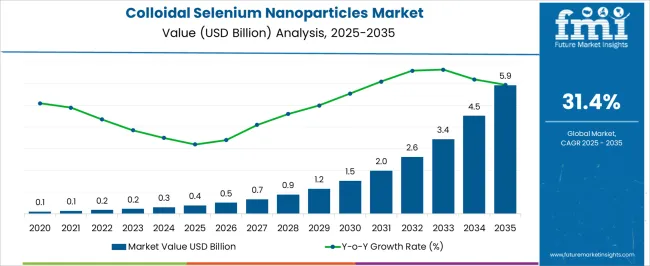

The colloidal selenium nanoparticles market is estimated to be valued at USD 0.4 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 31.4% over the forecast period. The market expansion is largely driven by wet chemical synthesis techniques, which dominate initial adoption due to relatively lower production costs, scalability, and established industrial processes. This technology accounts for a significant portion of the early market value, supporting incremental growth from USD 0.4 billion in 2025 to approximately USD 1.2 billion by 2029. Its continued refinement and integration with pharmaceutical and nutraceutical applications enhance its contribution to the overall market size, reinforcing its leading position.

Emerging technologies such as green synthesis and laser ablation-based production are expected to gain momentum in later years. These technologies, though initially contributing marginally to the market, benefit from increasing environmental and regulatory pressures, offering higher purity, better bioavailability, and reduced chemical residues. By 2035, green and physical synthesis methods collectively account for a growing share of the market, supporting the acceleration of value from USD 2.6 billion in 2031 to USD 5.9 billion in 2035.

The contribution analysis indicates that wet chemical methods drive early-stage growth, while environmentally friendly and advanced physical technologies progressively enhance market diversification. The shift in technology adoption reflects a transition toward sustainable, high-performance production, underpinning the market’s rapid expansion over the forecast period.

| Metric | Value |

|---|---|

| Colloidal Selenium Nanoparticles Market Estimated Value in (2025 E) | USD 0.4 billion |

| Colloidal Selenium Nanoparticles Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 31.4% |

The colloidal selenium nanoparticles market represents a specialized segment within the global nanomaterials and nutraceutical industry, emphasizing health, antioxidant properties, and technological applications. Within the broader nanomaterials sector, it accounts for about 5.6%, driven by demand from pharmaceuticals, dietary supplements, and biomedical research. In the dietary supplements and functional foods segment, its share is approximately 6.1%, reflecting adoption for antioxidant support and immune system enhancement.

Across the biomedical and pharmaceutical applications market, it holds around 4.8%, supporting drug delivery, diagnostics, and therapeutic interventions. Within the cosmetic and personal care ingredients category, it represents 4.3%, highlighting use in anti-aging and skin-protection formulations. In the industrial nanotechnology and material science sector, the market contributes about 3.9%, emphasizing applications in electronics, coatings, and advanced material development. Recent developments in this market have focused on green synthesis, bioavailability, and multifunctional applications. Innovations include plant-mediated and microbial synthesis methods that reduce chemical residues and environmental impact.

Key players are collaborating with pharmaceutical firms, nutraceutical companies, and research institutions to improve stability, dispersion, and targeted delivery of selenium nanoparticles. Adoption of surface-functionalized nanoparticles and encapsulation technologies is gaining traction to enhance bioavailability and efficacy in dietary and therapeutic applications. The integration into advanced biomaterials, antimicrobial coatings, and cosmetic formulations is being explored to expand market potential.

The colloidal selenium nanoparticles market is gaining significant traction due to their expanding role in biomedical, pharmaceutical, and industrial applications. This growth is being supported by ongoing research into their antioxidant, antimicrobial, and anticancer properties, which are unlocking new avenues for therapeutic and diagnostic uses. As industries prioritize the use of biocompatible and eco-friendly materials, selenium nanoparticles are being increasingly explored for their low toxicity and enhanced biological activity compared to conventional selenium forms.

Continued advancements in nanotechnology are enabling precise control over particle morphology, size, and surface characteristics, which is essential for tailoring functionality across diverse applications. Regulatory encouragement toward green synthesis methods and increasing academic-industry collaborations are further shaping product innovation and commercialization.

With growing awareness of the potential health benefits and industrial efficiencies offered by selenium-based nanomaterials, the market is poised for substantial long-term growth Rising demand from sectors such as medical research, pharmaceuticals, nutraceuticals, and cosmetics is expected to elevate the strategic importance of colloidal selenium nanoparticles across the global value chain.

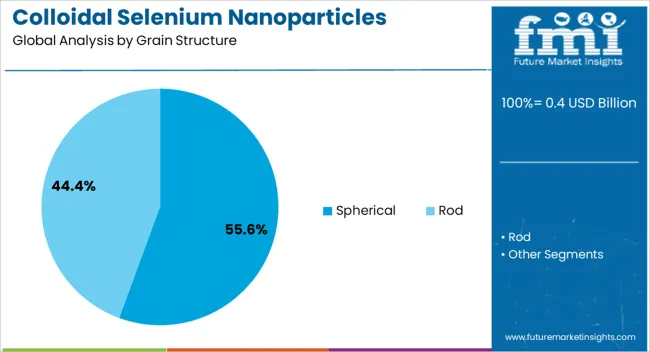

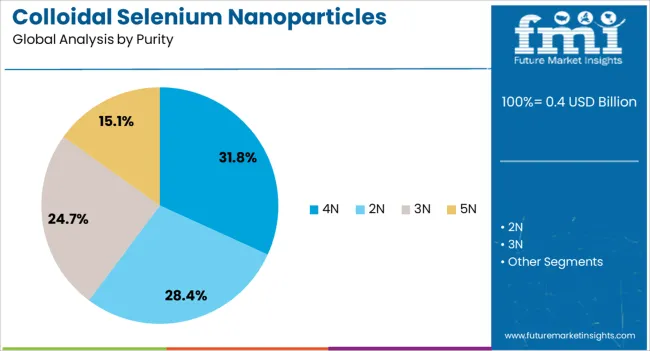

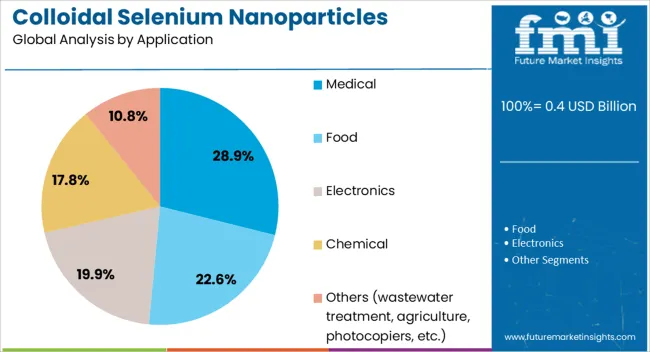

The colloidal selenium nanoparticles market is segmented by grain structure, purity, application, and geographic regions. By grain structure, colloidal selenium nanoparticles market is divided into Spherical and Rod. In terms of purity, colloidal selenium nanoparticles market is classified into 4N, 2N, 3N, and 5N.

Based on application, colloidal selenium nanoparticles market is segmented into Medical, Food, Electronics, Chemical, and Others (wastewater treatment, agriculture, photocopiers, etc.). Regionally, the colloidal selenium nanoparticles industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The spherical grain structure segment is projected to hold 55.6% of the colloidal selenium nanoparticles market revenue share in 2025, making it the dominant morphology type. This leadership is being driven by the superior dispersibility, uniform surface area, and stable colloidal behavior exhibited by spherical nanoparticles. Their consistent shape facilitates easier cellular uptake and controlled interaction with biological systems, making them highly suitable for targeted drug delivery, imaging, and therapeutic applications.

Spherical structures also demonstrate improved reactivity and catalytic behavior, enabling their use in antioxidant and antimicrobial formulations with enhanced performance. Advances in synthesis techniques have made it possible to reliably produce monodisperse spherical nanoparticles, thereby improving batch-to-batch consistency in both research and commercial settings.

Moreover, their compatibility with a wide range of solvents and delivery systems is allowing greater formulation flexibility for pharmaceutical and cosmetic applications. As demand for precision nanomedicine grows, the unique functional advantages of spherical colloidal selenium nanoparticles are expected to solidify their continued dominance within the market.

The 4N purity segment is expected to account for 31.8% of the colloidal selenium nanoparticles market revenue share in 2025, emerging as the leading purity grade. This position is being supported by the high demand for ultra-pure materials in biomedical and pharmaceutical applications, where impurities can significantly alter therapeutic efficacy and safety. 4N purity, which refers to 99.99 percent elemental purity, ensures optimal performance in sensitive formulations, especially those used in cellular imaging, drug delivery systems, and nutraceuticals.

Manufacturers are increasingly focusing on high-purity production methods to meet the stringent regulatory requirements associated with clinical and diagnostic use cases. The segment is also benefiting from advances in purification techniques and quality control standards, which are enabling consistent output at a commercial scale.

The growing emphasis on minimizing contamination risks and improving reproducibility in scientific research is further contributing to the preference for this grade. As precision applications expand, 4N purity colloidal selenium nanoparticles are likely to remain the preferred choice in high-performance sectors.

The medical application segment is anticipated to represent 28.9% of the colloidal selenium nanoparticles market revenue share in 2025, establishing itself as the largest application category. This dominance is being driven by the growing interest in selenium nanoparticles for use in cancer therapy, antimicrobial treatments, and drug delivery systems due to their unique biological properties. Their ability to induce selective cytotoxicity in cancer cells while protecting healthy cells is enabling new approaches in oncology.

Additionally, strong antioxidant and immune-boosting effects support their use in chronic disease management and preventative medicine. The segment is also benefiting from rising investments in nanomedicine research and the integration of selenium nanoparticles into clinical trials and experimental therapeutics.

As healthcare systems prioritize personalized treatment and targeted therapies, the functional versatility and biocompatibility of colloidal selenium nanoparticles are gaining wider acceptance. Continued innovation in medical nanotechnology and the emergence of novel delivery mechanisms are expected to further accelerate the adoption of selenium-based nanomaterials in a wide range of therapeutic and diagnostic applications.

The market has been expanding due to the growing recognition of selenium’s biological significance and its diverse applications in nutraceuticals, pharmaceuticals, and cosmetics. Colloidal forms provide higher bioavailability, improved stability, and controlled particle size distribution, enhancing efficacy in dietary supplements and therapeutic formulations. Increasing consumer awareness regarding antioxidant benefits, immunity support, and preventive healthcare has fueled demand. Research in nanotechnology and material sciences has enabled scalable production with uniform particle characteristics. Industrial applications, including electronics, coatings, and catalysis, are also emerging.

Colloidal selenium nanoparticles are widely utilized in dietary supplements and nutraceutical products due to their potent antioxidant properties. These nanoparticles help reduce oxidative stress, support immune function, and contribute to metabolic regulation. Encapsulation and colloidal dispersion improve absorption in the human body compared to bulk selenium compounds. Increasing consumer interest in preventive health and natural supplements has created significant demand in functional foods and beverages. Pharmaceutical research has also explored colloidal selenium nanoparticles for potential applications in oncology, neuroprotection, and cardiovascular support. Product development focuses on safety, dosage control, and bioavailability, driving collaborations between material scientists, pharmacologists, and nutraceutical manufacturers. Regulatory compliance and labeling transparency remain critical for market acceptance.

Beyond health, colloidal selenium nanoparticles are being integrated into industrial and technological applications, creating new growth avenues. Their unique optical, electrical, and catalytic properties make them valuable for electronic devices, photovoltaic cells, and chemical catalysis. Coatings infused with selenium nanoparticles offer antimicrobial and corrosion-resistant characteristics. Research in sensor technology and nanocomposite materials has demonstrated the potential of colloidal selenium to enhance performance and durability. Scaling production for industrial applications requires precise control over particle size, dispersion stability, and surface functionalization. These advancements are enabling cross-sector adoption, linking nanotechnology research with industrial manufacturing and catalysis, thereby broadening the market scope.

Safety and regulatory compliance play a crucial role in the colloidal selenium nanoparticles market. Toxicity at high concentrations necessitates strict dosage guidelines and rigorous testing for human and environmental safety. Regulatory frameworks vary across regions, impacting approvals for pharmaceutical, nutraceutical, and food applications. Compliance with international standards for nanoparticle synthesis, handling, and labeling is essential to avoid health risks and legal implications. Manufacturers are investing in validated production processes, quality assurance protocols, and toxicological studies to meet these requirements. Transparent safety data and adherence to permissible exposure limits are vital to maintain consumer trust, ensure regulatory approval, and support broader market penetration.

The production of colloidal selenium nanoparticles involves sophisticated techniques such as chemical reduction, green synthesis, and physical dispersion methods. Maintaining uniform particle size, stability, and functional properties adds complexity and increases production costs. Commercial scalability remains a challenge, particularly for high-purity applications in pharmaceuticals and electronics. Variations in raw material quality, synthesis conditions, and post-processing can affect consistency and performance. Manufacturers are exploring cost-effective synthesis routes, automation, and optimized process parameters to improve yield and reduce operational expenses.

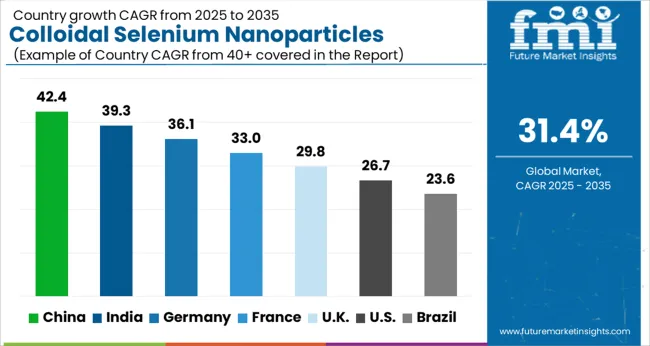

| Country | CAGR |

|---|---|

| China | 42.4% |

| India | 39.3% |

| Germany | 36.1% |

| France | 33.0% |

| UK | 29.8% |

| USA | 26.7% |

| Brazil | 23.6% |

The market is expected to expand at a CAGR of 31.4% from 2025 to 2035. Germany reached 36.1%, supported by advanced research facilities and adoption in nutraceuticals. China led with 42.4%, driven by large-scale production capacity and increasing biomedical applications. India recorded 39.3%, reflecting growing pharmaceutical and supplement manufacturing. The United Kingdom reached 29.8%, reflecting focused investments in nanotechnology research. The United States recorded 26.7%, driven by innovation in healthcare and dietary supplement sectors. These regions are actively scaling, producing, and innovating in the market. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 42.4%, driven by rising research and development activities in pharmaceuticals, nutraceuticals, and biomedical applications. Adoption is reinforced by increasing demand for antioxidant and immune boosting formulations, as well as investments in nanotechnology based drug delivery systems. Domestic manufacturers are developing high purity, biocompatible selenium nanoparticles for dietary supplements and therapeutic applications. Government support for nanomaterial research and industrial scaling accelerates market growth.

India is expected to grow at a CAGR of 39.3%, supported by increasing use in dietary supplements, functional foods, and therapeutic formulations. Adoption is reinforced by rising health awareness and focus on immune enhancing and antioxidant supplements. Domestic research institutions and manufacturers are developing biocompatible, stable nanoparticles for incorporation into capsules, powders, and liquid formulations. Regulatory approvals and safety certifications enhance market confidence.

Germany is forecast to grow at a CAGR of 36.1%, driven by pharmaceutical, nutraceutical, and cosmetic applications. Adoption is reinforced by demand for high purity, bioactive nanoparticles for drug delivery, anti-aging formulations, and functional foods. Manufacturers focus on reproducibility, stability, and regulatory compliance with EU safety standards. Research collaborations with academic institutions enhance innovation and commercialization of new selenium nanoparticle formulations.

The United Kingdom is projected to grow at a CAGR of 29.8%, supported by demand in nutraceuticals, dietary supplements, and functional foods. Adoption is reinforced by increasing consumer focus on immune health and antioxidant intake. Manufacturers emphasize production of stable, high bioavailability nanoparticles suitable for incorporation in liquid, powder, and capsule formulations. Regulatory adherence and quality assurance protocols further boost market confidence.

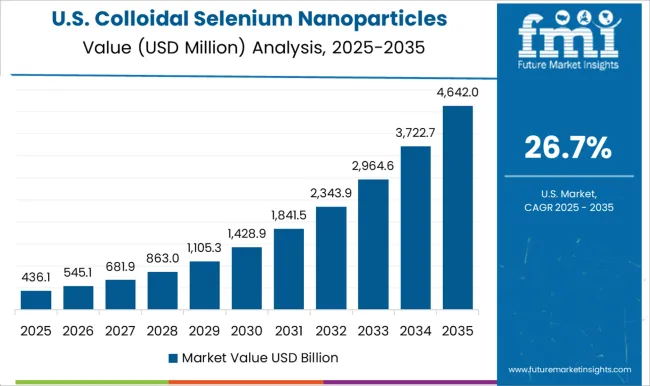

The United States is projected to grow at a CAGR of 26.7%, driven by pharmaceutical, nutraceutical, and cosmetic applications. Adoption is reinforced by demand for antioxidant, anti-inflammatory, and immune boosting formulations. Manufacturers focus on high stability, biocompatibility, and scalable production methods. Research in targeted drug delivery and anti-aging applications supports the commercial use of selenium nanoparticles. Expansion of dietary supplements and functional foods further sustains growth.

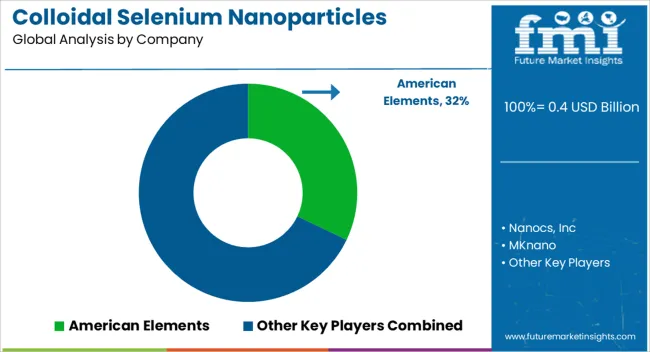

The market is shaped by specialized nanomaterial manufacturers focusing on high-purity, biocompatible, and stable selenium nanoparticles for applications in healthcare, nutrition, and electronics. American Elements is a prominent player, leveraging extensive chemical production capabilities to supply consistent, high-quality selenium nanoparticles for industrial and research applications. Nanocs, Inc. emphasizes tailored nanoparticle solutions, offering customization in particle size, surface functionalization, and concentration to meet specific biomedical and technological requirements. MKnano focuses on scalable nanoparticle synthesis, enabling both laboratory-scale and industrial-scale production while maintaining strict quality control standards.

SkySpring Nanomaterials, Inc. complements the competitive landscape with a broad portfolio of nanoparticles, emphasizing reproducibility, purity, and versatility across pharmaceutical, cosmetic, and analytical sectors. The competition in this market is driven by the ability to provide high-quality, application-specific, and cost-effective colloidal selenium nanoparticles, with differentiation occurring through purity, particle stability, functionalization options, and customer-focused R&D support.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.4 Billion |

| Grain Structure | Spherical and Rod |

| Purity | 4N, 2N, 3N, and 5N |

| Application | Medical, Food, Electronics, Chemical, and Others (wastewater treatment, agriculture, photocopiers, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | American Elements, Nanocs, Inc, MKnano, and SkySpring Nanomaterials, Inc |

| Additional Attributes | Dollar sales by nanoparticle type and application, demand dynamics across pharmaceuticals, nutraceuticals, and biomedical research sectors, regional trends in nanotechnology adoption, innovation in synthesis methods, bioavailability, and functionalization, environmental impact of production and nanoparticle disposal, and emerging use cases in antioxidant therapies, targeted drug delivery, and diagnostic applications. |

The global colloidal selenium nanoparticles market is estimated to be valued at USD 0.4 billion in 2025.

The market size for the colloidal selenium nanoparticles market is projected to reach USD 5.9 billion by 2035.

The colloidal selenium nanoparticles market is expected to grow at a 31.4% CAGR between 2025 and 2035.

The key product types in colloidal selenium nanoparticles market are spherical and rod.

In terms of purity, 4n segment to command 31.8% share in the colloidal selenium nanoparticles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Colloidal Silver Market Report - Trends, Innovations & Forecast 2025 to 2035

Colloidal Metal Particles Market - Growth & Demand 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Colloidal Alumina Market Growth - Trends & Forecast 2025 to 2035

Demand for Colloidal Silver in EU Size and Share Forecast Outlook 2025 to 2035

Selenium Yeast Market Growth - Health Benefits & Demand 2024 to 2034

Organic Selenium Market – Growth, Nutritional Benefits & Industry Demand

Chelated Selenium Market Analysis by Type, End-use, Distribution channel and Region through 2035

Lipid Nanoparticles Market Insights - Growth & Forecast 2025 to 2035

Silver Nanoparticles Market Size and Share Forecast Outlook 2025 to 2035

Platinum Nanoparticles Market

Metal Nitride Nanoparticles Market

Tungsten Disulphide Nanoparticles Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA