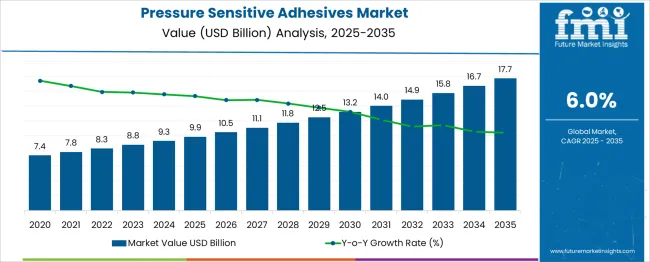

The Pressure-Sensitive Adhesives Market is estimated to be valued at USD 9.9 billion in 2025 and is projected to reach USD 17.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. Analyzing the saturation point reveals a steady yet slowing growth trend as the market approaches maturity. From 2025 to 2030, the market expands consistently from USD 9.9 billion to USD 13.2 billion. This initial phase shows robust demand driven by increasing applications across the packaging, automotive, and electronics industries. The market growth rate remains strong, indicating room for expansion and innovation.

Between 2030 and 2035, the market grows from USD 13.2 billion to USD 17.7 billion. However, annual increments become relatively smaller, signaling a deceleration in growth pace. This phase suggests that the market is nearing saturation, with most key segments reaching maturity and competitive pressures intensifying. Incremental growth will likely depend on product differentiation and entry into niche segments. The saturation point analysis indicates that while opportunities exist, the market’s expansion will slow as adoption levels plateau. Players in the Pressure Sensitive Adhesives Market should prioritize innovation, efficiency, and value-added solutions to maintain a competitive advantage as the market transitions into a mature stage.

| Metric | Value |

|---|---|

| Pressure-Sensitive Adhesives Market Estimated Value in (2025 E) | USD 9.9 billion |

| Pressure-Sensitive Adhesives Market Forecast Value in (2035 F) | USD 17.7 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The pressure sensitive adhesives (PSA) market is experiencing sustained demand, fueled by the expansion of packaging, automotive, electronics, and hygiene product sectors. Growing environmental regulations are encouraging the shift toward solvent-free and low-VOC adhesive technologies, with manufacturers focusing on eco-conscious formulations.

Industry participants are investing in high-performance polymers and functional additives to enhance adhesion, peel strength, and substrate compatibility. The rise of e-commerce and fast-moving consumer goods (FMCG) industries has significantly increased the need for reliable labeling and bonding solutions.

Technological innovations, such as UV-curable and hot-melt systems, are expanding application versatility, while increasing automation in manufacturing environments is reinforcing the demand for fast-setting and repositionable adhesives. The market outlook remains strong as sustainability, performance, and process efficiency continue to guide procurement decisions across diverse end-use sectors.

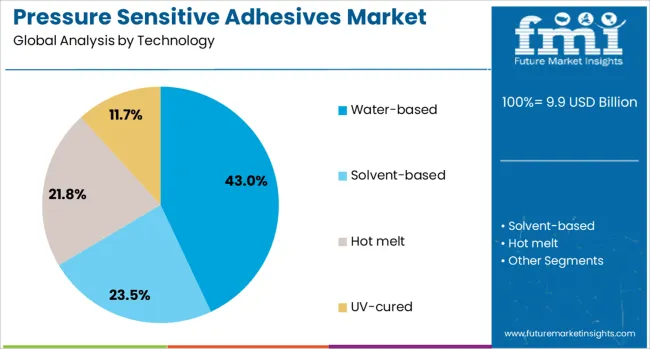

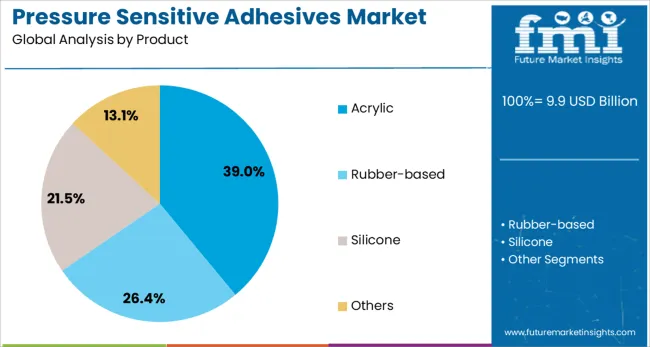

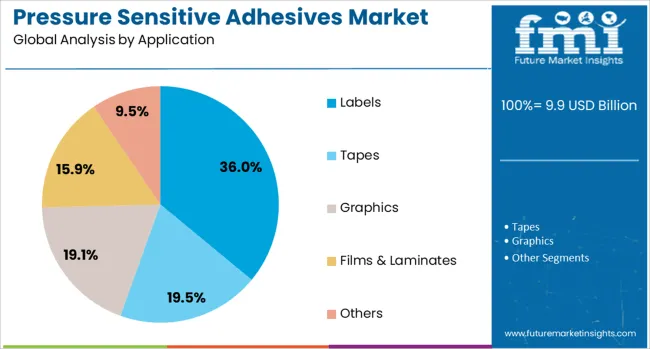

The pressure-sensitive adhesives market is segmented by technology, product, application, sector, and geographic regions. The technology of the pressure-sensitive adhesives market is divided into Water-based, Solvent-based, Hot melt, and UV-cured. In terms of the product, the pressure-sensitive adhesives market is classified into Acrylic, Rubber-based, Silicone, and others. The pressure-sensitive adhesives market is segmented into Labels, Tapes, Graphics, Films & Laminates, and Others. The pressure-sensitive adhesives market is segmented into Packaging, Food & Beverage, Electronics & Laminates, Medical & Healthcare, Building & Construction, Automotive & Transportation, and others. Regionally, the pressure-sensitive adhesives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The water-based technology segment is projected to lead with a 43.00% share of the total market in 2025. This position is being maintained due to its environmental compatibility, low VOC emissions, and regulatory compliance advantages.

Water-based PSAs offer strong adhesion without the use of harmful solvents, aligning with increasing sustainability mandates across the packaging and consumer goods industries. These adhesives are well-suited for porous and flexible substrates, supporting their use in labels, tapes, and hygiene products.

Technological enhancements have improved their drying time and water resistance, reducing historical performance gaps compared to solvent-based systems. As manufacturers seek safer workplace environments and reduced environmental impact, water-based technologies are being adopted as a preferred standard for high-volume applications.

Acrylic-based PSAs are expected to account for 39.00% of the market share in 2025, making them the leading product segment. This dominance is being supported by the material’s superior transparency, UV resistance, and aging stability, which are critical in outdoor and long-term bonding applications.

Acrylic PSAs provide excellent adhesion to a wide range of surfaces, including metals, plastics, and glass, which broadens their usability across industries such as automotive, medical devices, and building materials. The formulation flexibility of acrylic systems allows for customization in tack, peel strength, and cohesion, making them highly adaptable to both permanent and removable applications.

Growing demand for durable, weather-resistant adhesives in industrial settings continues to support the growth of this segment.

The labels segment is projected to hold a 36.00% revenue share in 2025, positioning it as the dominant application area within the PSA market. This leadership is being driven by the rising demand for pressure-sensitive labeling solutions in food & beverage, pharmaceuticals, and logistics industries.

Labels require consistent adhesion, clarity, and tamper-evidence properties that PSAs effectively deliver. Increased consumer awareness of packaging aesthetics and traceability is driving the adoption of specialty labels, smart labels, and linerless formats, further expanding PSA usage.

Additionally, the surge in e-commerce and global supply chain activity has necessitated efficient labeling for shipment tracking, inventory control, and brand integrity. Pressure-sensitive adhesives enable high-speed label application and compatibility with diverse packaging materials, solidifying their relevance in modern labeling operations.

The PSA market has expanded significantly due to their versatile applications across industries such as packaging, automotive, healthcare, electronics, and construction. PSAs provide strong adhesion at room temperature without the need for solvents, heat, or water, making them environmentally favorable and cost-effective. The growth of flexible packaging and labeling sectors has particularly driven demand, as PSAs enable easy application and residue-free removal. Innovations in acrylic, rubber, and silicone-based adhesives have enhanced performance characteristics such as tackiness, shear resistance, and temperature tolerance.

The packaging industry has been a principal consumer of pressure sensitive adhesives, driven by the need for lightweight, flexible, and easy-to-apply materials. PSAs have been widely used in food and beverage packaging for seals, labels, and tamper-evident closures, offering durability and compliance with safety standards. The rise of e-commerce and retail sectors has increased demand for pressure sensitive tapes and labels that support fast, automated packaging processes. Sustainable packaging trends have encouraged the use of recyclable and biodegradable adhesive solutions. High-performance acrylic PSAs have been preferred for their clarity, UV resistance, and bonding strength on various substrates including plastics, paper, and metal foils. Innovations such as removable and repositionable adhesives have also enhanced user convenience and package reusability.

Advances in polymer chemistry and formulation technology have led to PSAs with tailored adhesion properties, improved aging resistance, and compatibility with diverse substrates. Water-based acrylic PSAs have gained traction as environmentally friendly alternatives to solvent-based adhesives. Development of silicone-based PSAs has addressed the need for high-temperature stability and adhesion to low-energy surfaces. Hybrid adhesive technologies combining properties of different polymers have been introduced to meet specific application requirements. Nanotechnology and bio-based raw materials have been explored to improve adhesive strength and reduce ecological impact. Additionally, smart adhesives incorporating stimuli-responsive features have been developed for specialized uses in electronics and medical devices. These technological strides have expanded the range of applications and improved the reliability of pressure sensitive adhesives.

Stringent regulations regarding volatile organic compound (VOC) emissions and chemical safety have driven manufacturers toward low-VOC, solvent-free PSA formulations. Adoption of bio-based and biodegradable adhesive components has been motivated by increasing environmental concerns and corporate sustainability commitments. Compliance with food contact safety standards has been critical for adhesives used in packaging and healthcare products. Lifecycle assessments and eco-label certifications have become important criteria in product development and procurement decisions. However, balancing performance requirements with environmental regulations remains challenging, prompting ongoing research and development. Market players investing in green chemistry and sustainable manufacturing processes are better positioned to meet evolving regulatory landscapes and customer expectations.

The market is characterized by the presence of global chemical companies, specialty adhesive manufacturers, and regional players focusing on niche applications. Strategic partnerships, mergers, and acquisitions have been employed to expand product portfolios and geographic reach. Emerging economies have presented significant growth opportunities due to industrialization, urbanization, and increasing demand for packaged goods. Customization of adhesive solutions to meet local regulatory standards and application needs has provided competitive advantages. Expansion into sectors such as renewable energy, wearable electronics, and healthcare devices is anticipated to fuel future growth. Continued innovation, coupled with a focus on sustainability and cost-effectiveness, is expected to drive the evolution of the pressure sensitive adhesives market worldwide.

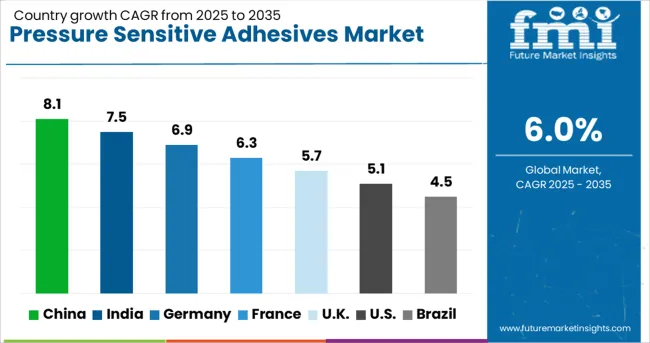

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The market is expected to grow at a CAGR of 6.0% between 2025 and 2035, driven by rising demand in packaging, automotive, and healthcare sectors. China leads with an 8.1% CAGR, supported by strong domestic production and expanding end-use industries. India follows at 7.5%, benefiting from growing manufacturing output and increasing applications in labeling and electronics. Germany, growing at 6.9%, focuses on advanced adhesive formulations and automotive sector demand. The UK, at 5.7%, experiences growth through packaging innovations and medical applications. The USA, with a 5.1% CAGR, is influenced by steady industrial usage and research into eco-friendly adhesive solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to grow at a CAGR of 8.1% from 2025 to 2035 in the pressure sensitive adhesives market, fueled by expanding automotive, electronics, and packaging industries. Domestic manufacturers are investing in formulation innovations that improve adhesion strength and environmental resistance. The use of pressure sensitive adhesives in electric vehicle battery assembly and flexible electronics is increasing. Government policies encouraging advanced manufacturing have supported R&D initiatives. Key players such as 3M China and H.B. Fuller are strengthening their presence through localized production and strategic partnerships.

India is projected to achieve a CAGR of 7.5% in the pressure sensitive adhesives market, driven by growing demand in packaging, labeling, and consumer goods sectors. Local producers are developing cost-effective adhesive solutions to meet requirements for diverse packaging materials. The rise of e-commerce and retail has accelerated adoption of pressure sensitive tapes and labels. Expansion in pharmaceutical packaging has also contributed to market growth. Collaboration with raw material suppliers is improving product quality and reducing costs.

Germany is forecasted to grow at a CAGR of 6.9% in the pressure sensitive adhesives market, emphasizing specialty adhesives tailored for automotive, construction, and electronics applications. High-performance adhesive technologies improving temperature resistance and bonding on difficult substrates are driving demand. Collaboration with automotive OEMs and electronic manufacturers has led to customized adhesive solutions. Regulatory compliance regarding volatile organic compounds is shaping product development. Established companies like Henkel are focusing on sustainable product lines and innovation.

The United Kingdom is anticipated to grow at a CAGR of 5.7% in the pressure sensitive adhesives market, supported by increasing demand for sustainable and solvent-free adhesive solutions. Growth in packaging, especially for food and beverage, is driving adoption of pressure sensitive tapes and labels that meet environmental standards. Manufacturers are investing in bio-based adhesive chemistries and recyclable backing materials. Partnerships between adhesive producers and packaging companies are accelerating innovation.

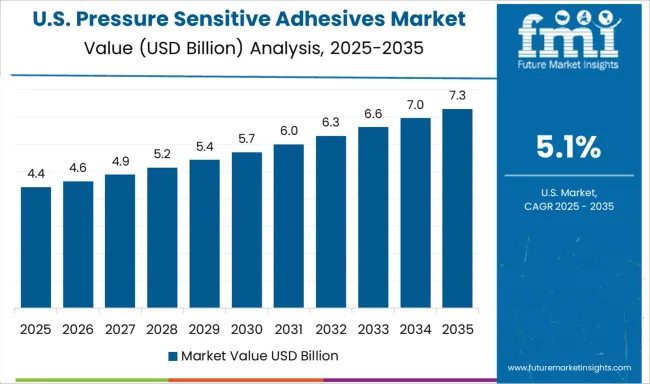

The United States is projected to expand at a CAGR of 5.1% in the pressure sensitive adhesives market, driven by innovations targeting healthcare devices, wearable electronics, and flexible packaging. Demand for biocompatible and medical-grade adhesives is rising, along with development of adhesives compatible with flexible substrates in electronics. The integration of nanotechnology is enhancing adhesive performance. Key market players like Avery Dennison and 3M are investing heavily in R&D and strategic acquisitions to strengthen their product portfolios.

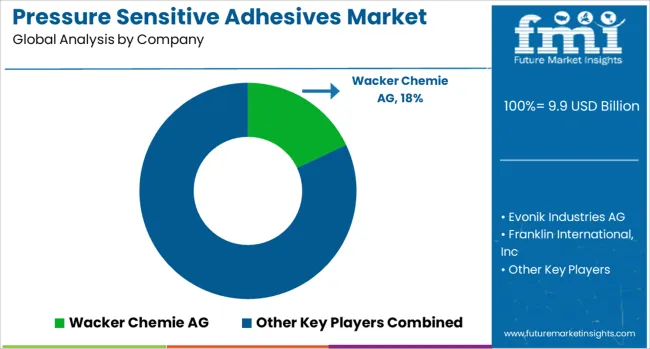

The PSA market is driven by applications across packaging, automotive, electronics, medical devices, and construction industries. These adhesives offer quick bonding solutions that require minimal surface preparation and deliver reliable adhesion to diverse substrates including plastics, metals, and paper. Market competition centers on developing formulations that balance tack, peel strength, and environmental resistance while meeting evolving regulatory and sustainability criteria. Wacker Chemie AG and Evonik Industries AG are recognized leaders providing innovative silicone- and acrylate-based PSAs with high performance in temperature stability and chemical resistance. Momentive Performance Materials specializes in silicone PSAs tailored for demanding electronic and medical applications requiring biocompatibility and durability.

Franklin International, Inc. emphasizes water-based and solvent-free adhesive technologies aligning with stricter environmental regulations. LG Chem Ltd offers a broad portfolio of acrylic and rubber-based PSAs designed for automotive and packaging sectors, focusing on durability and flexibility. Beardow Adams (Adhesives) Limited is known for custom formulation capabilities and serves diverse industries with specialty adhesives optimized for specific bonding challenges. Advancements in PSA chemistry targeting enhanced adhesion on low surface energy materials, recyclability, and improved processability are shaping competitive differentiation. Companies investing in R&D and customer collaboration to deliver tailored, high-performance adhesives are positioned to capture growth amid increasing demand for lightweight and efficient bonding solutions.

Primary strategies in the pressure-sensitive adhesives market emphasize innovation in product development to address varied application demands across sectors. Industry players prioritize creating environmentally friendly and solvent-free adhesives to meet regulatory requirements and minimize environmental impact. Partnerships between producers and end-users facilitate the formulation of customized solutions aligned with specific performance criteria.

Investments in cutting-edge manufacturing technologies improve production efficiency and product uniformity. Moreover, expanding presence in emerging markets through strategic alliances and acquisitions supports broader market access. These strategies work together to enhance product quality, maintain regulatory compliance, and promote sustainable market expansion.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.9 Billion |

| Technology | Water-based, Solvent-based, Hot melt, and UV-cured |

| Product | Acrylic, Rubber-based, Silicone, and Others |

| Application | Labels, Tapes, Graphics, Films & Laminates, and Others |

| Sector | Packaging, Food & Beverage, Electronics & Laminates, Medical & Healthcare, Building & Construction, Automotive & Transportation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Wacker Chemie AG, Evonik Industries AG, Franklin International, Inc, Momentive Performance Materials, LG Chem Ltd, and Beardow Adams (Adhesives) Limited |

| Additional Attributes | Dollar sales by adhesive type and end-use industry, demand dynamics across packaging, automotive, healthcare, and electronics sectors, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in bio-based formulations, high-performance acrylics, and low-VOC adhesives, environmental impact of solvent emissions, production waste, and recyclability challenges, and emerging use cases in flexible electronics, medical device bonding, and sustainable packaging solutions. |

The global pressure-sensitive adhesives market is estimated to be valued at USD 9.9 billion in 2025.

The market size for the pressure-sensitive adhesives market is projected to reach USD 17.7 billion by 2035.

The pressure-sensitive adhesives market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in pressure-sensitive adhesives market are water-based, solvent-based, hot melt and uv-cured.

In terms of product, acrylic segment to command 39.0% share in the pressure-sensitive adhesives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adhesives for Electric Vehicle Power Batteries Market Forecast and Outlook 2025 to 2035

Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Bioadhesives for Packaging Market

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Skin Adhesives Market

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Medical Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Acrylic Adhesives Market Growth - Trends & Forecast 2025 to 2035

2K Epoxy Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Silicone Adhesives And Sealants Market Size and Share Forecast Outlook 2025 to 2035

Hot Melt Adhesives Market Growth - Trends & Forecast 2025 to 2035

Footwear Adhesives Market

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Anaerobic Adhesives Market

Industrial Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Windscreen Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Automotive Adhesives & Sealants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA