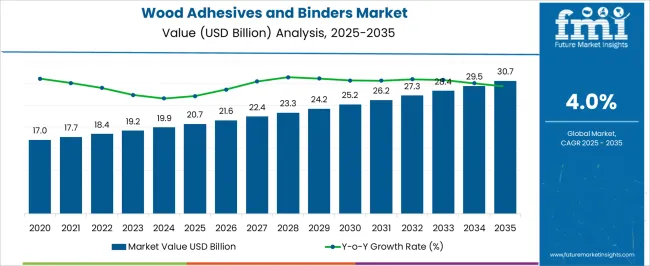

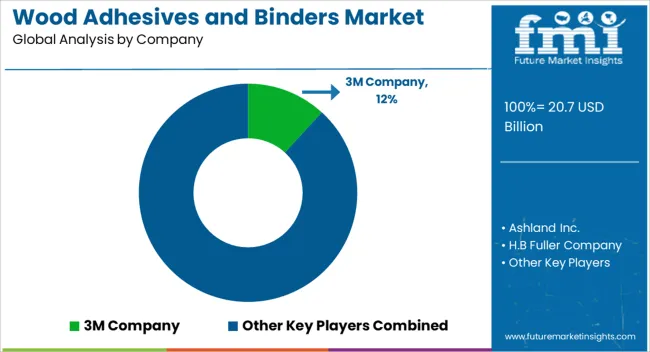

The wood adhesives and binders market is estimated to be valued at USD 20.7 billion in 2025 and is projected to reach USD 30.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

In the early stage from 2025 to 2028, the rolling CAGR remains slightly above the long-term average as demand benefits from growth in furniture production, residential construction, and packaging applications. Expansion during this phase is driven by rising use of engineered wood products in cost-effective and sustainable building solutions. From 2028 to 2032, rolling CAGR values reflect moderation as markets in developed regions approach maturity and replacement demand takes a larger share of consumption.

Competitive pressures from alternative bonding technologies also affect growth during this window. In the later phase from 2032 to 2035, rolling CAGR strengthens again, supported by technological advancements such as low-emission formulations, bio-based adhesives, and products tailored for high-performance engineered wood. This view underscores that while the overall CAGR for the decade is 4.0%, short-term fluctuations create periods of acceleration and moderation, making rolling analysis a valuable tool for identifying demand cycles and planning capacity or investment strategies effectively.

| Metric | Value |

|---|---|

| Wood Adhesives and Binders Market Estimated Value in (2025 E) | USD 20.7 billion |

| Wood Adhesives and Binders Market Forecast Value in (2035 F) | USD 30.7 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The market is driven by several upstream industries. Furniture and interior manufacturers account for approximately 39%, as adhesives are extensively used in panel bonding, laminates, and cabinetry. Construction and building material suppliers represent nearly 29%, applying binders in flooring, plywood, and structural composites. Packaging and engineered wood producers contribute about 15%, where adhesives support particleboard, MDF, and corrugated applications. Automotive and transportation sectors hold close to 10%, integrating lightweight wooden composites in interiors. Specialty and consumer goods manufacturers make up the remaining 7%, using adhesives for decorative laminates, handicrafts, and small-scale applications.

The market is advancing with stronger demand for bio-based and formaldehyde-free solutions. Over 30% of new formulations introduced in 2024 were based on soy, starch, or lignin, addressing both sustainability goals and regulatory compliance. High-performance polyurethane and epoxy-based adhesives are gaining share in furniture and flooring, offering enhanced durability and moisture resistance. Construction applications saw a 9% year-on-year increase, driven by rising demand for engineered wood products in residential and commercial projects. Manufacturers are deploying automated dispensing and precision application systems, reducing adhesive consumption by 8–10%. Regional production expansion is also underway to ensure supply stability in high-growth markets.

The wood adhesives and binders market is experiencing steady expansion, supported by growth in the construction, furniture, and interior décor sectors. Industry updates and manufacturing reports have noted a surge in demand for engineered wood products, which rely heavily on high-performance adhesives for durability and precision assembly.

Rising urbanization, coupled with the popularity of modular furniture and custom cabinetry, has further fueled consumption. Technological improvements in adhesive formulations have enhanced bond strength, water resistance, and environmental performance, catering to evolving regulatory standards on formaldehyde emissions.

Additionally, the market has benefited from investments in automated woodworking equipment, which require adhesives compatible with high-speed production lines. Sustainability considerations are also influencing product development, with a gradual increase in bio-based alternatives alongside conventional formulations. Over the forecast period, the market is expected to be driven by the dominant use of urea-formaldehyde (UF) adhesives in cost-sensitive applications and the growing demand for cabinet manufacturing in residential and commercial interiors.

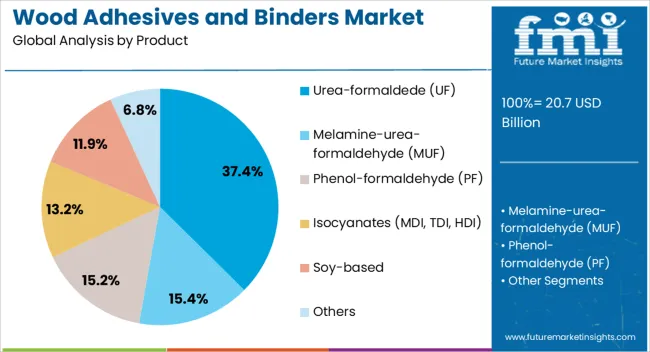

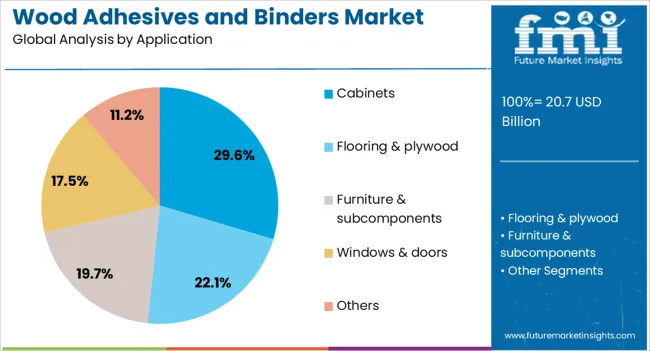

The wood adhesives and binders market is segmented by product, application, and geographic regions. By product, wood adhesives and binders market is divided into urea-formaldede (UF), melamine-urea-formaldehyde (MUF), phenol-formaldehyde (PF), isocyanates (MDI, TDI, HDI), soy-based, and others. In terms of application, wood adhesives and binders market is classified into cabinets, flooring & plywood, furniture & subcomponents, windows & doors, and others. Regionally, the wood adhesives and binders industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The urea-formaldehyde (UF) segment is projected to account for 37.4% of the wood adhesives and binders market revenue in 2025, holding its lead due to its cost-effectiveness and suitability for a wide range of interior woodworking applications. This dominance has been supported by UF’s fast curing properties, high tensile strength, and ease of application in mass production settings. Manufacturers have relied on UF adhesives for particleboard, MDF, and plywood fabrication, where high bond strength and smooth surface finishes are essential. Production cost advantages, combined with compatibility with automated pressing and assembly systems, have reinforced its widespread adoption. Although environmental regulations regarding formaldehyde emissions have prompted innovation in low-emission UF resins, demand has remained strong due to the balance of performance and price offered by these adhesives. In furniture and panel manufacturing operations, UF continues to be a preferred choice for achieving strong, consistent bonds in controlled indoor environments.

The cabinets segment is projected to contribute 29.6% of the wood adhesives and binders market revenue in 2025, maintaining its leading position within applications. Growth in this segment has been driven by the expansion of residential and commercial construction, which has spurred demand for functional and aesthetic storage solutions. Cabinet manufacturing requires adhesives with high bond strength, durability, and resistance to daily wear, all of which are provided by advanced wood adhesive formulations. Industry reports have highlighted the role of modular and customized cabinet designs in increasing adhesive consumption, as these often involve complex assembly and finishing processes. The rising trend of kitchen and bathroom renovations, particularly in developed markets, has also strengthened cabinet production volumes. Additionally, the use of engineered wood panels in cabinetry has increased reliance on adhesives to ensure structural integrity. As interior design trends continue to evolve toward high-quality finishes and long-lasting furniture, the cabinets segment is expected to remain a key driver of adhesive demand.

The wood adhesives and binders market is expanding as demand increases from furniture, construction, and interior design industries. Rising urbanization and growth in modular furniture manufacturing are creating consistent consumption of adhesive-based bonding solutions. The market is also evolving with technological advancements that enable stronger, lighter, and environmentally friendly bonding systems. Water-based and bio-based adhesives are gaining traction, supported by stringent emission standards. Manufacturers are diversifying product lines to cater to both large-scale construction projects and small-scale consumer applications in flooring, cabinetry, and decorative panels.

The surge in global construction activity and higher consumer spending on home furnishings are driving wood adhesive and binder demand. Engineered wood products such as plywood, particleboard, and laminated veneer lumber rely heavily on adhesives for durability and design flexibility. Furniture exports from Asia Pacific continue to rise, fueling adhesive consumption in manufacturing hubs. In my opinion, the combination of rising construction volumes and growing demand for customizable furniture ensures a strong foundation for adhesive producers.

The shift toward eco-friendly adhesives presents a major growth opportunity. Bio-based adhesives derived from natural polymers are increasingly replacing traditional petrochemical products. Waterborne formulations are gaining preference due to reduced VOC emissions and safer indoor air quality. Governments in Europe and North America are supporting adoption through environmental standards, encouraging manufacturers to accelerate R&D in this space. I believe companies focusing on sustainable innovation will secure stronger long-term partnerships with global furniture and construction firms.

Advancements in resin technology are shaping product innovation in the market. High-performance adhesives are now engineered to provide enhanced resistance to moisture, heat, and mechanical stress, making them suitable for both indoor and outdoor applications. Producers are incorporating polyurethane, epoxy, and phenol-formaldehyde resins to meet varied strength and durability needs. In my view, the adoption of these advanced chemistries will create strong demand in high-end furniture, flooring, and architectural wood applications.

Producers face challenges from volatile prices of petrochemical-based raw materials, which influence manufacturing costs and profitability. Compliance with strict environmental regulations on formaldehyde emissions creates additional burdens for traditional binder producers. Smaller manufacturers struggle with R&D and infrastructure costs required for transitioning to sustainable formulations. In my opinion, developing cost-efficient bio-based technologies and securing stable raw material supply chains will be essential to remain competitive.

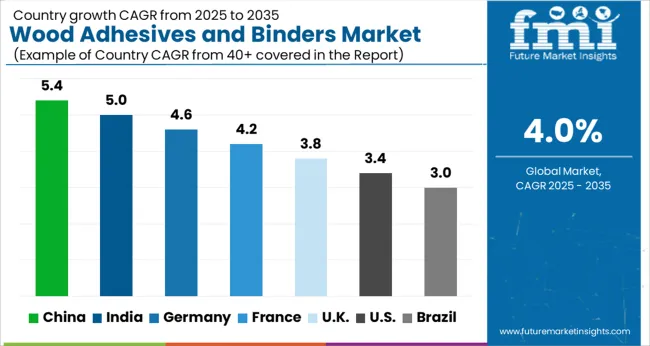

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

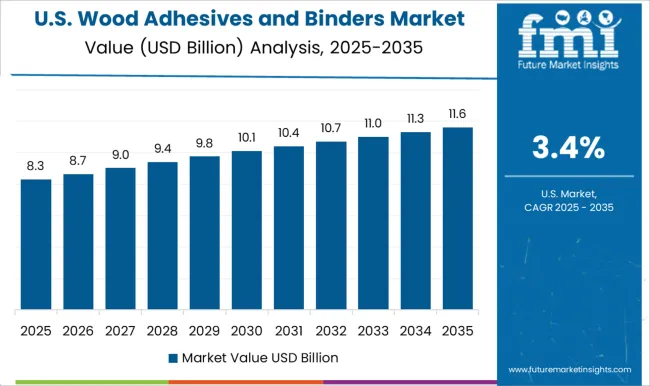

| USA | 3.4% |

| Brazil | 3.0% |

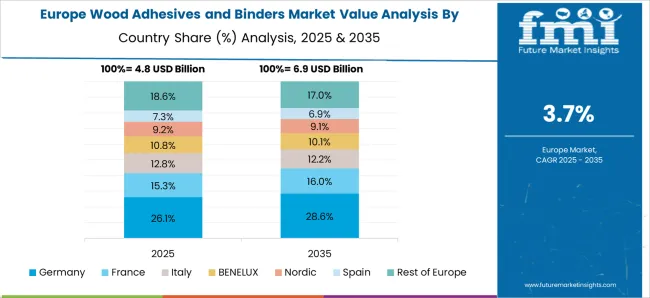

The wood adhesives and binders market is expanding at a global CAGR of 4% from 2025 to 2035, driven by growth in furniture manufacturing, construction, and engineered wood products. China leads with a CAGR of 5.4%, +35% above the global average, supported by BRICS-driven expansion in residential construction, large-scale furniture production, and rising exports. India follows at 5.0%, +25% over the global rate, reflecting strong demand from infrastructure development and increasing use of engineered wood in urban housing projects. Germany records 4.6%, +15% above global performance, with OECD-backed innovation in bio-based adhesives and high demand from the premium furniture sector. The United Kingdom posts 3.8%, slightly below the global CAGR, shaped by moderate growth in housing construction and selective adoption of eco-friendly binders. The United States stands at 3.4%, −15% under the global benchmark, influenced by market saturation in construction but supported by niche demand in remodeling and specialty applications.

China is growing at a CAGR of 5.4% in the wood adhesives and binders market, supported by its large furniture and construction industries. Rising production of wooden panels, flooring, and modular furniture is lifting demand for urea-formaldehyde and polyurethane-based adhesives. Domestic producers are increasing investments in high-capacity plants to cater to both export-oriented furniture manufacturers and local construction projects. With an expanding supply of raw materials like formaldehyde and resins, China maintains cost advantages in production. Government initiatives promoting energy-efficient housing and infrastructure development are further adding to adhesive consumption. Export markets in Asia-Pacific and Europe also provide steady growth opportunities for Chinese suppliers.

India is advancing at a CAGR of 5.0% in the wood adhesives and binders market, supported by rapid growth in furniture manufacturing and residential construction. Rising adoption of engineered wood products such as plywood, MDF, and laminates is stimulating adhesive consumption. Local manufacturers are scaling production of cost-effective urea-formaldehyde and phenol-formaldehyde resins while also exploring polyurethane-based solutions. Growth in office and commercial spaces is adding to wood product usage, enhancing demand for adhesives with higher strength and durability. With increased investments in smart cities and housing schemes, India’s demand for adhesives is expected to remain on an upward trajectory. Export of finished wood products is also supporting local adhesive consumption.

Germany is recording a CAGR of 4.6% in the wood adhesives and binders market, supported by its well-established furniture and flooring industries. Rising use of engineered wood in residential construction is creating demand for advanced adhesive solutions. German producers are focusing on formaldehyde-free and water-based adhesives to comply with stringent safety regulations. High demand for particleboard, MDF, and laminated flooring is contributing to steady consumption across manufacturing hubs in Bavaria and North Rhine-Westphalia. Export-driven furniture companies are also stimulating adhesive demand as they focus on premium-grade products. Research initiatives in Germany are encouraging development of bio-based binders, offering new opportunities for market growth.

The United Kingdom is progressing at a CAGR of 3.8% in the wood adhesives and binders market, shaped by construction and furniture industries. Demand for modular housing solutions and prefabricated furniture is driving adhesive consumption. Local manufacturers are relying on imports of resins and binders from European suppliers due to limited domestic raw material production. Adhesive demand is also expanding in flooring and panel manufacturing segments, where polyurethane and hybrid formulations are gaining preference. Growing focus on eco-compatible and low-emission adhesives is influencing product development. Market participants are forming long-term contracts with construction companies to ensure steady supply.

The United States is advancing at a CAGR of 3.4% in the wood adhesives and binders market, driven by residential renovation, furniture manufacturing, and flooring applications. Rising adoption of engineered wood in construction projects is contributing to steady consumption of binders. Polyurethane and water-based adhesives are gaining market share as manufacturers aim for improved bonding performance and reduced emissions. The USA furniture sector, particularly in states like North Carolina and Michigan, remains a major consumer of adhesives. Ongoing housing renovation and remodeling activities are also supporting demand. Local producers are investing in R&D to develop bio-based adhesives that meet regulatory standards and performance requirements.

The wood adhesives and binders market is shaped by global chemical producers and specialty adhesive companies providing bonding solutions for furniture, flooring, and construction applications. 3M Company holds a strong position with a portfolio that includes pressure-sensitive adhesives and bonding agents designed for high-performance wood applications. Ashland Inc. and H.B. Fuller Company emphasize customized formulations developed for industrial wood processing, while Henkel AG & Co. KGaA continues to expand with water-based and solvent-free adhesives for furniture and panel boards. BASF SE and Huntsman Corporation compete through resin innovations that support engineered wood products and laminated structures, ensuring high durability and strength under varying environmental conditions. Other prominent players enhance the competitive landscape with specialized strategies and global supply networks.

Avery Dennison Corporation provides adhesive technologies tailored for wood laminates and overlays, while Dow Chemical Company and Bostik develop binders for particleboard, plywood, and MDF manufacturing. H.B. Fuller, alongside repeated mentions of BASF, Henkel, and 3M, reinforces its standing through strong R&D programs, customer partnerships, and acquisitions aimed at broadening application coverage. Together, these companies focus on performance-driven solutions, eco-friendly formulations, and alignment with furniture and construction industry demands, ensuring product reliability across global supply chains.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.7 billion |

| Product | Urea-formaldede (UF), Melamine-urea-formaldehyde (MUF), Phenol-formaldehyde (PF), Isocyanates (MDI, TDI, HDI), Soy-based, and Others |

| Application | Cabinets, Flooring & plywood, Furniture & subcomponents, Windows & doors, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Company, Ashland Inc., H.B Fuller Company, Henkel AG & Co. KGaA, BASF SE, Huntsman Corporation, Avery Dennison Corporation, Dow Chemical Company, Bostik, Henkel, 3M Company, and H.B. Fuller |

| Additional Attributes | Dollar sales by adhesive type and wood application, demand dynamics across furniture, flooring, and construction, regional trends across North America, Europe, and Asia-Pacific, innovation in bio-based and moisture-resistant bonding solutions, environmental impact of low-emission formulations and recyclability, and emerging use in engineered wood products and modular housing. |

The global wood adhesives and binders market is estimated to be valued at USD 20.7 billion in 2025.

The market size for the wood adhesives and binders market is projected to reach USD 30.7 billion by 2035.

The wood adhesives and binders market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in wood adhesives and binders market are urea-formaldede (uf), melamine-urea-formaldehyde (muf), phenol-formaldehyde (pf), isocyanates (mdi, tdi, hdi), soy-based and others.

In terms of application, cabinets segment to command 29.6% share in the wood adhesives and binders market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Woodfree Paper Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Wood Plastic Composite Market Forecast and Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Wooden & Plywood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wooden Furniture Market Size and Share Forecast Outlook 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Wooden Interior Door Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Wood Activated Carbon Market Size and Share Forecast Outlook 2025 to 2035

Wood Pallets Market Trends – Innovations & Growth 2025 to 2035

Wood Based Panel Market Size and Share Forecast Outlook 2025 to 2035

Wood Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Wooden Decking Market Size, Growth, and Forecast 2025 to 2035

WPC Floorings Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA