The global wood pallets market is projected to expand from USD 2.77 billion in 2025 to USD 4.69 billion by 2035, reflecting a CAGR of 5.4% over the forecast period. This growth is driven by increased cross-border transportation of processed foods, pharmaceuticals, and electronics, leading exporters in Southeast Asia and Eastern Europe to favor lightweight, heat-treated wood pallets for compliance with international shipping standards.

In North America, rising raw timber costs have been mitigated through pallet recycling and refurbishment, enhancing supply chain resilience. The adoption of standard block pallet formats is expected to streamline global logistics and reduce supply chain disruptions. The advantages of wood pallets over plastic counterparts have been reinforced by their recyclability, biodegradability, and role in carbon sequestration.

Reports from Nature’s Packaging highlight that over 95% of wood pallets are recovered and reused or recycled in the USA. market, further embedding them within circular economy models. Industry leaders have acknowledged the potential of wooden pallets. For instance, Graham Chipchase, CEO of Brambles, the world's largest pallet company, stated, "We are beginning to think destocking has largely finished in the US and Europe, and we are seeing consumer confidence returning and good volume growth." Additionally, Brent McClendon, President and CEO of the National Wooden Pallet & Container Association, emphasized the resilience of the wooden pallet industry, noting that despite challenges, the sector continues to adapt and meet the demands of global supply chains. With strong industry backing, policy alignment, and clear environmental benefits, the wood pallet sector is expected to remain on a resilient growth path through 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.77 billion |

| Industry Value (2035F) | USD 4.69 billion |

| CAGR (2025 to 2035) | 5.4% |

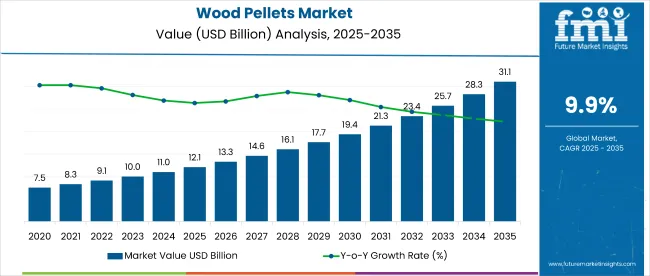

As conventional feedstocks like sawdust become constrained, producers are diversifying into bark, logging residues, and even agricultural biomass. Additives such as kraft lignin improve physical durability but can affect combustion outcomes.

The southeastern United States has emerged as a dominant player in global wood pellet exports, largely supplying European markets. What began as a niche activity in the early 2000s has scaled to millions of tonnes per year, reshaping both international trade and domestic supply chains.

Pellet combustion characteristics vary by feedstock, with measurable differences in emissions. Standards such as EN 14785 for carbon monoxide and nitrogen oxides guide system design and compliance, while additives like clay or bentonite are used to stabilize ash behavior.

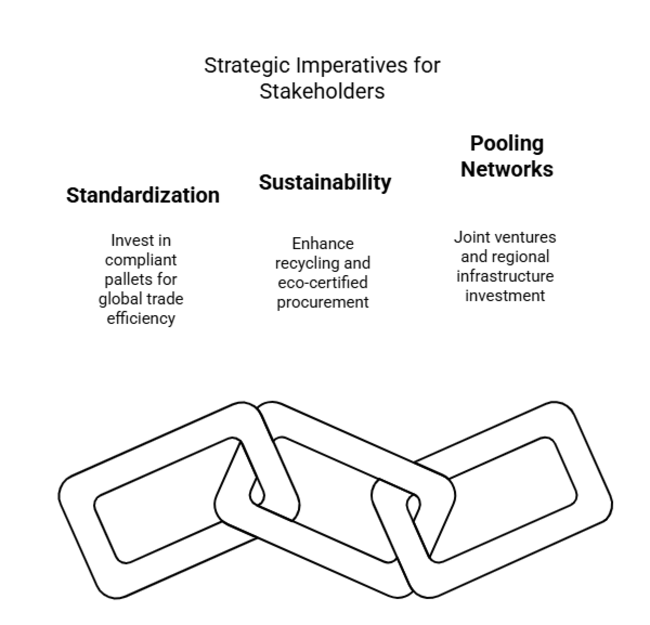

Invest in manufacturing block-style, ISPM-15 compliant wooden pallets to conform to global shipping rules and simplify cross-border supply chain logistics.

Enhance pallet recycling programs and implement eco-certified procurement to satisfy increasing client demands and regulatory trends toward low-carbon, biodegradable products.

Enter into joint ventures with third-party logistics companies and invest in regional pallet pooling infrastructure to maximize distribution reach and enhance recurring revenue potential.

| Risk | Assessment (Probability - Impact) |

|---|---|

| Volatility in Timber Prices and Supply Chain Disruptions | High Probability - High Impact |

| Increasing Preference for Plastic or Composite Alternatives | Medium Probability - Medium Impact |

| Regulatory Tightening on Deforestation and Carbon Emissions | Low Probability - High Impact |

| Priority | Immediate Action |

|---|---|

| Evaluate Regional Timber Supply Chains | Run a feasibility study on diversifying sourcing from low-volatility regions. |

| Strengthen Circular Logistics Models | Initiate OEM and 3PL feedback loop on reusable pallet systems. |

| Boost Industry Penetration in Asia | Launch a distributor and channel partner incentive pilot in Southeast Asia. |

To stay ahead in competition in a logistics environment transformed by sustainability requirements and cross-border efficiency demands, leadership needs to invest in standardized, recyclable pallet systems as a top priority and increase regional pooling partnerships by 2026.

This insight heralds a decisive shift away from low-margin, generic pallet manufacturing to value-added, compliance-enabled solutions that drive ESG objectives and long-haul longevity. Future-proofed strategies should also involve diversifying wood sources and increasing tech-facilitated tracking for pallet use. These moves not only will defend share in mature industries but also unlock new growth opportunities in Asia and Central Europe-regions set for warehouse and e-commerce infrastructure growth.

| Countries | Policies, Regulations & Certifications |

|---|---|

| United States | Export pallets must comply with ISPM-15, and there is an increased emphasis at the state level on sustainable forestry certifications such as SFI and FSC. EPA regulations also affect formaldehyde emissions in composite pallets. |

| United Kingdom | Post- Brexit, the UK now necessitates complete heat-treated wood standards compliance on all incoming and outgoing pallets, including to/from the EU. Timber packaging has to be in accordance with UK Plant Health Regulations. FSC or PEFC certification is promoted. |

| France | Complies strictly with the EU's heat-treated wood standards and EU Timber Regulation (EUTR). Traceability and legality of wood sources are to be ensured by importers. Carbon labeling on packaging is gaining traction under new eco-score systems. |

| Germany | Most stringent regulatory focus on sustainability: ISPM-15 mandatory, along with increasing enforcement of the German Packaging Act ( VerpackG ) and carbon transparency under the EU Green Deal. FSC certification is generally anticipated. |

| Italy | The product complies with EU heat-treated wood standards and EUTR regulations. The Ministry of Agriculture, Food, and Forestry Policies requires traceable timber origins. The use of bio-treated and heat-treated pallets is encouraged for agricultural exports. |

| South Korea | All wooden pallets utilized for import/export must comply with heat-treated wood standards. The National Plant Quarantine Service (NPQS) regulates enforcement. The forestry programs are increasingly promoting certified pest-free wood. |

| Japan | Heat-treated wood standards are required for export/import, but enforcement locally is less stringent. The Ministry of Agriculture encourages the use of wooden packaging alternatives that include pest treatment records. Green logistics promotion indirectly promotes reusable pallets. |

| China | ISPM-15 compliance is mandatory for both exports and imports. AQSIQ certification is required for manufacturers of pallets. China's 14th Five-Year Plan encourages recyclable packaging and more rigorous quarantine inspections. |

| Australia & New Zealand | The heat-treated wood standards regulation is extremely strict and applies to all wood packaging materials. Australia's Department of Agriculture and NZ MPI impose severe penalties for non-compliance. It is preferred to use heat-treated pallets that can be traced back to their origin. |

| India | Heat-treated wood standards are required for exports, but domestic regulation is patchy. Optional guidance on pallet size and materials from the Bureau of Indian Standards (BIS). Urge cost-effective compliance through heat treatment facilities. |

Hardwood pallets will be the most profitable segment in the Wooden Pallets Industry between 2025 and to 2035, propelled by their high durability, strength, and wear-and-tear resistance. The Hardwood segment is likely to have a CAGR of 5.8%, higher than the overall industry growth of 5.4%.

Hardwood pallets are gaining popularity because they can support heavy loads and hence are suitable for the pharmaceutical, automotive, and warehousing sectors. Furthermore, the ability to treat and meet phytosanitary standards makes hardwood pallets likely to meet strict international trade standards, including ISPM-15 regulations.

Between 2025 and to 2035, the four-way entry pallet segment is projected to be the most profitable, backed by its suitability and handling comfort. As the demand for efficient supply chains increases with ongoing growth in e-commerce, the Four-Way entry segment is expected to grow at a CAGR of 5.6%, marginally higher than the overall industry growth rate.

Four-way pallets have access from every side, facilitating more flexibility while storing, shipping, and stacking. As automation in logistics and warehousing increases, and efficient handling becomes crucial, industries such as food and beverages, pharmaceuticals, and consumer electronics are increasingly embracing four-way pallets.

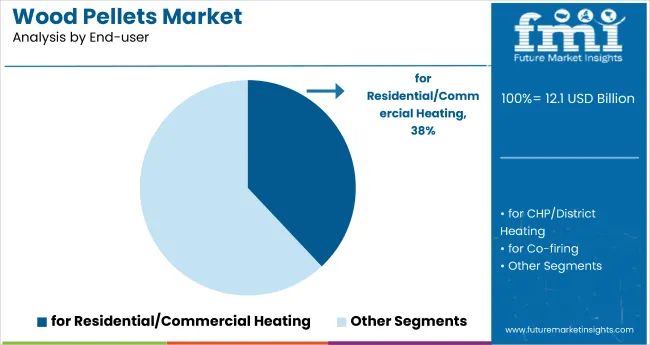

Between 2025 and to 2035, food and beverages will be the most profitable end-use application in the wood pallet industry due to the growing demand for safe, clean, and eco-friendly packaging solutions. The Food and Beverages segment is expected to develop at a CAGR of 6.2%, above the expected rate of growth in the overall industry, which stands at 5.4%.

The food and beverage sector has strict standards for pallet sanitation, recyclability, and international export compliance, all of which drive the growing demand for certified wooden pallets. The increasing global movement towards sustainable packaging, as well as heightened demand for packaged food and drinks, will drive demand for wooden pallets in the sector.

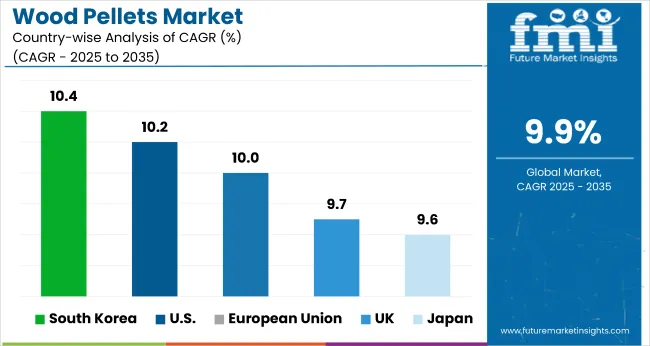

The sales in the United States for wood pallet landscape are anticipated to expand at a CAGR of 5.4% during 2025 to 2035. Wooden pallet demand will increase in food and beverages, e-commerce, and pharmaceutical sectors, and drive growth. Since there is increased regulatory pressure on sustainability, companies will be inclined towards greener practices.

ISPM-15 compliance remains an important consideration, especially for export. There is also a growing need for carbon footprint reduction and sustainably sourced materials, boosting demand for certified wood, thereby offering chances to FSC-approved companies to become leaders in the industry.

The wood pallet industry in the United Kingdom is projected to grow at a CAGR level of 5.0% between 2025 and 2035. British post-Brexit regulations demanding stricter import and export conditions in wooden packaging goods, including those that adhere to ISPM-15 standards, ensure constant levels of high-demand, treated pallets.

Companies are increasingly prioritizing FSC certification due to their focus on sustainability. There is also a growing trend in the use of reusable packaging systems to help curb waste and carbon footprints in the UK. Through incentives offered by governments in sustainable forestry sourcing and packaging, the industry will grow progressively as companies turn to meet environmental standards.

The French wood pallet sector is expected to grow at a CAGR of 5.7% from 2025 to 2035. The food and beverage, logistics, and pharmaceutical industries will continue to drive demand for wooden pallets. The observation of EU ISPM-15 and EUTR directives by France places pressure on compliance, thereby guaranteeing steady demand for compliant pallets.

Additionally, as environmental consciousness rises, the French government’s promotion of sustainability practices encourages the use of certified wood sources, spurring innovation in eco-friendly packaging solutions. This trend will shape long-term industry growth.

The German wooden pallet landscape is predicted to have a CAGR of 5.3% from 2025 to 2035. With a strong industrial base in automotive, pharma, and e-commerce, Germany remains among the biggest wooden pallet industries in Europe. The country's aggressive enforcement of the EU's Green Deal and its strong sustainability policies are making FSC-certified pallets increasingly essential.

Furthermore, Germany's waste minimization and carbon transparency focus provide tremendous demand for reusable and recyclable wooden pallets. As regulations become tighter, the wood pallet industry will benefit from investment fueled by technology and efficiency.

In Italy, sales for the wooden pallet industry are projected to register a CAGR of 5.1% from 2025 to 2035. The rising demand for packaging solutions in the food and beverage, manufacturing, and logistics industries continues to be the primary driver.

The Italian industry is also under the influence of EU regulations, such as ISPM-15 and the EU Timber Regulation (EUTR). Additionally, Italy's emphasis on sustainable forestry will lead businesses to purchase responsibly, as the demand for FSC-certified timber grows. The industry will expand as sectors shift towards green and compliance issues.

The South Korean wood pallet industry will grow at a CAGR of 4.9% from 2025 to 2035. With an export and international trade focus, there remains strong demand for ISPM-15 compliant pallets, especially in the electronics and auto sectors.

South Korea is also increasingly under pressure to be green, and environmentally friendly packaging options are gaining favor. The government's focus on creating green projects will encourage companies to invest in certified sustainable sources of wood. However, the relatively smaller local industry for wooden pallets guarantees that growth is more moderate than in greater overseas sectors.

Sales in Japan's wood pallet sector are forecasted to increase by a CAGR of 4.5% between 2025 and to 2035. Despite a declining local wood supply, demand remains strong, driven by Japan’s key manufacturing and export sectors.

The country is particular about ISPM-15 control to ensure import/export compliance. However, Japan's cautious adoption of high-tech eco-pallet solutions will restrain growth due to cost-related concerns. Japan's focus, however, on green practices such as hybrid pallets made with wood and reusable parts will steadily drive growth.

The Chinese wood pallet landscape has been estimated to register a CAGR of 6.0% during 2025 to 2035. One of the largest manufacturing bases globally, China has continued to show strong demand for wooden pallets, particularly in manufacturing sectors such as electronics, textiles, and consumer goods.

Implementing ISPM-15 export pallet compliance is crucial, with increased enforcement set to roll out in the coming days. Furthermore, the country's national push toward sustainability and carbon neutrality by 2060 will drive the adoption of certified, sustainable pallets. As China invests in logistics infrastructure, the wooden pallet industry has the potential to expand in the long run.

The Australian and New Zealand wood pallet sector has the potential to expand at a CAGR of 5.2% from 2025 to 2035. The export-driven Australian economy in agriculture and mining supports strong demand for ISPM-15 compliant pallets. Both countries impose stringent enforcement of biosecurity standards, and wooden packaging must meet phytosanitary requirements.

The focus in the region on sustainability and forestry management initiatives will encourage the use of certified timber. Additionally, growing Australian importance attached to circular economy practices will further augment demand for eco-friendly and reusable pallet solutions.

The Indian wood pallet industry is anticipated to grow at a CAGR of 5.6% from 2025 to 2035. India's fast-developing manufacturing and logistics sectors, particularly in the textile, pharmaceutical, and automobile industries, will further increase the demand for wooden pallets.

Although the industry remains price-sensitive, the government's increasing focus on sustainability and compliance with ISPM-15 standards for export will render certified pallet options profitable for firms. As India moves forward with upgrading its export infrastructure, demand for top-quality, durable wooden pallets is expected to grow steadily.

Several regional and global companies are competing in the fragmented wooden pallet sector. Consolidation is on the rise as bigger companies are acquiring smaller players to increase their presence. Leading players compete based on competitive pricing, product innovation, strategic alliances, and geographic reach. Several of them are investing in sustainable pallets, automation, and digital tracking solutions to address the growing demand for green and efficient supply chain solutions. Growth plans comprise M&A, capacity expansions, and alliances with logistics companies.

Brambles Limited, operating under the CHEP brand, leads the global wooden pallets market with an estimated 25-30% share. Its dominance stems from an extensive pallet pooling system and a strong presence in key markets such as North America and Europe. In 2024, the company expanded its operations in Europe with a focus on reusable pallets and circular economy initiatives, reinforcing its commitment to sustainability and supply chain efficiency.

Pallets Inc. holds approximately 10-12% of the market, primarily serving the USA industry with a focus on cost-effective solutions involving both new and recycled pallets. Its value-driven approach has helped it maintain a stable presence in the competitive domestic landscape.

Falkenhahn AG controls around 8-10% of the global market, primarily in Europe. The company bolstered its regional footprint in 2024 through the acquisition of Netherlands-based Pallets Group, reflecting its strategy to consolidate smaller players and expand market access across the continent.

Millwood Inc. accounts for about 7-9% of global market share, driven by its investments in logistics technology. In 2024, it launched AI-powered pallet tracking systems aimed at improving real-time supply chain visibility, giving it a tech-enabled edge in a traditionally manual industry.

Meanwhile, regional and local players collectively represent roughly 40-45% of the market, underscoring the fragmented nature of the wooden pallets industry. This fragmentation is further influenced by regional production norms, logistics requirements, and environmental compliance standards. Notably, in 2024, the USA Environmental Protection Agency introduced stricter sustainability guidelines for wooden pallet manufacturing, prompting many players to explore alternatives like treated or certified sustainable lumber to remain compliant and competitive.

The industry includes Hardwood and Softwood.

The industry includes Four-Way and Two-Way.

The industry is segmented into Food and Beverages, Building and Construction, Pharmaceuticals, Consumer Electronics, Cosmetics & Personal Care, Logistics and Transportation, and Others (Automotive, Textiles, etc.).

The industry is studied across North America, Latin America, Europe, the Middle East and Africa, East Asia, South Asia, and Oceania.

The demand for wooden pallets is fueled by their strength, affordability, recyclability, and universal use by food and beverage, pharmaceutical, consumer appliance, and logistics companies.

The wooden pallet industry is anticipated to witness steady growth, fueled by growing international trade, e-commerce, and a growing focus on sustainable packaging solutions, with ongoing growth up to 2035.

The leading players in the wood pallet industry are Interpak Industries Pvt. Ltd., Tri-Wall Holdings Limited, PalletOne, Falkenhahn AG, Larson Packaging Company, Inka-paletten, PECO Pallet, John Rock, Inc., Millwood, Inc., Value (USD Million), and Volume (Units). Pallet Services Inc., Herwood Inc., DNA Packaging Systems, Kronus LTD, Litco International Inc., LCN Pallets and Wooden Cases, Anderson Pallet and Crate, Best Pallet & Crate LLC.

Hardwood pallets are likely to dominate due to their higher durability, strength, and international regulation compliance, especially in industries where stronger packaging is required.

The sector is likely to expand at a CAGR of 5.4% during 2025 to 2035 and reach USD 4.69 billion by 2035 due to increasing demand for sustainable and efficient packaging solutions across the globe.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Wood Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Wood Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Entry type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Entry type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Wood Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Wood Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Entry type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Entry type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Wood Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Wood Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Entry type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Entry type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Wood Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Wood Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Entry type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Entry type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Wood Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Wood Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Entry type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Entry type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Wood Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Wood Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Entry type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Entry type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Wood Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Wood Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Entry type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Entry type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Wood Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Wood Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Entry type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Entry type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Wood Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Entry type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Wood Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Wood Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Wood Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Wood Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Entry type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Entry type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Entry type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Entry type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Wood Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Entry type, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Wood Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Entry type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Wood Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Wood Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Wood Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Wood Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Entry type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Entry type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Entry type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Entry type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Wood Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Entry type, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Wood Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Entry type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Wood Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Wood Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Wood Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Wood Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Entry type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Entry type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Entry type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Entry type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Wood Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Entry type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Wood Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Entry type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Wood Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Wood Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Wood Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Wood Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Entry type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Entry type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Entry type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Entry type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Wood Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Entry type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Wood Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Entry type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Wood Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Wood Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Wood Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Wood Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Entry type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Entry type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Entry type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Entry type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Wood Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Entry type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Wood Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Entry type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Wood Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Wood Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Wood Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Wood Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Entry type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Entry type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Entry type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Entry type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Wood Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Entry type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Wood Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Entry type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Wood Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Wood Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Wood Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Wood Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Entry type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Entry type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Entry type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Entry type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Wood Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Entry type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Wood Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Entry type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Wood Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Wood Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Wood Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Wood Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Entry type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Entry type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Entry type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Entry type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Wood Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Entry type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wooden Pallets Market

Presswood Pallets Market Analysis – Trends & Growth 2025 to 2035

Molded Wood Pallets Market Forecast and Outlook 2025 to 2035

Competitive Overview of Molded Wood Pallets Market Share

Wood Awning Window Market Size and Share Forecast Outlook 2025 to 2035

Woodcore Access Floor Market Size and Share Forecast Outlook 2025 to 2035

Woodworm Treatment Service Market Size and Share Forecast Outlook 2025 to 2035

Wood Plastic Composite Market Size and Share Forecast and Outlook 2025 to 2035

Wooden Pallet Rental Service Market Size and Share Forecast Outlook 2025 to 2035

Wood Recycling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Woodfree Paper Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Wooden & Plywood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA