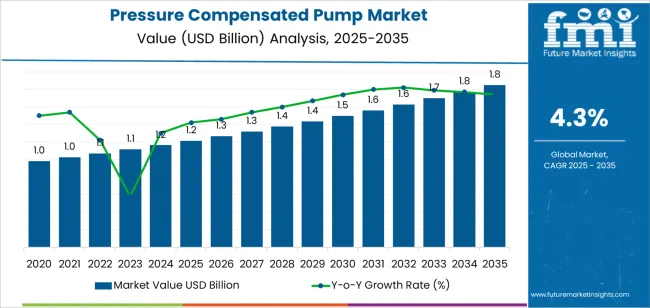

The pressure compensated pump market stands at the threshold of a decade-long expansion trajectory that promises to reshape hydraulic power transmission technology and industrial automation innovation across global manufacturing markets. The market's journey from USD 1,213.2 million in 2025 to USD 1,848.3 million by 2035 represents substantial growth, demonstrating the accelerating adoption of advanced variable displacement technology and energy-efficient hydraulic systems across aerospace operations, industrial manufacturing facilities, construction equipment sectors, and diversified mobile and stationary hydraulic applications.

This remarkable expansion reflects the fundamental transformation occurring within hydraulic power systems, where pressure compensated pumps have evolved from basic load-sensing devices to sophisticated electronic control systems that enable optimal energy efficiency, precise pressure regulation, and intelligent load management across multiple operating conditions and application environments.

The first half of the decade (2025-2030) will witness the market climbing from USD 1,213.2 million to approximately USD 1,497.4 million, adding USD 284.2 million in value, which constitutes 45% of the total forecast growth period. This phase will be characterized by the rapid adoption of electronically controlled pressure compensation systems, driven by increasing energy efficiency requirements, the growing demand for precision hydraulic control in industrial automation, and the worldwide emphasis on operational cost reduction that optimizes power consumption in hydraulic systems.

Enhanced pump capabilities with superior load-sensing accuracy, integrated electronic pressure control, and optimized variable displacement mechanisms will become standard expectations rather than premium options. Industrial manufacturing facilities will increasingly mandate pressure compensated pumps that deliver consistent pressure regulation while meeting stringent energy efficiency standards and predictive maintenance requirements. Construction equipment manufacturers will accelerate adoption of advanced load-sensing hydraulic systems to optimize fuel consumption, reduce operational costs, and improve machine productivity across diverse working conditions and application scenarios.

The latter half (2030-2035) will witness accelerated growth from USD 1,497.4 million to USD 1,848.3 million, representing an addition of USD 350.9 million or 55% of the decade's expansion. This period will be defined by mass market penetration of intelligent pressure compensation technologies, integration with comprehensive Industry 4.0 platforms, and seamless compatibility with autonomous equipment control systems.

Advanced pump systems including artificial intelligence-optimized pressure regulation for predictive load management, Internet of Things-connected monitoring platforms for real-time performance analytics, and hybrid electro-hydraulic architectures combining electric actuation with hydraulic power transmission will dominate new installations, while digital twin simulation technologies enabling virtual system optimization and condition-based maintenance strategies will gain significant market traction driven by operational excellence mandates and total cost of ownership reduction imperatives.

The market trajectory signals fundamental shifts in how industrial operators approach hydraulic system design and power transmission optimization, with participants positioned to benefit from growing demand across multiple pump configurations, application sectors, and technology integration levels. Emerging markets in Asia Pacific will continue driving volume growth through industrial automation expansion and construction equipment manufacturing, while developed economies will focus on premium electronic control systems and energy efficiency optimization, creating a balanced global growth dynamic that sustains market momentum throughout the forecast period with particular emphasis on connectivity, intelligence, and sustainability across diverse hydraulic power applications and operating environments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New pump sales (OEM equipment, replacement units) | 56% | Capital equipment, machine integration |

| Aftermarket parts & service (repair kits, maintenance) | 24% | Replacement components, servicing | |

| System integration & engineering (custom designs, applications) | 12% | Application engineering, system optimization | |

| Retrofits & upgrades (technology updates, efficiency improvements) | 8% | Legacy system enhancement, control upgrades | |

| Future (3-5 yrs) | Advanced electronic control pumps | 45-50% | IoT connectivity, intelligent load sensing |

| Energy-efficient premium systems | 20-25% | Ultra-low standby power, optimized efficiency | |

| Aftermarket & predictive maintenance | 18-22% | Condition monitoring, parts optimization | |

| System engineering & integration | 10-14% | Custom solutions, performance optimization | |

| Digital services & analytics | 5-8% | Performance monitoring, remote diagnostics | |

| Electro-hydraulic hybrid systems | 3-5% | Combined electric-hydraulic architectures |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,213.2 Million |

| Market Forecast (2035) | USD 1,848.3 Million |

| Growth Rate | 4.3% CAGR |

| Leading Technology | Vane Pressure Compensated Pump |

| Primary Application | Aerospace |

The market demonstrates solid fundamentals with vane pressure compensated pump systems capturing dominant market share through reliable performance characteristics and established aerospace applications. Aerospace applications drive primary demand, supported by stringent reliability requirements and precision control needs. Geographic expansion remains concentrated in developed markets with established aerospace and industrial manufacturing infrastructure, while emerging economies show accelerating adoption rates driven by industrial automation and construction equipment manufacturing growth.

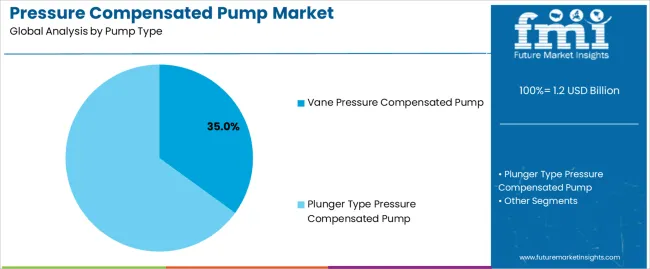

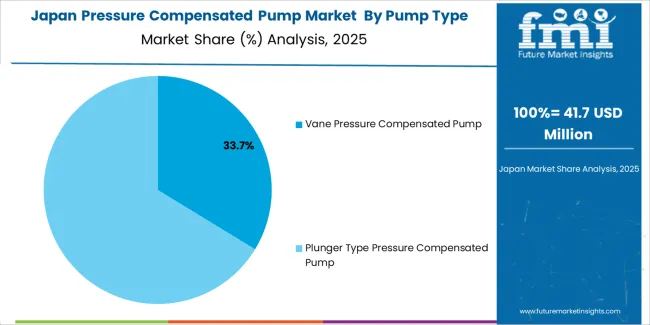

Primary Classification: The market segments by pump type into vane pressure compensated pumps and plunger type pressure compensated pumps, representing the fundamental technological division between rotating vane mechanisms and reciprocating plunger designs for variable displacement pressure control.

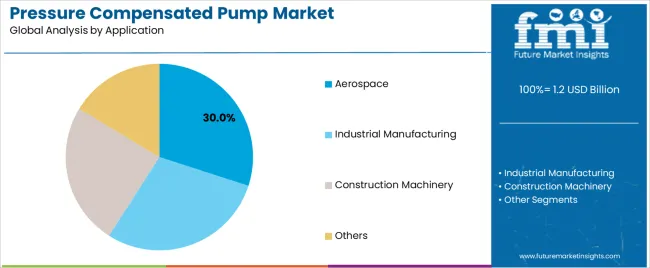

Secondary Classification: Application segmentation divides the market into aerospace, industrial manufacturing, construction machinery, and other sectors, reflecting distinct requirements for performance specifications, environmental conditions, and control precision standards.

Tertiary Classification: End-user segmentation covers aerospace manufacturers, industrial equipment producers, construction machinery OEMs, and hydraulic system integrators.

Regional Classification: Geographic distribution covers East Asia, South Asia Pacific, North America, Europe, Latin America, and Middle East & Africa, with developed markets leading technology adoption while emerging economies show accelerating growth patterns driven by industrialization and equipment manufacturing expansion programs.

The segmentation structure reveals technology progression from mechanical pressure compensation toward sophisticated electronic control systems with comprehensive monitoring and optimization capabilities, while application diversity spans from demanding aerospace environments to rugged construction equipment requiring specialized performance characteristics.

Market Position: Vane pressure compensated pump systems command the leading position in the pressure compensated pump market with 35% market share through proven reliability characteristics, including superior contamination tolerance, smooth flow delivery, and cost-effective pressure compensation that enable hydraulic system designers to achieve optimal performance across diverse aerospace, industrial, and mobile applications.

Value Drivers: The segment benefits from aerospace industry preference for vane technology providing reliable pressure regulation, established manufacturing infrastructure supporting cost-competitive production, and proven field performance demonstrating extended service life in demanding applications. Advanced vane pump designs enable electronic pressure control integration, variable displacement optimization, and load-sensing capabilities, where performance reliability and energy efficiency represent critical system requirements.

Competitive Advantages: Vane pressure compensated pumps differentiate through proven technology maturity, established supply chain infrastructure, and broad application suitability that enhance adoption while maintaining optimal cost-performance balance suitable for aerospace systems, industrial machinery, and mobile equipment applications.

Key market characteristics:

Plunger type pressure compensated pump systems maintain market position through specialized capabilities for high-pressure applications, ultra-precise control requirements, and demanding duty cycles. These pumps appeal to applications requiring maximum pressure capacity with superior volumetric efficiency for industrial presses, injection molding equipment, and specialized high-pressure hydraulic systems demanding premium performance specifications.

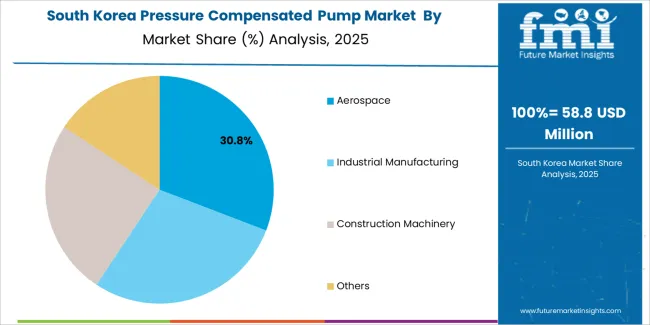

Market Context: Aerospace applications dominate the market with 30% share, reflecting the primary demand driver for pressure compensated pump technology in aircraft hydraulic systems, flight control actuation, and aerospace ground support equipment requiring reliable pressure regulation.

Business Model Advantages: Aerospace applications provide sustained premium market demand through stringent reliability requirements, extensive qualification testing, and long product lifecycles driving technology investment and quality standards while maintaining aerospace-grade specifications and certification requirements.

Operational Benefits: Aerospace implementations include flight control systems, landing gear actuation, and utility hydraulic systems that drive consistent premium pump demand while requiring proven reliability, redundancy capabilities, and comprehensive traceability for aviation safety compliance.

Growth Characteristics: The segment benefits from commercial aviation expansion, military aircraft modernization programs, and space exploration initiatives that mandate reliable pressure-compensated hydraulic systems for critical flight control and actuation applications requiring fail-safe operation and extended service life.

Industrial manufacturing applications capture market share through requirements for precision hydraulic control in machine tools, plastic injection molding equipment, metal forming presses, and automated production systems. These applications demand consistent pressure regulation with energy-efficient operation for manufacturing productivity optimization and operational cost reduction.

Construction machinery applications account for market share including excavators, wheel loaders, concrete pumps, and specialized construction equipment requiring load-sensing hydraulic systems for fuel efficiency optimization, precise implement control, and operator productivity enhancement across diverse working conditions.

Other applications maintain market share through specialized requirements for material handling equipment, agricultural machinery, marine hydraulic systems, and industrial power units requiring pressure compensation for varied industrial, mobile, and stationary hydraulic applications across multiple sectors.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Energy efficiency mandates & operational cost reduction (industrial power consumption, fuel economy) | ★★★★★ | Energy costs represent major industrial expense; pressure compensated pumps reduce power consumption 20-40% versus fixed displacement systems driving adoption for operational savings. |

| Driver | Industrial automation & precision control requirements (manufacturing automation, process control) | ★★★★★ | Advanced manufacturing requires precise hydraulic control; pressure compensation enables consistent actuator performance and position accuracy supporting automation system requirements. |

| Driver | Aerospace sector growth & aircraft production expansion (commercial aviation, defense programs) | ★★★★☆ | Aircraft production increases drive hydraulic system demand; pressure compensated pumps provide essential flight control reliability and redundancy for aviation safety requirements. |

| Restraint | High initial capital costs & system complexity (premium pricing, integration requirements) | ★★★★☆ | Pressure compensated pumps cost 30-50% premium versus fixed displacement; higher initial investment and system complexity create barriers in cost-sensitive applications and simple systems. |

| Restraint | Competition from electric actuation & electro-mechanical alternatives (servo motors, electric cylinders) | ★★★★☆ | Electric actuation technologies improving efficiency and control; hydraulic system displacement by electric alternatives threatens market share in precision positioning and automation applications. |

| Trend | IoT integration & condition monitoring systems (predictive maintenance, performance analytics) | ★★★★★ | Traditional pumps lack operational visibility; IoT-connected systems enable real-time monitoring and predictive maintenance creating operational efficiency and reducing unplanned downtime. |

| Trend | Electronic pressure control & adaptive systems (programmable regulation, load optimization) | ★★★★★ | Mechanical compensation reaches performance limits; electronic control enables dynamic pressure adjustment and intelligent load management creating premium product differentiation and efficiency gains. |

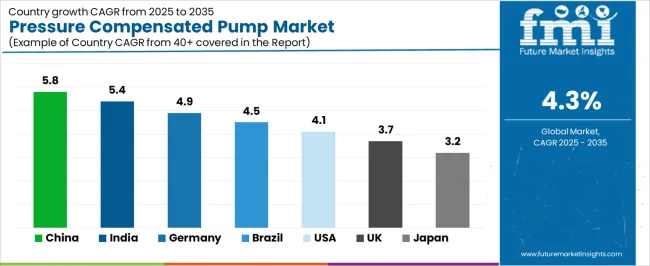

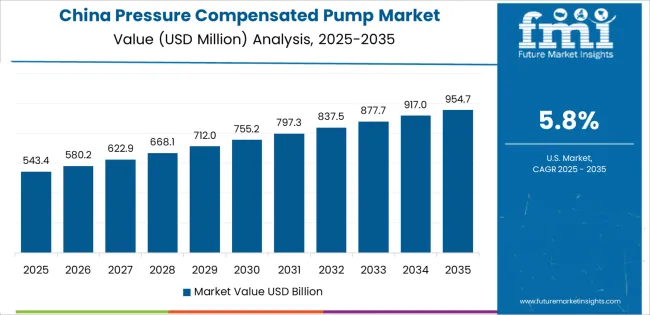

The pressure compensated pump market demonstrates varied regional dynamics with Growth Leaders including China (5.8% growth rate) and India (5.4% growth rate) driving expansion through industrial automation and construction equipment manufacturing. Steady Performers encompass Germany (4.9% growth rate), Brazil (4.5% growth rate), and developing regions, benefiting from established manufacturing industries and aerospace sector strength. Established Markets feature United States (4.1% growth rate), United Kingdom (3.7% growth rate), and Japan (3.2% growth rate), where mature industrial infrastructure and aerospace manufacturing support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through industrial manufacturing expansion and construction equipment production growth, while South Asian countries maintain strong growth supported by industrialization and infrastructure development. North American and European markets show moderate growth driven by aerospace sector strength and industrial automation advancement.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.8% | Lead with cost-effective solutions and local manufacturing | Quality perceptions; intellectual property challenges |

| India | 5.4% | Focus on construction equipment and industrial automation | Price sensitivity; infrastructure constraints |

| Germany | 4.9% | Offer premium engineering and Industry 4.0 integration | Over-engineering risks; conservative adoption |

| Brazil | 4.5% | Provide financing solutions and local technical support | Economic volatility; currency fluctuations |

| United States | 4.1% | Push IoT connectivity and predictive maintenance | Market maturity; electric actuation competition |

| United Kingdom | 3.7% | Emphasize aerospace applications and energy efficiency | Brexit impacts; limited manufacturing base |

| Japan | 3.2% | Focus on quality and construction equipment integration | Market maturity; conservative technology adoption |

China establishes fastest market growth through aggressive industrial manufacturing expansion and comprehensive construction equipment production development, integrating pressure compensated pumps as standard components in hydraulic systems across industrial machinery, construction equipment, and aerospace manufacturing.

The country's 5.8% growth rate reflects government initiatives promoting industrial automation and manufacturing capability enhancement that support adoption of advanced hydraulic technologies including pressure compensation systems. Growth concentrates in major industrial regions, including Yangtze River Delta, Pearl River Delta, and Beijing-Tianjin corridor, where manufacturing development showcases integrated hydraulic systems that appeal to equipment manufacturers seeking performance optimization and energy efficiency capabilities.

Chinese hydraulic component manufacturers and international suppliers are developing cost-effective pressure compensated pump solutions that combine manufacturing scale advantages with advancing technology capabilities, including electronic control integration and load-sensing functionality. Distribution channels through equipment manufacturers, hydraulic system integrators, and component distributors expand market access, while government industrial development policies and manufacturing upgrade initiatives support adoption across industrial automation, construction machinery, and aerospace equipment segments.

Market Intelligence Brief:

In Mumbai, Pune, and Bangalore, construction equipment manufacturers and industrial machinery producers are implementing pressure compensated pump systems as advanced hydraulic components for equipment performance optimization and energy efficiency applications, driven by increasing industrial automation and construction sector growth that emphasize the importance of hydraulic system efficiency.

The market holds a 5.4% growth rate, supported by government infrastructure development initiatives and manufacturing expansion programs that promote advanced hydraulic technologies for industrial equipment. Indian manufacturers are adopting pressure compensation technologies that provide performance improvement and operational cost benefits, particularly appealing in construction equipment markets where fuel efficiency and operational productivity represent critical competitive factors.

Market expansion benefits from growing hydraulic component manufacturing capabilities and international technology partnerships that enable adoption of advanced pressure compensation systems for domestic equipment production. Technology adoption follows patterns established in hydraulic systems markets, where performance enhancement and cost efficiency drive procurement decisions across equipment manufacturing and industrial automation applications.

Market Intelligence Brief:

Germany establishes hydraulic technology leadership through comprehensive engineering excellence and advanced industrial manufacturing infrastructure, integrating pressure compensated pumps across aerospace systems, industrial automation equipment, and mobile machinery applications. The country's 4.9% growth rate reflects established hydraulic industry expertise and sophisticated manufacturing technology that supports widespread use of pressure compensation in premium hydraulic systems. Growth concentrates in major industrial centers, including Baden-Württemberg, Bavaria, and North Rhine-Westphalia, where hydraulic equipment manufacturers showcase advanced pressure control technologies that appeal to European industrial markets seeking proven engineering quality and performance optimization.

German hydraulic manufacturers leverage engineering expertise and quality management systems, including precision manufacturing capabilities and comprehensive testing protocols that create competitive advantages in premium hydraulic component markets. Distribution channels through equipment manufacturers, system integrators, and industrial distributors expand market access, while strong industrial automation culture supports adoption across manufacturing equipment, mobile machinery, and aerospace applications.

Market Intelligence Brief:

Brazil establishes regional leadership through expanding construction equipment manufacturing and industrial development programs, integrating pressure compensated pumps across mobile machinery, agricultural equipment, and industrial manufacturing applications. The country's 4.5% growth rate reflects growing equipment production and infrastructure development initiatives that support adoption of hydraulic technologies including pressure compensation systems. Growth concentrates in major industrial regions, including São Paulo state, Minas Gerais, and Rio Grande do Sul, where equipment manufacturing showcases hydraulic system integration that appeals to construction and agricultural machinery markets seeking performance optimization.

Brazilian equipment manufacturers and hydraulic suppliers leverage growing industrial capabilities and regional market access, including construction sector expansion and agricultural mechanization that drive hydraulic component demand. Distribution channels through equipment manufacturers, hydraulic distributors, and industrial suppliers expand market penetration, while infrastructure development programs and agricultural productivity initiatives support adoption across mobile equipment and industrial machinery segments.

Market Intelligence Brief:

United States establishes mature market presence through comprehensive aerospace manufacturing infrastructure and extensive industrial equipment production, integrating pressure compensated pumps across commercial aircraft systems, defense equipment, industrial automation, and construction machinery. The country's 4.1% growth rate reflects established hydraulic industry relationships and mature technology adoption that supports widespread use of pressure compensation in aerospace and industrial applications. Activity concentrates in major aerospace centers and industrial manufacturing regions, where pump technology showcases established integration that appeals to aircraft manufacturers, defense contractors, and industrial equipment producers seeking proven hydraulic performance.

American hydraulic manufacturers and aerospace suppliers leverage established engineering capabilities and comprehensive certification experience, including aerospace qualification expertise and industrial standards compliance that create competitive advantages. Distribution channels through aerospace supply chains, industrial distributors, and equipment manufacturers expand market penetration, while aerospace sector strength and industrial automation advancement support sustained demand across diverse application segments.

Market Intelligence Brief:

United Kingdom's aerospace and industrial markets demonstrate sophisticated pressure compensated pump adoption with emphasis on aircraft systems and defense applications across major aerospace manufacturing centers and industrial facilities. The country maintains a 3.7% growth rate, driven by aerospace sector strength and industrial equipment manufacturing. Aerospace production facilities and defense contractors showcase pressure compensation technology integrated with comprehensive hydraulic control systems to optimize aircraft performance and system reliability requirements.

UK aerospace suppliers and hydraulic manufacturers focus on high-reliability systems and aerospace qualification expertise in pressure compensated pump development, creating demand for premium products with proven aviation performance characteristics. Distribution channels through aerospace supply chains, defense contractors, and industrial equipment suppliers expand market access, while established aerospace sector and precision manufacturing capabilities support adoption across aircraft systems and specialized industrial applications.

Market Intelligence Brief:

Japan's advanced industrial market demonstrates sophisticated pressure compensated pump adoption with emphasis on quality standards and manufacturing precision in construction equipment, industrial machinery, and aerospace applications. The country maintains a 3.2% growth rate, characterized by mature hydraulic industry and established engineering excellence. Manufacturing centers showcase premium pressure compensation technology where quality requirements and reliability represent primary equipment selection considerations for hydraulic system integration.

Japanese hydraulic manufacturers prioritize product quality and precision engineering in pressure compensated pump production, creating stable demand for premium components with proven performance characteristics and comprehensive quality documentation. Distribution channels through equipment manufacturers, industrial trading companies, and specialized hydraulic distributors expand market reach, while quality culture supports adoption across construction equipment, industrial automation, and mobile machinery applications.

Market Intelligence Brief:

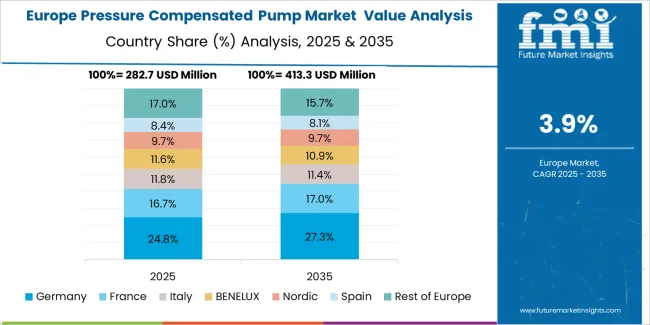

The European pressure compensated pump market is projected to grow from USD 459.9 million in 2025 to USD 673.2 million by 2035, registering a CAGR of 4.3% over the forecast period. Germany is expected to maintain its leadership position with a 35.2% market share in 2025, supported by its advanced hydraulic manufacturing infrastructure and strong aerospace sector.

United Kingdom follows with a 21.7% share in 2025, driven by comprehensive aerospace programs and defense equipment manufacturing. France holds a 17.3% share through aerospace industry strength and industrial automation development. Italy commands a 14.1% share, while Spain accounts for 11.7% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 8.9% to 9.6% by 2035, attributed to increasing pressure compensated pump adoption in Nordic countries and emerging Eastern European manufacturing facilities implementing industrial automation programs.

Japan establishes engineering excellence through comprehensive hydraulic system expertise and advanced manufacturing technology development, supporting industrial equipment markets with pressure compensated pump systems emphasizing quality and reliability. The country's 3.2% growth rate reflects established hydraulic industry leadership and sophisticated manufacturing standards that support consistent demand for premium pressure compensation technology in construction equipment and industrial machinery. Activity concentrates in major manufacturing regions, including Tokyo metropolitan area, Nagoya industrial zones, and Osaka manufacturing centers, where hydraulic component production showcases precision engineering that appeals to domestic and international equipment manufacturers seeking proven performance quality.

Japanese hydraulic manufacturers and equipment producers leverage decades of hydraulic system development expertise and comprehensive quality assurance systems, including rigorous testing protocols and precision manufacturing that create competitive advantages in premium component markets. Distribution channels through equipment manufacturers, construction machinery producers, and industrial machinery supply networks expand market reach, while quality culture supports sustained adoption across construction equipment, industrial automation, and mobile machinery applications worldwide.

Market Intelligence Brief:

South Korea establishes industrial growth through comprehensive manufacturing expansion and construction equipment production development, incorporating pressure compensated pumps across hydraulic systems for industrial machinery, construction equipment, and shipbuilding applications with emphasis on performance optimization and energy efficiency. The country demonstrates solid growth through expanding heavy equipment manufacturing and industrial automation that supports increasing adoption of advanced hydraulic technologies. Activity concentrates in major industrial centers, including Ulsan shipbuilding complex, southeastern machinery manufacturing zones, and Seoul metropolitan industrial areas, where hydraulic system integration showcases advanced pressure control that appeals to equipment manufacturers seeking competitive performance advantages.

Korean hydraulic manufacturers and equipment producers leverage established heavy industry capabilities and comprehensive manufacturing expertise, including modern production technologies and quality control systems that enable advanced hydraulic component development. Distribution channels through equipment manufacturers, industrial machinery producers, and shipbuilding supply chains expand market access, while export-oriented manufacturing and domestic infrastructure development drive adoption across construction equipment, industrial machinery, and marine hydraulic applications.

Market Intelligence Brief:

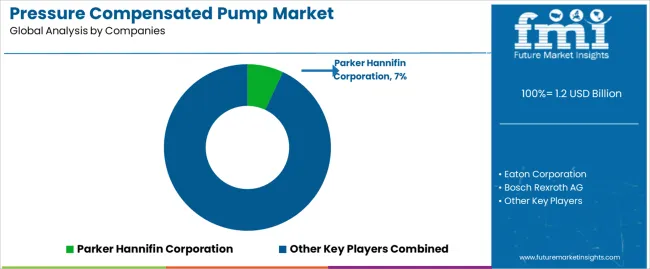

The pressure compensated pump market exhibits a moderately consolidated competitive structure with approximately 15-25 credible players, where the top 6-8 manufacturers hold roughly 55-60% market share by revenue. Market leadership is maintained through technology innovation, aerospace qualification portfolios, global manufacturing presence, and comprehensive aftermarket support that enable market positioning across diverse industrial, aerospace, and mobile equipment applications.

Structure: Global hydraulic component manufacturers dominate through integrated product portfolios and established OEM relationships, while specialized pump manufacturers compete on technology leadership and application expertise. The competitive landscape divides between full-line hydraulic suppliers providing comprehensive system solutions and focused pressure compensated pump specialists offering premium performance and customization capabilities.

Leadership is maintained through: Aerospace and industrial certifications (AS9100, ISO 9001), proven reliability track records, global manufacturing and service networks, and engineering support capabilities (application engineering, system design). Leading manufacturers leverage vertical integration from casting through final assembly for quality control while developing advanced electronic control technologies for premium differentiation.

What's commoditizing: Basic mechanical pressure compensation using conventional control valve designs, standard vane pump configurations for general industrial applications, and mature plunger pump technologies face increasing price competition as patent protections expire and manufacturing capabilities expand globally.

Margin Opportunities: Electronic pressure control systems with programmable regulation, IoT-connected pumps with predictive maintenance capabilities, aerospace-qualified high-reliability systems, custom-engineered pumps for specialized applications, and comprehensive service contracts including condition monitoring command premium pricing. Value-added engineering services including hydraulic system design, performance optimization consulting, and application-specific customization create differentiation beyond commodity pump supply. Long-term supply agreements with aircraft manufacturers, construction equipment OEMs, and industrial machinery producers for platform-specific pumps secure strategic positioning and sustained revenue streams.

Competitive Dynamics: Global hydraulic leaders compete on comprehensive product portfolios and worldwide support infrastructure, maintaining advantages through established aerospace qualifications and multi-decade OEM relationships. Technology specialists differentiate through advanced electronic control capabilities, superior efficiency performance, and application engineering expertise. Regional manufacturers provide cost-competitive alternatives for price-sensitive markets and standard industrial applications. Strategic partnerships between pump manufacturers and equipment OEMs drive co-development programs, creating integrated hydraulic architectures that reduce competitive intensity through preferred supplier relationships and platform lock-in securing long-term market positioning and aftermarket opportunities.

| Item | Value |

|---|---|

| Quantitative Units | USD million |

| Pump Type | Vane Pressure Compensated Pump, Plunger Type Pressure Compensated Pump |

| Application | Aerospace, Industrial Manufacturing, Construction Machinery, Others |

| End User | Aerospace Manufacturers, Industrial Equipment Producers, Construction Machinery OEMs, Hydraulic System Integrators |

| Regions Covered | East Asia, South Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, United States, Germany, United Kingdom, Japan, South Korea, Brazil, France, Italy, and 20+ additional countries |

| Key Companies Profiled | Parker Hannifin Corporation, Eaton Corporation, Bosch Rexroth AG, Kawasaki Heavy Industries Ltd., HYDAC International, Bailey International LLC, Dynex, Hyvair, Oilgear Company |

| Additional Attributes | Dollar sales by pump type and application categories, regional adoption trends across East Asia, South Asia Pacific, and North America, competitive landscape with hydraulic component manufacturers and specialized pump producers, equipment manufacturer preferences for reliability and energy efficiency, integration with electronic control systems and IoT platforms, innovations in pressure compensation technology and load-sensing capabilities, and development of advanced hydraulic solutions with enhanced performance and industrial optimization capabilities. |

The global pressure compensated pump market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the pressure compensated pump market is projected to reach USD 1.8 billion by 2035.

The pressure compensated pump market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in pressure compensated pump market are vane pressure compensated pump and plunger type pressure compensated pump.

In terms of application, aerospace segment to command 30.0% share in the pressure compensated pump market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pressure Switch Market Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Volume Loop Systems Market Size and Share Forecast Outlook 2025 to 2035

Pressure Transmitter Market Size and Share Forecast Outlook 2025 to 2035

Pressure Monitoring Extension Tubing Sets Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Pressure Bandages Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Sensitive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Controlled Vacuum Sealers Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Tapes and Labels Market Size, Share & Forecast 2025 to 2035

Pressure Infusion Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Pressure Ulcer Detection Devices Market Trends – Growth & Forecast 2025 to 2035

Pressure Cushions Market Trends - Growth, Size & Forecast 2025 to 2035

Pressure Infusion Cuffs Market Growth – Trends & Future Outlook 2024-2034

Pressure Cookers Market

Pressure Calibrator Market

Pressure Redistribution Pads Market

Pressure Relief Valve (PRV) Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA