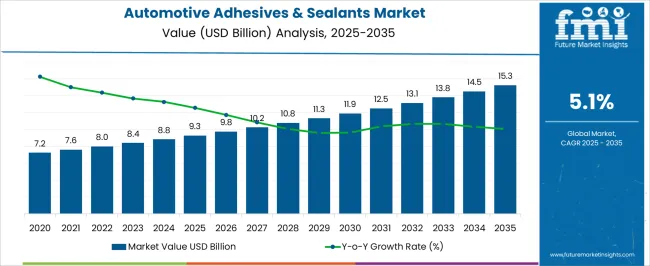

The global automotive adhesives and sealants market is projected to grow from USD 9.3 billion in 2025 to USD 15.3 billion by 2035, reflecting a Compound Annual Growth Rate (CAGR) of 5.1%. This growth is primarily driven by the increasing adoption of advanced adhesive solutions in automotive manufacturing to enhance vehicle safety, performance, and durability. The shift towards lighter, more fuel-efficient vehicles, combined with rising demand for enhanced vehicle interiors and exterior finishes, is fueling the need for high-performance adhesives and sealants. Moreover, growing regulations focused on reducing emissions and improving vehicle aerodynamics are contributing to the heightened application of these materials.

The market's expansion will be influenced by the growing trend of electric vehicle (EV) adoption, where adhesives and sealants play a critical role in lightweighting and improving energy efficiency. As the global automotive industry faces heightened competition, manufacturers are seeking cost-effective and efficient solutions, which further intensifies the demand for advanced bonding technologies. Market players are focusing on the development of more specialized, high-performance products to meet the diverse requirements of OEMs and suppliers. With automotive companies investing in research and production, the demand for automotive adhesives and sealants is expected to witness steady growth across both conventional and electric vehicle segments.

| Metric | Value |

|---|---|

| Automotive Adhesives & Sealants Market Estimated Value in (2025 E) | USD 9.3 billion |

| Automotive Adhesives & Sealants Market Forecast Value in (2035 F) | USD 15.3 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The automotive adhesives and sealants market is witnessing steady expansion, supported by the industry’s transition toward lightweight vehicle design, enhanced structural integrity, and improved safety standards. Growing emphasis on fuel efficiency and emission reduction is encouraging the use of advanced bonding solutions in place of traditional mechanical fasteners. Developments in electric vehicle manufacturing and the increasing complexity of automotive assemblies are further driving demand for high-performance adhesives and sealants that offer durability, flexibility, and resistance to environmental factors.

Enhanced chemical formulations are enabling superior bonding strength, vibration damping, and sealing performance, which align with evolving automotive design requirements. Rising production of passenger and commercial vehicles in emerging economies is expanding the customer base for adhesive and sealant products.

In addition, strict regulatory frameworks regarding vehicle safety, environmental compliance, and recyclability are influencing product development strategies With continued innovation in resin chemistry and application technologies, the market is expected to maintain strong growth, supported by the shift toward multi-material bonding and the increasing role of adhesives and sealants in structural and aesthetic vehicle components.

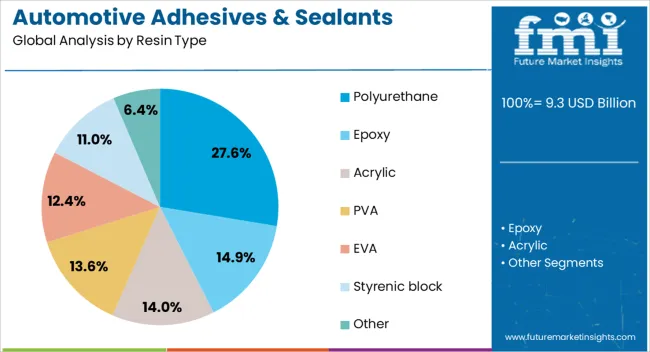

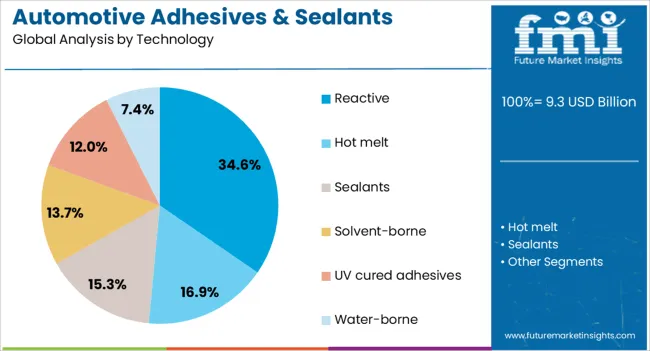

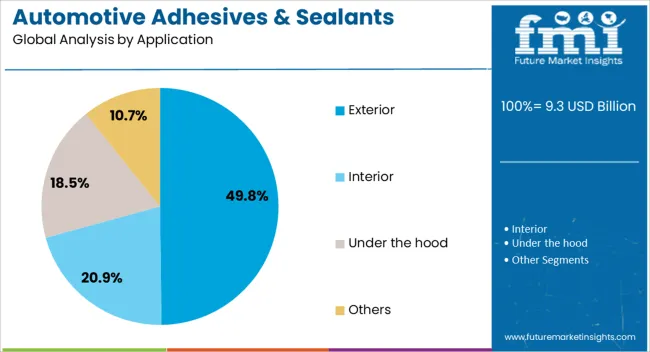

The automotive adhesives & sealants market is segmented by resin type, technology, application, and geographic regions. By resin type, automotive adhesives & sealants market is divided into Polyurethane, Epoxy, Acrylic, PVA, EVA, Styrenic block, and Other. In terms of technology, automotive adhesives & sealants market is classified into Reactive, Hot melt, Sealants, Solvent-borne, UV cured adhesives, and Water-borne. Based on application, automotive adhesives & sealants market is segmented into Exterior, Interior, Under the hood, and Others. Regionally, the automotive adhesives & sealants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyurethane resin type segment is projected to hold 27.6% of the automotive adhesives and sealants market revenue share in 2025, making it the leading resin category. This dominance is being supported by polyurethane’s versatility, which allows it to deliver strong adhesion across a wide range of substrates, including metals, plastics, and composites commonly used in automotive manufacturing.

The material’s inherent flexibility, combined with high tensile strength, makes it suitable for applications requiring both structural bonding and vibration resistance. Its ability to maintain performance under varying temperature and humidity conditions further enhances its suitability for diverse automotive environments.

The segment’s growth is reinforced by increasing adoption in body assembly, glass bonding, and interior component installation, where durability and resistance to environmental degradation are critical Continued advancements in formulation technology are enabling faster curing times and improved processing efficiency, making polyurethane-based adhesives and sealants a preferred choice for manufacturers seeking high productivity without compromising quality.

The reactive technology segment is anticipated to account for 34.6% of the automotive adhesives and sealants market revenue share in 2025, positioning it as the dominant technology. This leadership is attributed to the segment’s ability to provide permanent, high-strength bonds through chemical curing, which ensures superior performance in demanding automotive applications.

Reactive adhesives and sealants are highly valued for their resistance to temperature extremes, chemicals, and environmental exposure, making them suitable for both structural and sealing functions. The technology’s compatibility with lightweight materials, including aluminum and advanced composites, is supporting its adoption in modern vehicle designs focused on weight reduction and efficiency.

The segment is further benefiting from advancements in curing mechanisms that reduce cycle times and improve production throughput As automotive manufacturing increasingly shifts toward modular designs and multi-material assemblies, reactive technology is expected to maintain its leadership by offering a combination of durability, versatility, and performance under a wide range of operational conditions.

The exterior application segment is expected to capture 49.8% of the automotive adhesives and sealants market revenue share in 2025, establishing itself as the largest application area. This dominance is being driven by the critical role adhesives and sealants play in exterior components such as body panels, glass installations, roof systems, and trim assemblies. The demand for durable bonding and sealing solutions that can withstand exposure to weather extremes, UV radiation, and mechanical stress is contributing to strong adoption in this category.

The use of advanced adhesives and sealants in exterior applications enhances vehicle aesthetics by enabling smoother surfaces and eliminating visible fasteners, while also improving aerodynamics. Increasing focus on corrosion prevention and long-term durability is further supporting the segment’s growth.

Additionally, the rise in electric and hybrid vehicle production, which requires specialized sealing for battery enclosures and aerodynamic features, is reinforcing demand Continuous innovation in formulations to provide faster curing, higher strength, and improved environmental resistance is expected to sustain the segment’s leading position in the coming years.

The automotive adhesives & sealants market is poised for steady growth, supported by rising automotive manufacturing, particularly in the electric vehicle sector. With opportunities emerging from EV and autonomous vehicle segments, the market continues to evolve in response to shifting consumer preferences and technological advancements. As market players embrace innovations in adhesives formulations and adapt to stringent regulatory environments, the sector is expected to experience significant transformation over the next decade.

The automotive adhesives & sealants market is experiencing a significant uptick in demand, primarily driven by the expanding global automotive manufacturing sector. The surge in production volumes is linked to the rising adoption of electric vehicles (EVs) and the need for lighter, more efficient vehicles. Manufacturers increasingly rely on adhesives and sealants for structural bonding, noise, vibration, and harshness (NVH) control, as well as to meet regulatory safety standards. The trend of lightweight materials, including composites and plastics, is further propelling the demand for these adhesives and sealants. The rising consumer preference for advanced, fuel-efficient vehicles is fueling this demand.

A prominent growth opportunity for automotive adhesives and sealants lies in the growing adoption of electric vehicles (EVs) and autonomous driving technologies. EVs require specialized bonding materials to manage battery modules, thermal systems, and lightweight components. Similarly, autonomous vehicles demand adhesives for advanced sensor integration, which is expected to result in significant market potential. As these vehicles continue to evolve, new formulations of adhesives and sealants will emerge to address the specific needs of these advanced technologies. These developments offer a considerable opportunity for suppliers to cater to the unique demands of these markets.

The automotive adhesives and sealants market is seeing evolving trends in formulation technologies. Adhesives with higher strength, flexibility, and resistance to extreme temperatures are gaining traction due to the demand for better performance in automotive components. Innovations in hot-melt and pressure-sensitive adhesives (PSAs) are transforming bonding and sealing applications, providing enhanced durability and better performance. There is also a visible shift towards environmentally-friendly adhesive solutions, with market players focused on developing products that comply with stringent regulatory requirements while delivering high performance.

One of the significant challenges in the automotive adhesives and sealants market is navigating the stringent regulatory landscape. Manufacturers are faced with ever-tightening regulations related to the chemical composition of adhesives and sealants, particularly concerning volatile organic compounds (VOCs) and hazardous materials. The need to comply with regional regulations such as REACH in the EU and VOC limits in North America adds complexity to product development and manufacturing. Companies must invest heavily in R&D to ensure that their products meet these standards without compromising on performance.

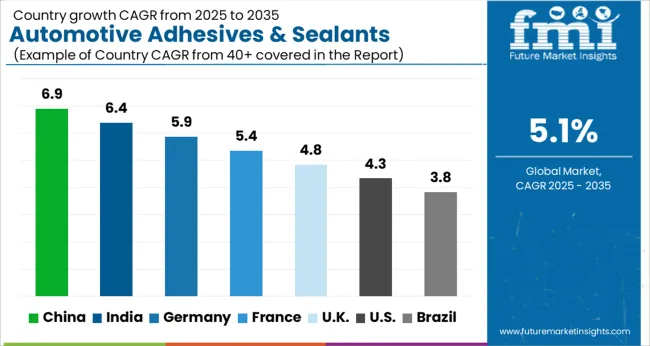

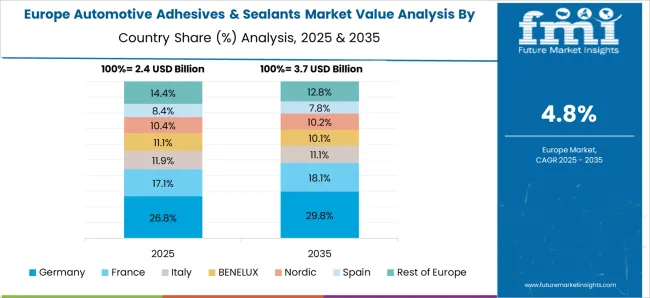

The global automotive adhesives and sealants market is projected to grow at a CAGR of 5.1% from 2025 to 2035. China leads with a growth rate of 6.9%, followed by India at 6.4%, and France at 5.4%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. These varying growth rates are driven by increasing demand for lightweight and durable materials in automotive manufacturing, the rise of electric vehicles (EVs), and stricter regulatory standards on emissions. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, rising automotive production, and increased investments in vehicle electrification. Meanwhile, more mature markets like the USA and the UK see steady growth driven by the shift toward sustainable manufacturing and the demand for more efficient and eco-friendly automotive solutions. This report includes insights on 40+ countries, with the top markets highlighted here for reference.

The global automotive adhesives and sealants market is projected to grow at a CAGR of 5.1% from 2025 to 2035. China leads with a growth rate of 6.9%, followed by India at 6.4%, and France at 5.4%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. These varying growth rates are driven by increasing demand for lightweight and durable materials in automotive manufacturing, the rise of electric vehicles (EVs), and stricter regulatory standards on emissions. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, rising automotive production, and increased investments in vehicle electrification. Meanwhile, more mature markets like the USA and the UK see steady growth driven by the shift toward sustainable manufacturing and the demand for more efficient and eco-friendly automotive solutions. This report includes insights on 40+ countries, with the top markets highlighted here for reference.

The automotive adhesives and sealants market in China is projected to grow at a robust CAGR of 6.9%. China’s rapidly growing automotive sector, which is the largest in the world, is driving the high demand for adhesives and sealants. The market is fueled by the need for lightweight materials, enhanced safety, and improved vehicle performance, particularly with the rise of electric vehicles (EVs) and autonomous vehicles. China’s focus on green and energy-efficient automotive solutions further boosts demand for these materials in manufacturing. The shift towards electric vehicles and the adoption of stricter regulatory standards are expected to accelerate market growth in the coming years.

The automotive adhesives and sealants market in India is projected to grow at a CAGR of 6.4%. India’s automotive industry is expanding rapidly, particularly with the increasing production of both traditional and electric vehicles. The country’s growing middle class, rising disposable incomes, and increasing demand for fuel-efficient and environmentally friendly vehicles are key drivers of this growth. Adhesives and sealants are increasingly being used for lightweighting and improving vehicle fuel efficiency. Government initiatives supporting the development of electric vehicle infrastructure further boost the demand for advanced automotive materials.

The automotive adhesives and sealants market in France is projected to grow at a CAGR of 5.4%. France, a leader in the European automotive industry, is increasingly adopting adhesives and sealants for both conventional and electric vehicle production. The growing demand for lightweight materials, improved vehicle aesthetics, and reduced emissions is driving the adoption of advanced adhesives and sealants in manufacturing. France’s push for sustainable automotive solutions and its focus on reducing vehicle weight for better fuel efficiency further support market growth.

The automotive adhesives and sealants market in the United Kingdom is expected to grow at a CAGR of 4.8%. The UK automotive industry is undergoing a transition towards electric vehicles and advanced manufacturing techniques, driving the demand for adhesives and sealants. The market is also supported by the increasing focus on improving vehicle efficiency, safety, and design. As manufacturers in the UK embrace lightweight materials and sustainable automotive technologies, the need for high-performance adhesives and sealants grows.

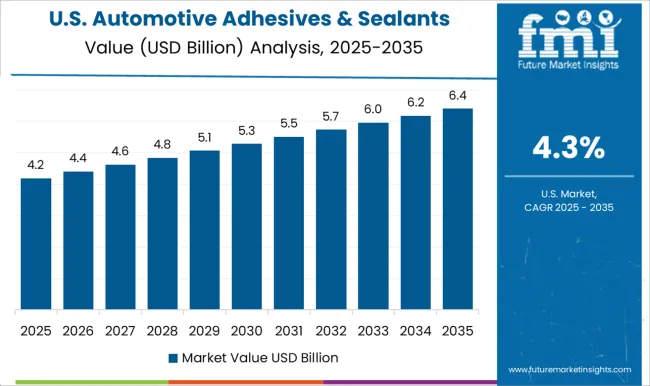

The automotive adhesives and sealants market in the United States is expected to grow at a CAGR of 4.3%. The USA automotive sector is heavily focused on the adoption of lightweight and high-performance materials in response to regulatory requirements and consumer demand for energy-efficient vehicles. The rise of electric vehicles, along with growing demand for fuel-efficient and safe vehicles, continues to support the demand for adhesives and sealants. With stringent government regulations on fuel efficiency and vehicle emissions, the USA market is expected to see steady growth in the automotive adhesives and sealants sector.

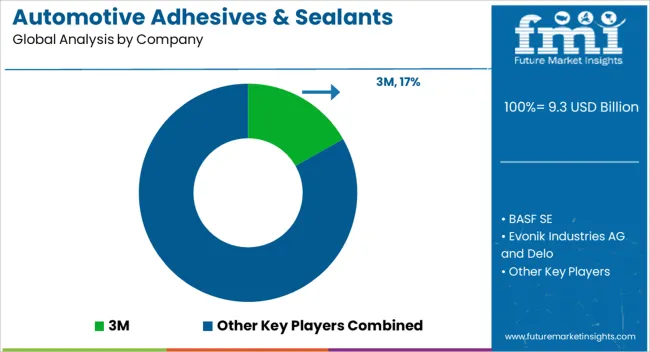

The automotive adhesives and sealants market is defined by a highly competitive landscape, with prominent players such as 3M, BASF SE, and Henkel AG & Co. KGaA leading the charge in developing high-performance solutions. These companies leverage their global reach and technical expertise to provide a wide range of bonding solutions, meeting the growing demands of the automotive industry. 3M’s adhesives are designed to bond a variety of substrates, including metals, plastics, and glass, offering versatility across multiple applications. BASF SE’s sealants contribute to vehicle lightweighting, supporting better fuel efficiency and structural integrity. Henkel AG & Co. KGaA’s offerings focus on thermal stability and durability, particularly for electric vehicle (EV) assembly, addressing the automotive sector’s increasing need for performance-enhancing materials.

Regional dynamics further shape the competitive environment, with each company tailoring its approach to meet local market demands. In North America, the push for vehicle lightweighting and compliance with emission regulations has led to a higher adoption of advanced adhesives and sealants. Meanwhile, the Asia-Pacific region, particularly China and India, sees rapid growth in the automotive sector, presenting significant opportunities for market expansion. Companies are investing heavily in research and development, focusing on products that cater to the rising demand for electric vehicles and materials with improved performance under extreme conditions. Strategic partnerships and collaborations are common in the market, enabling companies to enhance their product offerings and strengthen their foothold in key regions. This combination of innovation and regional strategies is propelling the automotive adhesives and sealants market forward.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Resin Type | Polyurethane, Epoxy, Acrylic, PVA, EVA, Styrenic block, and Other |

| Technology | Reactive, Hot melt, Sealants, Solvent-borne, UV cured adhesives, and Water-borne |

| Application | Exterior, Interior, Under the hood, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, BASF SE, Evonik Industries AG and Delo, H.B. Fuller Company, Henkel AG & Co., Hernon Manufacturing Inc., Jowat SE, KGaA, Huntsman International LLC, Permabond LLC, and PPG Industries, Inc. |

| Additional Attributes | Dollar sales by product type (epoxy, polyurethane, silicone, others), dollar sales by form (liquid, paste, film), trends in lightweight vehicle construction and fuel efficiency, use in electric vehicle assembly, growth in demand for durable and high-performance adhesives, and regional patterns of automotive adhesive formulations. |

The global automotive adhesives & sealants market is estimated to be valued at USD 9.3 billion in 2025.

The market size for the automotive adhesives & sealants market is projected to reach USD 15.3 billion by 2035.

The automotive adhesives & sealants market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in automotive adhesives & sealants market are polyurethane, epoxy, acrylic, pva, eva, styrenic block and other.

In terms of technology, reactive segment to command 34.6% share in the automotive adhesives & sealants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Cabin Air Quality Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fuel Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Homologation Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA