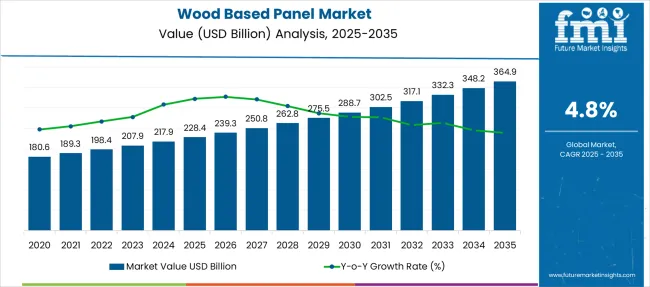

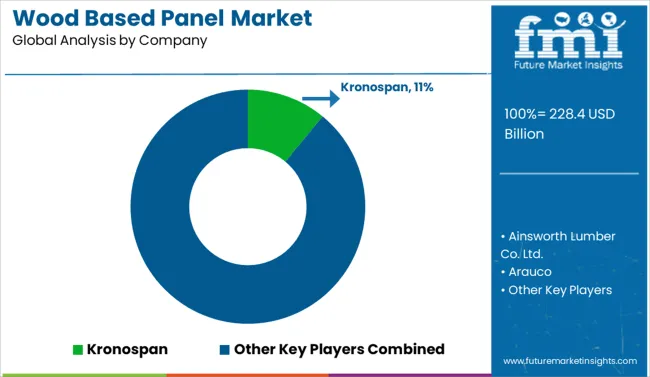

The Wood Based Panel Market is estimated to be valued at USD 228.4 billion in 2025 and is projected to reach USD 364.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period. Between 2025 and 2030, the market is set to expand by USD 60.3 billion, with consistent year-over-year increases averaging above USD 11 billion. By 2030, the market is expected to reach USD 288.7 billion, supported by rising demand for engineered wood in furniture, construction, and modular interiors. Medium-density fiberboard, particleboard, and oriented strand board are expected to maintain high demand due to their cost-efficiency and uniform properties compared to traditional hardwood.

From 2031 to 2035, the market is forecasted to grow by another USD 62.4 billion, reaching USD 364.9 billion by 2035. The CAGR of 4.8% is likely to remain steady due to expanding infrastructure investment and the wider use of prefabricated construction materials. Increasing production capacities, especially in Asia Pacific and Eastern Europe, are expected to meet rising domestic and export demands. Adhesive innovations and equipment upgrades will also support growth, enabling higher-value panel manufacturing for flooring, cabinetry, and industrial applications across both developed and emerging markets.

| Metric | Value |

|---|---|

| Wood Based Panel Market Estimated Value in (2025 E) | USD 228.4 billion |

| Wood Based Panel Market Forecast Value in (2035 F) | USD 364.9 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The market is expanding strongly as construction, furniture, and packaging industries shift toward engineered wood solutions. Innovations in ultra-low formaldehyde adhesives, cross‑laminated timber and finger‑jointed composites are improving strength and sustainability credentials while meeting stringent regulations. Automated production lines with real‑time quality inspection systems are boosting throughput and reducing waste. Demand for lightweight decorative panels with high moisture resistance is rising in interiors and modular housing applications.

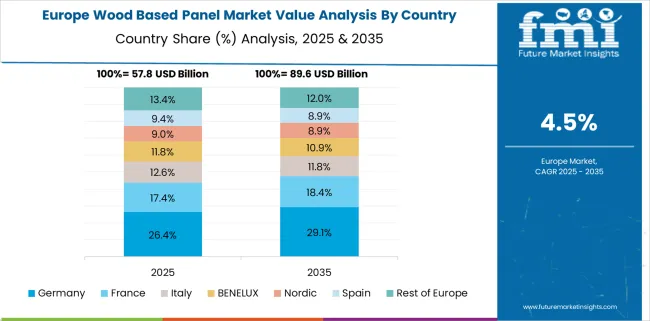

Growth in Asia Pacific remains robust, especially in infrastructure and affordable housing projects, while North America and Europe focus on certified sourcing and recycled fibre content. These trends are reshaping supply chains and raising performance benchmarks across the sector.

The industry is driven by five parent sectors with varying degrees of influence. Construction and building materials contribute around 35% of the demand, with applications in flooring, wall sheathing, and structural components. Furniture and cabinetry manufacturing follows with about 30%, using panels for desks, cabinets, and bed frames.

Interior design accounts for nearly 20%, covering decorative wall panels and ceiling systems. Packaging and industrial use represent around 10%, especially in pallets and crate linings. Retail DIY and home improvement hold the remaining 5%, where consumers purchase panels for home repairs and personal projects, keeping demand stable in consumer markets.

The wood based panel market is experiencing steady growth, fueled by rising demand for engineered wood products in residential construction, commercial interiors, and modular furniture systems. Increased urbanization and cost pressures have accelerated the shift from traditional solid wood to high-performance composite panels.

Technological advancements in adhesive systems, moisture resistance, and emissions control are contributing to improved durability and sustainability of wood-based panels. The growing preference for customizable and ready-to-assemble furniture formats is also supporting higher consumption in the furniture and interior design sectors.

Growing global trade networks and regional production hubs are facilitating access to low-emission, certified wood panels aligned with green building standards. Investments in bio-based resins and sustainable forestry practices are expected to shape procurement and product innovation strategies within the industry.

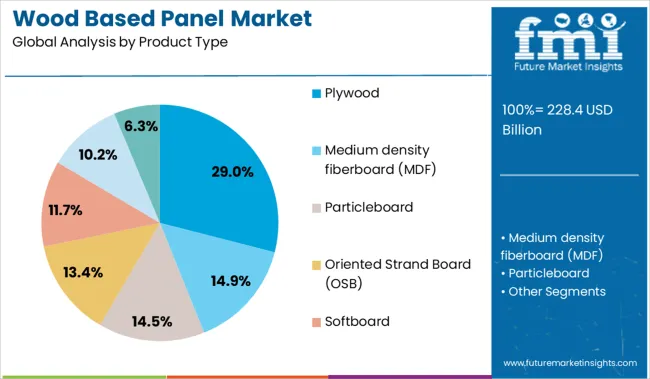

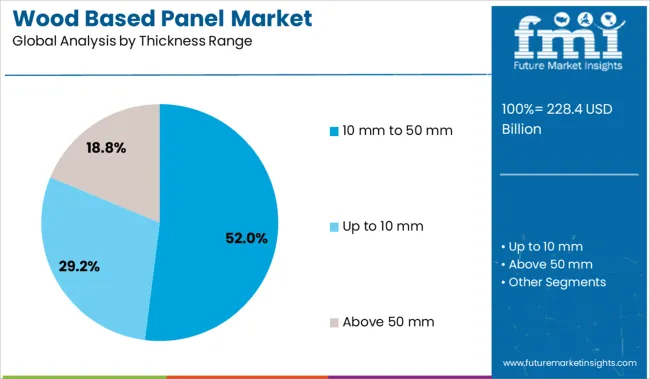

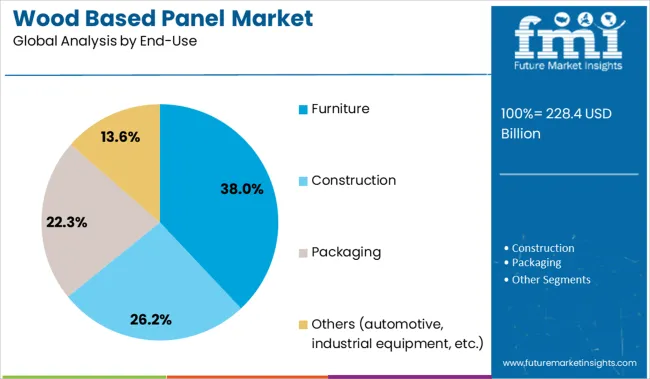

The market is segmented by product type, thickness range, end-use, distribution channel, and region. By product type, it includes plywood, medium density fiberboard (MDF), particleboard, oriented strand board (OSB), softboard, hardboard, and others such as high-density fiberboard and laminated veneer lumber, representing a wide range of engineered wood solutions. In terms of thickness range, the categories are 10 mm to 50 mm, up to 10 mm, and above 50 mm to suit varied structural and decorative applications. Based on end-use, the market is classified into furniture, construction, packaging, and others, including automotive and industrial equipment. By distribution channel, it is divided into offline and online platforms, reflecting both traditional and digital sales models. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Plywood is projected to account for 29.00% of the total revenue in the wood based panel market by 2025, making it the leading product type segment. Its continued dominance is being driven by its high strength-to-weight ratio, superior load-bearing properties, and versatility across structural and decorative applications.

Plywood’s resistance to warping, combined with its adaptability to various finishes, makes it well suited for construction, cabinetry, and wall paneling uses. The ability to source it in a range of hardwood and softwood veneers has widened its appeal across commercial and residential sectors.

Manufacturers are also increasingly adopting formaldehyde-free resins and precision bonding techniques, improving environmental compliance while maintaining performance standards..

Panels within the 10 mm to 50 mm thickness range are expected to contribute 52.00% of the market share in 2025, positioning this segment as the most widely used. This thickness range provides the ideal balance between structural rigidity and processing ease, supporting broad adoption in cabinetry, flooring substrates, and partition walls.

It allows for high screw-holding capacity and reduced material waste, enhancing cost efficiency in mass production environments. As furniture manufacturers and builders demand standardized, machine-compatible panels that meet both design and load specifications, this range continues to offer optimal versatility.

Regulatory focus on fire safety and low-emission interior materials is further influencing preference for panels in this standardized category..

The furniture sector is expected to hold 38.00% of the revenue share in the wood based panel market by 2025, making it the leading end-use segment. Demand is being fueled by the rise of modular and ready-to-assemble furniture, as well as growing interior design investments in residential and commercial settings.

Wood based panels offer dimensional stability, design flexibility, and cost advantages over solid wood, making them the preferred substrate for table tops, cabinets, and wardrobes. Their compatibility with laminates, veneers, and coatings enhances visual appeal while enabling mass customization.

Rising demand from urban dwellers for affordable, stylish, and space-saving furniture continues to strengthen this segment’s growth trajectory..

Demand for wood-based panels has been shaped by growing use in interior construction, modular furniture, and packaging industries. Engineered panel grades, such as plywood, medium-density fiberboard (MDF), and oriented strand board (OSB), have been preferred for dimensional stability, surface smoothness, and cost predictability. Integration of digital production processes and value-added treatments has been prioritized by manufacturers seeking operational efficiency and design flexibility.

Wood based panels are being favored in interior fit-out projects due to their consistency in thickness, support for varnish finishes, and compatibility with CNC routing systems. Gains have been linked to preferences for cabinetry applications, built-in shelving, partition systems, and joinery detailing. Medium-density fiberboard has been chosen for high-usage environments thanks to engineered density and smooth edges, whereas plywood and OSB have been sought for structural underlayment. Suppliers have been offering fire-resistant, water-repellent, and UV-faced variants to match building code specifications and hygienic requirements.

Adoption has been observed in residential, commercial, and hospitality fit-outs, where panel-grade selection is being driven by both aesthetic and performance objectives. Analyses of build cost efficiency have led project specifiers to rely on engineered boards over solid timber in repeatable modules.

Growth potential has emerged from digital-cut customization, value-added surface finishes, and environmentally compatible coating options. CNC-ready panels with near-zero edge chipping have been adopted to support bespoke furniture and joinery fabrication, reducing finish cycles and waste. Decorative surface textures, such as matte melamine, high-gloss lacquers, and tactile veneers, have been modularized into production-ready board faces. Interest in formaldehyde-free binders, soy-wax edge seals, and water-based primers has been observed across sensitive spaces such as children's interiors and healthcare settings.

Manufacturers are piloting product bundles that integrate pre-drilled holes, cam-lock fittings, and tooling templates to reduce assembly time for small contractors. Additionally, captive flooring and packaging manufacturers are investing in panel stock inventory to enable just-in-time production. These value propositions are positioning wood-based panels as flexible, specification-ready materials suited to both mass-market and specialist build-outs.

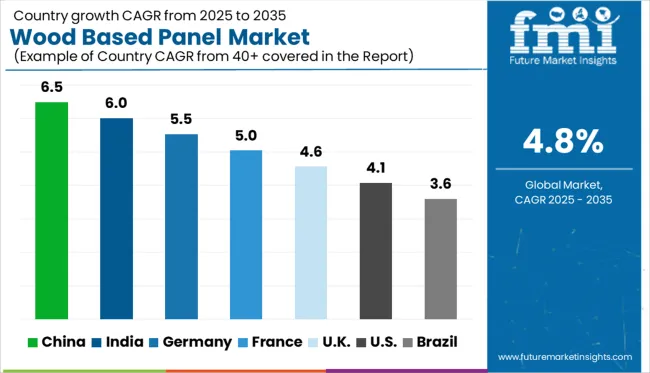

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

The global wood based panel market is projected to grow at a 4.8% CAGR from 2025 to 2035, influenced by rising demand in furniture, construction, and interior applications. China leads with 6.5%, supported by mass-scale panel production for modular furniture and housing projects. India follows at 6.0%, driven by residential urban projects, laminated board demand, and growing use in modular kitchens.

Germany records 5.5%, where engineered panels dominate the flooring and cabinetry markets under strict sustainability certifications. France, growing at 5.0%, focuses on lightweight composite boards for premium interiors and DIY retail chains. The United Kingdom, at 4.6%, emphasizes MDF and particleboard integration in compact living spaces and refurbishment projects. These trends indicate a shift toward engineered panels across 40+ markets.

China is expected to grow at a 6.5% CAGR through 2035, anchored in large-scale manufacturing of MDF, particleboard, and oriented strand board (OSB) for furniture and interior projects. Rising modular housing and prefab construction activity continues to drive bulk procurement of laminated and veneered panels. Local producers are investing in resin-optimized, low-emission panel lines to comply with domestic emission norms. E-commerce-led furniture brands are creating demand for flat-pack designs using lightweight MDF and HDF variants. Decorative surfacing, melamine overlays, and UV-coated panels dominate premium retail categories, catering to urban residential expansion. China’s capacity leadership positions it as a major exporter across ASEAN and African markets.

Demand for wood based panel in India is projected to grow at a 6.0% CAGR, driven by residential construction, interior refurbishment, and modular kitchen installations. Domestic mills are increasing production of pre-laminated particleboards, MDF, and decorative panels for organized retail. Infrastructure growth under Smart Cities and housing projects fuels plywood substitution with engineered panels. Import reliance for premium-grade MDF is reducing as domestic capacities in Gujarat and Andhra Pradesh scale up. Organized furniture brands and panel processors are adopting mechanized finishing, expanding the scope for decorative laminates. Public focus on green-certified products drives preference for E0/E1-compliant panels.

Germany is forecast to grow at a 5.5% CAGR, backed by demand for engineered wood in flooring, cabinetry, and prefabricated housing applications. MDF, OSB, and plywood panels dominate structured panel demand in residential and commercial refurbishments. Strict EU emission norms and PEFC/FSC certifications guide procurement across furniture and construction channels. Growth is supported by DIY retail expansion and home improvement trends in urban areas. Domestic players focus on lightweight laminated panels and fire-retardant grades for premium interior segments. Integrated digital printing on decorative boards for customized surfaces is emerging as a differentiator in the German market.

France is expected to grow at a 5.0% CAGR, supported by demand from furniture producers, renovation projects, and decorative panel manufacturing. MDF and veneered boards are widely used in kitchen cabinetry, premium wall cladding, and office interiors. Local converters emphasize eco-certified panels under EU sustainability mandates, incorporating low-formaldehyde adhesives in production. Decorative surfacing options such as embossed and matte laminates are gaining share in premium categories. DIY home improvement chains are expanding offerings in engineered boards for compact apartments. France’s reliance on domestic milling and import substitution programs continues to shape its competitive dynamics in premium decorative boards.

The United Kingdom is projected to grow at a 4.6% CAGR, slightly below the global average, driven by modular home installations, compact living solutions, and refurbishment activity. MDF and particleboard panels are preferred for kitchen fittings, wardrobes, and home office furniture. Demand for melamine-faced boards and textured laminates is increasing across residential interiors. Retail channels emphasize quick-installation panels compatible with flat-pack designs. Imports of premium MDF and veneered panels continue to dominate the high-end market due to limited domestic production capacities. Sustainability remains central, with FSC-certified engineered panels and low-emission board variants gaining procurement priority.

The wood based panel market is led by Kronospan, holding an estimated 11.00% share through its extensive range of MDF, particleboard, and OSB panels supplied across Europe and North America. EGGER Group and Swiss Krono Group maintain strong positions with integrated operations and sustainability-focused solutions tailored for furniture and interior applications. Arauco and Boise Cascade Company leverage large-scale forest resource management and advanced processing capabilities across the Americas.

Louisiana-Pacific (LP) and Georgia-Pacific, part of Koch Industries, provide engineered wood panels for structural and industrial applications with emphasis on durability and moisture resistance. Weyerhaeuser Company, West Fraser Timber Co., and Norbord Inc. sustain North American supply chains with OSB and commodity panel offerings. In Europe, Pfleiderer Group S.A. and Panels & Furniture Group (PFM) deliver value-added panels featuring decorative finishes and design versatility. Regional suppliers such as Ainsworth Lumber, Roseburg Forest Products, and USA Lumber Group serve niche markets with specialty grades. Competition is defined by sustainable raw material sourcing, diversified product portfolios including MDF, OSB, and HDF, and investments in integrated milling for cost optimization.

In May 2024, Kronospan announced the acquisition of Woodgrain’s particleboard facility in Island City, Oregon, strengthening its position in the North American wood panel market and reinforcing its growth strategy.

| Item | Value |

|---|---|

| Quantitative Units | USD 228.4 Billion |

| Product Type | Plywood, Medium density fiberboard (MDF), Particleboard, Oriented Strand Board (OSB), Softboard, Hardboard, and Others (High density fiberboard, Laminated Veneer Lumber) |

| Thickness Range | 10 mm to 50 mm, Up to 10 mm, and Above 50 mm |

| End-Use | Furniture, Construction, Packaging, and Others (automotive, industrial equipment, etc.) |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kronospan, Ainsworth Lumber Co. Ltd., Arauco, Boise Cascade Company, EGGER Group, Georgia-Pacific LLC (Koch Industries), Louisiana-Pacific Corporation (LP), Norbord Inc., Panels & Furniture Group (PFM Group), Pfleiderer Group S.A., Roseburg Forest Products, Swiss Krono Group, USA Lumber Group LLC, West Fraser Timber Co. Ltd., and Weyerhaeuser Company |

| Additional Attributes | Dollar sales in the wood-based panel market are segmented by product type such as particleboard, MDF, OSB, and plywood, with MDF and OSB gaining prominent share due to versatility and cost efficiency. Demand is growing for moisture-resistant, low-emission panels suited for furniture and interior applications. OEMs and contract manufacturers support large-scale production with tailored surface treatments and laminates. Adoption is strongest in Asia-Pacific and Europe, driven by construction growth and preference for engineered wood alternatives over solid timber. |

The global wood based panel market is estimated to be valued at USD 228.4 billion in 2025.

The market size for the wood based panel market is projected to reach USD 364.9 billion by 2035.

The wood based panel market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in wood based panel market are plywood, medium density fiberboard (mdf), particleboard, oriented strand board (osb), softboard, hardboard and others (high density fiberboard, laminated veneer lumber).

In terms of thickness range, 10 mm to 50 mm segment to command 52.0% share in the wood based panel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Woodfree Paper Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Wood Plastic Composite Market Forecast and Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Wooden & Plywood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Wooden Furniture Market Size and Share Forecast Outlook 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Wooden Interior Door Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Wood Activated Carbon Market Size and Share Forecast Outlook 2025 to 2035

Wood Pallets Market Trends – Innovations & Growth 2025 to 2035

Wood Moisture Tester Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Wooden Decking Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA