selenium Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

Colloidal Metal Particles Market - Growth & Demand 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Colloidal Alumina Market Growth - Trends & Forecast 2025 to 2035

Silver Sulphate Market Size and Share Forecast Outlook 2025 to 2035

Silver Pressure Sintering Machine Market Size and Share Forecast Outlook 2025 to 2035

Silver Sintering Chip Mounter Market Size and Share Forecast Outlook 2025 to 2035

Silver Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

Silver Food Market Size and Share Forecast Outlook 2025 to 2035

Silver Cyanide Market Size and Share Forecast Outlook 2025 to 2035

Silver Nitrate Market - Trends & Forecast 2025 to 2035

Silver Nanowires Market Growth - Trends & Forecast 2025 to 2035

Silver Food Market Share & Competitive Insights

Silver Powder and Flakes Market Growth - Trends & Forecast 2025 to 2035

Nanosilver Market Size and Share Forecast Outlook 2025 to 2035

Automatic Silver Sintering Die Attach Machine Market Size and Share Forecast Outlook 2025 to 2035

Industrial Silver Market

Fully Automatic Silver Sintering System Market Size and Share Forecast Outlook 2025 to 2035

Anti-Tarnish Agent for Silver Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA