The fragmented competitive stage is seen in the global wood vinegar market, which consists of a mixture of the main agrochemical companies, local biochar manufacturers, start-up companies, and contract manufacturers. The companies Tagrow Co. Ltd., ACE (Australia), and Nettenergy hold about 50% of the market, and are the biggest market holders.

The players are using cutting-edge pyrolysis technology and a strong supply network to meet the needs of the agricultural, animal feed, and pesticide sectors. Around 30% of the market is made up of the local producers, specifically in Southeast Asia and Latin America, and they play a big role. The local producers are using local biomass waste and local production strategies to cater to the specific needs of the eco-agriculture sector.

Companies like Byron Biochar are part of the small group of startups that hold approximately 15% of the share in market share because they provide organic-certified, small-batch solutions that are specialized in sustainable farming practices. The rest 5% belong to the private label brands and local cooperatives, which are usually the ones that make the most profit in rural markets.

The brands may not be known, and the marketing skills may not be developed, yet their loyalty in the region is vital. However, the forecast for the market is that it will develop in favor of those companies that are quick to adapt to changes and value ecological sustainability.

Global Market Share by Key Players

| Global Market Share, 2025 | Industry Share % |

|---|---|

| Top 3: Tagrow Co. Ltd., Nettenergy B.V., Ace (Singapore) Pte Ltd | ~45% |

| Rest of Top 5: PyroAg Wood Vinegar, VerdiLife Inc. | ~20% |

| Next 5 of Top 10: Byron Biochar, Canada Renewable Bioenergy Corp., New Life Agro, Applied Gaia Corporation, Taiko Pharmaceutical Co. Ltd. | ~15% |

| Emerging & Regional Brands: Dongying Runyi Biological Technology Co. Ltd., Nakashima Trading Co. Ltd., Sort Of Coal, Wood Vinegar Australia, Doi & Co. Ltd. | ~20% |

The wood vinegar market is divided into the pyrolysis process, use, and distribution channel, and each one of them connects and affects the rest, thereby helping in the construction of the market structure.

Slow Pyrolysis is the major segment, as it has around 50% of the total value, which is mainly because it gives a high yield, and the quality of the wood vinegar is very good. It is used more in the traditional pyrolysis with the longer processing times, and in some cases, can achieve a higher stability of the product.

Fast Pyrolysis is responsible for about 30% of the production, which can produce not only wood vinegar, but also bio-oil and charcoal, along with the aforementioned product, bespeaking it is often used in commercial applications. The niche section is Intermediate Pyrolysis, which accounts for about 20% of the production and is usually used in controlled production setups for outputs in specific industries.

Agriculture is the strongest sector, getting 45% value share, benefiting from the increasing interest in biological fertilizers and organic pesticides. Soil quality is improved with the use of wood vinegar, while it also supports the plant to resist pests and diseases, and finally, it decreases the use of synthetic products.

Animal Feed applications are in the next position with a 25% share, benefiting from wood vinegar being an antimicrobial agent, which in turn improves livestock digestion and decreases the need for using antibiotics. The application spectrum gets balanced with the usage of Consumer Products, Food, and Medicinal health applications (15%,10%, and 5% respectively), as all of them are increasing with the good health product demand.

In 2024, there will be a breakthrough in the wood vinegar industry, mainly driven by sustainable development, new products, and important players' great growth. Companies that are the key players in the wood vinegar market have transformed their operations and are now focusing on organic production inputs and bio-based products. The front-runners have not only been partly reactive to the trends set but have also taken a lead in setting them. Here is an overview of the leading contributors to the transformation in the global wood vinegar landscape.

Tagrow Co. Ltd.

Tagrow has maintained a powerful status in the market by increasing production and investing in novel, extensive pyrolysis techniques. This company has expanded the production of organic farming solutions through strategic partnerships with agricultural co-ops across Asia, thus increasing its scope of work in the emerging markets.

Nettenergy B.V.

A front-runner in Europe, Nettenergy has been environmentally oriented and has improved the balance with low-emission pyrolysis units. Their wood vinegars have found a place in the expansive soil restoration programs implemented in the EU, thus aligning with the green agriculture directive.

ACE (Singapore) Pte Ltd.

The company ACE has seen its regional preeminence consolidated by the introduction of high-end wood vinegar that is meant for not only medicinal but also cosmetic applications. The focus of the company's R&D has shifted to the opening of new niche markets and the diversification of revenues substantially.

VerdiLife Inc.

VerdiLife, located in the USA, has integrated blockchain technology into its product supply chain, thus making the process highly transparent for customers with ecological concerns. They supply USDA-certified organic vinegar that is also popular among high-end agri-product retailers.

PyroAg Wood Vinegar

PyroAg, a company from Australia, has achieved development through slow pyrolysis innovation and the production of a stable, highly potent wood vinegar. The organization's implementation of the educational program has led to the domestic market for farmers as well as supported environmentally-friendly cultivation.

The Boost in Demand for Organic Farm Inputs: The transition towards sustainability in the agricultural sector is reflected in the increasing adoption of wood vinegar as a natural pesticide and soil conditioner. This is expected to enhance demand in the Asia-Pacific and Latin America regions, where organic farming is becoming more popular.

Innovation in Pyrolysis Technology of the New Breed: Companies that invest in advanced pyrolysis techniques are generating wood vinegar with higher pury thanks to more consistent quality. Consequently, besides their previous segments, they are also moving into the pharmaceutical and cosmetic sectors.

Increase in Direct Sales Channels: E-commerce and Direct-to-consumer channels are the ones that achieve the fastest growth in rural and semi-urban areas, facilitating direct access to the wood vinegar products for smallholder farmers without intermediaries.

Targeting Crop-Specific Usage: Manufacturers are developing specific wood vinegar variants that are tailor-made for specific plants and climatic conditions. This customisation strategy will not only improve the product performance but also develop a deeper commitment within the agricultural sector.

Circularity and Sustainability Models: Businesses that use biomass waste as raw material for producing wood vinegar are synonymous with the global zero-waste philosophy. This practice not only boosts their investment returns by profit margins but also enhances their ESG appeal plus lowers the raw materials costs.

Diving into Human Care and Medical Applications: The penetration of the wood vinegar is not only in farming but also into the skincare and herbal medicine arenas due to it being antimicrobial and detoxifying, thus making a breakthrough in other high-value verticals.

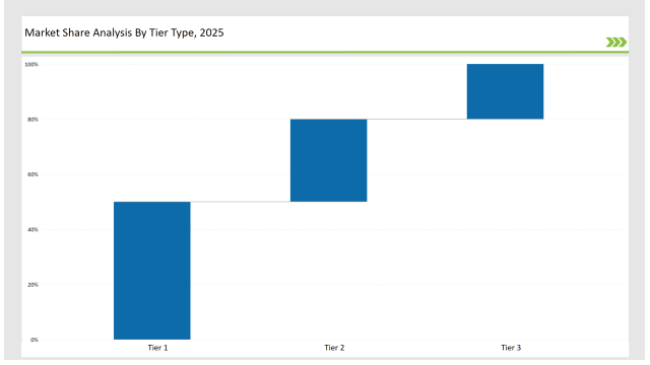

| By Tier Type | Tier 1 |

|---|---|

| Market Share % | 50% |

| Example of Key Players | Tagrow Co. Ltd., Nettenergy B.V., ACE (Singapore) Pte Ltd |

| By Tier Type | Tier 2 |

|---|---|

| Market Share % | 30% |

| Example of Key Players | PyroAg Wood Vinegar, VerdiLife Inc., Applied Gaia Corporation |

| By Tier Type | Tier 3 |

|---|---|

| Market Share % | 20% |

| Example of Key Players | Byron Biochar, Nakashima Trading Co. Ltd., Sort Of Coal |

| Brand | Key Focus |

|---|---|

| Tagrow Co. Ltd. | Expanded production facilities in Southeast Asia to meet growing demand in organic agriculture. |

| Nettenergy B.V. | Introduced mobile pyrolysis units for on-site production, enhancing flexibility for farmers. |

| ACE (Singapore) | Launched cosmetic-grade wood vinegar for skincare and herbal wellness products. |

| VerdiLife Inc. | Integrated blockchain for product traceability, targeting eco-conscious consumers. |

| PyroAg Wood Vinegar | Partnered with Australian agri-cooperatives to provide training on bio-input application. |

| Applied Gaia Corp. | Developed pharmaceutical-grade wood vinegar with a patented filtration process. |

| Byron Biochar | Launched small-batch artisan vinegar tailored for home gardening and urban farms. |

| New Life Agro | Focused on expanding regional distribution in Latin America with crop-specific formulations. |

| Sort Of Coal | Introduced wood vinegar-based detox products for health-conscious consumer markets. |

| Canada Renewable Bioenergy Corp. | Invested in R&D for multi-use wood vinegar suitable for both feed and food sectors. |

The success of the wood vinegar market is going to be the result of innovation, integration, and sustainability. As the interest in natural and biological solutions grows, especially within agriculture and wellness, manufacturers are expected to raise product volumes through the application of more efficient pyrolysis methods.

The promotion of direct-to-consumer models as well as subscription-based purchases will establish a major role in the supply of farmers and eco-conscious consumers with quality targeted products free from intermediaries. Education concerning the means of utilising such products and demonstration in the field will create trust and adoption of such projects.

Further, the market is expected to extend from agriculture into cosmetic products, animal health, and functional foods. Global penetration will be supported by marketing through improved packaging, gained certification, and the digital platform. In the coming five years, the market will grow through the expansion of strategic partnerships with agri-tech startups and government sustainability programs.

In brief, the industry is bound for paths of diversification, decentralization of production, and more value-added applications, with wood vinegar turning into a common input for the bio-based green industries.

The wood vinegar industry analysis has been carried out in key countries of North America, Latin America, Asia Pacific, Europe, Oceania, Middle East and Africa.

By Pyrolysis Method, the wood vinegar market is segmented as Fast Pyrolysis, Slow Pyrolysis, Intermediate Pyrolysis.

By Application, the wood vinegar market is segmented, Animal Feed, Agriculture, Consumer Products, Food, Medicinal.

The distribution channels for the product involve Pharmacies, Health & Beauty store, Super market, Direct Selling, Online providing to diverse segments of the industry.

Tagrow Co. Ltd., Nettenergy B.V., and ACE (Singapore) Pte Ltd are the top players, collectively holding around 50% of the global market share.

Regional brands account for approximately 20% of the market, focusing on localized production and distribution for agriculture-based solutions.

Startups and artisanal brands, like Byron Biochar, hold around 10% of the market, often serving niche and premium customer segments.

Private labels represent about 5% of the global wood vinegar market, usually offering low-cost alternatives via retail chains.

The market is moderately concentrated, with Tier 1 companies controlling 50%, indicating strong competition from Tier 2 and emerging players.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wood Awning Window Market Size and Share Forecast Outlook 2025 to 2035

Woodcore Access Floor Market Size and Share Forecast Outlook 2025 to 2035

Woodworm Treatment Service Market Size and Share Forecast Outlook 2025 to 2035

Wood Plastic Composite Market Size and Share Forecast and Outlook 2025 to 2035

Wooden Pallet Rental Service Market Size and Share Forecast Outlook 2025 to 2035

Wood Recycling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Woodfree Paper Market Size and Share Forecast Outlook 2025 to 2035

Wooden Crate Market Forecast and Outlook 2025 to 2035

Wood-Polymer Bottle Molders Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Wood Pellets Market Size and Share Forecast Outlook 2025 to 2035

Wooden Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Wood Coating Resins Market Size and Share Forecast Outlook 2025 to 2035

Wooden & Plywood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives and Binders Market Size and Share Forecast Outlook 2025 to 2035

Wood Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Wooden Furniture Market Size and Share Forecast Outlook 2025 to 2035

Woody Biomass Boiler Market Size and Share Forecast Outlook 2025 to 2035

Wooden Interior Door Market Size and Share Forecast Outlook 2025 to 2035

Woodworking Circular Saw Blades Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA